Blank Deed Form for New Jersey

In New Jersey, transferring property from one party to another is a process that necessitates the use of a specific legal document known as a New Jersey Deed form. This form plays a critical role in real estate transactions within the state, encapsulating details about the grantor (the person selling or transferring the property), the grantee (the recipient of the property), and the exact details of the property itself. Essential to ensuring the legality of the property transfer, it comes in various types, each tailored to different circumstances and requirements. For example, Warranty Deeds are used when the grantor guarantees they hold clear title to the property, while Quitclaim Deeds may be used in less formal situations among family members or to clear a title. The form must also be properly signed, witnessed, and, in most cases, notarized before being filed with the county clerk's office where the property is located, a step that makes the document a public record and finalizes the transaction. Understanding the intricacies of the New Jersey Deed form is key for anyone involved in the transfer of property in the state, ensuring that the process is conducted smoothly and legally.

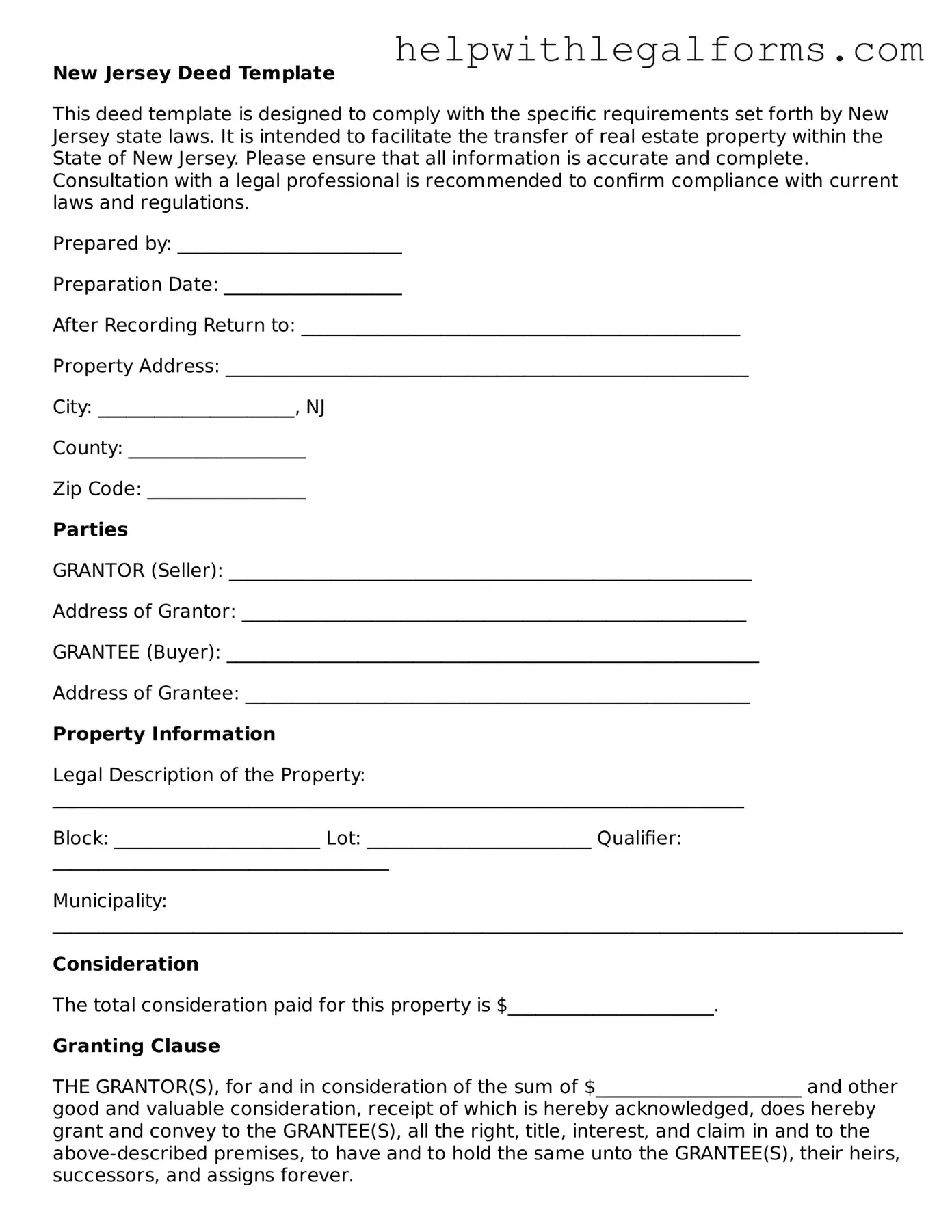

Example - New Jersey Deed Form

New Jersey Deed Template

This deed template is designed to comply with the specific requirements set forth by New Jersey state laws. It is intended to facilitate the transfer of real estate property within the State of New Jersey. Please ensure that all information is accurate and complete. Consultation with a legal professional is recommended to confirm compliance with current laws and regulations.

Prepared by: ________________________

Preparation Date: ___________________

After Recording Return to: _______________________________________________

Property Address: ________________________________________________________

City: _____________________, NJ

County: ___________________

Zip Code: _________________

Parties

GRANTOR (Seller): ________________________________________________________

Address of Grantor: ______________________________________________________

GRANTEE (Buyer): _________________________________________________________

Address of Grantee: ______________________________________________________

Property Information

Legal Description of the Property: __________________________________________________________________________

Block: ______________________ Lot: ________________________ Qualifier: ____________________________________

Municipality: ___________________________________________________________________________________________

Consideration

The total consideration paid for this property is $______________________.

Granting Clause

THE GRANTOR(S), for and in consideration of the sum of $______________________ and other good and valuable consideration, receipt of which is hereby acknowledged, does hereby grant and convey to the GRANTEE(S), all the right, title, interest, and claim in and to the above-described premises, to have and to hold the same unto the GRANTEE(S), their heirs, successors, and assigns forever.

Signatures

The parties have executed this deed on the date written below:

Date: ________________________

