Blank Deed Form for New York

In the bustling real estate market of New York, the Deed form serves as a cornerstone document, facilitating the transfer of property ownership from one person to another. This critical piece of the property puzzle is not just a mere formality but a legally binding agreement that outlines the precise terms and conditions under which property changes hands. Designed to safeguard the interests of all parties involved, it details the buyer, seller, the property itself, and the type of deed being executed, whether it be warranty, quitclaim, or another form. Beyond its basic function, the New York Deed form also plays a pivotal role in the documentation process, serving as an official record of the transfer for both legal and tax purposes. Navigating through its complexities, one can appreciate how this form underpins the integrity of property transactions, assuring both parties of their rights and responsibilities in the preservation of real estate integrity within the state.

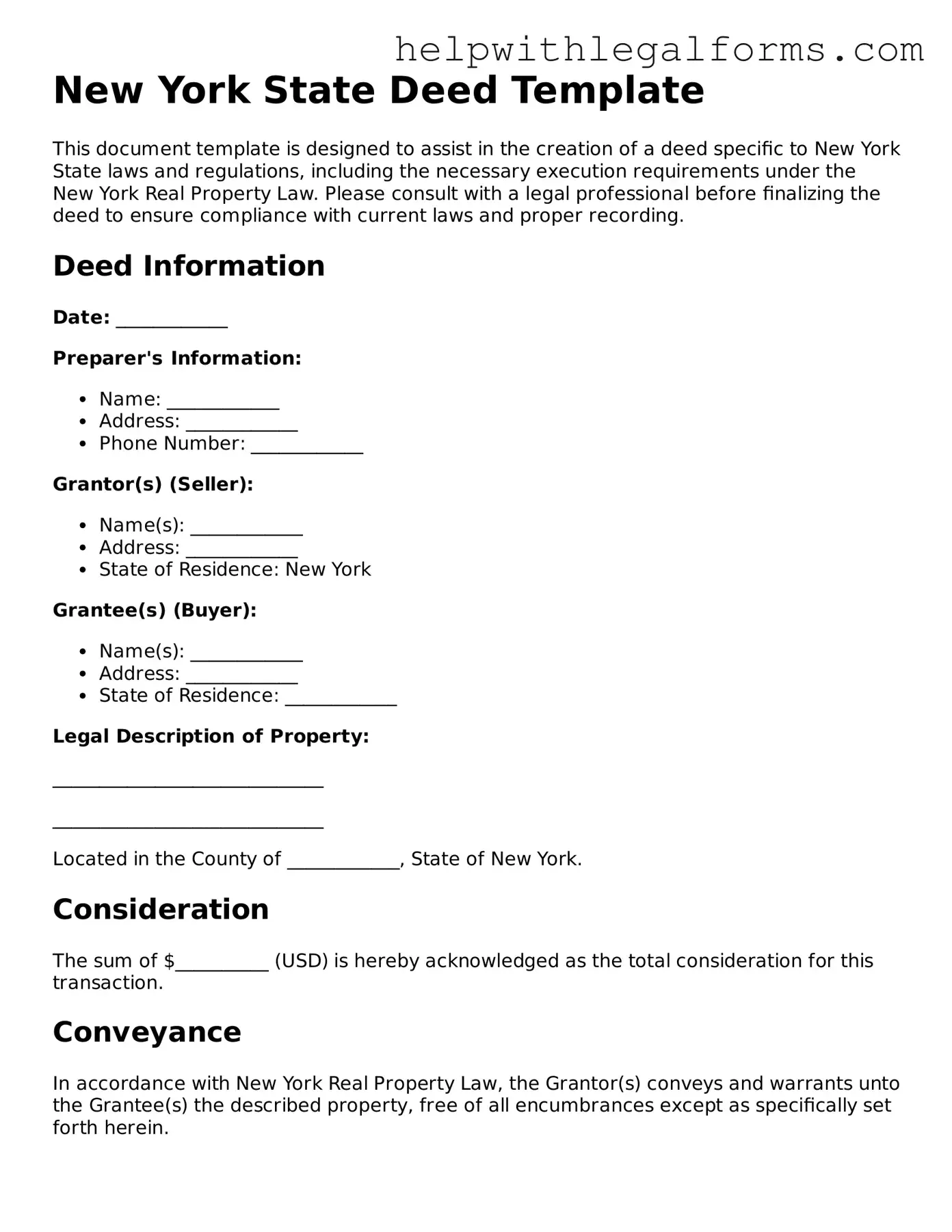

Example - New York Deed Form

New York State Deed Template

This document template is designed to assist in the creation of a deed specific to New York State laws and regulations, including the necessary execution requirements under the New York Real Property Law. Please consult with a legal professional before finalizing the deed to ensure compliance with current laws and proper recording.

