Blank Quitclaim Deed Form for Connecticut

In the state of Connecticut, transferring property interest from one party to another is efficiently accomplished using a legal document known as the Quitclaim Deed form. Distinguished from other real estate deed forms by its lack of warranties, this document ensures a swift transaction but does not guarantee the seller's ownership or that the property is free of other claims. Ideal for low-risk transactions between parties who trust each other, like family members, the form requires specific information to be valid, including details about the grantor and grantee, the legal description of the property, and signatures notarized to meet state filing standards. Moreover, understanding the nuances of this form, such as when it is most appropriately used and recognizing the implications of its no warranty clause, is paramount for anyone considering its application. Simplifying property transfers without the complexities of warranties, the Connecticut Quitclaim Deed form stands out for its straightforward approach to changing ownership in real estate matters.

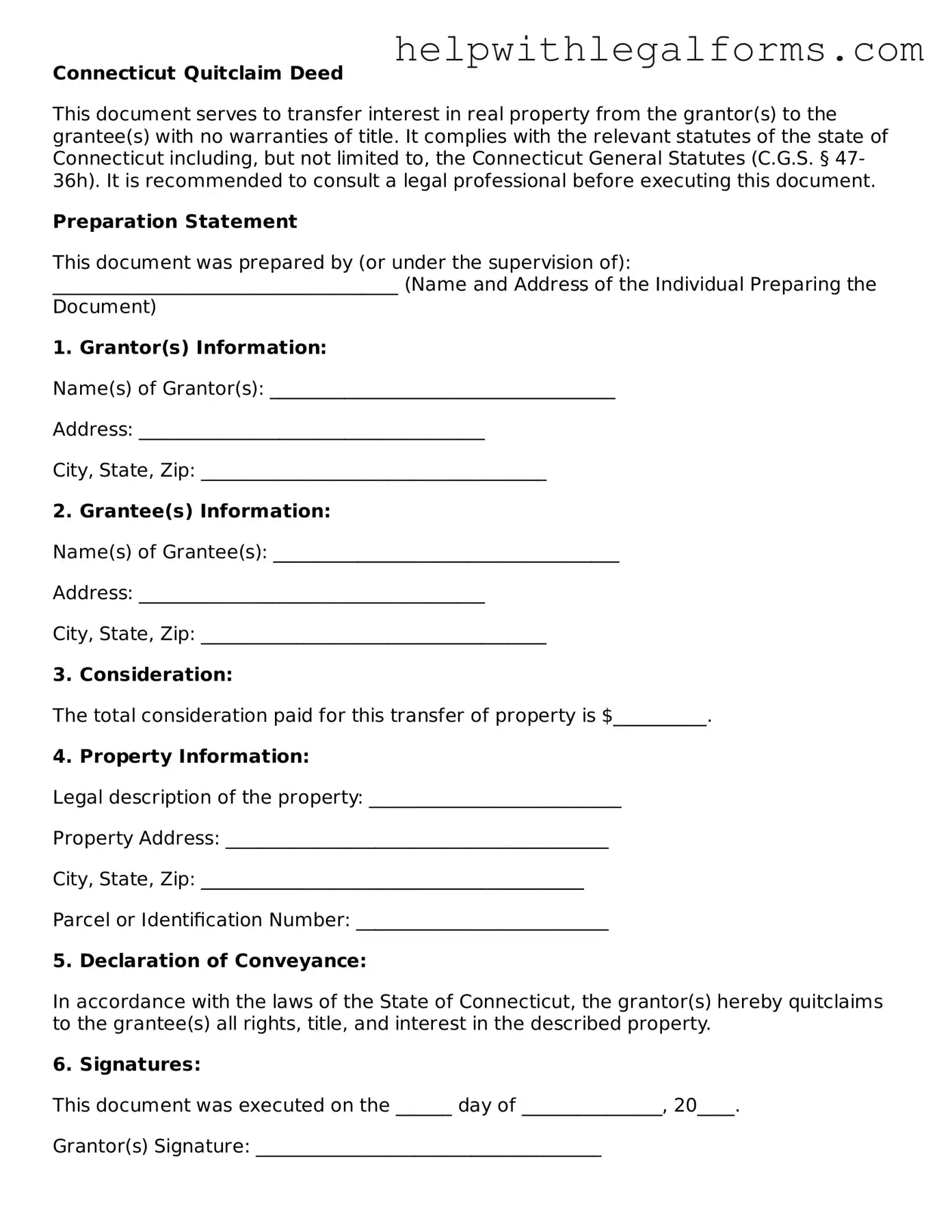

Example - Connecticut Quitclaim Deed Form

Connecticut Quitclaim Deed

This document serves to transfer interest in real property from the grantor(s) to the grantee(s) with no warranties of title. It complies with the relevant statutes of the state of Connecticut including, but not limited to, the Connecticut General Statutes (C.G.S. § 47-36h). It is recommended to consult a legal professional before executing this document.

