Blank Transfer-on-Death Deed Form for Maryland

The Maryland Transfer-on-Death (TOD) Deed form provides a straightforward mechanism for property owners to pass on their real estate to a designated beneficiary without the need for the property to go through probate upon their demise. This legal document allows for the seamless transition of ownership, ensuring that the beneficiary can claim their inheritance without the typical delays and expenses associated with probate court proceedings. It is crucial for property owners to understand that the deed becomes effective only upon their death, offering them the flexibility to change their beneficiary designation at any point during their lifetime without impacting their current ownership rights. Moreover, the form requires notarization to be legally valid, underscoring the importance of meeting all legal formalities to ensure the intended transfer of property occurs smoothly. With its potential to simplify the transfer of real estate at a critical time, the Maryland TOD Deed is an essential tool for individuals planning their estate, aiming to minimize complications for their heirs.

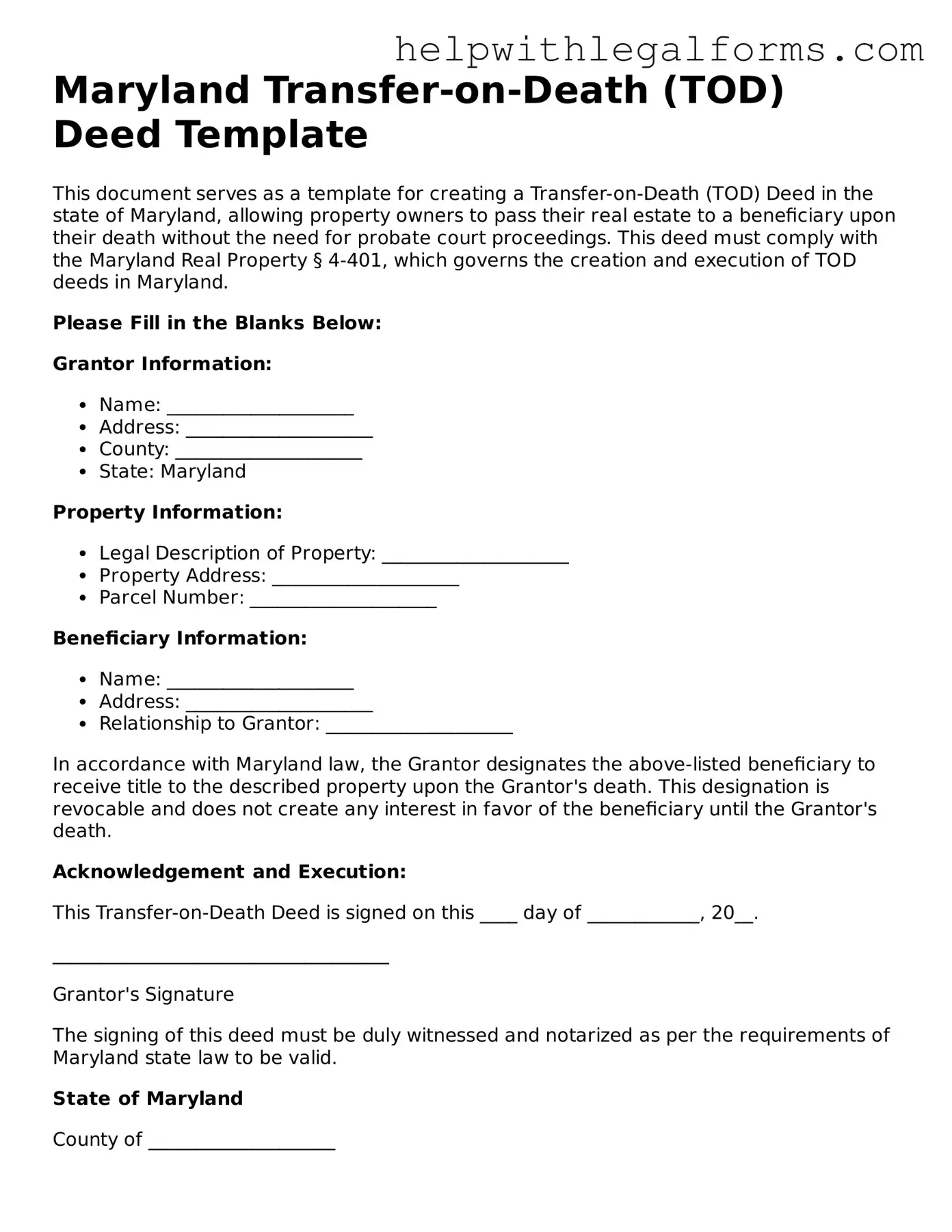

Example - Maryland Transfer-on-Death Deed Form

Maryland Transfer-on-Death (TOD) Deed Template

This document serves as a template for creating a Transfer-on-Death (TOD) Deed in the state of Maryland, allowing property owners to pass their real estate to a beneficiary upon their death without the need for probate court proceedings. This deed must comply with the Maryland Real Property § 4-401, which governs the creation and execution of TOD deeds in Maryland.

