Blank Deed Form for Oklahoma

In Oklahoma, the transfer of real estate ownership is a process that requires precision, understanding, and adherence to state laws to ensure that it is legally binding. At the heart of this process is the Oklahoma Deed form, a critical document that plays a pivotal role in the conveyance of property from one party to another. This form comes in various types, each catering to different conditions and requirements of the transfer. Understanding the nuances of this form, including its major types such as the Warranty Deed, Quitclaim Deed, and Special Warranty Deed, is essential for anyone involved in real estate transactions within the state. The form not only outlines the specifics of the property and the identities of the buyer and seller but also carries significant legal implications regarding the rights transferred and the warranties provided by the seller to the buyer. The proper completion and recording of the Oklahoma Deed form are fundamental steps to ensure that the property transfer complies with Oklahoma state law, thereby providing a clear and undisputed ownership title to the buyer.

Example - Oklahoma Deed Form

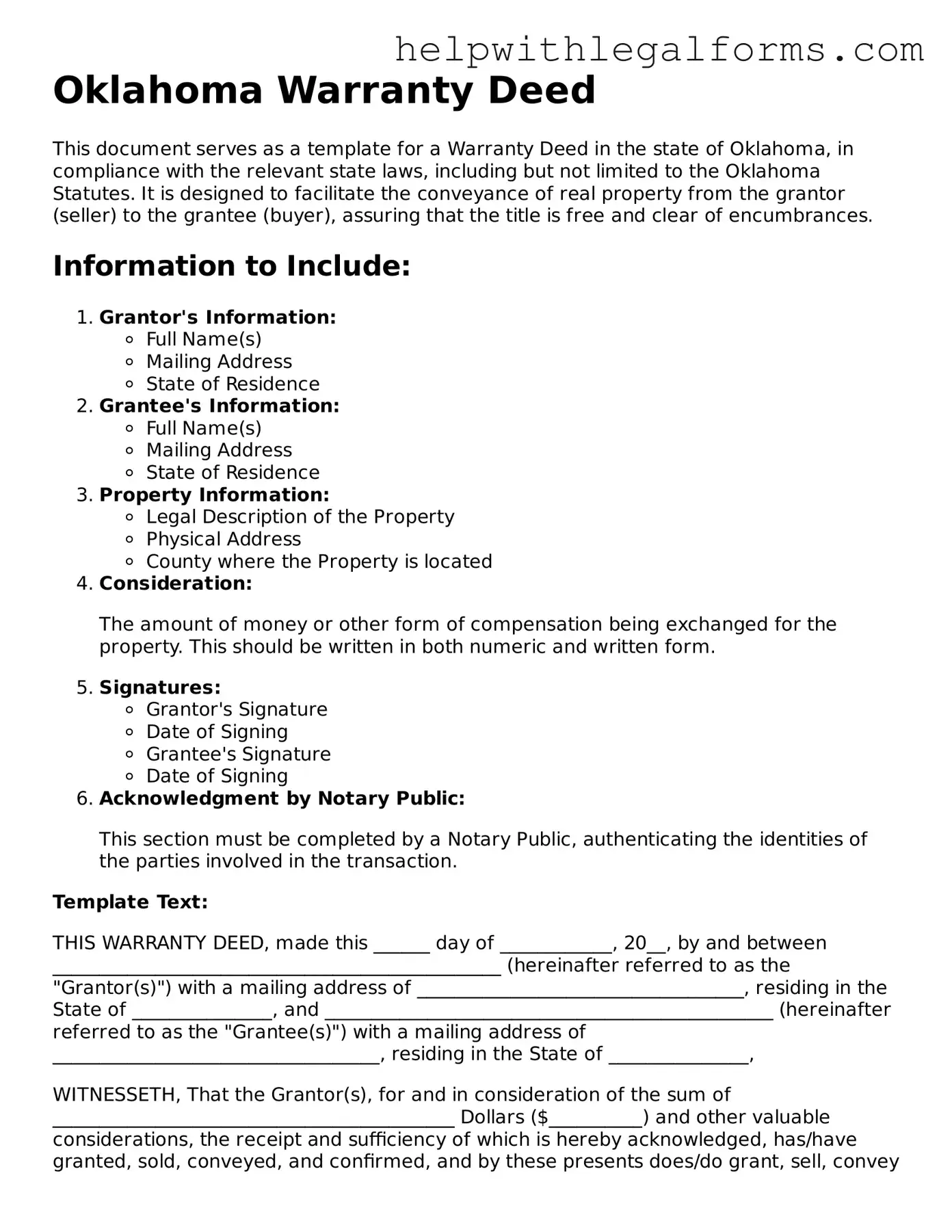

Oklahoma Warranty Deed

This document serves as a template for a Warranty Deed in the state of Oklahoma, in compliance with the relevant state laws, including but not limited to the Oklahoma Statutes. It is designed to facilitate the conveyance of real property from the grantor (seller) to the grantee (buyer), assuring that the title is free and clear of encumbrances.

