Blank Quitclaim Deed Form for Texas

In the vast landscape of property transactions within Texas, the Quitclaim Deed form emerges as a critical document, marking the transfer of interest in real estate from a grantor to a grantee without any warranty regarding the title's validity. It stands distinct from other deed forms, particularly because of its simplicity and the nature of the rights conveyed. This form is most commonly used among family members, during divorce proceedings, or in other situations where a formal guarantee of a clear title is not strictly necessary. The key features of a Texas Quitclaim Deed include its ability to transfer property rights swiftly and efficiently, albeit with the grantee assuming the risk of potential title issues. As it dispenses with the guarantees typically associated with more complex transactions, this legal instrument underscores the importance of trust between parties involved. Understanding the nuances and legal implications of this document is essential for anyone looking to navigate the real estate landscape in Texas, ensuring that property transfers are conducted smoothly and with full awareness of the form's limitations and potential implications.

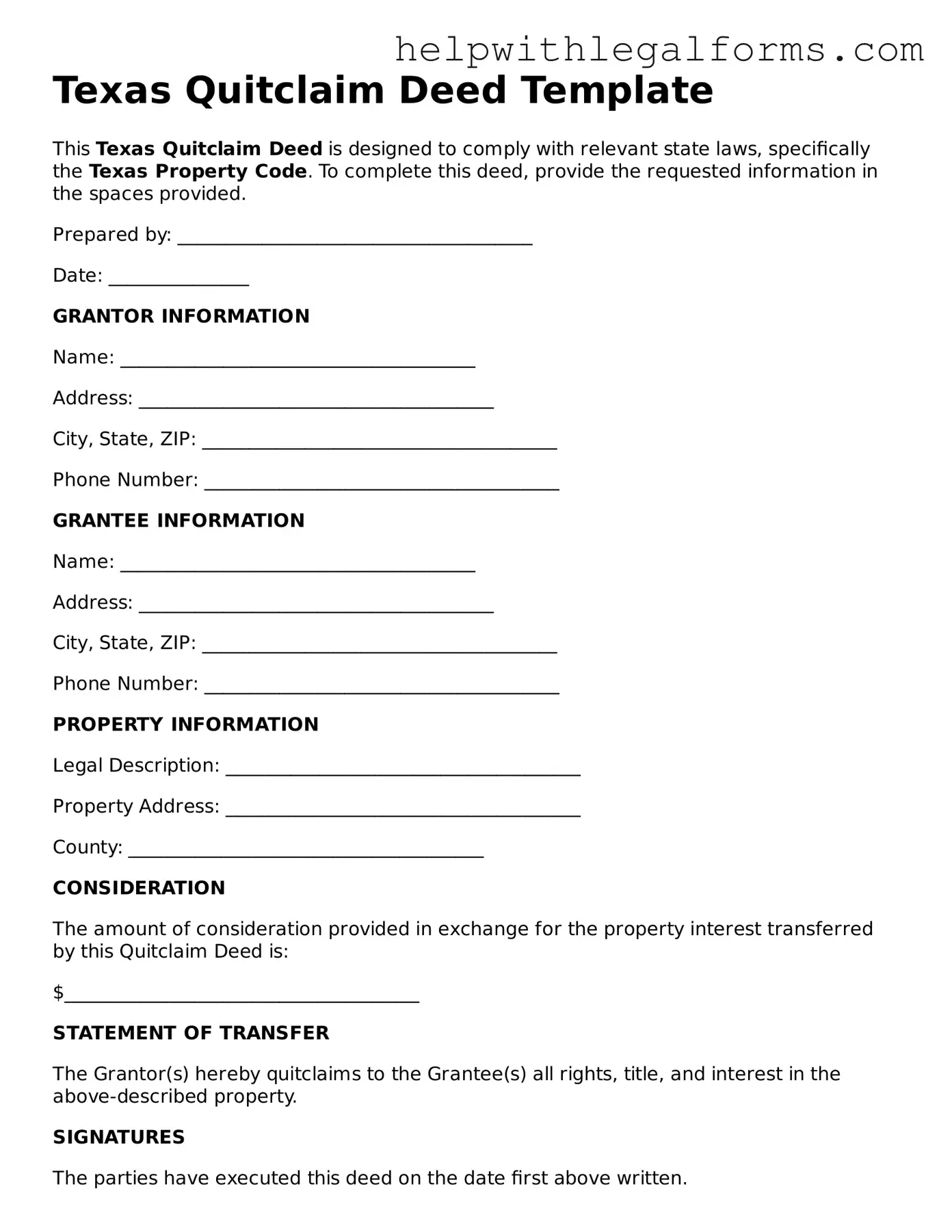

Example - Texas Quitclaim Deed Form

Texas Quitclaim Deed Template

This Texas Quitclaim Deed is designed to comply with relevant state laws, specifically the Texas Property Code. To complete this deed, provide the requested information in the spaces provided.

