Blank Gift Deed Form for Georgia

In the southern charm of Georgia, transferring property or cherished possessions from one person to another comes with its own set of rules, encapsulated in the Georgia Gift Deed form. This document, pivotal for seamless transitions, isn't just about transferring ownership. It's about doing so with love and without financial consideration, making it stand apart from typical sales or purchase contracts. For anyone looking to pass on heirlooms, property, or any significant gift to loved ones, understanding this form is crucial. It not only ensures the proper and legal transfer of these items but also helps in avoiding potential misunderstandings or disputes in the future. The Georgia Gift Deed form embodies generosity and consideration, ensuring that gifts are given officially and with clear intent. By navigating its requirements, donors can safeguard their gifts, ensuring they reach the intended recipient in the spirit they were given.

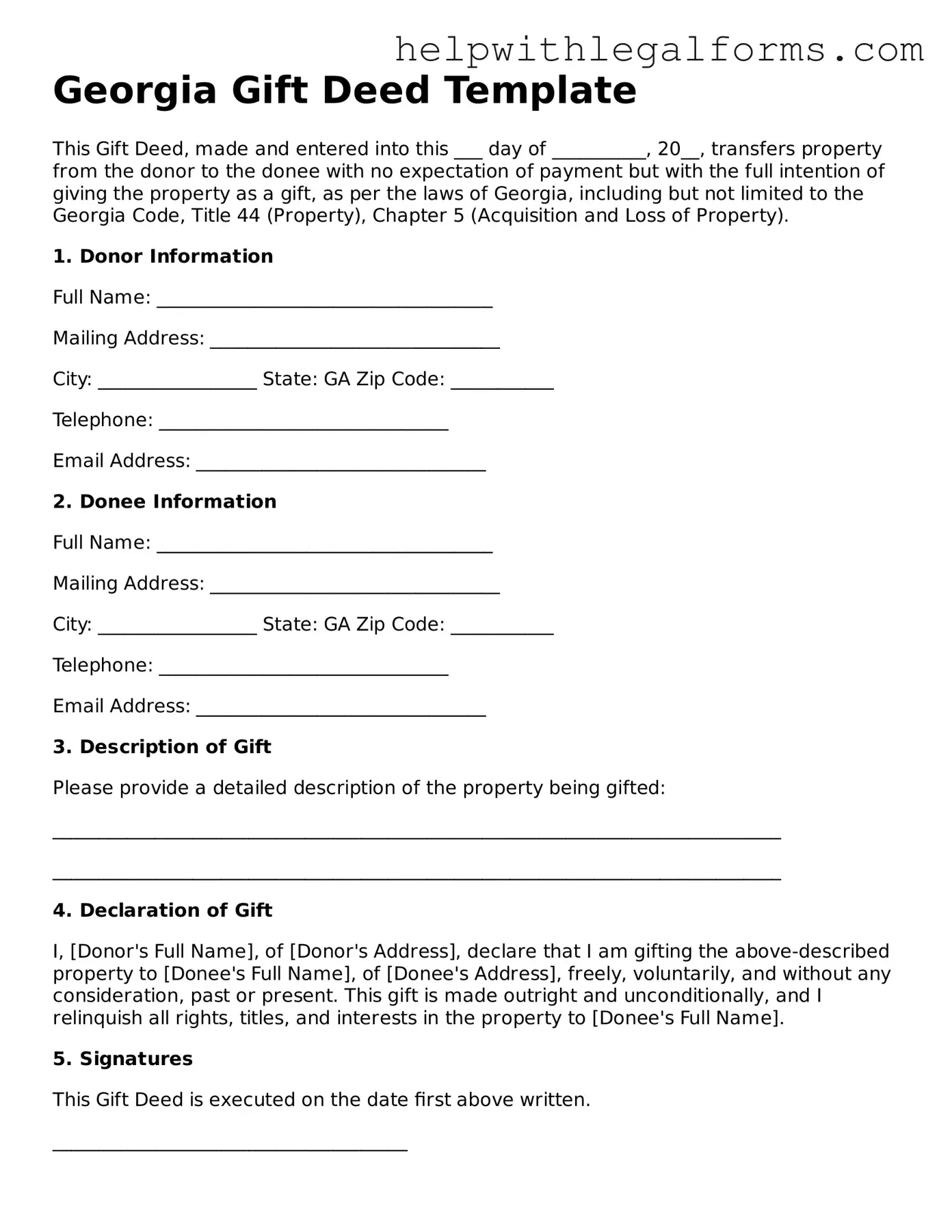

Example - Georgia Gift Deed Form

Georgia Gift Deed Template

This Gift Deed, made and entered into this ___ day of __________, 20__, transfers property from the donor to the donee with no expectation of payment but with the full intention of giving the property as a gift, as per the laws of Georgia, including but not limited to the Georgia Code, Title 44 (Property), Chapter 5 (Acquisition and Loss of Property).

1. Donor Information

Full Name: ____________________________________

Mailing Address: _______________________________

City: _________________ State: GA Zip Code: ___________

Telephone: _______________________________

Email Address: _______________________________

2. Donee Information

Full Name: ____________________________________

Mailing Address: _______________________________

City: _________________ State: GA Zip Code: ___________

Telephone: _______________________________

Email Address: _______________________________

3. Description of Gift

Please provide a detailed description of the property being gifted:

______________________________________________________________________________

______________________________________________________________________________

4. Declaration of Gift

I, [Donor's Full Name], of [Donor's Address], declare that I am gifting the above-described property to [Donee's Full Name], of [Donee's Address], freely, voluntarily, and without any consideration, past or present. This gift is made outright and unconditionally, and I relinquish all rights, titles, and interests in the property to [Donee's Full Name].

5. Signatures

This Gift Deed is executed on the date first above written.

______________________________________

Donor's Signature

______________________________________

Donee's Signature

6. Witness

In the presence of:

______________________________________

Witness's Name

______________________________________

Witness's Signature

7. Notary Acknowledgment

This section is to be completed by a Notary Public.

State of Georgia )

County of ___________ )

