Blank Transfer-on-Death Deed Form for Florida

In the state of Florida, the Transfer-on-Death Deed form serves as a crucial legal instrument for estate planning, allowing property owners to pass on their real estate assets straightforwardly and without the need for a will. This tool is designed to simplify the process of transferring property ownership upon the owner's death, ensuring that the designated beneficiaries receive the assets directly, thereby bypassing the often lengthy and costly probate process. The significance of this form lies not only in its ability to provide peace of mind to property owners but also in its role in facilitating a smooth transition of assets to the next generation, reducing potential conflicts among heirs. By stipulating clear instructions for the future of their property, owners can ensure that their wishes are respected, making the Transfer-on-Death Deed an essential component of comprehensive estate planning in Florida.

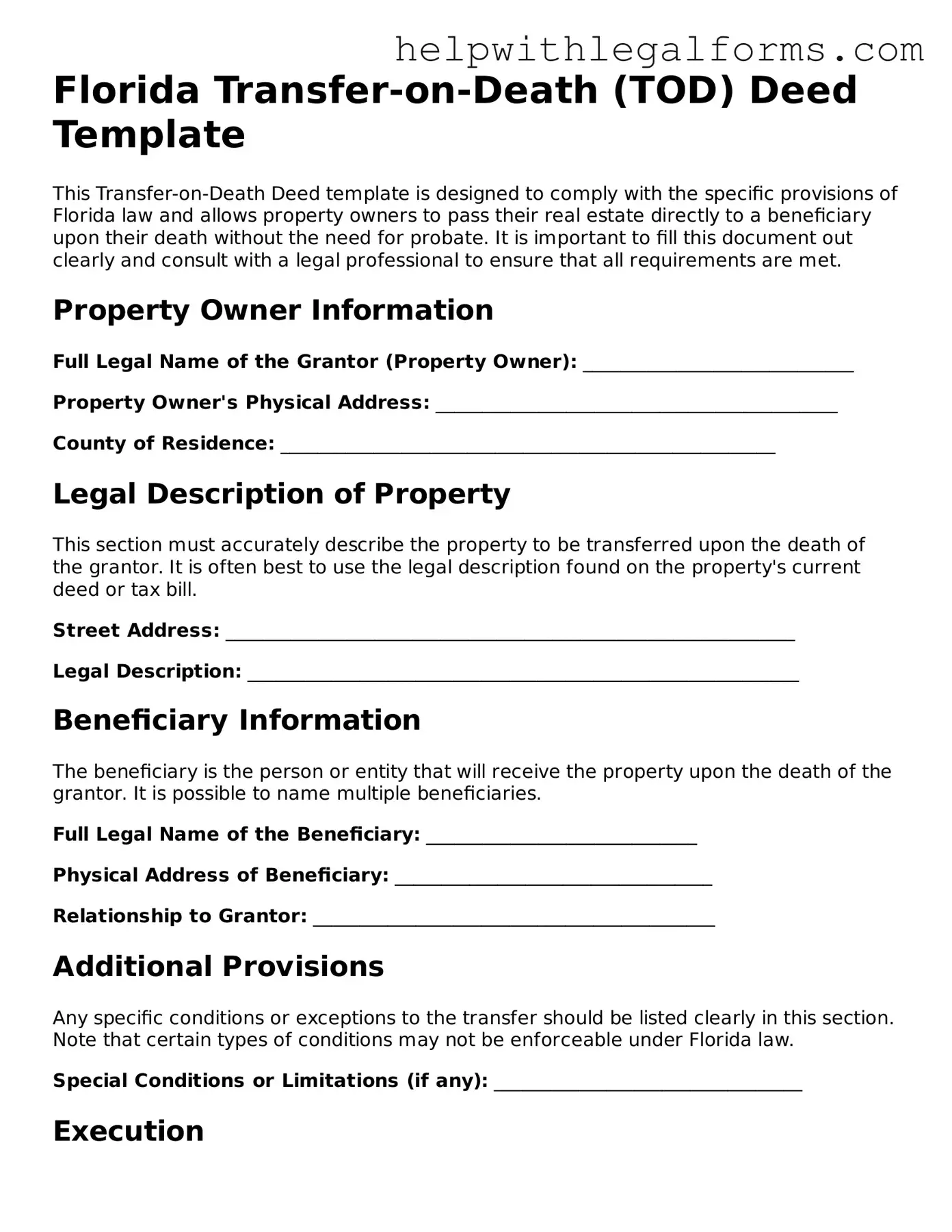

Example - Florida Transfer-on-Death Deed Form

Florida Transfer-on-Death (TOD) Deed Template

This Transfer-on-Death Deed template is designed to comply with the specific provisions of Florida law and allows property owners to pass their real estate directly to a beneficiary upon their death without the need for probate. It is important to fill this document out clearly and consult with a legal professional to ensure that all requirements are met.

Property Owner Information

Full Legal Name of the Grantor (Property Owner): _____________________________

Property Owner's Physical Address: ___________________________________________

County of Residence: _____________________________________________________

Legal Description of Property

This section must accurately describe the property to be transferred upon the death of the grantor. It is often best to use the legal description found on the property's current deed or tax bill.

Street Address: _____________________________________________________________

Legal Description: ___________________________________________________________

Beneficiary Information

The beneficiary is the person or entity that will receive the property upon the death of the grantor. It is possible to name multiple beneficiaries.

Full Legal Name of the Beneficiary: _____________________________

Physical Address of Beneficiary: __________________________________

Relationship to Grantor: ___________________________________________

Additional Provisions

Any specific conditions or exceptions to the transfer should be listed clearly in this section. Note that certain types of conditions may not be enforceable under Florida law.

Special Conditions or Limitations (if any): _________________________________

Execution

To be legally valid, this deed must be signed by the grantor in the presence of two witnesses and a notary public. The deed should then be recorded with the county recorder’s office in the county where the property is located.