Preparation Statement

This document was prepared by (or under the supervision of): _____________________________________ (Name and Address of the Individual Preparing the Document)

1. Grantor(s) Information:

Name(s) of Grantor(s): _____________________________________

Address: _____________________________________

City, State, Zip: _____________________________________

2. Grantee(s) Information:

Name(s) of Grantee(s): _____________________________________

Address: _____________________________________

City, State, Zip: _____________________________________

3. Consideration:

The total consideration paid for this transfer of property is $__________.

4. Property Information:

Legal description of the property: ___________________________

Property Address: _________________________________________

City, State, Zip: _________________________________________

Parcel or Identification Number: ___________________________

5. Declaration of Conveyance:

In accordance with the laws of the State of Connecticut, the grantor(s) hereby quitclaims to the grantee(s) all rights, title, and interest in the described property.

6. Signatures:

This document was executed on the ______ day of _______________, 20____.

Grantor(s) Signature: _____________________________________

Grantee(s) Signature: _____________________________________

7. Acknowledgment:

This section should be completed by a notary public.

State of Connecticut

County of _____________________

On this ____ day of ___________, 20____, before me, the undersigned notary public, personally appeared _____________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_____________________________________

Notary Public

My Commission Expires: _______________

8. Recording:

After signing, this document should be filed with the local town clerk's office in the county where the property is located to make it effective.

Important Note: This is a template designed for informational purposes only. Legal advice is recommended to ensure compliance with local laws and regulations, and for any situation requiring legal representation.

PDF Form Attributes

| Fact | Detail |

|---|---|

| Definition | A Connecticut Quitclaim Deed is a legal document used to transfer interest in real property from one person to another with no warranties about the title. |

| Governing Law | Connecticut General Statutes, specifically Title 47 - Land and Land Titles. |

| Recording Requirement | Must be recorded with the Town Clerk in the town where the property is located. |

| Consideration Statement | A statement of consideration is required, indicating the value being exchanged for the property. |

| Witness Requirement | Connecticut law requires two witnesses for the signing of the Quitclaim Deed. |

| Additional Form Requirement | An OP-236, Connecticut Real Estate Conveyance Tax Return form, must accompany the deed upon recording if applicable. |

Instructions on How to Fill Out Connecticut Quitclaim Deed

Completing a Quitclaim Deed form in Connecticut is an important process for individuals who wish to transfer property rights quickly and without the warranties that are usually involved in a traditional sale. This method is commonly used between family members, during the division of property, or in clear-cut situations where both parties are confident about the property's title. Follow the steps below to fill out the Connecticut Quitclaim Deed form accurately. Ensuring all details are correct can help avoid potential legal complications or delays.

- Gather all necessary information including the full names and addresses of both the grantor (the person transferring the property) and the grantee (the recipient of the property), as well as the exact legal description of the property being transferred.

- Head to the top of the form and enter the date on which the deed will be executed.

- Write the name and address of the grantor in the designated space, followed by the name and address of the grantee.

- Insert the county in Connecticut where the property is located.

- Record the legal description of the property. This information is typically found on the original deed or by contacting the county's land records office.

- Include any consideration being paid for the property. Consideration can be any amount of money or something of value being exchanged for the transfer of the property. If there is no consideration, a common approach is to write "for one dollar and other valuable considerations."

- Both the grantor and grantee must sign the deed in the presence of a Notary Public. Ensure the Notary Public also signs the document and affixes their seal, verifying the identities of the signatories.

- Review the form thoroughly to ensure all information is correct and no sections have been missed.

- Submit the completed form to the appropriate Town Clerk's office in the county where the property is located, along with any required filing fee. Fees vary by location, so it's important to check with the local office in advance.

