Blank Transfer-on-Death Deed Form for Georgia

In the state of Georgia, the Transfer-on-Death (TOD) Deed presents a strategic estate planning tool designed to streamline the process of transferring property upon the death of the owner. This particular form allows property owners to name beneficiaries who will inherit their property without the need for the property to go through probate, a legal process that can be both time-consuming and costly. One of the major advantages of the TOD Deed is its simplicity and flexibility; it enables property owners to retain full control over their property during their lifetime, including the right to change beneficiaries or sell the property at any time. It is also revocable, meaning that the property owner can amend or revoke the deed without the need for consent from the named beneficiaries. This ensures that the property owner’s wishes are honored up to their final moments, providing a clear and efficient means of transferring real estate directly to loved ones or other named beneficiaries upon the owner's death. The TOD Deed must be properly completed, signed, and recorded in the county where the property is located to be legally binding. It is an invaluable document for those seeking to ease the transfer of their real estate assets and mitigate the potential for legal complications during an already challenging time.

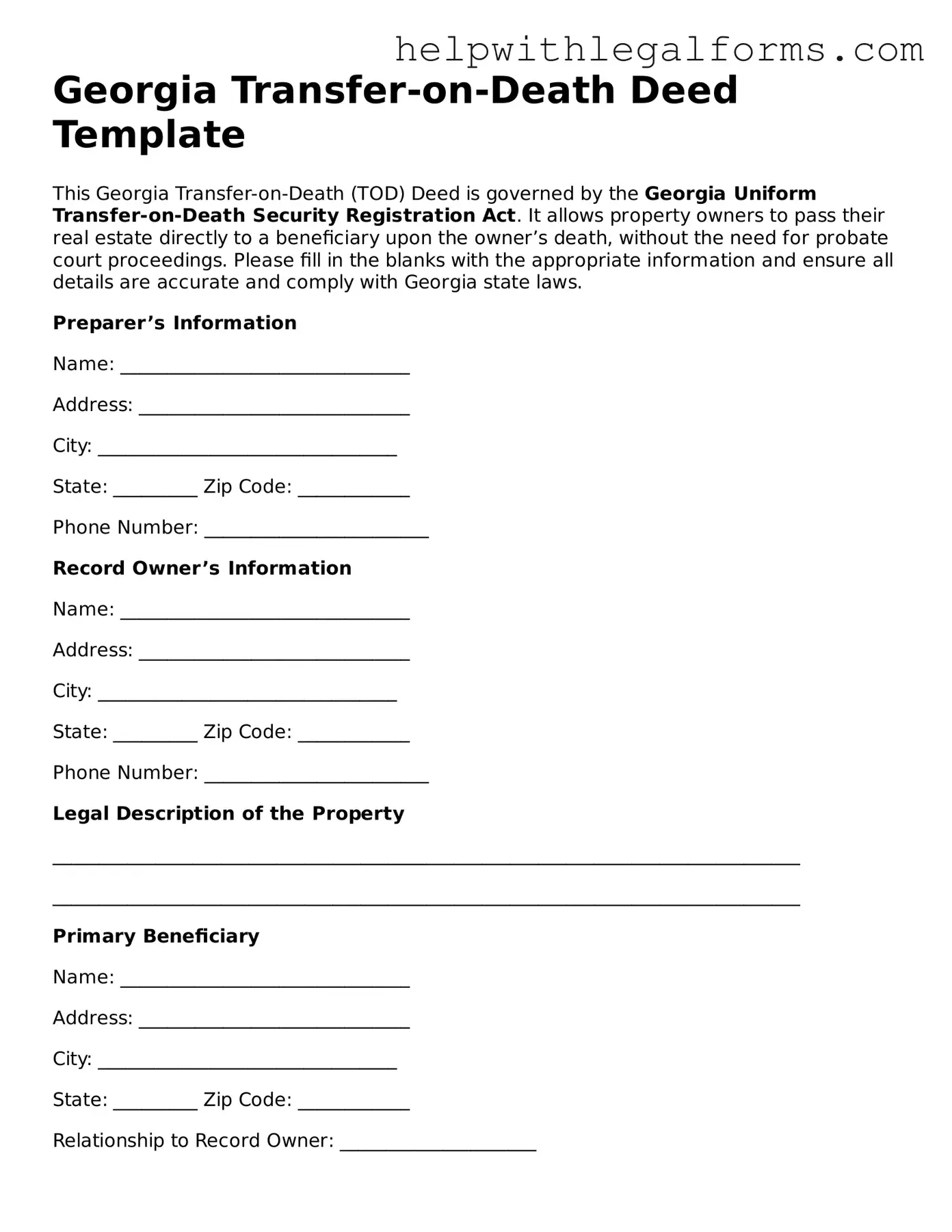

Example - Georgia Transfer-on-Death Deed Form

Georgia Transfer-on-Death Deed Template

This Georgia Transfer-on-Death (TOD) Deed is governed by the Georgia Uniform Transfer-on-Death Security Registration Act. It allows property owners to pass their real estate directly to a beneficiary upon the owner’s death, without the need for probate court proceedings. Please fill in the blanks with the appropriate information and ensure all details are accurate and comply with Georgia state laws.

Preparer’s Information

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _________ Zip Code: ____________

Phone Number: ________________________

Record Owner’s Information

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _________ Zip Code: ____________

Phone Number: ________________________

Legal Description of the Property

________________________________________________________________________________

________________________________________________________________________________

Primary Beneficiary

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _________ Zip Code: ____________

Relationship to Record Owner: _____________________

Alternate Beneficiary (If primary beneficiary predeceases the record owner)

Name: _______________________________

Address: _____________________________

City: ________________________________

State: _________ Zip Code: ____________

Relationship to Record Owner: _____________________

