Blank Deed Form for Texas

In the realm of property transactions within the Lone Star State, the Texas Deed form plays a pivotal role, acting as the official document that facilitates the transfer of ownership from one party to another. This form, while seemingly simple at a glance, encompasses a range of crucial details, including the identification of the buyer and seller, a comprehensive description of the property in question, and the specific type of deed being executed, among other elements. Its significance cannot be overstated, as it not only serves to legally codify the change in property ownership but also ensures that the process adheres to Texas law. For individuals navigating the complexities of buying or selling property, understanding the nuances of the different types of deeds available—such as warranty, quitclaim, or special warranty deeds—and the specific circumstances under which each is used, is essential. Furthermore, the meticulous completion and proper filing of this form with the relevant county office is a critical step in validating the transaction, safeguarding the rights and interests of all parties involved.

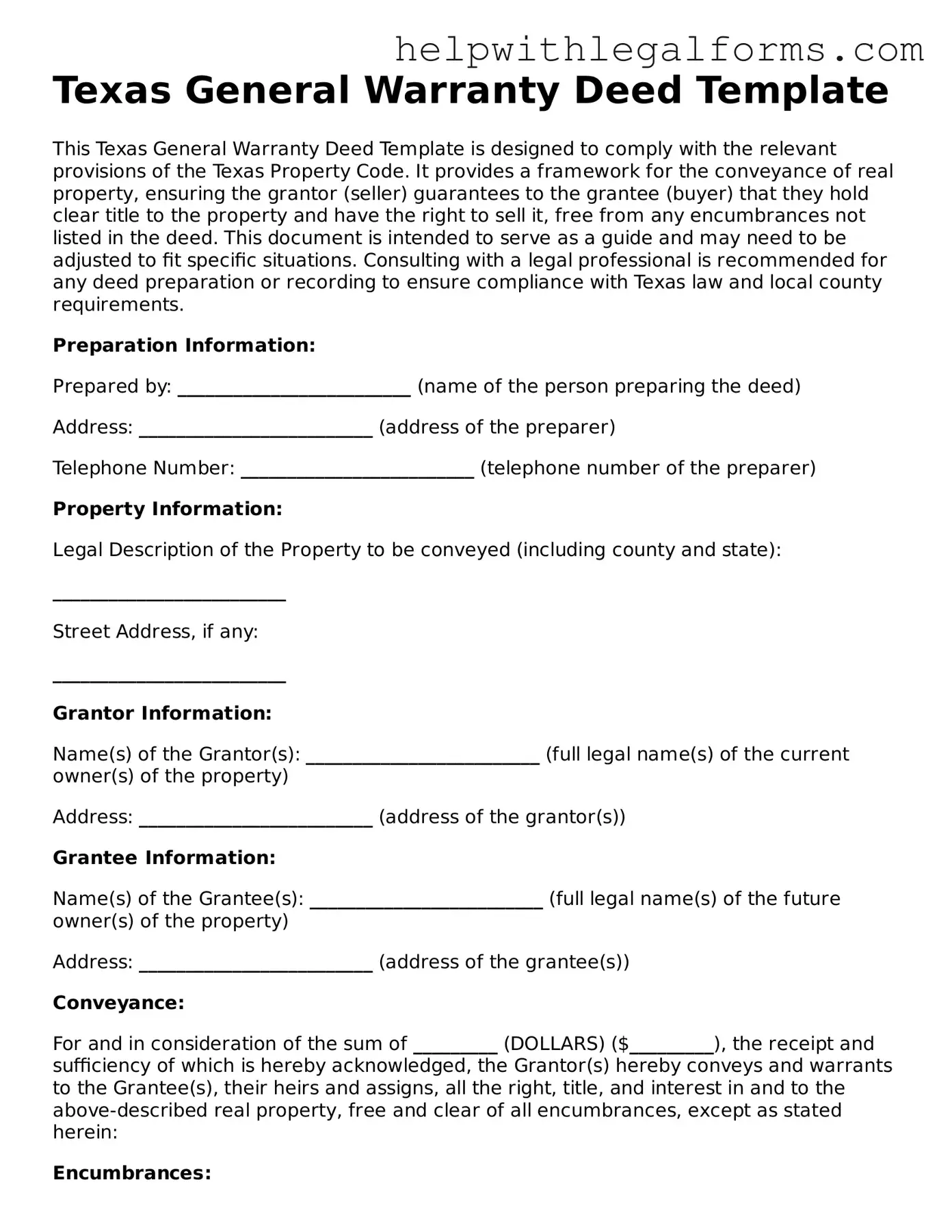

Example - Texas Deed Form

Texas General Warranty Deed Template

This Texas General Warranty Deed Template is designed to comply with the relevant provisions of the Texas Property Code. It provides a framework for the conveyance of real property, ensuring the grantor (seller) guarantees to the grantee (buyer) that they hold clear title to the property and have the right to sell it, free from any encumbrances not listed in the deed. This document is intended to serve as a guide and may need to be adjusted to fit specific situations. Consulting with a legal professional is recommended for any deed preparation or recording to ensure compliance with Texas law and local county requirements.

Preparation Information:

Prepared by: _________________________ (name of the person preparing the deed)

Address: _________________________ (address of the preparer)

Telephone Number: _________________________ (telephone number of the preparer)

Property Information:

Legal Description of the Property to be conveyed (including county and state):

_________________________

Street Address, if any:

_________________________

Grantor Information:

Name(s) of the Grantor(s): _________________________ (full legal name(s) of the current owner(s) of the property)

Address: _________________________ (address of the grantor(s))

Grantee Information:

Name(s) of the Grantee(s): _________________________ (full legal name(s) of the future owner(s) of the property)

Address: _________________________ (address of the grantee(s))

Conveyance:

For and in consideration of the sum of _________ (DOLLARS) ($_________), the receipt and sufficiency of which is hereby acknowledged, the Grantor(s) hereby conveys and warrants to the Grantee(s), their heirs and assigns, all the right, title, and interest in and to the above-described real property, free and clear of all encumbrances, except as stated herein:

Encumbrances:

List any easements, restrictions, or other encumbrances affecting the property:

_________________________

Signatures:

This document was signed on the ______ day of _______________, 20__.

Grantor(s) Signature(s): ___________________________________

Grantee(s) Signature(s): ___________________________________

Notarization:

This document was acknowledged before me on this ______ day of _______________, 20__, by ___________________________ (name of grantor(s)) and ___________________________ (name of grantee(s)).

Notary Public: ___________________________________

My Commission Expires: ___________________________________

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Purpose | The Texas Deed form is used for transferring ownership of property from one party to another in the state of Texas. |

| 2. Types | Common types include General Warranty, Special Warranty, and Quitclaim Deeds. |

| 3. Governing Law | They are governed by the Texas Property Code. |

| 4. Recording | Once signed and notarized, the deed must be recorded with the county clerk in the county where the property is located. |

| 5. Notarization | All Texas deeds must be notarized to be considered legal and valid. |

| 6. Witnesses | While notarization is mandatory, Texas law does not require witnesses for the deed to be valid. |

| 7. Consideration | The deed must state the consideration, or the value exchanged for the property, to be valid. |

Instructions on How to Fill Out Texas Deed

Filling out a deed form in Texas is an important step for anyone looking to legally transfer ownership of property from one person to another. This document serves as an official record of the change in ownership and ensures that the rights to the property are clearly defined and recognized by law. While the process may seem daunting at first, breaking it down into straightforward steps can make it manageable and stress-free. Here’s how to proceed with filling out your Texas deed form.

- Start by gathering all the necessary information about the property and the parties involved in the transfer. This includes the legal description of the property, the current owner's name(s), and the future owner's name(s).

- Obtain a blank Texas deed form. These forms can typically be found online or at your local county recorder's office.

- Fill in the date of the transfer at the top of the form. This is the date on which the property ownership is officially changing hands.

- Enter the grantor’s (current owner's) details, including full legal name and address, in the designated section. Be sure the information matches the public records exactly.

- Provide the grantee’s (new owner's) details, similar to the information provided for the grantor. Again, make sure these details are accurate and reflect the grantee's legal information.

- Include the legal description of the property. This might be a detailed description of the property boundaries and features or could reference a lot and block number if the property is in a platted subdivision. This information must be precise to ensure the correct property is transferred.