After submitting the Quitclaim Deed, the official recording process will begin. This is the final step in making the transfer of property official. Keep in mind, the office of the Town Clerk might have additional requirements or steps for filing, so it's a good idea to inquire about the complete process when planning to file the deed. Successfully recording your Quitclaim Deed ensures that the public records accurately reflect the current ownership of the property.

Crucial Points on This Form

What is a Connecticut Quitclaim Deed?

A Connecticut Quitclaim Deed is a legal document that transfers the grantor's interest in a property to the grantee without any warranties or guarantees about the property being free of claims or encumbrances. This means that the person receiving the property, the grantee, accepts it "as is." This type of deed is often used between family members or to clear up title issues.

How does a Quitclaim Deed differ from a Warranty Deed in Connecticut?

Unlike a Quitclaim Deed, a Warranty Deed provides the grantee with guarantees that the property is free from any liens or encumbrances and that the grantor has the legal right to transfer the property. While a Quitclaim Deed transfers only whatever interest the grantor has at the time of the transfer, a Warranty Deed offers more protection to the buyer, ensuring that the property title is clear.

What are the necessary steps to file a Quitclaim Deed in Connecticut?

To file a Quitclaim Deed in Connecticut, the deed must be in writing, include a legal description of the property, be signed by the grantor, and have the signature notarized. After preparing the deed, it needs to be recorded with the town clerk in the town where the property is located. Recording the deed provides public notice of the transfer and is necessary for the deed to be effective against third parties.

Are there any specific requirements for a Connecticut Quitclaim Deed to be valid?

Yes, for a Connecticut Quitclaim Deed to be valid, it must clearly state the names of the grantor and grantee, include a complete legal description of the property, be signed by the grantor, and have the grantor's signature notarized. Additionally, Connecticut law requires that the deed be recorded in the appropriate town clerk's office to be effective against third parties.

Can a Quitclaim Deed be used to transfer property to a family member in Connecticut?

Yes, a Quitclaim Deed is commonly used to transfer property to family members in Connecticut. It is a simple way to transfer ownership without the warranties provided by a Warranty Deed. This makes it ideal for transactions where the parties know each other well and there is trust regarding the property's condition and title.

What happens if there are problems with the property’s title after a Quitclaim Deed is executed?

If problems with the property's title arise after a Quitclaim Deed is executed, the grantee has limited recourse against the grantor. Since the grantor does not warrant the title's quality in a Quitclaim Deed, the grantee accepts the risk of any title defects present at the time of transfer. It is recommended to conduct a thorough title search before accepting a quitclaim transfer to mitigate potential issues.

Common mistakes

Filling out the Connecticut Quitclaim Deed form correctly is crucial for a smooth transfer of property ownership. However, people often make several common mistakes during this process. These errors can lead to delays, legal complications, or even the invalidation of the deed. Here are four mistakes to avoid:

-

Not Using the Correct Legal Description of the Property: It is essential to provide the exact legal description of the property as it appears on the current deed or property records. This description often includes lot numbers, subdivision names, and other specific details. A common mistake is using an informal or incomplete description, which can create confusion or disputes about what property is being transferred.

-

Failing to Include All Required Signatories: The Quitclaim Deed must be signed by all parties who have an ownership interest in the property. This often includes all individuals listed on the current deed or title. Failing to have all necessary parties sign can result in an ineffective transfer of interest.

-

Omitting Essential Filing Information: The deed requires certain information to be properly recorded, such as the grantee's address and the preparer's information. Leaving out these details can hinder the recording process or lead to the deed not being officially recognized.

-

Not Following Proper Notarization Procedures: In Connecticut, as in many states, a Quitclaim Deed must be notarized to be valid. This step involves the grantor(s) signing the deed in the presence of a notary public. A frequent mistake is not completing the notarization correctly — for example, forgetting to have the deed signed in the notary's presence or failing to obtain the notary's official seal and signature.

Avoiding these mistakes not only ensures the Quitclaim Deed is filled out accurately but also facilitates a smoother property transfer process.

Documents used along the form

In the real estate process, especially in Connecticut, a Quitclaim Deed form is crucial for the transfer of property without any warranty regarding the clear title of the property. However, completing a real estate transaction involves more than just a Quitclaim Deed. Several other forms and documents are often required to ensure the legality and completeness of the transaction. These documents may vary depending on the specifics of the transaction but generally include the following:

- Real Estate Sales Contract: This is an agreement between the buyer and seller outlining the terms and conditions of the property sale. It specifies the sales price, closing date, and any contingencies that must be satisfied before the sale can finalize.