Information to Include:

- Grantor's Information:

- Full Name(s)

- Mailing Address

- State of Residence

- Grantee's Information:

- Full Name(s)

- Mailing Address

- State of Residence

- Property Information:

- Legal Description of the Property

- Physical Address

- County where the Property is located

- Consideration:

The amount of money or other form of compensation being exchanged for the property. This should be written in both numeric and written form.

- Signatures:

- Grantor's Signature

- Date of Signing

- Grantee's Signature

- Date of Signing

- Acknowledgment by Notary Public:

This section must be completed by a Notary Public, authenticating the identities of the parties involved in the transaction.

Template Text:

THIS WARRANTY DEED, made this ______ day of ____________, 20__, by and between ________________________________________________ (hereinafter referred to as the "Grantor(s)") with a mailing address of ___________________________________, residing in the State of _______________, and ________________________________________________ (hereinafter referred to as the "Grantee(s)") with a mailing address of ___________________________________, residing in the State of _______________,

WITNESSETH, That the Grantor(s), for and in consideration of the sum of ___________________________________________ Dollars ($__________) and other valuable considerations, the receipt and sufficiency of which is hereby acknowledged, has/have granted, sold, conveyed, and confirmed, and by these presents does/do grant, sell, convey and confirm unto the said Grantee(s), the following described real estate, situated in the County of ____________, State of Oklahoma, to-wit:

[Insert Legal Description of the Property Here]

TO HAVE AND TO HOLD the above described premises unto the said Grantee(s), their heirs, administrators, and assigns forever. And the Grantor(s) hereby covenants with the Grantee(s) that at the time of the execution of this conveyance, the Grantor(s) is/are lawfully seized in fee simple of the above-described premises, that the premises are free from all encumbrances, except as herein specifically set forth, and that the Grantor(s) will warrant and forever defend the same to the Grantee(s) against the lawful claims of all persons whomsoever.

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set their hand(s) and seal(s) the day and year first above written.

__________________________________

Grantor's Signature

__________________________________

Date

__________________________________

Grantee's Signature

__________________________________

Date

STATE OF OKLAHOMA

COUNTY OF ____________

On this ______ day of ____________, 20__, before me, a Notary Public in and for said State, personally appeared _________________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and official seal.

__________________________________

Notary Public

My Commission Expires: ____________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1. | Oklahoma deed forms are used to transfer property ownership from one person to another. |

| 2. | There are several types of deeds in Oklahoma, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| 3. | A warranty deed provides the buyer with the highest level of protection, guaranteeing the seller owns the property free and clear of any liens or encumbrances. |

| 4. | Quitclaim deeds transfer ownership without any guarantees about the property title, commonly used between family members or to clear title issues. |

| 5. | Special warranty deeds guarantee that the seller owns the property and discloses any known liens during their ownership period only. |

| 6. | Oklahoma deeds must include a legal description of the property, the names of the grantor (seller) and grantee (buyer), and must be signed by the grantor. |

| 7. | Oklahoma law requires that all deeds be notarized to be valid. |

| 8. | Once a deed is executed, it should be filed with the county clerk's office in the county where the property is located to be effective against third parties. |

| 9. | The Oklahoma Documentary Stamp Tax applies to deeds, calculated based on the property's sale price or its fair market value at the time of transfer. |

| 10. | According to Oklahoma statutes, specifically Title 16, Section 15, deeds must be in writing to be valid. |

Instructions on How to Fill Out Oklahoma Deed

Completing the Oklahoma Deed form marks a critical step in the process of transferring ownership of real estate within the state. This document, required by law, ensures that the transfer is legally binding and properly recorded. The steps below guide individuals through this detailed process to guarantee accuracy and compliance, facilitating a smooth transition of property rights. Whether it's a gift, sale, or inheritance, correctly filling out the deed form is paramount in protecting all parties involved.

- Begin by downloading the official Oklahoma Deed form from the state's website or obtaining a hard copy from a local government office.

- Identify the type of deed required for your situation, such as a warranty deed or quitclaim deed, based on the level of protection you seek.

- Fill in the preparer's information section, which includes the name and address of the individual completing the form.

