Blank Gift Deed Form for Texas

In the heart of legal transactions, especially those concerning the generous act of gifting property, stands the Texas Gift Deed form, an instrument of significance that allows individuals to transfer ownership of their real estate to another person without any financial exchange. This document, pivotal in its function, is governed by specific rules and regulations unique to the state of Texas, ensuring that the transfer is not only legal but also irrevocable, meaning the giver cannot take back the property once the deed is executed and delivered. With its requirement for a clear expression of the donor's intention to make the gift, along with the necessity for acceptance by the recipient, the Texas Gift Deed ensures a seamless transition of property ownership. Furthermore, to safeguard against future legal complications, this deed must be properly recorded in the county where the property is located. Crafting this document with precision is crucial, as any oversight can potentially disrupt the intended outcome of the property transfer, making it imperative for those involved to understand the major aspects and steps required to execute a Gift Deed effectively in Texas.

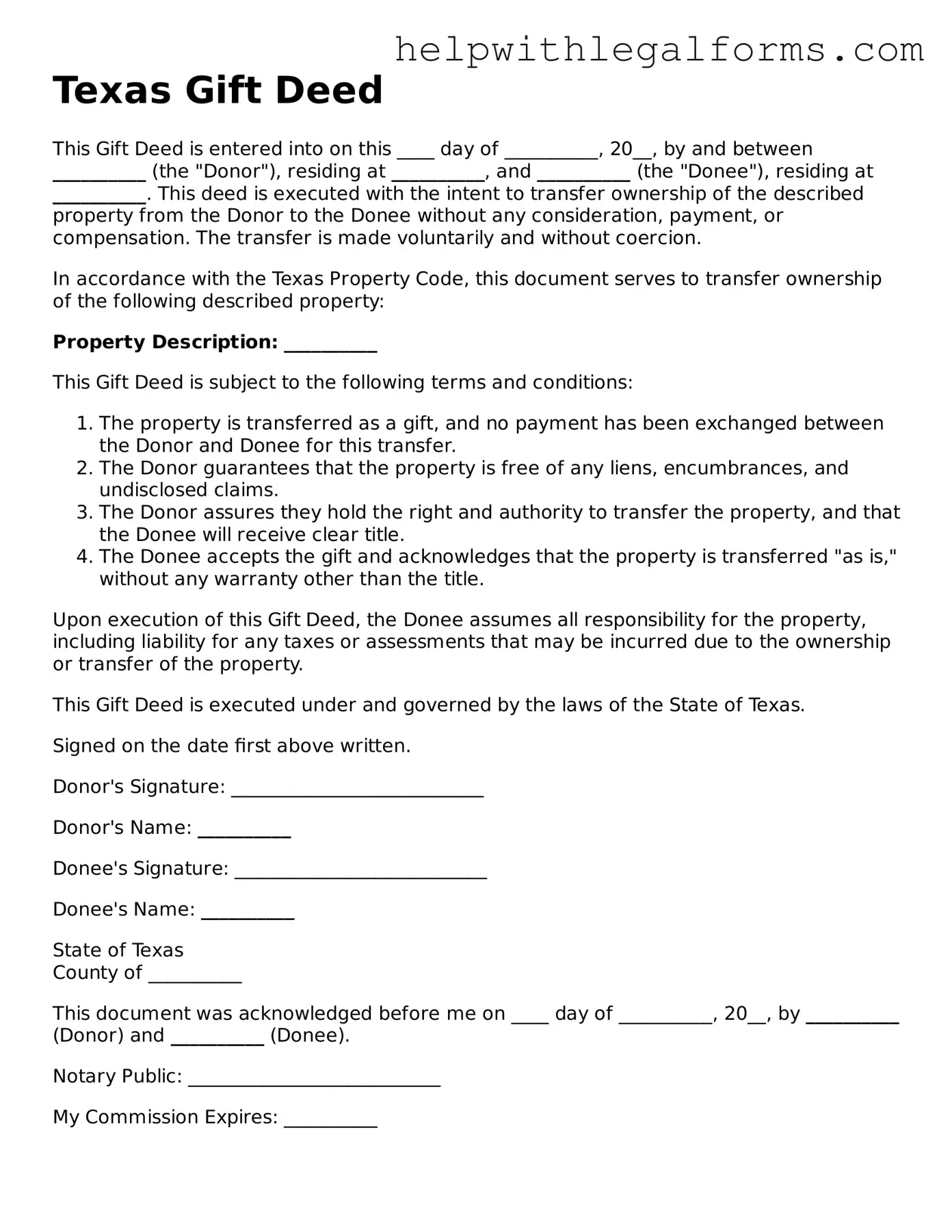

Example - Texas Gift Deed Form

Texas Gift Deed

This Gift Deed is entered into on this ____ day of __________, 20__, by and between __________ (the "Donor"), residing at __________, and __________ (the "Donee"), residing at __________. This deed is executed with the intent to transfer ownership of the described property from the Donor to the Donee without any consideration, payment, or compensation. The transfer is made voluntarily and without coercion.