Deed Information

Date: ____________

Preparer's Information:

- Name: ____________

- Address: ____________

- Phone Number: ____________

Grantor(s) (Seller):

- Name(s): ____________

- Address: ____________

- State of Residence: New York

Grantee(s) (Buyer):

- Name(s): ____________

- Address: ____________

- State of Residence: ____________

Legal Description of Property:

_____________________________

_____________________________

Located in the County of ____________, State of New York.

Consideration

The sum of $__________ (USD) is hereby acknowledged as the total consideration for this transaction.

Conveyance

In accordance with New York Real Property Law, the Grantor(s) conveys and warrants unto the Grantee(s) the described property, free of all encumbrances except as specifically set forth herein.

Signatures

All parties must sign this deed in the presence of a Notary Public.

Grantor(s) Signature(s):

_____________________________

Date: ____________

Grantee(s) Signature(s):

_____________________________

Date: ____________

Notary Public:

State of New York

County of ____________

On ____________, before me, ____________ (Notary name), personally appeared ____________ (Names of individuals signing), known to me (or proved to me based on satisfactory evidence) to be the person(s) whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In Witness Whereof, I have hereunto set my hand and official seal.

_____________________________

Notary Signature

Date: ____________

My Commission Expires: ____________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Type of Document | A New York Deed form is a legal document used to transfer property ownership from one person to another. |

| Required Signatures | The deed must be signed by the grantor(s) (the person transferring the property) in the presence of a notary public. |

| Governing Law | The deed and its execution are governed by New York State Real Property Law. |

| Types of Deeds | Common types in New York include Warranty Deeds, which guarantee a clear title to the buyer, and Quitclaim Deeds, which transfer any ownership the grantor may have without any guarantees. |

| Recording Requirement | Once signed and notarized, the deed must be filed with the County Clerk's office in the county where the property is located to be valid against third parties. |

| Consideration Statement | A statement of consideration (the value exchanged for the property) is required on the deed, and this amount can affect recording fees. |

Instructions on How to Fill Out New York Deed

Filling out a New York Deed form is a significant step in the process of transferring property ownership. This document is vital as it legally formalizes the change of ownership from the seller to the buyer. While the form may initially seem complex, breaking down the task into manageable steps makes the process straightforward. Below is a step-by-step guide designed to help simplify the completion of the New York Deed form. Remember, accurate and thorough completion of this form is crucial for a successful transfer of property.

- Begin with the preparer's information. This includes the name and address of the individual completing the form. Make sure to include a phone number and email address for contact purposes.

- Next, detail the consideration paid for the property. This refers to the amount of money exchanged or the value of any other type of compensation provided by the buyer to the seller.

- Enter the names and addresses of the grantor(s) and grantee(s). The grantor is the current owner selling or transferring the property, while the grantee is the future owner receiving the property.

- Describe the property being transferred. This should include the property’s physical address, any identifying numbers (like a tax map number), and a clear description of the property’s boundaries.

- Include any terms or conditions associated with the transfer. This may relate to easements, restrictions, or other rights that are part of the property’s usage.

- Signatures are essential. The form must be signed by all parties involved in the transfer, including witnesses. The grantor(s)' signatures must be notarized, validating the document’s authenticity.

- If applicable, attach any additional documents that are part of the transaction or required by local law. This could include title search documents or property surveys.

- Finally, file the completed deed form with the appropriate New York county office to officially record the property transfer. Each county may have its own specific requirements or fees associated with the filing, so it's important to verify this information beforehand.

Successfully completing and filing the New York Deed form is a vital step in the property transfer process. Taking the time to carefully follow these steps ensures the smooth legal transfer of ownership, protecting all parties involved. While the process requires attention to detail, understanding each step demystifies the procedure, making it accessible for everyone involved.

Crucial Points on This Form

What is a New York Deed form?

A New York Deed form is a legal document used to transfer property ownership from one party, known as the grantor, to another, known as the grantee, within the state of New York. This document is necessary for the legal conveyance of real estate and must be properly completed, signed, and recorded to be valid.

