Blank Transfer-on-Death Deed Form for New York

In the complex world of estate planning and property transfer, navigating the myriad of legal documents can be both daunting and critical. One such document that has gained attention in places where it is recognized is the Transfer-on-Death (TOD) deed, especially within the state of New York. This innovative legal instrument allows property owners to pass on their real estate directly to a beneficiary without the need for the property to go through the probate process. The TOD deed stands out for its simplicity and effectiveness, offering a streamlined approach to ensuring that a person's property is transferred according to their wishes after their passing. It's designed to function similarly to how assets are transferred via a life insurance policy or retirement account, bypassing the often lengthy and costly probate proceedings. For property owners in New York, understanding the nuances of the Transfer-on-Death Deed can provide significant peace of mind, making it a crucial component of comprehensive estate planning. However, it is important to note that as of the current legal landscape, not all states recognize TOD deeds, and the specific conditions and applicability can vary widely from one jurisdiction to another, highlighting the importance of thorough legal guidance in its execution.

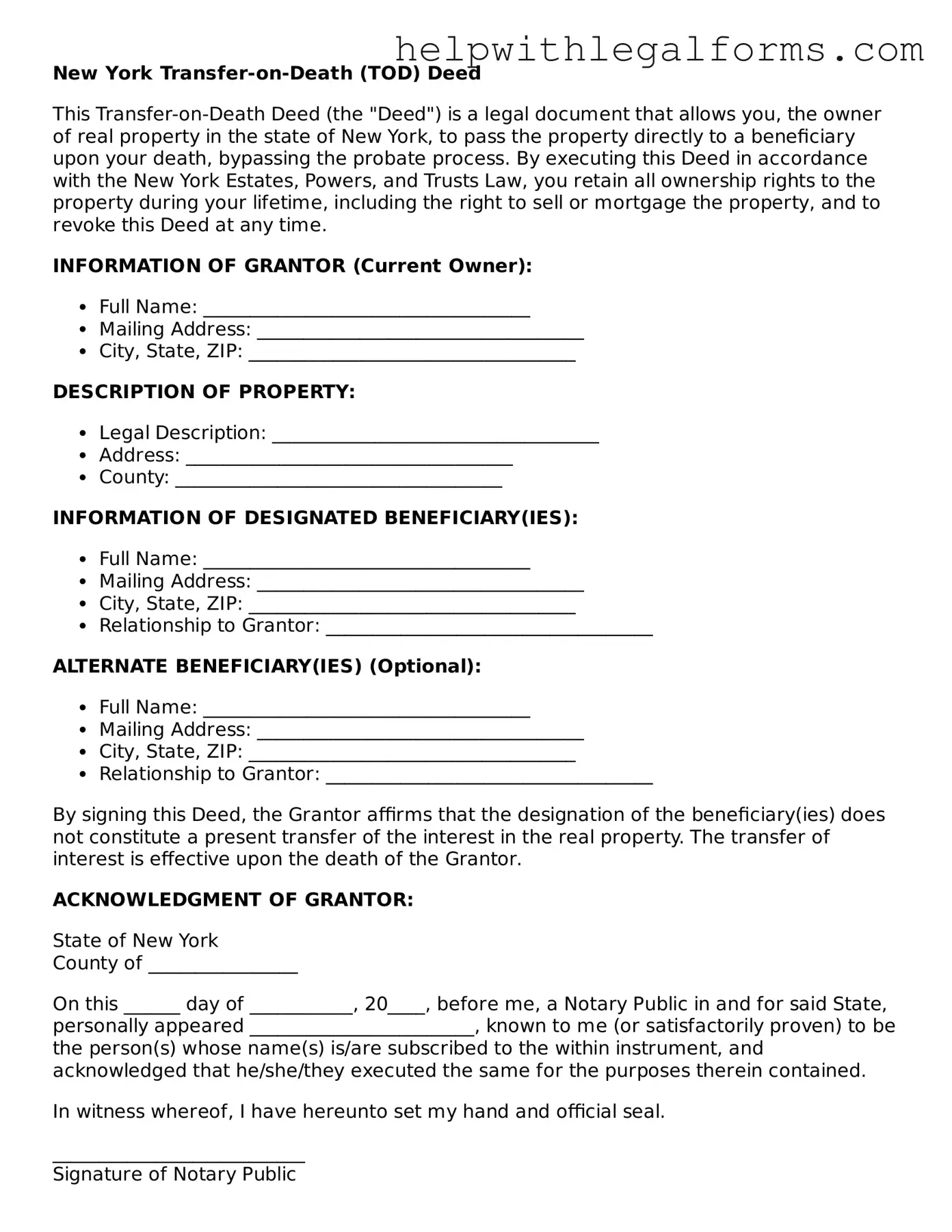

Example - New York Transfer-on-Death Deed Form

New York Transfer-on-Death (TOD) Deed

This Transfer-on-Death Deed (the "Deed") is a legal document that allows you, the owner of real property in the state of New York, to pass the property directly to a beneficiary upon your death, bypassing the probate process. By executing this Deed in accordance with the New York Estates, Powers, and Trusts Law, you retain all ownership rights to the property during your lifetime, including the right to sell or mortgage the property, and to revoke this Deed at any time.

INFORMATION OF GRANTOR (Current Owner):

- Full Name: ___________________________________

- Mailing Address: ___________________________________

- City, State, ZIP: ___________________________________

DESCRIPTION OF PROPERTY:

- Legal Description: ___________________________________

- Address: ___________________________________

- County: ___________________________________

INFORMATION OF DESIGNATED BENEFICIARY(IES):

- Full Name: ___________________________________

- Mailing Address: ___________________________________

- City, State, ZIP: ___________________________________

- Relationship to Grantor: ___________________________________

ALTERNATE BENEFICIARY(IES) (Optional):

- Full Name: ___________________________________

- Mailing Address: ___________________________________

- City, State, ZIP: ___________________________________

- Relationship to Grantor: ___________________________________

By signing this Deed, the Grantor affirms that the designation of the beneficiary(ies) does not constitute a present transfer of the interest in the real property. The transfer of interest is effective upon the death of the Grantor.

ACKNOWLEDGMENT OF GRANTOR:

State of New York

County of ________________

On this ______ day of ___________, 20____, before me, a Notary Public in and for said State, personally appeared ________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