In accordance with the Texas Property Code, this document serves to transfer ownership of the following described property:

Property Description: __________

This Gift Deed is subject to the following terms and conditions:

- The property is transferred as a gift, and no payment has been exchanged between the Donor and Donee for this transfer.

- The Donor guarantees that the property is free of any liens, encumbrances, and undisclosed claims.

- The Donor assures they hold the right and authority to transfer the property, and that the Donee will receive clear title.

- The Donee accepts the gift and acknowledges that the property is transferred "as is," without any warranty other than the title.

Upon execution of this Gift Deed, the Donee assumes all responsibility for the property, including liability for any taxes or assessments that may be incurred due to the ownership or transfer of the property.

This Gift Deed is executed under and governed by the laws of the State of Texas.

Signed on the date first above written.

Donor's Signature: ___________________________

Donor's Name: __________

Donee's Signature: ___________________________

Donee's Name: __________

State of Texas

County of __________

This document was acknowledged before me on ____ day of __________, 20__, by __________ (Donor) and __________ (Donee).

Notary Public: ___________________________

My Commission Expires: __________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of the Texas Gift Deed | Used to give a piece of property or asset from one person to another without any exchange of money or consideration. |

| Governing Law | Regulated by the Texas Property Code. |

| Document Must Be in Writing | The deed must be a written document according to Texas law. |

| Signature Requirement | Must be signed by the donor (the person giving the gift) in the presence of a notary public. |

| Filing with County Clerk | The signed deed needs to be filed with the County Clerk in the county where the property is located. |

| No Consideration Required | Unlike a sale, a gift deed transfers property without payment or consideration. |

| Revocability | Generally irrevocable if properly executed and delivered, unless specific conditions for revocation are stated. |

| Beneficiary Designation | Allows the donor to designate a recipient (grantee) who will receive the property. |

| Witness Requirement | Some counties may require the signature of one or more witnesses in addition to the notarization. |

Instructions on How to Fill Out Texas Gift Deed

Successfully transferring property in Texas through a gift deed requires careful completion of the necessary documentation. A gift deed is a legal document that transfers ownership of property from one person to another without any exchange of value. The process is straightforward, but attention to detail is crucial to ensure the deed is legally binding and correctly executed. Following these steps carefully will facilitate a smooth transfer of property through a gift deed in Texas.

- Begin with identifying the Grantor(s) - the person or persons giving the property. Provide their full legal name(s), address, and state of residence.

- Identify the Grantee(s) - the recipient(s) of the gift. Include their full legal names, addresses, and states of residence.

- Include a detailed description of the property being gifted. For real estate, this should include the physical address and legal description as found in the property's current deed or tax documents.

- State the relationship between the Grantor and Grantee, if applicable. This clarifies the nature of the gift, especially if the transfer is to a family member or close associate.

- The Consideration section should explicitly state that the property is being transferred as a gift. This is usually phrased as “For and in consideration of Ten Dollars ($10.00) and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, ..” followed by a statement that the property is being transferred without any exchange of value.

- Ensure the Grantor(s) sign the form in the presence of a notary public. The notary will verify the identity of the signatory and the date of signing, then seal the document, making it a legally binding instrument.

- The form must be filed and recorded with the county recorder’s office or county clerk’s office in the jurisdiction where the property is located. This step is critical for the gift deed to be recognized as valid and enforceable. Recording fees will apply.

Upon completing these steps, the property transfer via the gift deed will be official. It's essential to keep copies of the filed deed for your records. Should questions or issues arise with the property in the future, having easy access to this documentation will be invaluable. This process ensures that the property transfer is conducted legally, with the rights and interests of all parties protected under Texas law.

Crucial Points on This Form

What is a Texas Gift Deed form?

A Texas Gift Deed form is a legal document used to transfer property from one person (the donor) to another (the recipient or donee) without any exchange of money or consideration. This form is specifically tailored for use within the state of Texas and is commonly utilized to gift real estate or personal property to family members or close friends. It is important to ensure that the deed is properly completed, signed, and notarized for it to be legally binding.

