Blank Transfer-on-Death Deed Form for New Jersey

In the realm of estate planning, individuals are constantly seeking efficient methods to transfer their assets to heirs with minimal legal hurdles. New Jersey's introduction of the Transfer-on-Death (TOD) deed form serves as a significant development in this pursuit. This instrument allows property owners to designate beneficiaries to whom their property will pass upon their death, bypassing the probate process that often involves complex, time-consuming, and costly legal procedures. The crux of the TOD deed lies in its simplicity and effectiveness as it facilitates a smooth transition of real estate ownership without altering the current rights of the property owner. It is crucial, however, for property owners to understand the specific requirements and implications of utilizing this form, including the need for it to be properly executed and recorded before it takes effect. This deed represents a blend of foresight and practicality, offering a streamlined means of estate planning that underscores the evolving nature of property law in New Jersey.

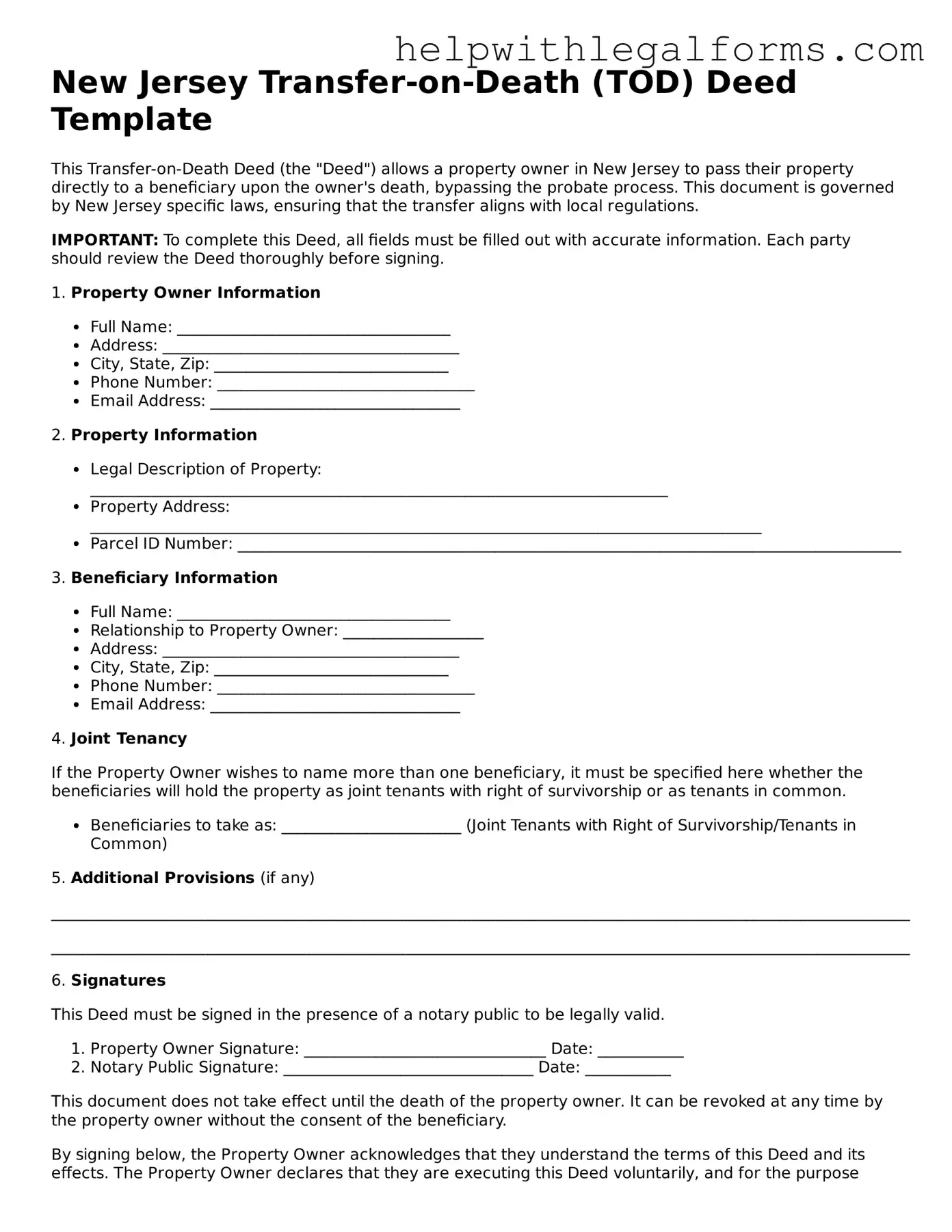

Example - New Jersey Transfer-on-Death Deed Form

New Jersey Transfer-on-Death (TOD) Deed Template

This Transfer-on-Death Deed (the "Deed") allows a property owner in New Jersey to pass their property directly to a beneficiary upon the owner's death, bypassing the probate process. This document is governed by New Jersey specific laws, ensuring that the transfer aligns with local regulations.

IMPORTANT: To complete this Deed, all fields must be filled out with accurate information. Each party should review the Deed thoroughly before signing.

1. Property Owner Information

- Full Name: ___________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Phone Number: _________________________________

- Email Address: ________________________________

2. Property Information

- Legal Description of Property: __________________________________________________________________________

- Property Address: ______________________________________________________________________________________

- Parcel ID Number: _____________________________________________________________________________________

3. Beneficiary Information

- Full Name: ___________________________________

- Relationship to Property Owner: __________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Phone Number: _________________________________

- Email Address: ________________________________

4. Joint Tenancy

If the Property Owner wishes to name more than one beneficiary, it must be specified here whether the beneficiaries will hold the property as joint tenants with right of survivorship or as tenants in common.

- Beneficiaries to take as: _______________________ (Joint Tenants with Right of Survivorship/Tenants in Common)

5. Additional Provisions (if any)

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

