Blank Deed Form for Maryland

In the picturesque state of Maryland, nestled between the rolling hills and the vast Atlantic Ocean, the process of transferring property from one owner to another is governed by a crucial document known as the Maryland Deed form. This form, steeped in legal tradition and yet constantly evolving with the times, serves as the linchpin in the conveyance of real estate. It encapsulates a range of information, including the identities of the buyer and seller, a detailed description of the property, and any conditions or warranties associated with the sale. The significance of this document cannot be overstated, as it not only embodies the agreement between parties but also ensures the legal transfer of ownership, subject to the state's meticulous regulatory framework. Moreover, this form is a testament to the parties' adherence to Maryland’s unique property laws, including those related to land use, zoning, and environmental considerations, making it a cornerstone of real estate transactions within the state.

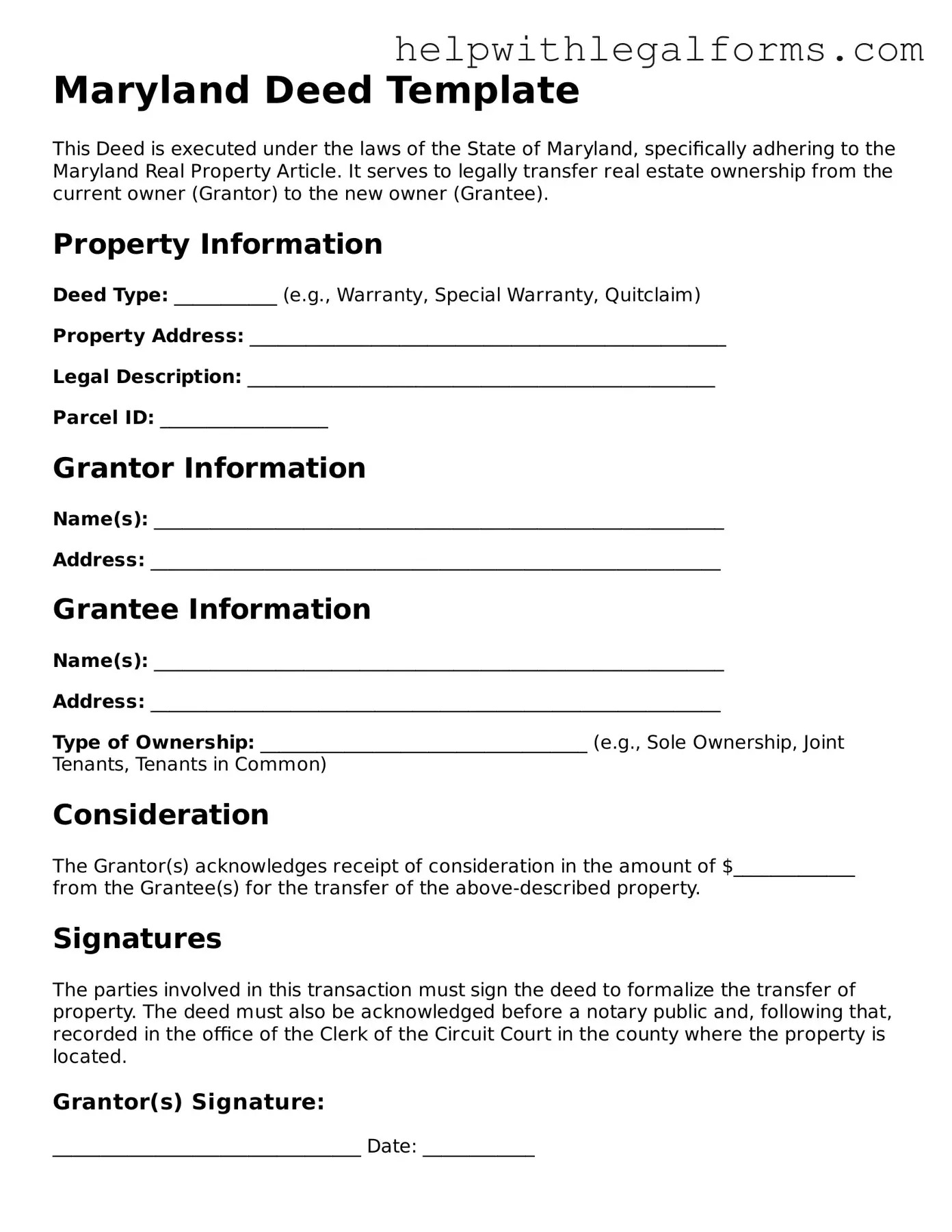

Example - Maryland Deed Form

Maryland Deed Template

This Deed is executed under the laws of the State of Maryland, specifically adhering to the Maryland Real Property Article. It serves to legally transfer real estate ownership from the current owner (Grantor) to the new owner (Grantee).

Property Information

Deed Type: ___________ (e.g., Warranty, Special Warranty, Quitclaim)

Property Address: ___________________________________________________

Legal Description: __________________________________________________

Parcel ID: __________________

Grantor Information

Name(s): _____________________________________________________________

Address: _____________________________________________________________

Grantee Information

Name(s): _____________________________________________________________

Address: _____________________________________________________________

Type of Ownership: ___________________________________ (e.g., Sole Ownership, Joint Tenants, Tenants in Common)

Consideration

The Grantor(s) acknowledges receipt of consideration in the amount of $_____________ from the Grantee(s) for the transfer of the above-described property.

Signatures

The parties involved in this transaction must sign the deed to formalize the transfer of property. The deed must also be acknowledged before a notary public and, following that, recorded in the office of the Clerk of the Circuit Court in the county where the property is located.

Grantor(s) Signature:

_________________________________ Date: ____________

Grantee(s) Signature:

_________________________________ Date: ____________

Notary Public:

State of Maryland

County of ____________________

