Blank Transfer-on-Death Deed Form for Oklahoma

In Oklahoma, the Transfer-on-Death Deed form provides a seamless way for individuals to pass real property to a beneficiary without the intricacies of going through probate after the owner's death. This document, while straightforward in concept, requires a detailed understanding of its implications and the proper steps for execution to ensure the property transfer aligns with the current real estate laws and estate planning strategies of Oklahoma. It allows property owners the luxury of mind, knowing their real estate assets will be transferred to their named beneficiaries, significantly reducing the time and financial cost typically associated with probate court proceedings. Moreover, it is revocable, offering the property owner the flexibility to make changes as life circumstances evolve. However, to effectively utilize this form, one must adhere to specific filing requirements, including notarization and recording with the appropriate county office, making it crucial for individuals to familiarize themselves with the intricacies involved in its preparation and execution. This tool, emblematic of thoughtful estate planning, underscores the importance of forward-thinking in asset management and inheritance facilitation.

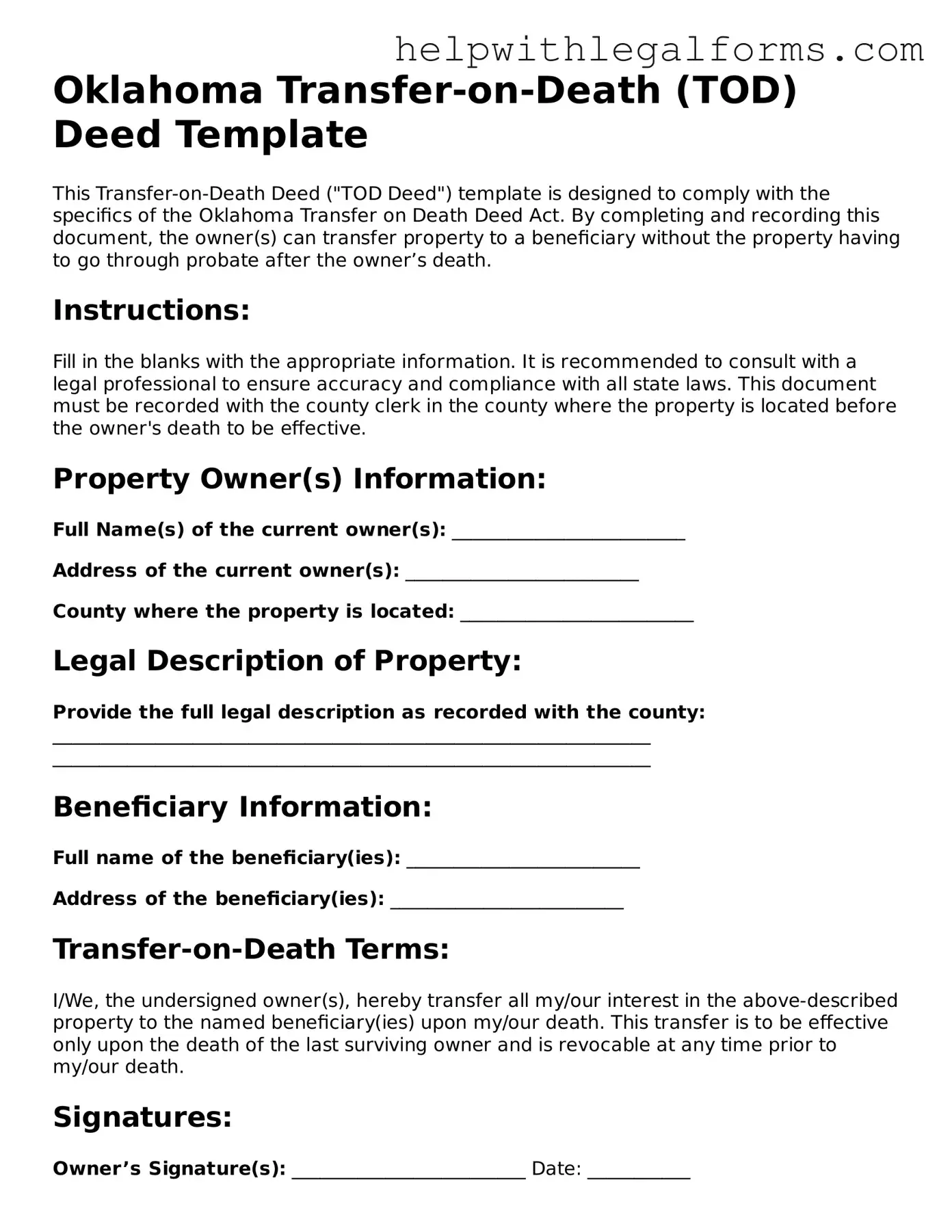

Example - Oklahoma Transfer-on-Death Deed Form

Oklahoma Transfer-on-Death (TOD) Deed Template

This Transfer-on-Death Deed ("TOD Deed") template is designed to comply with the specifics of the Oklahoma Transfer on Death Deed Act. By completing and recording this document, the owner(s) can transfer property to a beneficiary without the property having to go through probate after the owner’s death.

