Blank Quitclaim Deed Form for Georgia

In the realm of property transactions, particularly within Georgia, the Quitclaim Deed form plays a pivotal role. This document, fairly simplistic in its nature, facilitates the process of transferring property rights without the guarantees typically associated with more comprehensive property deeds. Its primary utility is observed in scenarios where property is transferred between family members or to clear title discrepancies rather than in traditional buy-and-sell situations. The essence of this form lies in its ability to expedite the transfer process, sidestepping the extensive checks and balances that often accompany real estate transactions. Nonetheless, it's crucial for individuals engaging with this form to understand the nuances of its application and the legal implications it carries. A detailed look into this form reveals its structure, required information, and circumstances under which its use is most appropriate, shedding light on its practicality and limitations within the Georgian legal framework.

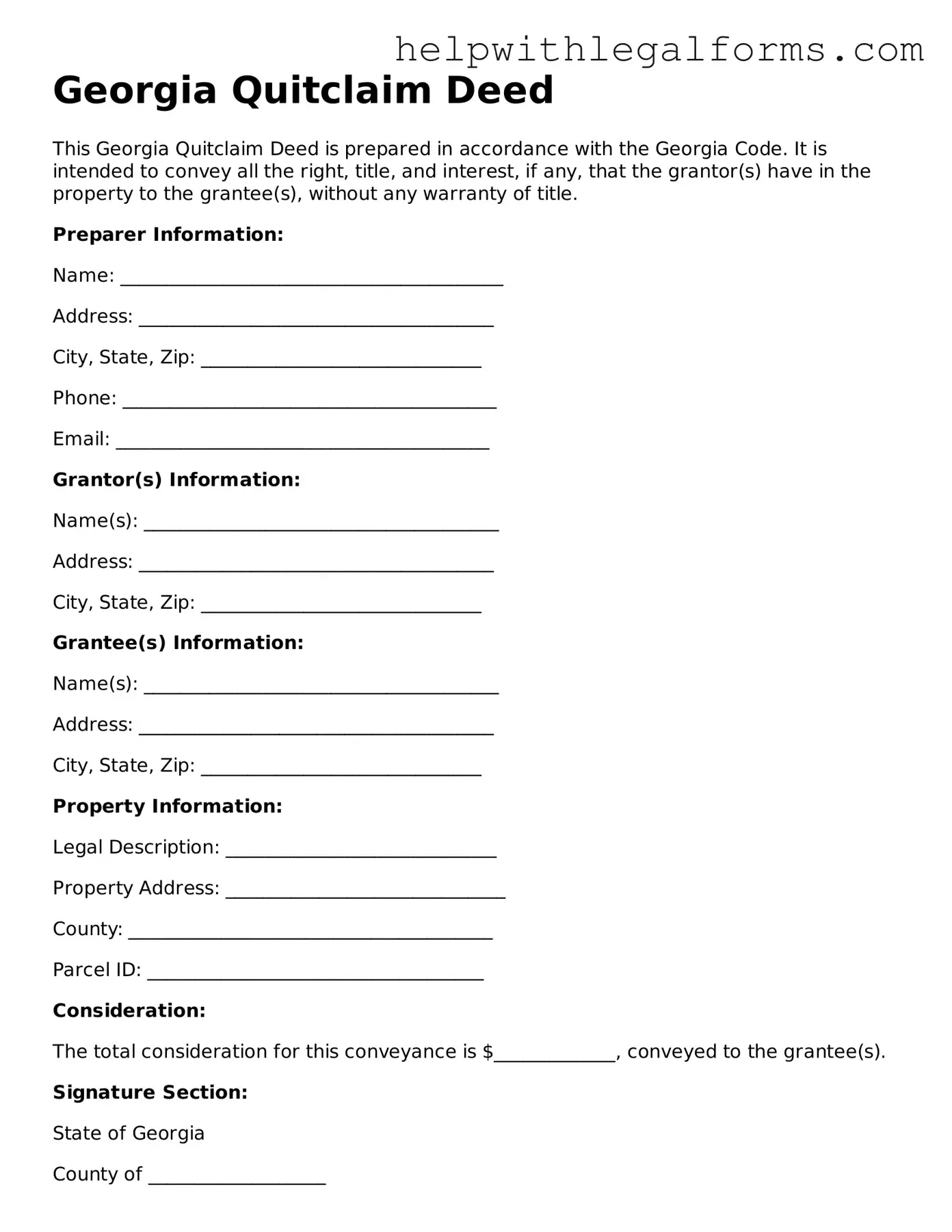

Example - Georgia Quitclaim Deed Form

Georgia Quitclaim Deed

This Georgia Quitclaim Deed is prepared in accordance with the Georgia Code. It is intended to convey all the right, title, and interest, if any, that the grantor(s) have in the property to the grantee(s), without any warranty of title.