On this ___ day of __________, 20__, before me appeared [Donor's Name] and [Donee's Name], known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Notary's Signature

My Commission Expires: ____________

PDF Form Attributes

| Fact No. | Description |

|---|---|

| 1 | The Georgia Gift Deed form is used to give a gift of property from one person to another in the state of Georgia. |

| 2 | It transfers ownership without any exchange of money and is irrevocable once delivered and accepted. |

| 3 | This deed requires the donor's signature to be notarized for the document to be valid. |

| 4 | Georgia law requires that the Gift Deed be filed with the county recorder's office where the property is located. |

| 5 | Under Georgia Code, particularly the Property Code, this deed is recognized and governed. |

| 6 | The deed must clearly identify the donor (giver), donee (recipient), and the property being gifted. |

| 7 | It must be executed with the same formality as a traditional real estate deed. |

| 8 | No consideration in terms of money is involved, distinguishing it from a sale or transfer for value. |

| 9 | It is commonly used for gifting property to family members, friends, or charities. |

| 10 | Specific tax implications may apply, and consulting with a legal or tax professional is recommended to understand potential obligations. |

Instructions on How to Fill Out Georgia Gift Deed

When transferring property as a gift in Georgia, using a Gift Deed form is an essential process. This document not only makes the gesture formal but also helps in recording the transfer in the state's public records, ensuring clarity and legality. The following steps, broken down for ease, ensure that you can fill out a Georgia Gift Deed form accurately, making sure the property transfer process is smooth and without legal complications.

- Start by filling in the Preparer's information. This includes the name and address of the individual who is preparing the Gift Deed form.

- Next, enter the Return Address. This should be the address where you would like the recorded deed sent after the county has filed it.

- Fill in the County where the property is located. This is crucial since it determines where the deed will be recorded.

- Enter the Grantor's Information. The grantor is the person who is giving the gift. Include the grantor’s full name and address.

- Specify the Grantee's Information. The grantee is the recipient of the gift. Like the grantor's, include the full name and address of the grantee.

- Provide a detailed description of the property being gifted. This should be as specific as possible, including the property's address and legal description found in previous deeds or tax bills.

- State the Relationship between the grantor and grantee, if any. This is not mandatory but is often included to give context to the gift.

- If there are Conditions or Reservations, include them in the designated section. However, most Gift Deeds are unconditional, meaning once the deed is delivered and accepted, the gift is irrevocable.

