Blank Quitclaim Deed Form for New Jersey

In the realm of property transactions, navigating the various forms and legal documents can be a daunting task for those not versed in the legalities of real estate. Among these documents, the New Jersey Quitclaim Deed form stands out for its specific function and use. This simple yet significant legal instrument is primarily utilized to transfer property rights from one person to another without the guarantees typically associated with more formal property sale deeds. Often used among family members or close acquaintances, the form expedites the transfer process by skipping the thorough vetting of a title's history. While its simplicity and speed can be advantageous, understanding the limitations and appropriate context for its use is crucial. The form, unique to New Jersey, reflects the state's specific legal requirements and nuances, making it an essential tool for residents navigating the transfer of property ownership within its borders.

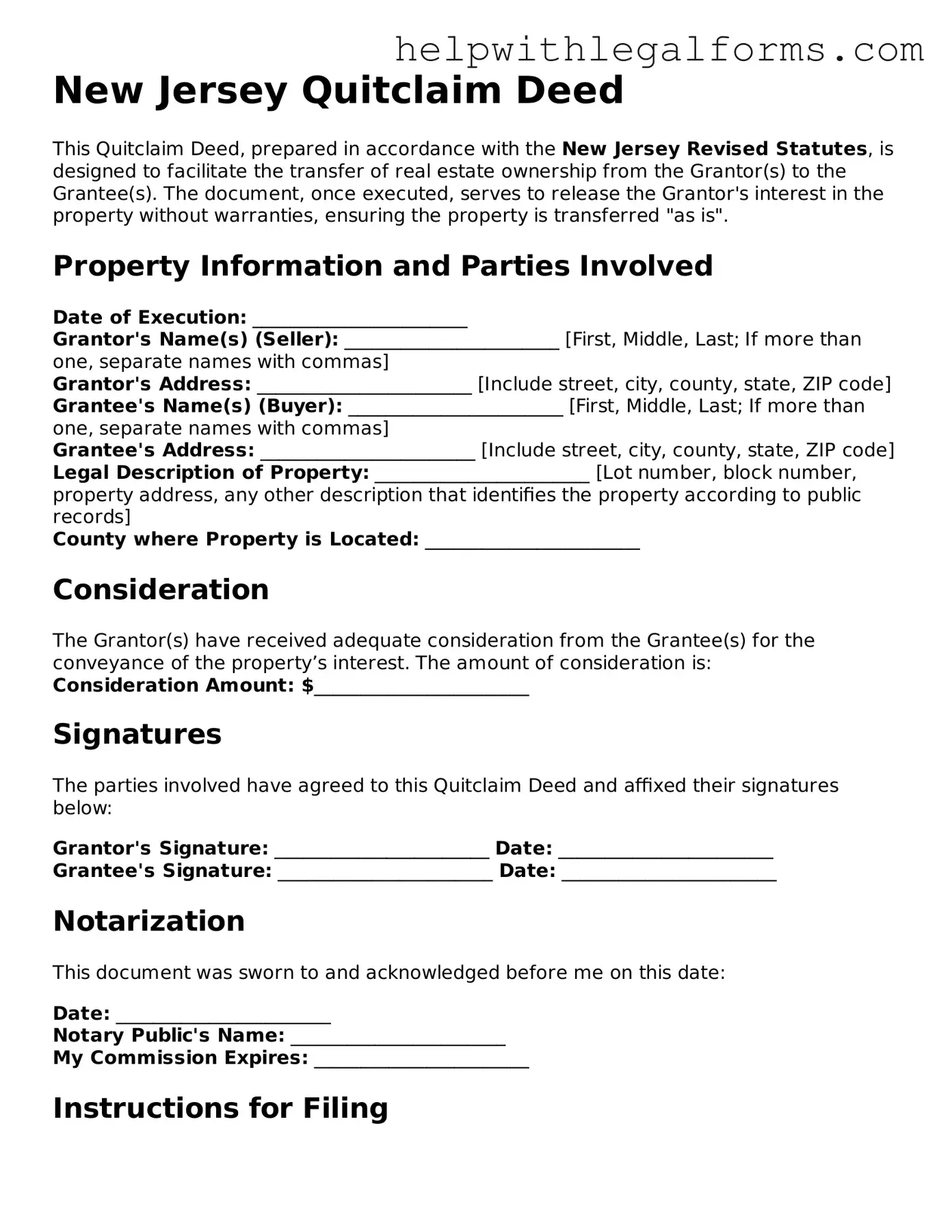

Example - New Jersey Quitclaim Deed Form

New Jersey Quitclaim Deed

This Quitclaim Deed, prepared in accordance with the New Jersey Revised Statutes, is designed to facilitate the transfer of real estate ownership from the Grantor(s) to the Grantee(s). The document, once executed, serves to release the Grantor's interest in the property without warranties, ensuring the property is transferred "as is".

