Blank Quitclaim Deed Form for Maryland

In the world of real estate transactions, various forms and documents are vital for the legal transfer of property titles from one party to another. Among these, the Maryland Quitclaim Deed form stands as a relatively straightforward and efficient means to convey property interests without the warranties typically associated with more traditional property transfers. This particular type of deed is often employed between family members, in divorce proceedings to transfer property from one spouse to another, or in other situations where a formal guarantee of clear title is not critically necessary. It's essential for those considering the use of a Maryland Quitclaim Deed to understand its purpose, the specific process involved in its execution, and the implications it has for both the grantor (the person transferring the property) and the grantee (the recipient of the property). While this method can simplify property transfers, it's important to approach with a clear understanding of its limitations and the protections it does not provide, which are often covered by other forms of deeds.

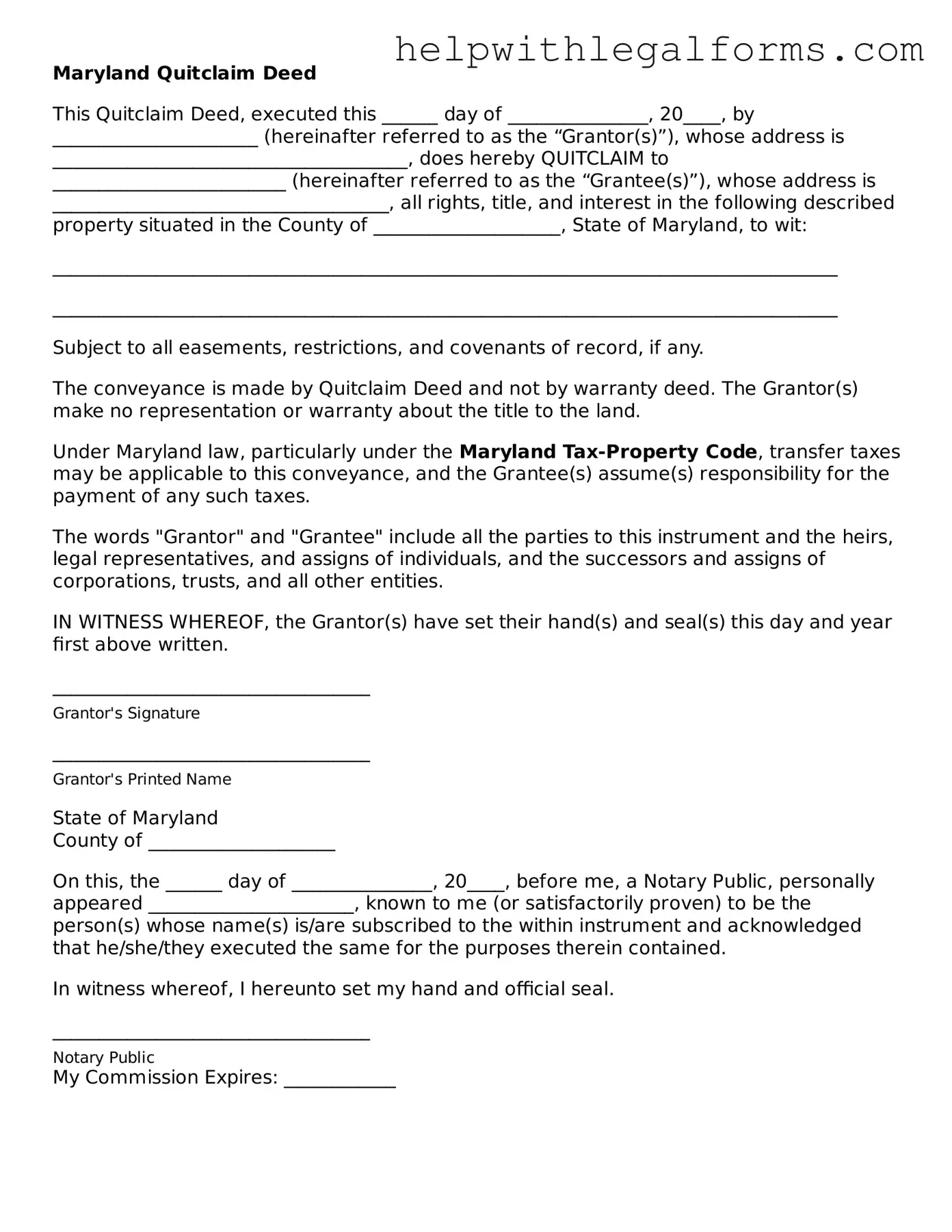

Example - Maryland Quitclaim Deed Form

Maryland Quitclaim Deed

This Quitclaim Deed, executed this ______ day of _______________, 20____, by ______________________ (hereinafter referred to as the “Grantor(s)”), whose address is ______________________________________, does hereby QUITCLAIM to _________________________ (hereinafter referred to as the “Grantee(s)”), whose address is ____________________________________, all rights, title, and interest in the following described property situated in the County of ____________________, State of Maryland, to wit:

____________________________________________________________________________________

____________________________________________________________________________________

Subject to all easements, restrictions, and covenants of record, if any.

The conveyance is made by Quitclaim Deed and not by warranty deed. The Grantor(s) make no representation or warranty about the title to the land.

Under Maryland law, particularly under the Maryland Tax-Property Code, transfer taxes may be applicable to this conveyance, and the Grantee(s) assume(s) responsibility for the payment of any such taxes.

The words "Grantor" and "Grantee" include all the parties to this instrument and the heirs, legal representatives, and assigns of individuals, and the successors and assigns of corporations, trusts, and all other entities.

IN WITNESS WHEREOF, the Grantor(s) have set their hand(s) and seal(s) this day and year first above written.

__________________________________

Grantor's Signature

__________________________________

Grantor's Printed Name

State of Maryland

County of ____________________

On this, the ______ day of _______________, 20____, before me, a Notary Public, personally appeared ______________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

__________________________________

Notary Public

My Commission Expires: ____________

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | Maryland Quitclaim Deed forms are used to transfer property without warranties, meaning the grantor does not guarantee they hold clear title to the property. |

