Blank Quitclaim Deed Form for California

Transferring property in California can seem like navigating a complex labyrinth, with different paths depending on the nature of the transaction. Among these paths, the Quitclaim Deed form stands out for its simplicity and specific use case. This document is particularly favored for transactions where property is transferred without the seller providing any warranty about the title. This means that unlike traditional deeds, the buyer accepts the property "as is," potentially including any hidden claims or liens against it. Ideal for transfers between family members, into a trust, or in divorce settlements, this form streamlines the process by bypassing the exhaustive guarantees typically associated with property sales. Understanding its nuances, including when and how to use it properly, is crucial for anyone looking to navigate property transfers efficiently in California. This exploration aims to demystify the major aspects of the form, providing a thorough grounding on its purpose, application, and the legal implications accompanying its use.

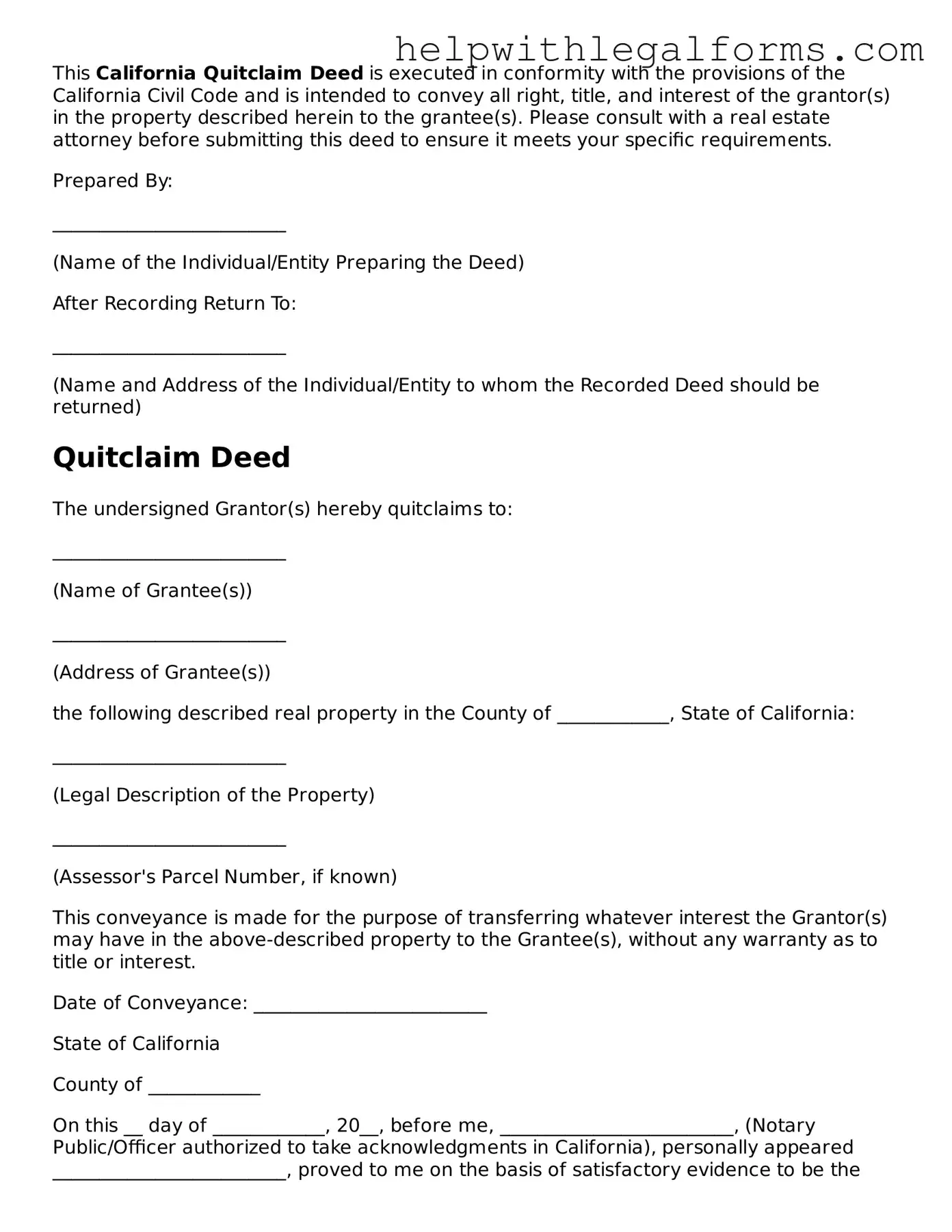

Example - California Quitclaim Deed Form

This California Quitclaim Deed is executed in conformity with the provisions of the California Civil Code and is intended to convey all right, title, and interest of the grantor(s) in the property described herein to the grantee(s). Please consult with a real estate attorney before submitting this deed to ensure it meets your specific requirements.