What are the different types of Deed forms available in New York?

In New York, there are primarily three types of Deeds used to transfer property: the Warranty Deed, which guarantees the buyer that the property is free from any liens or claims; the Quitclaim Deed, which transfers only the interest the seller has in the property without any warranties; and the Special Warranty Deed, which only warrants against claims made during the seller's ownership. Each type serves different purposes depending on the transaction.

Where can one obtain a New York Deed form?

New York Deed forms can be obtained from several sources including online legal document providers, local county clerk's office where the property is located, or by consulting with a legal professional specializing in real estate law. Choosing the correct form and ensuring its completeness is crucial, thus seeking professional advice is recommended.

What information is required to complete a Deed form in New York?

To complete a Deed form in New York, information such as the full legal names and addresses of the grantor and grantee, a complete legal description of the property, the consideration or purchase price, and the signature of the grantor in front of a notary public is required. Additional details might be necessary depending on the county where the property is located.

Is a lawyer required to fill out a Deed form in New York?

While it is not strictly required to have a lawyer to fill out a Deed form in New York, it is highly advisable. Real estate transactions can be complex, and having a legal professional ensures that the Deed is correctly completed and that the transfer of property is legally binding. A lawyer can also advise on the implications of the different types of Deeds.

How does one record a Deed in New York?

Once signed and completed, a Deed must be recorded with the county clerk's office where the property is located. Recording the Deed provides public notice of the property transfer and is necessary for the Deed to be considered valid. The process involves submitting the Deed to the clerk’s office along with any required fees and taxes, and possibly additional documents depending on local regulations.

What are the fees associated with recording a Deed in New York?

The fees for recording a Deed in New York vary by county and may include a recording fee based on the number of pages, as well as transfer taxes depending on the property’s sale price. Additional fees could apply for supplemental documents required for recording. It is advisable to contact the local county clerk’s office for the specific fee schedule.

Can a Deed be challenged or revoked after it has been recorded in New York?

Yes, a Deed can be challenged or revoked after recording under certain circumstances, such as if it was signed under duress, fraud was involved in the transaction, or if there were issues with the grantor's legal capacity to transfer the property. Challenges to a Deed require legal proceedings and it is highly recommended to consult with a legal professional specializing in real estate or contract law to address such concerns.

Common mistakes

When individuals embark on the journey of transferring property in New York, completing the deed form is a critical step that, if done incorrectly, can lead to considerable legal hurdles. Here are nine common mistakes to avoid:

Not using the correct deed form: New York State has various deed forms for different situations. Using the incorrect form can invalidate the transfer.

Failing to include all necessary parties: All individuals who hold an interest in the property must be listed on the deed for the transfer to be valid. Omitting a party can result in an incomplete transfer.

Incorrectly stating the grantor and grantee's information: It's crucial to accurately state the names and addresses of both the transferor (grantor) and the recipient (grantee). Mistakes here could hinder the transfer.

Omitting the legal description of the property: The deed must contain a detailed legal description of the property, not just its address. Errors or omissions can create ambiguity about what is being transferred.

Not including the consideration: The deed should state the amount of money exchanged for the property or other forms of consideration, even if the property is a gift.

Failure to secure witnesses: New York law requires deeds to be signed in the presence of one or two witnesses, depending on local requirements. Overlooking this step can render the deed unenforceable.

Forgetting to get the signature notarized: A notary public must acknowledge the signatories' identities and their signatures for the deed to be properly executed.

Not filing the deed with the county clerk: After execution, the deed must be filed with the appropriate county clerk’s office to effectuate the property transfer officially.

Ignoring tax forms: Transfer of real property in New York usually necessitates the completion and filing of certain tax forms, such as the Real Property Transfer Tax form. Neglecting these forms can result in fines and/or delays.

To navigate these complexities, many individuals find it beneficial to consult with a legal professional. This ensures that all aspects of the transfer comply with New York State laws, helping to secure a smooth transition of property ownership.

Documents used along the form

When participating in property transactions in New York, the deed form is crucial, but it's often just one piece in a larger puzzle. Numerous other documents support, verify, and complement the information on the deed, ensuring the transaction complies with legal standards and protecting all parties involved. These documents range from tax forms to identity verification, each playing a vital role in the real estate process. Understanding these documents can streamline the transaction process, making it smoother for buyers, sellers, and professionals alike.