Property Information and Parties Involved

Date of Execution: _______________________

Grantor's Name(s) (Seller): _______________________ [First, Middle, Last; If more than one, separate names with commas]

Grantor's Address: _______________________ [Include street, city, county, state, ZIP code]

Grantee's Name(s) (Buyer): _______________________ [First, Middle, Last; If more than one, separate names with commas]

Grantee's Address: _______________________ [Include street, city, county, state, ZIP code]

Legal Description of Property: _______________________ [Lot number, block number, property address, any other description that identifies the property according to public records]

County where Property is Located: _______________________

Consideration

The Grantor(s) have received adequate consideration from the Grantee(s) for the conveyance of the property’s interest. The amount of consideration is:

Consideration Amount: $_______________________

Signatures

The parties involved have agreed to this Quitclaim Deed and affixed their signatures below:

Grantor's Signature: _______________________ Date: _______________________

Grantee's Signature: _______________________ Date: _______________________

Notarization

This document was sworn to and acknowledged before me on this date:

Date: _______________________

Notary Public's Name: _______________________

My Commission Expires: _______________________

Instructions for Filing

After the completion and notarization of this Quitclaim Deed, the original signed deed should be filed with the County Clerk’s Office in the county where the property is located. It is crucial for this filing to occur promptly to ensure the deed is properly recorded and to maintain the integrity of the county’s public records.

Disclosure

It is recommended that the parties involved seek legal advice regarding the use of a Quitclaim Deed and its implications. The information provided in this template does not constitute legal advice and is provided for informational purposes only.

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Quitclaim Deed form in New Jersey is a legal document used to transfer the ownership of real estate without any guarantees. It simply passes whatever interest the grantor has in the property to the grantee. |

| Governing Law | New Jersey Statutes, specifically Title 46, govern Quitclaim Deeds and real property transactions in the state. |

| Requirement for Validity | In New Jersey, a Quitclaim Deed must be signed by the grantor in front of a notary public to be considered valid. Additionally, it must include the grantee's name and a legal description of the property. |

| Recording | After it is executed, the Quitclaim Deed should be filed with the appropriate county clerk’s office or Registrar of Deeds in New Jersey. This act of recording makes the deed a part of the public record. |

Instructions on How to Fill Out New Jersey Quitclaim Deed

A New Jersey Quitclaim Deed allows the transfer of real estate ownership without the seller providing any guarantees about the title. This document is straightforward but filling it out requires attention to detail to ensure the transfer is properly executed. The following steps will guide you through completing the form accurately.

- Identify the preparer: Write the name and address of the person completing the form.

- Include consideration: Enter the amount of money exchanged for the property. Even if the property is gifted, a minimal amount must be stated to make the deed legitimate.

- Document the grantor(s) and grantee(s): List the full legal names and addresses of the current property owner (grantor) and the new owner (grantee).

- Provide a legal description of the property: This includes the lot number, block number, and any other details that define the property's legal boundaries. This information can be found on the current deed or property tax documents.

- Signatures: The grantor(s) must sign the deed in front of a notary public. Ensure that this step is not overlooked as the notarization of signatures is a critical requirement for the deed to be considered legal.

- County recording: Once the document is completed and signed, it should be filed with the County Clerk’s office in the county where the property is located. A recording fee will have to be paid.

After the deed has been recorded, the property ownership is officially transferred. However, this document does not guarantee a clear title; it only transfers the grantor's rights, if any, to the grantee. It's recommended to perform a thorough check of the property's title history before proceeding with a quitclaim deed.

Crucial Points on This Form

What is a New Jersey Quitclaim Deed?

A New Jersey Quitclaim Deed is a legal document used to transfer interest in real estate from one party (the grantor) to another (the grantee) with no warranties regarding the title's quality. It's often used between family members or in situations where the property is well known to both parties.

When should I use a Quitclaim Deed in New Jersey?

Use a Quitclaim Deed when transferring property between family members, adding or removing a spouse’s name from the title, transferring property into a trust, or in other cases where the seller does not want to guarantee the title's quality. It's crucial for transactions where speed and simplicity are more valued than assurance of title.

Does a Quitclaim Deed affect mortgages in New Jersey?