6. Signatures

This Deed must be signed in the presence of a notary public to be legally valid.

- Property Owner Signature: _______________________________ Date: ___________

- Notary Public Signature: ________________________________ Date: ___________

This document does not take effect until the death of the property owner. It can be revoked at any time by the property owner without the consent of the beneficiary.

By signing below, the Property Owner acknowledges that they understand the terms of this Deed and its effects. The Property Owner declares that they are executing this Deed voluntarily, and for the purpose named herein.

________________________________________

Property Owner Signature

________________________________________

Date

NOTARY PUBLIC

State of New Jersey

County of _______________________

On this day, ___________________________, before me, _____________________________________(Name of Notary), personally appeared _________________________________________ (Name of Property Owner), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

________________________________________

Notary Public Signature

My commission expires: _______________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The New Jersey Transfer-on-Death (TOD) deed form is governed under the New Jersey Statutes, specifically N.J.S.A. 46:3-29 to 46:3-35. These statutes outline the use, creation, and requirements for TOD deeds in the state. |

| Function | The main purpose of the TOD deed is to allow property owners in New Jersey to pass their real estate directly to a beneficiary upon the owner's death, bypassing the probate process. |

| Probate Avoidance | By effectively transferring ownership of the property upon death directly to the designated beneficiary, the TOD deed helps avoid the lengthy and potentially costly probate process. |

| Revocability | A notable feature of the TOD deed is its revocability. This means the property owner may change the beneficiary or revoke the deed without the beneficiary’s consent at any time prior to the owner’s death. |

| Designated Beneficiary | The owner must designate a beneficiary or beneficiaries who will receive the property upon the owner's death. The deed must clearly identify the beneficiary to effectively transfer the property. |

| Does Not Avoid Creditors | While a TOD deed allows for the direct transfer of property to a beneficiary, it does not protect the property from the claims of creditors of the decedent's estate. |

| Filing Requirements | To be effective, the TOD deed must be properly executed in accordance with state law, which includes being notarized, and must be recorded with the appropriate county clerk’s office before the owner’s death. |

| No Immediate Effect | The TOD deed has no effect on the owner’s rights to the property during their lifetime. The owner retains full control and use of the property, including the right to sell or mortgage it, until death. |

