Blank Transfer-on-Death Deed Form for Colorado

In Colorado, securing the future of one’s property without the complexities of a will has been made simpler through the Transfer-on-Death (TOD) Deed form. This legal document enables property owners to name beneficiaries who will inherit their real estate upon the owner's passing without the necessity for the property to go through probate. As an essential tool for estate planning, the TOD Deed offers a straightforward approach for individuals to ensure their real estate is passed on to their desired heirs efficiently and with minimal legal hurdles. Unlike a traditional will, this form does not come into effect until the death of the property owner, allowing for the retention of full control over the property during the owner's lifetime. Additionally, it's worth noting that the form can be revoked or altered at any point as long as the property owner is alive and well, providing a level of flexibility that traditional inheritance methods lack. The utilization of the TOD Deed in Colorado represents a valuable option for property owners looking for a hassle-free method to manage the transfer of their estates.

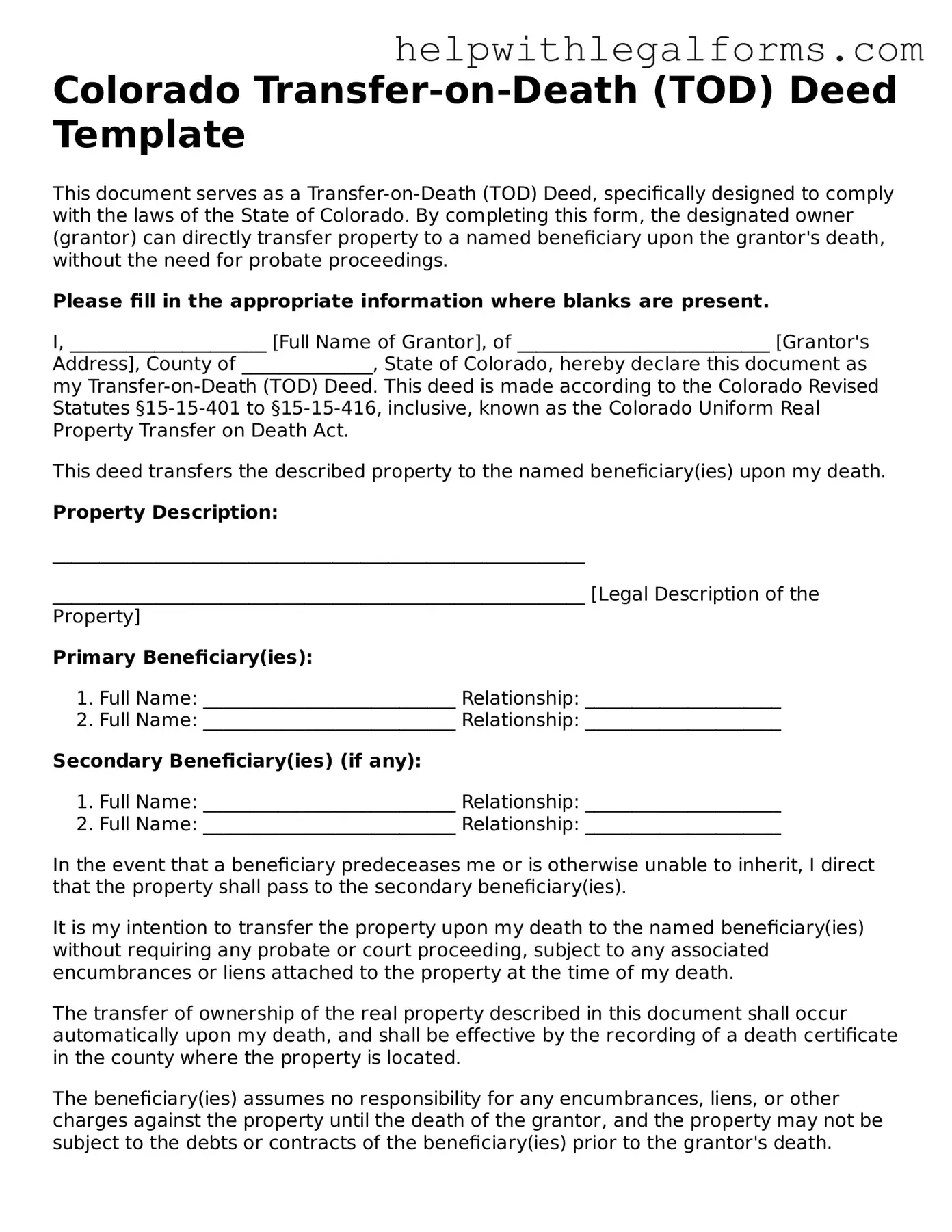

Example - Colorado Transfer-on-Death Deed Form

Colorado Transfer-on-Death (TOD) Deed Template

This document serves as a Transfer-on-Death (TOD) Deed, specifically designed to comply with the laws of the State of Colorado. By completing this form, the designated owner (grantor) can directly transfer property to a named beneficiary upon the grantor's death, without the need for probate proceedings.

