Blank Quitclaim Deed Form for Florida

In the realm of property transactions within Florida, navigating the legal instruments necessary for the transfer of real estate interests can seem daunting. The Quitclaim Deed form emerges as a pivotal document, widely recognized for its efficiency and straightforwardness in conveying property rights from one party to another without the guarantee of a clear title. This form holds particular significance for those looking to transfer property speedily among family members, settle property after a divorce, or adjust ownership stakes among co-owners without the formalities of a traditional sale. Despite its utility, the implications of its use—especially the lack of guarantees regarding the title's validity—necessitate a thorough understanding and cautious approach. The intricacies of filling out the form correctly, understanding the legal ramifications, and ensuring the document's proper execution under Florida law are crucial steps in securing the intended outcome of any property transfer utilizing a Quitclaim Deed.

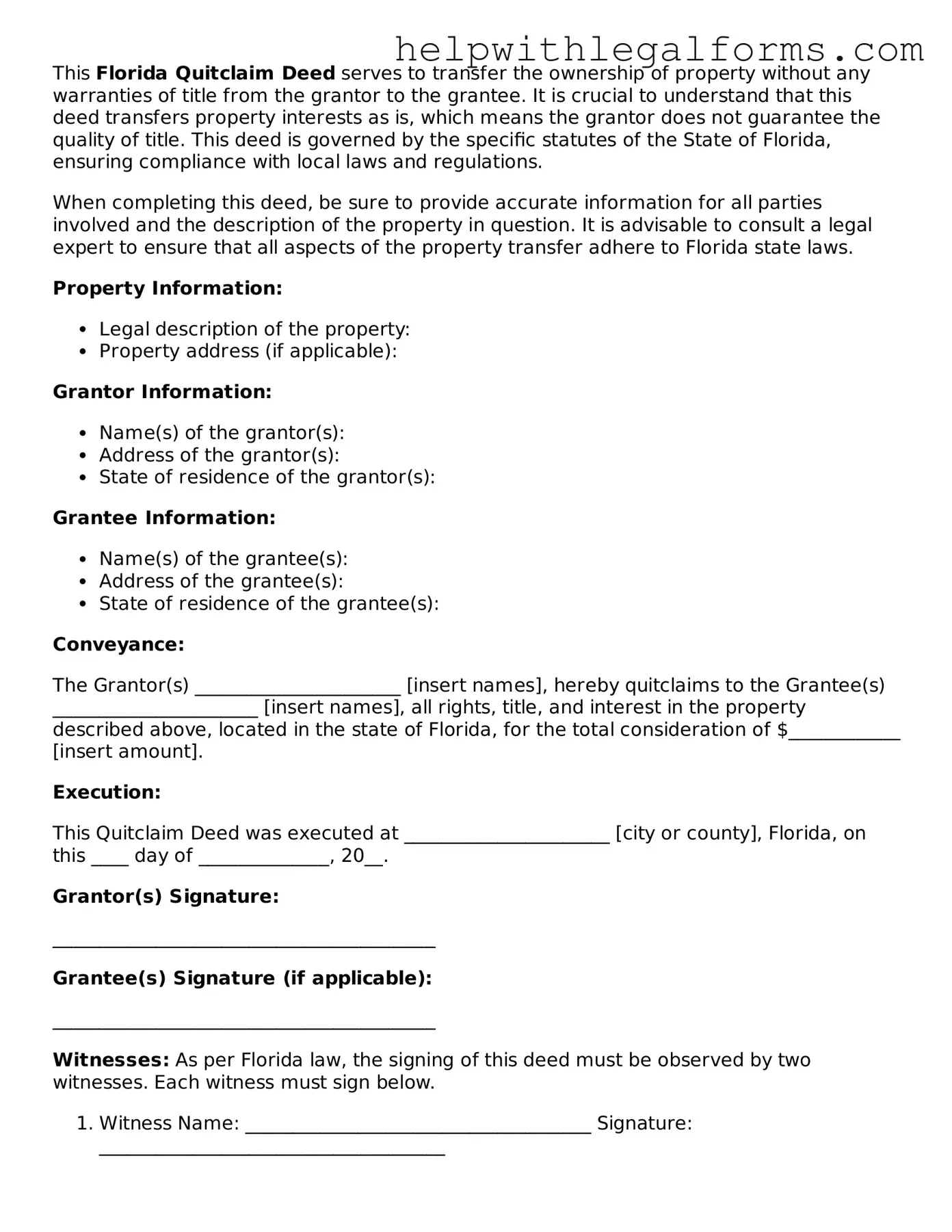

Example - Florida Quitclaim Deed Form

This Florida Quitclaim Deed serves to transfer the ownership of property without any warranties of title from the grantor to the grantee. It is crucial to understand that this deed transfers property interests as is, which means the grantor does not guarantee the quality of title. This deed is governed by the specific statutes of the State of Florida, ensuring compliance with local laws and regulations.