________________________________________________________ (Signature of Grantor)

________________________________________________________ (Print Name of Grantor)

________________________________________________________ (Signature of Grantee)

________________________________________________________ (Print Name of Grantee)

Acknowledgment by Notary Public

State of New Jersey

County of ____________________

On this, the __________ day of ____________, 20____, before me, a notary public in and for said state, personally appeared __________________________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

________________________________________________________ (Signature of Notary Public)

Print Name: ___________________________________________

My Commission Expires: _____________

PDF Form Attributes

| Fact Name | Detail |

|---|---|

| Form Purpose | Used to legally transfer property ownership in New Jersey. |

| Governing Law | New Jersey Real Property Law. |

| Required Signatures | Must be signed by the grantor(s) and notarized. |

| Recording Requirement | Must be recorded with the county clerk in the county where the property is located. |

| Types of Deeds | Includes warranty, quitclaim, and special warranty deeds, each serving different purposes. |

Instructions on How to Fill Out New Jersey Deed

After deciding to transfer property ownership in New Jersey, the next step involves accurately filling out the New Jersey Deed form. This document is crucial for the legal transfer of property from the current owner (grantor) to the new owner (grantee). Each section of the form must be completed with precise information to ensure the transfer is recognized under New Jersey law. Following the steps below will guide you through the process of filling out the form correctly. After submission, the deed will be reviewed for completeness and accuracy before being officially recorded.

- Begin by entering the date of the deed execution at the top of the form.

- Fill in the full name and address of the current property owner (grantor) in the designated section.

- Provide the full name and address of the recipient of the property (grantee).

- Include the legal description of the property being transferred. This description can be found on the current deed or property tax documents and must be precise.

- Specify the type of deed being executed (warranty, quitclaim, etc.) and detail any warranties or guarantees being made about the property.

- Enter the amount of consideration, if applicable. This is the value being exchanged for the property.

- If there are any conditions or restrictions on the property transfer, list them in the provided section.

- Have the grantor(s) sign and date the deed in the presence of a notary public. The notary will also need to sign the document and provide their seal to notarize the deed.

- If required by New Jersey law or local regulation, ensure that witnesses sign the deed as well.

- Review the completed deed to ensure all information is accurate and no sections have been missed.

- File the deed with the appropriate New Jersey County Recorder’s Office for it to be recorded. A fee may be associated with this filing.

It's essential to follow each step carefully to secure a legal transfer of property. Errors or omissions can delay or invalidate the process. Once the deed has been recorded, the property ownership is officially transferred, and the document serves as a record of this transaction.

Crucial Points on This Form

What is a New Jersey Deed form and why is it necessary?

