Legal Transfer-on-Death Deed Form

Planning for the future, especially when it involves one's own passing, can be a challenging but essential task. Among the various tools available for estate planning, the Transfer-on-Death (TOD) Deed form stands out as a powerful instrument. This form enables property owners to designate beneficiaries who will inherit their real estate without the need for probate, a legal process often seen as lengthy and costly. The beauty of a TOD Deed lies in its simplicity and the peace of mind it offers, allowing individuals to retain complete control over their property while they are alive. Upon the owner's death, the property is transferred swiftly to the named beneficiaries, bypassing the complexities of probate. This direct transfer not only simplifies the transition of ownership but also helps to ensure that the property goes to the intended persons. It's crucial, however, for property owners to understand the specific legal requirements and implications of executing a TOD Deed, as these can vary significantly from one jurisdiction to another. Despite its benefits, the decision to use a TOD Deed should be made as part of a comprehensive estate planning strategy, taking into account the owner's unique circumstances and goals.

State-specific Transfer-on-Death Deed Forms

Example - Transfer-on-Death Deed Form

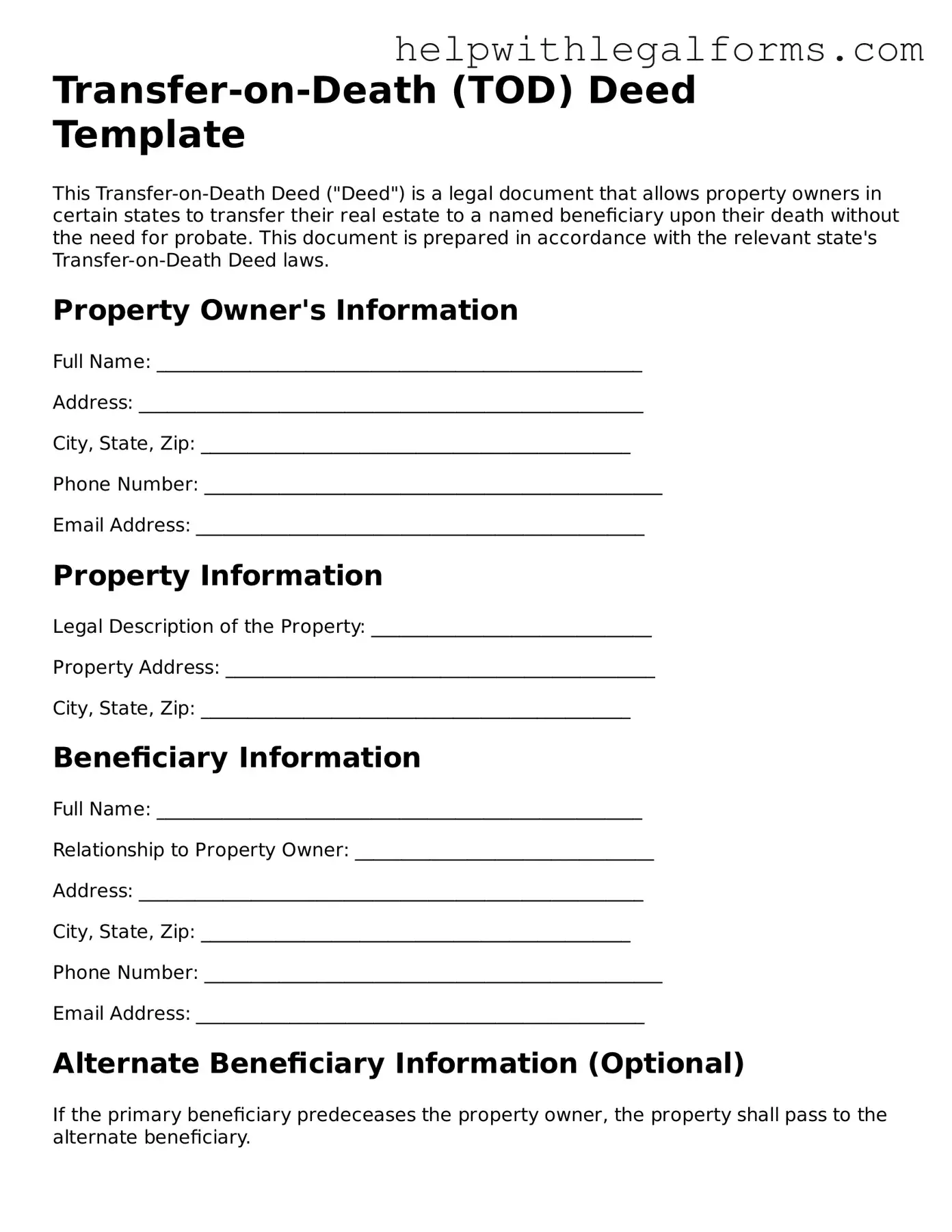

Transfer-on-Death (TOD) Deed Template

This Transfer-on-Death Deed ("Deed") is a legal document that allows property owners in certain states to transfer their real estate to a named beneficiary upon their death without the need for probate. This document is prepared in accordance with the relevant state's Transfer-on-Death Deed laws.

Property Owner's Information

Full Name: ____________________________________________________

Address: ______________________________________________________

City, State, Zip: ______________________________________________

Phone Number: _________________________________________________

Email Address: ________________________________________________

Property Information

Legal Description of the Property: ______________________________

Property Address: ______________________________________________

City, State, Zip: ______________________________________________

Beneficiary Information

Full Name: ____________________________________________________

Relationship to Property Owner: ________________________________

Address: ______________________________________________________

City, State, Zip: ______________________________________________

Phone Number: _________________________________________________

Email Address: ________________________________________________

Alternate Beneficiary Information (Optional)

If the primary beneficiary predeceases the property owner, the property shall pass to the alternate beneficiary.

Full Name: ____________________________________________________

Relationship to Property Owner: ________________________________

Address: ______________________________________________________

City, State, Zip: ______________________________________________

Phone Number: _________________________________________________

Email Address: ________________________________________________

Terms and Conditions

This Deed is executed in accordance with the laws of the state where the property is located and is subject to the following terms and conditions:

