Legal Quitclaim Deed Form

A quitclaim deed form plays a pivotal role in the transferring of property rights from one party to another without any warranties regarding the title's clearness. Unlike traditional warranty deeds, where the grantor asserts that the property is free of liens or claims, a quitclaim deed offers no such assurances, making it a simple yet potentially risky instrument for property transactions. This form is frequently utilized among family members, in divorce settlements, or in situations where speed and simplicity are prioritized over thorough title checks. Its appeal lies in the expedient manner in which property rights can be transferred, sidestepping the complexities and assurances typically involved in real estate transactions. However, the lack of guarantees can introduce elements of uncertainty, underscoring the importance of understanding when and how to use this form effectively. Ensuring that both parties are aware of the implications and limitations of a quitclaim deed is crucial in making informed decisions that align with their intentions and legal interests.

State-specific Quitclaim Deed Forms

Example - Quitclaim Deed Form

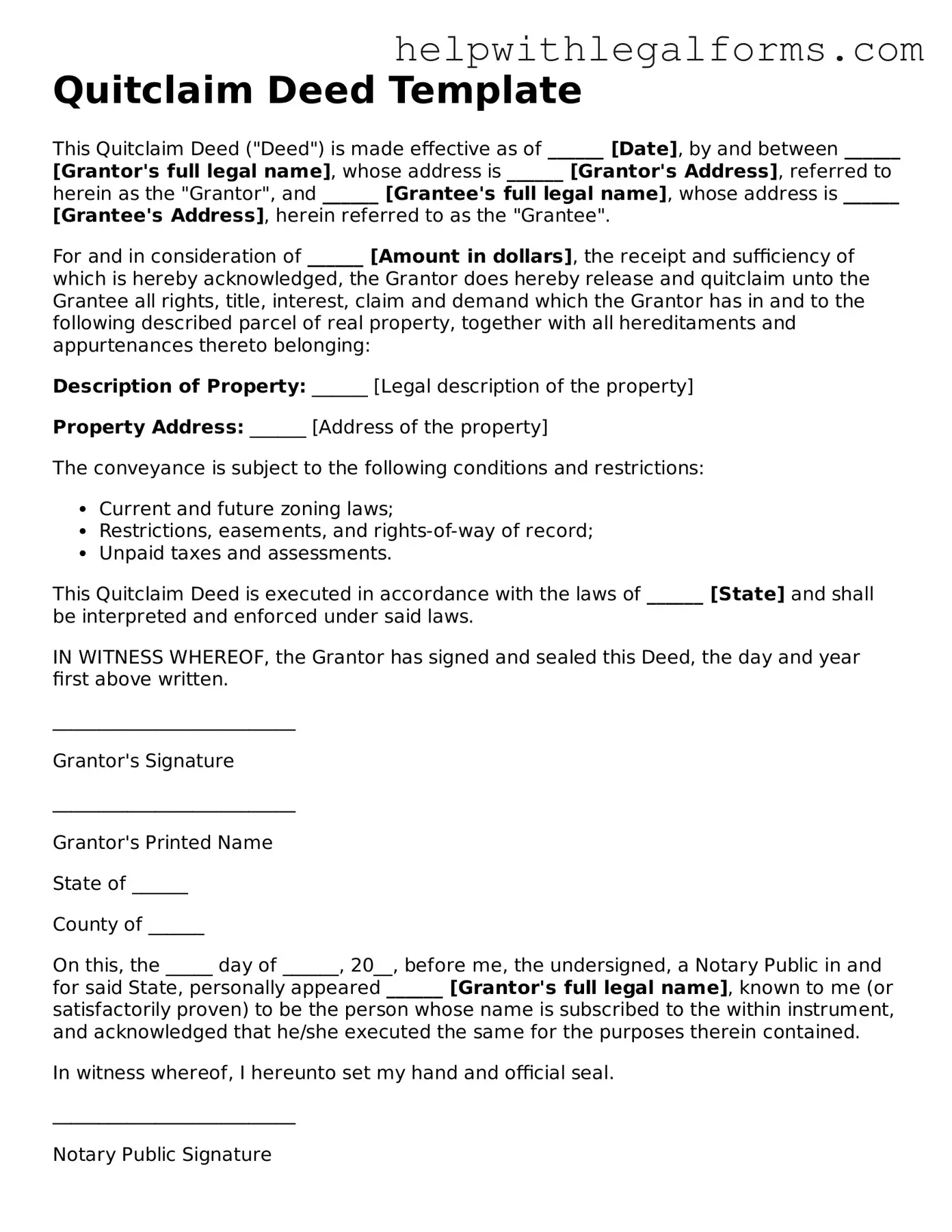

Quitclaim Deed Template

This Quitclaim Deed ("Deed") is made effective as of ______ [Date], by and between ______ [Grantor's full legal name], whose address is ______ [Grantor's Address], referred to herein as the "Grantor", and ______ [Grantee's full legal name], whose address is ______ [Grantee's Address], herein referred to as the "Grantee".