Instructions on How to Fill Out New Jersey Transfer-on-Death Deed

Filling out a Transfer-on-Death (TOD) deed form in New Jersey allows property owners to name beneficiaries to whom their real estate will automatically pass upon their death, bypassing the probate process. It's a straightforward way to ensure that your property is transferred according to your wishes without the need for legal proceedings. This document can be completed with careful attention to detail and by following step-by-step instructions.

To properly fill out the New Jersey Transfer-on-Death Deed form, follow these steps:

- Identify the preparer: Write the name and address of the individual who is completing the form.

- Enter the return address: Include the address where the recorded deed should be sent after filing.

- Specify the consideration: State the amount of money being exchanged for the property, if applicable, often noted as "$10.00 and other valuable considerations."

- Document the grantor(s) information: List the current property owner's name(s) and address(es), ensuring the spelling is correct and matches the title or existing deed.

- Include the grantee beneficiary(ies): Clearly write the name(s) and address(es) of the beneficiary(ies) who will receive the property upon the grantor's death.

- Detail the legal description of the property: Provide the full legal description of the property as listed on the current deed to ensure accuracy in identification.

- Sign and date the form: The grantor(s) must sign and date the form in the presence of a notary public to validate the deed.

- Have the form notarized: A notary public must witness the signing, sign, and seal the document, confirming the identity of the grantor(s) and the authenticity of the signature(s).

- Record the deed: Lastly, the completed form needs to be filed with the county recorder's office where the property is located to make it effective. There may be a recording fee associated with this process.

Filling out the Transfer-on-Death Deed form accurately is essential for ensuring that your property is transferred smoothly and according to your wishes. Therefore, it's recommended to consult with a legal professional if you have specific questions or need advice tailored to your situation. Following the above steps carefully will help guide you through the process of completing the form correctly.

Crucial Points on This Form

What is a Transfer-on-Death (TOD) Deed in New Jersey?

A Transfer-on-Death (TOD) Deed in New Jersey is a legal document that allows property owners to pass their real estate to a beneficiary without having to go through probate court. This deed becomes effective upon the death of the property owner, ensuring a smoother transition of property ownership to the named beneficiary or beneficiaries.

Who can create a Transfer-on-Death Deed in New Jersey?

Any property owner in New Jersey who holds a valid title to residential property can create a Transfer-on-Death Deed. The individual must have the legal capacity to make decisions and must clearly identify the beneficiary who will receive the property upon their death.

How can someone create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the property owner must complete a specific form that includes the legal description of the property, names the beneficiary or beneficiaries, and sign the deed in front of a notary public. It is then filed with the county recorder’s office where the property is located, preferably before the owner’s death to be effective.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked by the property owner at any time before their death. Revocation can be done in several ways: by completing a revocation form, by creating a new TOD deed that states the previous one is revoked, or by selling or transferring the property to someone else during the owner's lifetime.

What happens if the beneficiary predeceases the property owner?

If the named beneficiary predeceases the property owner, the Transfer-on-Death Deed generally becomes void unless a contingent beneficiary is named in the deed. The property owner can also update the TOD deed to name a new beneficiary if the original beneficiary dies before the owner.

Common mistakes

Filling out a New Jersey Transfer-on-Death (TOD) Deed form is a pivotal step in managing estate planning, ensuring that property can bypass probate and directly transfer to a designated beneficiary upon the owner’s death. Despite its importance, common mistakes can significantly impact the intended outcomes of this document. Below are eight typical errors to avoid:

- Not checking if the property is eligible: Not all property types may qualify for a TOD deed. It's imperative to verify that the property in question adheres to New Jersey's specific guidelines for Transfer-on-Death deeds.