In accordance with the Georgia Uniform Transfer-on-Death Security Registration Act, upon the death of the record owner, the described property shall transfer to the named beneficiary or beneficiaries. This deed does not give the beneficiary an immediate right to the property. The transfer-on-death deed can be revoked by the record owner at any time before the record owner's death.

Execution

The undersigned record owner affirms that this transfer-on-death deed is executed as part of a comprehensive estate plan and is done freely and voluntarily.

_________________________________

Signature of Record Owner

_________________________________

Date

Acknowledgment

This document was acknowledged before me on (date) _______________ by (name of record owner) _______________________________.

_________________________________

Signature of Notary Public

My commission expires: _______________

This Transfer-on-Death Deed must be properly recorded with the local county recorder’s office in Georgia where the property is located to be effective.

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Transfer-on-Death (TOD) Deed form allows Georgia property owners to pass real estate to a beneficiary without the need for probate court proceedings after their death. |

| 2 | This form must be properly completed, signed, and notarized to be valid and enforceable under Georgia law. |

| 3 | In Georgia, the Transfer-on-Death Deed form is governed by § 53-6-11 of the Georgia Code. |

| 4 | The property owner can change their mind at any time before their death and can revoke the TOD deed or name a different beneficiary without the consent of the original beneficiary. |

| 5 | The beneficiary gains no rights to the property, including no right to sell or mortgage it, until the death of the property owner. |

| 6 | Real estate is transferred to the designated beneficiary subject to any mortgages or liens attached to the property at the time of the owner’s death. |

| 7 | To be effective, the completed and notarized form must be filed with the county recorder’s office in the county where the property is located before the owner’s death. |

| 8 | Transfer-on-Death Deeds are a way to streamline the process of transferring property to a beneficiary but do not substitute for a will or influence other assets not covered by the deed. |

Instructions on How to Fill Out Georgia Transfer-on-Death Deed

When you decide to use a Transfer-on-Death (TOD) Deed for your property in Georgia, you're taking a significant step towards arranging your affairs and ensuring your real estate is passed along according to your wishes without going through probate. A TOD deed allows you to name a beneficiary who will become the owner of the property upon your death, without the need for a lengthy court process. It's important to fill out this form carefully to make sure your property transfers smoothly.