Yes. A Quitclaim Deed transfers only ownership interest and does not affect the mortgage on the property. If the property has an existing mortgage, the grantee becomes the owner but the original grantor remains responsible for the mortgage unless otherwise negotiated with the lender.

Are Quitclaim Deeds reversible in New Jersey?

Generally, Quitclaim Deeds are considered final once executed and delivered. Reversing a Quitclaim Deed requires the cooperation of the grantee to execute a new deed transferring the property interest back, or legal action in cases of fraud or duress.

What are the filing requirements for a Quitclaim Deed in New Jersey?

Once signed, a Quitclaim Deed must be filed with the county clerk's office where the property is located. The deed must include a complete legal description of the property and comply with local and state recording requirements, including any necessary filing fees.

How is a Quitclaim Deed taxed in New Jersey?

Transfer of property via a Quitclaim Deed in New Jersey may be subject to the state's Realty Transfer Fee, depending on the deed's circumstances and the property's value. There may also be federal and state tax implications for the grantor and grantee, especially in non-arm's length transactions.

Do both parties need to sign the Quitclaim Deed in New Jersey?

Only the grantor is required to sign the Quitclaim Deed for it to be valid in New Jersey. However, notarization of the grantor's signature is typically required to record the deed with the county.

Can I use a Quitclaim Deed to transfer property to a family member for $1?

Yes, people often use Quitclaim Deeds to transfer property to family members for nominal consideration, such as $1. The deed must state the consideration amount, but understand this could have tax implications for both parties.

What should I do if I find errors in my Quitclaim Deed after filing?

If errors are discovered in a Quitclaim Deed after filing, it may be necessary to execute a new deed correcting the errors. This corrected deed should be filed with the county clerk to ensure accurate public records of the property ownership.

Common mistakes

When filling out the New Jersey Quitclaim Deed form, individuals often encounter certain pitfalls that can lead to complications or the invalidation of the document. A quitclaim deed is a legal document used to transfer interest in real property from the grantor (the person transferring the property) to the grantee (the person receiving the property) with no warranties regarding the title. Here are four common mistakes to avoid:

Not Using the Correct Form: A frequent mistake is not using the specific form for New Jersey or using a generic form that may not comply with New Jersey's legal requirements. Each state has its own set of laws and regulations regarding real estate transactions, and New Jersey is no exception.

Incomplete Information: Leaving blank spaces or providing incomplete information can lead to significant issues. This includes failing to accurately describe the property being transferred, not providing the correct names and addresses of both the grantor and grantee, or missing other pertinent details necessary for the document to be legally binding.

Failure to Include All Required Signatures: The Quitclaim Deed must be signed by all parties involved for it to be valid. This includes the grantor, grantee, and occasionally a witness or notary public, depending on New Jersey's current requirements. Omitting any of these essential signatures can invalidate the entire deed.

Not Recording the Deed: After the Quitclaim Deed has been properly filled out and signed, it must be recorded with the county clerk’s office where the property is located. Failure to record the deed can lead to disputes over property ownership and complications in future transactions involving the property.

Attention to detail and thoroughness are crucial when completing the New Jersey Quitclaim Deed form. It’s advisable to consult with a professional if there are any doubts about the process or requirements. This ensures the transfer is executed properly and legally, safeguarding the interests of all parties involved.

Documents used along the form

Transferring property in New Jersey involves more than just handing over a Quitclaim Deed form. This legal document is merely a piece of the puzzle in the property transfer process. Often, several other forms and documents work in conjunction with a Quitclaim Deed to ensure the transaction is legitimate, thorough, and complies with state laws. Understanding these supplemental documents is key to a smooth transfer of ownership, as each one plays a crucial role in the overall process.

- Real Estate Transfer Tax Declaration (RTF-1 Form): This document is essential when recording a deed in New Jersey. It involves declaring the property's sale price among other financial details, which is necessary for calculating the applicable state transfer tax.

- Seller’s Residency Certification/Exemption (GIT/REP Forms): New Jersey requires sellers to clear their income tax status related to the property sale. These forms help determine whether the seller is a resident or non-resident for tax purposes and if any exemptions apply.

- Property Disclosure Statement: Although not always mandatory with a Quitclaim Deed, this document is crucial when the transfer is between parties that require full disclosure. It outlines the condition of the property, including any known defects, ensuring the buyer is fully informed.

- Notice of Settlement: A Notice of Settlement is filed with the county clerk’s office prior to closing. It serves to protect both the buyer and seller by publicly recording the impending change of ownership, thus preventing any conflicting claims during the transition period.