Prepared By:

_________________________

(Name of the Individual/Entity Preparing the Deed)

After Recording Return To:

_________________________

(Name and Address of the Individual/Entity to whom the Recorded Deed should be returned)

Quitclaim Deed

The undersigned Grantor(s) hereby quitclaims to:

_________________________

(Name of Grantee(s))

_________________________

(Address of Grantee(s))

the following described real property in the County of ____________, State of California:

_________________________

(Legal Description of the Property)

_________________________

(Assessor's Parcel Number, if known)

This conveyance is made for the purpose of transferring whatever interest the Grantor(s) may have in the above-described property to the Grantee(s), without any warranty as to title or interest.

Date of Conveyance: _________________________

State of California

County of ____________

On this __ day of ____________, 20__, before me, _________________________, (Notary Public/Officer authorized to take acknowledgments in California), personally appeared _________________________, proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Witness my hand and official seal:

_________________________

(Signature of Notary)

_________________________

(Printed Name of Notary)

_________________________

(Notary Public Seal)

Instructions for Completing the Quitclaim Deed

- Fill in all the blanks with the appropriate information.

- Ensure the grantor(s) sign(s) the deed in the presence of a notary public or an officer authorized to take acknowledgments in California.

- Record the executed deed with the county recorder's office in the county where the property is located to make the deed legally effective.

Note: This form is provided without any warranty, express or implied, as to its legal effect and completeness. It is recommended that the services of a competent professional are sought if you have questions regarding a quitclaim deed or its implications.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Quitclaim Deed is a legal document used to transfer interest, ownership, or rights in real property from one person to another without any guarantees or warranties. This means the grantor does not confirm the quality of the property title being transferred. |

| Governing Law | California Civil Code sections 1092, 1105, 1113, and others govern Quitclaim Deeds in California. These laws outline the requirements for a valid conveyance, including how the deed must be executed and acknowledged. |

| Recording Requirement | In California, to ensure the Quitclaim Deed is recognized and to protect both the grantee’s and the public’s interest, the deed must be recorded with the county recorder’s office where the property is located. Failure to record the deed does not invalidate it but does leave the grantee vulnerable to future claims. |

| Notarization Requirement | The signatures on a California Quitclaim Deed must be notarized to meet state legal requirements. This process involves signing the deed in the presence of a notary public who verifies the identity of the signers and ensures the signatures are made willingly and under no duress. |

Instructions on How to Fill Out California Quitclaim Deed

Filling out a California Quitclaim Deed form is a necessary step when a property owner wishes to transfer their interest in a piece of real estate to another person without providing any warranty on the title. This process requires precision and attention to detail to ensure the transfer is legally effective. By following the instructions laid out below, the involved parties can navigate the completion of the Quitclaim Deed form accurately.

- Begin by entering the date of the document transfer in the space provided at the top of the form. Use the format MM/DD/YYYY.

- Write the name(s) of the current owner(s) of the property (the grantor(s)) in the designated area, making sure to include their mailing address with city, state, and zip code.

- In the corresponding section, enter the name(s) of the recipient(s) of the property interest (the grantee(s)) along with their mailing address, city, state, and zip code.

- Specify the amount of money, if any, being exchanged for the property transfer. Even if no money is exchanged, a nominal amount such as $1.00 is traditionally stated to satisfy legal requirements for a contract.

- Detail the legal description of the property being transferred. This information can typically be found on the property's current deed or tax bill and must include lot number, block number, and subdivision, if applicable, as well as the county in which the property is located.

- If the property is located in a city, write the name of the city in the provided space.

- Include the assessor's parcel number (APN), which is a unique number assigned to parcels of real property by the tax assessor of a particular jurisdiction, for identification and tax purposes.

- The grantor(s) must sign the form in the presence of a notary public. Ensure that all parties who hold an interest in the property sign the form.

- The notary public will complete their section, which includes a notarial seal, to officially notarize the document.

- Check the completed form for accuracy and completeness. Make sure all required fields are filled out and that the information is correct.

- Record the Quitclaim Deed with the county recorder's office in the county where the property is located. This may require payment of a recording fee. Contact the specific county recorder’s office to ascertain the current fees and any additional documents that may need to accompany the Quitclaim Deed.