For and in consideration of ______ [Amount in dollars], the receipt and sufficiency of which is hereby acknowledged, the Grantor does hereby release and quitclaim unto the Grantee all rights, title, interest, claim and demand which the Grantor has in and to the following described parcel of real property, together with all hereditaments and appurtenances thereto belonging:

Description of Property: ______ [Legal description of the property]

Property Address: ______ [Address of the property]

The conveyance is subject to the following conditions and restrictions:

- Current and future zoning laws;

- Restrictions, easements, and rights-of-way of record;

- Unpaid taxes and assessments.

This Quitclaim Deed is executed in accordance with the laws of ______ [State] and shall be interpreted and enforced under said laws.

IN WITNESS WHEREOF, the Grantor has signed and sealed this Deed, the day and year first above written.

__________________________

Grantor's Signature

__________________________

Grantor's Printed Name

State of ______

County of ______

On this, the _____ day of ______, 20__, before me, the undersigned, a Notary Public in and for said State, personally appeared ______ [Grantor's full legal name], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

__________________________

Notary Public Signature

My Commission Expires: ______

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer interest in real property from one person (the grantor) to another (the grantee) without any warranty of title. |

| Warranty | It offers no guarantee on the ownership status of the property or the title's clearness. |

| Common Uses | Often used among family members, in divorce proceedings, or in informal transactions where the property’s history is well known. |

| State-Specific Forms | Requirements and forms can vary widely; most states have a specific format that needs to be adhered to. |

| Governing Law | Each state has its own statutes and laws governing the execution of Quitclaim Deeds. These laws determine the necessary content, signing requirements, and filing procedures. |

| Signing Requirements | Many states require the Quitclaim Deed to be signed in the presence of a notary public. Some states also require witness(es). |

| Filing | After signing, the Quitclaim Deed must be filed with the local county recorder’s office or land registry office, along with any required filing fee. |

| Revocation | Once executed and delivered, it is generally not possible to revoke a Quitclaim Deed without the grantee’s consent. |

| Risks | Given the lack of warranty, buyers should proceed with caution and conduct due diligence on the property’s history and title. |

Instructions on How to Fill Out Quitclaim Deed

After deciding to transfer property rights without a warranty, using a Quitclaim Deed is the next step. This document is a simple way to relinquish one's interest in a property to another person. It's important to fill out this form accurately to ensure a smooth transition. The following instructions will guide you through the process.

- Locate the legal description of the property. This is often found in a previous deed for the property and must be copied exactly.

- Write the full name of the grantor (the person giving up rights) at the top of the form, ensuring it matches the name on the property’s current deed.

- Enter the grantor's mailing address.

- Specify the full name of the grantee (the person receiving the property rights).

- Include the grantee's mailing address.

- Fill in the amount the grantee is paying for the property, if applicable. This can often be a nominal amount, like $10, or simply "love and affection."

- Copy the legal description of the property into the designated section of the form.

- The grantor must sign the Quitclaim Deed in front of a notary public.

- The document should then be filed with the county recorder or land registry office where the property is located.

Once these steps are completed, the transfer of property rights is legally recognized. It's crucial to keep a copy of the filed document for personal records. This ensures both parties have proof of the transfer and can address any future concerns that may arise regarding property ownership.

Crucial Points on This Form

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document that allows one person to transfer their interest in a property to another without making any guarantees about the property's title. It is a quick way to move ownership, but it doesn't ensure that the property is free from debts or other liens.

When should I use a Quitclaim Deed?

You might use a Quitclaim Deed when transferring property within the family, such as between parents and children or between siblings. It's also commonly used during divorce proceedings to transfer ownership of a property to one spouse. However, because it doesn't guarantee a clear title, it might not be suitable for all transactions, especially those involving a buyer who expects a guarantee of clear title.

What information do I need to fill out a Quitclaim Deed form?

To fill out a Quitclaim Deed form, you'll need several pieces of information: the legal description of the property, the name of the person transferring the property (the grantor), the name of the person receiving the property (the grantee), and the date of the transfer. Some states may also require a statement about the consideration exchanged for the transfer, even if it's just a nominal amount like $1.

Does a Quitclaim Deed need to be recorded?

Yes, for a Quitclaim Deed to be effective and to best protect the interests of the grantee, it should be recorded with the county recorder's office or the local land records office in the area where the property is located. Recording the deed makes it part of the public record, which helps to establish the grantee's claim to the property. There might be a fee to record the deed, which varies by county.

