Blank Quitclaim Deed Form for New York

When dealing with property transactions in New York, the Quitclaim Deed form serves as a critical document for individuals looking to transfer interest in real property with no guarantees about the title. This form is often used between family members or in cases where the property might not be sold in the traditional sense, such as adding a spouse's name to a property title or transferring ownership between siblings. It stands out because it requires minimal information about the grantor (the person transferring the property) and the grantee (the person receiving the property), and does not assure the grantee of a clean title. This means the grantee receives whatever interest the grantor has in the property, which might be none at all. The New York Quitclaim Deed is straightforward but must be executed correctly to be considered valid, including being signed by both parties in the presence of a notary public and subsequently filed with the appropriate county clerk’s office. While it simplifies the transfer process by omitting extensive guarantees, understanding its limitations and properly executing the form are crucial steps for anyone looking to use it for their real estate needs.

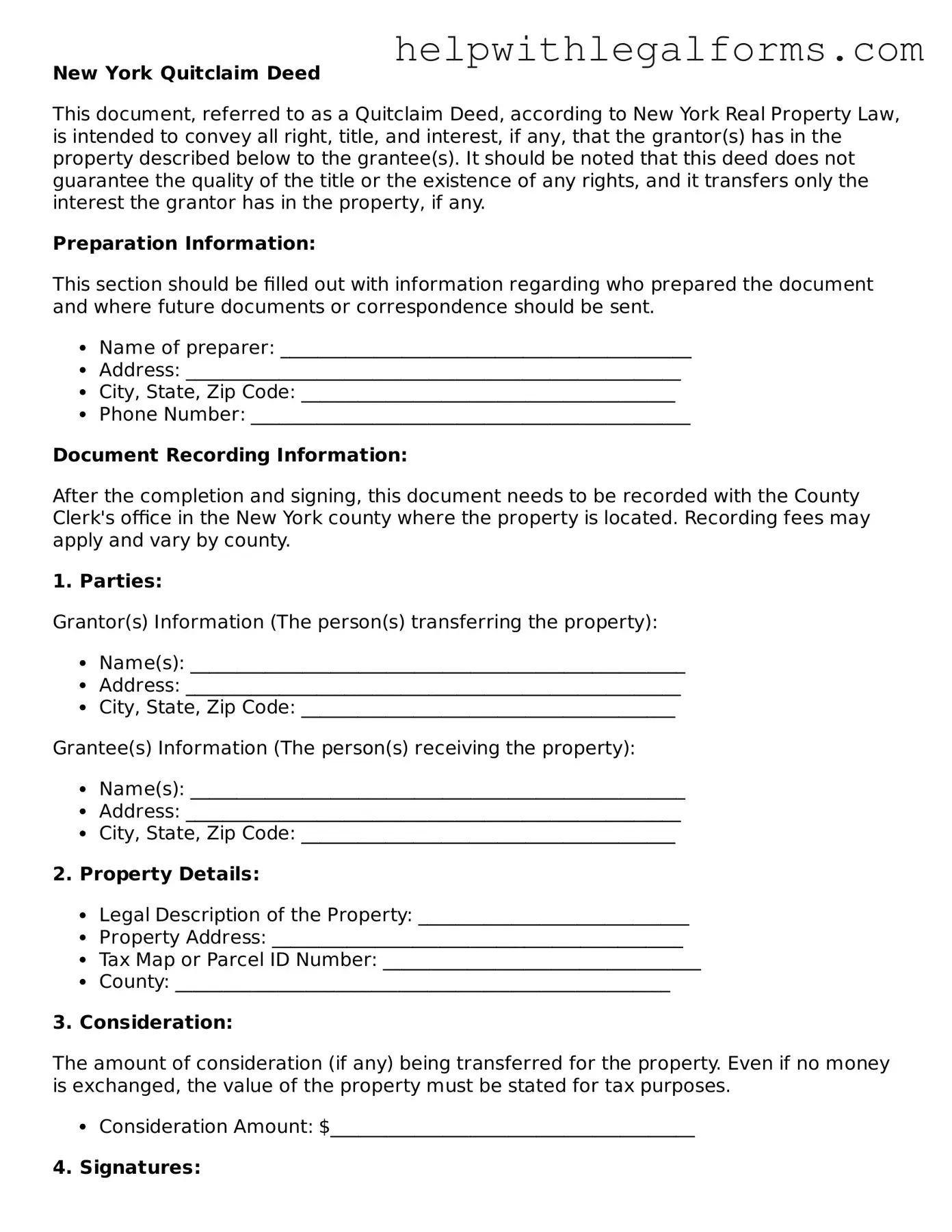

Example - New York Quitclaim Deed Form

New York Quitclaim Deed

This document, referred to as a Quitclaim Deed, according to New York Real Property Law, is intended to convey all right, title, and interest, if any, that the grantor(s) has in the property described below to the grantee(s). It should be noted that this deed does not guarantee the quality of the title or the existence of any rights, and it transfers only the interest the grantor has in the property, if any.