| 2 | These forms are often utilized between family members or to transfer property into a trust. |

| 3 | The Maryland State Department of Assessments and Taxation must be notified of the transfer through a completed and filed Deed Transfer form. |

| 4 | Governing laws for Maryland Quitclaim Deeds include, but are not limited to, the Maryland Real Property Code. |

| 5 | Before filing, the Quitclaim Deed must be signed by the grantor in front of a notary public. |

| 6 | The document requires precise information, such as the legal description of the property, to be considered valid. |

| 7 | Recording the deed with the county where the property is located is essential for the transfer to be recognized legally. |

Instructions on How to Fill Out Maryland Quitclaim Deed

Completing the Maryland Quitclaim Deed form is a crucial step in the process of transferring property rights from one party to another without making any guarantees about the title. This document, widely utilized in property transactions where the transfer of ownership does not need the typical warranty of title, essentially allows the current holder (the grantor) to release their interest in the property to the recipient (the grantee). Executing this document accurately ensures the legal transfer of property rights, thus it is imperative to follow the steps carefully to avoid any potential legal issues that might arise from mistakes or omissions.

- Begin by ensuring you have the correct form that complies with Maryland state requirements for a Quitclaim Deed.

- Enter the full name and address of the grantor(s) at the top of the form, ensuring it matches the information as described in the title or previous deed documents.

- Provide the full name and address of the grantee(s) below the grantor(s) information, specifying their legal capacity (e.g., individual, trustee, corporation).

- Clearly state the consideration amount, which is the value being exchanged for the transfer of the property. This can often be a nominal amount and should be written in both words and figures.

- Describe the property being transferred. This description should include the legal description of the property, which can be found in previous deed documents or obtained from a title company or the local county recorder’s office. Include the property's parcel number and physical address if available.

- Grantors must sign the quitclaim deed in the presence of a notary public. Ensure that all parties who have an interest in the property as grantors sign the deed.

- The document must be notarized, affirming that the grantors’ identities were verified and that they signed the deed voluntarily.

- File the completed and notarized quitclaim deed with the appropriate county land records office in Maryland to officially complete the transfer. There may be a filing fee, which varies by county.

Once these steps are completed, the property rights transfer process via the Quitclaim Deed is finalized. It is essential to maintain a copy of the notarized deed for personal records. The filed deed serves as a public record of the change in property ownership, solidifying the grantee's claim to the property. Understanding and executing these steps thoroughly can ensure a smooth and legally sound transfer of property rights.