- Incorrectly identifying the property: The legal description of the property must be accurate. Relying on a street address instead of the legal description can lead to uncertainties or disputes.

- Failing to precisely identify the beneficiary: A clear identification of the beneficiary is crucial. This includes their full legal name, relationship to the owner, and potentially their contact information or a unique identifier to avoid any confusion.

- Omitting to designate an alternate beneficiary: Life is unpredictable. If the primary beneficiary predeceases the owner and no alternate is named, the property may not bypass probate as intended.

- Overlooking the need for witness signatures: New Jersey may require witness signatures for the TOD deed to be valid. Neglecting this step can invalidate the entire document.

- Not having the deed notarized: A notary public must authenticate the owner’s signature for the deed to be legally binding. Without this, the document could be considered null and void.

- Forgetting to record the deed with the County Recorder’s Office: For the TOD deed to be effective, it must be properly recorded before the owner’s death. Failing to do so can result in the property not transferring as intended.

- Assuming the deed overrides other legal documents: A TOD deed should be consistent with other estate planning documents. Conflicts between documents can create legal complexities, delaying the transfer process or diverting the property to unintended beneficiaries.

Avoiding these mistakes requires careful attention to detail and an understanding of New Jersey's specific laws governing Transfer-on-Death deeds. Consulting with a legal professional can help ensure that all requirements are met and that the property will transfer smoothly to the intended beneficiary upon the owner’s death.

Documents used along the form

When planning for the future, a Transfer-on-Death (TOD) Deed form is a pivotal document for residents in New Jersey, allowing property owners to designate beneficiaries to inherit property without the need for probate proceedings. However, to create a comprehensive estate plan, several other documents are often used in conjunction with a TOD Deed form. These additional documents ensure a more rounded approach, providing clarity and directives for varying circumstances.

- Last Will and Testament: This crucial document outlines how you want your assets distributed after your death. It includes your final wishes regarding your estate and can name guardians for any minor children.

- Durable Power of Attorney for Finances: This authorizes someone else to manage your financial affairs if you’re unable to do so yourself. It's a safeguard ensuring that your finances are handled according to your wishes, even if you become incapacitated.

- Advance Health Care Directive: Also known as a living will, this document specifies your wishes regarding medical treatment in the event you can no longer communicate your decisions due to illness or incapacity.

- Health Care Proxy: Similar to an Advance Health Care Directive, a health care proxy allows you to appoint someone to make health care decisions on your behalf if you are unable.

- Beneficiary Designations: For certain assets like life insurance policies and retirement accounts, beneficiary designations provide a straightforward method to transfer wealth without the need for probate.

- Trust Documents: Trusts can be utilized for various purposes, such as avoiding probate, reducing estate tax liability, or providing for a minor or special needs beneficiary. Trust documents outline the terms and conditions under which your assets are held and distributed.

- Proof of Ownership: Essential for the TOD Deed process, documents proving your ownership of the property must be well-documented and accessible.

- Certificate of Real Estate Value: This document, often required for tax purposes, provides an official valuation of your property at the time of transfer.

- Death Certificate: Although not required until after death, a death certificate is necessary to activate a TOD Deed. It is the official document that proves the death of the property owner.

Together with the New Jersey Transfer-on-Death Deed, these documents form a solid foundation for estate planning. Each plays a vital role in ensuring that your wishes are respected and that your assets are distributed according to your desires. Preparing these documents in advance can significantly ease the burden on your loved ones during a challenging time. Comprehensive planning not only provides peace of mind but also secures a smoother transition of your legacy.

Similar forms

A Living Trust: Similar to a Transfer-on-Death (TOD) Deed, a living trust allows individuals to transfer ownership of their property to beneficiaries upon their death, without the need for probate court. Both documents enable the smooth transition of assets, but a living trust can include a wider range of properties and stipulate more specific terms of the transfer.