Here is a step-by-step guide to help you fill out the Georgia Transfer-on-Death Deed form:

- Start by identifying yourself as the current property owner. Write your full legal name and address in the designated spaces.

- Describe the property being transferred. Include the full address and any legal description that identifies the property in public records.

- Name the beneficiary (or beneficiaries) who will receive the property upon your death. Provide their full legal names and addresses. If naming more than one beneficiary, specify the ownership share each will receive.

- Review any optional provisions the form might have. Some forms allow you to name an alternate beneficiary in case the primary beneficiary predeceases you. If this option is available and you wish to use it, fill in the details of the alternate beneficiary as well.

- Sign the deed. In Georgia, the deed must be signed in the presence of a Notary Public and possibly additional witnesses depending on current state law requirements. Check the latest requirements to ensure your deed is notarized correctly.

- Record the deed with the county recorder’s office where the property is located. There may be a filing fee, which varies by county. Recording the deed makes it a matter of public record, which is necessary for the transfer-on-death provision to take effect

Filling out the Transfer-on-Death Deed form accurately is crucial for the deed to be valid. Double-check all entries, especially the legal description of the property and the details of the beneficiaries. After completing the form and ensuring all legal formalities are observed, your property will be set to transfer to your designated beneficiary without the need for probate, providing peace of mind to everyone involved.

Crucial Points on This Form

What is a Georgia Transfer-on-Death Deed form?

A Georgia Transfer-on-Death (TOD) Deed form is a legal document that allows property owners to pass their real estate to a beneficiary upon their death without the property having to go through probate. This type of deed is completed and recorded while the owner is still alive but does not take effect until after the owner's death. It simplifies the process of transferring property and can help avoid the time and expense associated with probate.

Who can use a Transfer-on-Death Deed in Georgia?

Any property owner in Georgia who wishes to transfer real estate upon their death can use a Transfer-on-Death Deed. It is ideal for individuals seeking a straightforward method to ensure their property is passed on to a loved one, friend, or even an organization immediately after their death. The property owner must be of sound mind and legally competent to execute the deed. Additionally, the beneficiary designated to receive the property must be clearly identifiable and alive at the time of the property owner's death.

How do you create a Transfer-on-Death Deed in Georgia?

To create a Transfer-on-Death Deed in Georgia, the property owner must prepare a deed that includes the legal description of the property, the name of the designated beneficiary, and a statement that the transfer of the property's title will occur upon the owner's death. This deed must be signed by the property owner in the presence of a notary public and then recorded with the appropriate county recorder's office where the property is located. It's important to consult with a legal professional to ensure the deed complies with Georgia law and properly reflects the owner's wishes.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time prior to the death of the property owner, as long as the owner is still legally competent. To revoke or change the deed, the owner can record a new deed that expressly revokes the previous one or creates a new TOD deed that names a different beneficiary. This new deed must also be properly signed, notarized, and recorded to be effective. Seeking legal advice before making changes is recommended to ensure the new deed accurately reflects the owner's intentions and complies with state laws.

Does a beneficiary automatically take ownership of the property upon the owner's death?

Upon the death of the property owner, the beneficiary designated in the Transfer-on-Death Deed automatically becomes the legal owner of the property, bypassing the probate process. However, to formalize the transfer of ownership, the beneficiary must take certain steps, such as filing a copy of the death certificate and a notarized affidavit with the county recorder's office where the property is located. These steps are necessary to update the title and public records, officially transferring the property to the beneficiary. It may be beneficial to consult with a legal professional to ensure all procedures are correctly followed.