Crucial Points on This Form

What is a Quitclaim Deed form in Maryland?

A Quitclaim Deed form in Maryland is a legal document used to transfer the interest, if any, that a person (grantor) has in a piece of real property to another person (grantee) with no warranties of title. This means that the grantor does not guarantee that they own the property or that the property is free of liens or other encumbrances. Quitclaim deeds are often used between family members or to clear title issues.

How is a Quitclaim Deed different from a Warranty Deed in Maryland?

The primary difference between a Quitclaim Deed and a Warranty Deed in Maryland lies in the level of protection offered to the buyer. A Warranty Deed guarantees that the grantor holds clear title to the property and has the right to sell it, providing the buyer with greater legal protection. In contrast, a Quitclaim Deed makes no assurances about the title's quality; it merely transfers whatever interest the grantor may have, if any, without any guarantees.

What information is required to complete a Quitclaim Deed form in Maryland?

To complete a Quitclaim Deed form in Maryland, the following information is typically required: the legal name of the grantor(s) and grantee(s), a legal description of the property being transferred, the consideration (the value being exchanged for the property, if any), and the date of the transfer. The deed must be signed by the grantor(s) in the presence of a Notary Public before it can be recorded with the appropriate county office.

Where do I file a Quitclaim Deed in Maryland?

In Maryland, a Quitclaim Deed must be filed with the Land Records office in the county where the property is located. Filing the deed makes the transfer public record, providing notice to others that the property interest has been transferred. It is important to ensure the deed is properly recorded to protect the interests of all parties involved.

Are there any special considerations for filing a Quitclaim Deed in Maryland?

When filing a Quitclaim Deed in Maryland, it is important to make sure that the document is properly completed, signed, and notarized. Additionally, Maryland requires the payment of a state and county transfer tax at the time of recording, unless an exemption applies. The grantor's and grantee's Social Security numbers must also be provided in a separate affidavit, which is kept confidential and not part of the public record.

Can I use a Quitclaim Deed to transfer property into or out of a trust in Maryland?

Yes, a Quitclaim Deed can be used to transfer property into or out of a trust in Maryland. This is a common method for changing the title of real property when managing an estate plan or trust. However, it is essential to consult with a legal professional or estate planner to ensure the deed is correctly executed and serves the intended purpose within the larger context of estate planning or asset management.

Common mistakes

Filling out a Maryland Quitclaim Deed form seems straightforward but is prone to errors if not handled carefully. Recognizing and avoiding common mistakes can ensure the process goes smoothly and the document serves its intended purpose without legal hiccups.

Not Checking Local Requirements: The form needs to meet specific local jurisdictional guidelines in Maryland, which can vary from county to county. Failing to comply with these can result in the document being rejected.

Omitting Necessary Information: Every field in the form is essential. Leaving blanks, such as the legal description of the property, grantee’s address, or the preparer's information, can make the deed invalid or unrecordable.

Ignoring the Need for Witnesses or Notarization: Depending on the county, Maryland may require the Quitclaim Deed to be witnessed or notarized. Overlooking this requirement can lead to the deed being considered invalid.

Forgetting to Record the Deed: After both parties sign the deed, it must be recorded with the appropriate county office in Maryland. Failure to do so does not change the property's ownership record, which can lead to disputes or complications in the future.

Avoiding these mistakes requires careful attention to detail and awareness of the specific requirements of the Quitclaim Deed process in Maryland. Valid and accurate completion of the deed is crucial for the smooth transfer of property rights.

Documents used along the form

When transferring property titles in Maryland, the Quitclaim Deed form is crucial but often not the only document needed. This process might involve several other forms and documents to ensure a smooth, legally compliant transaction. Below is a list of documents that are commonly used alongside the Maryland Quitclaim Deed form. Whether you're clearing a title, transferring property to a family member, or changing a name due to marriage or divorce, having the right paperwork is essential.

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed provides the grantee (buyer) guarantees that the grantor (seller) holds clear title to the property and has the right to sell it.

- Title Search Report: This report details the history of ownership for the property, including all liens, encumbrances, and issues with the title that need to be resolved.

- Property Tax Records: Ensures all taxes on the property are paid up to date. This document is necessary for the new owner to have a clear understanding of their tax obligations.

- Proof of Identity: Both parties involved in the transaction typically need to provide government-issued identification to verify their identities during the transfer process.