___________________________

Signature of Notary Public

My commission expires: _______________

GRANTOR'S SIGNATURE:

___________________________

Signature of Grantor

Date: ______________________

This document is prepared as a courtesy and is not intended as legal advice. It is recommended that a legal professional be consulted to ensure compliance with all state laws and requirements specific to your situation.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | New York Estates, Powers, and Trusts Law specifically does not provide for transfer-on-death deeds. However, some consider using joint tenancy with rights of survivorship or payable on death accounts as alternatives. |

| Form Availability | As of the last update, New York does not have a statutory Transfer-on-Death (TOD) deed form. |

| Primary Use | Transfer-on-Death deeds are used to pass on real estate to a beneficiary without the need for probate court proceedings. |

| Key Features | Transfer-on-Death deeds allow property owners to name beneficiaries to inherit property, ensuring a smoother transition of ownership after their death. |

| Recording Requirements | For states that allow Transfer-on-Death deeds, they must be properly recorded in the county where the property is located before the owner's death to be effective. |

| Revocability | Transfer-on-Death deeds are revocable. The property owner can change the beneficiary or cancel the deed without the beneficiary's consent as long as the owner is alive. |

Instructions on How to Fill Out New York Transfer-on-Death Deed

When completing a Transfer-on-Death (TOD) Deed form for property in New York, individuals are taking an important step in planning for the future. This form allows for the direct transfer of real estate to a named beneficiary upon the owner’s death, bypassing the potentially lengthy and costly probate process. It’s crucial to fill out the form accurately to ensure that it reflects the owner's wishes and is legally binding. Below are the steps to guide you through this process.

- Start by reading the form carefully to understand all the requirements and implications of the Transfer-on-Death Deed.

- Enter the full legal name and address of the current property owner(s) in the designated sections at the top of the form.

- Specify the exact legal description of the property as recorded in the property deed. This information can be found in previous deeds, at the county recorder's office, or through a title company.

- List the full legal name(s) of the beneficiary(ies) who will receive the property upon the owner’s death. If there are multiple beneficiaries, clearly indicate the percentage of ownership each will receive.

- If the deed requires witnesses or a notary public, arrange for their presence to observe the signing of the document. This requirement varies, so it’s important to check the current New York state laws or seek legal advice.

- Sign and date the deed in the presence of the notary public and/or witnesses, as required. The owner’s signature must be notarized to validate the Transfer-on-Death Deed.

- Finally, file the completed and notarized deed with the appropriate county clerk’s office to make it legally effective. There may be a filing fee, which varies by county.