When completing this deed, be sure to provide accurate information for all parties involved and the description of the property in question. It is advisable to consult a legal expert to ensure that all aspects of the property transfer adhere to Florida state laws.

Property Information:

- Legal description of the property:

- Property address (if applicable):

Grantor Information:

- Name(s) of the grantor(s):

- Address of the grantor(s):

- State of residence of the grantor(s):

Grantee Information:

- Name(s) of the grantee(s):

- Address of the grantee(s):

- State of residence of the grantee(s):

Conveyance:

The Grantor(s) ______________________ [insert names], hereby quitclaims to the Grantee(s) ______________________ [insert names], all rights, title, and interest in the property described above, located in the state of Florida, for the total consideration of $____________ [insert amount].

Execution:

This Quitclaim Deed was executed at ______________________ [city or county], Florida, on this ____ day of ______________, 20__.

Grantor(s) Signature:

_________________________________________

Grantee(s) Signature (if applicable):

_________________________________________

Witnesses: As per Florida law, the signing of this deed must be observed by two witnesses. Each witness must sign below.

- Witness Name: _____________________________________ Signature: _____________________________________

- Witness Name: _____________________________________ Signature: _____________________________________

Acknowledgment by Notary Public:

State of Florida

County of ______________________

On this ____ day of ________________, 20__, before me, ______________________ [insert name of notary], personally appeared ______________________ [insert names of grantor(s)], to me known to be the person(s) described in and who executed the foregoing instrument, and acknowledged that he/she/they executed the same as his/her/their voluntary act and deed.

Notary Public: ______________________

Seal:

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Document Purpose | The Florida Quitclaim Deed is used to transfer property ownership without any warranty regarding the validity of the property title. |

| Governing Law | In Florida, quitclaim deeds are governed by Chapter 689 of the Florida Statutes, which pertains to conveyances of real property and interests in real property. |

| Recording Requirement | To be effective against third parties, the executed deed must be recorded with the Clerk of the Circuit Court in the county where the property is located. |

| Witness Requirement | Florida law requires that quitclaim deeds be signed in the presence of two witnesses to be considered valid. |

Instructions on How to Fill Out Florida Quitclaim Deed

After deciding to transfer property ownership in Florida without any warranty regarding the title, the next crucial step involves filling out the Florida Quitclaim Deed form accurately. This document is a straightforward way to relinquish one's interest in a property to someone else. Below is a comprehensive guide designed to navigate you through each step of completing the form, ensuring the process is handled efficiently and effectively.

- Start by entering the preparer's full name and mailing address in the designated space at the top of the form. This is typically the person who is completing or filing the Quitclaim Deed.

- Next, fill in the "Return to" section with the name and mailing address of the individual who should receive the deed after recording. Usually, this is the grantee.

- In the "County" field, specify the Florida county where the property is located. This is important as it determines where the document will be recorded.

- Input the date of the deed transfer. Ensure this date is accurate, as it signifies when the property interest was officially relinquished.

- Identify the grantor(s) — the person or persons giving away their interest in the property — by writing down their full name(s) and address(es).

- Specify the grantee(s) — the recipient(s) of the property interest — including their full name(s) and address(es).

- Provide a legal description of the property. This should match the description used in previous deeds or the one found in property tax documents. It usually includes lot numbers, subdivision names, and other details that uniquely identify the property.

- State the amount paid for the property transfer, if any. This could be a dollar amount or simply a statement of consideration, such as "love and affection."

- The grantor(s) must sign the deed. Ensure the signature(s) are witnessed by two individuals, who must also sign the document, acknowledging they witnessed the grantor(s)' signature(s).

