Blank Transfer-on-Death Deed Form for Connecticut

In Connecticut, ensuring a smooth transition of property ownership after an individual's demise is of paramount importance to many. The Transfer-on-Death (TOD) Deed form emerges as a vital legal document in achieving this goal. It allows property owners to designate beneficiaries who will inherit their property, bypassing the often lengthy and costly probate process. This innovative estate planning tool not only simplifies the transfer of real estate upon one's death but also provides flexibility, allowing the property owner to retain control over the property during their lifetime. Moreover, it's revocable, meaning the owner can change the beneficiary or cancel the deed at any time before death. Understanding the legal nuances and the impact of such a deed on estate planning and beneficiaries' rights is crucial for anyone considering its use. Crucially, the form’s completion and execution must align with Connecticut law to ensure its validity. This intricate dance between easing property transfer and adhering to legal standards underscores the TOD Deed's significance in Connecticut estate planning.

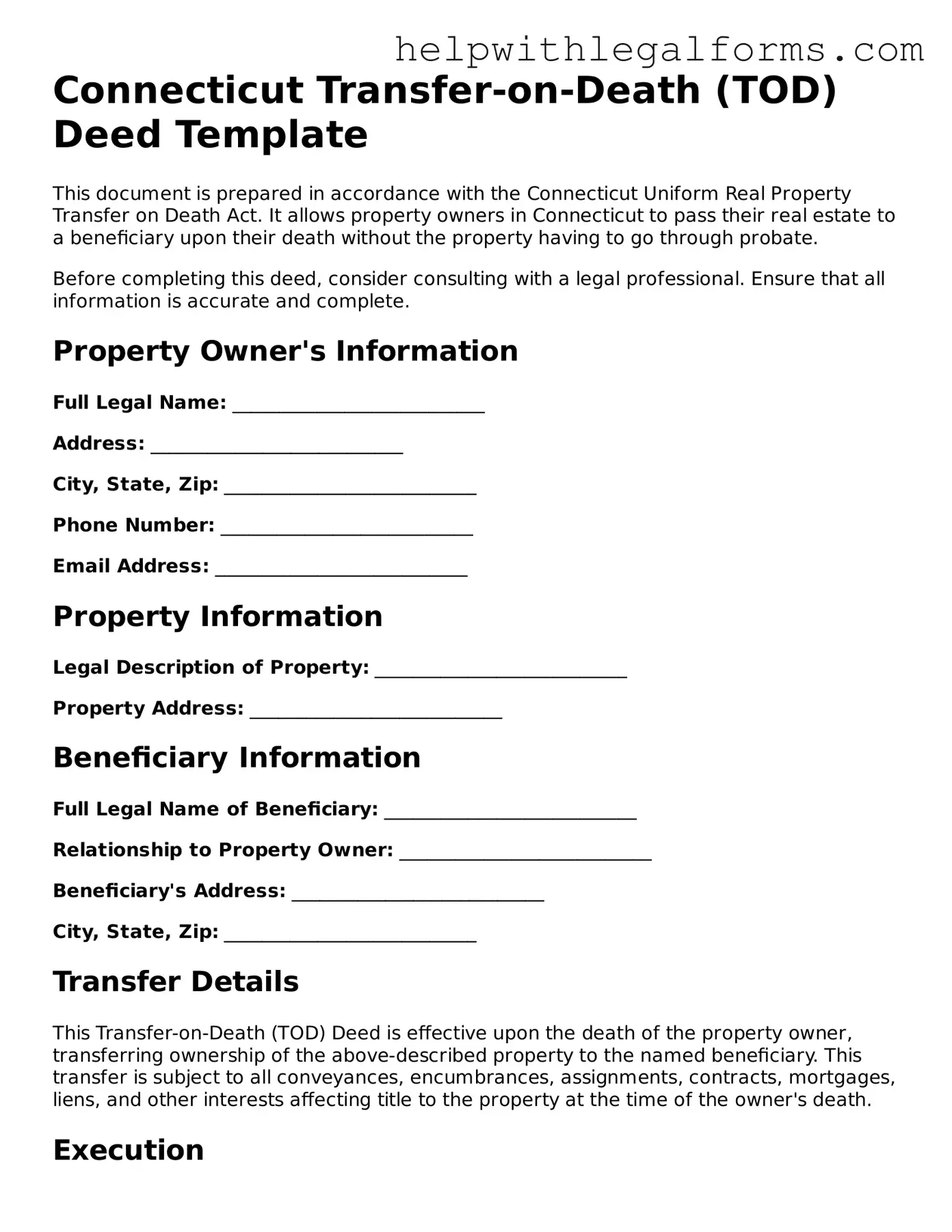

Example - Connecticut Transfer-on-Death Deed Form

Connecticut Transfer-on-Death (TOD) Deed Template

This document is prepared in accordance with the Connecticut Uniform Real Property Transfer on Death Act. It allows property owners in Connecticut to pass their real estate to a beneficiary upon their death without the property having to go through probate.

Before completing this deed, consider consulting with a legal professional. Ensure that all information is accurate and complete.

Property Owner's InformationProperty Owner's Information

Full Legal Name: ___________________________

Address: ___________________________

City, State, Zip: ___________________________

Phone Number: ___________________________

Email Address: ___________________________

Property InformationProperty Information

Legal Description of Property: ___________________________

Property Address: ___________________________

Beneficiary InformationBeneficiary Information

Full Legal Name of Beneficiary: ___________________________

Relationship to Property Owner: ___________________________

Beneficiary's Address: ___________________________

City, State, Zip: ___________________________

Transfer DetailsTransfer Details

This Transfer-on-Death (TOD) Deed is effective upon the death of the property owner, transferring ownership of the above-described property to the named beneficiary. This transfer is subject to all conveyances, encumbrances, assignments, contracts, mortgages, liens, and other interests affecting title to the property at the time of the owner's death.