- Document the return address to ensure the recorded deed is sent to the correct location after processing.

- Enter the consideration amount, which is the value being exchanged for the property. If the property is a gift, specify this in the designated area.

- Complete the "Grantor" section with the current owner's legal name and address.

- In the "Grantee" section, provide the name(s) and address(es) of the new owner(s) as they should appear on the recorded deed.

- Describe the property in detail, including its legal description found in previous deeds or tax documents, to accurately identify the land being transferred.

- For warranty deeds, include any covenants guaranteeing the grantor’s right to transfer the property and that the property is free from undisclosed encumbrances.

- The grantor must sign the deed in front of a notary public to verify their identity and willingness to transfer the property.

- Submit the signed and notarized deed to the local county clerk's office, along with any required filing fees, to officially record the transfer.

Once the document is filed, the property rights are legally transferred, and the new deed will be mailed to the aforementioned return address. This formalizes the change in ownership and updates public records accordingly. It’s imperative to keep a copy of the deed for personal records, as it serves as proof of ownership and may be required for future legal or financial transactions involving the property.

Crucial Points on This Form

What is an Oklahoma Deed form?

An Oklahoma Deed form is a legal document used to transfer property ownership from one party to another within the state of Oklahoma. This form outlines the details of the transaction, including information about the buyer, seller, and the property itself. It must be filed with the appropriate county office to be considered valid and enforceable.

Are there different types of Deed forms in Oklahoma?

Yes, Oklahoma recognizes several types of Deed forms, each serving different purposes. The most common types include the Warranty Deed, which provides the buyer with the highest level of protection, affirming that the seller holds a clear title to the property; the Quitclaim Deed, which transfers only the interest the seller has in the property without any guarantees; and the Special Warranty Deed, which only covers the period during which the seller owned the property.

What are the necessary elements to include in an Oklahoma Deed form?

A properly executed Oklahoma Deed form must include the legal names of the buyer and seller, a complete legal description of the property being transferred, the signature of the seller (and, in some cases, the buyer), and an acknowledgment by a Notary Public. Some deeds may require additional information or disclosures depending on the nature of the conveyance and local requirements.

Where can I obtain an Oklahoma Deed form?

Oklahoma Deed forms can be obtained from several sources, including online legal form providers, real estate attorneys, or the local county clerk's office where the property is located. It's crucial to ensure that the form complies with Oklahoma laws and requirements for it to be valid.

Is a lawyer required to fill out an Oklahoma Deed form?

While it's not legally required to have a lawyer fill out an Oklahoma Deed form, consulting with a real estate attorney is highly recommended. A lawyer can provide legal advice, ensure that the deed meets all state and local requirements, and help avoid costly mistakes during the property transfer process.

How do I file an Oklahoma Deed form?

Once completed and signed, an Oklahoma Deed form must be filed with the county clerk's office in the county where the property is located. The filing process typically involves submitting the deed along with any required filing fees. The clerk's office will then record the deed, making it a matter of public record.

What are the fees associated with filing an Oklahoma Deed form?

Filing fees for an Oklahoma Deed form vary by county. Generally, there is a standard filing fee for the first page of the deed and an additional fee for each subsequent page. Additional charges may apply for records search or other services. It's advisable to contact the local county clerk's office for the most current fee schedule.

Can an Oklahoma Deed form be voided or amended?

Once filed, an Oklahoma Deed form is legally binding and can only be voided or amended under certain circumstances, such as mutual agreement between the buyer and seller, court order, or proving that the deed was executed under fraud or duress. Amending a deed typically requires executing and filing a new deed with the corrected information.

What happens if there are errors in the Oklahoma Deed form?

Errors in an Oklahoma Deed form can often lead to legal disputes or complications in the title to the property. It is crucial to thoroughly review the deed before filing and, if errors are discovered after recording, seek legal advice to determine the best course of action. Correcting a recorded deed usually involves filing a correction deed or an affidavit with the county clerk's office.

Common mistakes

When filling out an Oklahoma Deed form, many people, eager to transfer their property, often make mistakes. These errors can delay the process, cost extra in fees, or even invalidate the deed altogether. By being aware of the common pitfalls, you can ensure a smoother transaction. Here are ten mistakes to watch out for:

Not using the correct form - Oklahoma has different types of deeds (warranty, quitclaim, etc.), and using the wrong one can affect your rights and obligations.

Failing to use the full legal name of the parties - It's crucial to use the full, legal names of both the grantor (seller) and grantee (buyer) as inaccuracies could lead to disputes about the deed's validity.