Date: _______________

Grantor's Signature: ________________________________________

Print Name: ________________________________________________

Witness #1 Signature: _______________________________________

Print Name: ________________________________________________

Witness #2 Signature: _______________________________________

Print Name: ________________________________________________

Notary Public Signature: ____________________________________

Print Name: ______________________ Notary Public, State of Florida

Commission Number: _________________________________________

This document was acknowledged before me on (date) ______________ by (name of grantor) _________________________________________, who is personally known to me or has produced _____________________________ as identification.

Instructions for Recording

After the execution of this deed, it must be recorded with the county recorder’s office to be effective. The grantor or beneficiary should bring or send the original signed document along with any required recording fee to:

County Recorder’s Office

Address: __________________________________________________

Recording this document as soon as possible after execution is crucial for ensuring the transfer of property is recognized under Florida law.

PDF Form Attributes

| Fact | Detail |

|---|---|

| 1. Purpose | The Florida Transfer-on-Death Deed form allows property owners to pass their real estate property directly to a beneficiary when they die, without the need for probate court proceedings. |

| 2. Revocability | This type of deed is revocable, meaning the property owner can change their mind at any time before their death, without needing consent from the named beneficiary. |

| 3. Beneficiary Designation | Owners can name one or more beneficiaries, as well as contingent beneficiaries, ensuring flexibility in how the property is passed on. |

| 4. Governing Law | While Florida recognizes Transfer-on-Death (TOD) deeds for vehicles and other assets, it does not currently allow real estate to be transferred using a TOD deed. Owners must explore alternative estate planning tools under Florida law. |

| 5. Effect on Probate | Where applicable, TOD deeds can help avoid the often lengthy and costly probate process, allowing for a smoother and more direct transfer of property to beneficiaries. |

Instructions on How to Fill Out Florida Transfer-on-Death Deed

Understanding how to correctly complete the Florida Transfer-on-Death (TOD) Deed form is of great importance for those wishing to pass real estate to a beneficiary upon their death, avoiding probate court. This document allows property owners to name one or more beneficiaries while retaining full control of the property during their lifetime. Completing this form accurately ensures your real estate is transferred seamlessly to your designated beneficiary(ies) without unnecessary legal complications.