On this day, ____________, before me, ______________________________ (notary's name), personally appeared _________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________________ Notary Public

My Commission Expires: ____________

Additional Provisions

If applicable, include any additional terms or conditions pertaining to the transfer of the property:

____________________________________________________________________________

____________________________________________________________________________

Disclaimer

This template is provided as a general guide to assist in the preparation of a Maryland Deed. It is highly recommended to consult with a legal professional to ensure compliance with all Maryland state laws and local regulations before executing any legal document.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Type of Document | The Maryland Deed form is a legal document used to transfer property ownership from one party to another. |

| Governing Law | In Maryland, deeds are governed by Title 3 of the Real Property Article of the Maryland Annotated Code. |

| Required Information | The deed must include details of the grantor (seller), the grantee (buyer), a legal description of the property, and the consideration (purchase price). |

| Signing Requirements | The deed must be signed by the grantor in front of a notary public and, in some cases, witnesses, to be legally valid. |

| Recording | Once signed and notarized, the deed must be recorded with the local county land records office to become effective. |

Instructions on How to Fill Out Maryland Deed

Filling out a Maryland Deed form is a key step in the process of transferring property ownership. Whether you're buying, selling, or otherwise transferring property, accurately completing this document is crucial. The process can seem daunting, but by breaking down the steps, property owners can ensure they fulfill their legal obligations and protect their interests. Below are the steps necessary to accurately fill out a Maryland Deed form.

- Prepare the necessary information: Gather all relevant details about the property and the parties involved. This includes legal descriptions of the property, the full names and addresses of the grantor (seller) and grantee (buyer), and the parcel identification number.

- Choose the correct type of deed: Maryland law provides for several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. Select the one that best fits the nature of the property transfer.

- Enter the date: At the top of the form, input the date on which the deed is being executed.

- Write the grantor's information: Include the name(s) and address(es) of the current owner(s) of the property, referred to as the grantor(s).

