Blank Quitclaim Deed Form for Colorado

In the legal landscape of Colorado, property transactions are facilitated through various means, one of which is the Quitclaim Deed form, a document that plays a pivotal role in the conveyance of property rights. Unlike other forms of property deeds that offer guarantees about the title's clarity and freedom from encumbrances, the Quitclaim Deed is unique in its function, providing a means by which the grantor releases their interest in a property to the grantee without making any declarations about the title's validity. This characteristic makes it particularly suitable for transactions among family members or close acquaintances where there is a high level of trust. It is also frequently utilized in situations requiring the swift adjustment of property interests, such as during divorce settlements or the correction of title errors. Colorado's specific requirements for executing a Quitclaim Deed, including notarization and, in certain counties, the necessity for the grantee's address to be included on the document, ensure that the process adheres to strict legal standards, safeguarding the interests of all parties involved. Additionally, understanding the implications of this form, especially concerning tax obligations and potential future disputes over property ownership, is essential for both grantors and grantees embarking on this route of title transfer.

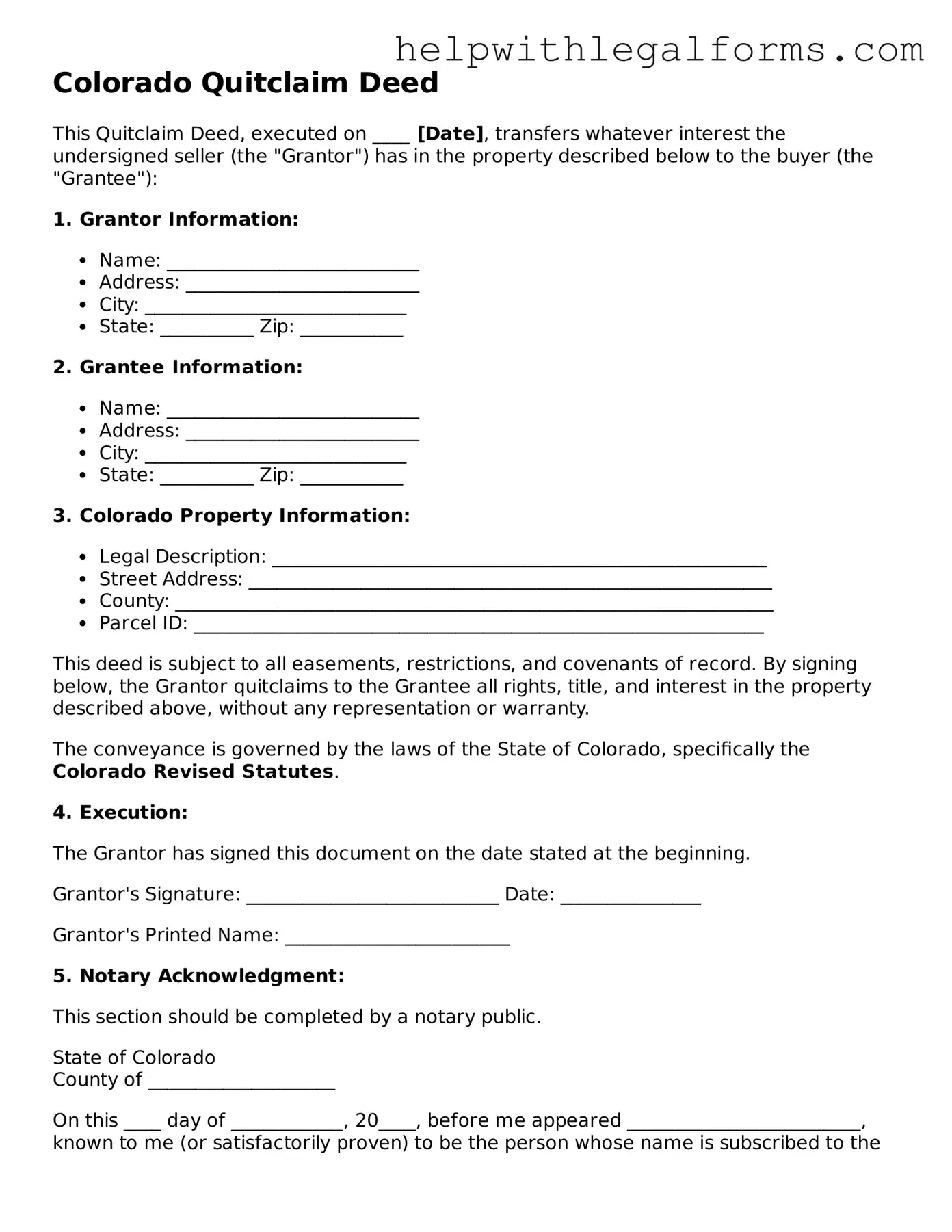

Example - Colorado Quitclaim Deed Form

Colorado Quitclaim Deed

This Quitclaim Deed, executed on ____ [Date], transfers whatever interest the undersigned seller (the "Grantor") has in the property described below to the buyer (the "Grantee"):