Preparer Information:

Name: _________________________________________

Address: ______________________________________

City, State, Zip: ______________________________

Phone: ________________________________________

Email: ________________________________________

Grantor(s) Information:

Name(s): ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________

Grantee(s) Information:

Name(s): ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________

Property Information:

Legal Description: _____________________________

Property Address: ______________________________

County: _______________________________________

Parcel ID: ____________________________________

Consideration:

The total consideration for this conveyance is $_____________, conveyed to the grantee(s).

Signature Section:

State of Georgia

County of ___________________

On this day, before me, ______________________________ (name of notary), a Notary Public in and for said State, personally appeared _________________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

__________________________________ (Signature of Notary)

Printed Name: _______________________

My commission expires: _______________

Grantor(s) Signature:

__________________________________ (Signature)

Printed Name: _______________________

Date: _______________________________

Grantee(s) Acknowledgment:

The undersigned grantee(s) acknowledges receipt of this document and consents to its terms and conditions.

__________________________________ (Signature)

Printed Name: _______________________

Date: _______________________________

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | The Georgia Quitclaim Deed is a legal document used to transfer interest in real estate from one person (the grantor) to another (the grantee) without any warranties of title. |

| 2 | This form of deed does not guarantee that the property title is clear or that the grantor has the right to transfer the property. |

| 3 | It is commonly used between family members, in divorce settlements, or in other situations where the parties know each other and the property well. |

| 4 | The deed must be signed by the grantor and must be notarized to be valid. |

| 5 | Georgia law requires that the Quitclaim Deed include a complete legal description of the property. |

| 6 | After the deed is signed and notarized, it must be filed with the Clerk of the Superior Court in the county where the property is located. |

| 7 | A filing fee will be required at the time of recording the deed with the county clerk's office. |

| 8 | The grantee's address must be included in the deed so that future tax statements can be correctly sent to the property’s new owner. |

| 9 | The Georgia Quitclaim Deed is governed by O.C.G.A. § 44-5-30 which stipulates the requirements for valid conveyance of property interests. |

Instructions on How to Fill Out Georgia Quitclaim Deed

Completing a Quitclaim Deed form in Georgia is a straightforward process that transfers any ownership interest the grantor has in a property to a grantee, without any warranties regarding the title. This type of deed is commonly used between family members or to transfer property into a trust. It's important to carefully follow each step to ensure the deed is legally binding and properly filed. Here are the steps needed to fill out the form correctly.

- Prepare the form: Start by obtaining the most current Quitclaim Deed form specific to Georgia. Ensure it meets local county requirements, as these can vary.

- Identify the parties: Clearly print the full legal names of the grantor (the person transferring the property) and the grantee (the person receiving the property) in the designated spaces.

- Property details: Include the full legal description of the property being transferred. This information can be found on the current deed or by contacting the county recorder's office.

- Consideration: Enter the amount of money, if any, being exchanged for the property. Even if no money is exchanged, a nominal amount such as $1.00 is often listed to fulfill the requirement for a consideration.

- Grantor’s signature: The grantor must sign the deed in the presence of a notary public. Some counties may also require the grantee to sign; it is advisable to check local regulations.

- Notarization: The form must be notarized to validate the grantor’s signature. The notary public will fill out this section, which includes the date of notarization, the notary’s signature, and their official seal.

- Witnesses: Georgia law requires the presence of two witnesses in addition to the notary. One witness can be the notary, while the second must be someone else who observes the grantor’s signature.

- File with the county: Once completed and signed, the Quitclaim Deed must be filed with the county recorder or clerk’s office in the county where the property is located. Recording fees must be paid at the time of filing.

After the Quitclaim Deed is filed with the county, the transfer process is complete. It is crucial to keep a copy of the filed deed for personal records. If there are any doubts or complexities involved in filling out the form, it may be wise to consult with a legal professional to ensure that all legal requirements are met and the transition of property ownership is smoothly executed.

Crucial Points on This Form

What is a Georgia Quitclaim Deed?