A New Jersey Deed form is a legal document that facilitates the process of transferring ownership of real property from a seller, often referred to as the grantor, to a buyer, known as the grantee. This document is necessary for ensuring the legal transfer of property titles, clarifying the extent of the land being transferred, and providing a recorded history of ownership. It must be accurately completed and filed with the county clerk’s office where the property is located, to validate the change in ownership and to safeguard both parties’ rights in the transaction.

What are the different types of Deeds in New Jersey, and how do they differ?

In New Jersey, there are primarily three types of Deeds: Warranty, Quitclaim, and Special Warranty. A Warranty Deed offers the highest level of buyer protection, guaranteeing that the property is free from all liens and encumbrances, and the seller holds clear ownership to convey. A Quitclaim Deed transfers only the interest the seller has in the property, with no warranties regarding liens or encumbrances. Lastly, a Special Warranty Deed guarantees that there are no title issues during the seller's ownership period, but does not cover any problems that may have arisen before their ownership. Each type serves different purposes, and the choice depends on the level of security the buyer and seller require.

How is a New Jersey Deed form filed and recorded?

To file and record a New Jersey Deed form, one must first ensure that the document has been properly completed, signed by all necessary parties, and notarized. The next step involves submitting the Deed to the county clerk’s office or the Register of Deeds in the county where the property is located. A recording fee, which varies by county, must be paid upon submission. The office will then record the document, making the transaction part of the public record. This process is crucial for confirming the change in property ownership and for future title searches.

Are there any specific requirements or stipulations for completing a New Jersey Deed form?

Yes, there are several specific requirements for completing a New Jersey Deed form. Key stipulations include the clear identification of the grantor and grantee, with full legal names and addresses; a precise description of the property being transferred, including its legal description and not just its physical address; the inclusion of consideration, which is the value exchanged for the property; and the requirement that the document be signed by the grantor(s) in the presence of a notary public. Additionally, some counties in New Jersey may require the Deed to include the grantee’s Tax ID number or social security number. It is advisable to consult with a legal professional to ensure all requirements are met.

Common mistakes

Filling out a New Jersey Deed form is an important step in transferring property ownership, but it's also a process where many people stumble. Avoiding common mistakes can ensure the deed is executed correctly, preventing future legal issues or unexpected complications. Here’s a closer look at errors to avoid:

-

Not Checking the Type of Deed Required: Various deeds serve different purposes—warranty, quitclaim, or special warranty deeds. Each offers varying levels of protection for the buyer. Choosing the wrong type can significantly affect your rights and obligations.

-

Incorrect Names or Spelling Errors: It's crucial that all names are spelled correctly and match the parties' legal documents. Misspellings or using informal names can invalidate the deed or create challenges in future property transfers.

-

Leaving Out Essential Details: Every party involved in the transaction must be correctly identified, including their full names and legal capacities (e.g., as individual, trustee). Omitting or inaccurately reporting these details can lead to disputes or void the deed.

-

Not Including a Complete Legal Description of the Property: The deed must contain a precise legal description of the property, not just an address. This description should match the one in the previous deed, to avoid ambiguities or claims of improper transfer.

-

Overlooking the Need for Witness Signatures: New Jersey law requires deeds to be signed in the presence of witnesses. Failing to comply with this requirement can render the document legally ineffective.

-

Forgetting to Obtain Notarization: A critical step in authenticating the deed is getting it notarized. Without notarization, the deed may be questioned or not accepted for recording.

-

Ignoring Tax Implications: Transferring property via a deed can have tax consequences. Not considering these can lead to unexpected liabilities for either the grantor or the grantee.

-

Mistakes in the Consideration Stated: The consideration, or the value exchanged for the property, must be accurately stated. This affects not only tax obligations but also the legal validity of the transfer.

-

Not Recording the Deed: After executing the deed, it must be recorded with the New Jersey county where the property is located. Failure to record can lead to challenges against the property's ownership and affect title clearness.

When tackling legal documents like the New Jersey Deed form, attention to detail makes all the difference. By sidestepping these common missteps, parties can ensure smoother property transactions and safeguard their legal interests.