- The property owner retains the right to use, sell, or mortgage the property during their lifetime without consent from the beneficiary.

- This Deed does not take effect until the death of the property owner.

- The property owner may revoke this Deed at any time prior to their death.

- The transfer of property through this Deed is subject to existing liens and encumbrances on the property.

Signatures

This Deed must be signed in the presence of a notary public and, depending on the state, may require witnesses.

Property Owner's Signature: ______________________________ Date: ____________

Notary Public's Signature: _______________________________ Date: ____________

Seal:

Recordation

For this Deed to be effective, it must be recorded with the county recorder's office in the county where the property is located before the property owner's death.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Transfer-on-Death (TOD) Deed allows homeowners to pass on their property directly to a beneficiary without going through probate upon their death. |

| Revocability | The owner retains the right to revoke or change the beneficiary on the TOD Deed at any time before their death. |

| Beneficiary Requirements | The designated beneficiary must survive the owner to inherit the property, and there can be multiple beneficiaries. |

| Governing Law | Each state has its own statutes governing Transfer-on-Death Deeds, making it crucial for property owners to comply with their specific state's legal requirements. |

Instructions on How to Fill Out Transfer-on-Death Deed

Filling out a Transfer-on-Death (TOD) Deed form is a critical step for property owners who wish to pass on their real estate without the complexities of probate. This process, while straightforward, requires attention to detail to ensure that all information is accurate and complete. The form allows property owners to designate one or more beneficiaries who will inherit the property upon the owner's demise. The following steps are designed to guide you through this process smoothly, ensuring that your wishes are clearly documented and legally binding.

- Begin by locating the current deed to the property. This document contains essential information that you will need to reference, such as the precise legal description of the property.

- Enter the full legal name(s) of the current owner(s) as they appear on the existing deed. If the property is owned jointly, include all names, ensuring they are spelled correctly.

- Specify the address of the property, including city, county, and state, to avoid any confusion about the property being transferred.

- List the full legal name(s) of the beneficiary(ies) who will inherit the property. Double-check the spelling of all names to prevent potential disputes or confusion in the future.

- Include a detailed legal description of the property as it appears on the current deed. This may include lot numbers, subdivision names, and the block and section, if applicable. Avoid using informal descriptions.

- If applicable, specify any conditions under which the transfer is to occur. This step is rarely used but could be essential depending on specific wishes or circumstances.

- Review the form thoroughly to ensure all information is accurate and complete. Any errors could lead to complications in transferring the property later on.

- Sign and date the form in the presence of a notary public. The notarization process is crucial as it validates the document, making it legally binding.