- Real Property Transfer Report (RP-5217): This form is required for the sale or transfer of real estate in New York. It provides the county with detailed information about the property, the sale price, and the parties involved in the transaction.

- TP-584 Combined Real Estate Transfer Tax Return: Necessary for documenting the transfer tax associated with the property sale. This form must be filed with the county clerk where the property is located and includes information on the sale's specifics and the parties involved.

- Mortgage Tax Affidavit: When a mortgage is part of the property purchase, this affidavit is required to calculate the mortgage recording tax due. It verifies the amount of the mortgage and the applicable tax rate.

- IT-2663 Nonresident Real Property Estimated Income Tax Payment Form: For sellers who are not residents of New York State, this form estimates and remits income tax on the sale's gain.

- Affidavit of Title: This document assures the buyer that the seller owns the property free and clear of any undisclosed liens, encumbrances, or legal disputes.

- Property Survey: Not a form per se, but an important document that maps out the property's boundaries, improvements, and any encroachments. It ensures that the property's physical dimensions match its legal descriptions.

- Closing Statement: An itemized list of all the fees, charges, and credits associated with the transaction. It provides a clear financial picture at the closing of the sale.

- Power of Attorney: If one party cannot be present at the closing, a power of attorney may be used to authorize another individual to sign documents on their behalf.

- Property Disclosure Statement: This form requires the seller to disclose any known defects or issues with the property. It's a crucial document that informs the buyer about the property's condition.

- Title Insurance Policy: While not a form, obtaining title insurance is a key step in protecting against past claims or undiscovered liens against the property. It guarantees the buyer's legal ownership of the property.

These documents, each with its specific purpose, create a comprehensive framework surrounding the deed form, ensuring every aspect of the property's sale is legally accounted for and transparent. Whether you're a buyer, seller, or legal professional, familiarity with these forms can help navigate the complexities of real estate transactions in New York with confidence.

Similar forms

A Mortgage Agreement: This document is similar to a Deed in that it involves real estate transactions. It outlines the terms under which the borrower agrees to repay a loan used to purchase property, often securing the loan by the property itself as collateral.

Bill of Sale: Used during the sale of personal property (cars, boats, etc.), this document parallels a Deed which is used for real property transactions. Both serve as legal proof that an item or property has been transferred from the seller to the buyer.

A Title Certificate: Similar to a Deed, it serves as proof of ownership. However, while a Deed transfers real estate, a Title Certificate usually relates to vehicles or other significant personal property.

Trust Deed: This document resembles a Deed as it involves property transfer. A Trust Deed transfers legal title of property to a trustee, who holds it as security for a loan, similar to how a Deed transfers property ownership under specific conditions.

Lease Agreement: Like a Deed, it is a crucial document in real estate transactions, detailing the terms under which one party agrees to rent property owned by another party. It demonstrates the transfer of the right to use property rather than the property itself.

Easement Agreement: This document, which grants the right for one party to use another party's property for a specific purpose (such as a driveway or utility line), shares the characteristic of affecting property rights, much like a Deed changes property ownership.

Power of Attorney: Though not limited to real estate, this document authorizes one person to act on behalf of another. It can include the power to buy, sell, and manage real estate, thus indirectly involving the transfer or management of property similar to a Deed.

Promissory Note: Often associated with real estate transactions like a Mortgage Agreement, it signifies a promise to pay a specified amount of money to another party. It's related to deeds in the context of financing property purchases.

Quitclaim Deed: Specifically, this type of Deed transfers any ownership interest the grantor might have in a property without any warranty. It is directly related to a Deed form as a variant, ensuring transfer of property rights, albeit with no guarantees.

Dos and Don'ts

Filling out the New York Deed form is a crucial step in the process of transferring property ownership. To ensure clarity and prevent future legal issues, here are essential dos and don'ts to consider:

- Do double-check the property's legal description. This includes lot numbers, addresses, and any other important distinguishing details. Accuracy here is critical.

- Do verify the grantor's and grantee's information. Full legal names and accurate identification ensure that the deed is legally binding and enforceable.

- Do sign in the presence of a notary. New York law requires notarization for the deed to be considered valid and recordable.

- Do keep a copy of the deed for your records. After recording, ensure you have a copy that confirms the document was filed with the county.

- Don't leave any fields blank. If a section does not apply, mark it with "N/A" to indicate it was not overlooked.