- If there is any consideration being paid for the property (e.g., money, another property, etc.), state this amount or value next to the corresponding section. This helps to document the economic terms of the property transfer.

- The grantor must sign and date the form in the presence of a notary public. The notary public will then fill their section, affixing their seal to the form, to notarize the grantor's signature.

- Check if your county requires any additional forms or documents to be submitted along with the deed. This might include a transfer tax form or a declaration of value.

- Submit the completed deed form to the county recorder's office in the county where the property is located, along with any required fees and supplementary documents. The office will record the deed, making the transfer of ownership official.

After you’ve submitted the deed form, the county recorder's office will process it and officially record the change in property ownership. This record is essential for establishing legal ownership and protecting your rights as the property owner. If you have any questions or concerns throughout this process, consider consulting with a legal professional who specializes in real estate transactions. They can offer guidance tailored to your specific situation and help you navigate any complexities you might encounter.

Crucial Points on This Form

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real estate from one party (the seller or "grantor") to another (the buyer or "grantee"). It is a critical document that must be filled out correctly, as it officially records the change of ownership in public records.

Are there different types of Deed forms in Texas?

Yes, in Texas, there are several types of Deed forms, each serving different purposes. The most common types include General Warranty Deeds, which provide the highest level of buyer protection, Special Warranty Deeds, which limit the warranty to the period of the grantor's ownership, and Quitclaim Deeds, which transfer only the grantor's interest in the property without any warranties.

What information is required on a Texas Deed form?

A Texas Deed form typically requires detailed information, including the legal description of the property, the names and addresses of both the grantor and grantee, the consideration (or purchase price), and any warranties or rights being transferred. It must also be signed by the grantor and notarized.

Do I need to hire a lawyer to prepare a Deed in Texas?

While it is not legally required to hire a lawyer to prepare a Deed in Texas, it is highly recommended. Real estate transactions can be complex, and a lawyer can ensure that the Deed complies with all legal requirements and accurately reflects the agreement between the parties.

How do I file a Texas Deed form?

Once completed and signed, a Texas Deed form must be filed with the County Clerk's Office in the county where the property is located. Filing fees vary by county, and the Deed becomes part of the public record once it is filed.

Can a Texas Deed form be changed or revoked once it's filed?

After a Texas Deed form is filed with the County Clerk's Office, it cannot be changed or revoked unless a new Deed is executed and filed. This process typically involves obtaining the consent of all parties involved and potentially undertaking a new transfer of ownership.

What are the consequences of not using a Texas Deed form?

Not using a Texas Deed form to document the transfer of property can lead to significant legal and financial complications. It may result in disputes over property ownership, difficulties in obtaining title insurance, and challenges in selling or mortgaging the property in the future.

Is it possible to prepare a Texas Deed form on my own?

While it is possible to prepare a Texas Deed form on your own, due to the legal complexities and the importance of ensuring the deed is correctly executed and filed, it is advisable to seek professional legal assistance. This helps to avoid any potential issues that could arise from errors or omissions in the document.

Common mistakes

-

Not verifying the legal description of the property. The most precise details are required. This includes lot, block, subdivision name, city, county, and state. Mistakes or omissions in this description can invalidate the deed.

-

Failing to use the correct deed type. Texas has several deed types, including general warranty, special warranty, and quitclaim deeds. The appropriate type must be used to match the intended legal effect and protection.

-

Omitting required signatures. Texas law mandates that all property owners sign the deed. If a property is owned jointly, missing any of the owners’ signatures could render the deed legally ineffective.

-

Not acknowledging the deed before a notary. The seller's signature must be notarized for the deed to be considered valid. A deed presented for recording without notarization will be rejected.

-

Incorrect or missing grantee information. The deed must clearly identify the person or entity to whom the property is being transferred. Errors in this section can lead to disputes or a faulty transfer of ownership.

-

Forgetting to include a preparer’s statement. Texas deeds require a statement indicating who prepared the document. Failure to include this information can lead to recording delays or rejection.

-

Failure to record the deed promptly. Not recording the deed with the county clerk’s office as soon as possible after execution leaves the transfer vulnerable to claims or liens against the seller that could affect the title.