- Title Search Report: Before the transfer, a title search is often conducted to verify the property’s legal ownership and to ensure there are no outstanding liens, encumbrances, or issues that could affect the transfer. While not a form, this document is critical to the quitclaim process.

Each document listed plays an instrumental role in transferring property rights securely and legally. They collectively work to provide a full picture of the property's status, ensuring that all financial and legal responsibilities are addressed. In the world of real estate transfers, understanding and properly executing these forms and documents is as crucial as the property itself. They not only support the Quitclaim Deed but also protect the interests of both the buyer and seller, paving the way for a transparent and hassle-free property transfer.

Similar forms

Warranty Deed: Similar to a Quitclaim Deed, a Warranty Deed transfers property ownership from one party to another. However, it provides the buyer with a guarantee that the seller holds a clear title to the property, unlike the Quitclaim Deed which offers no such assurances.

Grant Deed: Like Quitclaim Deeds, Grant Deeds are used to transfer property. The key difference lies in the level of protection offered to the buyer; Grant Deeds come with a promise that the property has not been sold to someone else and that it's free from certain types of encumbrances, though it does not guarantee against all potential issues as a Warranty Deed does.

Special Warranty Deed: This document shares similarities with a Quitclaim Deed by facilitating property transfer. However, it only guarantees against title defects or claims that arose during the time the seller owned the property, presenting a middle ground between the Quitclaim and Warranty Deed.

Deed of Trust: Although used in the financing of real estate, where a property is held as security for a loan, a Deed of Trust connects with a Quitclaim Deed through the transfer concept. The property is transferred to a trustee until the borrower pays off the loan.

Mortgage Agreement: While primarily a loan agreement secured by the property being purchased, Mortgage Agreements relate to Quitclaim Deeds because they entail the legal identification and transfer of property as collateral, affecting property title and ownership.

Transfer on Death Deed: This estate planning tool allows property owners to name a beneficiary who will receive the property upon the owner’s death, bypassing the probate process. It's similar to Quitclaim Deeds in transferring property titles, but it's effective upon the death of the grantor.

Lady Bird Deed: A specific type of life estate deed used in some states, a Lady Bird Deed allows property owners to transfer property upon their death without the need for probate, while retaining the right to use and profit from the property during their lifetime. It shares the post-mortem transfer feature with Transfer on Death Deeds but is still conceptually similar to Quitclaim Deeds in terms of property transfer.

Trust Agreement: In the context of managing or transferring property within a trust, a Trust Agreement can involve transferring property titles to a trust or from a trust to beneficiaries. This is akin to a Quitclaim Deed’s role in changing property titles, though it involves the intermediary step of trust involvement.

Dos and Don'ts

When dealing with the New Jersey Quitclaim Deed form, it's important to handle the process with care and attention to detail. A quitclaim deed is a legal instrument that is used to transfer interest in real property. The entity transferring its interest is called the grantor, and when the form is completed, the grantor “quits” any right and claim to the property, allowing the property's interest to pass to the recipient, or grantee. Knowing what you should and should not do can make the process smoother and help avoid common pitfalls. Here are five dos and five don'ts to consider:

Dos when filling out a New Jersey Quitclaim Deed:

- Double-check all information for accuracy. Ensure names are spelled correctly, and addresses and legal descriptions of the property are accurate.

- Use the correct legal description of the property. This information can usually be found on your current deed or at the county recorder's office.

- Sign in the presence of a notary public. New Jersey law requires quitclaim deeds to be notarized to be valid.

- Keep a copy for your records. After the deed is fully executed, make sure to keep a copy for your personal records.

- File the deed with the county clerk’s office. For the quitclaim deed to be effective and to put the public on notice, it must be recorded with the county clerk in the county where the property is located.

Don'ts when filling out a New Jersey Quitclaim Deed:

- Do not leave blank spaces. Complete all sections of the deed to avoid questions or issues later. If a section doesn’t apply, enter “N/A” for not applicable.

- Do not use informal property descriptions. Refrain from using addresses or common descriptions; only the legal description should be used.

- Do not forget to check county-specific requirements. Some counties may have additional requirements for filing a quitclaim deed, so it’s important to verify with the local county clerk.

- Do not neglect to consider the tax implications. Transferring property can have tax consequences for both the grantor and the grantee. It may be beneficial to consult a tax advisor.

- Do not assume a quitclaim deed clears the title. This type of deed transfers only the grantor's interest in the property and does not guarantee that the title is clear of other claims or liens.