Prepared by: ______________________________________

Date: _______________

GRANTOR INFORMATION

Name: ______________________________________

Address: ______________________________________

City, State, ZIP: ______________________________________

Phone Number: ______________________________________

GRANTEE INFORMATION

Name: ______________________________________

Address: ______________________________________

City, State, ZIP: ______________________________________

Phone Number: ______________________________________

PROPERTY INFORMATION

Legal Description: ______________________________________

Property Address: ______________________________________

County: ______________________________________

CONSIDERATION

The amount of consideration provided in exchange for the property interest transferred by this Quitclaim Deed is:

$______________________________________

STATEMENT OF TRANSFER

The Grantor(s) hereby quitclaims to the Grantee(s) all rights, title, and interest in the above-described property.

SIGNATURES

The parties have executed this deed on the date first above written.

Grantor Signature: ______________________________________

Date: _______________

Grantee Signature: ______________________________________

Date: _______________

TAX STATEMENTS

The party responsible for payment of any documentary transfer taxes is:

- Grantor

- Grantee

- Other: ______________________________________

The party responsible for property taxes due and payable for the current year is:

- Grantor

- Grantee

- Other: ______________________________________

This document is not valid until it is filed with the county clerk's office in the county where the property is located.

NOTARY ACKNOWLEDGMENT

State of Texas

County of ___________________

On this day, before me, ______________________________ (name of notary), a notary public, personally appeared _________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Signature: _____________________________

Date: _______________

My Commission Expires: _______________

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | Transfers property ownership rights from one person to another without any warranties. |

| Governing Law | Texas Property Code |

| Warranty | Does not guarantee that the title is clear. |

| Recording Requirement | Must be filed with the county clerk in the county where the property is located. |

| Preparation | Requires knowledge of the legal description of the property. |

| Notarization | Must be signed in the presence of a notary public. |

Instructions on How to Fill Out Texas Quitclaim Deed

When it comes to transferring property interests in Texas, one common but often misunderstood document involved in this process is the Quitclaim Deed. Crafting this document with precision is crucial for the parties involved, as it directly impacts ownership and rights over the designated property. The process may seem daunting; however, with a clear step-by-step guide, filling out the Texas Quitclaim Deed form can be straightforward. By breaking down each part, individuals can ensure they provide all the necessary information accurately, helping to streamline the transfer and recordation of property interests.

Steps to Fill Out the Texas Quitclaim Deed Form:

- Begin by identifying the preparer of the document. This refers to the person who is completing the form, typically the grantor or their legal representative. Enter the full name and address of the preparer at the top left corner of the form.

- Next, specify the return address. This is critical as it’s where the completed document will be sent after recording. The return address might belong to the grantee, the grantor, or a legal representative.

- Enter the date of the deed execution. This is the date on which the deed is signed by the grantor, effectively transferring the property interest.

- State the particulars of the grantor (the person transferring the property) and the grantee (the person receiving the property). Include full legal names, addresses, and state if the parties are individuals or entities. It’s imperative to be precise, as these details define who is involved in the transfer.

- Describe the property being transferred. This includes the legal description of the property, which can be found on the title document or a previous deed. The property’s physical address should also be included, though the legal description takes precedence for identification purposes.

- Signify the consideration. This term refers to what is being exchanged for the property interest. While Quitclaim Deeds often involve little to no consideration, stating a nominal amount like "$10 and other valuable consideration" is standard to satisfy legal requirements.

- Have the grantor(s) sign the deed in front of a Notary Public. The notarization of the grantor's signature is a crucial step to validate the document.

- File the completed deed with the appropriate county clerk’s office in Texas. The office location is determined by the property’s location. Filing the deed officially records the transaction and the property’s new ownership status.

Completing the Texas Quitclaim Deed form carefully and accurately is imperative for a smooth transfer of property. Once filled out, review the document thoroughly before proceeding to notarization and filing to ensure all information is correct and in compliance with Texas law. This process, while intricate, provides a legal framework for transferring interests in property, safeguarding the rights of all parties involved.

