Blank Lady Bird Deed Form for Texas

In the heart of Texas, where the real estate landscape stretches as far and wide as the eye can see, a unique vehicle for managing property ownership transition stands out: the Texas Lady Bird Deed. This especial tool, named whimsically after the first lady Lady Bird Johnson due to its widespread use in Texas, though there’s no official correlation, offers homeowners a remarkable option to pass on real estate to their heirs smoothly, without the need to navigate the often complex and costly process of probate court. It allows the property owner, or grantor, the freedom to retain control over their property during their lifetime, including the right to sell or mortgage, yet ensures the direct transfer to a predetermined beneficiary upon their passing. What sets it apart from regular deeds is its ability to preserve the grantor's rights until the very end, coupled with its beneficial impact on the beneficiary’s ability to sidestep probate, and in certain situations, positively affect the property’s eligibility for Medicaid. The Texas Lady Bird Deed form, with its unique blend of benefits - from avoiding the legal entanglements of probate, ensuring a smoother transition of assets, to potentially safeguarding against Medicaid estate recovery - embodies a powerful testament to the foresight and practicality entrenched in Texas real estate planning. Understanding the major aspects of this form can unravel many a knot for homeowners looking ahead, keen on leaving a legacy with minimal fuss and maximum efficiency.

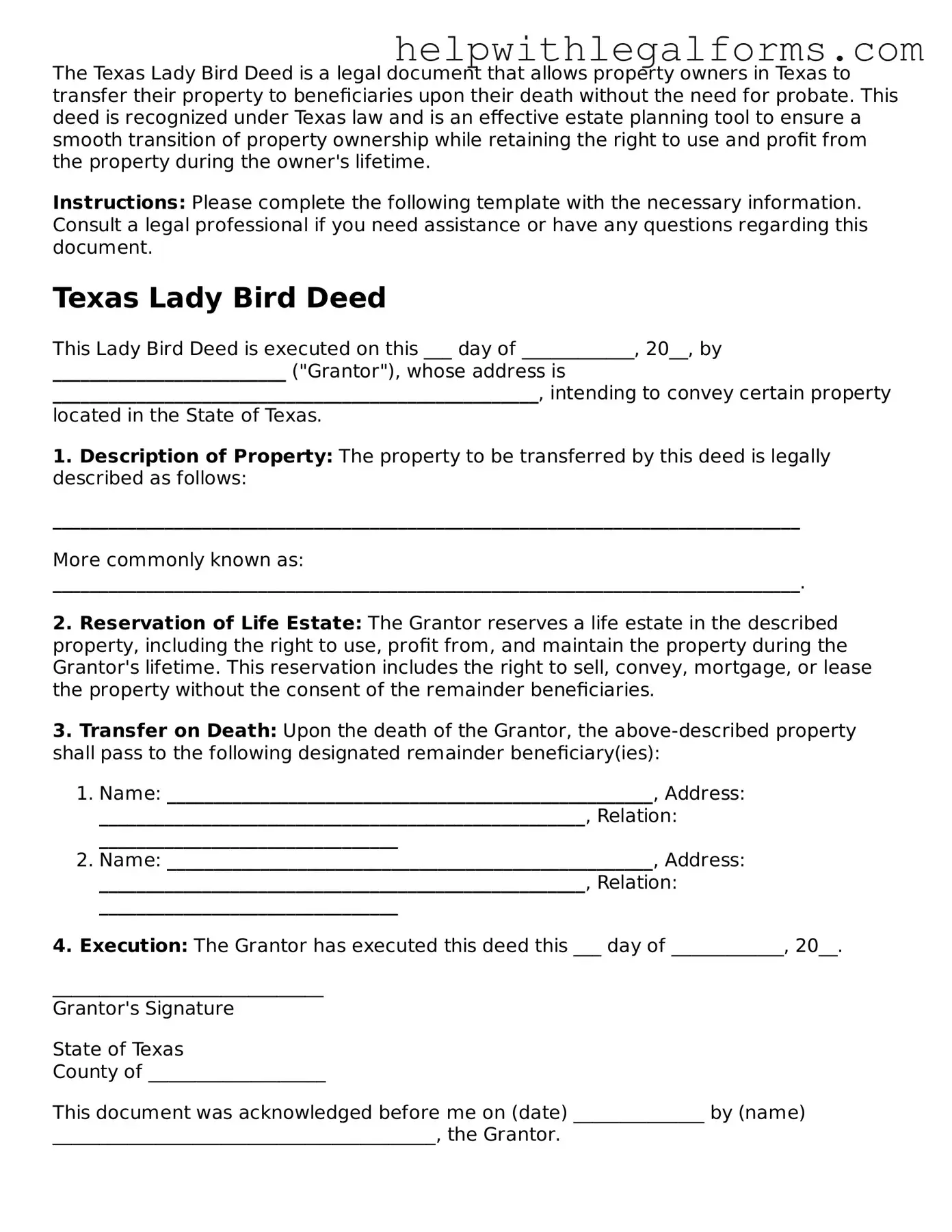

Example - Texas Lady Bird Deed Form

The Texas Lady Bird Deed is a legal document that allows property owners in Texas to transfer their property to beneficiaries upon their death without the need for probate. This deed is recognized under Texas law and is an effective estate planning tool to ensure a smooth transition of property ownership while retaining the right to use and profit from the property during the owner's lifetime.

Instructions: Please complete the following template with the necessary information. Consult a legal professional if you need assistance or have any questions regarding this document.

Texas Lady Bird Deed

This Lady Bird Deed is executed on this ___ day of ____________, 20__, by _________________________ ("Grantor"), whose address is ____________________________________________________, intending to convey certain property located in the State of Texas.

1. Description of Property: The property to be transferred by this deed is legally described as follows:

________________________________________________________________________________

More commonly known as: ________________________________________________________________________________.

