Blank Lady Bird Deed Form for Florida

Navigating the nuances of estate planning in Florida can seem like a daunting task, but the Florida Lady Bird Deed form offers a unique tool for homeowners to efficiently transfer property to their beneficiaries without the need for a traditional will or going through probate. This specialized deed, also known as an enhanced life estate deed, enables the property owner to retain control over their property during their lifetime, including the freedom to sell or modify the property, with the automatic transfer to the designated beneficiaries upon the owner’s death. The appeal of this deed lies in its simplicity and effectiveness in bypassing the often lengthy and costly probate process, providing peace of mind for property owners and their heirs alike. Understanding how to properly utilize a Lady Bird Deed, the benefits it offers, and any potential drawbacks is critical for anyone looking to include real estate in their estate planning strategy in Florida.

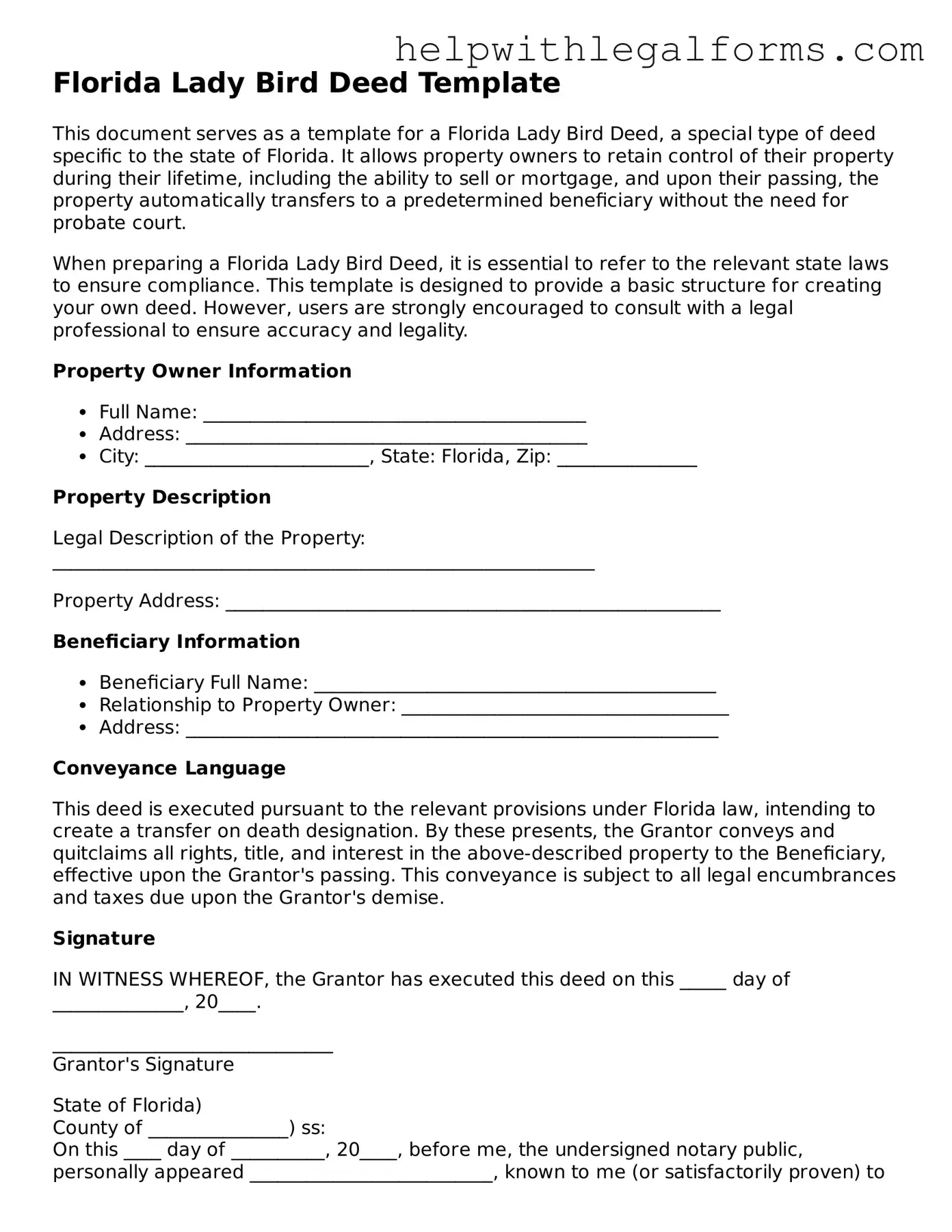

Example - Florida Lady Bird Deed Form

Florida Lady Bird Deed Template

This document serves as a template for a Florida Lady Bird Deed, a special type of deed specific to the state of Florida. It allows property owners to retain control of their property during their lifetime, including the ability to sell or mortgage, and upon their passing, the property automatically transfers to a predetermined beneficiary without the need for probate court.