Crucial Points on This Form

What is a Quitclaim Deed in Texas?

A Quitclaim Deed in Texas is a legal document used to transfer any ownership interest the grantor (the person transferring the property) may have in a piece of real property to a grantee (the person receiving the property), without any warranties of clear title. It is often used between family members or to clear up a title issue.

When should I use a Texas Quitclaim Deed?

This deed is most appropriate for transactions between family members, in divorce proceedings when one spouse is ceding interest in a property to the other, or when the property is being gifted. It can also be used to clear up doubts about the boundary of a property, though it does not guarantee that the seller has legal title.

Does a Quitclaim Deed guarantee the seller owns the property?

No, a Quitclaim Deed does not confirm that the seller has a legal claim to the property. It simply transfers whatever interest the seller might have, without any guarantee. This is what distinguishes it from warranty deeds, which do provide a guarantee of title.

Is a Quitclaim Deed in Texas legally binding once signed?

Yes, once properly executed and notarized, a Quitclaim Deed is legally binding. However, the deed must be filed with the county recorder’s office where the property is located to effectively notify third parties of the transfer.

What are the key elements that must be included in a Texas Quitclaim Deed?

A Texas Quitclaim Deed must include the legal description of the property, the name and address of both the grantor and the grantee, and the amount of consideration (if any) being exchanged for the property. It must be signed by the grantor and notarized to be valid.

Does the grantee have to sign the Quitclaim Deed?

No, typically only the grantor is required to sign a Quitclaim Deed. However, the document must be notarized to validate the grantor’s signature and it must then be filed with the county recorder’s office. That said, requirements can vary, so checking local statutes is always a good idea.

Can a Quitclaim Deed in Texas be revoked?

Once a Quitclaim Deed has been executed and delivered to the grantee, it is very difficult to revoke. Revocation would likely require the agreement of both parties and possibly a new deed or legal action. Seek legal advice if revocation is desired, as this can be a complex process.

How can a Texas Quitclaim Deed be filed?

After signing and notarization, the Quitclaim Deed should be filed with the county clerk or recorder's office in the county where the property is located. There may be a filing fee, and requirements can vary by county, so it is advisable to check the specific requirements of your local office.

What happens if a Quitclaim Deed is not recorded in Texas?

If a Quitclaim Deed is not recorded, it can lead to complications, including disputes over the property's true ownership. Recording the deed with the county helps ensure that the transfer of property is recognized officially and assists in protecting the grantee's interests.

Common mistakes

When it comes to transferring property rights in Texas, the Quitclaim Deed form is a commonly used legal instrument. However, its simplicity can sometimes lead to errors if not completed with caution. Understanding and avoiding common mistakes can ensure a smoother process for all parties involved.

Not Using the Correct Form: Each state has specific requirements for Quitclaim Deeds. Utilizing a generic form instead of one tailored to Texas laws can invalidate the document.

Failing to Include All Necessary Information: A complete legal description of the property, as recorded in county records, is crucial. Omissions can lead to disputes or a voided deed.

Incorrect Grantor/Grantee Information: The names and addresses of the current owner (grantor) and the new owner (grantee) must be accurate and fully spelled out. Any errors can create legal ambiguities.

Lack of Notarization: In Texas, a Quitclaim Deed must be notarized to be legally binding. Skipping this step can result in an unenforceable deed.

Forgetting to File with the County Clerk: After execution, the Quitclaim Deed must be filed with the county clerk's office where the property is located. Failure to do so can affect the legal transfer of ownership.

Overlooking Tax Implications: Transferring property can have tax consequences. It's advisable to consult a tax professional to avoid unexpected liabilities.

Misunderstanding the Warranty: Quitclaim Deeds do not guarantee a clear title; they only transfer the grantor's interest in the property. This misunderstanding often leads to disputes if title issues arise.

Sidestepping Professional Advice: Not seeking legal advice can be a critical mistake. Professionals can help identify potential issues with the property or the form itself.

Improper Execution or Delivery: The deed must be signed and delivered according to Texas law. Otherwise, it might not legally transfer the property rights.

By avoiding these common mistakes, individuals can better navigate the process of using a Quitclaim Deed in Texas. It's essential to proceed with care and seek professional guidance when necessary to secure the intended outcomes and ensure compliance with state laws.

