Blank Transfer-on-Death Deed Form for California

In the realm of estate planning, California residents have a valuable tool at their disposal: the Transfer-on-Death (TOD) Deed form. This legal document allows property owners to designate a beneficiary who will inherit their real estate upon the owner's passing without the need for the property to go through probate. This straightforward mechanism is part of a broader strategy to streamline the transfer of assets, ensuring a smooth transition of ownership while minimizing the time and expense typically associated with the probate process. By completing the TOD Deed, individuals can ensure their real estate is transferred directly to the named beneficiary, bypassing the often complex and lengthy probate court proceedings. It's crucial for property owners to understand that this form must be properly completed, signed, notarized, and recorded with the county recorder's office before the owner's death to be effective. Additionally, the form allows for a non-probate transfer of property, which can be particularly beneficial for small estates and serves as an efficient tool within a comprehensive estate planning strategy.

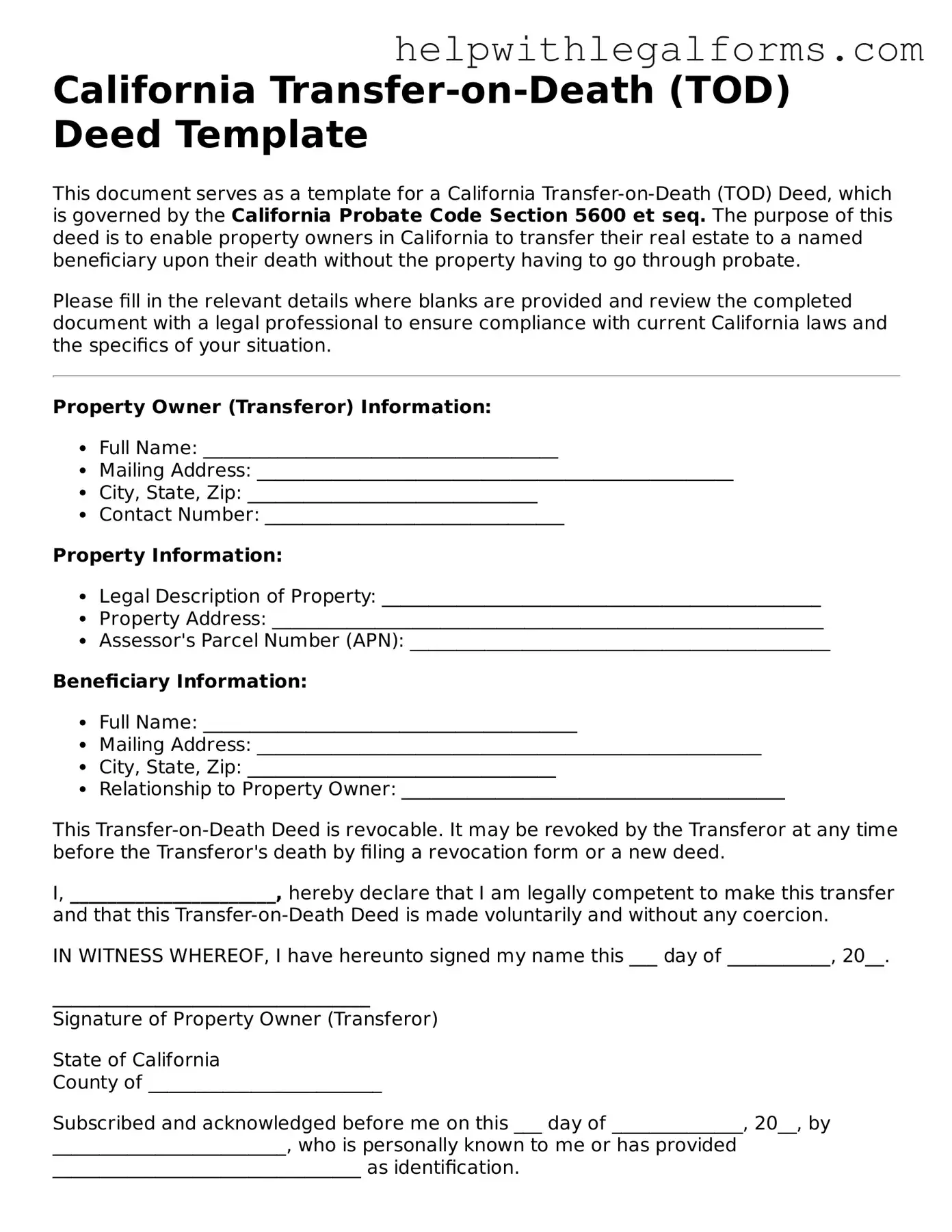

Example - California Transfer-on-Death Deed Form

California Transfer-on-Death (TOD) Deed Template

This document serves as a template for a California Transfer-on-Death (TOD) Deed, which is governed by the California Probate Code Section 5600 et seq. The purpose of this deed is to enable property owners in California to transfer their real estate to a named beneficiary upon their death without the property having to go through probate.

Please fill in the relevant details where blanks are provided and review the completed document with a legal professional to ensure compliance with current California laws and the specifics of your situation.

Property Owner (Transferor) Information:

- Full Name: ______________________________________

- Mailing Address: ___________________________________________________

- City, State, Zip: _______________________________

- Contact Number: ________________________________

Property Information:

- Legal Description of Property: _______________________________________________

- Property Address: ___________________________________________________________

- Assessor's Parcel Number (APN): _____________________________________________

Beneficiary Information:

- Full Name: ________________________________________

- Mailing Address: ______________________________________________________

- City, State, Zip: _________________________________

- Relationship to Property Owner: _________________________________________

This Transfer-on-Death Deed is revocable. It may be revoked by the Transferor at any time before the Transferor's death by filing a revocation form or a new deed.