When preparing a Florida Lady Bird Deed, it is essential to refer to the relevant state laws to ensure compliance. This template is designed to provide a basic structure for creating your own deed. However, users are strongly encouraged to consult with a legal professional to ensure accuracy and legality.

Property Owner Information

- Full Name: _________________________________________

- Address: ___________________________________________

- City: ________________________, State: Florida, Zip: _______________

Property Description

Legal Description of the Property: __________________________________________________________

Property Address: _____________________________________________________

Beneficiary Information

- Beneficiary Full Name: ___________________________________________

- Relationship to Property Owner: ___________________________________

- Address: _________________________________________________________

Conveyance Language

This deed is executed pursuant to the relevant provisions under Florida law, intending to create a transfer on death designation. By these presents, the Grantor conveys and quitclaims all rights, title, and interest in the above-described property to the Beneficiary, effective upon the Grantor's passing. This conveyance is subject to all legal encumbrances and taxes due upon the Grantor's demise.

Signature

IN WITNESS WHEREOF, the Grantor has executed this deed on this _____ day of ______________, 20____.

______________________________

Grantor's Signature

State of Florida)

County of _______________) ss:

On this ____ day of __________, 20____, before me, the undersigned notary public, personally appeared __________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained. In witness whereof, I hereunto set my hand and official seal.

______________________________

Notary Public

My Commission Expires: ______________

Witnesses

As required by Florida law, this deed must be duly witnessed by two individuals. Witnesses must sign in the presence of the Grantor and each other.

- Witness #1 Name: _________________________________________________

- Address: _________________________________________________________

- Signature: ___________________________________ Date: ______________

- Witness #2 Name: _________________________________________________

- Address: _________________________________________________________

- Signature: ___________________________________ Date: ______________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Florida Lady Bird Deed is a legal document that allows property to be automatically transferred to a new owner upon the death of the original owner, without the need for probate court. |

| Governing Law | This form is governed by Florida state laws, specifically those laws that pertain to estate planning and real property. |

| Control During Lifetime | The original owner retains full control over the property until their death, including the right to sell or modify the property. |

| Benefits | It helps to avoid the time and expense of probate, ensures a smoother transition of property, and can be a useful tool in estate planning. |

Instructions on How to Fill Out Florida Lady Bird Deed

Completing a Florida Lady Bird Deed form is an important process for property owners wishing to transfer ownership upon their passing without the need for probate. This document allows the current property owner to retain control over the property during their lifetime, including the right to sell or mortgage the property, while designating beneficiaries to automatically receive the property upon the owner's death. Follow these steps carefully to ensure the deed is filled out correctly and legally.

- Begin by gathering all necessary information, including the legal description of the property, the full names and addresses of the current owner(s) and the designated beneficiary or beneficiaries.

- At the top of the form, write the full name and address of the person preparing the deed.

- Enter the current property owner’s name(s) and mailing address(es) in the section designated for the Grantor(s).

- In the section titled “After-Acquired Title,” ensure the legal description of the property is accurately copied from a previous deed or property tax statement to avoid discrepancies.

- Specify the name(s) of the beneficiary(ies) in the section for the Grantee(s), alongside their mailing address(es). It's vital to clarify their relationship to the Grantor, if any, to prevent any ambiguity.

- Detail any conditions or stipulations under which the property is to be transferred. This may include specific actions the beneficiary must take or conditions that must be met for the property transfer to become effective.

- Have the Grantor(s) sign and date the deed in the presence of two witnesses. Both witnesses must also sign the document, verifying they observed the Grantor(s) signing.

- The deed must then be notarized. This involves a notary public verifying the identity of the Grantor(s) and witnesses, and then signing and sealing the document.

- Finally, file the completed and notarized deed with the county clerk’s office in the county where the property is located. There may be a filing fee, which varies by county.

Once the deed is properly filed, it becomes part of the official property records, ensuring the property will seamlessly transfer to the designated beneficiary(ies) without the need for probate. Remember, it's important to consult with a legal professional if there are any questions or if complex issues arise during the process of completing the Lady Bird Deed form.

Crucial Points on This Form

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed is a legal document that enables property owners to transfer their property to heirs automatically upon their death without the need for probate. This type of deed maintains the owner's right to use and control the property during their lifetime, including the ability to sell or mortgage the property, without the consent of the future beneficiaries.