- The Date of the Gift Deed should be entered. This is the date when the document is signed by the grantor.

- Have the Grantor sign the Gift Deed in the presence of a notary public. The notary will then fill out their section, confirming the identity of the signer and witnessing the signature.

- Finally, file the completed deed with the local county’s registry office to make the transfer official. There may be a filing fee, which varies by county.

By following these steps, individuals can ensure that the property gift transfer in Georgia is conducted properly. Remember, a properly completed and filed Gift Deed is a legal document that protects the interests of both the giver and the recipient. For any specific questions or concerns, it might be helpful to consult with a legal professional specialized in property transfers within the state.

Crucial Points on This Form

What is a Georgia Gift Deed form?

A Georgia Gift Deed form is a legal document used to transfer property from one person to another without any exchange of money. The giver is known as the donor, and the receiver is called the donee. This type of deed is often used to gift property to family members or loved ones.

Is a Georgia Gift Deed form legally binding?

Yes, a Georgia Gift Deed form is legally binding once it is properly completed, signed, and delivered to the donee. It must also be recorded with the local county's Clerk's Office where the property is located to be effective and to show a change in ownership.

Does the property transfer via a Georgia Gift Deed form incur taxes?

Transferring property through a gift deed can have tax implications. While there is no sales price, the transfer might be subject to federal gift tax rules. Donors should consult with a tax advisor to understand any tax liabilities and reporting requirements.

What are the necessary steps to complete a Georgia Gift Deed form?

To complete a Georgia Gift Deed form, the donor needs to provide detailed information about the property being gifted, clearly state that no payment is expected in return, and sign the deed in the presence of a notary public. After notarization, the deed should be delivered to the donee and recorded with the county to be effective.

Can I revoke a Georgia Gift Deed after it's been completed?

Once a Georgia Gift Deed is completed, signed, delivered to the donee, and recorded, it is usually irrevocable. This means the donor generally cannot change their mind and take back the property. It's important to be certain about the gift before completing the deed.

Do I need a lawyer to create a Georgia Gift Deed?

While it's not strictly required to use a lawyer to create a Georgia Gift Deed, consulting with a legal professional who understands state property laws can be very helpful. A lawyer can ensure the deed complies with Georgia law, provide advice on potential tax implications, and help to properly record the document.

Common mistakes

When filling out the Georgia Gift Deed form, people often make several common mistakes. Understanding these errors can help ensure that the process of gifting property is completed smoothly and without legal complication.

Not Specifying the Details of the Gift Clearly: It's crucial to describe the property being gifted with as much detail as possible. A vague or incomplete description can lead to confusion and legal challenges down the road.

Omitting Important Signatures: All required parties must sign the Gift Deed for it to be legally binding. This includes the donor (the person giving the gift) and the donee (the person receiving the gift). Failing to obtain all necessary signatures can invalidate the deed.

Ignoring the Need for Witness and Notarization: Georgia law requires that the signing of the Gift Deed be witnessed by at least one individual and notarized. This formalizes the process, adding a layer of legal protection and authenticity to the document.

Forgetting to File the Gift Deed with Local Authorities: After completion, the Gift Deed should be filed with the appropriate county office. This public recording formalizes the transfer of ownership and is necessary for the deed to be recognized and enforced.

Misunderstanding the Tax Implications: Many people are unaware that there can be tax consequences associated with gifting property. It’s advisable to consult a tax professional to understand any potential liabilities for both the donor and the donee.

Failing to Consult with a Legal Professional: A common mistake is not seeking legal advice when dealing with property transfer. A lawyer can offer crucial guidance and ensure that the Gift Deed complies with state laws and that all parties' interests are protected.

By avoiding these common pitfalls, individuals can help ensure their property gift transaction in Georgia is executed legally and efficiently.

Documents used along the form

When it comes to transferring property in Georgia, a Gift Deed form is often utilized to facilitate the process without compensation. This legal document is not only indicative of a generous act but also necessitates the inclusion of several other forms and documents to ensure compliance and effectiveness. The accompanying paperwork not only supports the execution of the Gift Deed but also helps in maintaining transparency and legality throughout the transaction. Here, we will explore five additional forms and documents that are commonly used alongside the Georgia Gift Deed form. Each plays a crucial role in the seamless transfer of property among parties.