I, ______________________, hereby declare that I am legally competent to make this transfer and that this Transfer-on-Death Deed is made voluntarily and without any coercion.

IN WITNESS WHEREOF, I have hereunto signed my name this ___ day of ___________, 20__.

__________________________________

Signature of Property Owner (Transferor)

State of California

County of _________________________

Subscribed and acknowledged before me on this ___ day of ______________, 20__, by _________________________, who is personally known to me or has provided _________________________________ as identification.

__________________________________

Signature of Notary Public

My commission expires: _______________

Including a Transfer-on-Death Deed as part of your estate planning can allow your loved ones to avoid the lengthy and costly probate process. Nonetheless, it's vital to consult with a qualified attorney to ensure this document fulfills your intentions and complies with the law.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Legal Basis | The California Transfer-on-Death (TOD) Deed is governed by California Probate Code sections 5600-5696. |

| Eligible Property Types | This deed can be used for residential properties with one to four dwelling units, a condominium unit, or agricultural land of 40 acres or less with a single-family residence. |

| Revocability | The Transfer-on-Death Deed is revocable at any time by the owner until the owner's death. |

| Bypasses Probate | Property transferred using a TOD deed bypasses probate, allowing for a quicker transfer to beneficiaries upon the owner's death. |

| Beneficiary Designation | Owners can designate one or more beneficiaries, including individuals, trusts, or organizations, to receive the property. |

| Witness and Notarization Requirement | The deed must be signed by the owner and notarized to be effective. Witness signatures are not required. |

| Recording Requirement | To be valid upon the owner's death, the TOD deed must be recorded with the county recorder's office before the owner passes away. |

Instructions on How to Fill Out California Transfer-on-Death Deed

When preparing to transfer property upon one's passing without the complexities of a will or the probate process, a Transfer-on-Death (TOD) Deed can be a streamlined option. Completing the California Transfer-on-Death Deed requires attention to detail and understanding the steps necessary to ensure the deed is legally binding. Once executed, the deed allows for the direct transfer of the described real property to the designated beneficiary upon the death of the property owner. Below is a guide to properly filling out the California Transfer-on-Death Deed form.