ExecutionExecution

The property owner must sign and date this Transfer-on-Death Deed in the presence of a notary public.

Property Owner's Signature: ___________________________ Date: ________________

Notary Public Signature: ___________________________ Date: ________________

This deed is not valid unless properly executed and filed with the appropriate Connecticut County Recorder's Office.

DisclaimerDisclaimer

This template is provided as a general guide and for informational purposes only. It is not a substitute for professional legal advice. Each situation is unique, and the laws and procedures may change. Always seek the guidance of a qualified professional when dealing with legal matters.

PDF Form Attributes

| Name of Fact | Detail |

|---|---|

| 1. Governing Law | Connecticut General Statutes Section 45a-317 et seq. governs the Transfer-on-Death (TOD) Deed in Connecticut. |

| 2. Purpose | The TOD deed allows property owners to pass their real estate to beneficiaries without the need for probate upon the owner's death. |

| 3. Eligible Property | Only real property, such as houses or land, can be transferred using a TOD deed in Connecticut. |

| 4. Beneficiary Designation | The property owner can name one or more beneficiaries, including individuals, trusts, or organizations, to inherit the property. |

| 5. Revocability | A TOD deed is revocable. The property owner can change their mind at any time before their death without the consent of the beneficiary. |

| 6. Effect on Property Ownership | The property owner retains full control and use of the property during their lifetime, including the right to sell or mortgage the property. |

| 7. Formalities for Execution | The TOD deed must be signed, witnessed, and notarized according to Connecticut law to be valid. |

| 8. Recording Requirement | To be effective, the signed TOD deed must be recorded with the local town clerk's office before the property owner's death. |

| 9. Impact on Eligibility for Public Benefits | Executed properly, a TOD deed does not affect the property owner’s eligibility for public benefits, as the ownership does not change until the owner's death. |

Instructions on How to Fill Out Connecticut Transfer-on-Death Deed

When planning for the future, taking steps to ensure your assets are distributed according to your wishes is vital. In Connecticut, one tool for estate planning is the Transfer-on-Death (TOD) Deed form. This document allows you to name a beneficiary who will receive your real estate directly upon your passing, bypassing the potentially lengthy and complicated probate process. While the concept might seem daunting, filling out the TOD Deed form is straightforward. Below is a step-by-step guide to help you complete the form accurately.