Documents used along the form

In the process of transferring property in New Jersey, several documents in addition to the Deed form are frequently utilized. These forms help ensure the legality of the transaction, confirm accuracy in the property's description and ownership, and fulfill state-specific legal requirements. Each document serves a specific purpose in the real estate transaction process, facilitating a smooth transfer of property from one party to another. Below is a description of up to nine forms and documents often used alongside the New Jersey Deed form.

- Affidavit of Title: This document is provided by the seller of the property. It attests to the ownership and the absence of liens or other encumbrances on the property, except those previously disclosed.

- Property Tax ID Form: Required for recording the deed, this form identifies the property's tax classification and ensures the correct municipal tax assessment.

- Seller’s Residency Certification/Exemption (GIT/REP Forms): Used to declare the seller's residency status, these forms are critical for tax purposes. They determine if the seller must withhold income tax on the sale of the property.

- Water Quality and Quantity Certification: In locations where applicable, this certification confirms that the property's water supply meets local standards for both quality and quantity.

- Smoke Detector and Carbon Monoxide Detector Compliance Certificate: Local regulations may require this certificate, ensuring that the property is equipped with working smoke and carbon monoxide detectors at the time of sale.

- Certificate of Occupancy: This certifies that the property meets all local building codes and is habitable. It is required by many municipalities before the new owner can legally occupy the property.

- Survey: Although not always required, a survey provides a detailed drawing of the property's boundaries, improvements on the lot, and any easements or encroachments. It clarifies what is being sold and can identify potential issues.

- Title Insurance Policy: This protects the buyer and the lender from potential losses caused by defects in the title that were not discovered during the initial title search.

- Mortgage Documents: If the property is being financed, the buyer will need to sign a mortgage agreement, which outlines the loan terms and grants the lender a lien on the property as security for the loan.

The detailed examination and execution of these documents, alongside the Deed form, are key steps in the property transfer process. They help protect all parties involved by ensuring that the property is transferred legally, safely, and in a manner that's transparent and fully compliant with New Jersey law. Understanding the purpose and requirement of each can greatly aid in navigating the complexities of real estate transactions.

Similar forms

A Mortgage Agreement - This document, like a deed, is integral to the process of buying and selling property. Both serve as formal, legal instruments that establish and confirm rights related to real estate. While a deed transfers ownership interest, a mortgage agreement secures the borrowed money with the property, indicating the lender's interest until the loan is paid off.

A Bill of Sale - Similar to a deed, a bill of sale is used to transfer ownership of property from one party to another. However, while a deed is specifically for real estate transactions, a bill of sale is more commonly used for personal property, such as vehicles or equipment, serving as proof of the transfer of ownership.

A Warranty - Like a warranty deed, which guarantees the buyer of the property receives a clear title free from liens or claims, a general warranty provides assurance from the seller to the buyer that a product or service is as represented or warranted. Both documents offer a level of protection and guarantee concerning the quality or ownership of what is being sold.

A Quitclaim Deed - This document is a specific type of deed that transfers any interests the grantor may have in the property without making any guarantees about the title's validity. Like other deeds, it is a legal instrument used in real estate transactions but differs in the level of protection it offers to the grantee.

A Title Certificate - A title certificate, like a deed, establishes someone's right to ownership of property. Both need to be filed and recorded in local government offices to be effective. While a deed transfers the property, a title certificate serves as evidence that the property has been legally transferred and shows the current owner's name.

A Lease Agreement - Similar to a deed in that it pertains to real estate transactions, a lease agreement, instead of transferring ownership, confers the right to use or occupy property for a certain period in exchange for rent. Both documents are crucial in establishing terms and protecting the rights of the parties involved in the transaction of property use.

Dos and Don'ts

When you're filling out a New Jersey Deed form, it's essential to approach the process with care and attention. This document is key in transferring property rights and any mistakes could delay the process or lead to legal complications. Here’s a comprehensive guide on what you should and shouldn't do:

- Do ensure all names are spelled correctly. The names on the deed must match the official documents. Any discrepancies could invalidate the form.

- Do not leave any blanks unfilled. If there's a section that doesn't apply, indicate with "N/A" rather than leaving it empty. This shows that you didn't overlook the section.

- Do double-check the legal description of the property. This includes the lot number, block number, and any easements or rights of way. Errors here can create significant problems.

- Do not use informal names or nicknames. Use the full legal names of all parties involved as they appear on their government-issued ID.

- Do verify the type of deed being prepared. Whether it’s a warranty, special warranty, or quitclaim deed, the type determines the guarantees being made about the property’s title.