Preparation Information:

This section should be filled out with information regarding who prepared the document and where future documents or correspondence should be sent.

- Name of preparer: ____________________________________________

- Address: _____________________________________________________

- City, State, Zip Code: ________________________________________

- Phone Number: _______________________________________________

Document Recording Information:

After the completion and signing, this document needs to be recorded with the County Clerk's office in the New York county where the property is located. Recording fees may apply and vary by county.

1. Parties:

Grantor(s) Information (The person(s) transferring the property):

- Name(s): _____________________________________________________

- Address: _____________________________________________________

- City, State, Zip Code: ________________________________________

Grantee(s) Information (The person(s) receiving the property):

- Name(s): _____________________________________________________

- Address: _____________________________________________________

- City, State, Zip Code: ________________________________________

2. Property Details:

- Legal Description of the Property: _____________________________

- Property Address: ____________________________________________

- Tax Map or Parcel ID Number: __________________________________

- County: _____________________________________________________

3. Consideration:

The amount of consideration (if any) being transferred for the property. Even if no money is exchanged, the value of the property must be stated for tax purposes.

- Consideration Amount: $_______________________________________

4. Signatures:

All parties involved must sign this document. In New York, the Quitclaim Deed must also be acknowledged before a notary public to be valid for recording.

Grantor(s) Signature: __________________________________________

Grantee(s) Signature: __________________________________________

Date: _________________________________________________________

State of New York, County of __________________: On this day, personally appeared before me, ______________________________, the signer(s) of the above Quitclaim Deed who acknowledged signing the deed as their free act and deed.

Notary Public: ________________________________________________

My Commission Expires: ________________________________________

PDF Form Attributes

| Fact Name | Detail |

|---|---|

| Purpose | Transfers property rights from one party to another without warranties. |

| Warranty Level | Provides no guarantee on the title's clarity or freedom from liens. |

| Governing Law | New York Real Property Law. |

| Required Signatures | Must be signed by the grantor(s) in front of a notary public. |

| Recording Requirement | Must be filed with the appropriate county clerk’s office to be effective. |

Instructions on How to Fill Out New York Quitclaim Deed

Completing a New York Quitclaim Deed form is a significant step in the process of transferring property rights without the guarantees typically included in a warranty deed. This form is typically used among family members or close associates when there is a high level of trust. Before starting, ensure you have all necessary information, including the legal description of the property and the current deed. Careful attention to detail and accuracy is crucial when filling out this form to ensure the conveyance is valid and legally binding. The following steps will guide you through the process, making it as straightforward as possible.

- Start by entering the preparer's information at the top left corner of the form, including their full name and address. This section helps identify who completed the document.

- Next, fill in the "Return to" section with the name and address of the individual who should receive the deed after it is recorded. This could be the grantee or an attorney involved in the transaction.

- Enter the name of the county where the property is located in the space provided for "County." This is crucial for ensuring the deed is filed correctly and in the appropriate jurisdiction.

- In the "Consideration" section, write the amount of money being exchanged for the property, if any. Even if no money is exchanged, a nominal amount must be stated for legal purposes.

- Provide the grantor’s (the person transferring the property) full name, followed by the grantee’s (the recipient of the property) full name. Make sure to include the marital status and address for both parties.

- Include the legal description of the property. This information can be found on the current deed or by contacting the county recorder’s office. It is vital to copy this information accurately, as it precisely identifies the property being transferred.

- Detail any specific terms or conditions under which the property is being transferred in the "Terms" section. If the property is being transferred without conditions, state that it is being conveyed "as is."

- The grantor must sign the form in the presence of a notary public. Ensure the notary public also signs, dates, and affixes their seal to the document, verifying the authenticity of the grantor’s signature.

- Finally, file the completed quitclaim deed with the county clerk’s office in the county where the property is located. A filing fee will likely be required. Check with the local office for the exact amount.

Once the New York Quitclaim Deed form has been properly filled out and filed, the transfer of property rights is officially recorded. This document serves as a permanent record of the transaction, establishing the grantee as the new property holder under the terms specified. While the process involves several important steps, following the instructions carefully ensures that the transaction complies with New York state laws, providing peace of mind to all parties involved.