How does a Lady Bird Deed work in Florida?

When a property owner executes a Lady Bird Deed, they are effectively creating a transfer-on-death designation for their real estate. The owner names one or more beneficiaries who will receive the property upon the owner's death. Until then, the owner retains full control over the property. Upon the owner's demise, the property passes directly to the named beneficiaries, bypassing the probate process.

What are the benefits of using a Lady Bird Deed?

The main benefits include avoiding the time-consuming and often costly probate process, maintaining the owner's complete control over the property during their lifetime, and potentially providing tax advantages related to inheritance. Additionally, it can offer a way to plan for Medicaid eligibility without affecting the owner's ability to qualify for such benefits.

Can a Lady Bird Deed be revoked?

Yes, one of the unique features of a Lady Bird Deed is that the original property owner retains the right to revoke it at any time during their lifetime. This provides flexibility and control, as the owner can change their mind about the beneficiary or wishes to sell the property.

Is a Lady Bird Deed right for everyone?

While a Lady Bird Deed offers many advantages, it is not the best option for everyone. Property owners should consider their overall estate planning goals, the potential impact on taxes and Medicaid planning, and the specific laws and regulations governing Lady Bird Deeds in Florida. Consulting with an estate planning attorney can provide clarity and guidance tailored to individual circumstances.

How can one create a Lady Bird Deed in Florida?

To create a Lady Bird Deed in Florida, the property owner must prepare a deed that includes specific language to establish the transfer-on-death intent, names the beneficiaries, and retains the owner's rights to use, sell, or mortgage the property. The deed must be signed in the presence of a notary and two witnesses. Finally, for the deed to be effective, it must be recorded with the county recorder's office in the county where the property is located.

Common mistakes

Filling out the Florida Lady Bird Deed form requires attention to detail and a clear understanding of property transfer upon death. Despite its advantages in estate planning, errors can compromise the deed's validity and the owner's intentions. Below are seven common mistakes people make with this form.

- Not Specifying the Correct Legal Description of the Property: A precise legal description is crucial; relying solely on the property's address can lead to misunderstandings and legal complications.

- Failure to Properly Identify the Beneficiaries: It's essential to clearly name all intended beneficiaries, including their full legal names, to avoid future disputes or confusion.

- Forgetting to Sign and Notarize the Document: For the deed to be legally binding, it must be signed in the presence of a notary and, in some cases, witnesses.

- Omitting the Reservation of Life Estate: The essence of a Lady Bird Deed is to retain control over the property during the grantor's lifetime. Not including this reservation can nullify the intended effect.

- Assuming It Automatically Overrides Other Estate Documents: A Lady Bird Deed works alongside other estate planning tools, but assumptions about its primacy without proper legal advice can lead to unintended outcomes.

- Improper Filing with the Local Records Office: After execution, the deed needs to be correctly filed with the appropriate local government office. Failing to do so prevents the deed from taking effect.

- Using an Incorrect or Outdated Form: Estate laws can change, rendering forms obsolete. Utilizing the most current form is essential for the deed's validity.

In conclusion, careful completion and filing of the Florida Lady Bird Deed form, with attention to these common pitfalls, can ensure property is transferred smoothly and according to the owner's wishes.

Documents used along the form

When dealing with estate planning and property transfer in Florida, the Lady Bird Deed is a unique and powerful tool. It allows the property owner to retain control over the property during their lifetime while ensuring a smooth transfer to beneficiaries upon their death, without the need for probate. However, to effectively manage an estate or property, other documents might need to be used in conjunction with the Lady Bird Deed. These forms and documents play various roles, from specifying wishes regarding medical care to outlining the complete distribution plan for all assets.

- Living Will - A document that spells out what types of medical treatment are desired towards the end of life if the individual is unable to make decisions for themselves.

- Durable Power of Attorney for Finances - This grants a trusted person the authority to manage the financial affairs of the individual, should they become incapacitated.

- Health Care Surrogate Designation - Similar to a durable power of attorney, but specifically for making health care decisions, this document appoints someone to make medical decisions on the individual's behalf if they're unable to do so.

- Revocable Living Trust - A form of estate plan that manages and protects assets as the grantor, or owner, ages. It allows for a seamless transfer of assets to beneficiaries, often without the need for probate, similar to a Lady Bird Deed.

- Last Will and Testament - While the Lady Bird Deed covers real estate, a Last Will and Testament covers the distribution of other assets and can appoint guardians for minor children.