A Will: Wills and TOD Deeds serve the crucial role of specifying heirs for one's assets. While a TOD Deed is restricted to real estate, a will can encompass a broader array of assets. However, assets designated in a TOD Deed bypass probate, unlike those distributed via a will.

A Joint Tenancy with Right of Survivorship: This form of ownership means that when one owner dies, the remaining owner(s) automatically receive the deceased owner's share of the property. It mimics the TOD Deed's feature allowing for the bypassing of probate. However, it differs as it takes effect during the owner's life and influences ownership rights before death.

A Beneficiary Designation Form for Financial Accounts: Similar to TOD Deeds for real estate, these forms allow account holders to name beneficiaries for financial accounts like bank savings, IRAs, and brokerage accounts, facilitating the transfer of funds without the need for probate proceedings.

A Payable-on-Death (POD) Account: Just as a TOD Deed transfers real estate without probate, a POD account similarly bypasses probate for the assets held within financial accounts. Both offer a straightforward way to transfer assets upon death.

A Life Estate Deed: By creating a life estate, the property owner can remain on the property until death, after which the property directly transfers to a remainder beneficiary. This mirrors the TOD Deed’s purpose of avoiding probate but requires the original owner to relinquish some control during their lifetime.

A Revocable Transfer on Death Deed: It is actually a specific type of TOD deed that explicitly allows the grantor to revoke the deed if they decide to change the beneficiary or wish to remove the TOD designation altogether. It highlights the flexibility and control the property owner retains over the asset until death.

Dos and Don'ts

Filling out a New Jersey Transfer-on-Death (TOD) Deed requires careful attention to detail. Unlike traditional real estate transactions, a TOD deed allows property owners to pass on their real estate to a beneficiary without going through probate. Here are some essential dos and don'ts to consider:

Do:- Double-check the beneficiary's information: Make sure the name, address, and other identifying details of your beneficiary are accurate to avoid confusion later.

- Clearly describe the property: Provide a clear and precise legal description of the property to ensure there are no ambiguities about what is being transferred.

- Sign in the presence of a notary: Your signature must be notarized to validate the deed. This formal step is crucial for the document's legality.

- Keep the deed safe: Store the deed in a secure location, such as a safe deposit box, and let your beneficiary know where it is kept.

- Consult a professional: Considering the legal intricacies, it's wise to seek advice from a real estate attorney or a specialist familiar with TOD deeds in New Jersey.

- Record the deed: Once completed, the deed needs to be recorded with the county clerk’s office where the property is located. This public record is vital for the transfer to be recognized.

- Overlook eligibility requirements: Not every property or owner may qualify for a TOD deed due to specific legal stipulations. Be sure you're eligible before proceeding.

- Forget to update as necessary: Life changes, such as a marriage, divorce, or the death of a beneficiary, require updating the TOD deed to reflect your current wishes.

- Assume it overrides other documents: A TOD deed is part of your broader estate plan but doesn't necessarily supersede other documents like a will. Ensure all your documents are consistent.

- Fill it out in haste: Rushing the process can lead to errors or omissions that could invalidate your intentions. Take your time and review all the details thoroughly.

- Ignore potential disputes: While a TOD deed simplifies the property transfer, it doesn't eliminate the possibility of disputes among heirs or beneficiaries. Consider family dynamics and potential issues beforehand.

- Assume it's irrevocable: Unlike some estate planning tools, you can revoke or change a TOD deed as long as you comply with legal requirements and procedures.

Misconceptions

Transfer-on-Death (TOD) deeds allow individuals to transfer their real property to a beneficiary upon their death without the property having to go through probate. While TOD deeds can be advantageous, there are several common misconceptions about the use of the New Jersey Transfer-on-Death Deed form. Understanding these misconceptions is crucial for effectively managing estate planning.