Documents used along the form

When individuals decide to transfer property rights in Texas, utilizing a Quitclaim Deed form is a common approach. This document is straightforward but often works in tandem with several other forms and documents to ensure the transaction complies with legal requirements and to provide clarity for all parties involved. The surrounding paperwork plays crucial roles, ranging from validating the transaction to recording the change in ownership.

- Warranty Deed - While a Quitclaim Deed transfers any ownership the grantor may have without guaranteeing the title's validity, a Warranty Deed goes a step further by promising the grantee a clear title. It's often used to provide peace of mind and protection against future claims.

- Title Search Report - Before a property can change hands, it's important to conduct a title search. This report uncovers any liens, encumbrances, or legal issues tied to the property, ensuring the buyer is aware of potential complications.

- Loan Payoff Statement - If there's an existing mortgage on the property, a Loan Payoff Statement is crucial. It outlines the remaining balance and terms for paying off the loan, ensuring the transfer aligns with the lender's requirements.

- Property Disclosure Statement - Though not always mandatory, this document is valuable. It outlines any known issues or defects with the property, allowing the buyer to make an informed decision.

- Homestead Exemption Forms - If the property served as the seller's primary residence, these forms are necessary to adjust or remove the homestead exemption, potentially affecting property taxes and legal protections.

- Transfer Tax Declarations - Depending on the jurisdiction, transferring property may incur taxes. These declarations outline any owed transfer taxes or exemptions that apply to the transaction.

- Real Estate Transfer Declaration - This detailed form is often required by the county clerk to record the transfer officially. It may include the property's sale price, identifying information, and certification of accuracy from both parties.

Each document serves a unique purpose and contributes to the seamless execution and recording of property transfers. While a Quitclaim Deed may appear to be a simple form, the associated documents ensure that all aspects of the transaction are legally sound and fully transparent. For individuals navigating this process, understanding these documents and their roles can demystify the complexities of property transactions, paving the way for a smooth and successful transfer of ownership.

Similar forms

Warranty Deed: Like the Quitclaim Deed, a Warranty Deed transfers property ownership from one person to another. However, unlike a Quitclaim Deed, the Warranty Deed comes with guarantees by the seller that they own the property free and clear of any liens or claims.

Grant Deed: Similar to Quitclaim Deeds, Grant Deeds are used to transfer property title. The key difference is that Grant Deeds contain guarantees that the property has not been sold to someone else and is free of encumbrances, at least up to the point of the sale.

Special Warranty Deed: This document, like the Quitclaim Deed, is used in property transactions. The Special Warranty Deed only guarantees against title issues or claims arising during the period the seller owned the property, unlike the Quitclaim Deed, which does not provide any guarantees.

Trustee's Deed: Though different in purpose, a Trustee's Deed, which conveys property from a trust to a beneficiary, shares similarities with a Quitclaim Deed because it may not come with guarantees about the property’s title.

Deed of Trust: A Deed of Trust is part of loan arrangements, securing the loan by using the property as collateral. While its main function is different, it's similar to a Quitclaim Deed in that it involves the transfer of property interest.

Executor's Deed: Used to transfer property from an estate, the Executor's Deed, like the Quitclaim Deed, transfers property without any guarantee or warranty. It is typically used when an executor is authorized to sell a decedent’s property.

Life Estate Deed: This deed transfers property rights during the owner's lifetime but retains certain rights for the original owner. Similar to Quitclaim Deeds, Life Estate Deeds can be used to quickly transfer property interest, although with distinctly different future rights retained.

Dos and Don'ts

When dealing with the Texas Quitclaim Deed form, carefully navigating the do's and don'ts is vital for a successful transfer of property rights. The following guidelines are designed to assist in this process.

Do's:

- Ensure all parties' names are spelled correctly. The accuracy of this information is crucial for the deed's validity.

- Clearly describe the property being transferred. A legal description and any identifying numbers should be included to avoid any ambiguities.

- Sign the document in the presence of a notary public. This step is essential for the document to be legally binding.

- File the completed deed with the county clerk’s office where the property is located. This public recording is necessary to inform all interested parties of the change in ownership.

Don'ts:

- Do not leave any blank spaces. If a section does not apply, it is better to indicate this with "N/A" or "Not Applicable" to prevent misunderstandings or the impression of incomplete documentation.

- Avoid informal agreements not reflected in the quitclaim deed. All agreements concerning the property transfer should be documented in the deed to ensure they are legally recognized.

- Refrain from using unclear legal descriptions. The property needs to be described with enough detail to be easily identified and located.