Successfully submitting the Quitclaim Deed for recording finalizes the process of transferring property interest from the grantor to the grantee. This action doesn't guarantee a clear title but allows the grantee to claim an interest in the specified property. It's recommended to consult with a legal professional or a real estate expert when completing this form to ensure all legal requirements are met and rights are protected.

Crucial Points on This Form

What is a Quitclaim Deed in California?

A Quitclaim Deed in California is a legal document used to transfer interest in real estate from one person (the grantor) to another (the grantee) without any warranties of title. It means that the grantor does not guarantee that they own the property clear of all liens and encumbrances, or even that they own the property at all. This type of deed is often used between family members or close friends where there is a high level of trust.

When should you use a Quitclaim Deed?

You should use a Quitclaim Deed when transferring property ownership without a traditional sale. This may occur in situations like adding or removing someone’s name on the property title, transferring property into a trust, or settling property matters in a divorce proceeding. They are most suitable when both parties know each other well and the property’s history is clear.

What information is required on a California Quitclaim Deed form?

The California Quitclaim Deed form requires specific information to be considered valid. This includes the names and addresses of both the grantor and the grantee, a legal description of the property being transferred, the parcel number, the date of the transfer, and the signature of the grantor. The document must also be notarized and then recorded with the County Recorder’s Office where the property is located.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides the grantee with warranties regarding the title and the ownership of the property, assuring that the property is free of liens and encumbrances. A Quitclaim Deed, on the other hand, offers no such guarantees or warranties, transferring only whatever interest the grantor has in the property, if any.

Does a Quitclaim Deed remove you from the mortgage?

No, executing a Quitclaim Deed does not remove the grantor from the mortgage. The deed transfers ownership interest in the property but does not affect the mortgage or the grantor’s responsibility for the loan. If the grantor wants to remove their responsibility for the mortgage, the loan must be refinanced in the grantee’s name only.

How can you file a Quitclaim Deed in California?

To file a Quitclaim Deed in California, the completed and notarized form must be taken to the County Recorder’s Office in the county where the property is located. Filing fees will apply, and these vary by county. The staff at the Recorder's Office can provide guidance on the exact process and current fees. It’s important to ensure that the form is filled out correctly to avoid it being rejected.

Is it necessary to have a lawyer for a Quitclaim Deed?

While it is not legally required to have a lawyer to prepare a Quitclaim Deed, consulting with one can be beneficial. A lawyer can ensure that the deed is correctly filled out, that it accomplishes what you intend it to, and that it doesn’t lead to unforeseen legal complications. They can also advise on any potential tax implications.

What are the tax implications of a Quitclaim Deed?

The transfer of property using a Quitclaim Deed can have tax implications, including capital gains tax or gift tax, depending on the circumstances of the transfer. It's important to consult with a tax professional or attorney to understand how these taxes might apply to your specific situation.

Can a Quitclaim Deed be reversed?

Reversing a Quitclaim Deed is challenging and usually requires the agreement and cooperation of both the grantor and the grantee. In some cases, if the deed was executed under fraud, duress, or with a significant misunderstanding, legal action could be taken to invalidate the deed. However, these actions can be complex and time-consuming, underscoring the importance of being certain about the transaction before proceeding.

Common mistakes

-

Many people fail to provide complete information about the grantor and grantee. Every detail, including full legal names, addresses, and marital status, is crucial. Incomplete information can delay the process or invalidate the deed.

-

Incorrect property description is another common mistake. The legal description of the property, which may include lot number, subdivision, and parcel number, must match the description used in official records exactly. Relying on a property’s street address alone often leads to discrepancies.

-

Overlooking the need for witness signatures and a notary public’s seal can invalidate a quitclaim deed in California. While the requirements for witnesses can vary, the presence of a notary public to acknowledge the signatures of the grantor is mandatory.

-

Failing to file the quitclaim deed with the county recorder’s office promptly is another oversight. Once signed, the deed must be recorded to be effective and to provide public notice of the change in property ownership. A delay in recording can result in complications.

-

Lastly, individuals often misunderstand the legal effect of a quitclaim deed. A quitclaim deed transfers only the interest the grantor has in the property, without any warranty regarding the quality of the title. Assuming it guarantees clear title can result in future legal challenges.

Documents used along the form

When it comes to transferring property ownership in California, a Quitclaim Deed is often the document of choice for its simplicity and speed. However, this form doesn't stand alone in the process of legally transferring property rights from one party to another. Several other forms and documents complement the Quitclaim Deed, ensuring that the transfer adheres to legal requirements and preserves the rights of all parties involved. Let’s take a closer look at four of these essential documents.