- Declaration of Preneed Guardian - This document specifies the individual's preference for a guardian in the event they become incapacitated before dying.

- Warranty Deed - In cases where a Lady Bird Deed may not be suitable, a Warranty Deed can transfer ownership of property with guarantees about the title's status.

- Quitclaim Deed - This is used to transfer interest in real property without any warranties regarding the title. It's often used between family members or to clear up title issues.

- Personal Property Memorandum - Attached to a will, this document lists personal property items not specifically distributed in the will itself and names who gets each item.

Together, these documents create a comprehensive approach to estate planning and property management. While the Lady Bird Deed is a valuable component for passing on real estate efficiently, the additional documents ensure broad coverage of financial, medical, and personal decisions. Understanding and implementing these forms correctly can provide a solid foundation for managing one’s estate, offering peace of mind to both the property owner and their beneficiaries.

Similar forms

Transfer on Death Deed (TODD): Similar to a Lady Bird Deed, a Transfer on Death Deed allows property owners to pass their real estate directly to a beneficiary upon their death without the property having to go through probate. Both documents allow the property to bypass the time-consuming and possibly costly probate process, streamlining the transfer of property ownership.

Living Trust: Like a Lady Bird Deed, a Living Trust can be used to manage and transfer assets upon the grantor's death without probate. Owners retain control over their assets during their lifetime and can specify terms for their distribution after death. Both create mechanisms for a more efficient asset transfer process than traditional wills.

Last Will and Testament: A Last Will and Testament outlines how a person’s estate should be distributed after their death. While a Will covers a broad range of assets and requires probate, a Lady Bird Deed is specific to real estate and avoids probate. Both documents express the property owner's intentions for the disposition of their assets.

Joint Tenancy with Right of Survivorship (JTWROS): This document allows co-owners of property to automatically inherit the other's share upon their death. Similar to a Lady Bird Deed, it helps avoid probate by facilitating the direct transfer of property. However, it requires co-ownership, while a Lady Bird Deed can be unilateral.

Beneficiary Deed: Another deed that avoids probate, a Beneficiary Deed also permits property owners to name someone to inherit their property upon death. Functionally, it's similar to a Lady Bird Deed by streamlining the transfer of property, although the specific legal mechanisms and availability by jurisdiction can vary.

Revocable Transfer on Death (TOD) Agreement: This document applies to personal property like bank accounts and securities, allowing owners to name beneficiaries who will inherit upon their death, avoiding probate. It parallels the Lady Bird Deed’s function for real estate, extending the concept of direct transfer to other asset types.

Durable Power of Attorney for Asset Management: This allows an individual to designate another person to manage their assets if they become incapacitated. Although it serves a different function during the owner’s life, it shares the goal of a Lady Bird Deed in planning for the efficient management and transition of assets under specific circumstances.

Life Estate Deed: A Life Estate Deed enables a property owner to transfer their property while retaining the right to use and live in it until death. Similar to a Lady Bird Deed, a Life Estate Deed involves planning for future property transfer without relinquishing current property control, though a Lady Bird Deed provides more flexibility in that the owner can sell or mortgage the property without the beneficiary's consent.

Dos and Don'ts

Filling out a Florida Lady Bird Deed requires great care and attention to detail. This legal document, often used to transfer property upon the death of the property owner without the need for probate, can have significant legal and tax implications. For those completing this form, here are things you should and shouldn't do:

Do:Verify eligibility: Ensure that the property and situation meet all Florida legal requirements for a Lady Bird Deed. It's specific to certain types of property and ownership situations.

Include precise legal descriptions: Use the exact legal description of the property as recorded in the county records. This is crucial for the deed's validity.

Consult a legal professional: Seeking advice from a lawyer experienced in estate planning and real estate can ensure that the deed fulfills its intended purpose without unforeseen consequences.

Clearly identify the remainder beneficiaries: Specify who will inherit the property clearly and unambiguously to avoid any confusion or legal disputes after the grantor's death.

Sign in the presence of a notary: The deed must be notarized to be valid. Ensure all parties sign the deed in the presence of a Florida notary public.

Record the deed promptly: Once signed, record the deed with the appropriate county office to make it effective. Delays can complicate or invalidate the transfer.

Review the deed periodically: Circumstances change, so review and, if necessary, update the deed to reflect current wishes regarding the property.

Overlook tax implications: Understand how a Lady Bird Deed affects estate and property taxes. While it offers advantages, each situation is different.

Assume it's right for everyone: Although powerful, a Lady Bird Deed is not suitable for all properties or estate plans. Assess all options.

