Blank Quitclaim Deed Form for Oklahoma

In real estate, transferring property ownership is a significant step, entailing various forms and legal documents to solidify the transaction between parties. Among these, the Oklahoma Quitclaim Deed form serves as a pivotal document, especially in transactions where property is transferred without the guarantee of a clear title. This particular form, widely used in Oklahoma, facilitates the conveyance of the grantor's interest in a property to the grantee, if any, with no warranties regarding the title's validity against any claims. It is commonly utilized in scenarios such as property transfers between family members, divorce settlements, or in instances where a quick property transfer is desirable, excluding the extensive warranties typically associated with a general warranty deed. Understanding the nuances of this form is essential for anyone looking to navigate the complexities of property transfer in Oklahoma, ensuring a smoother, more informed transaction process.

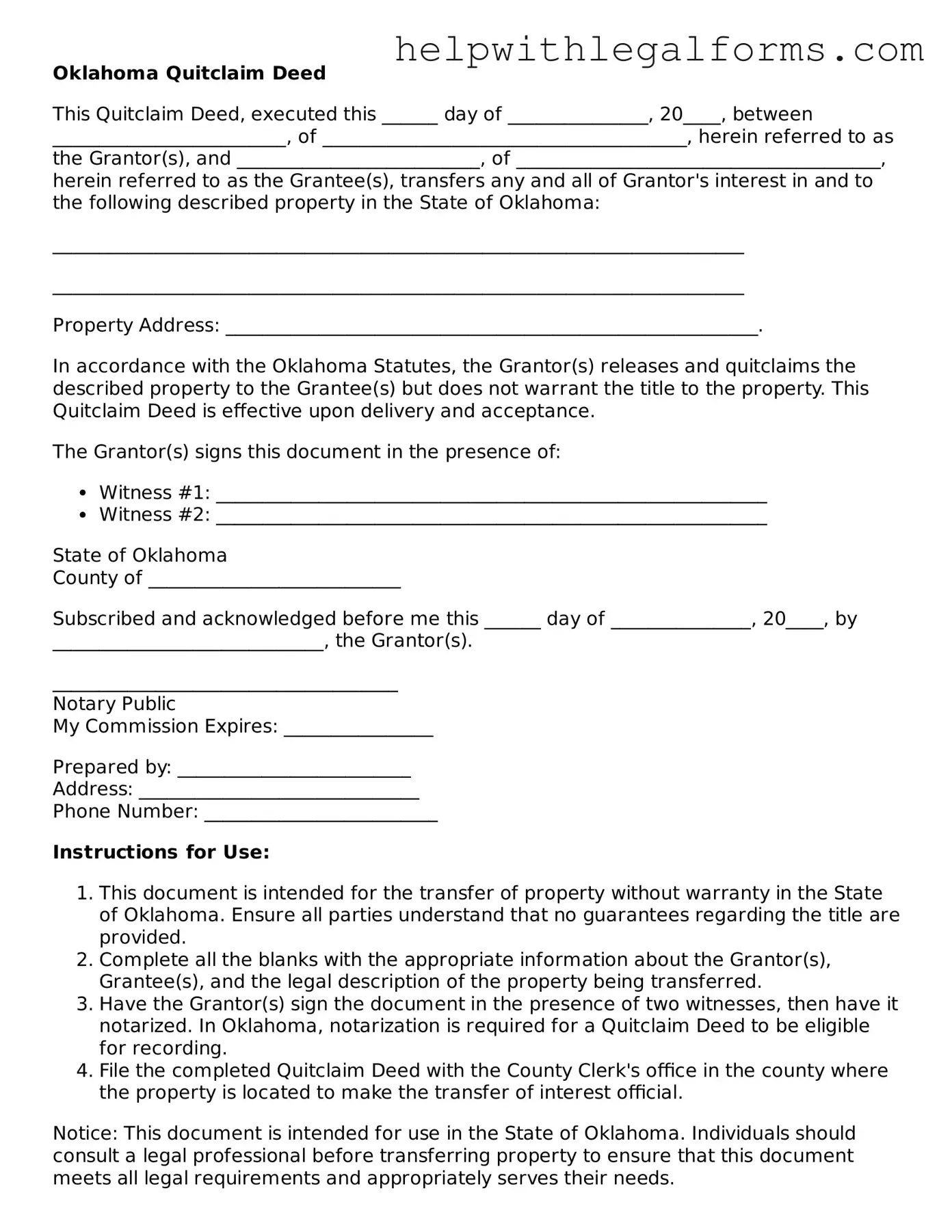

Example - Oklahoma Quitclaim Deed Form

Oklahoma Quitclaim Deed

This Quitclaim Deed, executed this ______ day of _______________, 20____, between _________________________, of _______________________________________, herein referred to as the Grantor(s), and __________________________, of _______________________________________, herein referred to as the Grantee(s), transfers any and all of Grantor's interest in and to the following described property in the State of Oklahoma:

__________________________________________________________________________

__________________________________________________________________________

Property Address: _________________________________________________________.