Please Fill in the Blanks Below:

Grantor Information:

- Name: ____________________

- Address: ____________________

- County: ____________________

- State: Maryland

Property Information:

- Legal Description of Property: ____________________

- Property Address: ____________________

- Parcel Number: ____________________

Beneficiary Information:

- Name: ____________________

- Address: ____________________

- Relationship to Grantor: ____________________

In accordance with Maryland law, the Grantor designates the above-listed beneficiary to receive title to the described property upon the Grantor's death. This designation is revocable and does not create any interest in favor of the beneficiary until the Grantor's death.

Acknowledgement and Execution:

This Transfer-on-Death Deed is signed on this ____ day of ____________, 20__.

____________________________________

Grantor's Signature

The signing of this deed must be duly witnessed and notarized as per the requirements of Maryland state law to be valid.

State of Maryland

County of ____________________

On this ____ day of ____________, 20__, before me, a notary public, personally appeared ____________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

____________________________________

Notary Public

My Commission Expires: ______________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | Maryland Estates and Trusts Article, Title 14.5 - Maryland General and Limited Power of Appointment Act, governs the Transfer-on-Death (TOD) Deed form. |

| Revocability | A Transfer-on-Death Deed is revocable at any time by the owner during their lifetime without the consent of the beneficiaries. |

| Beneficiary Designation | The owner can designate one or more beneficiaries, including individuals, trusts, or organizations, to receive the property upon their death. |

| No Probate Necessary | Property transferred using a TOD Deed bypasses probate, allowing for a direct transfer to the beneficiary upon the owner's death. |

| Recording Requirements | The TOD Deed must be signed, notarized, and recorded with the local land records office before the owner's death to be effective. |

Instructions on How to Fill Out Maryland Transfer-on-Death Deed

When it comes to managing your estate and ensuring that your assets are distributed according to your wishes after you pass away, Maryland residents have a valuable tool at their disposal: the Transfer-on-Death (TOD) deed. This legal document allows property owners to name one or more beneficiaries who will inherit their property automatically upon the owner's death, without the need for the property to go through probate. Filling out the TOD deed correctly is crucial to ensure that your real estate is transferred smoothly and efficiently to your designated beneficiaries when the time comes. Below is a step-by-step guide to help you complete the Maryland Transfer-on-Death Deed form properly.

- Identify the preparer of the document: Write the name and address of the person completing the form.

- Provide the current property owner's information: Enter the full legal name and address of the current owner(s) as listed on the property's existing title or deed.

- List the legal description of the property: This can be found on your current deed or by contacting your local county’s land records office. Include the lot number, subdivision, and any other details that are part of the legal description.

- Name the designated beneficiary(ies): Clearly write the full legal names of the individuals, trusts, or entities you wish to inherit the property upon your death. If naming multiple beneficiaries, specify whether they will hold the property as joint tenants or as tenants in common.

- Sign and date the deed in front of a notary public: The property owner(s) must sign the form in the presence of a notary public. Be sure the notary completes their section, which includes a notarization stamp or seal.

- Record the deed with the Maryland land records office: After the form is completed and notarized, file it with the land records office in the county where the property is located. You may need to pay a recording fee at the time of filing.

Upon completion, the Maryland Transfer-on-Death Deed becomes part of the official property records, ensuring that the transition of the property to the named beneficiary(ies) will be executed according to your wishes, without the complexity and expense of probate proceedings. Remember, the TOD deed can be revoked or changed at any time before the owner's death, provided that any modifications or the revocation process adhere to Maryland's legal requirements. It's always a good practice to consult with an attorney when creating or changing any significant legal documents, including the TOD deed, to ensure that your rights are protected and your wishes are clearly expressed.

Crucial Points on This Form

What is a Transfer-on-Death (TOD) Deed in Maryland?