Common mistakes

When it comes to transferring property, a Quitclaim Deed is often used because of its simplicity. However, its straightforwardness doesn't prevent people from making mistakes. To ensure that the process goes smoothly, it's important to be mindful of the most common errors.

-

Not Checking for Correct Spelling of Names: Every name on the deed must match the legal documents of the individuals involved. Misspelling a name can invalidate the document or lead to legal complications down the line.

-

Leaving Out Legal Descriptions of the Property: A legal description goes beyond the street address. It includes boundaries, easements, and other legal nuances of the property. Failing to include this description can result in uncertainty about what exactly is being transferred.

-

Not Having the Document Notarized: Many jurisdictions require a Quitclaim Deed to be notarized to be valid. Notarization certifies that the signatures on the document are genuine and that the signers were not under duress.

-

Forgetting to File the Deed with the County Recorder's Office: After the deed is signed and notarized, it needs to be filed or recorded with the local County Recorder's Office. If this step is skipped, the transfer might not be officially recognized, affecting future transactions.

-

Omitting Important Details about the Given Rights: A Quitclaim Deed transfers only the interest the grantor has in the property, which may be none. It's essential to clearly state this in the deed to avoid misunderstandings about the property rights being transferred.

In summary, while filling out a Quitclaim Deed appears to be straightforward, attention to detail is crucial. By avoiding these common mistakes, you can ensure the property transfer process is legal and binding.

Documents used along the form

When transferring property ownership, a Quitclaim Deed is often just the beginning of the paperwork journey. This pivotal document, essential for its ease in transferring rights without making any warranties about the property title's quality, works hand-in-hand with various other legal forms to ensure the transaction complies with local laws and meets all parties' needs. Understanding these accompanying documents can help streamline the process, providing clarity and security to what can be an intricate legal procedure.

- Real Estate Transfer Tax Declarations: Many states require a form to accompany the Quitclaim Deed for tax assessment purposes. This form discloses the sale price, property value, and other pertinent transaction details to determine if transfer taxes are due.

- Title Search Report: Prior to or during a quitclaim deed transaction, a title search is often conducted to reveal any liens, encumbrances, or mortgages existing on the property. This report, while not a form per se, is a crucial document that informs parties about the property's legal standing.

- Property Disclosure Statement: While a Quitclaim Deed does not warrant the condition of the property, many jurisdictions still require a seller to provide this document. It details the property’s condition, including any known defects or issues, giving the buyer a clearer picture of what they are acquiring.

- Mortgage Satisfaction Letter: If the property was previously under a mortgage that has been paid off, this letter from the mortgage lender confirms that the property is free and clear of that lien. It's an essential document for the property's chain of title, ensuring there are no outstanding claims.

- Homestead Declaration: In some states, when transferring a primary residence, the grantor (seller) may need to file a homestead declaration form. This document protects a portion of the home's value from creditors and can affect how property transfer taxes are calculated.

While the Quitclaim Deed simplifies the transfer of property rights, it’s the supporting documentation that enriches the process, ensuring everything is legally sound and transparent. Buyers and sellers alike should understand what additional paperwork might be needed to avoid any surprises. Properly executed and accompanied by the necessary forms, the Quitclaim Deed helps make property transactions smooth and straightforward, ensuring everyone's rights are protected.

Similar forms

Warranty Deed - Just like a quitclaim deed, a warranty deed is used to transfer property ownership. However, unlike a quitclaim deed, which does not guarantee the seller has clear title to the property, a warranty deed comes with a guarantee that the property title is clear and the seller has the right to sell the property. This key difference makes a warranty deed a more secure option for the buyer.

Grant Deed - Similar to quitclaim deeds, grant deeds are employed to convey ownership of real estate. Both documents serve the purpose of transferring title. The distinction lies in the level of protection they offer. A grant deed offers the buyer some assurances, such as the promise that the property hasn't been sold to someone else and there are no undisclosed liens against it, unlike a quitclaim deed that offers no guarantees.

Special Warranty Deed - This document shares similarities with the quitclaim deed in its use for transferring property interests. However, a special warranty deed differs as it provides the buyer with a limited warranty. This warranty only covers the period during which the seller owned the property, ensuring there are no defects in the title during that time, unlike the quitclaim deed that offers no warranties at all.

Deed of Trust - Although a deed of trust is not a direct tool for transferring property ownership between sellers and buyers, it shares a common ground with a quitclaim deed in that it involves property. A deed of trust is used to secure a real estate transaction, involving a lender, borrower, and trustee, essentially placing the property as collateral for a loan. It becomes similar in terms of dealing with interests in real property.