Crucial Points on This Form

What is a New York Quitclaim Deed?

A Quitclaim Deed in New York is a legal document used to transfer interest, or ownership, in real property from one person (the grantor) to another (the grantee) without warranties. This means that the grantor does not guarantee that they own the property or that there are no other claims against the property. It is a simple way to convey property, often used among family members or in situations where the property is well known to both parties.

When should a Quitclaim Deed be used in New York?

Quitclaim Deeds are generally used when transferring property between family members, such as parents to children, between siblings, or between spouses in a divorce situation. They can also be utilized in scenarios where the ownership of a property is clear and undisputed, to clear up a title issue, or to transfer property into a trust. It is vital to understand that this type of deed provides the least protection for the buyer (grantee).

What information is required for a New York Quitclaim Deed?

To properly complete a New York Quitclaim Deed, one needs to provide the full legal names of the grantor and grantee, a complete description of the property being transferred (including the property's tax map number or section, block, and lot number, if available), the address of the property, and the consideration being given for the transfer. Afterward, the deed must be signed by the grantor in the presence of a notary public before it can be filed with the county clerk's office where the property is located.

How is a Quitclaim Deed different from a Warranty Deed in New York?

Unlike a Quitclaim Deed, a Warranty Deed provides the grantee with guarantees that the grantor holds clear title to the property, meaning it is free of liens or other encumbrances, and that they have the legal right to sell the property. A Warranty Deed offers more protection to the buyer because it ensures that the seller is responsible for any title issues that might arise. In contrast, a Quitclaim Deed transfers whatever interest the grantor has in the property, if any, without any warranties regarding the property's title.

What are the legal requirements for a Quitclaim Deed in New York?

In New York, for a Quitclaim Deed to be legally valid, it must be in writing, contain the names of the grantor and grantee, provide a legal description of the property, state the consideration, and be signed by the grantor and notarized. Additionally, the deed must be filed with the appropriate county clerk’s office to effectuate the property transfer.

Does a Quitclaim Deed need to be witnessed in New York?

While New York law requires the grantor’s signature on a Quitclaim Deed to be notarized, state law does not specifically require witnesses for the signing of a Quitclaim Deed. However, it is essential to verify if local county regulations have additional requirements that need to be met.

Can a Quitclaim Deed in New York be used to transfer property to a family member?

Yes, a Quitclaim Deed is often used to transfer property between family members. This method is common for adding a spouse to a home's title, transferring property ownership to children, or distributing property as part of an estate plan. It is a straightforward process that can simplify property transfer within families without the extensive warranties of a Warranty Deed.

How do you file a Quitclaim Deed in New York?

After ensuring that the Quitclaim Deed has been correctly completed, signed by the grantor, and notarized, the document must be filed with the county clerk's office in the county where the property is located. Each county may have its own specific filing requirements, including filing fees and necessary accompanying documents, such as tax forms. It is advisable to contact the county clerk’s office directly or review their website for detailed instructions.

What are the potential risks of using a Quitclaim Deed?

Since a Quitclaim Deed transfers property without any warranties regarding the title, the grantee assumes all risks related to potential title issues or claims against the property. This means that if there is a lien, mortgage, or any claim on the property that was not disclosed, the grantee has limited legal recourse against the grantor. For this reason, Quitclaim Deeds are best used when the property and any potential issues are well known to both parties, and there is a high level of trust.

Common mistakes

-

Not verifying the correct legal description of the property. The legal description is more detailed than just an address; it includes lot numbers, subdivision names, and measurements. Errors here can lead to disputes about what property was intended to be transferred.

-

Failing to include all necessary parties. Both the grantor (the person transferring the interest) and the grantee (the person receiving the interest) must be correctly identified by full legal names and must sign the document if required by law.

-

Forgetting to check local requirements. Some counties in New York may have specific filing requirements or additional forms that must be submitted alongside the Quitclaim Deed.

-

Overlooking the necessity of a notary. In New York, a notary public must acknowledge the signatures on the form. Missing this step can render the document legally ineffective.

-

Misunderstanding the form's purpose. A Quitclaim Deed transfers only the grantor's interest in the property, if any, without any warranty as to the title's quality. Mistaking it for a warranty deed, which guarantees the grantor owns the property free and clear of liens, can lead to significant problems.

-

Inaccurate or outdated information. All information on the form must be current and accurate, including the names and addresses of the parties involved, the date of transfer, and any other relevant details.