- File the completed and notarized form with the county recorder’s office or the appropriate government entity that handles property records in the jurisdiction where the property is located. A recording fee may apply.

Once the form is correctly filled out, signed, notarized, and filed, the property will pass directly to the named beneficiary(ies) upon the death of the owner(s) without the need for probate. This process not only simplifies the transfer of property but also provides peace of mind, knowing that your real estate will be passed on according to your wishes. Bear in mind the importance of keeping the document in a safe place and informing the beneficiaries about the TOD deed to avoid any surprises.

Crucial Points on This Form

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners to name a beneficiary who will inherit their property without the need for the property to go through probate. This deed becomes effective upon the death of the property owner.

How does a Transfer-on-Death Deed differ from a traditional will?

Unlike a traditional will, a Transfer-on-Death Deed is a non-probate instrument that directly transfers ownership of real property to a designated beneficiary upon death, bypassing the lengthy and potentially costly probate process. While a will can distribute various assets, a TODD specifically deals with real property.

Who can use a Transfer-on-Death Deed?

Most property owners can use a Transfer-on-Death Deed, but it's important to check the laws in your specific state since not all states recognize TODDs. Property owners should also be of sound mind and legal age to execute this document.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time by the property owner before their death. Revocation can be done in several ways, including executing a new TODD that names a different beneficiary or explicitly revokes the previous deed, or by transferring the property to someone else during the owner's lifetime.

What happens if the beneficiary predeceases the property owner?

If the named beneficiary predeceases the property owner, the Transfer-on-Death Deed typically becomes void. The property owner should then execute a new TODD to designate a different beneficiary. Without a valid TODD or other estate planning in place, the property may have to go through probate.

Is a Transfer-on-Death Deed subject to any debts or mortgages on the property?

Yes, inheriting property through a Transfer-on-Death Deed does not eliminate any existing debts or mortgages on the property. The beneficiary will inherit the property subject to these encumbrances.

Do beneficiaries need to take action to accept the property?

Beneficiaries typically need to take certain actions to formally accept the property, such as filing a claim or notice with the local county or court. The specific requirements can vary by state, so beneficiaries should consult local laws or an attorney.

How is a Transfer-on-Death Deed executed?

To execute a Transfer-on-Death Deed, the property owner must complete the TODD form, sign it in the presence of a notary, and record it with the county recorder's office where the property is located. The requirements for executing a TODD can vary by state.

Can a property with a Transfer-on-Death Deed be sold?

Yes, a property owner can sell the property even if a Transfer-on-Death Deed has been recorded. Executing a TODD does not restrict the owner's right to use, sell, or otherwise deal with the property during their lifetime.

What are the potential drawbacks of using a Transfer-on-Death Deed?

While a Transfer-on-Death Deed can offer a simple way to avoid probate for real property, there are potential drawbacks, such as difficulties in revoking the deed if the witnesses or notary are not available, challenges by other potential heirs, and lack of flexibility compared to other estate planning tools. Additionally, TODDs may not be the best option for those wishing to leave property to minors, as the property cannot be directly managed on their behalf without a guardian or trust.

Common mistakes

-

Not Verifying State Requirements: Each state has its own rules regarding Transfer-on-Death (TOD) Deeds. People often make the mistake of not checking their state’s specific requirements, which can lead to their TOD Deed being invalid.

-

Incorrect Property Description: Providing an incomplete or inaccurate legal description of the property can cause serious issues. It's essential to use the exact legal description from the current deed to prevent disputes or confusion after the owner’s passing.

-

Failing to Name an Alternate Beneficiary: If the primary beneficiary predeceases the owner and an alternate is not named, the property could end up going through probate, which defeats the purpose of a TOD Deed.

-

Assuming All Property Can Be Transferred: Some types of property, such as jointly owned property or property with existing liens, may have restrictions or complications when using a TOD Deed.

-

Not Having the Deed Properly Witnessed or Notarized: Failing to comply with witnessing and notarization requirements can render the deed void. Requirements vary by state, so it’s crucial to ensure all legal formalities are correctly followed.

-

Forgetting to File the Deed Before Passing: A TOD Deed must be filed with the local county office before the owner’s death to be effective. Unrecorded deeds may not be enforceable.

-

Misunderstanding the Impact on Mortgages or Other Liens: Many people wrongly assume that transferring property through a TOD Deed will erase mortgages or other liens. Beneficiaries inherit the property with any attached debts.