In accordance with the Oklahoma Statutes, the Grantor(s) releases and quitclaims the described property to the Grantee(s) but does not warrant the title to the property. This Quitclaim Deed is effective upon delivery and acceptance.

The Grantor(s) signs this document in the presence of:

- Witness #1: ___________________________________________________________

- Witness #2: ___________________________________________________________

State of Oklahoma

County of ___________________________

Subscribed and acknowledged before me this ______ day of _______________, 20____, by _____________________________, the Grantor(s).

_____________________________________

Notary Public

My Commission Expires: ________________

Prepared by: _________________________

Address: ______________________________

Phone Number: _________________________

Instructions for Use:

- This document is intended for the transfer of property without warranty in the State of Oklahoma. Ensure all parties understand that no guarantees regarding the title are provided.

- Complete all the blanks with the appropriate information about the Grantor(s), Grantee(s), and the legal description of the property being transferred.

- Have the Grantor(s) sign the document in the presence of two witnesses, then have it notarized. In Oklahoma, notarization is required for a Quitclaim Deed to be eligible for recording.

- File the completed Quitclaim Deed with the County Clerk's office in the county where the property is located to make the transfer of interest official.

Notice: This document is intended for use in the State of Oklahoma. Individuals should consult a legal professional before transferring property to ensure that this document meets all legal requirements and appropriately serves their needs.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Oklahoma Quitclaim Deed is a legal document that transfers a grantor's interest in a property to a grantee without warranties of title. |

| Governing Law | It is governed by the Oklahoma Statutes, Title 16, Section 18. |

| Warranty of Title | Unlike a warranty deed, the Quitclaim Deed does not guarantee that the grantor has clear title to the property. |

| Use | Often used in transferring property between family members or to clear a title. |

| Recording | After execution, it must be recorded with the county clerk in the county where the property is located. |

| Acknowledgment | The deed must be acknowledged by a notary public to be valid. |

| Filing Fee | Recording the Quitclaim Deed requires a fee that varies by county. |

| Required Information | Must include details like the legal description of the property, the names of the grantor and grantee, and the consideration paid, if any. |

| Format Requirements | Oklahoma law requires the Quitclaim Deed to meet specific formatting requirements, such as font size, margins, and paper size. |

| Effectivity | The transfer of ownership is effective immediately upon the grantee's acceptance of the deed. |

Instructions on How to Fill Out Oklahoma Quitclaim Deed

Filling out an Oklahoma Quitclaim Deed form might seem daunting, but it's a necessary step in transferring property from one person to another without any warranty. The process involves a series of straightforward tasks. By following the steps outlined below accurately and thoroughly, you ensure the deed is completed correctly, paving the way for a smooth property transfer. This guide is designed to assist you, ensuring each necessary detail is covered and submissions are made correctly.

- Gather the necessary information: Before you start, make sure you have all the required details including the legal description of the property, the name and address of the grantor (the person transferring the property), and the name and address of the grantee (the recipient of the property).

- Enter the preparer's information: At the top of the form, fill in the name and address of the individual preparing the document. If you are filling out this form on your own behalf, use your information here.

- Specify the mailing address: Directly below the preparer's information, enter the mailing address where the finalized document should be sent after recording.

- Fill in the consideration amount: Indicate the amount of money being exchanged for the property, if applicable. If no money is exchanged, a nominal amount like "Ten Dollars ($10.00)" or "One Dollar ($1.00)" is typically used to imply consideration.

- Input the grantor's details: In the designated section, write the full legal name(s) and address(es) of the grantor(s). Ensure this information is accurate, reflecting how it appears in public records.

- Enter the grantee's details: Similarly, fill in the grantee's full legal name(s) and address(es). Double-check for accuracy to avoid any issues with property transfer records.

- Legal description of the property: This part is crucial. Write the complete legal description of the property being transferred. This information can usually be found on a previous deed or at the county recorder's office. It often includes lot numbers, subdivision names, and other details that uniquely identify the property.

- Date the document: Make sure to include the date when the quitclaim deed is being executed. This indicates when the property transfer officially takes place.

- Grantor(s) signature: The grantor(s) must sign the document in the presence of a notary public. This legally binds the document.