- Begin by reading the entire form to familiarize yourself with its requirements and to gather all necessary information.

- Enter your full legal name as the current property owner in the section labeled “Grantor.” Make sure to provide an accurate and complete name to avoid any confusion regarding the property's ownership.

- Write the legal description of the property you’re transferring on death. This information can usually be found on your property deed or by contacting your local land records office. It’s crucial to include the exact legal description to ensure proper identification of the property.

- Fill in the name of the designated beneficiary (or beneficiaries) in the “Grantee/Beneficiary” section. If naming more than one beneficiary, specify the type of ownership (joint tenants, tenants in common) and the share each beneficiary will receive.

- Include the addresses of all named beneficiaries. Providing current and complete addresses helps facilitate the transfer process after your passing.

- Review the form to ensure all information is accurate and no sections have been inadvertently skipped.

- Sign the TOD Deed form in the presence of a notary public. The notarization process is an essential step for the document to be legally binding.

- Record the completed TOD Deed form with your local county land records office. Filing fees may vary, so it's wise to contact the office in advance to confirm the cost.

After completing these steps, the Transfer-on-Death Deed will be in place, designating your desired beneficiary for your property upon your death. This action can significantly simplify the estate settlement process for your loved ones. Remember, life circumstances and relationships may change, so it’s important to review and, if necessary, update your TOD Deed periodically to reflect your current wishes.

Crucial Points on This Form

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed is a legal document that allows property owners in Connecticut to pass their real estate to a beneficiary without the need for a traditional will or going through probate court after they pass away. It's a simple way to ensure that your property goes directly to the person you choose.

How does a Transfer-on-Death Deed work in Connecticut?

In Connecticut, when a property owner signs and records a Transfer-on-Death Deed, they are naming who they want to inherit their property after their death. The deed does not take effect until the owner dies. Until then, the owner retains full control over the property and can change or revoke the deed at any time.

Who can be named as a beneficiary on a Transfer-on-Death Deed?

Any person or legal entity can be named as a beneficiary on a Transfer-on-Death Deed. This includes family members, friends, a trust, or a charitable organization. It's important, however, to provide clear information to identify the beneficiary accurately.

Can a Transfer-on-Death Deed be revoked?

Yes, the owner can revoke a Transfer-on-Death Deed at any time before their death. This can be done by filing a revocation form or creating a new Transfer-on-Death Deed that names a different beneficiary. It's crucial that the revocation process is completed correctly to ensure the deed is legally nullified.

What happens to the property if the beneficiary predeceases the owner?

If the named beneficiary predeceases the owner, the Transfer-on-Death Deed typically becomes ineffective unless an alternate beneficiary is named in the deed. In such cases, the property could become part of the estate and pass according to a will or state law.

Is a Transfer-on-Death Deed subject to creditor claims?

After the owner's death, the property transferred via a Transfer-on-Death Deed may still be subject to creditor claims against the estate. Beneficiaries should be aware that creditors may have rights to seek payment from the estate, which can include the transferred property.

Does recording a Transfer-on-Death Deed have tax implications?

Creating and recording a Transfer-on-Death Deed by itself generally does not trigger immediate tax consequences. However, inheriting property can have tax implications for the beneficiary, such as estate or inheritance taxes. Owners and beneficiaries should consult with a tax professional to understand any potential tax implications.

Common mistakes

-

Not Reviewing the Eligibility Requirements: Often, people overlook the necessity to ensure they meet specific eligibility criteria before executing a Transfer-on-Death (TOD) Deed. These criteria can include, but are not limited to, the type of property and the location. It’s fundamental to confirm these details to ensure the TOD deed is valid.