- Write the grantee's information: Fill in the name(s) and address(es) of the new owner(s) of the property, known as the grantee(s).

- Provide the legal description of the property: Include the complete legal description of the property as found on the current deed or latest tax assessment documents. This typically involves lot numbers, subdivision names, measurements, boundaries, and any applicable easements.

- State the consideration: Include the amount of money being exchanged for the property. If the property is a gift, you should still state a nominal consideration, such as $10.

- Include any relevant declarations or agreements: This might involve stating the property is being transferred with no liens or encumbrances or specifying any conditions of the transfer.

- Signatures: The deed must be signed by the grantor(s) in the presence of a notary public. Some counties may require witnesses in addition to the notary.

- Notarize the deed: The notary public will sign and seal the deed, making it a legally binding document.

- File the deed with the Maryland Land Records Department: After completing the deed, you must file it with the local land records office in the county where the property is located. Filing fees will apply.

Once these steps have been completed, the deed will officially transfer property ownership. It's important to retain copies of the notarized deed for your records. Successfully navigating this process ensures the legal transfer of property, protecting the rights and interests of all parties involved.

Crucial Points on This Form

What is a Maryland Deed form?

A Maryland Deed form is a legal document used to transfer ownership of real property from one party (the seller or "grantor") to another (the buyer or "grantee") in the state of Maryland. This document is crucial in the process of buying or selling property, as it officially records the change of ownership.

How do I know which type of Deed form I need in Maryland?

In Maryland, there are several types of Deed forms, including General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds. The type you need generally depends on the level of protection the buyer and seller agree upon. Consult with a real estate professional or attorney to understand which form suits your specific transaction.

Where can I obtain a Maryland Deed form?

Maryland Deed forms can be obtained from several sources, including online legal document providers, the local county's Clerk Office where the property is located, or through a hired attorney who specializes in real estate law.

Is a lawyer required to fill out a Maryland Deed form?

While you're not required by law to use a lawyer to fill out a Maryland Deed form, consulting with one is highly recommended. Real estate transactions can be complex, and an attorney can provide valuable guidance to ensure the Deed form is correctly completed and the legal requirements are met.

What information is needed to complete a Maryland Deed form?

To complete a Maryland Deed form, you'll need to have certain information at hand, including the full names and addresses of the grantor and grantee, a detailed description of the property being transferred, and the consideration (price paid for the property). Additionally, terms of the property transfer and signatures of all parties involved, including witnesses, might be required.

How do I officially record a Maryland Deed?

After completing the Maryland Deed form, it must be officially recorded with the county's Land Records Office where the property is located. Often, this involves paying a recording fee and may require the form to be notarized before submission. Recording the Deed makes the transaction a matter of public record and legally transfers the property rights.

Are there any specific requirements for a Maryland Deed form to be valid?

Yes, for a Maryland Deed to be valid, certain requirements must be met, including the signatures of all involved parties and, in most cases, the signature of a notary public. The document must also clearly state the grantor's intention to transfer the property and include a complete legal description of the property.

What are the consequences of not using a Maryland Deed when transferring property?

Not using a Maryland Deed to transfer property can have several significant consequences, including legal disputes over the property's ownership, potential tax implications, and issues with future sales of the property. It's essential to officially document the transaction through a Deed to protect all parties involved.

Can I change or cancel a Maryland Deed after it's been recorded?

Once a Maryland Deed has been recorded, changing or cancelling it involves a formal legal process. This may require drafting and recording a new Deed that nullifies the previous one, known as a Deed of Reconveyance or a Quitclaim Deed to transfer the property back. It's important to seek legal advice in these situations.

Where can I find more information about Maryland Deed forms?

For more information about Maryland Deed forms, consider consulting with a real estate attorney or visiting the local Clerk's Office. Additionally, the Maryland Department of Assessments and Taxation website provides resources and guidance that might be helpful.

