Legal Lady Bird Deed Form

Navigating the transfer of property after one’s demise is a task filled with legal complexities and emotional intricacies. A tool that has gained popularity for its efficiency and simplicity in this domain is the Lady Bird Deed. This particular piece of legal documentation allows property owners to transfer their real estate to beneficiaries upon their death without the need for the property to go through the probate process. Distinguished by its ability to grant the original owner control over the property during their lifetime, including the right to sell or modify the property without the consent of the beneficiaries, it bridges the gap between retaining control over one's assets and ensuring a smooth transition upon one's passing. Its namesake, often associated with Lady Bird Johnson, though the connection is more titular than historical, offers a glimpse into the uniqueness of this legal instrument. Despite its benefits, the Lady Bird Deed is not universally applicable in all states, making it crucial for property owners to understand the legal landscape of their residence before proceeding. As a tool, it exemplifies the intersection of legal foresight and personal legacy, encapsulating the desire to protect one’s assets while minimizing future legal hurdles for loved ones.

Example - Lady Bird Deed Form

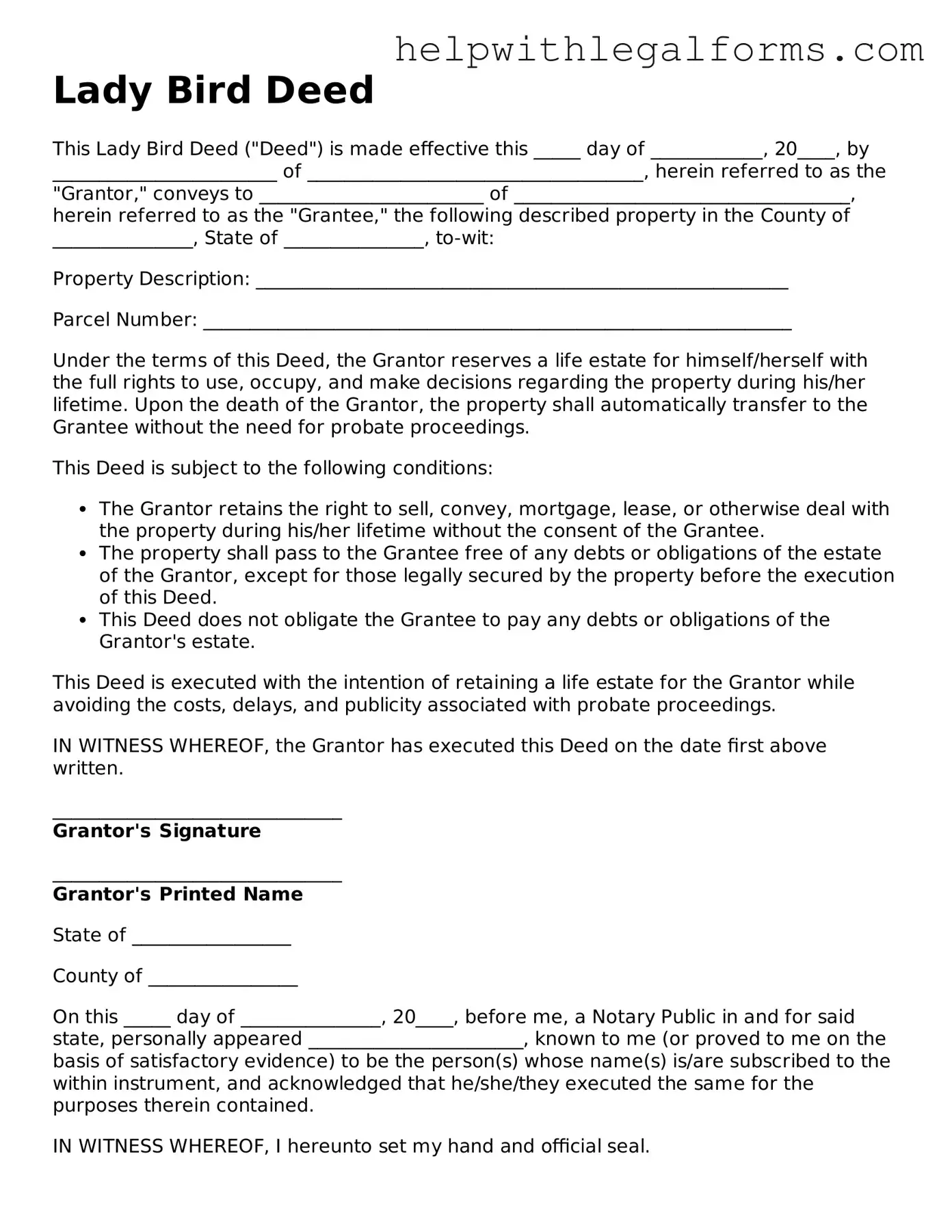

Lady Bird Deed

This Lady Bird Deed ("Deed") is made effective this _____ day of ____________, 20____, by ________________________ of ____________________________________, herein referred to as the "Grantor," conveys to ________________________ of ____________________________________, herein referred to as the "Grantee," the following described property in the County of _______________, State of _______________, to-wit:

Property Description: _________________________________________________________

Parcel Number: _______________________________________________________________

Under the terms of this Deed, the Grantor reserves a life estate for himself/herself with the full rights to use, occupy, and make decisions regarding the property during his/her lifetime. Upon the death of the Grantor, the property shall automatically transfer to the Grantee without the need for probate proceedings.

This Deed is subject to the following conditions:

- The Grantor retains the right to sell, convey, mortgage, lease, or otherwise deal with the property during his/her lifetime without the consent of the Grantee.

- The property shall pass to the Grantee free of any debts or obligations of the estate of the Grantor, except for those legally secured by the property before the execution of this Deed.

- This Deed does not obligate the Grantee to pay any debts or obligations of the Grantor's estate.

This Deed is executed with the intention of retaining a life estate for the Grantor while avoiding the costs, delays, and publicity associated with probate proceedings.

IN WITNESS WHEREOF, the Grantor has executed this Deed on the date first above written.

_______________________________

Grantor's Signature

_______________________________

Grantor's Printed Name

State of _________________

County of ________________

On this _____ day of _______________, 20____, before me, a Notary Public in and for said state, personally appeared _______________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

_______________________________

Notary Public

My Commission Expires: _______________

PDF Form Attributes

| Fact | Description |

|---|---|

| Name Origin | The Lady Bird Deed is named after Lady Bird Johnson, although there is no direct connection to her or legislation she was involved in. |

| Purpose | It allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. |

| Control | The property owner maintains complete control over the property until death, including the right to sell or mortgage. |

| Revocability | This type of deed is revocable, meaning the property owner can change their mind at any time before death. |

| Cost-effectiveness | It is generally a more cost-effective method of estate planning compared to trusts or traditional wills. |

| Medicaid Benefits | It helps in estate planning with regard to Medicaid eligibility, as the property is not considered part of the estate for Medicaid recovery purposes. |

| States Where Used | Primarily used in Texas, Florida, Michigan, Vermont, and West Virginia, among others. Laws vary by state. |

| Governing Law(s) in Texas | In Texas, for example, the Texas Estates Code governs the use and validity of Lady Bird Deeds. |

| Beneficiary Rights | Beneficiaries have no legal right to the property or any decision-making regarding the property until the owner’s death. |

| Property Types | This deed can be used for various types of real estate, including single-family homes, condos, and land. |

Instructions on How to Fill Out Lady Bird Deed

Filling out a Lady Bird Deed form is an important step for property owners who wish to pass on their real estate to beneficiaries while retaining certain rights during their lifetime. This document allows the property to transfer automatically to the named beneficiaries upon the owner’s death, potentially avoiding the need for probate. Understanding how to properly complete this form is crucial to ensure that your wishes are clearly documented and will be honored. Below are the necessary steps to fill out the Lady Bird Deed form.

- Begin by gathering all relevant information about the property, including its legal description, address, and the current deed under which you hold the property. This information is crucial for correctly identifying the property in the deed.

- Identify the current owner(s) of the property as listed on the existing deed. It’s important to use the full legal name(s) and ensure it matches the current deed exactly.

- Decide who you wish to name as the remainder beneficiary(ies). This is the person or persons who will inherit the property upon your death. Full legal names of the beneficiaries are required.

- Prepare to state the specific rights you wish to retain over the property during your lifetime. Typically, this includes the right to sell, lease, or mortgage the property.

- Locate a Lady Bird Deed form that is specific to your state or jurisdiction, as laws can vary significantly. Ensure the form complies with local regulations.

- Fill in the form with the information gathered in Steps 1 through 4, making sure to clearly detail the property description, the current owner’s information, the beneficiary(ies), and the rights retained during the owner’s lifetime.

- Review the deed carefully, ensuring all information is accurate and clearly stated. Errors can lead to disputes or complications in the future.

- Have the deed signed and notarized. The signing requirements can vary by state, but typically the owner(s) must sign the deed in front of a notary public.