Please fill in the appropriate information where blanks are present.

I, _____________________ [Full Name of Grantor], of ___________________________ [Grantor's Address], County of ______________, State of Colorado, hereby declare this document as my Transfer-on-Death (TOD) Deed. This deed is made according to the Colorado Revised Statutes §15-15-401 to §15-15-416, inclusive, known as the Colorado Uniform Real Property Transfer on Death Act.

This deed transfers the described property to the named beneficiary(ies) upon my death.

Property Description:

_________________________________________________________

_________________________________________________________ [Legal Description of the Property]

Primary Beneficiary(ies):

- Full Name: ___________________________ Relationship: _____________________

- Full Name: ___________________________ Relationship: _____________________

Secondary Beneficiary(ies) (if any):

- Full Name: ___________________________ Relationship: _____________________

- Full Name: ___________________________ Relationship: _____________________

In the event that a beneficiary predeceases me or is otherwise unable to inherit, I direct that the property shall pass to the secondary beneficiary(ies).

It is my intention to transfer the property upon my death to the named beneficiary(ies) without requiring any probate or court proceeding, subject to any associated encumbrances or liens attached to the property at the time of my death.

The transfer of ownership of the real property described in this document shall occur automatically upon my death, and shall be effective by the recording of a death certificate in the county where the property is located.

The beneficiary(ies) assumes no responsibility for any encumbrances, liens, or other charges against the property until the death of the grantor, and the property may not be subject to the debts or contracts of the beneficiary(ies) prior to the grantor's death.

Grantor's Signature: ___________________________

Date: _____________________

State of Colorado

County of _______________

On this day, _______________ [date], before me, a notary public, personally appeared __________________ [Name of Grantor], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Notary Public

My commission expires: ___________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in Colorado to pass their real estate to a beneficiary upon their death without the need for probate. |

| Governing Law | The Colorado Revised Statutes, specifically C.R.S. 15-15-401 to 15-15-415, govern the use and execution of Transfer-on-Death deeds. |

| Eligible Property Types | Most types of real estate, including homes and land, can be transferred using a TOD deed in Colorado. |

| Beneficiary Requirements | The beneficiary must be a competent individual, trust, or legal entity and must survive the grantor to inherit the property. |

| Revocability | The grantor can revoke or change the TOD deed at any time before their death, as long as the revocation is done in accordance with Colorado law. |

| Impact on Estate Planning | A TOD deed is part of a comprehensive estate plan, allowing for the seamless transfer of property while avoiding probate, but does not substitute for a will or other estate planning instruments. |

Instructions on How to Fill Out Colorado Transfer-on-Death Deed

Transferring ownership of property upon death might seem daunting, but the Colorado Transfer-on-Death (TOD) Deed simplifies this process. By using this form, you can directly pass down your real estate to a chosen beneficiary without the need for a lengthy probate process. The steps to fill out the form are straightforward, ensuring your property will smoothly transition to your loved one after your passing.

- Prepare the Deed: Start by obtaining the official Colorado Transfer-on-Death Deed form. This can typically be found online through the Colorado state website or by visiting a local legal forms provider.

- Identify the Grantor(s): Enter your name (and if applicable, any co-owners' names) as the current owner(s) of the property. Specify your legal capacity and state that you are executing the deed.

- Describe the Property: Clearly describe the real estate being transferred, including its legal description as found on your current deed or property records. Accurate description ensures no confusion regarding what property is being transferred.

- Name the Beneficiary: Designate the person or persons who will receive the property upon your death. Include full legal names and a clear indication of their relationship to you, if any. Multiple beneficiaries can be named, but specifics on how the property is to be divided should be clear.

- Sign in the Presence of a Notary: After reviewing the document for accuracy, sign it in front of a notary public. The notary must witness your signature to validate the deed.

- Record the Deed: Once signed and notarized, take the deed to the county recorder’s office in the county where the property is located. They will file your deed, making it a legal document. There may be a filing fee associated with recording the deed.

By following these steps, you can ensure your property is transferred to your intended beneficiary without the need for them to go through a potentially complicated and time-consuming probate process. It's a thoughtful way to plan for the future, taking care of your loved ones even after you're gone.