Do I need to pay taxes on property received through a Texas Gift Deed?

In most cases, the recipient of a gift does not need to pay income tax on the property received. However, there may be other tax implications to consider, such as federal gift taxes for the donor if the value of the gift exceeds the annual exempt amount set by the IRS. Additionally, property taxes and other local taxes may still apply to the recipient. It's advisable to consult with a tax professional to understand the specific tax obligations that might arise from accepting a gift deed.

Is a Texas Gift Deed permanent?

Yes, once a Texas Gift Deed has been properly executed, delivered, and accepted by the recipient, it represents a permanent transfer of property. The donor cannot reclaim the gifted property unless the deed contains specific conditions under which the gift can be revoked. Such conditions should be clearly outlined in the deed, but they are rare and must comply with Texas law.

How do I file a Texas Gift Deed?

After the donor and recipient have both signed the deed and it has been notarized, the deed must be filed with the Clerk of the County Court in the county where the property is located. This process, referred to as "recording" the deed, makes the gift a matter of public record. Recording fees vary by county, so it's a good idea to contact the local County Clerk's office to verify the exact cost and any additional requirements for recording a gift deed.

Can I use a Texas Gift Deed to transfer money?

No, a Texas Gift Deed is specifically designed for the transfer of real estate or tangible personal property. It cannot be used to gift money. To transfer money as a gift, other forms of transfer, such as a bank transfer or gifting a check, would be more appropriate and straightforward.

Are there any special considerations when gifting property to a family member in Texas?

When gifting property to a family member in Texas, it is crucial to consider the potential implications for both parties. This includes understanding any possible impact on Medicaid eligibility, especially for elderly donors, and the responsibility for existing mortgages or liens on the property. Additionally, it's important to consider how the gift affects the estate plan of the donor and the potential need for a formal appraisal to establish the fair market value of the property for tax purposes. Consulting with a legal or tax professional can help navigate these complexities.

Common mistakes

When filling out the Texas Gift Deed form, people often aim to complete the process correctly and swiftly. However, errors can and do occur, potentially complicating what should be a smooth transfer of property. Understanding these common mistakes can help individuals avoid them.

Not Clearly Identifying the Parties Involved - A frequent mistake is not properly identifying the giver (donor) and the receiver (donee) of the gift. This involves more than just names; it should include accurate contact information and addresses to prevent any confusion about who is involved in the transaction.

Failing to Describe the Property Adequately - A gift deed requires a thorough description of the property being transferred. This goes beyond just an address or plot number; it should include legal descriptions and any other identifiers that unambiguously identify the property. When this information is vague or incomplete, it could lead to disputes or complications in the property’s transfer.

Omitting Required Signatures and Notarization - All gift deeds in Texas must be signed by the donor in the presence of a notary public to be legally effective. Sometimes, individuals overlook this step or assume that a less formal acknowledgment is sufficient. However, without the proper notarization, the deed may not be legally binding.

Ignoring the Need for Witness Signatures - While the primary focus is often on the donor's signature and notarization, ensuring that witnesses sign the document is crucial. Witnesses add an additional layer of validity to the document, ensuring all parties understand the deed’s finality.

Forgetting to File the Deed with the County Clerk - After a gift deed is completed, notarized, and witnessed, it must be filed with the county clerk's office in the county where the property is located. Failing to do so means the transfer is not recorded, potentially causing legal headaches for the donee in the future.

Addressing these common errors can streamline the property transfer process, ensuring that both the donor and the donee can carry out their intentions without unnecessary obstacles. A well-prepared gift deed shields all parties from potential future disputes and safeguards the intended transfer of property ownership.

Documents used along the form

When transferring property in Texas through a Gift Deed, various other forms and documents may be required to ensure the transaction complies with state laws and provides a clear record of the transfer. These supporting documents can help streamline the process, offering further details, legal protections, and official registrations needed alongside a Gift Deed. Here is a list of up to ten forms and documents often used in conjunction with a Texas Gift Deed:

- Warranty Deed - This document provides the recipient (grantee) with the highest level of protection, guaranteeing that the giver (grantor) holds a clear title to the property and has the right to transfer it.

- Quitclaim Deed - Unlike a Warranty Deed, a Quitclaim Deed transfers ownership without any guarantees about the property's title, simply conveying whatever interest the grantor has in the property, if any.