A Georgia Quitclaim Deed is a legal document used to transfer a property owner's interest to another person without providing any warranty regarding the title. It is a quick method to convey property rights but does not guarantee that the property is free from other claims or liens.

When should someone use a Quitclaim Deed in Georgia?

This form is often used among family members, in divorce proceedings to transfer property between spouses, or in situations where the property is being transferred as a gift. It is also used when the property owner wants to clear up any doubts about the boundary lines or has to correct the name on a title.

Does a Georgia Quitclaim Deed guarantee a clear title to the property?

No, it does not. Unlike a warranty deed, a quitclaim deed does not certify that the property title is clear of liens or other encumbrances. It simply transfers the grantor's interest, if any, in the property to the grantee.

What information is needed to complete a Quitclaim Deed in Georgia?

To complete a quitclaim deed, one needs to provide the full legal names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a detailed description of the property, the county where the property is located, and the consideration (the amount paid for the property, if any). It must also be signed by the grantor and notarized.

How does one file a Quitclaim Deed in Georgia?

After the quitclaim deed is completed, signed, and notarized, it needs to be filed with the Clerk of the Superior Court in the county where the property is located. A filing fee will be required, and the amount varies by county.

Is there a specific form required for a Quitclaim Deed in Georgia?

While there's no mandatory state-wide form for a quitclaim deed in Georgia, the document must meet specific state and local requirements regarding the content and format. It's essential to ensure that the quitclaim deed is prepared in accordance with Georgia law to be valid.

Can a Quitclaim Deed be revoked in Georgia?

Once a quitclaim deed is executed, delivered, and filed with the appropriate county office in Georgia, it is generally not possible to revoke it without the agreement of the grantee. If the grantee agrees, they can execute a quitclaim deed back to the grantor.

Common mistakes

When filling out the Georgia Quitclaim Deed form, it's easy to make mistakes if you're not careful. Such errors can delay the process or even invalidate the deed entirely. Here are eight common pitfalls to avoid:

-

Not checking for the most current form. Always ensure you're using the latest version of the form, as requirements may change.

-

Incorrect or incomplete legal description of the property. This is a crucial part of the form. The legal description must match the one in the official property records exactly. Many people mistakenly use the property's address instead.

-

Failing to list all parties correctly. Every person with a legal interest in the property should be named accurately on the form, including middle names or initials if they are part of the legal property title.

-

Missing signatures or notarization. For a quitclaim deed to be valid, it must be signed by the grantor in the presence of a notary public. Sometimes, people forget this critical step.

-

Omitting important details about the grantee. Just as with the grantor, the grantee’s full legal name and mailing address must be included. These details are necessary for future correspondence or legal matters.

-

Skimping on the details of the conveyance. Even though it's a quitclaim deed, outlining the specific rights being transferred is important. Some people mistakenly believe a general statement is sufficient.

-

Not attaching necessary additional documents. Depending on the situation, additional documents or disclosures may be required for the deed to be legally valid or accepted by the county recorder’s office.

-

Failing to file the completed deed with the county recorder’s office. After the quitclaim deed is executed, it must be filed with the county recorder’s office to be effective. This is a step some might overlook or delay, potentially leading to complications later on.

By avoiding these mistakes, the process of completing and filing a Georgia Quitclaim Deed can proceed more smoothly, ensuring the legal transfer of property rights is done correctly and efficiently.

Documents used along the form

When transferring property in Georgia, a Quitclaim Deed form is often used to convey property from one party to another without making any guarantees about the title. Alongside the Quitclaim Deed, there are several other forms and documents typically involved in the process to ensure a smooth and legally compliant transaction. Each of these documents serves a unique purpose, from declaring the property's value to ensuring the new deed is recognized officially.

- Warranty Deed - While a Quitclaim Deed transfers property with no guarantees, a Warranty Deed guarantees that the grantor holds clear title to the property and has the right to sell it.

- Special Warranty Deed - This document offers limited guarantees, only covering the period during which the seller owned the property.

- Title Search Report - A title search report details the history of the property's ownership and highlights any encumbrances or liens on the property that could affect the transfer.

- Title Insurance Policy - To protect against potential title defects, buyers often purchase title insurance. This policy provides financial protection from claims or legal fees that could arise from disputes over the property title.

- Transfer Tax Declaration Form - In Georgia, a Transfer Tax Declaration Form must be filed with the Quitclaim Deed for property transactions. This form calculates the tax due on the transfer.