Omitting vital details from the legal description of the property - An accurate legal description is essential; it's not enough to just provide the address. Leaving out any part can create confusion about what property is being transferred.

Not having the deed signed in the presence of a notary public - For a deed to be legally valid in Oklahoma, it must be notarized. Not doing so is a common mistake that invalidates the document.

Forgetting to file the deed with the County Clerk's office - After execution, the deed must be recorded at the local County Clerk's office to make it official; failure to do so can result in legal complications.

Leaving blank spaces - Any unfilled sections or blanks can lead to ambiguities or questions about the deed's intent, potentially requiring legal clarification.

Misunderstanding the difference between joint tenancy and tenancy in common - These terms describe how multiple owners hold title to the property, and misunderstanding them can have significant implications for future property rights and succession.

Incorrectly calculating the documentary stamp tax - This tax, based on the property's sale price, must be accurately calculated and affixed to the deed. An incorrect amount can lead to penalties.

Not consulting a professional when needed - Property transfers can be complex. Failing to seek advice from a legal or real estate professional can lead to errors.

Failing to consider the impact of a deed transfer on a mortgage - If the property still has a mortgage, the deed transfer might trigger a due-on-sale clause unless properly managed, leading to the full loan amount being due immediately.

By sidestepping these common errors, you can help ensure your Oklahoma Deed form is filled out correctly, paving the way for a successful property transfer.

Documents used along the form

When transferring property ownership in Oklahoma, the deed form is just the beginning. To ensure a smooth transfer process, several other forms and documents often accompany the deed. These documents help in verifying the details of the transaction, ensuring legal compliance, and safeguarding the interests of all parties involved. Let's explore some of these critical documents that are usually part of the property transfer process in Oklahoma, shedding light on their purpose and importance.

- Real Estate Transfer Declaration: This document provides essential information about the property and the terms of the sale. It's used by the county assessor to ensure the property is accurately listed for tax purposes. It includes details such as the property’s sale price and conditions of the transfer.

- Title Insurance Policy: Offering protection against financial loss from defects in title to real property, this policy is a necessity for most property transactions. It safeguards both the buyer and lender against any legal challenges that might arise due to disputes over property ownership.

- Mortgage Documents: If the property purchase involves a mortgage, these documents outline the terms and conditions of the loan. They detail the repayment plan, interest rates, and the rights and responsibilities of both the lender and borrower. It’s crucial for securing the necessary financing for the property.

- Closing Disclosure: This document is provided to the buyer at least three days before closing the sale. It outlines the final details of the mortgage loan, if applicable, including the loan terms, projected monthly payments, and all closing costs. The Closing Disclosure ensures transparency and allows the buyer to review the costs before finalizing the transaction.

These documents play a vital role in property transactions in Oklahoma, ensuring that all aspects of the transfer are clear, legally compliant, and mutually agreed upon. By understanding these additional forms and documents, individuals engaging in property transactions can better navigate the intricacies of real estate dealings, ensuring a secure and efficient transfer of ownership.

Similar forms

Mortgage Agreement: Like a Deed, a Mortgage Agreement creates a legal relationship involving real property. While a Deed transfers ownership rights, a Mortgage Agreement secures a loan using the property as collateral. Both documents are recorded in public records, ensuring transparency and legal recognition.

Lease Agreement: Similar to a Deed, a Lease Agreement pertains to the rights over real estate. However, instead of transferring ownership like a Deed, a Lease Agreement grants the right to use or occupy the property for a defined period under specified conditions. Both documents establish terms that bind the parties involved.

Bill of Sale: The Bill of Sale is akin to a Deed as both serve as written evidence of the transfer of rights; the Deed covers real property, whereas the Bill of Sale is used for personal property (e.g., vehicles or equipment). Each document officially records the transaction, providing proof of ownership transfer.

Warranty Deed: A specific type of deed, a Warranty Deed, not only transfers ownership but also guarantees the grantor holds clear title to the property. Both a general Deed and a Warranty Deed ensure the legal transfer of property, but the Warranty Deed offers additional assurances to the buyer regarding the status of the property title.

Quit Claim Deed: This document, closely related to a standard Deed, is used to transfer any interest in real property that the grantor may have, without any warranty of title. While it serves a similar purpose as a Deed in transferring rights in a property, a Quit Claim Deed carries no guarantee about the extent of those rights or if they exist at all.

Dos and Don'ts

Filling out a deed form is a crucial step in the process of transferring property ownership. When dealing with the Oklahoma Deed form, certain practices should be followed to ensure the process goes smoothly and legally. Below are eight key dos and don'ts to consider:

- Do double-check the form type. Oklahoma has various deed forms, such as warranty, quitclaim, and special warranty deeds. Ensure you're using the right one for your transaction.