- General Warranty Deed - Similar to a Warranty Deed, this document assures the grantee about the condition of the property's title, including protections against any future claims.

- Special Warranty Deed - Offers a middle ground between a General Warranty and Quitclaim Deed, where the grantor only guarantees against title defects that occurred during their ownership.

- Transfer on Death Deed (TODD) - This form allows the property owner to name a beneficiary who will inherit the property upon the owner's death without going through probate.

- Affidavit of Heirship - Used in the absence of a will, this document helps establish ownership of the property when it passes to heirs through inheritance laws.

- Property Tax Exemption Forms - Certain exemptions (like homestead, senior, disabled, or veterans exemptions) may require forms to be filed with the local taxing authority to reduce property taxes.

- Title Insurance Policy - While not a form, purchasing title insurance can protect the grantee from future claims against the property's title not known at the time of transfer.

- Real Estate Transfer Declaration - This form, required in some areas, provides tax authorities with information about the property transfer to assess and update tax records.

- Declaration of Condominium - If the gift property is a condo, this document defines the condominium's common elements and units, essential for clear property definition and rights.

Using these documents in collaboration with a Gift Deed can help ensure a smooth property transfer, offering peace of mind and legal clarity to all parties involved in the transaction. It's important for individuals to understand the purpose and requirement of each document as they navigate through the process of transferring property rights under Texas law.

Similar forms

A Will is similar to a Gift Deed in that both are instrumental in planning the distribution of an individual’s assets upon their death or, in the case of a Gift Deed, potentially during their lifetime. Both documents express the intentions of the owner regarding who should receive specific assets.

A Trust Agreement shares similarities with a Gift Deed as both involve transferring assets to beneficiaries. A Trust Agreement, however, allows for more detailed management instructions and can even specify conditions under which beneficiaries can access the assets.

The Quitclaim Deed and Gift Deed involve transferring property rights, but a Quitclaim Deed is often used between known parties to clear up any title issues and does not guarantee that the title is clear, unlike a Gift Deed which is used to give a gift without consideration.

A Warranty Deed is akin to a Gift Deed in transferring ownership of property but differs as it usually involves a sale and guarantees that the grantor holds a clear title, which means it assures the recipient that the property is free from any claims.

Power of Attorney documents share the feature of allowing one person to make decisions on behalf of another. While a Gift Deed transfers property as a gift, a Power of Attorney might enable someone to manage this transfer among other financial or health-related decisions.

The Bill of Sale is similar to a Gift Deed since both are used to transfer property from one party to another. However, a Bill of Sale is typically used for selling goods, where the buyer pays consideration, unlike a Gift Deed that transfers property as a gift without any consideration.

Transfer-on-Death (TOD) Deed bears resemblance to a Gift Deed as it designates beneficiaries to receive property upon the owner's death, avoiding probate. However, the key difference is that control over the property remains with the owner until death.

A Promissory Note might seem distinct, but it is similar to a Gift Deed in the sense that both can involve transfers. A Promissory Note records a debt and the promise to pay, which can be transferred as a gift in some circumstances, making these legal documents important for estate and financial planning.

Lastly, the Buy-Sell Agreement among business owners regarding the future sale of their business shares can clandestinely operate like a Gift Deed when structured to pass ownership to a person without direct compensation, serving as a planning tool for business succession.

Dos and Don'ts

In Texas, when you're ready to transfer your property to someone else without any payment in return, a Gift Deed form is one way to make it official. Handling this document correctly is crucial to ensure the gift is legally binding and to prevent misunderstandings or disputes down the line. Here's a straightforward guide on what you should and shouldn't do when filling out a Texas Gift Deed form.

Do:- Verify all parties' full legal names and spell them accurately on the form. This helps to ensure there's no confusion about who is involved.

- Include a complete and accurate description of the property being gifted. This typically means the physical address and legal description.

- Sign the document in the presence of a Notary Public to make the deed legally binding. This authenticates the identities of the parties involved.

- Make sure the recipient (grantee) accepts the gift, as this is a requirement for the transfer to be valid.

- File the completed deed with the County Clerk's office in the county where the property is located. This step is necessary for the deed to be recognized legally and to ensure the public record is updated.

- Leave any sections of the form blank. Every field should be filled out to avoid delays or legal challenges.

- Forget to check if witness signatures are required in addition to notarization. Some counties may have specific requirements.

- Assume you don't need legal advice. Consulting with a legal professional can help clarify any uncertainties and ensure the deed is properly filled out and filed.