- Begin by locating the most current version of the California Transfer-on-Death Deed form. This can typically be found on the California State government's official website or at a local office that handles real estate records.

- Print the form legibly in ink or type the information to avoid any misunderstandings or legal complications after submission.

- Enter the full legal name(s) of the current property owner(s) in the section designated for the grantor(s). Ensure the name(s) match exactly as it appears on the current deed or real property record.

- Clearly identify the legal description of the real property being transferred. This information can usually be obtained from the current deed or by contacting the county recorder's office. The legal description may include a lot number, subdivision name, and other details that distinguish it from other properties.

- Provide the full legal name(s) of the beneficiary(ies) who will receive the property upon the death of the owner(s). It is important to spell all names correctly to prevent any future disputes or confusion.

- Include any specific conditions or stipulations that govern the transfer of the property. However, keep in mind that the TOD deed cannot impose obligations on the beneficiary beyond accepting the property.

- Review the completed form to ensure all provided information is accurate and complete. Any errors or omissions could invalidate the deed or cause delays in the transfer process.

- Have the form notarized. The property owner(s) must sign the deed in the presence of a notary public to authenticate their identity and their intention to execute the deed.

- File the completed and notarized Transfer-on-Death Deed form with the county recorder’s office where the real property is located. There may be a filing fee, which varies by county.

- Keep a copy of the filed deed for personal records and provide a copy to the beneficiary(ies) so they are aware of the property transfer upon the owner’s death.

Completing and filing a Transfer-on-Death Deed is a significant step that allows property owners to pass on their real estate to a designated person without the property having to go through probate. By following these steps, property owners can ensure their wishes are honored, and their beneficiaries can receive their inheritance in a more direct and streamlined manner.

Crucial Points on This Form

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death (TOD) Deed, also known as a beneficiary deed, is a legal document that allows property owners in California to transfer their real estate to a beneficiary upon their death, without the need for the property to go through probate. This deed must be properly filled out, notarized, and recorded before the owner’s death to be effective.

Who can use a Transfer-on-Death Deed?

Almost any owner of residential real property in California can use a TOD Deed. This includes owners of single-family homes, condominiums, and certain types of mobile homes. It's important for the property owner to have the legal capacity to make decisions and to understand the implications of signing a TOD Deed.

How can one revoke a Transfer-on-Death Deed?

A Transfer-on-Death Deed can be revoked at any time before the property owner's death. There are a few ways to do this: by completing and notarizing a formal revocation form, by creating a new TOD Deed that states the previous one is revoked, or by selling the property. Like the original deed, the revocation must be filed with the county recorder to be effective.

Does a Transfer-on-Death Deed avoid inheritance taxes?

While a TOD Deed allows the property to avoid probate, it does not necessarily avoid inheritance or estate taxes. The value of the property transferred might still be subject to state or federal taxes. Property owners should consult with a financial advisor or an estate planning attorney to understand the tax implications.

What happens to a mortgage on the property when using a Transfer-on-Death Deed?

When property is transferred using a TOD Deed, any existing mortgages or debts tied to the property also transfer to the beneficiary. The beneficiary becomes responsible for the remaining mortgage balance upon the owner's death. It's crucial for both the property owner and the beneficiary to understand the financial responsibilities that come with the transfer.

Common mistakes

In the state of California, the Transfer-on-Death (TOD) deed allows property owners to name a beneficiary who will obtain the property without the need for a probate process upon the death of the owner. However, when completing this form, individuals commonly make several mistakes that can lead to unexpected outcomes or the invalidation of the deed. Understanding these errors can help property owners ensure their intentions are clearly and effectively documented.

-

Not Adequately Identifying the Property

One common mistake is failing to adequately describe the property. The deed must include a clear and precise description that identifies the property being transferred. This includes not only the address but also the legal description, which may entail lot numbers or other details found in property records. When this information is incomplete or inaccurate, it can lead to disputes or challenges regarding the rightful beneficiary.