- Real Estate Transfer Tax Form - This is a state-specific form used to calculate and report the tax owed on the transfer of real estate.

- Property Tax Declaration Form - A document used to report the value of the property for taxation purposes, ensuring the tax assessment reflects the current property value.

- Homestead Exemption Application - For residential property owners, this application can reduce the amount of property tax owed by claiming a homestead exemption on their primary residence.

- Mortgage Discharge Statement - If the property being transferred has a mortgage, this statement from the lender confirms that the mortgage has been paid off and can be discharged.

- Loan Payoff Statement - Similar to the mortgage discharge statement, this document outlines the remaining balance on any loan associated with the property, confirming that it will be paid off as part of the transaction.

Understanding and properly managing these documents is crucial for anyone involved in property transactions in Georgia. Each document plays an essential role in verifying the details of the transfer, ensuring the legality of the transaction, and protecting the interests of both buyer and seller. It is advisable for parties to consult with legal professionals to ensure all paperwork is in order and complies with Georgia law.

Similar forms

Warranty Deed: Like a quitclaim deed, a warranty deed is used in property transactions. However, it provides more protection to the buyer since the seller guarantees that they hold clear title to the property.

Grant Deed: Similar to a quitclaim deed, a grant deed transfers ownership of a property. It also assures the buyer that the property has not been sold to someone else and is free from any undisclosed encumbrances.

Deed of Trust: This document, used in place of a traditional mortgage in some states, involves a trustee, who holds the property's title until the borrower repays the loan. Like a quitclaim deed, it's a pivotal document in transferring interest in real property.

Special Warranty Deed: This deed is akin to a quitclaim deed but with a slight variation; the seller only guarantees the title against their own actions or omissions. It doesn't cover any issues that might have arisen before they owned the property.

Mortgage Agreement: This agreement is between a borrower and lender, where the borrower's property is used as collateral for a loan. It shares similarities with a quitclaim deed as it involves legal rights over a property.

Transfer on Death Deed: This document allows property owners to name a beneficiary who will receive the property upon the owner's death, bypassing probate. Like a quitclaim deed, it's a non-probate way to transfer property ownership.

Easement Agreement: This agreement grants the right to use another's property for a specific purpose, like a right of way. It's similar to a quitclaim deed in that it involves the transfer of usage rights, though not ownership of the land itself.

Trustee's Deed: Used when property is held in a trust, this deed transfers property from the trust to another party. It’s similar to a quitclaim deed as it's often used in non-sale situations to change the title or ownership.

Power of Attorney: While not a deed, this legal document allows someone to act on behalf of another in legal or financial matters. It’s similar to a quitclaim deed in that it can be used to manage property transactions.

Release of Lien: This document is used to remove a lien (a legal claim) on a property once a debt is repaid. Like a quitclaim deed, it impacts the title and clears rights to a property, ensuring it's free from specific encumbrances.

Dos and Don'ts

When dealing with a Georgia Quitclaim Deed form, it's crucial to handle the process carefully and knowledgeably. This legal document is used to transfer property without guaranteeing its title, making it vital for both parties to approach this transaction with the right precautions. Below, find essential dos and don'ts that can help guide you through the process.

Do:

- Verify the accuracy of all the information: Double-check names, property descriptions, and all other details for accuracy.

- Consult a professional: Consider getting advice from a real estate attorney to understand the implications fully.

- Use the correct form: Ensure that the form specifically states that it is for the state of Georgia, as requirements can vary by state.

- Include a complete legal description of the property: This usually includes the lot number, subdivision name, and any other detail that identifies the land uniquely.

- Fill out the form legibly: Use black ink or type the information to ensure that all details are readable.

- Sign the deed in front of a notary public: Georgia law requires quitclaim deeds to be notarized to be valid.

- Record the deed promptly: After signing, file the document with the county recorder's office where the property is located to make it official.

Don't:

- Leave blanks in the form: Incomplete forms may be considered invalid, so ensure every field is filled out.

- Use generic descriptions of the property: Avoid vague terms by providing a precise legal description of the property.

- Forget to include the date: The deed should have the current date to mark when the transaction occurred.

- Sign without witnesses or a notary, as required by Georgia law: A notary public must acknowledge all signatures for the deed to be legally binding.

- Rely solely on a quitclaim deed for legal advice: It's a tool for transferring property rights, not a substitute for professional legal advice.