- Finally, the deed must be notarized. This involves having a notary public sign and affix their official seal to the document, verifying the identity of the grantor(s) and the witnesses.

Once all these steps have been completed, the Quitclaim Deed form is ready to be filed with the local county recorder's office. Filing this document is the final step in the process, formally completing the transfer of property ownership. It's also advised to keep a copy of the recorded deed for personal records. The local county office may charge a recording fee, so be prepared to pay this when submitting the document. The steps outlined ensure a smooth and structured approach to transferring property ownership in Florida using a Quitclaim Deed.

Crucial Points on This Form

What is a Florida Quitclaim Deed form?

A Florida Quitclaim Deed form is a legal document that allows a property owner (the grantor) to transfer their interest in a piece of property to another person (the grantee) without making any warranties or guarantees about the property's title. This means the grantee receives whatever interest the grantor has in the property, if any, without any promise that the title is clear or free of liens.

When should I use a Florida Quitclaim Deed?

Florida Quitclaim Deeds are often used when property is being transferred without a traditional sale. This can include transferring property between family members, adding or removing a spouse from the title, clearing up a cloud on a title, or transferring property into a trust. It's important to use this form when the grantor does not want to be responsible for any title defects.

What information is needed to complete a Florida Quitclaim Deed form?

To complete a Florida Quitclaim Deed form, you'll need the legal description of the property being transferred, the names and addresses of the grantor and grantee, and the amount of consideration being exchanged for the property, if any. The deed must also be signed by the grantor in front of a notary public and two witnesses for it to be legally valid.

How do I file a Florida Quitclaim Deed?

Once the Florida Quitclaim Deed form is completed and signed, it needs to be filed with the Clerk of the Circuit Court in the county where the property is located. There may be a filing fee, which varies by county. The deed becomes part of the public record once it is filed, and the property transfer is officially recognized.

Are there any specific legal requirements for Florida Quitclaim Deeds?

Yes, Florida has specific requirements for Quitclaim Deeds. The deed must be in writing, contain a legal description of the property, be executed (signed) by the grantor, and be witnessed by two people. In addition, the grantor's signature must be notarized. Meeting these requirements ensures the deed is legally valid and enforceable in Florida.

Common mistakes

-

Not verifying the legal description of the property is accurate can lead to significant issues. The legal description is more detailed than just an address; it includes lot numbers, subdivision names, and sometimes metes and bounds descriptions. If this part isn't correct, it might mean the deed does not actually convey the property one thinks it does.

-

Forgetting to check whether the form meets all of Florida's recording requirements could prevent the deed from being officially recorded. Florida has specific standards, including the need for the grantor's (person transferring the property) signature to be notarized. If any of these requirements are overlooked, the county might reject the document.

-

Omitting to identify the grantee (person receiving the property) correctly. It's critical to ensure that the grantee's full legal name is used and spelled correctly. Any discrepancies here can create confusion or disputes about the property's rightful owner in the future.

-

Not acknowledging if there are any taxes or fees due at the time of the transfer is a common oversight. In some cases, property transfers can trigger taxes or fees that need to be paid either before or at the time of recording the deed. Without addressing these, the transfer might not be considered valid.

-

Ignoring the requirement to submit the deed to the appropriate county office for recording. Once a quitclaim deed is properly filled out and signed, it doesn't automatically change the property records. It needs to be delivered to the county recorder or clerk's office where the property is located. Failing to do this means the property transfer isn't officially in the public record.

Documents used along the form

When managing real estate transactions, especially those involving a Florida Quitclaim Deed, various other forms and documents are often utilized to ensure the accuracy and legality of the transaction. These documents complement the Quitclaim Deed form by providing additional legal protections, clarifying the specifics of the property transfer, or ensuring proper tax treatment. A clear understanding of these documents can help those involved in real estate transactions to navigate the process more smoothly.

- Warranty Deed - Unlike a Quitclaim Deed, a Warranty Deed provides the buyer with guarantees that the seller holds clear title to the property. This document is often used in sales where the buyer seeks assurance about the status of the property’s title.

- Title Search Report - This report outlines the history of ownership and any encumbrances on the property. It's a crucial document for identifying liens, easements, or other restrictions that might affect the property's use.

- Property Tax Declaration Form - This form is submitted to the local taxing authority and provides details about the property, ensuring that tax records reflect the current ownership and status of the property.