Crucial Points on This Form

What is a Transfer-on-Death (TOD) Deed in Colorado?

In Colorado, a Transfer-on-Death (TOD) Deed allows property owners to pass their real estate to a designated beneficiary upon their death without the need for probate court proceedings. This instrument is beneficial as it simplifies the process of transferring property, ensuring a smoother transition for the beneficiary. It must be properly filled out, signed, notarized, and recorded in the county where the property is located before the owner's death.

Who can create a TOD Deed in Colorado?

Any property owner with legal capacity can create a TOD Deed in Colorado. Legal capacity means the person must have the ability to understand the nature and implications of the deed at the time of its creation, including the property being transferred and the identity of the beneficiary. It's designed for individuals who wish to maintain control over their property until death, at which point it automatically transfers to the named beneficiary.

Can a TOD Deed in Colorado be revoked?

Yes, a TOD Deed in Colorado can be revoked at any time by the property owner as long as they have the legal capacity to do so. Revocation can be accomplished in several ways: by executing a new deed that explicitly revokes the previous one, by selling the property, or by filing a formal revocation document in the county where the property is located. Changes in personal circumstances, such as marriage or divorce, might necessitate a review and possible revision of the TOD Deed.

Does a TOD Deed avoid inheritance taxes in Colorado?

While a TOD Deed simplifies the process of transferring property and avoids probate, it does not inherently exempt the beneficiary from potential inheritance taxes. In Colorado, inheritance tax is not imposed, but the estate might be subject to federal estate taxes depending on its total value. Beneficiaries should consult with a tax advisor or attorney to understand any tax implications.

How does one create a valid TOD Deed in Colorado?

To create a valid TOD Deed in Colorado, the document must clearly identify the property, name the beneficiary who will inherit the property, and be signed by the property owner in the presence of a notary public. Additionally, it must be recorded in the county recorder’s office or the office responsible for property records in the county where the property is located, before the owner's death. Consulting with a legal professional can ensure all requirements are met.

What happens if the beneficiary named in the TOD Deed dies before the owner?

If the beneficiary named in the TOD Deed dies before the owner, the deed will have no effect, treating the property as if the TOD Deed was never executed. It means the property would become part of the owner's estate upon their death and would be distributed according to their will or, in the absence of a will, according to Colorado's intestacy laws. Property owners may consider naming an alternate beneficiary in the TOD Deed to prevent such situations.

Can a TOD Deed transfer property to multiple beneficiaries in Colorado?

Yes, a property owner can name multiple beneficiaries in a TOD Deed in Colorado. The property will be transferred to the surviving beneficiaries upon the owner's death. If there are multiple beneficiaries, the property is divided equally among them, unless the deed specifies a different form of division. It's important for the deed to clearly outline how the property should be distributed to avoid confusion and potential disputes among the beneficiaries.

Common mistakes

When preparing for the future, many people in Colorado opt for a Transfer-on-Death (TOD) deed as a way to pass on real estate to their loved ones without the need for a lengthy probate process. However, even with its simplicity, there are common mistakes that can complicate or invalidate the deed. Awareness and careful attention to detail can prevent these issues, ensuring a smooth transfer of property when the time comes.

Here are five mistakes frequently made on the Colorado Transfer-on-Death Deed form:

Not Providing the Legal Description of the Property: A common mistake is providing an incomplete or inaccurate legal description of the property. This description is not just the property's address but a detailed legal delineation found in the property's deed. Failing to include this exact description can render the TOD deed ineffective.

Failing to Sign in the Presence of a Notary: The law requires the property owner to sign the TOD deed in the presence of a notary public. Skipping this step or improperly completing it can lead to the deed being considered invalid. The notarization process is a critical step for verifying the authenticity of the signature.

Not Specifying the Beneficiaries Clearly: Sometimes, the deed doesn't clearly name the beneficiaries or properly identify them. Using vague terms like "my children" without specifying names can lead to disputes among potential heirs. It's crucial to be as specific as possible about who the beneficiaries are.

Omitting to File the Deed Before Death: For a TOD deed to be effective, it must be properly filed with the county recorder's or clerk's office where the property is located before the death of the property owner. If this critical step is missed, the deed won't transfer the property upon death, negating its purpose.

Misunderstanding the Revocability of the Deed: Sometimes, individuals think once they've filed a TOD deed, it cannot be changed. This is not true; the TOD deed is fully revocable during the owner's lifetime. A property owner can change the beneficiary or revoke the deed entirely if circumstances change, provided this is done correctly.