Common mistakes

Filling out a Maryland Deed form is an important task that helps to officially transfer property from one person to another. However, it's easy to make mistakes during this process. Here are five common errors people often encounter:

Not Double-Checking Names for Accuracy: One of the simplest yet most critical mistakes is failing to ensure that all names are spelled correctly and match the names on the official property records. Inconsistencies here can lead to significant delays or even make the deed invalid.

Omitting Necessary Signatures: Every deed must be signed by all parties involved in the transaction, but it’s surprisingly common for people to miss a signature. Remember, if the property is owned jointly, or if there are multiple buyers, each person must sign the deed.

Forgetting to Include the Legal Description of the Property: Simply putting the address of the property is not enough. The deed needs to include a detailed legal description, which you can usually find in previous deeds or property tax documents. This description includes the boundaries and dimensions of the property.

Ignoring the Need for Witness and/or Notary Signatures: Depending on local requirements, deeds often need to be signed in the presence of witnesses and/or a notary public. Not having these additional signatures can prevent the deed from being legally effective.

Using the Wrong Deed Form: Maryland, like many states, has several types of deeds (e.g., warranty, quitclaim, and special warranty deeds). Using the wrong form can affect your rights as the new property owner. It's important to research or consult a professional to ensure you’re using the appropriate form for your transaction.

Making sure you address these common mistakes can save you a lot of time and trouble in the property transfer process. Double-check everything, follow the instructions carefully, and don't hesitate to seek legal advice if you're uncertain about any part of the form or process.

Documents used along the form

Real estate transactions go beyond the signing of a deed. In Maryland, various forms and documents complement the deed form, ensuring that the transfer of property adheres to legal and regulatory requirements. Each document serves a unique purpose, contributing to the transparency, legality, and completeness of the property transfer process. Here’s a list of forms and documents often used alongside the Maryland Deed form, providing a more comprehensive picture of what parties involved might need to prepare for.

- Property Tax Declaration Form: This document is critical for disclosing the property's assessed value and the corresponding property taxes. It ensures that property taxes are correctly apportioned between the buyer and the seller at the time of sale.

- Title Insurance Policy: A vital document offering protection against financial loss from defects in the title to the property. It covers the cost of legal defense against any title disputes that arise after the sale.

- Mortgage Pre-Approval Letter: For buyers, securing a pre-approval letter from a lender is crucial. It verifies the buyer's financial ability to purchase the property and is often required to be submitted with the offer to purchase.

- Settlement Statement: An all-encompassing statement that details all costs related to the transaction. It is used at closing to outline the financial transactions enacted between the buyer, seller, real estate agents, lenders, and other parties involved in the sale.

- Home Inspection Reports: These reports provide a comprehensive look at the condition of the property. They highlight any issues or potential repairs that may need to be addressed, affecting the final sale negotiations.

- Pest Inspection Reports: Essential in areas where pests and termites are common, these reports detail any current or potential pest infestations that could impact the property's integrity and value.

- Homeowners’ Association (HOA) Documents: For properties within an HOA, these documents outline the rules, regulations, and fees associated with the association. They are crucial for understanding the obligations and benefits of living within an HOA-governed community.

Understanding and preparing these documents in conjunction with the Maryland Deed form ensures a smoother, more secure transfer of property. Each document addresses different aspects of the sale, from financial arrangements and legal protections to property conditions and community obligations. Together, they form the backbone of a thorough and legally compliant real estate transaction process.

Similar forms

Title Certificates - Like deeds, title certificates are essential in legally acknowledging ownership, but they specifically relate to vehicles like cars and boats. Where deeds confer ownership rights of real estate, title certificates do the same for vehicles.

Mortgages - Mortgages, agreements that secure a loan on a property, share the deed's transactional nature. Both documents are pillars in the real estate transaction process, with the mortgage detailing the borrower's obligations and the deed transferring property ownership.