After the Transfer-on-Death Deed form is properly completed and filed, the property owner can have peace of mind knowing their real estate will transfer to their designated beneficiary in a manner that is direct and avoids unnecessary complications. It is important to keep a copy of the filed deed for personal records and inform the beneficiary of the arrangement to ensure a smooth transfer of ownership when the time comes.

Crucial Points on This Form

What is a Transfer-on-Death (TOD) Deed in New York?

A Transfer-on-Death Deed, often referred to as a TOD Deed, allows property owners in New York to pass their real estate directly to a beneficiary upon their death, without the need for the property to go through probate. This type of deed is executed by the property owner before their death but only takes effect upon their demise. It enables a seamless transition of ownership, thus avoiding the potentially lengthy and costly probate process.

How does one create a TOD Deed in New York?

To create a TOD Deed in New York, the property owner must prepare a deed that complies with state law requirements. This includes providing a clear description of the property, specifying the beneficiary, and stating that the transfer of ownership will occur at the owner’s death. The deed must be signed by the property owner in the presence of a notary public to ensure its validity. After notarization, the deed should be recorded with the county recorder’s office in the county where the property is located. It is important to note that the TOD Deed can be revoked or amended by the property owner at any time before their death.

Can a Transfer-on-Death Deed in New York be contested or revoked?

Yes, a Transfer-on-Death Deed can be contested or revoked. The property owner retains the right to revoke the deed at any point during their lifetime. Revocation can be accomplished by executing a new deed that explicitly revokes the previous one or by selling or otherwise transferring the property to another party. Contestations, on the other hand, may arise from beneficiaries or other parties with a claim to the property, generally based on arguments that the deed was executed under duress, coercion, or that the property owner lacked the mental capacity to make such decisions at the time of the deed's execution.

What happens to a mortgage or debt attached to the property transferred by a TOD Deed in New York?

When a property is transferred by a Transfer-on-Death Deed in New York, any existing mortgages, liens, or debts against the property do not simply vanish. The beneficiary who receives the property also assumes responsibility for any outstanding financial obligations. Therefore, it is imperative for beneficiaries to be aware of any encumbrances on the property before accepting the transfer, as they will be required to manage these debts, which may include continuing mortgage payments or settling other liens, to retain ownership of the property.

Common mistakes

In the state of New York, the Transfer-on-Death (TOD) Deed form is a crucial document that allows individuals to transfer their property to a beneficiary upon their death without the property having to go through probate. However, when filling out this form, individuals often make several common mistakes that can result in complications or the deed being invalidated. Understanding these mistakes is essential for anyone looking to use this estate planning tool effectively. Here are ten common missteps:

-

Not checking for form updates: The laws and regulations around TOD Deeds can change. People often use an outdated form without checking for the most current version, potentially making their deed invalid.

-

Incorrect property description: The legal description of the property must match public records exactly. A mistake in the property's legal description can render the TOD Deed ineffective.

-

Failing to name an alternate beneficiary: If the primary beneficiary predeceases the property owner and no alternate is named, the property may end up going through probate, defeating the purpose of the TOD Deed.

-

Not understanding joint ownership implications: If the property is owned jointly, the TOD Deed may not work as intended unless all owners execute separate TOD Deeds or take specific actions that account for joint ownership.

-

Forgetting to sign and date the deed: Like any legal document, the TOD Deed is not valid unless it's properly signed and dated by the property owner before a notary public.

-

Omitting notarization: A TOD Deed must be notarized to be valid. Failing to have the deed notarized is a common oversight that invalidates the document.

-

Lack of witnesses: Though not always required, having witnesses present during the signing and having them sign the document can bolster the deed's validity, especially if its authenticity is later challenged.

-

Not filing the deed with the county clerk: A TOD Deed must be filed with the county clerk where the property is located to be effective. Failure to record the deed can result in it not being honored upon the owner's death.

-

Inconsistency with other estate documents: A TOD Deed should be consistent with other estate planning documents, such as wills or trusts. Conflicting information can cause legal complications after the owner's death.

-

Attempting to transfer property that is subject to certain restrictions or encumbrances: Not all properties can be transferred via a TOD Deed. Attempting to transfer property that is restricted or has certain encumbrances without addressing these issues can invalidate the deed.

Avoiding these mistakes requires careful attention to detail and an understanding of both the current laws governing TOD Deeds in New York and the specific circumstances of the property being transferred. It may be advantageous to consult with a legal professional who can provide guidance and ensure that the TOD Deed accomplishes its intended purpose effectively and legally.