- Notary Public: The form must be taken to a Notary Public, where the grantor's signature(s) will be officially witnessed and notarized. This step is mandatory and ensures the document's legitimacy.

- File with the county clerk: Once fully executed, the quitclaim deed needs to be filed with the county clerk's office in the county where the property is located. This step makes the property transfer public record and completes the process.

By carefully following these steps, you are on your way to successfully transferring property in Oklahoma. Remember, it's important to double-check all information for accuracy and completeness before filing the document with the county clerk. Taking these measures helps prevent future disputes or complications regarding property ownership.

Crucial Points on This Form

What is a Quitclaim Deed form in Oklahoma?

A Quitclaim Deed form in Oklahoma is a legal document used to transfer a property owner’s interest to a recipient, without any warranties regarding the property’s title. It is typically used among family members or close acquaintances where there is a high level of trust, as it only transfers the interest the owner has at the time of the transfer, without guaranteeing that the property is free of claims or liens.

How does a Quitclaim Deed differ from a Warranty Deed in Oklahoma?

The primary difference between a Quitclaim Deed and a Warranty Deed in Oklahoma lies in the level of protection offered to the buyer. A Warranty Deed provides the buyer with guarantees that the seller holds a clear title to the property, free of liens or other encumbrances. Conversely, a Quitclaim Deed offers no such assurances, simply transferring whatever interest the seller has in the property, if any, without any guarantee of clear title.

What information is required to complete a Quitclaim Deed form in Oklahoma?

To complete a Quitclaim Deed form in Oklahoma, several pieces of information are required. These include the legal names of the grantor (seller) and grantee (buyer), a legal description of the property being transferred, the county where the property is located, and the date of the transfer. Additionally, the grantor's signature must be notarized for the document to be legally valid. Some counties may have additional requirements, such as witness signatures or specific forms for the legal description.

Are there any special filing requirements for a Quitclaim Deed in Oklahoma?

Yes, after a Quitclaim Deed is completed and notarized in Oklahoma, it must be filed with the County Clerk’s office in the county where the property is located. The document must be recorded to be effective and provide public notice of the transfer. There is typically a recording fee, which varies by county. It is also important to check if the county requires any additional forms or fees for the recording process.

Can a Quitclaim Deed be used to transfer property to a family member in Oklahoma?

Yes, one of the most common uses of a Quitclaim Deed in Oklahoma is to transfer property between family members. This can include adding or removing a spouse's name from the property title or transferring property ownership to a child or sibling. Since Quitclaim Deeds do not offer any guarantee of clear title, they are best used in situations where there is a high degree of trust between the parties and the property’s history is well understood.

Common mistakes

In Oklahoma, correctly filling out a Quitclaim Deed form is crucial for the legal transfer of property ownership without warranty. Mistakes in this process can lead to legal complications, delays, and potential invalidation of the deed. Here are nine common mistakes that individuals often make when completing the Oklahoma Quitclaim Deed form:

-

Not verifying the accuracy of the legal description of the property. A legal description differs from a postal address and usually contains detailed information about the property's boundaries and measurements. Errors in this section can invalidate the transfer or create disputes over property boundaries.

-

Omitting necessary information about the grantor and the grantee. The form requires complete and accurate details of both the person transferring the property (grantor) and the person receiving it (grantee). This includes full legal names, addresses, and sometimes additional identification details. Incomplete information can cause the deed to be rejected.

-

Failing to have witnesses or a notary public during the signing. Oklahoma law may require the presence of witnesses and definitely requires notarization for the document to be legally valid. Not adhering to these requirements can render the deed void.

-

Not using the correct legal terminology or form. Utilizing a generic form or incorrect terminology that doesn't comply with Oklahoma standards may result in the deed being non-compliant with state laws.

-

Misunderstanding the effect of a quitclaim deed. Some individuals mistakenly believe that a quitclaim deed guarantees clear title to the property, whereas, in reality, it only transfers the grantor's interest in the property, if any, without any warranty of title.

-

Failure to file the deed with the county clerk's office. Merely having a signed and notarized deed does not complete the transfer process. The document must be filed with the appropriate local government office to be effective and legally recognized.

-

Incorrectly stating the consideration given for the property. While quitclaim deeds may involve property transfers without a traditional sale, stating the consideration—whether monetary or otherwise—is vital for tax purposes and the validity of the deed.

-

Not consulting a legal professional. Property transfers can have significant legal and tax implications. Without professional advice, individuals might not fully understand the ramifications of the transaction.

-

Overlooking the need for approval from mortgage lenders or violating the terms of the mortgage. Some property transfers may require the consent of the mortgage holder, and a quitclaim deed can sometimes trigger a due-on-sale clause, making the full mortgage amount due immediately.