A Transfer-on-Death Deed in Maryland is a legal document that enables property owners to pass on their real estate to a designated beneficiary without the need for probate after their death. This document is unique because it allows the property to be transferred directly to the named beneficiary, bypassing the often lengthy and expensive probate process. However, it's important to note that the deed does not take effect until the death of the property owner, allowing them to retain full control over the property during their lifetime.

How can one create a TOD Deed in Maryland?

To create a TOD Deed in Maryland, the property owner must complete a deed form that complies with state law. This involves specifying the current property owner's details, identifying the beneficiary(ies), and providing a legal description of the property. The deed must then be signed by the property owner in the presence of a notary public to be considered valid. After notarization, the deed must be filed with the local county land records office where the property is located. It is highly recommended to consult with a legal professional to ensure accuracy and compliance with Maryland law.

Can a TOD Deed in Maryland be revoked, and if so, how?

Yes, a TOD Deed in Maryland can be revoked by the property owner at any time before their death. To do so, the owner must either prepare and notarize a new deed that explicitly revokes the previous TOD Deed or sells or gifts the property to someone else, effectively nullifying the intended transfer on death. It is also possible to create a subsequent TOD Deed that names a different beneficiary, which automatically revokes the earlier deed, provided the new deed is properly completed, notarized, and recorded. Similar to creating a TOD Deed, revoking one should be done with careful consideration and, ideally, with legal advice.

Are there any restrictions or limitations to using a TOD Deed in Maryland?

While a TOD Deed offers many benefits, there are restrictions and limitations. For instance, if the property is owned jointly, such as by spouses as tenants by the entirety, the TOD Deed can only be applied by the surviving owner. Additionally, the beneficiary must survive the property owner to inherit the property. Moreover, this type of deed does not override debts or other obligations attached to the property; the beneficiary will inherit the property subject to any existing encumbrances. Furthermore, to prevent fraud and ensure clear transfer, the deed must accurately describe the property and comply with all Maryland legal requirements.

Common mistakes

A Transfer-on-Death (TOD) Deed allows property owners in Maryland to pass their real estate to a beneficiary without going through probate. When filling out the Maryland TOD Deed form, people often make mistakes that can complicate or invalidate the process. Here are the five most common errors:

- Not specifying the beneficiary clearly. The name, address, and relationship of the beneficiary should be clearly stated to avoid any ambiguity.

- Forgetting to sign and date in the presence of a notary. The TOD Deed must be signed by the property owner in the presence of a notary public to be legally valid. A failure to do so renders the deed ineffective.

- Failure to record the deed with the county land records office. After notarization, the deed must be recorded with the appropriate county land records office before the property owner’s death, or it will not be effective.

- Lack of witnesses. While not all states require witnesses for a TOD deed, it's crucial to comply with Maryland's specific requirements, which may change. Ensuring that the document is properly witnessed according to the current legal requirements is important.

- Ignoring the need to coordinate with other estate planning documents. The TOD deed should be part of a larger estate plan. It's important to ensure that the instructions in the TOD deed do not conflict with those in wills, trusts, or other estate planning documents.

Mistakes on a Transfer-on-Death Deed can significantly impact the transfer of property upon death. It is always advisable to consult with a professional to ensure that the deed is completed correctly and harmonizes with the overall estate plan.

Documents used along the form

When managing estate planning in Maryland, particularly focusing on the Transfer-on-Death (TOD) Deed, it's valuable to understand several other forms and documents that can either supplement or are closely related to the process. These documents ensure comprehensive estate planning and can help in avoiding probate or clarifying the decedent's wishes regarding their assets after death. Below is a carefully curated list that highlights some other crucial documents often used in tandem with the Maryland TOD Deed form.

- Last Will and Testament: A legal document that spells out an individual's wishes about how their property should be distributed and who should manage the estate until its final distribution.

- Revocable Living Trust: This is an estate planning tool that allows an individual to manage their assets during their lifetime and specifies how these assets should be handled after death, often bypassing the probate process.

- Financial Power of Attorney: A document granting someone authority to manage financial affairs on behalf of another person, possibly including the ability to manage real estate assets, bank accounts, and other financial decisions.

- Advance Medical Directive: Sometimes known as a living will, this outlines an individual's wishes regarding medical treatment and life support measures if they become unable to communicate their decisions due to illness or incapacity.