Steps to Fill Out the Florida Transfer-on-Death Deed Form:

- Gather all necessary information, including the legal description of the property, your full legal name, and the full legal names of all beneficiaries.

- Locate the appropriate form, which can be obtained from a legal forms provider or an attorney specializing in estate planning.

- Enter your full legal name as the current property owner in the section labeled “Grantor.”

- Write the complete legal description of the property in the designated section. This information can be found on your property deed or by contacting your local county recorder’s office.

- List the full legal names and addresses of all designated beneficiaries in the specified section titled “Beneficiary.” Make sure to accurately spell all names and include any necessary details to avoid future disputes or confusion.

- Specify the type of ownership (if more than one beneficiary is named) by choosing between "joint tenancy" or "tenants in common.”

- Sign the form in the presence of a notary public. Make sure the notary public completes their section, including their seal and signature, to officially notarize the document.

- Record the completed and notarized Transfer-on-Death Deed form with your county’s recorder office to make it legally effective. There may be a recording fee, which varies by county.

By following these steps with care and attention to detail, property owners can ensure that their real estate is passed on according to their wishes, while beneficiaries can avoid the lengthy and costly process of probate court. It's strongly advised to consult with a legal professional before finalizing any estate planning document to confirm compliance with current Florida laws and regulations.

Crucial Points on This Form

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death (TOD) deed in Florida allows property owners to pass their real estate to a beneficiary directly upon their death, without the property having to go through probate. It is a legal document that must be signed, notarized, and recorded with the county records to be effective.

Who can create a Transfer-on-Death Deed in Florida?

Any property owner in Florida who has the legal capacity to own and transfer property can create a TOD deed. This means the individual must be of sound mind and at least 18 years old or legally emancipated.

Can a Transfer-on-Death Deed be revoked?

Yes, a TOD deed can be revoked at any time before the death of the owner. Revocation can be done by preparing and recording a new deed that explicitly revokes the previous one or conveys the property to someone else.

Is it necessary to notify the beneficiary about the Transfer-on-Death Deed?

While it is not a legal requirement in Florida to notify the beneficiary about the TOD deed, it is considered a good practice. Informing the beneficiary can help ensure a smoother transition of ownership after the property owner's death.

What happens to a property with a Transfer-on-Death Deed if the beneficiary predeceases the owner?

If the beneficiary predeceases the owner, the TOD deed generally becomes ineffective unless an alternate beneficiary is named. The property would then be distributed according to the property owner’s will or, if there is no will, through Florida’s intestate succession laws.

Are there any limitations on what type of property can be transferred using a Transfer-on-Death Deed in Florida?

Yes, the TOD deed in Florida is specifically for real estate properties. It cannot be used to transfer personal property, such as cars or jewelry. Additionally, the property must be located in Florida.

Does a Transfer-on-Death Deed avoid probate in Florida?

Yes, one of the primary benefits of a TOD deed is that it allows the property to bypass the probate process. The transfer of ownership happens automatically upon the death of the property owner, simplifying the transfer process and potentially saving time and money.

Can creditors claim against the property transferred by a Transfer-on-Death Deed?

After the property owner's death, creditors may have claims against the estate, including property passed through a TOD deed. However, Florida law provides certain protections for homestead property. It's advisable to consult with a legal professional for specific advice regarding creditors and debt obligations.

How is a Transfer-on-Death Deed recorded in Florida?

To record a TOD deed, the completed and notarized document must be filed with the Clerk of the Circuit Court’s office in the county where the property is located. A recording fee will be required, and the amount can vary by county.

Can joint property owners use a Transfer-on-Death Deed in Florida?