- Preliminary Change of Ownership Report (PCOR): This form is filed with the county recorder's office alongside the Quitclaim Deed. The PCOR provides the county assessor with information about the transfer, helping determine if the property transaction qualifies for any reassessment exclusions under California law. This step is crucial for tax purposes and helps in the smooth processing of the deed.

- Transfer Tax Declarations: Many counties in California impose a transfer tax on real estate transactions. This document declares the transfer tax due or states the exemption claimed under specific provisions of the tax code. It's a necessary step for legal compliance and ensuring the right amount of tax is paid or rightfully exempted.

- Notarization: While not a separate form, the requirement for a notary public to witness the signing of the Quitclaim Deed is vital. The notarization process adds a layer of verification, confirming the identities of the parties involved in the transfer and helping to prevent fraud. This essential step ensures the deed's legitimacy and acceptance by the county recorder.

- Title Report: Often requested before the transfer, a title report provides a detailed history of the property, including any encumbrances such as liens, easements, or current mortgages. This document is crucial for the grantee (the person receiving the property) to understand any potential issues or limitations associated with the property they are acquiring.

Understanding and gathering these accompanying documents is essential for anyone looking to use a Quitclaim Deed in California. They serve to protect the interests of all parties involved, ensure legal compliance, and provide clarity around the specifics of the property being transferred. By familiarizing oneself with these additional requirements, individuals can navigate the property transfer process more effectively, making it as smooth and hassle-free as possible.

Similar forms

Warranty Deed: Like a Quitclaim Deed, a Warranty Deed is a document used in the transfer of real estate. However, while a Quitclaim Deed offers no guarantees about the property title, a Warranty Deed provides the buyer with a guarantee that the seller holds a clear title to the property and has the right to sell it.

Grant Deed: Similar to a Quitclaim Deed in its use for transferring property rights, a Grant Deed goes a step further by assuring the recipient that the property has not been sold to someone else and that it is free from any undisclosed encumbrances. This level of assurance is between what a Quitclaim and a Warranty Deed offer.

Deed of Trust: This document is used in some states instead of a mortgage. It involves three parties: the borrower, the lender, and a trustee. While it serves a different function than a Quitclaim Deed, transferring property rights to secure a loan, it is another critical document in real estate transactions.

Special Warranty Deed: This document is similar to a Quitclaim Deed but offers limited warranty. It only covers the period during which the seller owned the property. Like a Quitclaim Deed, it is used in property transfers, offering more assurance than a Quitclaim Deed but less than a full Warranty Deed.

Mortgage Agreement: A mortgage agreement is a document between a borrower and lender where the borrower's property is used as collateral for a loan. Unlike a Quitclaim Deed, which transfers property rights without securing loans, both documents play pivotal roles in real estate financing and transfers.

Title Insurance Policy: While not a document for transferring property rights, a Title Insurance Policy provides protection against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans, similar to the peace of mind sought through documents like Quitclaim Deeds.

Power of Attorney: This legal document allows one person to act on another's behalf in various situations, including real estate transactions. Although its scope is broader and not limited to property transfers like a Quitclaim Deed, it can authorize the handling of property transfers and signing of such deeds.

Dos and Don'ts

When filling out a California Quitclaim Deed form, it's essential to pay close attention to detail and follow the correct procedures. Quitclaim deeds are frequently used to transfer property between family members, add or remove someone's name from the title, or to clear up a cloud on the title in real estate transactions. Here is a list of dos and don'ts to consider to ensure that the process goes smoothly and accurately.

Do:- Verify the legal description of the property. Ensuring you have the exact legal description from a current deed or the county assessor’s office is critical.

- Clearly print or type all information. This improves readability and prevents processing delays.

- Use the full legal names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Check if you need to get the document notarized, as this is a requirement in California.

- Review the form for accuracy before signing. Any errors can lead to potential issues with the deed.

- Record the deed with the county recorder’s office where the property is located after it's signed and notarized.

- Pay the appropriate recording fees. Failure to do so could delay the recording process.

- Consider consulting with a real estate attorney if you are unsure about any of the steps or requirements.

- Keep a copy of the recorded deed for your records.

- Make sure to fill out any required supplemental forms that your county recorder might require.

- Forget to include the Assessor’s Parcel Number (APN). This number is crucial for identifying the property in public records.

- Overlook the importance of the grantee’s mailing address, as it is necessary for future tax statements.