-

Improperly Signing or Notarizing the Document

A properly executed deed is crucial. This requires the property owner's signature to be notarized in accordance with California law. Any errors in the signing or notarization process, such as missing signatures or incorrect information about the notary public, can render the deed void and ineffective. It's essential to follow every step carefully to ensure the document is legally binding.

-

Naming an Incapacitated or Minor Beneficiary Without Appropriate Arrangements

When a beneficiary is named, the owner must consider the beneficiary's ability to own property. Naming a minor or an incapacitated person without making appropriate legal arrangements—such as establishing a trust or naming a legal guardian to manage the property—can complicate or invalidate the transfer. Appropriate planning is necessary to ensure the property can be managed and transferred according to the owner's wishes.

-

Not Updating the Deed as Circumstances Change

Life changes, such as marriage, divorce, or the death of a named beneficiary, can impact the effectiveness of a TOD deed. Property owners often overlook the need to update the deed when their circumstances or intentions change. Regularly reviewing and, if necessary, amending the deed ensures that the document reflects the owner's current wishes and circumstances.

-

Failing to Consider the Impact on Estate Planning

A TOD deed is a powerful tool, but it must align with the owner's broader estate plan. Sometimes, individuals fail to consider how this deed interacts with wills, trusts, and other estate planning documents. This oversight can lead to unintended consequences, such as unequal distributions among heirs or conflicts that require legal intervention to resolve.

In summary, when completing a California Transfer-on-Death Deed, property owners must pay close attention to detail and consider how the deed fits into their overall estate planning strategy. Avoiding common mistakes ensures that the property is transferred smoothly and according to the owner's wishes, minimizing potential disputes and legal complications.

Documents used along the form

When managing one's estate planning goals, particularly in California, the Transfer-on-Death (TOD) Deed form is a crucial tool for passing on property without going through the process of probate. However, utilizing just the TOD Deed form often isn't enough to fully address all the legal and logistical aspects of a well-rounded estate plan. To ensure one's wishes are honored in full, there are several other forms and documents that typically complement the TOD Deed. Each of these serves a unique purpose, contributing to the ease of transferring assets and handling matters after one's passing.

- Advanced Healthcare Directive: This document allows individuals to outline their preferences for medical care and appoint someone to make healthcare decisions on their behalf if they are unable to do so. This can be critical in ensuring that one's health care wishes are followed, particularly in situations where they're unable to communicate their desires.

- Financial Power of Attorney: This legal document grants a trusted individual the authority to handle financial matters for the person creating the document, should they become incapacitated. This can cover a wide range of tasks from paying bills, managing investments, and even selling property, ensuring that financial matters are taken care of in line with the principal's wishes.

- Will: Even with a TOD Deed in place, having a will is important. It addresses assets not covered by the TOD deed. Wills can outline the distribution of personal property, name guardians for minor children, and sometimes, even specify funeral wishes. This document ensures that all assets are distributed according to the deceased's wishes and can help avoid potential conflicts among beneficiaries.

- Living Trust: A living trust can be used in conjunction with a TOD deed to manage and distribute a person's assets efficiently, avoiding probate for virtually all assets. It allows for more comprehensive control over the distribution of assets than a TOD Deed alone and can provide clear directions on managing the person's estate.

While the California Transfer-on-Death Deed form stands as a significant document for transferring real estate without probate, knowledgeable integration with other legal documents can provide a full spectrum of control over your estate plans. This holistic approach ensures your wishes are honored thoroughly and efficiently, covering aspects beyond mere asset transfer to include healthcare decisions, financial management, and caretaking of minors or dependents. Utilizing these documents in concert can bring peace of mind to you and your loved ones, knowing that every detail has been addressed.

Similar forms

Last Will and Testament: This document, like a Transfer-on-Death Deed, allows individuals to dictate how their assets should be distributed upon their death. Both outline the transfer of assets to designated beneficiaries, but a Last Will covers a broader range of assets, whereas a Transfer-on-Death Deed is specific to real property.