Executor’s Deed - An executor's deed is used in the context of estate management when property needs to be transferred pursuant to a will's instructions. Like a quitclaim deed, an executor's deed facilitates the transfer of property interest. However, it is unique because it is executed by an estate’s executor, who may offer certain warranties about the title based on the executor’s knowledge, differing from the quitclaim deed's absence of any warranty.

Dos and Don'ts

When filling out a Quitclaim Deed form, it's essential to take your time and pay close attention to detail to ensure that the process is completed correctly and effectively. Below are some dos and don'ts to guide you through this process:

- Do thoroughly review the form before starting to understand all the information you need.

- Do ensure you have the correct legal descriptions of the property. This can usually be found on your current deed or by contacting your county recorder's or assessor's office.

- Do print or type the information clearly and legibly to prevent any misunderstandings or legal issues down the line.

- Do verify all names are spelled correctly, especially the names of the grantor(s) and the grantee(s), and ensure they match the names on the property’s current deed.

- Don't leave any blanks on the form. If a section doesn't apply to your situation, it's better to enter "N/A" (not applicable) than to leave it empty.

- Don't forget to sign and date the deed in the presence of a notary public. This step is crucial for the document to be considered legally valid.

- Don't overlook the need to file the completed deed with the appropriate county office, as failing to do so will mean the deed change won't be officially recorded.

- Don't hesitate to seek legal advice if you have any questions or concerns about completing the form. Getting it right is important, and sometimes the help of a professional can make all the difference.

By following these guidelines, you can fill out your Quitclaim Deed form confidently and correctly, ensuring a smooth and successful transfer of property.

Misconceptions

Many people have misconceptions about the Quitclaim Deed form. Understanding what it is and what it's not can help in making informed decisions regarding property transactions.

A Quitclaim Deed guarantees a clear title. This is incorrect. A Quitclaim Deed does not guarantee that the grantor holds a clear title to the property. It simply transfers whatever interest the grantor has in the property, if any, without making any promises about the property’s ownership status.

Quitclaim Deeds are only for transferring ownership between strangers. Actually, Quitclaim Deeds are more commonly used between family members, trusted friends, or divorcing spouses to transfer property quickly without a formal property sale. The simplicity and lack of warranties make it ideal for transfers where the parties know each other well and the transfer is not for monetary compensation.

Quitclaim Deeds can solve all property disputes. This is a misconception. Quitclaim Deeds transfer the grantor’s interest in a property, but they do not resolve disputes about property ownership or boundaries. Legal advice and possibly a different type of deed may be required to solve these issues.

A Quitclaim Deed provides the same protection as a Warranty Deed. This is not true. Unlike a Warranty Deed, which guarantees the grantee against previous claims or liens on the property, a Quitclaim Deed offers no such protections. It leaves the grantee with little recourse if problems arise regarding the property's title.

Key takeaways

Understanding how to correctly fill out and use the Quitclaim Deed form is crucial for ensuring a smooth and legally sound transfer of property. Here are key takeaways to guide you through this process:

A Quitclaim Deed is used to transfer ownership of property from a grantor (the person selling or giving away the property) to a grantee (the recipient) without any guarantee that the title is clear and free of issues.

Before filling out the form, verify the specific requirements in your state or jurisdiction since legal statutes governing the use of Quitclaim Deeds can vary.

Correctly identifying the grantor and grantee, including their full legal names and contact information, is vital to ensure the legality of the deed.

Include a complete and accurate description of the property being transferred. This typically means including the property’s legal description, which is more detailed than the physical address.

The Quitclaim Deed must be signed by the grantor in front of a notary public to be legally binding. Some states may also require the grantee’s signature.

Consideration should be documented in the deed. Consideration is anything of value exchanged for the property, even if it is a symbolic amount like $1.

After signing, the Quitclaim Deed must be filed with the county recorder’s office or local land registry to make the transfer public record. Filing fees will apply.

Having a real estate attorney review the document can provide peace of mind by ensuring that all legal requirements are met and that the document accurately reflects the agreement between the parties.

A Quitclaim Deed does not remove the former owner’s financial obligations related to the property unless specifically agreed upon by the parties or through separate legal arrangements.

Understand that a Quitclaim Deed offers no warranties regarding the condition of the property title. If ensuring a clear title is important, consider using a Warranty Deed instead.

By familiarizing yourself with these key aspects, you can navigate the process of completing and filing a Quitclaim Deed with greater confidence and legal precision.

Discover Other Types of Quitclaim Deed Documents

California Transfer on Death Deed - It serves to complement a comprehensive estate plan, guaranteeing that real estate assets are addressed without impacting other aspects of the estate.

Deed of Trust Form - It provides a legal framework that allows for the property to be sold in the event of default, ensuring lenders can recover funds.