- Don't sign without reviewing every detail. Mistakes on a deed can create significant legal complications down the line.

- Don't forget to check for any specific county requirements. Some localities may have additional forms or stipulations.

- Don't hesitate to seek legal advice. If any part of the deed or process is unclear, professional guidance can prevent errors.

By following these guidelines, parties involved can ensure a smoother, more reliable transfer of property ownership.

Misconceptions

When discussing the New York Deed form, numerous misconceptions arise, fueled by a mixture of misinformation and lack of understanding of legal documents. Clarifying these misconceptions is essential for individuals engaged in property transactions to make informed decisions. Here are five common misunderstandings about the New York Deed form:

- One Form Fits All: Individuals often believe there is a single, universal form that is applicable to all property transactions across New York. However, the reality is more complex. Different types of deeds (such as warranty, quitclaim, and special warranty deeds) are used depending on the guarantees provided by the seller and the specifics of the property transaction. Each type addresses different needs and offers varying levels of protection to the buyer.

- Signing Equals Immediate Ownership: Another common misconception is that once the deed form is signed, the property ownership is immediately transferred to the buyer. In truth, the transfer of ownership is only completed upon the deed's delivery to and acceptance by the grantee, followed by the proper recording of the document with the appropriate county office. This process ensures that the change in ownership is public record, providing protection against future claims.

- Attorney Presence Is Optional: While it is theoretically possible to complete a deed transfer without legal assistance, this approach often overlooks the complexity of real estate laws and regulations in New York. Involving attorneys ensures that the deed complies with all state and local requirements, minimizes the risk of future disputes, and safeguards both parties' interests.

- No Need for Witnesses: The assumption that deed signings do not require witnesses is another prevalent error. New York State law mandates the presence of witnesses for the signing of the deed. This crucial step lends additional legality and credibility to the document, helping to solidify the transaction's validity.

- Fillable Forms Guarantee Accuracy: With the availability of online resources, many people presume that using a fillable form guarantees the deed will be completed accurately. While these forms provide a template, filling them out correctly necessitates a deep understanding of the specific legal language and terms required. An improperly completed form can lead to significant issues, possibly invalidating the deed or creating legal challenges in the future.

Correcting these misconceptions ensures that parties involved in property transactions are better equipped to navigate the complexities of New York's real estate laws. Appreciating the nuances of the deed process in New York can significantly impact the success and legality of a property transfer.

Key takeaways

Filling out and using the New York Deed form is a crucial step in the process of real estate transactions. This document, essential for the transfer of property ownership, requires careful attention to detail. Here are ten key takeaways to keep in mind:

- The New York Deed form must include the full names and addresses of both the seller (grantor) and the buyer (grantee) to ensure clarity in ownership transfer.

- Legal descriptions of the property being transferred are mandatory; these descriptions go beyond the street address, often including block and lot numbers and other identifiers.

- Signatures of all involved parties are required for the deed to be valid. This typically includes the grantor and grantee, and may also require witnesses.

- The deed must indicate the type of ownership being transferred. Common types include warranty, grant, and quitclaim deeds, each offering different levels of protection for the buyer.

- The consideration or sale price of the property must be clearly stated in the deed to maintain transparency and legal compliance.

- Transfer taxes, often based on the sale price, must be calculated and included, as they are a obligatory part of property transactions in New York.

- The document needs to be filed with the appropriate New York County Clerk’s Office or local land records office where the property is located, to make the transfer public record.

- An acknowledgment section, usually notarized, is required to confirm the identities of the parties involved and the voluntariness of the transaction.

- Incorporation of any additional terms or conditions specific to the sale or transfer, agreed upon by all parties, should be clearly documented in the deed.

- Review and verification by a legal professional can help to avoid common mistakes and ensure the deed adheres to New York state laws and regulations.

Understanding these elements before filling out the New York Deed form can streamline the property transfer process, making it more efficient and legally sound. This document is not just a formality but a pivotal legal instrument that protects the rights and interests of all parties involved in a property transaction.

Create Other Deed Forms for US States

Oklahoma Property Deed - Executor's deeds are used when property is transferred through a will, where the executor of the estate has the authority to sell the property.

Property Owners Search - Recording the deed is a critical step for confirming the transaction in public records, affecting property taxes and ownership rights.

General Warranty Deed Colorado - Can be categorized into different types, such as warranty deeds or quitclaim deeds, each offering different levels of protection.