- File the completed, signed, and notarized deed with the local county clerk or land records office. There may be a filing fee, which varies by jurisdiction.

- Finally, it is wise to inform the beneficiaries of the deed and where a copy can be found, to ensure they are aware of their future interest in the property.

Each step in filling out the Lady Bird Deed form is crucial for accurately documenting your wishes and ensuring the smooth transfer of your property to your beneficiaries. Taking the time to complete each step carefully can provide peace of mind and clarity for the future.

Crucial Points on This Form

What is a Lady Bird Deed?

A Lady Bird Deed is a special type of property deed used in some states that allows property owners to retain control over their property during their lifetime, including the right to sell or mortgage, and upon their death, the property automatically passes to the named beneficiaries without the need for probate. This deed is beneficial for individuals wanting to ensure a smooth transition of property to their heirs while avoiding the lengthy and costly probate process.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike traditional life estate deeds, where the life tenant's ability to manage the property is significantly limited, a Lady Bird Deed gives the property owner enhanced powers, including the ability to sell, gift, or mortgage the property without the consent of the remainder beneficiaries. This type of deed provides a unique blend of flexibility and control to the property owner, ensuring that they can adjust their plans without needing approval from anyone else.

In which states is a Lady Bird Deed recognized?

A Lady Bird Deed is not recognized in all states. Its validity is typically restricted to a handful of states, such as Florida, Texas, and Michigan, among others. It's crucial for property owners to consult with a legal expert within their state to determine if Lady Bird Deeds are a viable option for estate planning, as real estate and probate laws vary significantly across state lines.

What are the benefits of using a Lady Bird Deed for estate planning?

Utilizing a Lady Bird Deed in estate planning offers several advantages, including avoiding probate, which saves time and money; maintaining control over the property during the owner's lifetime; and providing a straightforward means of transferring property to beneficiaries upon the owner's death. Additionally, it can offer tax advantages, such as avoiding reassessment of the property at current market values for tax purposes in some states. These benefits make the Lady Bird Deed an attractive option for many property owners looking to streamline the transfer of their assets.

Common mistakes

Filling out a Lady Bird Deed requires precision and attention to detail. A mistake can have serious ramifications, affecting property transfer after death without the need for probate. Here are five common errors people make during this process:

-

Not providing precise legal descriptions of the property. It's critical to use the exact legal description found on your deed or title documents. General descriptions or street addresses are not sufficient. This ensures the right property is transferred.

-

Failure to properly identify all parties. Every party involved, including the grantor (the person creating the deed) and the grantee (the beneficiary), must be correctly identified by their full legal names. Nicknames or incomplete names can create confusion and legal challenges.

-

Forgetting to specify the type of transfer. The deed must clearly state that it is transferring property upon the death of the grantor, avoiding probate. Omitting this crucial detail can lead to the deed not working as intended.

-

Overlooking the need for witness signatures and notarization. Like many legal documents, Lady Bird Deeds typically need to be signed in the presence of witnesses and notarized to be valid. Skipping these steps can invalidate the whole document.

-

Not filing the deed with the county recorder’s office. After completing, signing, and notarizing the deed, it must be filed with the appropriate county office. Failure to do so means the deed won't legally transfer the property, as it's not considered part of the public record.

Documents used along the form

When handling real estate planning, a Lady Bird Deed is an important document for transferring property upon death without the need for probate court. However, it is often one piece of a broader estate planning strategy. There are several other forms and documents that are typically used in conjunction with a Lady Bird Deed to ensure a comprehensive plan is in place. These documents help in different aspects, from specifying wishes regarding medical care to designating agents to make decisions on one's behalf.

- Will: A will is a legal document that outlines how a person's property and assets will be distributed upon their death. It can appoint guardians for any minor children and specify final arrangements, complementing the Lady Bird Deed in a complete estate plan.

- Durable Power of Attorney: This document allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. It's crucial for handling matters not covered by the Lady Bird Deed.

- Health Care Power of Attorney: Similar to the Durable Power of Attorney, this document appoints someone to make health care decisions on behalf of the individual if they are unable to do so, ensuring medical wishes are followed.

- Living Will: Also known as an advance directive, it outlines a person's wishes regarding medical treatment in the event they cannot make decisions for themselves. This is often used in conjunction with a Health Care Power of Attorney.

- Revocable Living Trust: This allows an individual to maintain control over their assets while alive but have them transferred to designated beneficiaries upon death, without going through probate. It can be altered or revoked as long as the individual is still capable.