Forget to coordinate with other estate planning tools: Ensure that the deed works in harmony with wills, trusts, and other estate planning documents.

Use generic forms without customization: Each property and family situation is unique. A deed that isn't tailored to specific needs can be ineffective or problematic.

Skip details about the life estate: The deed must clearly grant the original owner continued use and control over the property during their lifetime.

Ignore potential eligibility for government benefits: A Lady Bird Deed can affect eligibility for Medicaid and other government aid. Consider this in broader estate planning.

Forget to consider the impact on heirs and beneficiaries: Discuss plans with potential heirs to prevent surprises and ensure that the deed aligns with broader estate goals.

Misconceptions

A Lady Bird deed, often utilized in Florida, is a legal document that enables property owners to transfer their property to others upon their death without the need for probate. Despite its benefits, there are several misconceptions about the Lady Bird deed form:

It's only for women. The name "Lady Bird" deed might suggest that it is exclusively for women, but this is not the case. The deed is available to all property owners regardless of gender.

It avoids all types of taxes. While a Lady Bird deed can help avoid probate, it does not necessarily avoid all types of taxes. Property owners are still subject to estate and property taxes as applicable.

It's recognized in all states. Not every state recognizes the Lady Bird deed. Its use is limited to a handful of states, including Florida, where it is a recognized estate planning tool.

It offers the same protections as a trust. Although a Lady Bird deed can offer some of the benefits of a trust, such as avoiding probate, it does not provide the comprehensive asset protection or control over the distribution of assets that a trust does.

It's a complicated process. Many believe that executing a Lady Bird deed is complicated. However, with proper legal guidance, the process can be straightforward and efficient.

It transfers property immediately. Some might think that signing a Lady Bird deed means that the property is transferred immediately. However, the transfer only occurs upon the death of the property owner.

It can't be revoked. Unlike other forms of property transfer deeds, a Lady Bird deed allows the property owner to retain control over the property, including the right to revoke the deed or sell the property at any time.

There are no drawbacks. While Lady Bird deeds can be beneficial, they are not suitable for everyone. Potential drawbacks include the impact on Medicaid eligibility and the possibility that beneficiaries might not agree with the property distribution.

Key takeaways

Filling out and using a Florida Lady Bird Deed form correctly is essential for effectively managing and transferring property upon one’s passing without the need for probate court intervention. This specialized deed allows you to retain control over your property until your death, at which point the property is transferred to the designated beneficiaries. Here are key takeaways to keep in mind:

- Understand the Purpose: The Lady Bird Deed, also known as an enhanced life estate deed, is unique in that it allows the original property owner to maintain control over the property during their lifetime, including the ability to sell or mortgage, while designating a beneficiary to automatically inherit the property upon their death.

- Determine Eligibility: Not every state recognizes Lady Bird Deeds. It's crucial to ensure that this estate planning tool is valid and effective in Florida, which is one of the few states that does.

- Identify Beneficiaries Clearly: When filling out the form, clearly identify the beneficiary or beneficiaries who will inherit the property. Ambiguities can lead to complications and potentially defeat the purpose of avoiding probate.

- Consult with a Professional: Despite the form's seeming simplicity, it's advisable to consult with an estate planning attorney or a professional document preparer who is familiar with Florida laws to ensure the deed meets all legal requirements and accurately reflects your intentions.

- Sign in the Presence of a Notary: For the Lady Bird Deed to be valid, it must be signed by the current property owner in the presence of a notary public. This formalizes the document and is a critical step in its execution.

- Record the Deed: After signing, the deed must be recorded with the local county recorder’s office. Recording the deed makes it a matter of public record, which is necessary for the transfer of property to the beneficiary upon the owner's death.

- Understand the Tax Implications: One of the benefits of a Lady Bird Deed is the potential to avoid certain tax implications. However, it's essential to understand how the deed might affect estate taxes and the beneficiary’s basis in the property for capital gains tax purposes.

- Revoke if Necessary: The owner retains the right to revoke the deed at any time during their lifetime. If circumstances change, the property owner can choose to alter the beneficiary designation or cancel the deed altogether, providing a level of flexibility not found in all estate planning tools.

Incorporating a Lady Bird Deed into your estate plan can offer significant benefits, including avoiding probate and simplifying the transfer of property. However, it’s vital to approach this document with care and proper legal guidance to ensure it aligns with your overall estate planning goals and complies with Florida law.

Create Other Lady Bird Deed Forms for US States

Lady Bird Deed Form Texas - It's particularly useful in avoiding fragmentation of land ownership among multiple heirs, promoting a clear line of succession.