Common mistakes

When completing the Georgia Transfer-on-Death Deed form, individuals often encounter several common mistakes. These errors can affect the validity of the deed or cause confusion for the beneficiaries. Paying close attention to detail during the preparation of this document is crucial. Below are ten mistakes frequently made:

Not including the full legal names of beneficiaries can create ambiguity. It's important to use the complete legal name of each person designated to receive property.

Failing to accurately describe the property can lead to disputes or confusion about what property is being transferred. A detailed legal description is essential.

Omitting any existing encumbrances or liens against the property can cause problems for the beneficiaries. Full disclosure ensures they are aware of any obligations.

Incorrectly signing or notarizing the document invalidates the deed. The signature must comply with state requirements, and notarization must be done correctly.

Neglecting to file the deed with the county recorder’s office renders it ineffective. Proper filing is required for the deed to be legally valid.

Assuming it overrides other legal documents without verification can lead to unexpected outcomes. This deed should align with the overall estate plan.

Forgetting to update the deed after significant life changes, such as marriage or divorce, can result in unintended beneficiaries.

Adding or removing beneficiaries improperly can hinder the transfer. Any changes should be made following the correct legal process, potentially requiring a new deed.

Misunderstanding the impact of the Transfer-on-Death Deed on estate taxes is a common error. Consulting with a professional can clarify any tax implications.

Not considering the wishes of the beneficiaries or failing to discuss the deed with them can lead to disputes or disagreements after the transferor's death.

Avoiding these mistakes can help ensure that the Transfer-on-Death Deed accomplishes the property owner's intentions and that the transition process is as smooth as possible for the beneficiaries.

Documents used along the form

When dealing with the transfer of property after someone's passing, the Transfer-on-Death (TOD) Deed form in Georgia is one of several critical documents involved in estate planning and execution. This document allows property owners to name beneficiaries to whom the property will automatically pass upon the owner's death, without the need for probate court proceedings. However, to ensure a comprehensive approach to estate planning and the smooth transfer of assets, several other forms and documents are often used in conjunction with the TOD Deed. These documents cater to different aspects of estate planning, from designating decision-making powers in the event of incapacity to specifying desires for funeral arrangements.

- Last Will and Testament: This document outlines how an individual's assets will be distributed upon their death. It can complement a TOD deed by covering assets not included in the deed.

- Durable Power of Attorney: This grants someone else the authority to make financial decisions on behalf of the person creating the document, should they become unable to do so themselves.

- Health Care Directive: Also known as a living will, this document specifies an individual's wishes regarding medical treatment and end-of-life care, and may appoint a health care agent to make decisions if the individual is incapacitated.

- Revocable Living Trust: This allows an individual to manage their assets during their lifetime and specify how these assets are distributed after death, potentially avoiding probate for the assets placed in the trust.

- Designation of Health Care Surrogate: This appoints another person to make health care decisions if the individual is unable to make them themselves.

- Beneficiary Designations: Forms that designate beneficiaries for specific assets, such as life insurance policies and retirement accounts, which may not be covered under a TOD deed.

- Funeral Instructions: These outline an individual's preferences for their funeral and burial arrangements.

- HIPAA Release Form: This authorizes the disclosure of an individual's health information to specified people, potentially including those named in health care directives.

- Inventory of Assets: This document lists all of an individual's assets, including those that may be transferred via a TOD deed, which helps in planning and executing the estate.

- Property Deed: For real estate not covered by a TOD deed, a standard property deed may be used to transfer ownership according to the terms specified in a will or trust.

These documents work collectively to ensure that an individual's estate planning objectives are met, providing clarity and direction for the disposition of their assets and affairs. Each plays a unique role in the broader context of estate management and planning, often simplifying the legal and administrative processes involved in transferring assets to beneficiaries and ensuring wishes are honored in the event of incapacity or death. Utilizing these documents in conjunction with a TOD Deed can create a comprehensive estate plan tailored to an individual's specific needs and circumstances.