1. Grantor Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: __________ Zip: ___________

2. Grantee Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: __________ Zip: ___________

3. Colorado Property Information:

- Legal Description: _____________________________________________________

- Street Address: ________________________________________________________

- County: ________________________________________________________________

- Parcel ID: _____________________________________________________________

This deed is subject to all easements, restrictions, and covenants of record. By signing below, the Grantor quitclaims to the Grantee all rights, title, and interest in the property described above, without any representation or warranty.

The conveyance is governed by the laws of the State of Colorado, specifically the Colorado Revised Statutes.

4. Execution:

The Grantor has signed this document on the date stated at the beginning.

Grantor's Signature: ___________________________ Date: _______________

Grantor's Printed Name: ________________________

5. Notary Acknowledgment:

This section should be completed by a notary public.

State of Colorado

County of ____________________

On this ____ day of ____________, 20____, before me appeared _________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public's Signature: ___________________________

Printed Name: ___________________________

Commission Expiration: ___________________________

PDF Form Attributes

| Name | Fact |

|---|---|

| Purpose of a Quitclaim Deed | A Quitclaim Deed is used to transfer ownership of property quickly without the guarantee that the property is free of claims or liens. |

| Governing Law | In Colorado, Quitclaim Deeds are governed by Colorado Revised Statutes Title 38 - Property - Real and Personal. |

| Recording Requirement | The deed must be recorded with the county clerk and recorder in the county where the property is located to be effective against third parties. |

| Grantee's Address | Colorado law requires the Quitclaim Deed to include the address of the grantee (the person receiving property). |

| Notarization | The Quitclaim Deed must be signed by the grantor (the person transferring the property) in the presence of a notary public. |

| Consideration Statement | A statement of consideration (the value exchanged for the property) is required, though a specific amount does not need to be stated. |

Instructions on How to Fill Out Colorado Quitclaim Deed

Filling out a Colorado Quitclaim Deed form is a significant step in transferring property rights from one person to another without making any guarantees about the property title's clarity. Quitclaim deeds are commonly used between family members or to add a spouse to a title, for instance. This straightforward document requires careful attention to detail to ensure the transfer is processed accurately and legally. Below are the steps to fill out a Colorado Quitclaim Deed form, ensuring a smooth transition of property rights.

- Prepare the document by gathering all necessary information, including the legal description of the property, the names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property), and the parcel number if applicable.

- At the top of the form, fill in the name and address of the person to whom the document will be returned after recording. This is often the grantee, but it might also be an attorney or a title company.

- Specify the consideration being transferred for the property. This is often a nominal amount, such as "$10 and other good and valuable consideration," but it could also reflect the actual purchase price.

- Input the full legal name of the grantor(s) as it appears on the current deed of the property, followed by the grantor's mailing address.

- Enter the full legal name of the grantee(s) along with the grantee’s mailing address.

- Provide the legal description of the property. This is not the same as the street address, but rather a detailed description found on the current deed or obtained from the county recorder's office.

- If the property is located in a city or town, indicate this by including the municipality in the appropriate section of the form.

- Review the statement about the grantor releasing their rights to the property, which is a standard part of the quitclaim deed. This confirms the grantor is transferring whatever interest they have in the property without warranties.

- The grantor must sign the quitclaim deed in front of a notary public. Ensure the notary completes their section, which includes a signature, a seal, and the date the deed was notarized.

- Finally, submit the completed and notarized quitclaim deed to the county clerk and recorder’s office in the county where the property is located for official recording. A fee will likely be required at the time of filing.

By accurately following these steps, you will have completed the necessary process to transfer property rights in Colorado using a quitclaim deed. Remember, this document is crucial in the conveyance process, and it's important to proceed with caution and thoroughness to ensure all details are correctly represented and that the transition of ownership is recorded properly within the legal system.

Crucial Points on This Form

What is a Colorado Quitclaim Deed form?

A Colorado Quitclaim Deed form is a legal document used to transfer interest, ownership, or rights in a property from one person (the grantor) to another (the grantee) without any warranties or guarantees about the title of the property. This means the grantor does not confirm that the title is clear or that they own the property free of liens or other encumbrances. It is commonly used among family members or in situations where the property is being transferred without a traditional sale.