- Mistake a Gift Deed for a transfer with consideration. Unlike traditional sale transactions, a Gift Deed indicates there's no payment received for the property.

- Underestimate the importance of a property description. A vague or incorrect description can invalidate the deed or create confusion about what property is being transferred.

Correctly filling out and filing a Texas Gift Deed form might seem daunting, but it's a crucial step in gifting property. By paying attention to these dos and don'ts, you'll be on your way to making a smooth and hassle-free transfer. Remember, while this list provides a solid starting point, legal situations can vary widely, so consider seeking personal legal advice tailored to your circumstances.

Misconceptions

When it comes to transferring property in Texas, the Texas Gift Deed form is often misunderstood. People may think it's a straightforward document, but there are several misconceptions that can complicate the process.

- It's just a simple form. A common misconception is that a Gift Deed is a mere formality. In fact, it must meet specific legal requirements in Texas to be valid, including the grantor's intention to gift the property, acceptance by the grantee, and proper delivery and filing.

- Notarization isn't necessary. Quite the contrary, for a Gift Deed to be legally binding in Texas, it must be notarized. This step is crucial to authenticate the document and prevent future disputes.

- You don't need a lawyer to prepare a Gift Deed. While it's technically true that you can prepare a Gift Deed without a lawyer, consulting with one can ensure that the deed meets all legal requirements and truly reflects your intentions without causing unintended legal consequences.

- A Gift Deed avoids future legal issues. Simply executing a Gift Deed doesn't guarantee that there won't be disputes later. For instance, unclear language or failing to address potential claims against the property could lead to legal challenges.

- Gift Deeds are only for real estate. While often used for real estate transactions, Gift Deeds can also transfer personal property. However, the process and form may vary depending on the type of property being gifted.

- Taxes aren't a concern with Gift Deeds. There's a belief that gift deeds allow the donor to avoid taxes. However, depending on the value of the gift, there may be tax implications, including federal gift tax considerations.

- Once given, the property is no longer the grantor's concern. In some cases, if not properly planned, the grantor may face unexpected responsibilities or impacts, such as remaining liable for certain types of property taxes or debts attached to the property.

- The recipient automatically assumes all responsibilities for the property. This is not always the case. The specifics of what responsibilities the grantee assumes should be clearly delineated, and certain encumbrances may remain with the grantor.

- A Gift Deed is irreversible. While it's often intended to be a final transaction, there are circumstances under which a Gift Deed could be contested or revoked, such as fraud or a lack of mental capacity at the time of signing.

Understanding these misconceptions can help individuals better navigate the legal landscape of transferring property through a Gift Deed in Texas. It underscores the value of legal advice and thorough consideration in the process.

Key takeaways

The Texas Gift Deed form is a legal document used to transfer property from one person to another without any payment or consideration. It's a generous act, often among family members, but requires careful handling to ensure the transfer is legal, and the rights of both the giver and receiver are protected. Here are key takeaways to remember when filling out and using this form.

- Understand the purpose: A Gift Deed is specifically designed for gifts of property, where the donor does not expect anything in return. This clarity in intention is crucial for the document to be valid.

- Complete the form accurately: Ensure all required information is filled out correctly. Details such as the full names of the donor and recipient, a legal description of the property, and the date of the gift are essential.

- Notarization is required: For a Texas Gift Deed to be valid, it must be signed by the donor in the presence of a Notary Public. This step is critical for the document's legality and future enforceability.

- Consider the tax implications: While a gift deed transfers property without payment, there may still be federal and state tax considerations. Donors should consult with a tax professional to understand any potential tax liability.

- Record the deed: After the gift deed is properly executed and notarized, it should be filed with the local county clerk's office where the property is located. Recording the deed makes the transfer public record, protecting the recipient's rights to the property.

- Keep copies: Both the donor and recipient should keep signed and notarized copies of the gift deed for their records. This practice ensures that both parties have proof of the transfer and can address any future disputes or questions.

While the act of giving property can be a profound gesture of generosity, it's important that both parties approach the transaction with the seriousness it deserves. The Texas Gift Deed form is a tool that supports this process, providing a clear, legal framework for changing ownership of property. Utilizing this form correctly will help protect the interests of all involved and ensure that the gift is made with full legal effect.

Create Other Gift Deed Forms for US States

Transfer a Deed - This document outlines the details of transferring an asset from one person to another as a gift.

Gift Deed California - Includes specific information about the gift, the giver, and the recipient, avoiding any ambiguity regarding the transfer.