2. Reservation of Life Estate: The Grantor reserves a life estate in the described property, including the right to use, profit from, and maintain the property during the Grantor's lifetime. This reservation includes the right to sell, convey, mortgage, or lease the property without the consent of the remainder beneficiaries.

3. Transfer on Death: Upon the death of the Grantor, the above-described property shall pass to the following designated remainder beneficiary(ies):

- Name: ____________________________________________________, Address: ____________________________________________________, Relation: ________________________________

- Name: ____________________________________________________, Address: ____________________________________________________, Relation: ________________________________

4. Execution: The Grantor has executed this deed this ___ day of ____________, 20__.

_____________________________

Grantor's Signature

State of Texas

County of ___________________

This document was acknowledged before me on (date) ______________ by (name) _________________________________________, the Grantor.

________________________________

Notary Public, State of Texas

My Commission Expires: ______________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Lady Bird Deed is a legal document that allows property owners to retain control over their property until death, at which point it automatically transfers to a designated beneficiary without the need for probate. |

| Governing Law | Though not explicitly defined by Texas statutes, the use of Lady Bird Deeds is recognized and governed under general Texas property and estate law principles. |

| Benefits | It offers benefits such as avoiding probate, simplifying the transfer of property, and potentially providing certain Medicaid eligibility advantages. |

| Limitations | The deed does not protect the property from all claims, such as federal tax liens, and may impact the grantor's eligibility for some forms of public assistance. |

| Revocability | One of the key features of a Lady Bird Deed is its revocability, allowing the grantor to change their mind at any time prior to their death. |

Instructions on How to Fill Out Texas Lady Bird Deed

Filling out a Texas Lady Bird Deed form is a practical step for property owners who want to plan their estate. This document allows the property to pass on to a named beneficiary without going through probate. Here are the steps you need to follow to complete the form accurately. Remember, the process requires attention to detail to ensure your real estate is transferred as intended.