In filling out a TOD deed, attention to these details ensures that the document fulfills its intended purpose without unnecessary legal battles or complications. It's always recommended to consult with a legal professional to guarantee that all aspects of the deed meet the legal requirements and accurately reflect the property owner's wishes.

Documents used along the form

In the state of Colorado, using a Transfer-on-Death (TOD) deed can be an efficient way to transfer property upon the death of the owner without the need for probate. Along with the TOD deed, there are several other forms and documents that are frequently used to ensure that all aspects of an estate are managed correctly and according to the owner's wishes. These documents complement the TOD deed by addressing other elements of estate planning and property management.

- Last Will and Testament: This essential document specifies how an individual's assets and estate will be distributed upon their death. While the TOD deed directly transfers real estate to a beneficiary, the Last Will and Testament covers the distribution of other personal assets and can appoint guardians for minor children.

- Financial Power of Attorney: This legal document grants someone the authority to handle financial decisions on behalf of another person. It can be crucial if the property owner becomes incapacitated before death, ensuring that their financial matters, including aspects of their estate and properties not covered by the TOD deed, are managed according to their wishes.

- Advanced Healthcare Directive: Often referred to as a living will, this document outlines an individual's preferences for medical care if they become unable to communicate their decisions due to illness or incapacity. It works in concert with the TOD deed by providing comprehensive instructions that include healthcare decisions alongside property management after the individual's passing.

- Revocable Living Trust: This document allows an individual to place assets in a trust to be managed by a trustee for the benefit of the beneficiaries. Like the TOD deed, a living trust can help avoid the probate process for the assets it covers, providing a seamless transition of assets to beneficiaries.

Together, these documents form a comprehensive estate plan that ensures an individual's wishes are respected in terms of both property distribution and personal care. When used in conjunction with a TOD deed, they provide a solid framework for managing one's legacy while minimizing the legal complexities for survivors.

Similar forms

A Will: Similar to the Transfer-on-Death (TOD) deed, a will allows individuals to specify how their assets should be distributed upon their death. However, assets passed through a will must go through probate, while a TOD deed bypasses this process.

A Beneficiary Designation Form: This form, often used for retirement accounts and life insurance policies, designates beneficiaries to receive assets upon the account holder's death, similar to a TOD deed, avoiding probate.

A Joint Tenancy With Right of Survivorship Deed: This deed allows property to pass automatically to the surviving owner(s) when one owner dies, akin to how a TOD deed transfers property, but it takes effect during the owner's life, not after death.

A Life Estate Deed: Similar to the TOD deed, a life estate deed allows property owners to use the property during their lifetime and specifies a remainderman to receive the property upon their death, though control is limited during the owner's lifetime.

A Revocable Living Trust: Like a TOD deed, assets placed in a revocable living trust can avoid probate. The trust controls the asset during the owner’s lifetime and specifies beneficiaries upon death.

A Payable-On-Death (POD) Account: Similar to a TOD deed for bank accounts, a POD designation allows account holders to name a beneficiary to receive funds in the account upon their death, bypassing probate.

A Gift Deed: While a gift deed transfers property immediately without consideration, and without the owner's death triggering the transfer, like a TOD deed, it changes ownership of property without traditional sale mechanisms.

A Trust Certificate: Trust certificates, representing ownership in a trust, can be similar to a TOD deed in that they specify beneficiaries who will receive the trust's assets upon the trustor's death, often bypassing probate.

A Durable Power of Attorney for Property: This legal document allows an individual to appoint an agent to manage their property affairs. While not a post-mortem transfer tool like a TOD deed, it provides for management of assets during the owner’s lifetime, including making arrangements for the transfer of assets upon death.

Dos and Don'ts

To correctly and effectively fill out the Colorado Transfer-on-Death (TOD) Deed form, it is important to follow certain guidelines. Below is a list of actions that should be taken as well as those that should be avoided to ensure the process is completed properly.

Do:

Thoroughly read and understand the form's instructions before starting to fill it out. This ensures that you are aware of all requirements and conditions associated with the Transfer-on-Death Deed.

Ensure all provided information is accurate and complete, including the legal description of the property, to avoid any future disputes or legal complications.

Use a notary public to witness the signing of the form, as Colorado law requires notarization for the deed to be valid.

Keep a copy of the signed and notarized form for your records. It is crucial to have this documentation readily available when needed.

Record the deed with the county recorder’s office in the county where the property is located. Failing to do so will result in the Transfer-on-Death Deed not being legally effective.

Don't:

Leave any sections of the form incomplete. An incomplete form may be considered invalid, which could void the transfer.

Use informal language or nicknames when entering names. Legal documents require full legal names to ensure clarity and legitimacy.