Making sure all details are correct and the form complies with Oklahoma laws can significantly smooth the property transfer process. Each step should be approached with care to avoid the common pitfalls that can complicate or negate a quitclaim deed transaction.

Documents used along the form

When transferring property rights quickly and efficiently, the Oklahoma Quitclaim Deed form is a common tool used in real estate transactions. However, to ensure the process is smooth and legally sound, several other forms and documents are often utilized alongside this deed. Understanding the purpose and importance of each of these documents can help both the grantor and grantee comprehend the full scope of the transaction and its requirements.

- Title Search Report: A Title Search Report is crucial as it reveals the legal status of the property, including ownership details, any liens, judgments, or unpaid taxes associated with the property. This report provides a comprehensive background check to ensure the grantee receives the title free of unforeseen claims or disputes.

- Real Estate Transfer Tax Declaration: Depending on the location of the property, a Real Estate Transfer Tax Declaration might be required. This document is a disclosure of the financial details of the transaction, including the sale price, and is used to calculate any transfer taxes due at the time of the property's change in ownership.

- Notary Acknowledgment: A Notary Acknowledgment is a formal declaration by a notary public that the parties involved in the transaction have willingly signed the deed. This acknowledgment is part of the process of making the document legally binding and ensures that all signatures are legitimate and voluntary.

- Property Disclosure Statement: Although not always required in transactions involving a Quitclaim Deed, a Property Disclosure Statement can be a valuable document. It outlines the condition of the property, including any known defects or issues. This disclosure helps protect the buyer and ensures transparency in the transaction.

Collectively, these documents, along with the Oklahoma Quitclaim Deed, play a pivotal role in the transfer of property. They not only support the deed but also add layers of protection for both parties involved. By meticulously preparing and reviewing each document, individuals can navigate the complexities of real estate transactions with greater confidence and legal security.

Similar forms

Warranty Deed: Similar to a Quitclaim Deed, a Warranty Deed is used in real estate transactions. However, it offers more protection to the buyer, guaranteeing that the property is free from any liens and encumbrances, and the seller holds a clear title to the property.

Grant Deed: Like a Quitclaim Deed, a Grant Deed transfers ownership of property from one party to another. The difference lies in the promises made: while a Quitclaim offers no guarantees about the property's title, a Grant Deed assures the recipient that the property has not been sold to someone else.

Special Warranty Deed: This document also facilitates the transfer of real estate ownership. It resembles a Quitclaim Deed but provides limited warranties only against the claims that arose while the grantor owned the property, not before.

Deed of Trust: A Deed of Trust is employed in some states instead of a mortgage. It involves three parties: the borrower, the lender, and a trustee. It's similar to a Quitclaim Deed in that it involves the transfer of property rights, but it specifically does so as a security for a loan.

Mortgage Agreement: This is a contract between a borrower and lender where the borrower’s property is used as collateral for the loan. It's akin to a Quitclaim Deed in the aspect of involving property in a legal document, but it distinctly outlines the terms for borrowing funds against property.

Transfer on Death Deed: Similar to a Quitclaim Deed, this document transfers property rights, but it only takes effect upon the death of the owner, avoiding probate court. It allows for direct transfer of property to a designated beneficiary without the guarantees of a clear title.

Power of Attorney: While primarily used to grant someone the authority to make decisions on another’s behalf, a Power of Attorney can authorize the holder to buy, sell, or manage real estate properties, thereby indirectly involving property transfer, akin to a Quitclaim Deed.

Dos and Don'ts

When filling out the Oklahoma Quitclaim Deed form, it’s important to be mindful of the steps to follow, as well as common mistakes to avoid. This will help in ensuring the process is completed correctly and efficiently.

Things you should do:

- Verify that all parties involved have their full legal names correctly spelled on the form. This includes both the grantor (person transferring the property) and the grantee (person receiving the property).

- Ensure that the legal description of the property is complete and accurate. This description can usually be found on the current deed or by contacting your local county clerk’s office.

- Include all necessary signatures. The person transferring the property must sign the quitclaim deed. Depending on local regulations, witnesses or a notary public might also need to sign the form.

- File the completed form with the local county clerk’s office. There may be a filing fee, which varies by county. It's important to submit the form promptly to make the property transfer official in public records.

Things you shouldn't do:

- Do not leave any sections of the form blank. Incomplete forms may lead to processing delays or the form being rejected entirely.

- Do not guess on legal descriptions or spellings of names. Incorrect information can invalidate the deed or complicate future transactions.