Misconceptions

In understanding the Quitclaim Deed form specific to New Jersey, various misconceptions can lead to confusion for those not well versed in real estate transactions. These misunderstandings can significantly impact the parties involved, potentially affecting the legal and financial outcome of a property transfer. Below is a list of seven common misconceptions:

- Guarantees About Property Ownership: Many believe that a Quitclaim Deed guarantees that the grantor (the person transferring the property) has a valid ownership interest in the property. However, this deed transfers only whatever interest the grantor has at the time of the transfer, without any promises or guarantees about that interest’s quality or extent.

- Protection Against Liens and Encumbrances: Another misconception is that receiving a Quitclaim Deed provides the grantee (the person receiving the property) protection against liens or other encumbrances on the property. In reality, this type of deed offers no such protections, meaning any existing claims against the property become the grantee's responsibility.

- Equal to a Warranty Deed: People often confuse Quitclaim Deeds with Warranty Deeds. Unlike a Warranty Deed, which provides guarantees about the property's title and the owner's right to sell, a Quitclaim Deed offers no warranties whatsoever about the property's title status.

- Only for Transferring Ownership Between Strangers: A common belief is that Quitclaim Deeds are primarily for transactions between strangers. In truth, they are more often used between family members, close relatives, or businesses where there is a trusted relationship, because of the lack of protection regarding the property’s title.

- Eliminates Previous Legal Claims: Some think that executing a Quitclaim Deed eliminates previous legal claims against the property, such as mortgages or liens. This is not accurate; these claims remain in place until they are satisfied or resolved separately.

- Changes to Property Taxes: There's a notion that transferring property through a Quitclaim Deed automatically results in changes to property taxes or reassessments. Property taxes are determined by local tax authorities, and a Quitclaim Deed in itself does not necessarily alter the tax valuation.

- No Need for Legal or Professional Advice: Lastly, a major misconception is that handling a Quitclaim Deed is straightforward and doesn’t require professional advice. Given the potential implications of transferring property rights without warranties, seeking legal advice is strongly recommended to ensure that parties fully understand the transaction.

Correctly navigating the specifics of a Quitclaim Deed in New Jersey requires an informed approach. Misunderstandings can lead to unexpected results, making it essential for parties involved in such transactions to seek out accurate information and consider professional guidance.

Key takeaways

In New Jersey, the Quitclaim Deed form is a legal document used to transfer interest in real estate from one party (the grantor) to another (the grantee) without any warranty regarding the title of the property. It is typically used between parties where trust is established, such as family members or close associates. Understanding the correct filling out and using of the New Jersey Quitclaim Deed form is crucial for a valid transfer. Here are key takeaways:

- Accuracy is paramount: Every detail filled out in the Quitclaim Deed form must be accurate, including the full names of both grantor and grantee, the legal description of the property, and the date of transfer. Inaccuracies can lead to disputes or a void transaction.

- Legal description of the property: Unlike a simple street address, a legal description provides the exact boundaries of the property being transferred. This might include lot, block, and subdivision or metes and bounds. Obtaining this description from a previous deed or the county recorder’s office is essential.

- Signing requirements: In New Jersey, the law requires the grantor(s) to sign the Quitclaim Deed in the presence of a notary public. The notarization process is crucial for the document’s validity and for recording purposes.

- Consideration: The form must mention the consideration, which is the value exchanged for the property transfer. While this amount does not need to match the property's market value, disclosing a nominal consideration, like $1.00, is common in transactions where the property is gifted.

- Recording the deed: After the Quitclaim Deed is fully executed, it should be recorded with the county clerk or registrar’s office in the county where the property is located. Recording is not immediately mandatory, but it is highly recommended. It serves as public notice of the property transfer and protects the grantee against claims by third parties.

Following these guidelines will help ensure a smooth property transfer process using a New Jersey Quitclaim Deed form. Consulting with a real estate attorney before proceeding can provide additional assurance and handle any complexities or unique situations that may arise.

Create Other Quitclaim Deed Forms for US States

Oklahoma Quit Claim Deed Form Individual - This document is favorable in scenarios where speed and simplicity in transferring property rights are prioritized over guarantees.

Quit Claim Deed Form Ny Pdf - This deed can facilitate property transfers in a divorce settlement by transferring one spouse's interest to the other.

Quick Claim Deed Form Connecticut - This form of deed is ideal for situations where property is being transferred as a gift and the recipient does not require a warranty of clear title.

Wuick Claim Deed - A go-to document for transactions that do not involve monetary exchange but require a change in property title.