Attempt to use the form to transfer property held in joint tenancy without consulting with a legal professional. The implications of changing property held in such a manner can be complex.

Forget to update the deed if circumstances change, such as the death of a named beneficiary or a change in the property’s ownership.

Assume that the TOD deed overrides any conflicting statements in a will. Always seek legal advice to understand how multiple documents might interact.

Misconceptions

When it comes to planning for the future, understanding the ins and outs of different estate planning tools is crucial. The Colorado Transfer-on-Death (TOD) Deed form is one such tool that offers a streamlined way to pass real property to a beneficiary upon the owner's death, without the need for probate court proceedings. However, there are several misconceptions about how this form works and what it can do. Let's clear up some of these misconceptions:

- Misconception 1: A Transfer-on-Death Deed is only for people with significant property holdings.

In reality, the TOD Deed can be a beneficial estate planning tool for anyone who owns real property, regardless of the property's value. It's about ensuring that your property seamlessly passes to your chosen beneficiary upon your death. - Misconception 2: A Transfer-on-Death Deed overrides a will.

This is not the case. A Transfer-on-Death Deed directly transfers property to the designated beneficiary upon the owner's death, independent of the will. However, if there is a discrepancy between the will and the TOD Deed, the provisions in the TOD Deed take precedence for the specific property it covers. - Misconception 3: Once a Transfer-on-Death Deed is filed, it cannot be revoked.

Owners have the flexibility to revoke a TOD Deed at any time before their death, as long as the revocation is done correctly according to state laws. Changes in circumstances do not have to mean a permanent decision with a TOD Deed. - Misconception 4: The beneficiary automatically owns the property once the deed is filed.

The beneficiary has no legal right to the property until the owner's death. Until then, the owner retains full control over the property, including the right to sell or mortgage it. - Misconception 5: Filing a Transfer-on-Death Deed is a complicated process.

The process is relatively straightforward. The owner must complete the form, have it notarized, and then record it with the county recorder’s office where the property is located. While it's advisable to consult with an estate planning attorney, the process itself is designed to be user-friendly. - Misconception 6: A Transfer-on-Death Deed avoids all taxes.

While a TOD Deed can help avoid the probate process, it does not eliminate the beneficiary's responsibility for any taxes associated with inheriting the property. This can include estate, inheritance, or other transfer taxes, depending on the situation.

Understanding the Transfer-on-Death Deed and dispelling these misconceptions ensures that property owners can make informed decisions about how to best plan for the future transfer of their property. It's an important step in estate planning that can provide peace of mind for both property owners and their beneficiaries.

Key takeaways

Understanding how to properly complete and utilize the Colorado Transfer-on-Death (TOD) Deed form is crucial for effectively managing and transferring your property without the need for probate. Here are key takeaways to guide you through this process:

- Eligibility: Only individuals who hold title to real property in Colorado can use the TOD deed to convey property upon death.

- Easy to Execute: The TOD deed must be signed in the presence of a notary to be valid. It is simpler than many other legal processes for transferring property.

- Revocability: One of the most significant benefits of a TOD deed is that it can be revoked at any time before the property owner's death, providing flexibility and control over the property.

- Does Not Avoid Estate Taxes: While a TOD deed simplifies the process of transferring property, it does not shield the property from estate taxes that might be applicable.

- Mandatory Filing: After it is signed and notarized, the deed must be recorded with the county recorder’s office in the county where the property is located before the owner's death to be effective.

- No Impact on Ownership: The current owner retains full control and ownership of the property until their death, including the right to sell or mortgage the property.

- Beneficiary Designations: It is critical to clearly identify the beneficiary or beneficiaries in the TOD deed to ensure the property is transferred according to the owner's wishes.

- Co-owners and Joint Tenants: If the property is owned with someone else, the impacts of the TOD deed can vary. It's important to understand how joint tenancy or co-ownership affects the transfer of the property upon death.

Effectively using a Colorado Transfer-on-Death Deed can ensure a smoother transition of property to a beneficiary, avoiding the time and expense of probate court. Nevertheless, it's advisable to consult with a legal professional to understand all implications fully and to tailor the deed to one’s specific circumstances.

Create Other Transfer-on-Death Deed Forms for US States

Transfer on Death Deed Form Oklahoma - Provides a straightforward method for transferring property to a loved one without the complexities of probate court.

Transfer on Death Deed Maryland - It stands as a testament to your intentions, clearly indicating who you want to inherit your real estate without requiring a traditional will.

Free Printable Transfer on Death Deed Form Florida - Specific to certain states, this legal document's availability and requirements may vary, making it essential to consult local laws.