Leases - Leases, which outline the conditions under which one party rents property from another, parallel deeds in establishing control over a property. However, unlike deeds, leases transfer the right to use property rather than the ownership itself.

Wills - Wills and deeds both concern the transfer of assets. A will specifies how a person’s assets are to be distributed upon their death, potentially including the transfer of real property through execution of a new deed, maintaining the legal tradition of documenting the conveyance and ownership of assets.

Trusts - Trusts resemble deeds in their role in managing property ownership. A trust document formalizes the arrangement to hold property for the benefit of another, similar to how a deed transfers property rights, but with an emphasis on future management and disbursement.

Bill of Sale - The bill of sale, like a deed, is a document evidencing the transfer of ownership, but it is generally used for personal property (e.g., furniture, equipment) rather than real estate. Both serve as critical evidence in confirming transaction legitimacy.

Power of Attorney - A power of attorney grants someone the authority to act on another’s behalf in legal matters and decisions. It can include the power to buy or sell real estate, thus indirectly affecting property ownership like a deed does, though it is not itself a conveyance document.

Dos and Don'ts

Filling out a Maryland Deed form is a critical step in transferring property ownership. To ensure the process goes smoothly, here are some key dos and don'ts you'll want to keep in mind:

- Do double-check the legal description of the property. This includes lot number, subdivision, and exact address. Accuracy here is key, as any mistake can invalidate the deed.

- Do verify all parties' legal names and include them exactly as they appear on official documents. This means double-checking spelling and including middle names or initials if they are part of the legal name.

- Do decide on the right type of deed. Maryland offers several, including general warranty deeds, special warranty deeds, and quitclaim deeds, each with different levels of protection for the buyer.

- Do consult a legal professional if you have any doubts. Real estate transactions can be complex, and legal guidance can prevent costly mistakes.

- Do ensure that all parties required to sign the deed are present and have valid identification at the time of signing. Maryland law may require notarization, which means signatures will need to be done in the presence of a notary public.

- Don't leave any blanks on the form. If a section does not apply, mark it with N/A (not applicable) instead of leaving it empty. This helps prevent unauthorized alterations after the document is signed.

- Don't forget to contact a title company or an attorney for a title search. This step is essential to ensure the property is free of liens or claims that could affect your ownership.

- Don't ignore local and state tax obligations. Transferring property can have tax implications, and in Maryland, there may be county or state transfer taxes and stamps that need to be paid.

- Don't attempt to use a generic form if you're unsure of its validity. The Maryland Department of Assessments and Taxation provides state-specific forms that comply with local laws.

- Don't delay in recording the deed. Once it's signed and notarized, the deed should be filed with the local county's land records office as soon as possible. This act records the change of ownership and protects the grantee's interests.

By following these dos and don'ts, participants can navigate the process of filling out a Maryland Deed form with confidence, ensuring a smooth and legally sound transfer of property.

Misconceptions

Understanding the nuances of property transactions can be complex, and misconceptions regarding the Maryland Deed form are common. Addressing these misunderstandings is vital for anyone engaging in real estate transactions within the state. Below is a clarification of several misconceptions to help guide individuals through the process.

All deed forms are the same. – This is not true. In Maryland, several types of deed forms exist, each serving different purposes. For example, a Warranty Deed offers the grantee a high level of protection, whereas a Quitclaim Deed offers very limited protection. Choosing the right form depends on the circumstances of the transaction.

Filling out a deed form is enough to transfer ownership. – Simply completing the form does not effectuate the transfer. The deed must be properly executed, often requiring notarization, and then recorded with the appropriate Maryland county land records office to be legally effective.

The Maryland Deed form can be freely downloaded and filed without any cost. – While the form itself may be accessible at no charge, recording the deed with the county will incur a filing fee. The amount varies by county and the specifics of the transaction, such as the property's value and the type of deed being recorded.