- Begin by identifying the preparer. This person can be you, an attorney, or someone else who is assisting with the deed. Write their name and address at the top of the form.

- Next, specify the “After Recording Return To” information. This is where the deed will be sent after it's filed. Include the name and address of the individual or entity.

- Enter the name of the county where the property is located under the “County of” section.

- List the current owner(s) of the property, also known as the grantor(s), including their full legal names and mailing addresses.

- Specify the legal description of the property. This includes lot numbers, subdivision names, or any other details that appear on the official deed. If necessary, attach a separate sheet with the complete legal description.

- Identify the beneficiary(ies), also known as the grantee(s). Include full legal names along with mailing addresses. Clearly state that the property will pass to these beneficiaries upon the grantor's death.

- In the section provided, describe any conditions or limitations of the life estate. This includes specifying that the grantor reserves the right to sell or use the property during their lifetime.

- Sign and date the deed. The grantor(s) must sign the deed in the presence of a notary public. Make sure the signatures are properly witnessed as required.

- Have the deed notarized. The notary public will fill out their section, sign, and seal the deed, making it official.

- Finally, file the completed deed with the county clerk's office in the county where the property is located. Pay any required filing fees.

After these steps are completed, the Texas Lady Bird Deed will be effective. This means the property will automatically transfer to the named beneficiary when the time comes, without the need for court involvement. It's a simple process that can provide peace of mind and ensure your property passes according to your wishes.

Crucial Points on This Form

What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a special type of property deed used in estate planning to transfer property upon the death of the owner, without the need for probate. It allows the current property owner to retain control over the property during their lifetime, including the right to use, sell, or mortgage the property, and then automatically transfers the property to a designated beneficiary upon their death.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike traditional life estate deeds, a Lady Bird Deed grants the original owner more flexibility. The key difference lies in the retained rights by the current owner. With a traditional life estate deed, the current owner (life tenant) cannot sell or mortgage the property without the agreement of the remainder beneficiaries. However, a Lady Bird Deed allows the current owner to retain these rights, making it possible to sell, mortgage, or otherwise dispose of the property without needing consent from the future beneficiaries.

What are the benefits of using a Texas Lady Bird Deed?

One of the primary benefits is the avoidance of probate for the property specified in the deed, which can save time and legal fees. It also provides peace of mind and control for the property owner, who can retain full use and control of the property until their death. Additionally, it can help in maintaining eligibility for certain benefits, such as Medicaid, as the property does not count as an asset in the hands of the future beneficiary until the death of the current owner.

Who can use a Lady Bird Deed in Texas?

Any property owner in Texas can use a Lady Bird Deed, as long as they wish to retain control over their property while ensuring it passes smoothly to a beneficiary upon their death. It is particularly useful for individuals seeking a simple estate planning tool without going through the complexities and costs of probate court.

Are there any drawbacks to using a Lady Bird Deed?

While beneficial for many, it may not be suitable for all estate planning needs. For example, if the property has a mortgage, the mortgagee may have specific clauses that could affect the use of a Lady Bird Deed. Additionally, because it is a relatively straightforward document, it might not provide for contingencies such as the predecease of the designated beneficiary. In such cases, consulting with a legal professional is advisable to explore all estate planning options.

How to create a Lady Bird Deed in Texas?

To create a Lady Bird Deed, specific language must be used to ensure it is valid and achieves the desired outcome. The deed must be drafted, specifying the current owner's retained rights and defining the beneficiary who will receive the property upon the owner's death. Once drafted, it must be signed in the presence of a notary public and then filed with the county recorder's office in the county where the property is located. Due to the legal complexities, it's recommended to seek legal advice or assistance when drafting this document.

Common mistakes

Filling out a Texas Lady Bird Deed form requires careful attention, as errors can undermine the intentions of the property owner and potentially lead to unexpected complications. Below are some common mistakes that individuals often make when completing this form:

Not specifying the beneficiary clearly: A critical mistake often made is not providing clear details about the beneficiary (or beneficiaries). It's essential to include the full legal name(s) and address(es) to avoid any confusion about who the property should transfer to upon the grantor’s death.