Yes, joint property owners can use a TOD deed to specify beneficiaries. However, it’s important to understand how joint ownership is structured, as this will impact the way the TOD deed operates upon the death of one owner. Each owner may need to complete a separate TOD deed depending on their intentions for the property after their death.

Common mistakes

Filling out the Florida Transfer-on-Death (TOD) Deed form is an important step for individuals planning their estates. It allows property to pass to a beneficiary without going through probate. However, people often make mistakes during this process. Understanding these common errors can help ensure that one's wishes are honored smoothly and without undue delay.

-

Not properly identifying the beneficiary. The individual or entity designated to receive the property must be clearly and accurately named. When information is missing or incorrect, it can lead to disputes among potential heirs and may require legal intervention to resolve.

-

Failing to adequately describe the property. A detailed legal description of the property is critical. This includes not only the address but also the legal description used in public records. An incomplete or incorrect description can create confusion and potential legal challenges.

-

Overlooking the need for witness signatures. Florida law requires that TOD deeds be signed in the presence of witnesses. Neglecting this step can invalidate the document entirely, as witnesses play a critical role in the authentication process.

-

Not having the deed notarized. In addition to witness signatures, the deed must be notarized to be legally binding. The notarization process confirms the identity of the signer and ensures that the signature was made willingly and without coercion.

-

Forgetting to file the deed with the county recorder’s office. Simply completing and signing the deed is not enough. For the transfer to be effective upon death, the document must be properly filed with the appropriate county office. Failure to do so means the deed may not be recognized, and the property could still go through probate.

Avoiding these mistakes requires diligence and attention to detail. Individuals are encouraged to seek professional advice to ensure that all legal requirements are met. Proper completion and filing of the TOD deed are fundamental steps in making a seamless transition of property ownership after one's passing.

Documents used along the form

When handling estate planning and property transfers in Florida, the Transfer-on-Death (TOD) Deed form is a crucial document that allows property owners to pass real estate directly to a beneficiary without the need for probate. Alongside this key document, several other forms are often used to ensure that the property transfer goes smoothly and in compliance with the law. Here is a list of these documents, which play pivotal roles in the estate planning and property transfer process.

- Revocation of Transfer-on-Death Deed Form: This form is essential if the property owner decides to change their mind about the beneficiary or wishes to revoke the TOD deed. Just as the TOD deed enables a seamless transfer upon the owner's death, this document allows for easy revocation of that transfer if circumstances change.

- Last Will and Testament: Often used in conjunction with a TOD deed, the last will outlines the decedent's wishes regarding the distribution of their assets, excluding the property covered by the TOD deed. It's a critical document for a comprehensive estate plan.

- Florida Durable Power of Attorney: This legal document allows someone you trust to make decisions on your behalf, particularly useful if you become incapacitated before your death. It's important for managing your affairs and ensuring your estate plan is executed effectively.

- Living Will: This document specifies your wishes concerning life-sustaining treatment if you are terminally ill or in a persistent vegetative state, ensuring your medical and end-of-life preferences are respected.

- Designation of Health Care Surrogate: Similar to a living will, this form names someone to make healthcare decisions for you if you're unable to communicate your wishes, ensuring your healthcare is in trusted hands.

- Declaration of Preneed Guardian: By declaring a preneed guardian, you can choose who will manage your affairs if you become mentally incapacitated, providing you with control over this important decision before it's needed.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) prevents the disclosure of medical information to unauthorized individuals. This form allows designated persons to have access to your medical records, vital for making informed health decisions on your behalf.

- Notice of Confidential Information within Court Filing: When filing estate planning documents that contain sensitive information, this form helps protect that information by notifying the court of its presence, ensuring it's treated with the confidentiality it deserves.

- Property Deed: Prior to executing a TOD deed, having a current property deed is necessary as it proves your ownership of the property and details the property's legal description, both crucial for accurately completing the TOD deed.