- Title Search Report: A document that provides a history of the property, including its ownership and any liens or encumbrances against it. It's crucial for ensuring the seller has a clear title to transfer.

- Property Tax Statements: These statements show the current status of property taxes. They confirm whether taxes are up to date or if there are any outstanding liabilities the new owner needs to be aware of.

- Homeowners' Association (HOA) Documents: If the property is within an HOA, these documents are essential. They include the association's rules and regulations, which the new owner must follow.

Warranty Deed: In some cases, alongside or instead of a Quitclaim Deed, a Warranty Deed might be used. This form guarantees the buyer that the property title is clear and free of liens, offering more protection than a Quitclaim Deed. - Closing Disclosure: A form that outlines the final closing costs, provided to the buyer at least three days before closing. It details the loan amount, interest rates, and other costs related to the purchase.

- Mortgage or Trust Deed: If the purchase involves taking out a mortgage, this document secures the loan by making the property collateral. It outlines the terms of the loan, including repayment schedule and interest rates.

Understanding and preparing these documents is essential for a smooth and legally compliant real estate transaction. Individuals involved in property transfers should consider seeking legal advice to navigate the complexities of the process effectively. While the Quitclaim Deed is a significant part of transferring property rights, the additional documents ensure the transaction's legal soundness from all angles.

Similar forms

Warranty Deed: Like a Quitclaim Deed, a Warranty Deed is used in property transactions. However, a Warranty Deed provides a guarantee that the seller holds clear title to the property, offering more protection to the buyer compared to the Quitclaim Deed, which does not guarantee clear title.

Grant Deed: Similar to the Quitclaim Deed, the Grant Deed is a document used to transfer property ownership. Both require the current owner's signature. The key difference lies in the level of protection; the Grant Deed offers certain guarantees about the property's history that the Quitclaim does not.

Deed of Trust: A Deed of Trust also pertains to real estate transactions. It involves three parties—the borrower, lender, and trustee—and functions similarly to a mortgage. While it differs in purpose from a Quitclaim Deed, both are critical in the realm of property transfer and financing.

Mortgage Agreement: This document outlines the terms of a loan used to purchase property, making it a cornerstone of real estate transactions, akin to Quitclaim Deeds. The primary difference is that Mortgage Agreements involve a lender's rights to the property as security for the loan, not the transfer of property ownership.

Promissory Note: A Promissory Note is a commitment to pay a certain amount of money to someone else and is often associated with property transactions, similar to a Quitclaim Deed. While it deals more with the financial side rather than transferring property rights, both are integral in real estate deals.

Bill of Sale: A Bill of Sale is used to transfer ownership of personal property, such as vehicles or equipment, and is comparable to a Quitclaim Deed in that it transfers ownership rights. Unlike the Quitclaim, which is used for real estate, the Bill of Sale is for personal property.

Title Insurance Policy: Like a Quitclaim Deed, a Title Insurance Policy is related to real estate transactions. It protects the buyer from future claims against the property's title. While the Quitclaim Deed transfers ownership without any assurances, Title Insurance offers protection after the transfer.

Power of Attorney: This document grants someone the authority to act on behalf of another in various situations, including real estate transactions. While its purpose differs from a Quitclaim Deed, which transfers property ownership, both may be required to manage or finalize property deals.

Homeowners' Association (HOA) Agreement: An HOA Agreement, impacting property ownership and usage, is akin to Quitclaim Deeds in the real estate domain. Though its primary role is to establish community standards rather than transfer property rights, both are significant in the context of property ownership.

Dos and Don'ts

When filling out the Connecticut Quitclaim Deed form, it is crucial to ensure that the process is done correctly to avoid any future legal problems. Here are some guidelines to help you complete the form accurately and effectively.

Things You Should DoEnsure that all parties' names are spelled correctly and match their official documents. Accuracy in names confirms the identity of the parties involved.

Include a complete and accurate description of the property. This description should match the one on the current deed to prevent any confusion about the property being transferred.

Verify that the form complies with Connecticut's specific requirements. State laws can vary, making it essential to use a form that meets all local legal conditions.

Have all signing parties present before a notary public when signing the deed. A notary’s seal and signature are required to authenticate the signatures on the deed.

Record the quitclaim deed with the local town clerk’s office once it is signed. This step is vital for the deed to be considered valid and to put the public notice of the property transfer.