- Skip recording the deed: Not registering the document can lead to legal complications down the line.

- Assume the quitclaim deed resolves all property issues: This form transfers ownership but doesn't guarantee clear title or settle disputes over property lines or outstanding debts.

Taking the right steps when filing out a Georgia Quitclaim Deed form is crucial to ensure the smooth transfer of property. By following these guidelines, you can navigate the process with confidence and legal propriety.

Misconceptions

In discussing the Georgia Quitclaim Deed form, several misconceptions commonly arise. Understanding these misconceptions is crucial for proper use and interpretation of the document. Here are eight misconceptions explained:

- Transfers Complete Ownership: Many believe that a quitclaim deed transfers complete ownership with the same assurances as a warranty deed. However, a quitclaim deed only transfers the interest the grantor has in the property, which might be none.

- Clears All Encumbrances: Another misconception is that executing a quitclaim deed removes any liens or other encumbrances on the property. In fact, it does not affect encumbrances; they remain attached to the property.

- Changes to a Mortgage: People often think that a quitclaim deed can change the parties responsible for a mortgage on a property. The reality is that it does not affect the mortgage. The original borrowing party remains liable unless the lender agrees to a change.

- Acts as a Will: Some assume that a quitclaim deed can serve as a will, effectively passing property to a grantee upon the grantor's death. However, quitclaim deeds do not supersede estate laws or will provisions.

- Only for Residential Properties: There's a notion that quitclaim deeds are exclusively for transferring residential property. They can be used for any type of real estate, including commercial and undeveloped land.

- Guarantees a Good Title: A common misunderstanding is that quitclaim deeds guarantee the grantor holds a good title. Unlike warranty deeds, quitclaim deeds do not provide any warranties about the quality of the title being transferred.

- Immediate Transfer: Many believe the transfer effectuated by a quitclaim deed is immediate and cannot be contested. While the transfer might be immediate, it can be contested under certain circumstances, such as issues of fraud or coercion.

- Eliminates Past Claims: Some individuals think that once a quitclaim deed is executed, past claims against the property by third parties are eliminated. In reality, these claims can still exist and impact the grantee’s use of the property.

Understanding these misconceptions ensures that individuals are fully informed about the legal implications and limitations of using a Georgia Quitclaim Deed form. It's a practical tool in specific situations but comes with nuances that necessitate a clear grasp of what it does and does not do.

Key takeaways

When it comes to transferring property rights without a sale, in Georgia, one common way is through the use of a Quitclaim Deed form. This form has particular features and requirements that are essential to understand for anyone involved in such a transaction. Here are key takeaways:

- The Quitclaim Deed form must clearly identify the grantor (the person transferring the property) and the grantee (the person receiving the property). Proper identification includes full legal names and can also include additional identifying information to ensure there's no confusion about the parties involved.

- Details of the property being transferred need to be precisely described in the Quitclaim Deed. This description should include the physical address of the property and its legal description, which can be found on the property’s current deed or at the county recorder’s office.

- Signing requirements in Georgia dictate that the Quitclaim Deed must be signed by the grantor in the presence of a notary public. Some counties may have additional requirements, such as the need for witnesses alongside the notarization.

- After filling out the Quitclaim Deed, it's necessary to file the form with the County Recorder’s or Clerk’s Office in the county where the property is located. This step is crucial for the deed to be legally effective and for the property records to reflect the new ownership status.

- Understanding the tax implications and whether any money changes hands with a Quitclaim Deed is important. While the Quitclaim Deed itself might not specify a purchase price, if the grantee takes on debt or pays the grantor, there could be tax consequences for both parties.

Utilizing a Quitclaim Deed in Georgia is a significant step that can affect property ownership and financial responsibility. Parties should consider seeking legal advice to ensure that they understand their rights and obligations fully.

Create Other Quitclaim Deed Forms for US States

Quit Claim Deed Form Ny Pdf - Before using a Quitclaim Deed, it's essential to understand its impact on property taxes and mortgage obligations.

Colorado Quit Claim Deed Joint Tenancy With Right of Survivorship - The Quitclaim Deed is commonly used during a divorce to convey one spouse's interest in the marital home to the other.

Quitclaim Deed Maryland Cost - It provides a solution for transferring titles when there's no need for the complex guarantees a warranty deed offers.

How Do I File a Quit Claim Deed - Commonly used for adjusting or correcting titles, this deed form streamlines the process by forgoing formal title reviews.