When should a Quitclaim Deed be used in Colorado?

A Quitclaim Deed is appropriate in situations where the property is being transferred without a traditional sale, such as adding or removing someone’s name from the property title, transferring property into a trust, transferring property to a spouse as part of a divorce settlement, or in informal sales between family members or close acquaintances. It is crucial to understand that a Quitclaim Deed offers the least protection of any deed, as it only transfers the grantor's current interest in the property, if any.

Does a Colorado Quitclaim Deed guarantee a clear title?

No, a Colorado Quitclaim Deed does not guarantee a clear title. The grantor of a Quitclaim Deed transfers only whatever interest they may have in the property at the time of the transfer, with no warranties or promises regarding the quality of the property’s title. Therefore, the grantee receives no guarantees against title defects or liens and assumes any risk of title issues.

What are the essential elements of a Colorado Quitclaim Deed?

The essential elements of a Colorado Quitclaim Deed include the grantor's name and address, the grantee's name and address, a legal description of the property being transferred, the date of the transfer, the signature of the grantor, and, in Colorado, the deed must be notarized to be valid. Additionally, the deed must be filed with the local county recorder’s office to be effective against claims from third parties.

How is a Quitclaim Deed filed in Colorado?

To file a Quitclaim Deed in Colorado, the completed and notarized deed must be brought to the clerk and recorder’s office in the county where the property is located. Filing fees will apply, and the amount can vary by county. It is essential to check with the specific county for any additional requirements or fees. Once the deed is recorded, it becomes part of the public record, indicating the transfer of the property’s interest.

Can a Colorado Quitclaim Deed be revoked?

Once a Quitclaim Deed has been executed, delivered to the grantee, and filed with the appropriate county recorder's office, it generally cannot be revoked without the consent of the grantee. If both parties agree to revoke the deed, a new deed must be executed, delivered, and recorded. If a grantor wishes to change the property transfer or believes the deed was executed under duress or with insufficient understanding, they should consult with a legal professional to explore possible remedies or actions.

Common mistakes

When filling out a Colorado Quitclaim Deed form, attention to detail is crucial. However, people often make mistakes that can lead to complications or even invalidate the deed. Below are five common errors to avoid:

-

Not using the correct legal names of the grantor and grantee. It's important to ensure that the names are spelled correctly and match the names on the property's current deed and official identification. This mistake can cause confusion about the property's rightful ownership.

-

Failing to include a complete legal description of the property. A property's legal description is more detailed than its address. It often includes lot numbers, boundary descriptions, or other specifics that identify the property within public records. Leaving out any part of this description can lead to disputes over what property was intended to be transferred.

-

Omitting signatures or notarization. Colorado law requires the quitclaim deed to be signed by the grantor and notarized. If either of these elements is missing, the deed may not be legally effective. This oversight is easily avoided but often overlooked.

-

Ignoring the requirement to file the deed with the county. After the quitclaim deed is signed and notarized, it needs to be filed with the county clerk and recorder's office where the property is located. This step is vital for the deed to be recognized as valid and for the change in ownership to be officially recorded.

-

Forgetting to consider tax implications. While a quitclaim deed itself doesn't normally involve the exchange of money, there can still be tax consequences for the grantor and grantee. It's a common mistake to not consult a tax professional or attorney about these potential implications before proceeding with the transfer of property.

By taking care to avoid these errors, individuals can help ensure the process goes smoothly and that the transfer of property via a quitclaim deed is successfully completed.

Documents used along the form

When handling property transactions in Colorado, particularly with the use of a Colorado Quitclaim Deed, various other forms and documents are often necessary to ensure the process is thorough and legally sound. These forms complement the Quitclaim Deed by providing necessary disclosures, establishing clear property boundaries, or updating official records. Below is a list of documents frequently used in conjunction with a Colorado Quitclaim Deed.

- Warranty Deed: Used to guarantee that the property seller holds a clear title to the property and has the right to sell it. This is particularly useful for providing the buyer with additional assurance beyond what a Quitclaim Deed offers.

- Title Insurance Policy: This policy protects the buyer against future claims about property ownership and issues that were not identified during the initial title search. Title insurance is crucial for peace of mind and to safeguard against potential legal troubles down the line.

- Real Estate Transfer Declaration (TD-1000): This form provides essential information about the real estate transaction to the county and is required for most property transfers in Colorado. It helps in calculating the documentary transfer tax.

- Property Disclosure Statement: Though not always required in transactions involving a Quitclaim Deed, this document discloses the condition of the property, including any known defects or issues, to the buyer.