- Do not guess on details. If you’re unsure about specifics like the property's legal description, consult with a professional or the original deed.

- Do sign in the presence of a notary public. New Jersey law requires deeds to be notarized for validity. This step is crucial for the document’s legality.

- Do not forget to list the Grantee’s mailing address. This address is used for future tax bills and correspondence related to the property.

- Do ensure that all necessary attachments are included. If the deed refers to attachments or exhibits, make sure they are attached and fully executed.

Correctly completing and understanding your New Jersey Deed form is vital for a smooth transfer of property. If you have any doubts during the process, seeking professional guidance can help avoid costly errors.

Misconceptions

When dealing with property transactions in New Jersey, the deed form plays a crucial role. However, there are several misconceptions about this document that can cause confusion. It’s important to clarify these myths so that individuals can navigate their real estate transactions with a better understanding.

All New Jersey deed forms are the same: This is a common misconception. There are various types of deeds used in New Jersey, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and providing different levels of protection to the buyer.

A deed and title are the same: Another misconception is confusing deeds with titles. A deed is a legal document that transfers ownership of property from one person to another, whereas a title is a conceptual term that represents the legal right to own, use, or sell the property.

Filing a deed automatically clears all claims against the property: Simply filing a deed does not erase all claims or liens against the property. It’s essential to perform a title search to uncover any existing claims and address them before the transfer of ownership.

The deed form needs to be notarized by a New Jersey notary only: While the deed must be notarized to be considered valid, it does not have to be specifically a New Jersey notary. A deed can be notarized in any state, as long as it meets the New Jersey state requirements for recording.

You can change information on the deed form after it has been recorded: Once a deed has been recorded with the county, any alterations to the document would require a new deed to be prepared, executed, and recorded. It’s vital to ensure all information is correct before recording the deed.

Filling out a deed form transfers the property immediately: Completing and signing the deed form is a crucial step, but the transfer of property is not official until the deed is delivered to and accepted by the grantee, and then properly recorded with the appropriate county office.

Understanding the nuances of New Jersey's real estate laws and deed forms can help make the process of transferring property smoother and more straightforward. It’s always recommended to consult with a professional to ensure that you are fully aware of your rights and obligations in a real estate transaction.

Key takeaways

In the state of New Jersey, the process of transferring property ownership is formalized through the completion and use of a deed form. This legal document is crucial in establishing and recording the change of ownership in real estate transactions. The following key takeaways aim to provide clarity on the essential aspects of filling out and using the New Jersey deed form, ensuring that both the grantor (the seller) and the grantee (the buyer) execute the document properly for a lawful transfer.

- Identification of Parties: It's imperative to accurately identify both the grantor and grantee by their legal names, ensuring these names are consistent throughout the document. This clarity prevents any potential disputes about the parties involved in the transaction.

- Legal Description of Property: The deed form requires a precise legal description of the property being transferred. This description includes the lot number, block number, and any other details that delineate the exact location and boundaries of the property. Unlike a street address, a legal description uniquely identifies the property in question.

- Consideration: The document must state the consideration, typically the amount of money, being exchanged for the property. This detail provides evidence of the transaction's value, which could have implications for tax purposes.

- Signing Requirements: New Jersey law mandates that the deed be signed by the grantor in the presence of a notary public or other authorized official. This step legitimizes the signature, thereby authenticating the document.

- Witnesses: Although New Jersey does not require witnesses for the deed to be valid, having a witness to the signing, in addition to notarization, can add an extra layer of verification and protection against future disputes over the document's authenticity.

- Recording of the Deed: After the signing, the deed must be recorded with the county clerk or registrar in the county where the property is located. Recording the deed is crucial as it gives "notice to the world" that the property has changed hands, protecting the grantee's interests against claims from third parties.

By adhering to these key practices, individuals involved in real estate transactions within New Jersey can ensure that the transfer of property ownership is conducted legally and efficiently. The deed, as a cornerstone of property law, thus serves not only as a record of sale but also as a crucial document for establishing clear and undisputed ownership.

Create Other Deed Forms for US States

Life Estate Deed New York Form - The Deed must be kept in a safe place as it is proof of property ownership.

Oklahoma Property Deed - The form serves as a permanent record of the property transaction, filed with the county recorder or a similar local government entity.