-

Incorrect Property Description: A common mistake is providing an inaccurate or incomplete description of the property. It’s crucial to use the legal description of the property as recorded in the land records, not just the address or a general description, to avoid any ambiguity.

-

Failing to Specify Beneficiaries Clearly: The deed must clearly state the name of the beneficiary or beneficiaries. Ambiguities in naming beneficiaries can lead to disputes and potential legal challenges after the grantor's death.

-

Omitting Alternate Beneficiaries: Not naming alternate beneficiaries can create complications if the primary beneficiary predeceases the owner. It's advisable to consider specifying successors to ensure the property is transferred according to the owner’s wishes.

-

Not Having the Deed Properly Witnessed or Notarized: Depending on Connecticut law, having the deed witnessed and notarized may be necessary for its validity. Skipping these steps can render the deed unenforceable.

-

Assuming the TOD Deed Overrides a Will: People sometimes mistakenly believe that the TOD deed supersedes any provisions in their will that pertain to the same property. It's important to understand that the TOD deed directly transfers property upon death and operates outside of the will, potentially conflicting with its terms if not carefully coordinated.

-

Forgetting to File the Deed Before Death: A TOD deed must be filed with the appropriate county land records office before the owner's death. If this crucial step is overlooked, the deed may not be effective, frustrating the intent of the property transfer.

-

Inaccurately Reporting Ownership Status: If the property is owned jointly, by more than one person, the details of how co-ownership is held should be correctly reported. Misunderstandings about the nature of joint ownership can lead to disputes and complications in transferring the property.

-

Handling the Deed without Legal Consultation: Attempting to execute a TOD deed without professional advice can be risky. Legal nuances and state-specific requirements make it advisable to consult with a lawyer experienced in estate planning to ensure the deed accomplishes the owner’s intentions without unforeseen consequences.

Documents used along the form

When planning for the future, especially in the context of estate planning, a variety of documents can be important tools alongside the Connecticut Transfer-on-Death (TOD) Deed form. This form allows property owners in Connecticut to pass their real estate to a beneficiary upon their death without the need for probate. While highly beneficial for a smooth transition of property ownership, it's often just one piece of a comprehensive estate plan. Other forms and documents may also play crucial roles, each serving specific purposes in executing a well-rounded estate plan.

- Last Will and Testament: This fundamental document outlines how a person's assets and estate will be distributed upon their death. It appoints an executor who will manage the estate and ensure that the decedent’s wishes are carried out.

- Living Trust: Similar to a TOD deed but broader in scope, a living trust allows individuals to transfer assets into a trust during their lifetime. Upon death, these assets can be transferred to designated beneficiaries without going through probate.

- Advance Healthcare Directive: This document specifies an individual's preferences regarding medical care, particularly concerning life-sustaining treatment if they become unable to make decisions for themselves.

- Financial Power of Attorney: This legal document grants another individual—the agent—the authority to make financial decisions on the principal’s behalf should they become incapacitated.

- Designation of Health Care Surrogate: This designates another person to make healthcare decisions for someone if they’re unable to do so themselves due to incapacity or illness.

- Beneficiary Designations: Separate from wills or TOD deeds, these designations apply to life insurance policies, retirement accounts, and other financial instruments, directing these assets to the named beneficiaries upon the policyholder’s or account holder’s death.

- Revocable vs. Irrevocable Trust Documents: Trusts can be either revocable, meaning they can be altered or canceled by the grantor, or irrevocable, meaning they cannot be easily changed after their creation. These documents govern the terms of the trust.

- Gift Deed: This allows the transfer of real estate between living parties as a gift, often to a family member, without financial consideration.

- Digital Assets Memorandum: While not a formal legal document, a digital assets memorandum can guide executors or heirs in managing and distributing online assets, including social media accounts and digital files.

Each of these documents serves to address distinct aspects of an individual's estate and personal wishes. In Connecticut, as in many states, crafting an estate plan that effectively incorporates these documents requires thoughtful consideration of one's assets, family dynamics, and legal implications. Together with the Connecticut Transfer-on-Death Deed, these documents can create a robust framework for managing one’s estate, thereby easing the transition for loved ones during a difficult time. Consulting with a qualified estate planning attorney can ensure that all legal documents align with state laws and personal objectives.