Don’t leave any blanks on the form. Incomplete documents may be considered invalid or cause delays in processing.

Avoid using informal language or nicknames for the grantor(s) and grantee(s). The formal legal names should be used to ensure the deed’s validity and enforceability.

By following these guidelines, you can help ensure that your Connecticut Quitclaim Deed is filled out correctly, reducing potential legal complications and ensuring a smoother transfer of property.

Misconceptions

When it comes to transferring property rights in Connecticut, the Quitclaim Deed form is often misunderstood. This form is an essential tool for conveying property from one party to another without making warranties about the title's quality. Let's clarify five common misconceptions about this legal document.

Misconception 1: A Quitclaim Deed guarantees a clear title. Many believe that a Quitclaim Deed ensures the seller (grantor) holds a clear and unencumbered title to the property, which is a misconception. In reality, this form does not guarantee the quality of the title; it merely transfers the grantor's interest in the property, if any, to the recipient (grantee).

Misconception 2: Quitclaim Deeds are only for transactions without financial exchange. While it's true these deeds are commonly used among family members or to clear up a title issue, they're not exclusively for transactions without a purchase price. Quitclaim Deeds can be used in various situations, including traditional buy-and-sell scenarios, though they're less common in such cases due to the lack of title warranty.

Misconception 3: A Quitclaim Deed immediately changes the property's ownership. The process involves more than just signing the deed. For a Quitclaim Deed to officially transfer ownership in Connecticut, it must be delivered to and accepted by the grantee, and then recorded with the appropriate municipal land records office. Only upon recording does the ownership transfer get publicly recognized.

Misconception 4: Quitclaim Deeds can solve all property disputes. Some believe that executing a Quitclaim Deed can resolve all disputes related to property boundaries or ownership claims. This is not accurate. While they can be useful in clarifying the rights of parties involved in the ownership of the property, they don't address issues unrelated to the grantor's interest and may not resolve all types of disputes.

Misconception 5: The use of a Quitclaim Deed eliminates the need for title insurance. Given that a Quitclaim Deed does not warrant the quality of the property's title, it's a mistake to assume there's no need for title insurance. Buyers receiving property through a Quitclaim Deed often purchase title insurance to protect themselves against potential undisclosed or unknown title issues.

Key takeaways

In Connecticut, a Quitclaim Deed is a legal document used to transfer interest in real property from one party to another without any warranty regarding the title. Here are key takeaways for filling out and using the Connecticut Quitclaim Deed form:

- Ensure Accuracy: It's crucial to fill out the form accurately. Incorrect information can lead to problems with the property transfer, including legal disputes. Double-check all entries, especially the legal description of the property and the names of the grantor (seller) and grantee (buyer).

- Legal Description of Property: A distinctive feature of quitclaim deeds is the requirement for a precise legal description of the property. This is more detailed than just an address and may include lot numbers, boundaries, and other specifics that identify the property's location and extents.

- Signatures: The Connecticut Quitclaim Deed must be signed by the grantor in the presence of a notary public. This step is essential for the document's legality, as the notary verifies the identity of the signing parties.

- Consideration: The form requires a statement of consideration, which is the value exchanged for the property. Even if the property is a gift, a nominal consideration amount must be stated to meet legal requirements.

- Recording the Deed: After the quitclaim deed is signed and notarized, it should be recorded with the local town clerk in the county where the property is located. Recording fees must be paid, and the deed becomes a matter of public record, providing notice of the property transfer.

- Legal Consultation: Given the lack of warranties with a quitclaim deed, consulting with a legal professional before completing or accepting such a deed can provide valuable insights into its implications. A legal professional can help ensure that the grantee understands the potential risks, including any possible encumbrances or liens against the property.

By following these key points, individuals involved in a Connecticut property transfer can better navigate the process of completing and using a quitclaim deed. Understanding each step ensures the transfer is conducted legally and efficiently, minimizing future complications.

Create Other Quitclaim Deed Forms for US States

How Do I File a Quit Claim Deed - Those looking to gift real estate to another person often use the Quitclaim Deed for its ease and low complexity.

Georgia Quit Claim Deed Requirements - This form does not include any guarantee regarding the grantor's ownership status or claims against the property.

Colorado Quit Claim Deed Joint Tenancy With Right of Survivorship - Understanding the limitations and benefits of a Quitclaim Deed can help parties make informed decisions in property transactions.