A lawyer is not necessary when dealing with deed forms. – Although it's not legally required to have a lawyer, navigating the complexities of property law and ensuring that the deed is appropriately handled can be difficult without professional assistance. A lawyer can provide valuable advice and help avoid costly mistakes.

The information required on a deed form is basic and does not require much attention to detail. – Inaccuracies in the information provided on a deed form, such as spelling errors in names or incorrect property descriptions, can lead to significant legal issues. It is crucial to ensure that all information is accurate and fully detailed.

Electronic signatures are sufficient for Maryland Deed forms. – Maryland law requires that deeds be signed in the presence of a notary public. While electronic signatures are increasingly accepted for many types of documents, real estate deeds typically require a wet ink signature to ensure authenticity and comply with recording standards.

The seller's mortgage does not need to be cleared before signing the deed. – If there is an existing mortgage on the property, it must be settled or adequately addressed before, or at the time of, the transfer. Failure to do so can result in significant legal and financial complications for the buyer.

Once the deed is recorded, the transaction is complete. – While recording the deed is a critical step in the transfer of property ownership, other steps may be necessary depending on the transaction, such as settling closing costs, addressing any liens on the property, and ensuring that property taxes are up to date.

Any mistakes on the deed form can easily be corrected after filing. – Correcting errors on a recorded deed can be a complicated and sometimes costly process that may involve filing additional legal documents and potentially going to court. It's essential to review the deed thoroughly before submission to prevent such issues.

Addressing these common misconceptions about the Maryland Deed form underscores the importance of meticulous attention to detail and, often, the need for professional guidance in real estate transactions. Whether you're buying, selling, or otherwise transferring property rights in Maryland, understanding the legal requirements and implications of the deed form is crucial for a smooth process.

Key takeaways

When preparing and utilizing the Maryland Deed form, it's important to know the following key takeaways to ensure the process is handled correctly and effectively:

- Understand the different types of deeds available in Maryland, such as the warranty deed, which provides the highest level of buyer protection, and the quitclaim deed, which transfers only the interest the seller has in the property, without any warranties.

- Ensure all parties involved are correctly identified, including the grantor (seller) and the grantee (buyer), and that their full legal names are accurately recorded on the document.

- The legal description of the property must be precise. This includes the lot number, subdivision, and any other details that uniquely identify the property. It's often helpful to reference the property's previous deed for exact wording.

- Consideration, or the value exchanged for the property, needs to be stated in the deed. This can be a monetary amount or other forms of value.

- The deed must be signed by the grantor in the presence of a notary public to be legally binding. Maryland may also require witnesses, so it's crucial to check the current requirements.

- The notary public must acknowledge the deed, confirming that the grantor signed the document willingly and under their own power.

- After the deed is signed and notarized, it must be filed with the appropriate Maryland county office, typically the Clerk of the Court or the Land Records office, depending on the county where the property is located.

- There may be filing fees associated with recording the deed, which vary by county. Verify the exact amount with the local office to ensure proper payment and avoid processing delays.

- Verify if Maryland's state or local jurisdictions require any additional forms to be filed with the deed, such as a property transfer tax declaration or exemption forms.

- Consider consulting a real estate attorney to ensure the deed complies with Maryland law and addresses any specific concerns. The legal landscape can be complex, and professional guidance can provide peace of mind and prevent future complications.

Using these guidelines can help navigate the process of preparing and recording a deed in Maryland effectively, ensuring legal requirements are met and the property is transferred smoothly.

Create Other Deed Forms for US States

Warranty Deed Form - Amendments or corrections to a deed form after signing can be complex, highlighting the importance of getting it right the first time.

Life Estate Deed New York Form - It is a key document used in the process of buying or selling property.

Property Owners Search - When handled properly, this document assists in the smooth transition of property, preventing legal hurdles for heirs or new owners.

Oklahoma Property Deed - Joint tenancy or tenancy in common arrangements are specified in deed forms, clarifying the nature of shared ownership.