Similar forms

Living Trust: Similar to a Transfer-on-Death (TOD) Deed in the way it allows property to bypass probate court, a Living Trust lets you transfer property to your beneficiaries without the need for a traditional probate process.

Beneficiary Deeds: Just like Transfer-on-Death Deeds, Beneficiary Deeds allow property to be passed directly to a named beneficiary upon the owner’s death, avoiding probate court.

Pay-On-Death (POD) Accounts: Similar to TOD Deeds in the aspect of designating a beneficiary, POD accounts are used for bank and financial accounts to pass directly to a named person upon the account holder's death, without going through probate.

Life Insurance Policies: Life insurance policies designate beneficiaries who receive the policy’s proceeds upon the policyholder's death, which is similar to how TOD Deeds designate a beneficiary for real estate.

Joint Tenancy With Right of Survivorship: This form of property ownership allows property to pass automatically to the surviving owner(s) upon one owner’s death, akin to the way TOD Deeds transfer property instantly upon death.

TOD Registration for Vehicles: Some states allow vehicles to be registered with a TOD beneficiary, making it similar to TOD Deeds by letting vehicles bypass probate and go directly to the beneficiary when the owner passes away.

Retirement Accounts: Like TOD Deeds, retirement accounts such as IRAs and 401(k)s often require a beneficiary to be named, allowing the account's assets to pass directly to the beneficiary upon the account holder's death, outside of probate.

Stocks and Bonds: Stocks and bonds can often be registered in a TOD form, directly transferring ownership to a beneficiary upon the owner’s death, which streamlines the process much like a TOD Deed does for real estate.

Dos and Don'ts

When dealing with a Transfer-on-Death (TOD) deed form in Connecticut, it's crucial to handle the process accurately and thoughtfully. A TOD deed allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing the probate process. To help you navigate this process, here is a list of things you should and shouldn't do:

Do:- Ensure you meet all state-specific requirements for creating a TOD deed in Connecticut.

- Clearly identify the property being transferred, including its legal description and address.

- Name one or more beneficiaries clearly, including their full names and addresses.

- Consider specifying alternate beneficiaries in case the primary beneficiary predeceases you.

- Sign the deed in front of a notary public to validate its authenticity.

- Record the deed with the Connecticut town clerk's office in the county where the property is located before your death to make it effective.

- Keep a copy of the recorded deed in a safe place, and inform your beneficiaries about the TOD deed.

- Review and update the deed as necessary, especially after major life events such as a marriage, divorce, or the death of a beneficiary.

- Consider consulting with a real estate attorney to ensure the deed complies with current Connecticut laws and estate planning goals.

- Remember that filing a TOD deed does not restrict your rights to use or sell the property during your lifetime.

- Attempt to transfer property through a TOD deed that is co-owned with someone else without understanding the implications for the co-owner.

- Forget to update the deed if your intended beneficiary's circumstances change.

- Overlook the importance of having the deed properly notarized, as this is a legal requirement for its validity.

- Fail to record the deed with the appropriate town clerk's office; unrecorded deeds may not be effective.

- Ignore the potential impact of a TOD deed on your overall estate plan and the distribution of your assets.

- Misunderstand that a TOD deed can be revoked or changed at any time before your death, provided you are competent to do so.

- Assume that the TOD deed automatically overrides other estate planning documents like wills; conflicts may require legal resolution.

- Rely solely on a TOD deed for all estate planning. Consider a comprehensive approach that includes other tools like wills or trusts.

- Forget to consult with a legal professional if you have doubts or questions about filling out the TOD deed correctly.

- Dismiss the need to inform your beneficiaries about the TOD deed, as sudden surprises can lead to confusion or disputes after your death.