Instructions:

Fill in the blanks with the appropriate information. It is recommended to consult with a legal professional to ensure accuracy and compliance with all state laws. This document must be recorded with the county clerk in the county where the property is located before the owner's death to be effective.

Property Owner(s) Information:

Full Name(s) of the current owner(s): _________________________

Address of the current owner(s): _________________________

County where the property is located: _________________________

Legal Description of Property:

Provide the full legal description as recorded with the county:

________________________________________________________________

________________________________________________________________

Beneficiary Information:

Full name of the beneficiary(ies): _________________________

Address of the beneficiary(ies): _________________________

Transfer-on-Death Terms:

I/We, the undersigned owner(s), hereby transfer all my/our interest in the above-described property to the named beneficiary(ies) upon my/our death. This transfer is to be effective only upon the death of the last surviving owner and is revocable at any time prior to my/our death.

Signatures:

Owner’s Signature(s): _________________________ Date: ___________

State of Oklahoma, County of ___________________: This document was acknowledged before me on (date) ___________ by (name of owner) ___________________.

Notary Public Signature: _________________________

Notary Printed Name: _________________________

My commission expires on _______________.

This document does not require beneficiary signature(s) for validity but must be recorded with the appropriate county to be effective.

Recording Information:

Once completed and signed, this document must be filed with the County Clerk’s office in the county where the property is located. It is important to keep a copy of the recorded document for your records.

Disclaimer:

This template is provided as a courtesy and is intended for informational purposes only. It does not constitute legal advice, nor does it substitute for legal counsel. The user assumes all responsibility for its use.

PDF Form Attributes

| Fact | Detail |

|---|---|

| 1. Legal Foundation | The Oklahoma Transfer-on-Death Deed is governed by the Nontestamentary Transfer of Property Act, tit. 58, §§ 1251-1258 of the Oklahoma Statutes. |

| 2. Purpose | It allows property owners to pass their real estate to a beneficiary upon the owner’s death without the need for probate. |

| 3. Revocability | The deed is revocable, meaning the property owner can change their mind and cancel or change the deed during their lifetime. |

| 4. No Effect During Owner’s Lifetime | The deed does not take effect until the death of the owner, allowing them to retain full control and use of the property during their lifetime. |

| 5. Simple Process | Filing the Transfer-on-Death Deed is a simpler process compared to the traditional methods of transferring property, requiring only the completion and recording of the form. |

| 6. Beneficiary Designation | Owners can designate one or more beneficiaries, including individuals, trusts, or organizations. |

| 7. No Immediate Rights for Beneficiary | The beneficiary acquires no immediate rights to the property or its use before the death of the owner. |

| 8. Avoids Probate | Transfer-on-Death Deeds help in avoiding the lengthy and costly probate process by directly transferring property rights to the beneficiary upon the owner's death. |

| 9. Notarization Required | The deed must be signed by the owner and notarized to be legally valid. |

| 10. Recording Is Necessary | For the deed to be effective, it must be recorded with the county clerk in the county where the property is located before the owner’s death. |

Instructions on How to Fill Out Oklahoma Transfer-on-Death Deed

Preparing an Oklahoma Transfer-on-Death (TOD) Deed is an essential step for property owners who wish to pass on their real estate without the complexity of probate court. This document allows you to designate one or more beneficiaries who will receive your property upon your death, seamlessly transferring ownership. It's pivotal to understand that the execution of this form must be done with accuracy and precision to ensure your property is transferred according to your wishes without legal complications. Below is a detailed guide to help you correctly fill out the Oklahoma Transfer-on-Death Deed form.

- Begin by locating the latest version of the Oklahoma Transfer-on-Death Deed form. Ensure it's the correct document specifically designed for use in Oklahoma.

- Enter your full legal name as the Grantor. This is the person currently owning the property and executing the deed.

- Specify the full legal name(s) of the designated beneficiary(ies). If more than one, include the share each will receive, and whether they will hold the property as joint tenants or as tenants in common.

- Provide a complete and accurate legal description of the real estate property. This information can be found on your current deed or by contacting your county recorder's office. It must include lot numbers, subdivision name, and any other details that are part of the legal description.

- Sign the deed in the presence of a notary public. Oklahoma law requires that the Grantor's signature be notarized for the deed to be valid.

- Keep a copy for your records and provide a copy to your beneficiary(ies) so they are aware of the TOD deed.

- Finally, file the completed and notarized deed with the county clerk's office in the county where the property is located. There may be a filing fee, so it's advisable to inquire about the cost when planning to file your deed.

Completing the Oklahoma Transfer-on-Death Deed form is a straightforward process that can provide peace of mind for property owners and their beneficiaries. It's a proactive step toward ensuring your property is passed along according to your wishes, with minimal legal fuss. Remember, while this guide provides a basic overview, consulting with a legal professional familiar with Oklahoma real estate law can provide additional insight and ensure your deed complies with state requirements.

Crucial Points on This Form

What is a Transfer-on-Death (TOD) Deed in Oklahoma?