- Mortgage Payoff Statement: If there's an existing mortgage on the property, this document shows the amount required to pay off the mortgage in full at the time of the transfer.

- Flood Zone Statement: Indicates whether the property is in a flood zone, which affects insurance requirements and costs for the new owner.

- Homeowners Association (HOA) Documents: If the property is within an HOA, these documents detail any restrictions, dues, or fees that the new owner must be aware of.

- Real Estate Transfer Tax Declaration: Some jurisdictions require this form for recording the transfer and calculating any applicable transfer taxes.

- Loan Application: If the grantee is financing the purchase, a loan application will be necessary to secure the mortgage for the property.

Completing a property transfer in Maryland requires careful attention to detail and thorough preparation of necessary documents. Each document plays a vital role in ensuring the transaction is legal, transparent, and in compliance with state laws. Whether you are gifting property, settling an estate, or buying a new home, understanding and preparing these documents will help streamline the process.

Similar forms

Warranty Deed - Like a Quitclaim Deed, a Warranty Deed is used to transfer property ownership. However, it provides the buyer with a warranty or guarantee against future claims on the property, something a Quitclaim Deed does not.

Grant Deed - Similar to Quitclaim and Warranty Deeds, the Grant Deed transfers property from one party to another. It implies certain promises, including that the seller hasn’t previously sold the property, which is not explicitly stated in a Quitclaim Deed.

Special Warranty Deed - This deed, while similar to the Quitclaim Deed in terms of transferring property, offers limited warranties to the grantee. It only covers the period during which the seller owned the property.

Deed of Trust - A Deed of Trust involves three parties and is used in real estate transactions as a method of securing a loan. It’s similar to a Quitclaim Deed in that it deals with property rights, but it involves a borrower, lender, and trustee.

Transfer on Death Deed (TODD) - Similar in intent to convey property, this document allows a property owner to name a beneficiary who will receive the property upon their death, bypassing probate. Unlike a Quitclaim Deed, it guarantees a seamless transition upon the grantor's death.

Interspousal Transfer Deed - Often used in divorce proceedings, this deed transfers property ownership between spouses, similar to how a Quitclaim Deed might be used to quickly transfer property rights without warranties.

Fiduciary Deed - This is used when a property is transferred by a trustee, executor, or other fiduciary. While similar to a Quitclaim Deed in transferring property rights, it involves a fiduciary acting on behalf of someone else.

Correction Deed - Used to correct errors in a previously recorded deed, like a Quitclaim Deed, it deals with the conveyance of property rights, but specifically addresses and amends prior mistakes.

Easement Deed - Grants the right to use another person’s land for a specific purpose. It’s similar to a Quitclaim Deed in transferring certain rights related to property, though it’s more about use than ownership.

Lady Bird Deed - A type of deed used in some states that allows property owners to retain control over their property until death, at which time it passes to the beneficiary. Similar to a TODD, it avoids probate, differing from a Quitclaim Deed by allowing the original owner to maintain control during their lifetime.

Dos and Don'ts

When filling out the Maryland Quitclaim Deed form, ensuring accuracy and compliance with state requirements is crucial for the deed to be legally binding. Here are four essential dos and don'ts to guide you through the process.

Do:Verify all parties' names are spelled correctly. Accuracy in the names of the grantor (seller) and grantee (buyer) avoids future legal complications.

Include a complete and precise description of the property. This description should match the one on the current deed to prevent disputes over property boundaries.

Sign in the presence of a notary public. Maryland law requires quitclaim deeds to be notarized to be recorded and legally effective.

Record the deed with the local county land records office where the property is located. Filing the deed makes it part of the public record, providing notice of the transfer.

Leave any blank spaces on the form. Incomplete forms may be rejected or cause legal issues in the future. If a section does not apply, it is safer to input 'N/A' or 'None.'

Omit any attachments or legal descriptions that should accompany the deed. These documents are often crucial for validating the deed's legality and accuracy.

Forget to check for any specific county requirements. Some counties have additional stipulations for recording deeds, such as cover sheets or specific formatting.

Assume a quitclaim deed relieves the grantor of financial obligations related to the property. Unlike warranty deeds, quitclaim deeds do not guarantee the property is free from liens or mortgages.