Misconceptions

When considering estate planning, the concept of a Transfer-on-Death (TOD) Deed can often be misunderstood, especially within the context of Connecticut's laws and regulations. Here are six common misconceptions about the Connecticut Transfer-on-Death Deed form that people frequently have:

It avoids probate for all your assets. Many believe that simply having a TOD Deed will bypass the probate process for all of their assets. In reality, the TOD Deed only applies to the specific piece of real estate mentioned in the deed. Other assets not similarly designated will likely have to go through probate.

It's recognized in every state. While TOD Deeds are useful, it's important to remember that they are not recognized in every state. As of the last update, Connecticut does not recognize Transfer-on-Death Deeds for real estate. A person's ability to use this tool depends entirely on the state where the property is located.

You can't change your mind after recording it. Another common misconception is that a TOD Deed is irrevocable and cannot be changed once it has been recorded. However, property owners retain the right to revoke or amend this deed as long as they follow the legal requirements to do so.

It eliminates the need for a will. Some people mistakenly think that if they have a TOD Deed, they don't need a will. This is not the case, as the TOD Deed only covers the transfer of real estate. A comprehensive estate plan, including a will, is important for addressing other assets and specifying executors and guardians if necessary.

All types of real estate can be transferred using a TOD Deed. People often think that any type of real estate can be transferred with a TOD Deed. However, the kind of real estate that can be transferred using a TOD Deed might be limited by state law, and as mentioned, Connecticut does not currently allow for the use of TOD Deeds for real estate.

It overrides a will. There's a misconception that a TOD Deed will override provisions made in a will pertaining to the same piece of property. While a TOD Deed does take precedence over a will for the specific piece of real estate it covers, it's important to ensure that all estate planning documents are consistent to avoid potential conflicts and confusion.

Understanding the specifics and limitations of any estate planning tool, including the Transfer-on-Death Deed, is crucial for effectively managing one's estate. It's always advisable to consult with a legal professional to ensure your estate planning aligns with your goals and complies with the relevant laws of your state.

Key takeaways

Filling out and using the Connecticut Transfer-on-Death (TOD) Deed form can be an effective estate planning tool that allows property owners to pass their real estate directly to a beneficiary upon their death without the need for probate. Understanding the nuances of this document is critical for ensuring a smooth transfer of ownership. Here are five key takeaways to guide you through this process:

- Ease of Avoiding Probate: One of the primary benefits of a TOD deed is its ability to bypass the probate process. This can save the beneficiary time and money, making it a straightforward method to transfer property.

- Revocability: The TOD deed is fully revocable during the life of the property owner. This means that the property owner can change beneficiaries or revoke the deed entirely without needing consent from the designated beneficiary.

- Does Not Affect Ownership Rights: Completing a TOD deed does not restrict the owner's rights to use or sell the property during their lifetime. The owner retains full control over the property, and the deed only takes effect upon their death.

- Requirements for Validity: For a TOD deed to be valid, it must meet specific requirements, including being properly completed, signed, and notarized. Additionally, it must be recorded with the appropriate local government office before the owner's death to be effective.

- Consideration of Other Estate Planning Tools: While a TOD deed can be a valuable part of an estate plan, it's essential to consider it within the broader context of your estate planning needs. Consulting with a legal professional who understands Connecticut's real estate and estate laws can help ensure that a TOD deed complements other estate planning documents and strategies.

Remember, every property owner's situation is unique, and laws can vary from state to state. While the TOD Deed form is a powerful tool in Connecticut, its use should be carefully evaluated within the framework of your overall estate planning goals and in consultation with a legal expert. This approach ensures that your property and your beneficiaries are protected according to your wishes.

Create Other Transfer-on-Death Deed Forms for US States

Transfer Deed Upon Death - It’s an excellent tool for anyone desiring a hassle-free way to ensure their property legacy is preserved according to their wishes.

Avoid Probate in California - Facilitates a smooth transition of property ownership from the deceased to the named beneficiary without court involvement.

Colorado Beneficiary Deed - Transfer-on-Death Deeds can be a cornerstone for individuals who wish to simplify their estate planning concerning real property.