Overlooking the need for precise legal description of the property: Another frequent error is failing to include a complete and accurate legal description of the property. This description is crucial for the deed to be valid and enforceable. Merely providing the address is not sufficient; the legal boundaries of the property must be detailed.

Not understanding the revocable nature of the deed: Some may mistakenly believe that once a Lady Bird Deed is executed, it cannot be changed or revoked. The unique aspect of a Lady Bird Deed is that it allows the grantor to retain control over the property, including the right to sell or encumber it, during their lifetime. This misunderstanding can lead to confusion regarding the property’s control and ownership.

Failure to properly execute the document: For a Lady Bird Deed to be legally valid, it must be executed according to Texas law. This includes having the deed signed by the grantor in the presence of a notary public. Neglecting these legal formalities can render the deed unenforceable.

Omitting to file the deed with the county clerk’s office: Simply completing and signing a Lady Bird Deed does not finalize the process. The deed must be filed with the county clerk’s office in the county where the property is located. Failing to file the deed means it may not be recognized as valid, potentially leading to disputes over property ownership after the grantor's death.

When dealing with important legal documents like a Lady Bird Deed, individuals are encouraged to seek professional advice. This can help ensure that the deed accurately reflects the grantor's intentions and complies with all legal requirements, thereby avoiding the common mistakes outlined above.

Documents used along the form

When creating or updating an estate plan, individuals often consider how to pass their property to their heirs in the most efficient and effective manner. In states like Texas, the Lady Bird Deed is a unique legal document that allows the property owner to retain control and use of the property during their lifetime, while automatically transferring the property to a designated beneficiary upon their death, without the need for probate. Along with the Lady Bird Deed, there are several other forms and documents that are typically used to ensure a comprehensive estate plan. Each plays a role in safeguarding the individual’s wishes and making the transition smoother for family members.

- Will: A legal document that outlines how an individual's assets should be distributed after their death. It may appoint guardians for minor children and specify wishes for certain personal items, beyond what is covered in the Lady Bird Deed.

- Durable Power of Attorney: This grants someone else the authority to manage the individual’s financial affairs if they become incapacitated. It can ensure that bills continue to be paid and financial decisions are made in their best interest.

- Medical Power of Attorney: Similar to the Durable Power of Attorney but specific to medical decisions. This allows an appointed person to make medical decisions on the individual’s behalf if they are unable to do so themselves.

- Advance Directive (or Living Will): States the individual’s wishes regarding life support and other life-sustaining treatments if they become terminally ill or permanently unconscious, providing guidance to family members and healthcare providers.

- Declaration of Guardian in the Event of Later Incapacity: Specifies who should be appointed as guardian should the individual become incapacitated and unable to make decisions for themselves, avoiding a potentially lengthy court process.

- Transfer on Death Deed: Like the Lady Bird Deed, this allows for the direct transfer of certain types of real estate to a beneficiary upon the owner’s death without going through probate, but it does not offer the same level of control during the owner's life.

- Revocable Living Trust: Holds assets during the individual's lifetime, then transfers them to the designated beneficiaries upon death, potentially avoiding probate. The individual can change or revoke the trust as they see fit.

- Designation of Health Care Surrogate: Appoints a surrogate to make health care decisions if the individual is unable to do so, similar to a Medical Power of Attorney but can include additional instructions about the individual's healthcare preferences.

These documents, when used alongside the Lady Bird Deed, form a protective network around an individual's estate, ensuring that their wishes are followed and reducing the burden on family members during a difficult time. While the Lady Bird Deed addresses the direct transfer of property, these additional documents cover a broad spectrum of personal and financial affairs, providing peace of mind for everyone involved. It's important for individuals to consult with a legal professional to understand how these documents work together within the context of their unique situations.