-

Ignoring Potential Conflicts with Wills or Other Estate Planning Tools: A TOD Deed can override provisions in a will concerning the same piece of property, leading to unintended consequences and disputes among heirs.

-

Lack of Coordination with Overall Estate Plan: Individuals sometimes fail to consider how a TOD Deed fits into their broader estate plan, possibly creating discrepancies or conflicts with their ultimate wishes for asset distribution.

When filling out a Transfer-on-Death Deed form, it's crucial to avoid these common mistakes to ensure the property transfers according to the owner's wishes without unnecessary legal complications.

Documents used along the form

When managing one's estate, a Transfer-on-Death (TOD) Deed form is an essential document that allows property to be passed directly to a designated beneficiary without going through probate. However, it is often not the only document needed to ensure a comprehensive estate plan. Several other forms and documents frequently accompany the TOD Deed to create a full scope of legal and financial directives, safeguarding an individual's wishes and providing clarity for survivors. The following is a list of documents that are commonly used alongside the TOD Deed form.

- Last Will and Testament - Specifies how an individual's assets and responsibilities are to be distributed and handled after their death. It can encompass assets not covered by the TOD Deed.

- Durable Power of Attorney - Grants someone the authority to make legal and financial decisions on an individual's behalf should they become unable to do so.

- Medical Power of Attorney - Appoints a trusted person to make healthcare decisions for an individual if they become incapacitated.

- Living Will - Outlines an individual's wishes regarding medical treatments and life-sustaining measures in the event they can no longer communicate their decisions due to illness or incapacity.

- Revocable Living Trust - Allows an individual to retain control over their assets while living but ensures that those assets are transferred to designated beneficiaries upon their death, potentially bypassing probate.

- Beneficiary Designations - Forms that designate beneficiaries for specific assets like retirement accounts and life insurance policies, which are not covered by a will or TOD Deed.

- Letter of Intent - A document that provides additional instructions and wishes that are not legally binding but can guide executors and beneficiaries.

- Document Organizer - While not a form itself, a comprehensive organizer that includes locations and access information for all important documents, accounts, and digital assets can be invaluable after an individual's death.

Arranging these documents in conjunction with a Transfer-on-Death Deed ensures an estate plan is robust and can effectively communicate an individual's wishes regarding their assets and healthcare. They are integral to a thorough estate planning process, providing peace of mind to both the individual and their loved ones. It's important for individuals to consult legal professionals when preparing these documents to make sure they align with current laws and personal circumstances.

Similar forms

A Living Trust: Similar to a Transfer-on-Death (TOD) Deed, a Living Trust allows individuals to designate beneficiaries who will inherit their assets upon their death. Both tools enable the transfer of assets without the necessity of going through probate court. However, a Living Trust is a more comprehensive document that can include a variety of assets and provide more detailed instructions for the distribution of those assets.

A Beneficiary Designation Form: Often used with retirement accounts and life insurance policies, Beneficiary Designation Forms directly name one or more beneficiaries to receive the assets upon the account holder's death. Like a TOD Deed, these forms permit the transfer of assets directly to beneficiaries, bypassing the probate process. The main difference lies in the type of assets they cover; TOD Deeds typically relate to real property, whereas beneficiary designations commonly apply to financial accounts and insurance proceeds.

A Joint Tenancy With Right of Survivorship (JTWROS): This form of property ownership involves two or more people owning property together. Upon the death of one owner, their interest in the property automatically transfers to the surviving owner(s), similar to how a TOD Deed operates. However, unlike a TOD Deed—which only takes effect upon death—Joint Tenancy affects the rights of ownership immediately upon creation.

A Payable-on-Death (POD) Account: Also designed to avoid probate, POD accounts transition financial assets to a named beneficiary upon the account holder's death. This mechanism is akin to a TOD Deed in spirit, as both are designed to facilitate a smooth transfer of assets upon the passing of the owner. However, while a TOD Deed pertains to real estate, POD accounts primarily deal with bank and investment accounts.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's essential to pay close attention to the details to ensure that your real estate transfers smoothly to your designated beneficiaries upon your passing. Below are some vital dos and don'ts to remember:

- Do double-check the legal description of the property. Ensuring the description is accurate will help prevent any disputes or confusion regarding what property is being transferred.