In conclusion, while the Florida Transfer-on-Death Deed form plays a pivotal role in bypassing the probate process for real estate, it is only a part of a broader set of legal documents and forms that together create a comprehensive estate plan. From revoking a TOD deed to designating a health care surrogate, each document serves a specific purpose, ensuring that an individual's estate is managed according to their wishes both before and after their passing. Thus, understanding and utilizing these documents in conjunction with the TOD deed is essential for effective estate planning in Florida.

Similar forms

Living Trusts: Just like a Transfer-on-Death (TOD) Deed, living trusts allow individuals to bypass probate by directly transferring property to beneficiaries upon death. Both documents enable the control of assets during the owner's lifetime, with a seamless transition upon their passing.

Joint Tenancy with Right of Survivorship: This form of co-ownership automatically transfers the ownership of property to the surviving owner(s) when one owner dies, akin to how TOD Deeds transfer real estate to named beneficiaries. Both processes avoid probate court.

Beneficiary Designations on Retirement Accounts: Similar to TOD Deeds, designating beneficiaries on retirement accounts like IRAs or 401(k)s directly passes assets to chosen individuals without going through probate. It specifies who inherits the assets after the account holder's death.

Payable-on-Death (POD) Accounts: Often used for bank accounts, these allow for the direct transfer of funds to named beneficiaries upon the account holder's demise. The mechanism resembles TOD Deeds by avoiding probate and ensuring assets pass to beneficiaries right away.

Life Insurance Policies: Life insurance policies designate beneficiaries who receive the death benefits directly upon the policyholder's death. This mirrors the concept of TOD Deeds by bypassing the probate process and providing immediate financial support to beneficiaries.

Transfer-on-Death Registration for Vehicles: Some states offer TOD registration for vehicles, allowing owners to name beneficiaries for their cars or trucks. Upon the owner's death, the vehicle is transferred to the beneficiary, similar to how real estate is transferred through TOD Deeds, avoiding probate.

Dos and Don'ts

When dealing with the intricacies of transfer-on-death (TOD) deeds in Florida, it's paramount to approach the process with both care and diligence. These deeds allow for the direct transfer of property to a beneficiary upon the death of the original owner, bypassing the often lengthy and complex probate process. To ensure a smooth and legally sound transfer, here are several guidelines to keep in mind:

- Do thoroughly read the form instructions before filling it out. Misunderstanding the requirements can lead to delays or even a voided deed.

- Do accurately identify all parties by their full legal names and include their complete and correct addresses to prevent any confusion about the identities of the owner and the beneficiaries.

- Do clearly describe the property being transferred. Include all relevant details such as the address, legal description, and parcel identification number to ensure the deed correctly references the intended property.

- Do sign the deed in the presence of a notary public. Notarization is critical for the document's validity and ensures that it is legally binding and recognized.

- Don't neglect to check if any additional documents are required to accompany the TOD deed when filing. Sometimes, specific forms or attachments are necessary for the deed to be accepted and processed correctly.

- Don't hesitate to consult with a legal professional if you have questions or concerns about the TOD deed process. An attorney can provide valuable guidance tailored to your situation and help avoid common pitfalls.

- Don't forget to file the completed TOD deed with the appropriate local office, commonly the county recorder's office, where the property is located. Failing to officially record the deed can result in it not being recognized as valid.

- Don't overlook the need to inform the beneficiary about the TOD deed. While not a legal requirement, doing so can prepare them for their future responsibilities and rights regarding the property.

Adhering to these do's and don'ts can streamline the process of establishing a transfer-on-death deed in Florida, ensuring the property smoothly transitions according to the owner's wishes without unforeseen legal hurdles.

Misconceptions

When it comes to planning for the future, the Transfer-on-Death (TOD) deed can be a useful tool. Specifically, in Florida, there are some common misconceptions about the TOD deed that need clarification to ensure individuals are fully informed about their estate planning options.

It avoids probate for all your assets. Many believe that a TOD deed will help them avoid the probate process for their entire estate. However, it only applies to the specific property named in the deed. Other assets not included in the TOD deed or otherwise properly planned for may still go through probate.