Misconceptions

When it comes to transferring property in Maryland, the Quitclaim Deed form is often misunderstood. People frequently have incorrect beliefs about what this document can and cannot do. Below are some common misconceptions:

It guarantees a clear title: Many believe that a Quitclaim Deed ensures the seller (grantor) has a valid title to the property. However, this type of deed makes no warranties about the title's status. It simply transfers whatever interest the grantor has in the property, if any, without promising that the title is clear or free of liens.

It's only used for sales: A misconception is that Quitclaim Deeds are strictly for selling property. In reality, they are often used for transferring property between family members, divorcing spouses, or into a trust, where the grantee is not paying for the property.

It provides immediate ownership: Some think that once a Quitclaim Deed is signed, the grantee immediately becomes the legal owner. The deed must be properly filled out, signed, and, most importantly, recorded with the local county land records office to be effective.

It is more powerful than a warranty deed: This is false. Unlike a warranty deed, which promises that the grantor owns the property free and clear of any liens or claims, a Quitclaim Deed offers no such assurances. It transfers only the grantor's rights to the property, which might be none at all.

It can resolve property disputes: People sometimes wrongly believe that a Quitclaim Deed can settle disputes over property ownership. While it can transfer one party's interest to another, it doesn't affect third-party claims or legal disputes about who truly owns the property.

It's fast and doesn't require a lawyer: The perception that Quitclaim Deeds are quick and easy, needing no legal advice, can lead to mistakes. Incorrectly filling out the form or failing to follow state-specific requirements can invalidate the deed. It's often wise to seek legal advice when dealing with property matters.

It eliminates the need for a title search: Since Quitclaim Deeds do not guarantee a clear title, it's a good practice to conduct a title search before accepting such a deed. This will reveal any existing liens or encumbrances.

It absolves the grantor of mortgage responsibility: People often mistakenly think that if they use a Quitclaim Deed to transfer property that still has a mortgage, they are no longer responsible for the mortgage payments. The deed transfers property ownership but does not affect the mortgage, for which the original signer remains responsible unless officially released by the lender.

Understanding the specifics of Maryland's Quitclaim Deed is crucial in managing property transactions accurately and effectively. Dispelling these common misconceptions helps clarify the deed's purpose and limitations. When in doubt, consulting with a legal professional can provide the necessary guidance and peace of mind.

Key takeaways

A Maryland Quitclaim Deed form is a legal document used to transfer ownership of real estate without any guarantees or warranties. This means the seller, called the grantor, does not promise that they hold clear title to the property.

It's crucial for the person receiving the property, known as the grantee, to conduct thorough research or a title search to ensure there are no undisclosed liens or claims against the property, as the quitclaim deed offers no protection against these issues.

When completing the Maryland Quitclaim Deed, it’s essential to accurately describe the property being transferred. This description should include the address, tax identification number, and legal description as found in previous deed documents.

The form must be signed by the grantor in the presence of a notary public. This process not only formalizes the document but also helps prevent fraud by verifying the grantor's identity.

After the Maryland Quitclaim Deed form is notarized, it must be filed with the local county’s land records office where the property is located. Filing the form publicly records the transfer and protects the grantee's interests in the property.

The importance of accurately calculating and paying any applicable transfer taxes cannot be overstated. These taxes vary by location within Maryland, so it’s advisable to consult with local authorities or a legal professional to understand the specific obligations.

While a Quitclaim Deed is often used among family members to transfer property quickly and without the formalities of a sale, it’s important to consider potential tax implications. Transfers of property ownership can affect property taxes and may have gift tax considerations.

For individuals who are not legally proficient, soliciting the guidance of a legal professional when dealing with a Maryland Quitclaim Deed is wise. This ensures that all aspects of the transfer are conducted properly, adhering to Maryland laws.

Remember, a Quitclaim Deed affects ownership and potential future usage of the property but does not relieve the grantor of any mortgage or financial obligations tied to the property unless specifically agreed upon by the lender. Therefore, if the property is mortgaged, the grantee assumes the risk of any existing debts or encumbrances.

Create Other Quitclaim Deed Forms for US States

Oklahoma Quit Claim Deed Form Individual - It is effective in avoiding probate by transferring property interests directly to a designated heir or beneficiary.

Florida Quit Claim Deed Filled Out - This tool is invaluable for estate planning, allowing individuals to transfer property to heirs with ease.