-

Ignoring tax considerations. Transferring property might have tax implications. It is critical to understand these and address any required tax forms or payments concurrently.

-

Lack of witness signatures. Depending on jurisdiction, witness signatures may be required for the document to be valid. Failing to include these can invalidate the deed.

-

Not including consideration. While "consideration" can be nominal, such as "$1.00 and other valuable considerations," it's a necessary component of the form to show that the transfer is intentional.

-

Delaying the recording of the deed. Once executed, the deed should be recorded promptly with the appropriate county clerk's office to ensure legal recognition of the transfer and to preserve the grantee's interests.

By avoiding these mistakes, individuals can ensure a smoother, more effective transfer of property rights through a Quitclaim Deed in New York. Whether you are transferring property to a family member or changing the ownership for other reasons, the accuracy and completeness of this form are paramount.

Documents used along the form

When transferring property in New York, the Quitclaim Deed form is a common document used to convey interest in real property from one party to another without warranties. However, this form is often accompanied by various other forms and documents to ensure the legality and completeness of the property transfer process. Below is a list of other essential forms and documents that are commonly used alongside the New York Quitclaim Deed.

- TP-584 – Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax: This multi-purpose form is required for documenting the transfer tax liability and exemptions related to the property transfer.

- RP-5217 – Real Property Transfer Report: A real property transfer report required for all transfers of real property, which provides essential data for tax assessment purposes.

- Property Tax Bills: Current property tax bills are often required to prove that all taxes on the property have been paid up to the date of transfer.

- Title Search Report: A document that outlines the history of ownership and any liens, encumbrances, or issues with the title that could affect the transfer.

- Title Insurance Policy: An insurance policy that protects the buyer against losses due to defects in the title not listed in the title search report.

- Mortgage Payoff Statement: A statement from the current lender stating the amount required to pay off the existing mortgage in full as of a specific date.

- Affidavit of Consideration: A statement declaring the amount of money exchanged for the property. This document may be necessary for tax assessment and legal purposes.

- Closing Statement: A detailed account of all the transactions and fees paid by both the buyer and the seller during the closing process of the property transfer.

Each of these documents plays a crucial role in the property transfer process, ensuring that all legal, tax, and financial aspects are adequately addressed. To successfully navigate a property transfer in New York, parties involved should gather and complete these documents in conjunction with the Quitclaim Deed to ensure a smooth and legally sound transaction.

Similar forms

Warranty Deed: Like a Quitclaim Deed, a Warranty Deed is used to transfer property ownership. However, it provides the buyer with greater protection by guaranteeing the seller holds clear title to the property and there are no liens or encumbrances against it. This is a significant difference, as Quitclaim Deeds do not assure the quality of the title being transferred.

Grant Deed: Similar to Quitclaim Deeds in their use for transferring property rights, Grant Deeds go a step further by providing assurances that the property has not already been sold to someone else and that there are no undisclosed encumbrances. However, it doesn't offer the same level of warranty against defects in the property title as a Warranty Deed does.

Special Warranty Deed: This document also facilitates the transfer of real estate ownership but limits the seller's warranties to the period during which they owned the property. This is a middle ground between the Quitclaim Deed, which makes no assurances, and the full Warranty Deed, which provides comprehensive guarantees about the title's status throughout its history.

Deed of Trust: Although primarily used to secure a loan on a property, a Deed of Trust is related to Quitclaim Deeds in that it involves the transfer of property rights. In this case, the borrower transfers legal title to a trustee, who holds it as security for the lender until the loan is repaid. The functional differences lie in their purposes and the types of rights transferred.

Transfer on Death Deed (TODD): This estate planning tool allows property owners to name a beneficiary who will receive the property upon the owner's death, without going through probate. Like a Quitclaim Deed, a TODD transfers property rights, but it only becomes effective upon the death of the owner, offering a streamlined way to manage asset distribution after death without the guarantees or assurances provided by other types of deeds.

Dos and Don'ts

When completing the New York Quitclaim Deed form, it's crucial to proceed with care to ensure everything is done correctly. This document plays a significant role in the transfer of property ownership, and mistakes can lead to complications. Below, you'll find a list of things you should and shouldn't do when filling out this form.

Things You Should Do

- Double-check the legal description of the property. This includes the lot number, subdivision, and any other details that identify the property uniquely.

- Make sure all parties involved, both the grantor(s) (seller) and grantee(s) (buyer), have their names spelled correctly and included in full.

- Have the document notarized. This is a legal requirement for the Quitclaim Deed to be considered valid and enforceable.