- Do verify all parties' names are spelled correctly. The names on the deed should exactly match the parties' legal documents.

- Do include a complete legal description of the property. This information can usually be found on the previous deed or at the county recorder's office.

- Do consult with a legal professional if you have any doubts. The implications of transferring property are significant and professional advice can be invaluable.

- Don't leave any blanks on the form. If a section does not apply, mark it as "N/A" (not applicable) rather than leaving it empty.

- Don't forget to sign and date the deed in front of a notary public. This step is essential for the document to be legally valid.

- Don't overlook the requirement for witness signatures if applicable. Oklahoma deeds may require witness signatures in addition to notarization, depending on the county.

- Don't delay in recording the deed with the county clerk's office after it's signed. Recording the deed makes the transaction a matter of public record and protects the new owner's interests.

By following these guidelines, you can help ensure the deed form is filled out correctly, paving the way for a smooth property transfer process.

Misconceptions

When dealing with Oklahoma Deed forms, several misconceptions commonly arise. These misunderstandings can lead to confusion about how property titles are transferred in the state of Oklahoma.

One signature suffices for a joint property. People frequently believe that if a property is owned jointly, a single owner can sign the deed for the transfer. In Oklahoma, both (or all) parties must sign the deed to validly convey co-owned property, ensuring that all owners' rights are considered.

Notarization is optional. Another misconception is the belief that notarization of the deed is a mere formality and not a necessity. In Oklahoma, notarization is a legal requirement for the document to be considered valid and recordable. The notary public confirms the identity of the signers, helping to prevent fraud.

Deeds transfer immediately upon signing. Some people think that the deed's transfer of property rights is effective immediately upon signing. However, in Oklahoma, the deed must be delivered to the grantee (the person receiving the property) and, ideally, recorded with the county clerk to safeguard against claims from third parties and ensure the deed's effectiveness.

All deeds offer the same level of protection. A common misconception is that all deeds provide the same rights and protections. Oklahoma recognizes several types of deeds, such as warranty deeds, which guarantee the property is free from claims, and quitclaim deeds, which do not guarantee clear title. Each type serves different purposes and offers varying levels of protection for the grantee.

Legal descriptions are not critical. The final frequent misunderstanding is that a street address is sufficient for the deed's property description. Oklahoma law requires a legal description of the property (such as lot, block, and subdivision or a metes and bounds description) to accurately identify the property being transferred. This legal description is crucial for the deed to be valid and for future property title searches.

Key takeaways

When dealing with the process of filling out and using the Oklahoma Deed form, several critical takeaways must be considered to ensure the document is completed and utilized accurately. Understanding these points can help in avoiding common mistakes and ensuring that property transfers in Oklahoma are done smoothly and legally.

Ensure all the required information is complete and accurate. This includes the full names and addresses of both the grantor (seller) and grantee (buyer), legal description of the property, and any other requisite details.

Verify the type of deed being used, as Oklahoma recognizes several types, including warranty deeds, quit claim deeds, and special warranty deeds, each serving different purposes.

Include a thorough legal description of the property. This is crucial as it distinguishes the specific parcel of land in question. It usually encompasses the lot number, block number, addition name, city, and county, along with a metes and bounds description if available.

Ensure the deed is signed by the grantor(s) in the presence of a notary public. The notary acknowledgment is vital for the document to be considered legally binding and for recording purposes.

Understand the importance of the consideration statement, which details the amount paid for the property or the value of the exchange. Stating this accurately is essential for tax purposes and legal validation of the sale.

Record the deed at the county clerk's office in the county where the property is located. Recording the deed is a public declaration of the ownership change and protects the grantee's interests.

Check if any transfer taxes or recording fees are due at the time of filing. These costs can vary by county and must be settled for the deed to be recorded properly.

After recording, ensure the original deed is returned to the grantee or the grantee's legal representative for safekeeping. This serves as a physical proof of ownership and may be needed for future legal or transactional purposes.

By adhering to these key points, individuals can navigate the complexities of transferring property in Oklahoma with confidence, ensuring all legal requirements are met and protecting the interests of all parties involved.

Create Other Deed Forms for US States

Life Estate Deed New York Form - The Deed is often the final step in the process of a property sale or transfer.

Property Owners Search - For mortgage or loan-related property transfers, the form plays a key role in specifying the new owner's liabilities.

General Warranty Deed Colorado - Often accompanied by a detailed explanation of any warranties or guarantees about the property condition.