Beneficiary Deeds: Similar to Transfer-on-Death Deeds, Beneficiary Deeds allow property owners to name beneficiaries for their real estate that will inherit the property upon the owner’s death, avoiding probate. The main similarity is in the direct transfer to a beneficiary without the need for probate proceedings.

Payable-on-Death (POD) Accounts: These are bank or investment accounts that name a beneficiary who will receive the assets in the account when the account owner dies. Like Transfer-on-Death Deeds, POD accounts bypass the probate process and directly transfer assets to the beneficiaries.

Transfer-on-Death (TOD) Designations for Securities: This allows individuals to name beneficiaries for their stocks, bonds, or brokerage accounts. Much like Transfer-on-Death Deeds for real estate, TOD designations ensure these assets transfer directly to the beneficiaries upon the owner's death, avoiding probate.

Life Insurance Policies: While not a deed or account, life insurance policies designate beneficiaries who will receive the policy's payout upon the policyholder's death, which is similar to how Transfer-on-Death Deeds work by naming a beneficiary for property. Both bypass the probate process.

Living Trusts: These allow individuals to place assets in a trust for the benefit of beneficiaries, with the assets being distributed according to the terms of the trust upon the individual's death. Living Trusts and Transfer-on-Death Deeds both help avoid probate, but a living trust can encompass a wide range of assets beyond real property.

Joint Tenancy with Right of Survivorship: This form of co-ownership allows property to pass automatically to the surviving co-owners upon one’s death, circumventing the probate process. Like Transfer-on-Death Deeds, it facilitates the direct transfer of property but involves ownership shared between two or more people during their lifetimes.

Community Property with Right of Survivorship: In states recognizing community property, this designation allows spouses to co-own property so that upon the death of one spouse, the property automatically transfers to the surviving spouse, much like a Transfer-on-Death Deed, but exclusively designed for married couples.

Tenancy by the Entirety: Available only to married couples in certain states, it is similar to joint tenancy but provides additional protections against creditors. Like a Transfer-on-Death Deed, it allows property to bypass probate and go directly to the surviving spouse upon the other’s death.

Dos and Don'ts

When filling out the California Transfer-on-Death (TOD) Deed form, it's crucial to follow specific guidelines to ensure that the document is valid and reflects your intentions accurately. Here are some crucial dos and don'ts to keep in mind:

Do:

Thoroughly read the instructions that come with the form to ensure you understand each part of the document.

Use clear and precise language to describe the property being transferred. This includes the address and any identifying information to avoid any confusion about which property is being discussed.

Ensure the form is signed in the presence of a notary public. California law requires notarization for the document to be valid.

Keep a copy of the completed form for your records, in a safe place where it can be easily found when needed.

Immediately record the deed with the county recorder's office where the property is located, as failure to do so could void the deed.

Clearly identify the beneficiary(ies) with full names and provide any additional information required to avoid any misidentification.

Review the form with a legal professional if you have any concerns or questions about your specific situation.

Don't:

Forget to specify all required details about the beneficiary, such as their full legal name, and relationship to you, if any. Ambiguity could complicate the transfer process.

Overlook the importance of updating the form if your intentions change. If you decide to change beneficiaries or revoke the deed, a new form must be completed, notarized, and recorded.

Attempt to use the TOD deed to transfer property held in joint tenancy or as community property with right of survivorship without professional legal advice.

Fill out the form with assumptions about your legal situation without consulting a professional, especially if your estate is complex or you have concerns about how the transfer could affect your beneficiaries.

Sign the form without a notary present. Not having the form properly notarized is a common mistake that can invalidate the entire deed.

Delay recording the deed with the appropriate county office. Timeliness is crucial to its validity.

Assume the TOD deed overrides all other estate planning documents. It's essential to understand how this deed integrates with your broader estate plan.