- Florida Documentary Stamp Tax Form - When a property changes hands, Florida requires the payment of a documentary stamp tax. This form is used to calculate and report the tax due on the transaction.

- Closing Statement - The closing statement details the financial transactions involved in the property’s sale, including sales price, taxes, and fees. It is used at the closure of the sale to ensure all parties have an accurate accounting of the deal.

- Power of Attorney (POA) for Property Transactions - This legal document authorizes someone to act on behalf of another in legal or financial matters relating to the property. A POA is useful if the property owner cannot be present to sign the necessary documents during the sale process.

In real estate transactions using a Florida Quitclaim Deed, these additional forms and documents play vital roles in ensuring that the transfer of property is conducted legally and efficiently. Each document serves a specific purpose, from guaranteeing the property's title to ensuring accurate financial reporting. By familiarizing themselves with these documents, parties involved in a property transfer can better prepare for and navigate the complexities of real estate transactions.

Similar forms

Warranty Deed: Like the quitclaim deed, a warranty deed transfers property ownership from one party to another. However, a warranty deed provides assurances from the seller to the buyer about the clear title of the property, which is not guaranteed with a quitclaim deed. Both serve to transfer property rights but differ in the level of protection offered to the buyer.

Grant Deed: Similar to a quitclaim deed, a grant deed transfers property ownership from the grantor to the grantee. The key difference lies in the grantor's promise that they have not transferred the title to someone else and that the property is not burdened by encumbrances (except those stated in the deed). Essentially, both documents are used for transferring property rights, albeit grant deeds offer slightly more assurance than quitclaim deeds.

Trustee's Deed: This document also involves property transfer but is used specifically when a trustee conveys property held in a trust, similar to how a quitclaim deed is used for property transfer. Unlike the quitclaim, which does not guarantee a clear title, the trustee's deed may provide some assurances, depending on the terms of the trust.

Deed of Trust: A deed of trust involves three parties (borrower, lender, and trustee) and is used to secure a loan on real property, similarly to how a quitclaim in some regions may be used to transfer property rights as security for obligations. However, a quitclaim deed directly transfers property interest without creating a lien or securing a loan.

Special Warranty Deed: This deed is akin to a quitclaim deed in that it transfers property ownership. However, the grantor of a special warranty deed only guarantees against title defects that occurred during their ownership period, not before. This makes it a middle ground between a quitclaim deed, which offers no guarantees, and a full warranty deed, which covers all title defects.

Correction Deed: A correction deed is used to correct errors in a previously recorded deed, similar to how a quitclaim deed can be used to clear up potential title issues by transferring any interest the grantor may have in the property, even if it's uncertain. Both can modify the state of the title without a full transaction.

Life Estate Deed: This deed transfers property rights to someone for their lifetime, reverting to the original owner or another designated party upon their death. Quitclaim deeds can also be used to create life estates, although the specifics of the rights transferred can vary more broadly without inherent guarantees.

Tax Deed: Similar to quitclaim deeds in the aspect of transferring property titles, a tax deed is issued when a property is sold by the government to recover unpaid taxes. Like quitclaim deeds, tax deeds may come with no guarantees regarding the property's lien status, offering a clear parallel in the risk potential for the buyer.

Dos and Don'ts

When it comes to transferring property in Florida, the Quitclaim Deed form is a popular choice for its simplicity and efficiency. However, filling out this form correctly is crucial to ensure the transfer is valid and legal. Here are some dos and don'ts to guide you through the process:

- Do make sure all parties involved fully understand the nature and consequences of the transfer. A Quitclaim Deed transfers property without guarantees, so it's imperative everyone is on the same page.

- Do verify all spellings of names and addresses. Accuracy is key, as any mistakes can lead to legal complications or delays in the property transfer.

- Do include a complete legal description of the property. This information can typically be found on the current deed or by contacting the county recorder's office.

- Do have the Quitclaim Deed notarized. In Florida, notarization is a requirement for the deed to be considered valid and legally binding.

- Don't leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty to avoid any confusion.

- Don't attempt to use a Quitclaim Deed to avoid creditors or legal judgments. Such actions can be considered fraudulent and have serious legal consequences.

- Don't forget to file the deed with the county clerk's office after it has been executed. The transfer isn't complete until the deed is officially recorded.