-

Ignoring tax implications. Transferring property can affect property taxes and potentially trigger gift taxes. Not considering these implications can lead to unexpected costs.

-

Overlooking the need for legal advice. Completing a deed without consulting a legal professional can lead to mistakes regarding the deed's terms, the property description, or compliance with state laws. These errors can have significant legal consequences.

Documents used along the form

When dealing with property transactions in Texas, the deed form is a critical document that transfers property ownership from the seller to the buyer. However, to ensure a smooth, legally compliant transaction, various other forms and documents are often used in conjunction with the Texas Deed form. These documents play a vital role in clarifying terms, protecting the parties involved, and adhering to Texas state laws regarding property transactions.

- Title Insurance Commitment: This document offers a detailed report on the property’s title, listing any defects, liens, or encumbrances that could affect the buyer's ownership rights. It's a precursor to obtaining title insurance, which protects the buyer from future legal claims against the property's title.

- Bill of Sale: Although more commonly used in personal property transactions, a bill of sale sometimes accompanies the deed for the sale of the property's non-real estate assets. This could include appliances, furniture, or other personal property included in the property sale.

- Property Disclosure Statement: Sellers use this form to disclose any known defects or issues with the property. It’s a comprehensive account of the property’s condition, including problems with the foundation, roof, or any known hazardous conditions like lead paint.

- Loan Payoff Statement: If there’s an existing mortgage on the property, a loan payoff statement from the current lender is necessary. It details the outstanding balance on the seller’s mortgage that must be paid off at closing to transfer ownership free and clear of previous encumbrances.

- Closing Disclosure: For transactions involving a mortgage, the closing disclosure is crucial. It outlines the loan terms, projected monthly payments, and all fees and costs associated with the transaction. It's provided to the buyer for review before closing.

Together with the Texas Deed form, these documents form a comprehensive package that ensures the legality and transparency of the property transaction. They serve to protect the interests of both buyer and seller, while also meeting the regulatory requirements of the state of Texas. Understanding each document’s purpose and how it contributes to the transaction can help parties navigate the process more effectively.

Similar forms

Mortgage: A mortgage document is similar to a deed in that it represents a legal agreement concerning real estate. While a deed transfers property ownership between parties, a mortgage involves using the property as collateral for a loan. Both documents must be formally executed and typically filed with a local government or registry to be valid and enforceable.

Lease Agreement: Lease agreements, much like deeds, involve rights to a property. However, instead of transferring ownership like a deed, a lease agreement grants a tenant the right to use the property for a specified period in exchange for rent. Both documents outline the terms and conditions related to a specific property and require signatures from the parties involved.

Title: Though 'title' refers more to a concept than a document, it is intrinsically connected to deeds and the functions they serve. The title represents the legal right to own or use a property. A deed, when executed, transfers this title between parties. Essentially, the deed is the physical document that changes the titleholder in public records.

Bill of Sale: A bill of sale is akin to a deed in that it is a legal document facilitating the transfer of ownership, but it is typically used for personal property (such as vehicles or equipment) rather than real estate. Both a deed and a bill of sale need to include critical information about the parties involved and the item or property being transferred, along with signatures to verify the agreement.

Dos and Don'ts

When preparing a Texas Deed form, certain practices should be followed to ensure the document is valid and accurately reflects the transfer of property. Below is a guide outlining what you should and shouldn't do during this process:

Things You Should Do

- Verify the correct deed type for your situation. Texas recognizes several types of deeds, including general warranty, special warranty, and quitclaim deeds. Choose the one that best suits your circumstance.

- Ensure all parties' names are spelled correctly. The grantor (seller) and grantee (buyer) must be accurately identified to ensure the deed is legally binding.

- Include a complete and precise legal description of the property. This goes beyond the street address, encompassing the lot, block, subdivision name, city, county, and state where the property is located.

- Sign the deed in the presence of a notary public. Texas law requires deeds to be notarized to be valid.

- File the deed with the county clerk's office in the county where the property is located. This step is crucial for the deed to be considered valid and to put the public on notice of the change in ownership.

Things You Shouldn't Do

- Don't use unclear or vague language. The terms and conditions, as well as the property description, should be clear and unambiguous to prevent future disputes.