- Do not delay the filing of the deed. Once signed and notarized, promptly filing the document with the appropriate county clerk's office is crucial to finalize the transfer.

Misconceptions

When discussing property transactions in Texas, the Quitclaim Deed is often a topic of confusion. Several misconceptions surround its use and legal implications. Addressing these can help property owners and purchasers navigate their property transactions more effectively. Below are four common misconceptions about the Texas Quitclaim Deed form:

- It guarantees a clear title. A prevalent misconception is that a Quitclaim Deed ensures the grantor holds a clear title to the property. Unlike Warranty Deeds, Quitclaim Deeds do not guarantee that the title is free from claims or liens. Essentially, the grantor only transfers whatever interest they have in the property, without any warranty regarding its validity or extent.

- It overrides a will or divorce decree. Some believe that a Quitclaim Deed can change ownership that's already dictated by a will or divorce decree. However, this is not the case. A Quitclaim Deed cannot alter previously established legal rights or ownership specified by court orders or in wills. Instead, it can only transfer the grantor's current rights in the property, if any.

- It is only for transferring property between family members. While it's true that Quitclaim Deeds are often used to transfer property between family members due to their simplicity, this is not their sole application. They can be used in a variety of situations where the parties involved agree to a transfer of property without warranties, including but not limited to settling property issues in a divorce or transferring property to a trust.

- It offers immediate legal protection. Another misconception is that filing a Quitclaim Deed with the county immediately provides legal protection or alters ownership on public records. The reality is the effectiveness of a Quitclaim Deed, like any legal document, depends on its execution, delivery, and acceptance. Proper filing with the appropriate county office is necessary to make the transfer of interest public record, which is crucial for the protection of the grantee’s interest in the property.

Key takeaways

When handling the Texas Quitclaim Deed form, it's important to approach the process with attention and care. This document is used to transfer interest in property without warranties, which means the seller does not guarantee that they own the property free and clear of any claims. Here are key takeaways to keep in mind:

- Understand the form's purpose: A Quitclaim Deed in Texas is mainly used to transfer property between family members, to clear up a title, or within a divorce settlement. It's a straightforward way to transfer interest without the assurances found in traditional warranty deeds.

- Fill out the form accurately: All information on the Quitclaim Deed must be accurate, including the legal description of the property, the names of the grantor (seller) and grantee (buyer), and the property's address. Mistakes can lead to complications in the property's title, potentially requiring legal action to correct.

- Notarization is required: For the deed to be legally binding, it must be signed by the grantor in front of a notary public. This formalizes the document, ensuring that the signature is authentic and the grantor is executing the deed willingly and under no duress.

- File promptly with the county: After notarization, the Quitclaim Deed should be filed with the County Clerk's Office in the county where the property is located. Delaying this step can leave the transfer unrecorded, affecting future transactions.

- Keep copies for records: Both the grantor and grantee should keep copies of the notarized deed for their records. Having accessible records can be crucial for resolving any future disputes over property ownership or to clarify the property's history.

- Review by a professional: Considering the deed's potential implications on property rights and ownership, it might be wise to have the form reviewed by a legal professional or a real estate attorney. They can ensure that the deed complies with Texas law and that the transfer serves your best interests.

- No warranties: Remember, the quitclaim deed transfers ownership as-is. The grantor makes no guarantees regarding the property's title status, leaving the grantee with little recourse if issues arise post-transfer.

- Impact on mortgages and liens: A quitclaim deed does not affect mortgages or other liens on the property. If the grantor has a mortgage, the grantee does not take over responsibility for it unless separately agreed upon. Similarly, any existing liens remain attached to the property.

- Tax implications: Transferring property can have tax implications for both the grantor and grantee. It's advisable to consult with a tax professional to understand any potential liability or requirements triggered by the transfer.

Handling a Texas Quitclaim Deed with due diligence is crucial for a smooth transfer of property rights. By taking these key points into account, parties can ensure a more secure and informed transaction.

Create Other Quitclaim Deed Forms for US States

Florida Quit Claim Deed Filled Out - This deed is especially beneficial in situations where the property is not being sold for monetary value.

Colorado Quit Claim Deed Joint Tenancy With Right of Survivorship - This deed is often preferred for its speed and efficiency in non-commercial property transactions.

Oklahoma Quit Claim Deed Form Individual - When transferring ownership rights to a property within closely held entities, quitclaim deeds provide an uncomplicated path.