- Beneficiary Designations: Forms that specify who will receive assets from accounts like IRAs, 401(k)s, and life insurance policies. These designations can supersede wishes expressed in a will or TOD deed.

- Property Title Documents: Legal papers showing the ownership of property, which may need to be referenced or amended in line with the TOD deed to ensure the title accurately reflects the intended transfer on death.

- Trust Agreement: If a property is held in a trust, this document outlines the terms of the trust, including who will manage the property and who the beneficiaries are, playing a crucial role in estate planning alongside the TOD deed.

- Death Certificate: Although not used in the preparation of a TOD deed, it's essential after death to prove the owner's passing and facilitate the transfer of the property as outlined in the TOD deed.

- Probate Court Documents: In some cases, parts of an estate might still go through probate. These legal documents are used to navigate the probate process when required, despite the presence of a TOD deed for some assets.

Understanding and preparing these documents in conjunction with a Transfer-on-Death Deed form can offer a robust strategy for estate planning in Maryland, ensuring wishes are honored and providing clarity and ease for loved ones after death. Each document serves a unique purpose in the broader context of estate and end-of-life planning, making it crucial to consider them carefully within your comprehensive estate plan.

Similar forms

A Living Trust serves as a foundational document in estate planning, permitting individuals to manage their assets while they're alive and allowing a seamless transition of the estate to beneficiaries upon their death, without the need for probate. This similarity to a Transfer-on-Death (TOD) Deed lies in its primary goal to avoid the probate process, though a Living Trust can encompass a broader range of assets than a TOD Deed, which is specifically focused on real property.

Joint Tenancy with Right of Survivorship Deeds establish ownership of property among two or more individuals in such a manner that when one owner dies, their share automatically passes on to the surviving owner(s). This mechanism of bypassing probate and facilitating the direct transfer of property interest mirrors the TOD Deed's function, albeit TOD Deeds transfer property ownership to a named beneficiary, not necessarily a co-owner, upon the owner’s death.

The Beneficiary Deed, a term often used interchangeably with Transfer-on-Death Deed in some jurisdictions, directly designates a beneficiary to inherit property upon the death of the current owner. Like the TOD Deed, it allows property to pass outside of probate, emphasizing a streamlined approach to transferring property rights without the complexities or delays of probate court proceedings.

Payable-on-Death (POD) Accounts function similar to TOD Deeds but in the context of bank and financial accounts. They allow account holders to name beneficiaries who will receive the assets in the account upon the holder's death, bypassing the probate process. This direct transfer mechanism parallels the TOD Deed’s simplicity and effectiveness in estate planning, tailored to non-real estate assets.

A Life Insurance Policy is an agreement that promises payment of a death benefit to designated beneficiaries upon the policyholder's death. Similar to a TOD Deed, it circumvents the probate process, ensuring that beneficiaries receive benefits directly, without the delays and expenses associated with probate. This immediate transfer upon death is a key feature shared with the TOD Deed.

The Retirement Account with Designated Beneficiaries (such as IRAs or 401(k) plans), parallels the TOD Deed in its approach to designating beneficiaries. Account owners can specify who will inherit the account's assets after their death, offering a straightforward pass-through that avoids probate. While TOD Deeds apply to real estate, retirement accounts apply this concept to financial assets, emphasizing beneficiary designation as a tool for efficient estate planning.

Dos and Don'ts

Filling out a Transfer-on-Death (TOD) Deed form in Maryland requires attention to detail and a clear understanding of what is required. Here's a guide to help you navigate the process effectively, ensuring that your property is transferred according to your wishes after your death. Following these dos and don'ts will help you avoid common mistakes and ensure that your TOD deed is legally binding and effective.

Do:- Thoroughly review the form and instructions before you begin to ensure you understand how to complete it correctly.

- Provide all required information accurately, including your full legal name, the full legal names of the beneficiaries, and a precise description of the property.

- Ensure that the deed is signed in the presence of a notary public to validate its authenticity. Maryland law requires notarization for the deed to be legally binding.

- Record the deed with the Maryland land records office in the county where the property is located. Filing the deed makes it a public record and notifies interested parties of the intended transfer upon death.

- Forget to check if there are any updates to the TOD deed requirements in Maryland before you start. Laws can change, and it's important to have the latest information.

- Leave any sections of the form blank. Incomplete forms may not be legally effective, potentially leading to disputes or the property passing through probate.