Documents used along the form

When managing estate planning in New York, utilizing a Transfer-on-Death (TOD) Deed can significantly simplify the process of transferring real estate to a beneficiary without the need for probate. This document is an important tool, yet it often works hand in hand with several other forms and documents to ensure a comprehensive approach to estate planning. Let’s explore some of these key documents that are commonly used alongside a TOD Deed.

- Last Will and Testament: This foundational document is where most people start with estate planning. It outlines how one's assets should be distributed, appoints an executor to oversee the estate, and can specify guardians for any minor children. While a TOD Deed directly transfers real estate to a beneficiary upon death, a Last Will covers broader aspects of one's estate.

- Durable Power of Attorney: This legal document grants someone else the authority to act on your behalf in financial matters, should you become incapacitated. It's vital for estate planning, as it ensures that your financial affairs can be managed according to your wishes, even if you're unable to oversee them yourself.

- Health Care Proxy: Similar to the Durable Power of Attorney, a Health Care Proxy designates someone to make medical decisions on your behalf if you're unable to do so. This document is crucial for maintaining control over your medical care and ensuring that your health care wishes are followed.

- Revocable Living Trust: This tool allows individuals to manage their assets during their lifetime and specify how these assets should be distributed upon their death, without going through probate. A Revocable Living Trust can work in tandem with a TOD Deed by covering assets not specifically named in the deed or other estate documents.

Integrating a TOD Deed with these documents creates a protective web for one's assets and health care preferences. Each plays a distinct role, yet when combined, they offer a comprehensive strategy to manage and transfer an individual’s estate efficiently and according to their wishes. Engaging with these documents allows individuals to address a wide range of estate planning needs, from specifying guardians for children to ensuring financial matters are handled seamlessly. It's a holistic approach that reflects the complexities and nuanced needs of modern estate planning.

Similar forms

Living Trust: Both allow you to pass property to beneficiaries without going through probate court. While a living trust can cover virtually any asset, a Transfer-on-Death Deed is specifically for real estate.

Last Will and Testament: They both specify beneficiaries for your assets upon death. However, a will goes through probate, whereas a Transfer-on-Death Deed bypasses this process, directly transferring real estate to the beneficiary.

Beneficiary Designations on Financial Accounts: Similar to how you can designate beneficiaries on retirement accounts or life insurance policies, a Transfer-on-Death Deed allows your property to directly pass to the named individuals, avoiding probate.

Joint Tenancy with Right of Survivorship: Both arrangements allow property to pass to the surviving owners without probate. Yet, unlike joint tenancy, a Transfer-on-Death Deed does not give the beneficiary any rights until the owner's death.

Payable-on-Death (POD) Accounts: Like POD accounts for bank assets, a Transfer-on-Death Deed immediately transfers ownership of the property to the beneficiary upon the death of the original owner, sidestepping probate.

Life Estate Deed: With both, you can designate who will receive your property after you die. A key difference is that with a life estate deed, the future owner has an irrevocable interest during your lifetime, unlike with a Transfer-on-Death Deed.

Revocable Transfer on Death Deed: They are quite similar, with the main distinction being regulatory variances across different jurisdictions. Both allow property transfer to a beneficiary at death without probate, but with revocable deeds, you can change the beneficiary at any time before death.

Dos and Don'ts

The New York Transfer-on-Death (TOD) Deed form is a useful tool in estate planning, allowing property owners to directly transfer their real estate to a designated beneficiary upon death, bypassing the probate process. While filling out this form might seem straightforward, several important do’s and don’ts need to be considered to ensure the deed is valid and accurately reflects the owner's wishes. Below is a list of ten key points to keep in mind:

What You Should Do:- Review state laws: make sure you're aware of the specific requirements for Transfer-on-Death Deeds in New York to ensure compliance.

- Correctly identify the property: provide a clear and accurate description of the property to prevent any confusion or disputes in the future.

- Designate beneficiaries clearly: clearly state the name(s) of the beneficiary or beneficiaries to whom the property will be transferred.

- Sign in the presence of a notary: ensure the deed is signed in front of a notary public to validate its authenticity.

- Record the deed: file the completed form with the county recorder’s office where the property is located to make it effective.

- Ignore legal advice: consult with an estate planning attorney to ensure the TOD Deed aligns with your overall estate plan and to address any state-specific nuances.

- Omit any potential heirs: be mindful of state laws regarding spouses or children and how your TOD Deed affects their rights to your property.

- Forget to update: review and update your TOD Deed as life circumstances change, such as marriage, divorce, the birth of a child, or the death of a beneficiary.

- Assume it covers all assets: understand that the TOD Deed only applies to the specific property described in the deed and not to other assets or property you may own.