- Real Estate Transfer Tax Form: This document is required for recording the transfer of property ownership. Although gift deeds often qualify for exemptions, this form still needs to be filled out to document the transfer and qualify for the tax exemption properly.

- Property Description Form: Providing a detailed description of the property being gifted is crucial. This form ensures that there is an accurate and legal description that matches public records, thereby avoiding any disputes or confusion regarding the property in question.

- Affidavit of Title: By completing this document, the donor certifies that the property is free of liens, disputes, and other encumbrances that could impact the transfer. It's a reassurance to the recipient that the property's title is clear.

- Homestead Exemption Form: If the gifted property serves as the primary residence, this form could be necessary. It allows for tax exemptions under certain conditions, which can be financially beneficial to the recipient.

- Closing Statement: Though not always required, a closing statement may be used to record the final details of the transaction, including any associated costs paid by either party (even if minimal) and a confirmation of the property transfer.

Together with the Gift Deed form, these documents ensure a smooth and legally sound transfer of property. They act as supporting pillars that uphold the intentions of the giver, protect the interests of the receiver, and fulfill state requirements. Handling property transfers without such documentation can lead to future disputes or legal complications. Therefore, it is advisable to understand and utilize these forms correctly to guarantee the best outcomes for all parties involved.

Similar forms

Will: Similar to a Gift Deed, a Will is a legal document that details how a person's property should be distributed after their death. Both documents are instrumental in planning the distribution of assets, although a Will takes effect after death, whereas a Gift Deed becomes effective during the lifetime of the giver.

Trust Instrument: This document establishes a trust, where one party holds property on behalf of another. Like a Gift Deed, it involves transferring assets to benefit someone else, but the management and control of the assets lie with the trustee until certain conditions are met.

Quitclaim Deed: Used primarily in real estate, a Quitclaim Deed transfers any ownership interest the grantor has in a property without warranties. It is similar to a Gift Deed as it can be used to transfer property as a gift, but it does not guarantee that the title is clear.

Warranty Deed: While a Warranty Deed is also a document for transferring property, it guarantees that the grantor holds a clear title to the property. Like a Gift Deed, it changes the ownership of an asset, but with the addition of certain guarantees.

Power of Attorney: This document allows one person to make decisions on behalf of another, often including the power to gift assets. Although its primary function is not the transfer of assets like a Gift Deed, it can authorize such transactions.

Life Insurance Assignment: This legal document changes the beneficiary of a life insurance policy. Similar to how a Gift Deed transfers ownership of assets, a Life Insurance Assignment modifies who benefits from the policy, effectively altering the recipient of the policy's proceeds.

Dos and Don'ts

Filling out the Georgia Gift Deed form is a significant step if you're planning on gifting property to someone. This legal document has its particularities, and being mindful of how you approach it can make all the difference. Below you'll find essential dos and don'ts to guide you through the process smoothly and effectively.

Do:

- Review the Form Thoroughly: Before you start filling out the form, take your time to go through it completely. Understanding every section ensures you know the information required and how to present it accurately.

- Provide Accurate Information: When completing the form, it's crucial to provide accurate details about both the donor (the person giving the gift) and the donee (the person receiving the gift). Mistakes can lead to delays or even the voiding of the deed.

- Sign in the Presence of a Notary Public: Georgia law requires that gift deeds be notarized to be valid. Make sure both parties sign the deed in front of a notary to ensure its legality.

- Keep a Record: After the form is completed and notarized, make copies for both the donor and the donee. It's important to keep these documents safe, as they are proof of the gift's transfer.

- Understand the Tax Implications: Be aware of any tax responsibilities that come with gifting property. Depending on the value of the gift, there may be federal tax implications. Consulting with a tax professional can provide clarity and help avoid any unexpected surprises.

Don't:

- Rush Through the Process: Filling out the form hastily can lead to errors or omissions that might complicate the gift transfer. Take your time to fill out each section properly.

- Forget to Verify Property Details: The legal description of the property being gifted must match public records exactly. Any discrepancy can invalidate the deed.