- Declaration of Homestead: This legal document protects a portion of a person's home from creditors in the event of a bankruptcy or financial distress. It doesn't replace a Lady Bird Deed but can offer additional protection for the home.

Using these documents in conjunction with a Lady Bird Deed can provide a clear, legally sound plan for an individual's assets and health care preferences. It's crucial to consult with a legal professional to ensure that each document aligns with the individual's wishes and complies with state laws, offering peace of mind that affairs are in order.

Similar forms

Warranty Deed: Like a Lady Bird Deed, a Warranty Deed is used to transfer property ownership. However, a Warranty Deed provides a guarantee that the property is free from any claims and liens, which is not a feature exclusive to the Lady Bird Deed.

Quitclaim Deed: This document also facilitates property transfer between parties. Unlike a Lady Bird Deed, a Quitclaim Deed does not guarantee a clear title, offering no warranties about the property's lien status.

Life Estate Deed: Both Life Estate Deeds and Lady Bird Deeds allow the original owner to retain certain rights over the property during their lifetime, transferring it upon their death. The key difference lies in the grantor's ability to sell the property without the beneficiary's consent with a Lady Bird Deed.

Transfer on Death Deed (TODD): Similar to a Lady Bird Deed, a TODD allows property to bypass probate and go directly to the designated beneficiary upon the owner’s death. However, TODDs are not recognized in all states.

Revocable Living Trust: A Revocable Living Trust can be altered or revoked by the grantor during their lifetime. It shares the probate avoidance feature with the Lady Bird Deed, as the property is transferred directly to the beneficiaries upon the grantor's death.

Joint Tenancy with Right of Survivorship: This form of co-ownership permits the property to pass to the surviving owner(s) upon one's death, akin to the Lady Bird Deed's direct beneficiary transfer, bypassing probate.

Beneficiary Deed: Similar to the Lady Bird Deed, a Beneficiary Deed allows property owners to name a beneficiary who will inherit the property upon the owner’s death, circumventing probate court.

Grant Deed: A Grant Deed is used to transfer property from one person to another. While it confirms that the property has not been sold to someone else, it provides fewer protections compared to a Warranty Deed and lacks the retained life interest of a Lady Bird Deed.

Intestate Succession Laws: Although not a document, Intestate Succession Laws dictate property distribution when someone dies without a will. Lady Bird Deeds preempt these laws by establishing a clear beneficiary, ensuring that the property passes according to the owner’s wishes and not state default rules.

Dos and Don'ts

A Lady Bird Deed, also known as an enhanced life estate deed, is a useful legal instrument for property management and estate planning. It allows the property owner to retain control during their lifetime and automatically transfer the property to a designated beneficiary upon their passing, bypassing the probate process. Properly filling out this form is crucial. Here's what you should and shouldn't do to ensure its effectiveness.

What You Should Do- Consult with an estate planning attorney: Laws vary by state, and it's essential to ensure that this deed is valid and beneficial for your specific situation.

- Clearly identify the property: Include the full legal description of the property as recorded in the county records to avoid any ambiguity about which property is being transferred.

- Name the beneficiaries accurately: Use full legal names and specify their relationship to you to avoid any confusion or disputes among potential heirs after your death.

- Sign and notarize the document: In front of a notary public, you must sign the deed. Many states require witnesses in addition to notarization. Check your state's requirements to ensure proper execution.

- Fill out the deed without legal advice: Failing to understand the intricacies of your state's laws can render the deed ineffective or create unintended consequences for your estate.

- Omit any potential beneficiaries to "keep things simple": This can lead to disputes or unintended exclusion of loved ones. Clearly outline all intended beneficiaries.

- Forget to file the deed with the county clerk's office: An unrecorded deed can cause complications and may not effectively transfer the property upon your passing.

- Use unclear or ambiguous language: Vague descriptions of the property or beneficiaries can lead to interpretations that conflict with your intentions, potentially requiring court intervention to resolve.

Misconceptions

Lady Bird Deeds, often seen as a versatile estate planning tool, carry with them a fair share of misconceptions. Understanding these can shed light on their practical applications and limitations, ensuring they are utilized effectively. Here, we aim to clarify some of the common misunderstandings associated with Lady Bird Deeds.

- They Allow You to Avoid Probate in Every State: A common misconception is that Lady Bird Deeds can be used to avoid probate in any U.S. state. In reality, their acceptance varies by state law. Only a handful of states recognize the use of Lady Bird Deeds as a valid method to transfer property and avoid probate.