Similar forms

A Last Will and Testament shares similarities with a Transfer-on-Death (TOD) Deed, as both documents facilitate the distribution of assets upon death. However, the TOD Deed specifically addresses the transfer of real estate without the need for probate, while a Will can include various types of assets and requires probate to legally transfer ownership.

A Life Insurance Policy is similar because it also designates beneficiaries to receive assets upon the death of the policyholder. The key similarity lies in the direct transfer to beneficiaries without going through probate, providing a streamlined process for specific assets, unlike the TOD Deed, which is focused solely on real estate.

A Living Trust serves a purpose similar to a TOD Deed by managing and distributing a person's assets upon their death. Both documents allow for the avoidance of probate. However, a Living Trust can cover more than just real estate and includes provisions for management of the assets if the owner becomes incapacitated.

Joint Tenancy with Right of Survivorship agreements allow properties to pass automatically to the surviving owners when one owner dies, similar to how a TOD Deed operates. The primary difference is that Joint Tenancy involves ownership by two or more individuals together, while a TOD Deed allows a property owner to name any beneficiary, who has no ownership rights until the owner’s death.

Payable-on-Death (POD) or Transfer-on-Death (TOD) Accounts in banking and brokerage sectors allow account holders to name beneficiaries who will receive the assets in the account upon the account holder's death. Like TOD Deeds for real estate, these designations bypass the probate process, providing a clear path for assets to transfer directly to the named beneficiaries.

Dos and Don'ts

Do's:

Ensure all information is accurate. Double-check the legal description of the property, the names of the beneficiaries, and your personal information to avoid any mistakes.

Keep the language clear and concise. Legal documents are not the place for ambiguity or unnecessary complexity.

Consult with a legal professional. It’s always wise to seek advice from an attorney experienced in estate planning to ensure that the TOD deed is properly executed in accordance with Georgia law.

Clearly identify the beneficiary or beneficiaries. Specify their full legal names and their relationship to you to avoid any confusion after your passing.

Ensure the deed is properly witnessed and notarized in accordance with Georgia law. This may require two non-beneficiary witnesses and a notary to legally acknowledge your signature.

Keep the deed in a safe and accessible place, and let your executor or personal representative know where it is stored.

Review and update the deed as necessary. Life changes, such as marriage, divorce, or the birth of a child, could affect your intentions with the property.

Don'ts:

Don’t fill out the deed in haste. Take the time to review all the sections and ensure full understanding before proceeding.

Don’t forget to file the deed with the appropriate county office in Georgia. An unrecorded deed may not be effective.

Don’t use uncertain language when naming beneficiaries or describing property. Make sure the wording unequivocally reflects your wishes.

Don’t ignore state-specific requirements. Georgia’s laws regarding TOD deeds may differ from those in other states.

Don’t name a minor directly as a beneficiary without considering the need for a legal guardian or trust to manage the property until they reach legal age.

Don’t overlook the potential impact on your overall estate plan. Consider how the TOD deed will affect the distribution of your assets.

Don’t attempt to use the TOD deed to transfer property that is co-owned without understanding the rights of the other owner(s).

Misconceptions

The Georgia Transfer-on-Death (TOD) Deed form is a legal document that allows property owners to pass real estate directly to a beneficiary upon their death, bypassing the probate process. However, several misconceptions exist regarding the use and implications of this form. Understanding the reality behind these misconceptions is essential for property owners and beneficiaries alike.

- It avoids estate taxes. A common misconception is that transferring property through a TOD deed will avoid estate taxes. In reality, the property's value is included in the decedent's estate for tax purposes, potentially subjecting it to estate taxes.

- It eliminates the need for a will. While a TOD deed can transfer real estate directly to a beneficiary, it does not replace the need for a will. Other assets not covered by TOD deeds or similar arrangements still require a will for distribution.

- It provides immediate ownership to the beneficiary. Another misconception is that the beneficiary gains immediate ownership rights upon the form's execution. Ownership only transfers after the property owner's death.