- Overlook the Need for Witnesses: In addition to notarization, some jurisdictions may require witnesses during the signing. While Georgia law doesn't specify the need for witnesses besides the notary, it's wise to check if any additional steps are required for your specific situation.

- Assume It’s Revocable: Once a gift deed is executed and delivered, it is generally considered irrevocable. This means the donor cannot change their mind and take back the gift. Be certain of your decision before proceeding.

- Neglect to Consult an Expert: If there's any confusion or uncertainty about the process, it's always a good idea to consult with a legal or tax professional. They can offer personalized advice and help navigate any complex aspects of gifting property.

Misconceptions

When discussing the Georgia Gift Deed form, several misconceptions commonly arise. This document is used to transfer property from one person to another without any consideration, payment, or exchange involved. Understanding its intricacies is crucial to ensure that the process is conducted smoothly and legally. Below are five of the most common misconceptions about the Georgia Gift Deed form:

- Gift Deeds are irrevocable. Many believe once a gift deed is executed in Georgia, it cannot be revoked. In reality, the irrevocability of a gift deed depends on the specific terms set forth within the deed itself and the circumstances under which it was given. There are cases where a gift deed may be challenged or revoked, though these circumstances are generally limited and well-defined by law.

- All Gift Deeds are tax-exempt. Another common misconception is that transferring property through a gift deed automatically exempts the transfer from taxes. While it's true that gift deeds may be used to reduce estate taxes or avoid gift tax, the donor may still be responsible for reporting the gift to the IRS and potentially paying a federal gift tax if the value exceeds the annual exclusion limit.

- A Gift Deed guarantees clear title to the property. Simply using a gift deed to transfer property does not, in itself, guarantee that the title to the property is clear of liens or other encumbrances. A thorough title search and the purchase of title insurance are advisable to ensure clear title when transferring any real estate, including through a gift deed.

- Only relatives can be recipients of a Gift Deed. This is a common myth. Although gift deeds are often used to transfer property among family members, there are no legal restrictions limiting the recipients to relatives. Any person or entity can be designated as a recipient of a gift deed, provided all other legal requirements for a valid gift are met.

- Gift Deeds are simple and always easy to execute. While a gift deed can be simpler than other real estate transactions, it still requires careful execution to be legally effective. This includes the need for the deed to be in writing, include a proper legal description of the property, be signed by the donor in the presence of a notary public, and be recorded in the county where the property is located.

Understanding these common misconceptions about the Georgia Gift Deed form helps clarify the rules and requirements surrounding this unique type of property transfer. While gift deeds can be an effective estate planning tool, it is important to approach them with a clear understanding of their legal implications.

Key takeaways

When considering the transfer of property as a gift in Georgia, understanding the ins and outs of filling out and using the Georgia Gift Deed form is crucial. A properly executed gift deed not only facilitates the smooth transfer of assets but also helps avoid potential legal hiccups. Here are five key takeaways to guide you through the process:

- Legally Binding Document: The Georgia Gift Deed form serves as a legally binding document that transfers ownership of property from one person (the donor) to another (the donee) without any consideration, or payment, involved. Its official nature requires precise attention to detail when preparing and executing the document.

- Complete and Accurate Information is Critical: To ensure that the gift deed is valid and enforceable, all provided information must be accurate and complete. This includes the full legal names of both the donor and the donee, a detailed description of the gifted property, and any relevant legal identifiers (e.g., parcel numbers).

- Witness and Notarization Requirements: For a gift deed to be recognized as valid under Georgia law, it must be signed in the presence of a notary public and, depending on local regulations, may also require witnessing by one or two disinterested parties (individuals who have no stake in the deed’s contents).

- Filing with Local Authorities: Following its execution, the gift deed should be filed with the appropriate county office in Georgia. This is typically the county where the property is located. Filing ensures that the deed becomes a matter of public record, solidifying the transfer in legal terms.

- Consideration of Federal Gift Tax: While the transfer of property via gift deed does not typically involve state taxes in Georgia, donors should bear in mind the potential implications of federal gift taxes. It’s important to consult with a tax professional to understand any tax liabilities that may arise from transferring property through a gift deed.

Create Other Gift Deed Forms for US States

Gift Deed California - Use a Gift Deed to avoid any future legal disputes over the ownership of the gifted property.