Misconceptions

In California, the Transfer-on-Death (TOD) Deed form is a legal document that allows property owners to designate a beneficiary who will receive their property upon their death, bypassing the need for the property to go through probate. However, there are several misconceptions regarding this form that need clarification.

- Misconception 1: The Transfer-on-Death Deed gives the beneficiary immediate rights to the property. In reality, the beneficiary has no legal right to the property until the death of the property owner. Until then, the owner retains full control and can sell or mortgage the property, or revoke the deed.

- Misconception 2: It’s complicated and requires a lawyer to complete. While it's always recommended to consult with legal counsel when planning your estate, the TOD deed form is designed to be straightforward. California provides a statutory form that property owners can fill out, sign, and notarize to make it effective.

- Misconception 3: A Transfer-on-Death Deed can transfer any type of property. This deed is limited to transferring real estate properties, such as houses or land. It cannot be used for vehicles, bank accounts, or other types of personal property.

- Misconception 4: The deed cannot be revoked. Property owners have the right to revoke the deed at any time, as long as they are alive and competent. Revocation requires a formal process, typically involving completing and recording a revocation form or executing a new, contradictory TOD deed.

- Misconception 5: The TOD deed avoids all taxes. While the TOD deed can help avoid probate, it does not eliminate or reduce estate taxes or property taxes. Beneficiaries are still responsible for any taxes owed.

- Misconception 6: Creditors can't claim against the property after the owner's death. The property transferred through a TOD deed is not protected from the deceased’s creditors. Creditors may make claims against the estate, possibly affecting the property transferred via the TOD deed.

- Misconception 7: Once executed, the deed cannot be changed. The property owner can change the beneficiary or terms of the deed any time before death by completing a new TOD deed form and following the recording process.

- Misconception 8: The beneficiary needs to sign the deed. The beneficiary does not sign the Transfer-on-Death Deed form. Only the property owner is required to sign and notarize the deed for it to be valid. The beneficiary’s acceptance is presumed unless they formally decline the property after the owner's death.

Understanding these key points about the Transfer-on-Death Deed can help California property owners make informed decisions about managing their estate and ensure their property is transferred according to their wishes without unnecessary complications.

Key takeaways

To ensure a smooth and legally sound process when utilizing the California Transfer-on-Death (TOD) Deed form, it's crucial to recognize and adhere to several key takeaways:

- Ownership of property can be transferred upon the death of the property owner without the property having to go through probate court, using a Transfer-on-Death Deed.

- This form should be filled out with accurate and clear information to avoid any disputes or legal complications after the owner's death.

- The property owner must sign the Transfer-on-Death Deed form in the presence of a notary public to ensure it is legally binding.

- It is important for the property owner to provide an exact description of the property, ensuring it matches the description used in official real estate documents.

- Once completed and notarized, the Transfer-on-Death Deed must be recorded with the county recorder's office in the county where the property is located, and this should be done before the owner's death.

- The deed allows the property to pass directly to the designated beneficiary or beneficiaries upon the property owner's death, bypassing the need for the property to go through probate court.

- It's crucial for both the property owner and the designated beneficiaries to understand that the Transfer-on-Death Deed can be revoked by the property owner at any time before their death, as long as the revocation is properly executed and recorded.

Adherence to these key points can ensure that the transfer of property after the owner's death occurs as intended, providing peace of mind to all parties involved.

Create Other Transfer-on-Death Deed Forms for US States

Transfer on Death Deed Connecticut - A Transfer-on-Death Deed is a responsible way to plan for the future of your real estate, ensuring that your assets go to the right person with minimal delay.

Transfer Deed Upon Death - This deed is revocable, meaning you can change your mind at any time before your death.

Does a Beneficiary Deed Avoid Probate - This legal document enables direct transfer of real estate to a designated person upon the owner's death, without needing a will.

Transfer on Death Deed Form Oklahoma - Prevents the potential for family disagreements over estate distribution by clearly defining a property beneficiary.