- Attempt to use the TOD deed to transfer property that is owned as joint tenants or as tenants by the entirety without consulting a legal professional. These types of ownership have survivorship rights that override the TOD deed.

- Ignore the need to update your TOD deed if your circumstances change (e.g., divorce, marriage, or the death of a beneficiary). Keeping your TOD deed current ensures that your property will transfer according to your most recent wishes.

Misconceptions

When it comes to planning for the future, the Maryland Transfer-on-Death (TOD) Deed form is a valuable tool that allows homeowners to pass their property directly to a named beneficiary upon their death, bypassing the probate process. However, there are several misconceptions regarding the use and implications of this form:

Misconception #1: A Transfer-on-Death Deed replaces a will. Many believe that if they have completed a TOD deed, they no longer need a will. This isn’t true. A will is comprehensive, covering assets not specifically named or accounted for by other means, such as personal property without named beneficiaries.

Misconception #2: The beneficiary has rights to the property before the death of the owner. This is false. The beneficiary has no legal rights to the property until after the death of the owner. Until then, the owner retains full control and can revoke the deed or sell the property without the beneficiary's consent.

Misconception #3: Transfer-on-Death Deeds are complicated to create. Some people hesitate, thinking the process is complex. However, in Maryland, creating a TOD deed involves filling out a straightforward form and recording it with the appropriate county’s land records office.

Misconception #4: The beneficiary takes on the property debts. Beneficiaries inherit property free of personal debts of the deceased. However, encumbrances on the property, like a mortgage, remain in effect. Beneficiaries inherit the property along with any obligations attached to it.

Misconception #5: Only family members can be named beneficiaries. There is no restriction on who can be named a beneficiary on a TOD deed. Owners can designate any individual, multiple people, or even organizations as beneficiaries.

Misconception #6: Transfer-on-Death Deeds avoid all forms of probate. While TOD deeds allow the property to bypass the probate process, this does not mean all assets will avoid probate. Assets not specifically designated to pass outside of probate or not otherwise accounted for in estate planning may still go through the process.

Misconception #7: A Transfer-on-Death Deed cannot be contested. Like other estate planning tools, TOD deeds can be contested. Challenges may arise based on claims of undue influence, fraud, or the mental capacity of the owner at the time the deed was executed.

Misconception #8: Once a Transfer-on-Death Deed is filed, it cannot be changed. Owners retain the right to revoke or amend a TOD deed at any time during their lifetime, as long as it is done in accordance with Maryland laws. This flexibility allows property owners to respond to changes in their personal circumstances.

Understanding these misconceptions can help property owners in Maryland make informed decisions about their estate planning, ensuring their assets are distributed according to their wishes with minimal complications for their beneficiaries.

Key takeaways

The Maryland Transfer-on-Death (TOD) Deed allows property owners to pass on their real estate to a beneficiary without going through probate. Here are seven essential takeaways for properly filling out and using this form:

- Eligibility: Only individuals, not entities, can use the TOD deed. The property must be located in Maryland, and the deed must comply with state law requirements.

- Clear Identification of Property: The deed must accurately describe the property being transferred. This includes the legal description used in public records, not just the address.

- Beneficiary Designation: One or more beneficiaries can be named. It’s important to clearly identify each person or entity intended to receive the property and understand that the beneficiary has no legal rights to the property until the owner's death.

- Witness and Notarization Requirements: Maryland law requires the TOD deed to be signed in the presence of two witnesses and notarized. Both steps are crucial for the deed's validity.

- Revocability: The TOD deed can be revoked at any time before the owner's death, provided the revocation is done according to legal procedures. This might include executing a new deed or a formal revocation document.

- Recording the Deed: For a TOD deed to be effective, it must be recorded with the county recorder’s office in the county where the property is located, prior to the owner's death. Failure to record the deed renders it ineffective.

- Impact on Estate Planning: The TOD deed should be coordinated with other estate planning documents to ensure a cohesive plan. Owners should consider how the TOD deed fits with their overall wishes, especially regarding their will, to prevent any unintended consequences.

Understanding and following these key points ensures that the Transfer-on-Death Deed is correctly filled out and effectively used, making it a powerful tool in estate planning in Maryland.

Create Other Transfer-on-Death Deed Forms for US States

Avoid Probate in California - Significantly reduces the legal hurdles families face when transferring property ownership after a loved one’s death.

Colorado Beneficiary Deed - A strategic tool for avoiding probate and ensuring that your real estate is passed on to the person you choose.