- They Provide Complete Protection Against Creditors: While it's true that Lady Bird Deeds can offer some level of protection against claims from creditors, they do not provide an absolute shield. Creditors may still have a claim against the property, especially if the deed is seen as an attempt to defraud creditors.

- They Can Replace a Will: Another misunderstanding is the belief that a Lady Bird Deed can replace a will entirely. Although the deed can transfer real estate according to the grantor's wishes, it doesn't cover other aspects of estate planning, such as the distribution of personal property, that a comprehensive will would.

- They Result in Higher Taxes: Some people assume that utilizing a Lady Bird Deed will lead to higher property taxes or affect eligibility for tax exemptions. On the contrary, since the property owner maintains control and ownership until death, property tax status typically remains unchanged, and exemptions (like homestead) are preserved.

- Only for the Elderly: The misconception that Lady Bird Deeds are only useful for the elderly can limit their consideration by younger property owners. In fact, these deeds can be a proactive estate planning measure for any property owner looking to streamline the transfer of their properties while retaining the right to use and profit from them during their lifetime.

- Complex and Expensive to Create: There is a belief that Lady Bird Deeds are overly complex and expensive to create. Although it's essential to get them right, creating a Lady Bird Deed can be a straightforward process with the help of a knowledgeable attorney, and typically, they are less expensive than the cost associated with probate or the creation of a living trust.

- They Disqualify You From Medicaid: Finally, a major concern is that transferring property via a Lady Bird Deed might disqualify the grantor from Medicaid. While Medicaid eligibility requires careful planning, properly executed Lady Bird Deeds are designed in a way that the transfer of property should not affect Medicaid eligibility, mainly because the grantor retains an interest in the property for life.

Dispelling these misconceptions helps property owners make informed decisions regarding their estate plans. Lady Bird Deeds offer a flexible option for many, but like any legal tool, they work best when their use is tailored to individual circumstances and state laws.

Key takeaways

The Lady Bird Deed, a unique estate planning tool, offers several benefits and considerations that are essential for property owners to understand. This form of property transfer allows the current owner to retain control over the property until their death, at which point it is automatically transferred to the designated beneficiaries without the need for probate. Here are eight key takeaways for effectively filling out and using the Lady Bird Deed form:

- Understanding the Purpose: A Lady Bird Deed allows property owners to pass real estate to beneficiaries immediately upon their death without the property having to go through the probate process. This can save time and money for the beneficiaries.

- Retain Control: The current owner retains full control over the property until death, including the right to sell or mortgage the property. It’s essential to understand that this deed does not restrict the owner's ability to manage the property as they see fit during their lifetime.

- State-Specific: Not all states recognize the Lady Bird Deed. Before proceeding, ensure that it is a legally valid option in your state. Consultation with a legal professional familiar with your state’s laws is advisable.

- Clear Beneficiary Designation: Clearly identify the beneficiary or beneficiaries who will receive the property upon the death of the current owner. Incorrect or vague designations can lead to disputes or probate, which undermines the deed's purpose.

- Avoid Probate: One of the primary advantages of a Lady Bird Deed is the avoidance of the probate process for the property in question. This can significantly expedite the transfer of property to the beneficiaries and reduce associated costs.

- Does Not Replace a Will: Although a Lady Bird Deed can be an effective tool for transferring real estate, it does not replace a will. Other assets not included in the deed will still need to be addressed through a will or other estate planning documents.

- Tax Considerations: The use of a Lady Bird Deed can have implications for estate taxes, capital gains taxes, and property taxes. It’s important to understand these implications to avoid unexpected tax liabilities for the owner or the beneficiaries.

- Legal Assistance: Given the legal complexities and the significant implications of incorrectly filling out the Lady Bird Deed form, seeking the assistance of a lawyer who specializes in estate planning is highly recommended. They can provide guidance specific to your situation and help ensure that the deed achieves its intended purpose without unforeseen consequences.

Properly utilized, a Lady Bird Deed can be an effective component of a comprehensive estate plan, offering a smooth and cost-effective transfer of property to the next generation. However, due to the potential for complexity and the need for precise execution, professional legal advice is strongly advised to ensure that all aspects of the deed are correctly addressed.

Discover Other Types of Lady Bird Deed Documents

Deed of Trust Form - It details borrower responsibilities, including insurance maintenance and property tax payments, safeguarding the property's value.

Property Gift Deed Rules - In case of disputes or legal questions, this document serves as concrete evidence of the transfer’s terms and parties involved.

How Long Does a Quit Claim Deed Take to Process - A favored approach for transferring ownership in non-arm's length transactions where trust exists between parties.