- Don't forget to check for any restrictions or covenants on the property. Ignoring these can lead to legal complications down the line.

- Don't neglect to keep a copy of the filed deed for your records. Having proof of ownership is essential for addressing any future property-related issues.

Misconceptions

When it comes to transferring property in Texas, the deed form is a crucial document. However, there are several common misconceptions about this form that can lead to confusion. By dispelling these myths, individuals can better understand the process and ensure their property transactions are handled correctly.

All deed forms in Texas are the same: This isn't true. Texas has various types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and providing different levels of protection to the buyer.

A deed must be notarized to be valid: While having a deed notarized is a common practice to validate the identities of the parties involved, Texas law mainly requires a deed to be delivered to and accepted by the grantee (recipient) to be considered legally effective.

Only a lawyer can prepare a deed: Technically, anyone can prepare a deed. However, understanding the legal requirements and ramifications of the specific deed being prepared is crucial. Therefore, consulting a legal professional is highly recommended to avoid mistakes.

Filing a deed with the county is optional: This misconception could lead to significant legal issues. In Texas, to effectively transfer real property and protect against claims from third parties, the deed must be recorded with the county clerk in the county where the property is located.

The terms "deed" and "title" are interchangeable: They are not. The deed is a physical document that conveys property from one party to another. Title, however, refers to the legal ownership of the property. While the deed is evidence of the transfer, holding the title means one has legal ownership.

You can transfer property to someone without their consent: Under Texas law, the grantee must accept the deed for the transfer to be valid. Consent is crucial, and the transfer of property without the recipient's agreement can be contested.

A quitclaim deed guarantees a clear title: This is a common misunderstanding. A quitclaim deed transfers any interest the grantor (the person selling or transferring the property) has in the property without any guarantee of clear title, leaving the grantee to accept the risk of title issues.

Handwritten changes on a deed are legally binding: Any changes made to a deed after it has been signed and notarized must be agreed upon by all parties involved and ideally, documented in a new deed. Handwritten modifications without proper legal formalities may not be enforceable.

Deeds are public records open to anyone: While recorded deeds are public records in Texas, accessing these documents may require payment of a fee or fulfillment of specific request procedures established by the county clerk’s office.

Understanding these misconceptions about Texas deed forms can help individuals navigate the complex world of real estate transactions more smoothly. It emphasizes the importance of due diligence and, often, the need for legal guidance in property dealings.

Key takeaways

Filling out and utilizing the Texas Deed form is a critical step in the process of transferring property ownership. It is vital to approach this process with careful attention to detail to ensure the transfer is executed correctly and legally. Below are four key takeaways to help guide individuals through this process.

- Accuracy is crucial: It is important to ensure that all information on the Texas Deed form is accurate. This includes the legal description of the property, the correct names of the grantor (seller) and grantee (buyer), and the date of the transaction. Incorrect information can lead to disputes or issues with the property title down the line.

- Understand the different types of deeds: Texas law recognizes several types of deeds, each serving different purposes and providing different levels of protection to the buyer. Common types include the General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. Choosing the right one depends on the situation and the level of risk the buyer is willing to assume.

- Notarization is required: For a Texas Deed to be considered valid and legally binding, it must be signed by the grantor in the presence of a Notary Public. This step is essential for the document to be recorded with the county clerk, which is necessary for the official transfer of property.

- Recording the deed: After the deed is properly filled out, signed, and notarized, it must be filed with the appropriate county clerk’s office. Recording the deed with the county provides public notice of the new ownership and is crucial for protecting the grantee’s rights to the property.

Attending to these key points can markedly smooth the process of transferring property in Texas, ensuring that all legal requirements are met and helping to secure the rights of all parties involved.

Create Other Deed Forms for US States

Maryland Deed Form - This document acts as the official record in a real estate transaction, marking the moment a property changes hands.

Warranty Deed Form - A properly executed deed form offers peace of mind that the property transfer is legally sound.

Quit Claim Deed Form Georgia - Legal advisors often recommend reviewing a recorded deed form to ensure accuracy and completeness after it has been filed.

Property Deed Form - Ensures that property transfers are conducted fairly and legally.