- Don't hesitate to seek legal advice. If you have any doubts or questions about filling out the Quitclaim Deed, consulting with an attorney can help clarify the process and ensure everything is in order.

Misconceptions

When it comes to transferring property in Florida, many individuals turn to the Quitclaim Deed form. However, there are several misconceptions about this document that need to be addressed:

Quitclaim Deeds guarantee a clear title: Contrary to popular belief, a Quitclaim Deed does not guarantee that the title to the property is clear or free from liens; it merely transfers whatever interest the grantor has in the property, if any.

Quitclaim Deeds are only for transactions without payment: While often used to transfer property among family members without financial consideration, Quitclaim Deeds can also be used in transactions involving payment.

All defects can be remedied with a Quitclaim Deed: This is not true. A Quitclaim Deed does not address or correct any defects in the title. It simply transfers the owner's interests.

Use of a Quitclaim Deed avoids property taxes: This is a misconception. Transferring property via a Quitclaim Deed does not exempt the grantee from property taxes due on the property.

A Quitclaim Deed transfers property rights immediately: While it's true that the deed can transfer the grantor's interest immediately upon execution and delivery, any effect on ownership rights is subject to the state’s laws and any existing liens or encumbrances.

The process is the same in every state: Each state has its own laws and requirements for executing a Quitclaim Deed. Florida's specific statutes and guidelines must be followed for a valid transfer.

Quitclaim Deeds can transfer any type of property: In Florida, Quitclaim Deeds are commonly used for real estate transactions but may not be appropriate or valid for transferring other types of property, like vehicles or intellectual property.

Quitclaim Deeds can resolve boundary disputes: Merely executing a Quitclaim Deed does not resolve boundary disputes or issues regarding property lines. Such disputes often require a survey and possibly legal resolution.

Recording the Quitclaim Deed is optional: To protect the grantee’s interest in the property, the completed Quitclaim Deed must be recorded with the county clerk’s office where the property is located. Failure to do so does not nullify the deed, but it may compromise the grantee’s claim to the property against subsequent claims.

Quitclaim Deeds are only for residential properties: Quitclaim Deeds can be used for both residential and commercial property transactions. The key consideration is the type of interest being transferred, not the type of property.

Key takeaways

A Florida Quitclaim Deed is a legal document used to transfer property from one person to another without any warranties regarding the title. These are often used between family members or to clear up titles. To ensure the process is smooth and legally sound, here are ten key takeaways to consider:

- Ensure Accuracy: Double-check names, addresses, and legal descriptions of the property to avoid any disputes or legal issues down the line.

- Legal Description of the Property: This goes beyond the address; it includes the lot number, subdivision name, and other details that legally identify the property.

- Presence of Grantee: The person receiving the property, or grantee, should be clearly identified and their legal capacity accurately represented.

- Notarization: Quitclaim deeds in Florida must be notarized to validate the identities of the parties involved and to be legally binding.

- Witnesses: Florida law requires the presence of two witnesses during the signing of the quitclaim deed for it to be valid.

- Filing with the County Clerk: After it is signed and witnessed, the quitclaim deed must be filed with the clerk of the court in the county where the property is located.

- Consideration: This refers to what the grantee is giving in exchange for the property. Even if no money is exchanged, a nominal consideration should be indicated to ensure the deed is legally enforceable.

- Understand the Impact: A quitclaim deed transfers only the owner's interests in the property and does not guarantee that the title is clear of liens or encumbrances.

- Get Legal Advice: Before executing a quitclaim deed, it's wise to consult with a legal professional to understand the implications fully and ensure that it is the best choice for the situation.

- Recording Time Frame: Promptly record the deed with the county clerk. Delaying this step can lead to complications, making the transfer vulnerable to disputes or fraud.

Completing a quitclaim deed in Florida with diligence and an understanding of the legal landscape will ensure a smoother, more secure transfer of property rights. Whether between family members or in more complex situations, adhering to these guidelines will help protect all parties involved.

Create Other Quitclaim Deed Forms for US States

Georgia Quit Claim Deed Requirements - Unlike warranty deeds, the quitclaim deed offers no protection to the buyer regarding the validity of the property title.

Quit Claim Deed Form Ny Pdf - Real estate professionals might advise against accepting a Quitclaim Deed when purchasing property.