It gives the beneficiary immediate rights to the property. Another misconception is that the beneficiary has rights to the property as soon as the TOD deed is signed. In reality, the beneficiary's rights only become effective upon the death of the property owner.

The owner cannot sell the property. Some people think that once a TOD deed is created, the owner cannot sell or mortgage the property. This is not accurate. The owner retains full control over the property and can sell, lease, or mortgage the property at any time.

It's only for individuals with large estates. The perception that TOD deeds are only for those with large estates is widespread but incorrect. Individuals at various asset levels can use TOD deeds as part of their estate planning strategy.

It eliminates the need for a will. Another common belief is that having a TOD deed means you don't need a will. While TOD deeds can be a valuable part of an estate plan, they do not replace the need for a comprehensive will that covers assets not included in the TOD deed.

It's complicated to create. The process of creating a TOD deed is often thought to be complicated and time-consuming. In truth, with the right guidance, the process can be straightforward and simple.

It cannot be revoked. Some people mistakenly believe that once a TOD deed is executed, it cannot be revoked. However, the property owner can revoke the deed at any time if they decide to change their estate planning strategy.

It automatically covers all debts on the property. A common misconception is that if there are any debts or liens against the property, they are automatically taken care of by the TOD deed. In reality, the beneficiary takes the property subject to any existing debts or liens.

All states recognize the Transfer-on-Death Deed. Finally, not all states in the U.S. recognize the TOD deed, and the rules can vary significantly where they do exist. It's important to consult with a legal professional to understand how these deeds work in your state.

Understanding the facts about the Transfer-on-Death (TOD) deed, especially within Florida's specific legal context, can ensure that individuals make informed decisions about managing and transferring their assets. Consulting with a legal advisor who understands the intricacies of estate planning within your state is always recommended to navigate these complex issues effectively.

Key takeaways

In Florida, the Transfer-on-Death (TOD) Deed form can be a valuable tool when planning your estate. It allows property to be passed directly to a beneficiary upon the owner’s death, bypassing the probate process. Here are nine key takeaways you should keep in mind when filling out and using this form:

- Specific Requirements: The requirements for a TOD Deed in Florida must be closely followed to ensure its validity. These include proper signing, witnessing, and notarization.

- Revocability: A TOD Deed can be revoked by the owner at any time before their death. This provides flexibility in case of changes in personal circumstances or wishes.

- Beneficiary Designations: Clearly identify each beneficiary by their full legal name to avoid any confusion regarding who should inherit the property.

- Multiple Beneficiaries: If designating more than one beneficiary, specify how the property interest is to be divided. Be explicit whether the beneficiaries should own the property equally or in specific shares.

- Avoiding Probate: One of the main advantages of a TOD Deed is the ability to transfer property directly to beneficiaries without going through the potentially lengthy and costly probate process.

- Not a Substitute for a Will: While a TOD Deed can transfer real estate, it does not replace a will. Other assets not specified in a TOD Deed should be addressed in a will or through other estate planning tools.

- Recording the Deed: After completing the TOD Deed, it must be recorded with the local county recorder’s office. Failure to record the deed makes it ineffective for transferring property upon death.

- No Immediate Effect on Ownership: Filling out a TOD Deed does not affect your current ownership rights. You retain full control and use of the property during your lifetime.

- Legal and Financial Considerations: Before executing a TOD Deed, consider consulting with a legal or financial advisor to understand all implications fully, especially regarding tax consequences and potential impacts on Medicaid eligibility.

Create Other Transfer-on-Death Deed Forms for US States

Where Can I Get a Tod Form - Sets the stage for a smooth and immediate transition of your property to your chosen beneficiary.

Transfer on Death Deed Maryland - Completing this form can be a crucial part of your estate planning, helping to ensure your wishes are fulfilled after you're gone.

Does a Beneficiary Deed Avoid Probate - It offers a peace of mind, knowing real estate will securely transfer to the chosen heir with minimal legal hurdles.