Similar forms

-

Warranty Deed - Like a Lady Bird Deed, a Warranty Deed is used to transfer ownership of real estate, offering the grantee a warranty that the title is clear of any claims. Both documents ensure that the property is conveyed effectively, but the Lady Bird Deed also retains a life estate for the grantor, allowing them to use the property until death, which is not a feature of the Warranty Deed.

-

Quitclaim Deed - A Quitclaim Deed, similar to the Lady Bird Deed, is involved in transferring property rights from one person to another. However, unlike a Lady Bird Deed, it does not guarantee a clear title to the property and doesn't necessarily convey full ownership rights, merely any interest the grantor has in the property at the time of transfer.

-

Life Estate Deed - This document shares a critical feature with the Lady Bird Deed; both create a life estate, allowing the original owner to maintain use of the property during their lifetime. However, the key difference lies in the control over the property. With a Lady Bird Deed, the grantor retains the ability to sell or mortgage the property without the beneficiary's consent during their lifetime.

-

Trust - A Trust is an estate planning tool that, like a Lady Bird Deed, helps manage and transfer assets to beneficiaries, often bypassing the probate process. Both allow for the control of assets (in this case, real estate) during the grantor's lifetime, with specified instructions for transfer after death.

-

Transfer on Death Deed (TODD) - Similar to the Lady Bird Deed, a TODD allows property owners to name a beneficiary who will receive the property upon the owner’s death without going through probate. Both instruments are effective estate planning tools to avoid probate while maintaining control over the property during the owner's lifetime. The main difference is that a TODD is recognized in fewer states than the Lady Bird Deed.

-

Joint Tenancy with Right of Survivorship (JTWROS) - This form of co-ownership allows property to pass automatically to the other owner(s) upon one's death without probate, similar to the way a Lady Bird Deed operates in transferring property to a designated beneficiary. However, JTWROS involves joint ownership while the owner is alive, unlike the retained full control characteristic of a Lady Bird Deed.

-

Beneficiary Deed - Like a Lady Bird Deed, a Beneficiary Deed permits the direct transfer of property to a beneficiary upon the death of the property owner, bypassing the probate process. Both deeds allow the current owner to retain possession and control of the property until death, although the specific legal recognition and name may vary by state.

-

General Warranty Deed - Serving a similar purpose in ensuring the transfer of clear title, a General Warranty Deed offers the highest level of protection to the buyer, guaranteeing against title defects. While both the Lady Bird Deed and the General Warranty Deed facilitate property transfer, the former incorporates retaining life tenancy and potential Medicaid benefits, which aren't features of the latter.

-

Special Warranty Deed - This deed guarantees that the grantor owns the property and that there are no title issues during their period of ownership. Similar to a Lady Bird Deed, it is used for transferring property. However, the Lady Bird Deed uniquely allows the grantor to retain control over the property until death and potentially bypass probate, which is not an assurance provided by the Special Warranty Deed.

Dos and Don'ts

When completing a Texas Lady Bird Deed form, it is essential to ensure accuracy and compliance with Texas law to effectively manage your real estate's future transition. Here is a list of things you should and shouldn't do during this process.

Do:

- Verify the legal description of the property. This information must match the description used in your current deed or the real estate’s official records to prevent any discrepancies.

- Clearly identify the grantor(s) and grantee(s). The grantor is the current property owner, while the grantee will be the recipient of the property upon the grantor's passing.

- Sign the document in front of a notary public. A notarized signature is required for the document to be legally binding and recordable.

- File the completed deed with the county clerk's office in the county where the property is located. This ensures the deed is officially recorded and recognized.

- Consult with a legal professional if you have any uncertainties. This ensures that your rights are protected and that the deed meets all legal requirements.

Don't:

- Leave any fields blank. Incomplete forms may be considered invalid or cause delays.