- Do not forget to check if your county requires the deed to be notarized. Failing to notarize a deed when required can result in the deed being considered invalid.

- Do not delay in filing the quitclaim deed. Prompt filing ensures that the property records are updated, which is crucial for the grantee’s legal ownership status.

Misconceptions

In discussing the Oklahoma Quitclaim Deed form, several misconceptions commonly arise, leading to confusion and misunderstanding about its use and implications. Here are four notable misconceptions explained in detail:

- Guarantees About Property Title: A common misconception is that a Quitclaim Deed guarantees a clear and unencumbered title to the property being transferred. In reality, this deed transfers only the interest, if any, the grantor has in the property without any warranty. Hence, if the grantor does not actually own the property, or if there are any liens or encumbrances against it, the grantee receives no protection against these issues.

- Effectively Removes Names from Mortgages: Another misconception is the belief that executing a Quitclaim Deed removes an individual's obligation from a mortgage associated with the property. In truth, a Quitclaim Deed affects only the title and ownership of the property, not the responsibility for its mortgage. Individuals remain liable for any mortgages they have committed to unless they formally refinance the property or otherwise negotiate removal with the lender.

- Only for Use Between Family Members: While it is true that Quitclaim Deeds are often used in transactions between family members due to their simplicity and the absence of warranty, they are not exclusively reserved for such transactions. These forms can be used in a variety of situations where the parties involved agree that a warranty of title is not necessary. However, the choice of this deed should be informed by the specific circumstances and the relationship between the parties.

- Substitute for a Will: Some individuals mistakenly believe that a Quitclaim Deed can serve as a substitute for a will in the transfer of property upon death. This is incorrect. While a Quitclaim Deed can transfer property rights during the grantor's lifetime, it does not have the provisions to designate what happens to property upon the grantor’s death. Estate planning objectives typically require a will or other estate planning tools to ensure property is distributed according to the deceased's wishes.

Understanding the realities behind these misconceptions is crucial for individuals involved in any property transactions. By demystifying the Quitclaim Deed, parties can better navigate their property transfer needs in Oklahoma with more accuracy and assurance.

Key takeaways

When dealing with the Oklahoma Quitclaim Deed form, it's important to approach the task with a clear understanding of what the form is and how properly filling it out can impact the transfer of property rights. Here are nine key takeaways to consider:

- Understand the Purpose: The Oklahoma Quitclaim Deed is primarily used to transfer property rights from one person to another without any warranties regarding the title's quality. This means the grantor does not guarantee that they own the property free and clear of other claims.

- Identify the Parties: Clearly identifying the grantor (the person transferring the property) and the grantee (the person receiving the property) is crucial. Full legal names should be used to avoid any confusion or disputes about who the parties are.

- Legal Description of the Property: The deed must include a complete and accurate legal description of the property being transferred. This includes lot numbers, subdivision names, and any other details that appear on the property's current deed or title record.

- Signatures: The Quitclaim Deed must be signed by the grantor in the presence of a notary public. Some counties may also require the grantee's signature. Check local requirements to ensure compliance.

- Notarization: The signing of the deed must be notarized. This step is essential for the document to be considered valid and for recording purposes.

- Filing with the County Clerk: After the deed is signed and notarized, it must be filed with the County Clerk's office in the county where the property is located. Failure to record the deed can lead to disputes over property ownership.

- Consideration: The deed should state the consideration, or the value exchanged for the property transfer. In Oklahoma, even a nominal consideration (like $10) or the phrase "for love and affection" is usually sufficient.

- Tax Implications: Be aware of any potential tax implications for both the grantor and grantee. It's wise to consult with a tax advisor to understand any impacts the transfer may have.

- Legal Advice: Since a Quitclaim Deed has significant legal effects and might affect property rights, seeking the advice of a legal professional is advisable. They can provide guidance tailored to your specific situation.

Using the Oklahoma Quitclaim Deed form correctly is vital for a smooth and legally sound property transfer. By paying attention to these key takeaways, parties can help ensure their interests are protected throughout the process.

Create Other Quitclaim Deed Forms for US States

Florida Quit Claim Deed Filled Out - In some states, additional forms or declarations may be required alongside the Quitclaim Deed for a valid transfer.

Quit Claim Deed Form Ny Pdf - A Quitclaim Deed is a legal document used to transfer interest in real estate from one person to another without any warranties regarding the title.

Colorado Quit Claim Deed Joint Tenancy With Right of Survivorship - It is one of the simplest forms of deed, with minimal requirements for completion and execution.

Quick Claim Deed Form Connecticut - Quitclaim Deeds are a cost-effective solution for simple property transfers, often requiring no legal representation to complete.