- Misconception 1: A Transfer-on-Death Deed overrides a will.

It’s often thought that a TOD deed can override provisions in a will regarding real estate. However, the truth is that a TOD deed takes precedence over a will when it comes to the specific piece of property named in the deed. This means if a property is designated to a beneficiary in a TOD deed, that designation will stand, even if the will states otherwise. - Misconception 2: Once executed, a Transfer-on-Death Deed cannot be revoked.

Many believe that once a TOD deed is executed, it is set in stone and cannot be changed or revoked. This is not the case. In New Jersey, as in many other states, a Transfer-on-Death Deed can be revoked by the owner at any time before their death, as long as the revocation is done in the manner prescribed by law. This usually involves executing a new deed or a formal revocation document. - Misconception 3: Transfer-on-Death Deeds avoid all estate taxes.

A common misunderstanding is that transferring property through a TOD deed allows the beneficiary to avoid paying estate taxes on that property. In reality, the value of the property transferred via a TOD deed is included in the total estate value for the purpose of calculating estate taxes. Beneficiaries may still be responsible for paying estate taxes on the value of the property, depending on the total value of the estate and the tax laws in effect at the time of the owner’s death. - Misconception 4: A Transfer-on-Death Deed can transfer any type of property.

People often think a TOD deed can be used to transfer any type of property. However, TOD deeds are specifically for real estate. Other assets, such as vehicles or personal property, cannot be transferred through a TOD deed but may be transferable through other means like Transfer-on-Death registrations, payable-on-death accounts, or specific beneficiary designations. - Misconception 5: Creating a Transfer-on-Death Deed is a complex and expensive process.

There’s a notion that creating a TOD deed is both complicated and costly. In truth, drafting a TOD deed can be relatively straightforward and inexpensive, especially when compared to the processes and potential costs involved in passing real estate through probate. With proper guidance, individuals can execute a TOD deed efficiently, ensuring their real property is transferred according to their wishes while avoiding probate.

Key takeaways

When considering a Transfer-on-Death (TOD) deed in New Jersey, it's important to understand its purposes, benefits, and specific requirements. Here are some key takeaways to guide you through filling out and using the New Jersey Transfer-on-Death Deed form effectively:

- Understand its purpose: A TOD deed allows property owners to pass real estate directly to a beneficiary upon their death without the need for probate court proceedings. It’s a powerful tool for estate planning.

- Eligibility criteria: Not all properties may qualify for a TOD deed. Ensure your property meets New Jersey’s specific criteria for this type of transfer.

- Choose beneficiaries wisely: You can name one or more persons, trusts, or organizations as beneficiaries. Consider how this choice will affect all parties involved, both during your lifetime and after your passing.

- Legal requirements: The deed must be completed accurately, following all of New Jersey’s legal stipulations, including witness and notary public signatures, to be valid.

- Revocability: TOD deeds are revocable. This means you can change your mind at any time before your death, adjusting beneficiaries or revoking the deed entirely, as long as the revocation complies with New Jersey laws.

- Maintaining property rights: Filing a TOD deed does not affect your ownership rights. You retain full control over the property during your lifetime, including the right to sell or mortgage it.

- After-death considerations: Upon the property owner's death, the beneficiary must take specific steps to claim ownership of the property. This might include filing a death certificate and a formal request for property transfer under the TOD deed.

By keeping these key points in mind, you can navigate the process of filling out and utilizing a Transfer-on-Death Deed in New Jersey with more confidence and ease, ensuring a smooth transition of your property to your chosen beneficiaries.

Create Other Transfer-on-Death Deed Forms for US States

Transfer Deed Upon Death - A Transfer-on-Death Deed form is an essential tool for proactive property management and estate planning.

Free Printable Transfer on Death Deed Form Florida - For individuals with straightforward estate planning needs, this deed presents a cost-effective solution for transferring real estate.