- Use vague language: clarity is crucial when designating beneficiaries and describing the property, to prevent complications or legal battles after your passing.

Misconceptions

When individuals consider managing their estate planning in New York, the concept of a Transfer-on-Death (TOD) deed often comes up. This legal document is designed to simplify the process of transferring property upon someone's death, bypassing the often lengthy and complex probate process. However, there are several misconceptions associated with New York's Transfer-on-Death Deed form that need clarification:

- It's available in all states, including New York. One common misconception is that the Transfer-on-Death Deed form is available and legally recognized in every state, New York included. However, New York state law does not currently recognize Transfer-on-Death Deeds as a valid legal instrument. This means that residents of New York cannot use this form to bypass probate for the transfer of real property upon death.

- It can transfer any type of property. Another misunderstanding is that a Transfer-on-Death Deed can be used to transfer any type of property, including personal property, automobiles, and real estate. In jurisdictions where TOD deeds are permitted, they are primarily used for the transfer of real estate only. Other arrangements must be made to transfer different types of assets outside of probate.

- It overrides a will. People often believe that a Transfer-on-Death Deed will override provisions in a will concerning the same piece of property. While a TOD deed does take precedence over a will in states where it is valid, it's crucial to ensure that all estate planning documents are consistent to prevent potential legal disputes among heirs.

- It avoids all forms of estate settlement issues. Some might think that utilizing a Transfer-on-Death Deed will avoid any estate settlement complications. While it's true that a TOD deed can simplify the transfer of real property by avoiding probate, it does not eliminate all potential issues. For instance, it does not remove the responsibility for any debts or encumbrances on the property, and those matters must still be settled.

Tackling these misconceptions head-on ensures that individuals are better informed about their estate planning options and the legal landscape in New York. Estate planning is a complex area that often requires professional guidance to navigate effectively. Understanding the tools available, and their limitations, is crucial for anyone looking to manage their estate efficiently and in accordance with their wishes.

Key takeaways

When navigating the complexities of transferring real estate upon death in New York, utilizing a Transfer-on-Death (TOD) Deed can significantly streamline the process. This legal instrument allows property owners to designate beneficiaries to whom the property will pass upon their demise, circumventing the often lengthy and complex probate process. Below are key takeaways to understand when filling out and utilizing the New York Transfer-on-Death Deed form:

- Eligibility and Documentation: Only individuals who hold clear title to residential real property in New York are eligible to execute a TOD Deed. Ensure all property documentation is accurate and up-to-date.

- Completeness and Accuracy: Provide complete and accurate information on the form, including full legal names and addresses of all beneficiaries. Mistakes can lead to disputes or delays in transferring ownership.

- Multiple Beneficiaries: If designating more than one beneficiary, define the nature of their ownership (e.g., joint tenants, tenants in common) upon your passing. This affects their rights and obligations.

- Revocability: Understand that the TOD Deed is revocable. You maintain the right to sell or change the beneficiary of the property at any time before your death without consent from the named beneficiary.

- Witness and Notarization: For the deed to be legally binding, it must be signed in the presence of a notary and, depending on jurisdiction, witnessed by one or two individuals not named in the deed.

- Filing the Deed: After execution, file the deed with the New York county recorder’s office where the property is located. Failure to record the deed may render it ineffective.

- Taxes and Liabilities: Be aware that the TOD Deed does not absolve the property from any mortgages, liens, or tax obligations. Beneficiaries inherit the property subject to these encumbrances.

- Consulting Legal Advice: Given the legal nuances and potential for future disputes, it’s prudent to consult with a legal professional when drafting a TOD Deed. This ensures that your intentions are clearly articulated and legally sound.

Effectively leveraging a Transfer-on-Death Deed can offer peace of mind and a streamlined way to pass on one’s estate to their intended beneficiaries. However, it demands careful attention to detail and compliance with New York law to ensure that the transition after death occurs as intended.

Create Other Transfer-on-Death Deed Forms for US States

Colorado Beneficiary Deed - It provides a straightforward solution for transferring property, devoid of the complications often associated with wills and probate court.

New Jersey Transfer on Death Deed - It is an essential document for anyone seeking to ensure their real estate is seamlessly and securely passed on to the next generation.

Does a Beneficiary Deed Avoid Probate - The document protects the beneficiary's interests, ensuring they inherit the property directly, avoiding claims against the estate.

Transfer Deed Upon Death - An invaluable resource for those looking to efficiently allocate their real estate without incurring unnecessary legal fees.