- Loan Payoff Statement: If there’s an existing mortgage on the property, this statement outlines the amount required to pay off the current mortgage in full. It’s crucial for ensuring that all claims against the property are settled.

- Survey: A survey outlines the property's exact boundaries and dimensions. It can identify any encroachments or easements that affect the property, which is essential information for both the buyer and the seller.

- HOA Documents: If the property is part of a homeowners' association (HOA), these documents outline the rules, regulations, and fees. They are vital for the buyer to understand any obligations they are assuming with the property.

Together with a Colorado Quitclaim Deed, these documents help facilitate a smoother and legally secure property transaction. They ensure that all parties are well-informed, all legal requirements are met, and the transfer of property goes as smoothly as possible. Whether you're selling, buying, or transferring property to a family member, preparing and understanding these documents can significantly aid in achieving a successful property transaction in Colorado.

Similar forms

-

Warranty Deed: Similar to a Quitclaim Deed, a Warranty Deed is used to transfer property ownership. However, it differs because it provides the grantee (the person receiving the property) with warranties, including that the grantor (the person transferring the property) holds clear title to the property. This means the grantee is protected against previous claims or liens on the property.

-

Grant Deed: Like a Quitclaim Deed, a Grant Deed transfers property ownership from one party to another. The key difference is that with a Grant Deed, the grantor guarantees they haven't transferred the property title to someone else and that the property is free of any encumbrances made by them, though it doesn't cover any unseen issues.

-

Special Warranty Deed: This document is somewhat a mix between a Quitclaim Deed and a Warranty Deed. While a Special Warranty Deed does provide a warranty, it is limited to the period the grantor owned the property. This means the grantor ensures there are no defects in title during their ownership, but does not guarantee against any issues that might have arisen before they owned it.

-

Deed of Trust: A Deed of Trust is used in some states instead of a mortgage. It involves three parties: the borrower, the lender, and a trustee. This document transfers the property’s legal title to the trustee, who holds it as security for the loan. Although it serves a different function, it's similar to a Quitclaim Deed because both involve a legal document that transfers an interest in real property.

-

Transfer on Death Deed (TODD): This document allows property owners to name a beneficiary who will inherit the property upon the owner’s death, without going through probate. Like a Quitclaim Deed, it is a non-probate method of transferring property ownership. However, a TODD is revocable until the property owner’s death, at which point it automatically transfers the property to the named beneficiary.

-

Fiduciary Deed: Used when property is transferred by a trustee or executor, a Fiduciary Deed is similar to a Quitclaim Deed in its function to convey property from one party to another. The difference lies in the fact that the person transferring the property does so in a fiduciary capacity, not personally, which means they are bound by legal and ethical standards to act in the best interest of the beneficiary or estate.

Dos and Don'ts

When dealing with the Colorado Quitclaim Deed form, it's vital to approach the task with diligence and care. This form is used to transfer property rights from one person to another with no warranty as to the title's condition. By following best practices, you can ensure the process goes smoothly. Here are seven dos and don'ts to guide you.

Dos:

- Double-check the legal description of the property. This includes lot number, subdivision name, and any additional details that identify the property. Accuracy here is crucial.

- Ensure that the grantor (the person transferring the property) signs the deed in the presence of a notary public. This step validates the document.

- Use the correct names and spellings for all parties involved. Even minor mistakes can create big problems down the line.

- Verify that the form complies with Colorado's recording requirements, including margin size, paper size, and any other formatting specifics.

- Keep a copy of the signed and notarized deed for your records before filing the original with the county recorder's office.

- Include the mailing address of the property being transferred, as well as the contact information for the grantee (the person receiving the property).

- Pay the appropriate filing fee when submitting the deed to the county recorder. Fees vary by county, so check in advance.

Don'ts:

- Avoid using generic legal forms that may not meet Colorado's specific requirements. Always use a form designed for Colorado.

- Don't leave any sections blank. Incomplete forms can lead to delays or even the rejection of your quitclaim deed.

- Refrain from guessing on legal descriptions or other critical details. If uncertain, obtaining a copy of a previous deed or consulting with a professional is advisable.

- Do not notarize the document without the grantor present. A notary must witness the grantor's signature for the document to be legally valid.

- Avoid overlooking the need for the grantee's information, such as their full legal name and mailing address.

- Don't forget to check for any additional forms or documents your county might require for recording a quitclaim deed.

- Don't delay in submitting the deed to the county recorder. Prompt filing ensures that the property transfer is documented in public records as quickly as possible.