- Assume it overrides your will. While a Lady Bird Deed is a non-probate transfer, it’s essential to ensure it aligns with your will and overall estate plan.

- Forget to update the deed if circumstances change. If you wish to change the beneficiary or other details, a new deed must be completed and filed.

- Overlook the requirement for specific language that retains life estate while granting the remainder interest to the beneficiary. This precise language is crucial for the deed’s validity.

- Rely on generic forms without verifying they comply with the latest Texas laws. Real estate laws can change, and using an outdated form may render your deed ineffective.

Misconceptions

A Lady Bird Deed, often utilized in Texas estate planning, allows property owners to transfer real estate to beneficiaries upon their death without going through probate. Despite its effectiveness, numerous misconceptions cloud its understanding and application. Addressing these can clarify its benefits and limitations.

- It offers the same protections as a traditional life estate deed. A common misconception is that a Lady Bird Deed and a traditional life estate deed offer the same level of protection and flexibility. However, a Lady Bird Deed provides the grantor with more control, allowing them to retain the ability to sell or mortgage the property without the beneficiary's consent. This key difference makes it a more flexible estate planning tool compared to the traditional life estate deed.

- It avoids all forms of estate recovery. Another misunderstanding is the belief that a Lady Bird Deed completely protects the property from any form of estate recovery. While it does offer some level of protection against claims from Medicaid estate recovery, it does not shield the property from all types of estate recoveries or creditors. The specifics vary, and understanding the nuances is critical for anyone considering this as part of their estate planning.

- It is recognized and operates the same in all states. The assumption that a Lady Bird Deed is recognized and operates uniformly across the United States is incorrect. Its recognition and operation largely depend on state law, and not all states recognize the validity of Lady Bird Deeds. Texas, among a few others, does recognize it, but individuals should consult legal advice based on their state's specific guidelines and statutes.

- It serves as a comprehensive estate planning tool. Finally, there's a misconception that a Lady Bird Deed is a one-size-fits-all solution for estate planning. While it can be an effective part of an estate plan, it should not be considered a comprehensive solution. A well-structured estate plan typically involves various tools and documents to address different aspects of an individual's assets and wishes. Relying solely on a Lady Bird Deed could leave gaps in one's estate planning.

Clearing up these misconceptions helps property owners make informed decisions about incorporating a Lady Bird Deed into their estate planning. It emphasizes the importance of understanding the specific benefits and limitations of this legal instrument and underscores the value of tailored legal advice.

Key takeaways

A Texas Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining the right to use and control the property during their lifetime. This type of deed is also referred to as an enhanced life estate deed.

One of the key benefits of using a Lady Bird Deed is that the property can bypass probate, making the process simpler and faster for heirs to gain ownership of the property upon the original owner's passing.

It's important to correctly fill out the Lady Bird Deed form to ensure that it's legally valid. This includes accurately identifying the property, the current property owner(s), and the future beneficiary(s).

When preparing a Lady Bird Deed, the property owner retains the right to sell, lease, or mortgage the property without requiring consent from the beneficiaries named in the deed. This level of control is a distinctive feature of this deed type.

The deed must be signed in the presence of a notary public to be legally enforceable. This formalizes the document and helps protect against disputes or challenges to the deed's validity.

After the Lady Bird Deed is signed and notarized, it needs to be filed with the county clerk's office in the county where the property is located. This recording process is crucial for the deed to be effective and recognized legally.

Using a Lady Bird Deed can help avoid potential conflicts among heirs or beneficiaries, as the transfer of property is clearly outlined and established prior to the original owner's death.

Consult with a legal professional before creating a Lady Bird Deed. It is important to ensure that this approach aligns with your overall estate planning goals and to navigate any state-specific legal nuances.

Create Other Lady Bird Deed Forms for US States

Lady Bird Deed Texas Pros and Cons - This deed type is becoming increasingly popular as an estate planning tool due to its effectiveness and simplicity.