- Attempt to use the quitclaim deed to avoid creditors or legal responsibilities. This can result in legal complications.

- Leave any blanks on the form. If a section doesn’t apply, mark it as “N/A” (not applicable).

- Sign the document without a notary present. In California, a notary must witness your signature for the deed to be valid.

- Fail to identify each party's marital status if required, as this can affect property rights.

- Ignore the guidance of a professional if there are any uncertainties about the process.

- Assume the process is the same in every county. Requirements can vary slightly, so always check with the local county recorder.

- Use the quitclaim deed to transfer property to a trust without consulting an attorney, to ensure it's done correctly.

- Forget to inform the grantee that they should file a Preliminary Change of Ownership Report (PCOR) with the deed, as this can save time and potential rejections.

Misconceptions

Many individuals hold misconceptions about the California Quitclaim Deed form, which can lead to confusion when attempting to transfer property. It is vital to clarify these misunderstandings to ensure that property transactions are conducted smoothly and according to legal standards. The following are six common misconceptions about the California Quitclaim Deed form:

A Quitclaim Deed guarantees a clear title. Contrary to common belief, a Quitclaim Deed does not provide any guarantee about the property's title status. It simply transfers the grantor's interest in the property to the grantee, without ensuring that the title is clear of liens, encumbrances, or claims.

It offers the same protection as a Warranty Deed. A Quitclaim Deed offers significantly less protection to the buyer compared to a Warranty Deed. A Warranty Deed includes guarantees about the title's quality and promises that the seller holds a clear title, which is not the case with a Quitclaim Deed.

The process is complex and time-consuming. Many people believe that the process of completing and recording a Quitclaim Deed is complicated and takes a lot of time. In reality, it is relatively straightforward and can be expedited quickly if all the necessary information is accurately provided and the proper steps are followed.

It only applies to residential properties. The usage of a Quitclaim Deed is not limited to residential properties; it can be used for various types of real property, including commercial and land transactions. Its versatility makes it an option for different property transfers, provided the situation fits the deed's limitations.

It resolves all property disputes. Utilizing a Quitclaim Deed does not inherently resolve disputes regarding property ownership or rights. While it can transfer an individual's rights to another, it does not affect third-party claims or legal disputes that may exist regarding the property.

Filing a Quitclaim Deed with the county recorder immediately changes ownership. While filing the deed with the county recorder is a critical step, the actual change of ownership is not instantaneous. The deed must be properly executed, delivered, accepted, and, finally, recorded. The recording date provides a timestamp for the transaction, but the effective transfer of interest happens when these conditions are fulfilled.

Understanding these misconceptions is crucial for anyone involved in a property transfer in California using a Quitclaim Deed. It ensures all parties have realistic expectations and can make informed decisions based on the actual implications and limitations of using such a deed for property transactions.

Key takeaways

When dealing with the California Quitclaim Deed form, it's important to have a clear understanding of what you're signing and the implications it may have. Here are eight key takeaways:

- Understand what a Quitclaim Deed does: This document transfers any ownership interest the grantor has in the property without any guarantee or warranty. It's often used between family members or to clear up a title issue.

- Ensure the form is complete and accurate: Fill out the Quitclaim Deed form with all the necessary information, including the legal description of the property, and double-check for accuracy.

- Legal description is critical: The legal description of the property, not just the address, is crucial. This can be found on the current deed or property tax bill.

- Signatures: The form must be signed by the grantor (the person transferring the interest) in the presence of a notary public.

- Notarization is required: For the Quitclaim Deed to be legally effective, it must be notarized. This step verifies the identity of the signatories.

- Recording the deed: Once notarized, the Quitclaim Deed must be recorded with the county recorder’s office where the property is located. This makes the transfer public record.

- Filing fees: Be prepared to pay a filing fee when recording your Quitclaim Deed. The amount varies by county.

- Consider potential tax implications: Transferring property can have tax consequences for both the grantor and grantee. It's wise to consult with a tax professional to understand these implications.

Executing a Quitclaim Deed can be straightforward, but ensuring each step is done correctly is crucial to protect the interests of all parties involved. If unsure, seeking advice from a legal professional can provide clarity and peace of mind.

Create Other Quitclaim Deed Forms for US States

Quit Claim Deed Form Ny Pdf - Lawyers often recommend using Quitclaim Deeds for simple transfers but suggest caution due to its limitations.

Florida Quit Claim Deed Filled Out - A Quitclaim Deed is a legal document used to transfer interest in property from one person to another without warranties.