- It cannot be revoked. Contrary to what some might think, a TOD deed can be revoked by the property owner at any time before their death, as long as the revocation is properly executed and recorded.

- It overrides joint tenancy rights. Some believe that a TOD deed can override rights of survivorship associated with joint tenancy. However, the TOD deed only takes effect after all owners have passed away.

- It is recognized in all states. Not all states recognize Transfer-on-Death deeds, which can lead to confusion and misconceptions. Property owners should verify that their state acknowledges TOD deeds and understand the specific requirements.

- It allows transfer of any property type. A TOD deed specifically applies to real estate and cannot be utilized to transfer personal property, such as vehicles or securities, which may have their own transfer-on-death registration or designation.

- Beneficiaries can assume mortgages or liens. It's often misunderstood that beneficiaries will automatically assume responsibility for any mortgage or lien on the property. While the property is transferred subject to these encumbrances, arrangements for their satisfaction must be made.

- It confers immediate rights to use the property. Beneficiaries do not gain any right to use the property or dictate its use until after the owner's death. The current owner retains full control and enjoyment of the property during their lifetime.

- It avoids probate for all assets. A final misconception is the belief that a TOD deed avoids the probate process for all the deceased's assets. This form only applies to the specific property described in the deed, and other assets may still have to go through probate.

Clearing up these misconceptions is vital for anyone considering a Transfer-on-Death Deed in Georgia or any jurisdiction where such arrangements are recognized. Consulting with a legal professional can provide clarity and ensure that all actions taken align with the individual's estate planning goals.

Key takeaways

The Georgia Transfer-on-Death (TOD) deed form allows property owners to pass on real estate to a designated beneficiary without the need for the property to go through the probate process. This can simplify the transfer of property upon the owner’s death. Below are key takeaways to consider when filling out and using the Georgia TOD deed form:

- Eligibility: Not all property types may be eligible for transfer using a TOD deed. Ensure the property in question qualifies under Georgia law.

- Form Requirements: The Georgia TOD deed must meet specific state requirements to be valid. This includes being correctly filled out, signed, and notarized.

- Designating a Beneficiary: Clearly identify the beneficiary or beneficiaries. You can name individuals, trusts, or organizations, but their identities must be clear to avoid future disputes.

- Revocability: A TOD deed can be revoked by the owner at any time before death. This flexibility allows the property owner to change their mind if circumstances change.

- Filing the Deed: For the TOD deed to be effective, it must be properly filed with the local county recorder’s office. Failing to file correctly could render the deed invalid.

- Avoiding Probate: Properly executed, a TOD deed allows the property to pass directly to the beneficiary without going through probate, simplifying the transfer process after the owner's death.

- Impact on Estate Planning: Consider how a TOD deed fits into your broader estate plan. It should complement other estate planning tools and not inadvertently conflict with the terms of a will or trust.

- Legal and Tax Advice: Consult with legal and tax professionals to understand the implications of using a TOD deed, including any tax responsibilities the beneficiary may inherit with the property.

Understanding these key points before completing a Georgia Transfer-on-Death deed form can help ensure that the property transfer aligns with your estate planning goals and complies with Georgia law.

Create Other Transfer-on-Death Deed Forms for US States

Transfer Deed Upon Death - It's a cost-effective way to transfer real estate to a loved one without the hassles of traditional estate processes.

Transfer on Death Deed Connecticut - Choosing to use a Transfer-on-Death Deed can also help in preventing future legal disputes among potential heirs by clearly specifying the owner's intentions.

Transfer on Death Deed Maryland - By naming a beneficiary, you ensure that your property goes to the intended person, safeguarding your last wishes.

Free Printable Transfer on Death Deed Form Florida - Utilizing a Transfer-on-Death Deed can help avoid the time-consuming and often costly process of probate, facilitating a more efficient transfer of assets.