Misconceptions

When it comes to transferring property rights in Colorado, the Quitclaim Deed form is a common tool. However, there are several misconceptions about how this form works and what it guarantees. Dispelling these myths is crucial for anyone looking to use a Quitclaim Deed to ensure they fully understand the document’s implications.

A Quitclaim Deed guarantees a clear title: Many believe that when you receive a property through a Quitclaim Deed, it comes with a guarantee of a clear title. This is not the case. Essentially, this deed transfers only the interest the grantor has in the property, if any, without any warranties regarding the condition of the title. Therefore, it's possible to acquire a property that has liens, easements, or other encumbrances.

Quitclaim Deeds and Warranty Deeds are the same: Another misconception is that Quitclaim Deeds and Warranty Deeds are interchangeable. While both are used to transfer property rights, a Warranty Deed comes with guarantees from the grantor that they own the property free and clear of any encumbrances. A Quitclaim Deed, however, has no such assurances.

Quitclaim Deeds can only be used between family members: Although frequently used in transfers between family members, Quitclaim Deeds can actually be utilized between any parties. They are often used in divorce settlements or to clear up title issues but are not limited to these situations.

Quitclaim Deeds are only for residential properties: People commonly think that Quitclaim Deeds are designed solely for the transfer of residential properties. In reality, they can be used for any type of real property including commercial and undeveloped land.

Quitclaim Deeds transfer property immediately: The process involves more than just signing the deed. The deed must be properly executed, which includes ensuring it contains all the required information, getting it signed by the grantor, and having it notarized. Following these steps, it should then be filed with the appropriate county recorder’s office. The transfer becomes official once the deed is recorded.

Using a Quitclaim Deed avoids estate taxes: A common myth is that transferring property via a Quitclaim Deed can help avoid estate taxes. Estate tax liability depends on many factors, and the manner of property transfer might not necessarily impact estate taxes. It's important to consult with a tax professional to understand the tax implications of any property transfer.

A Quitclaim Deed can remove someone from a mortgage: Another major misconception is that executing a Quitclaim Deed can remove an individual’s legal responsibility from a mortgage. The deed only affects property ownership and does not impact existing mortgages or loans. Thus, if a person’s name is on a mortgage, they remain responsible for the loan unless they officially refinance or otherwise modify the loan terms with the lender.

Key takeaways

When handling the transfer of property ownership in Colorado, the Quitclaim Deed form is a common document used for its simplicity and speed of process. However, its use also requires careful consideration and understanding of its implications. Below are key takeaways for filling out and using the Colorado Quitclaim Deed form effectively.

- The Colorado Quitclaim Deed form should be clearly and accurately filled out to ensure the legal transfer of any interest in real property from the grantor (the person transferring the property) to the grantee (the recipient).

- It's crucial to verify the precise legal description of the property being transferred. This description can include the subdivision, block number, lot number, and any additional details that specify the exact location and boundaries of the property.

- Identify the grantee correctly and include their legal name along with an accurate address to ensure they receive the property rights without issues.

- All parties involved, especially the grantor, must sign the Quitclaim Deed form in the presence of a notary public to validate the document. Colorado law requires this step for the deed to be considered legally binding.

- Remember that the Quitclaim Deed does not guarantee a clear title; it only transfers whatever interest the grantor has in the property. It's recommended to conduct a title search beforehand to understand any potential encumbrances or liens against the property.

- Once completed and notarized, file the Quitclaim Deed with the appropriate county recorder’s office or land records office in Colorado where the property is located. This filing is necessary for the document to be legally effective and to put the public on notice of the change in ownership.

- There might be a filing fee required by the county recorder’s office, which can vary by county. It’s advisable to confirm this fee in advance to ensure correct payment at the time of filing.

- Consider seeking legal advice before proceeding with a Quitclaim Deed, especially in complex situations involving significant property interests or rights. Professional legal advice can help clarify the implications and ensure the proper handling of the transfer.

The use of a Quitclaim Deed in Colorado is a significant legal action with direct impacts on property rights. Proper completion, verification, notarization, and filing of the form are essential steps in its effective use. Always prioritize accuracy and legal compliance in this process to secure the intended outcomes of property transfers.

Create Other Quitclaim Deed Forms for US States

Oklahoma Quit Claim Deed Form Individual - Quitclaim deeds offer a solution for resolving disputes over property boundaries by transferring disputed territories without admitting ownership.

Florida Quit Claim Deed Filled Out - It is crucial for grantees to conduct thorough research on the property’s history before accepting a quitclaim deed.

How Do I File a Quit Claim Deed - Without the assurances of a warranty deed, the Quitclaim is best used when the grantee is certain of the property’s encumbrance status.