- File the completed document with the county clerk’s office where the property is located, as this is necessary for the deed to be officially recorded.

Things You Shouldn't Do

- Don’t leave any fields blank. If a section does not apply, mark it with "N/A" (not applicable) instead of leaving it empty.

- Don’t use informal language or nicknames. The Quitclaim Deed is a legal document, and as such, formal language and full legal names are required.

- Avoid making corrections or alterations on the form once it’s been notarized. If errors are discovered after notarization, you should complete a new form rather than altering the existing one.

- Don’t forget to include contact information for both the grantor and grantee, as this might be necessary for any follow-up or correspondence regarding the property transfer.

Misconceptions

When it comes to transferring property ownership in New York, the Quitclaim Deed form is commonly used. However, there are several misconceptions about this legal document that often lead to confusion. It is important to understand what a Quitclaim Deed is and what it is not to ensure the process aligns with your expectations.

Misconception #1: A Quitclaim Deed guarantees a clear title. Contrary to common belief, a Quitclaim Deed does not guarantee that the title to the property is free of liens or other encumbrances. Instead, it transfers any interest the grantor has in the property without any warranty as to the extent of their interest or the title's status.

Misconception #2: Quitclaim Deeds are only for transactions without payment. While Quitclaim Deeds are frequently used in transfers that do not involve a traditional sale, such as adding or removing a family member from the property title, they can also be used in sales. The key factor is that the deed does not guarantee the status of the property’s title.

Misconception #3: Quitclaim Deeds can solve all property disputes. Quitclaim Deeds are helpful in specific scenarios, such as clarifying ownership among family members or transferring property to a trust. However, they are not a one-size-fits-all solution for all property disputes and may not be appropriate in situations where the property title is contested.

Misconception #4: Filing a Quitclaim Deed with the local county is all that’s needed to transfer ownership. While filing the Quitclaim Deed is a critical step, it is not the only requirement. The deed must be properly executed, meaning it must meet New York's legal requirements, including being signed by both parties and notarized.

Misconception #5: Quitclaim Deeds provide tax advantages. The act of transferring property using a Quitclaim Deed does not inherently provide tax benefits. Taxes related to property transfer, such as real estate transfer taxes or capital gains taxes, may still apply. It is essential to consult with a tax advisor to understand the tax implications of transferring property through a Quitclaim Deed.

Key takeaways

Understanding the nuances of filling out and using a New York Quitclaim Deed form is crucial for a smooth and effective transfer of property rights. These documents are particularly used when a property is transferred without a traditional sale, such as between family members or to clear a title. Here are several key takeaways to keep in mind:

- Accurate Information is Critical: The Quitclaim Deed requires details about the grantor (the person who is transferring the property), the grantee (the person who is receiving the property), and the property itself. Ensure that all names are spelled correctly and that the property description is precise and matches public records.

- Signatures Must Be Notarized: In New York, the law requires that the Quitclaim Deed be signed by the grantor in the presence of a notary public. This step is critical for the document to be considered valid and legally binding.

- Consider the Need for Witness Signatures: While New York does not strictly require witnesses for the signing of a Quitclaim Deed, having one or two witnesses can add a layer of validity and protection against future disputes.

- Understanding the Lack of Guarantees: By using a Quitclaim Deed, the grantor does not guarantee that the property is free of liens or other encumbrances. The grantee receives only the interest that the grantor has, if any, in the property.

- Filing the Deed: After the deed is properly executed, it must be filed with the County Clerk’s Office in the county where the property is located. This step is imperative as it makes the deed part of the public record and the transfer official.

- Assessment of Transfer Taxes: When filing the deed, it’s important to assess whether any transfer taxes are due. In New York, both the state and possibly the local municipality may require transfer taxes on the conveyance of real property.

Approaching the Quitclaim Deed process with diligence and attention to detail ensures the rightful transfer of property rights and helps prevent potential legal issues. Consulting with a legal professional can provide more personalized guidance tailored to your specific situation.

Create Other Quitclaim Deed Forms for US States

Wuick Claim Deed - A practical solution for property transfers within a family, such as gifting property from parents to children.

What Does a Deed Look Like in Nj - Keys to a hassle-free method of property gifting or transferring ownership without financial exchange.

How Do I File a Quit Claim Deed - The Quitclaim Deed stands out for those seeking a direct and uncomplicated path to adjust or transfer property ownership.

Florida Quit Claim Deed Filled Out - The process for using a Quitclaim Deed varies slightly by locality, so it's important to follow your area's guidelines.