- Do clearly list the beneficiary or beneficiaries who will receive the property. If you're naming multiple beneficiaries, specify their shares clearly to avoid potential conflicts.

- Do sign and date the form in the presence of a notary public. This step is crucial for the document to be legally binding.

- Do keep a copy of the completed form in a safe place, and let your beneficiaries know where to find it.

- Do record the deed with the county recorder's office where the property is located. This makes the transfer-on-death deed a matter of public record.

- Don't leave any sections blank. Incomplete forms can lead to unnecessary legal complications after your passing.

- Don't forget to consult with a legal professional if you have any doubts. Understanding the implications of the form for your estate plan is vital.

- Don't use this form to transfer property held in joint tenancy or as community property with the right of survivorship unless you've consulted an attorney.

- Don't neglect to update the form if your intended beneficiaries change. Life changes such as marriage, divorce, or the death of a beneficiary should prompt a review of your estate documents.

Misconceptions

Transfer-on-Death (TOD) Deeds can be a useful estate planning tool, allowing homeowners to pass their property directly to a beneficiary without the need for probate. However, there are several misconceptions about TOD Deeds that can lead to confusion. Here are four common ones:

- It overrides a will: Many believe that a TOD Deed can override the stipulations of a will regarding property distribution. In reality, a TOD Deed takes precedence over a will. This means that the property will transfer to the beneficiary named in the TOD Deed, regardless of what the will states.

- It avoids all taxes: Another misconception is that a TOD Deed allows the beneficiary to avoid paying taxes on the property. While it can help avoid probate, the beneficiary may still be responsible for state inheritance taxes and federal taxes, depending on the value of the property and the laws in place.

- It's irrevocable: Some believe that once a TOD Deed is signed, it cannot be changed or canceled. However, the property owner can revoke a TOD Deed or change the beneficiary at any time before their death, as long as they follow the legal requirements to do so.

- It transfers the property immediately upon death: While it's true that the property is meant to transfer to the beneficiary without probate, the transfer is not always immediate. The beneficiary must often take steps to legally claim the property, which may include filing the death certificate and a claim form with the relevant local authority.

Key takeaways

When considering the use of a Transfer-on-Death (TOD) Deed to handle the distribution of real property upon one's passing, several key takeaways can guide individuals through this process efficiently and effectively. The TOD Deed is a legal document that allows property owners to name beneficiaries who will receive the property without the need for probate court proceedings, making it an attractive estate planning tool.

Understand state laws: Before using a TOD Deed, it's crucial to confirm that they are recognized and permitted in the state where the property is located. Not all states allow for the use of TOD Deeds, and the requirements can vary significantly where they are allowed.

Clearly identify the property: On the TOD Deed form, the real property must be described with precision. This typically means including the address, legal description, and any other information required to ensure there are no misunderstandings about which property is being referred to.

Designate beneficiaries carefully: When filling out the TOD Deed, naming one or more beneficiaries who will inherit the property is necessary. Choices should be considered carefully, understanding that these individuals or entities will receive the property directly upon the owner's death.

Witnesses and notarization: After the TOD Deed is completed, most states require the signature of the property owner to be witnessed and the document to be notarized to be legally valid. The specifics, including how many witnesses are needed, can vary by state.

File the deed with the county recorder: To be effective, the TOD Deed must be filed with the county recorder's office (or similar entity) in the county where the property is located. This usually involves a filing fee and the submission of the original, notarized document.

Revocability: A key feature of TOD Deeds is their revocability. The property owner can change their mind at any time before their death, revoking the deed or changing beneficiaries through a new deed or a formal revocation document.

Does not avoid taxes: While a TOD Deed simplifies the transfer of property ownership after death and avoids probate, it doesn't protect against estate taxes or absolve the property from being considered in the determination of federal estate taxes.

Consult with professionals: Given the legal complexities and potential implications for estate planning, consulting with real estate or estate planning professionals before executing a TOD Deed is wise. They can provide personalized advice and ensure that the deed complements other estate plans.

Taking these considerations into account helps to ensure that the Transfer-on-Death Deed achieves the intended outcomes, facilitating a smoother transition of property to the designated beneficiaries while minimizing legal challenges and complications.

Discover Other Types of Transfer-on-Death Deed Documents

Deed of Trust Form - Clarifies rights and responsibilities regarding property use, ensuring that the property is not misused or devalued during the loan term.