A Transfer-on-Death (TOD) Deed is a legal document that allows property owners in Oklahoma to transfer their real estate to a designated beneficiary upon the owner’s death without the need for probate court proceedings. It is a non-probate mechanism to transfer property, meaning the property bypasses the probate process and goes directly to the named beneficiary upon the death of the property owner.

Who can use a TOD Deed in Oklahoma?

Any individual who owns real property in Oklahoma and wishes to transfer it upon their death to a beneficiary can use a TOD Deed. It’s important that the individual be competent to understand what they are signing and must do so voluntarily without any coercion.

How does one create a TOD Deed in Oklahoma?

To create a TOD Deed in Oklahoma, the property owner must complete a TOD Deed form which includes the legal description of the property, the name of the designated beneficiary, and must be signed by the property owner in the presence of a notary public. The deed must then be filed with the county clerk in the Oklahoma county where the property is located before the owner’s death.

Can a TOD Deed be revoked or changed?

Yes, a TOD Deed can be revoked or changed at any time before the death of the property owner. This can be done by executing a new TOD Deed that revokes the prior deed or conveys the property to a different beneficiary, executing a document that explicitly revokes the TOD Deed, or selling the property to someone else. Any revocation or change must also be notarized and filed with the county clerk to be effective.

Is the beneficiary of a TOD Deed responsible for the decedent's debts?

No, the beneficiary of a TOD Deed typically is not directly responsible for the decedent's debts. However, the transferred property may still be subject to claims by the decedent’s creditors, depending on state law and the specific circumstances. Beneficiaries should consult legal advice regarding potential liabilities and claims against the estate.

What happens if the designated beneficiary predeceases the property owner?

If the designated beneficiary of a TOD Deed predeceases the property owner, the TOD Deed would generally have no effect, and the property would become part of the owner’s estate upon their death. To avoid this, property owners can name alternate beneficiaries in the TOD Deed or update the deed to reflect new beneficiaries if necessary.

Are there any tax implications for using a TOD Deed in Oklahoma?

While using a TOD Deed can simplify the transfer of property upon death, it does not eliminate taxes. The value of the property might be subject to estate taxes if the total value of the estate exceeds federal or state tax exemption levels. Additionally, the beneficiary may be subject to inheritance taxes depending on their relationship to the decedent and applicable laws. Consulting a tax professional is recommended for specific tax advice.

Can TOD Deeds be used for any type of property?

In Oklahoma, TOD Deeds can be used for real estate only. This includes houses, buildings, and land. It does not apply to personal property such as vehicles, bank accounts, or other types of personal assets. For these types of assets, other estate planning tools like payable-on-death accounts or living trusts might be more appropriate.

Common mistakes

When preparing an Oklahoma Transfer-on-Death (TOD) Deed, it's easy to overlook key details or make common mistakes. This document allows property owners to pass their real estate directly to a beneficiary without going through probate. Here are ten common mistakes people often make with this form:

Not meeting witness or notarization requirements. Oklahoma law requires the presence of a notary and, in some cases, witnesses. Failure to comply with these requirements can invalidate the deed.

Incorrectly identifying the property. It's crucial to describe the property accurately, including its legal description, which is more detailed than just the address.

Forgetting to specify alternate beneficiaries. Without an alternate, the property might end up in probate if the primary beneficiary predeceases the owner.

Failing to properly revoke a previous TOD deed. If you've previously filed a TOD deed and wish to change it, you must properly revoke the old one before the new one is effective.

Not understanding the effect on mortgages. The TOD deed transfers property, but not the obligation to pay existing mortgages or liens against it, which the beneficiary assumes.

Leaving blank spaces. Complete all fields on the form to prevent unauthorized alterations after signing.

Omitting the preparation statement. This is a requirement that certifies who prepared the document, and neglecting it can cause problems.

Misunderstanding joint ownership. If the property is owned jointly, all owners must execute the TOD deed for it to be valid upon their deaths.

Overlooking the need to file the deed. A TOD deed must be filed with the county clerk in the county where the property is located before the owner's death to be effective.

Believing the TOD deed avoids estate taxes. The value of the property will still be included in the estate for tax purposes, even though it passes outside of probate.

In summary, while a Transfer-on-Death Deed can simplify the process of passing on property, paying attention to these details is crucial. Avoiding these common mistakes can help ensure that your property is transferred smoothly and according to your wishes.

Documents used along the form

Handling property and estate planning requires careful consideration and the right paperwork. In Oklahoma, the Transfer-on-Death Deed form is a valuable tool for designating beneficiaries for real property without going through probate court. However, to ensure a smooth transfer and address all potential issues, several other forms and documents are often used alongside this deed. These forms help in detailing the specifics of the property transfer, ensuring legal requirements are met, and safeguarding the interests of all parties involved.

- Last Will and Testament: This document is essential for outlining how your other assets, besides those covered by the Transfer-on-Death Deed, should be distributed upon your death. It can appoint guardians for minor children, specify executors for the estate, and indicate wishes for personal property distribution.

- Power of Attorney for Finances: This form grants someone you trust the authority to handle your financial affairs if you become incapacitated. It can cover a wide range of financial decisions but does not apply to the transfer of real estate upon death—which is the Transfer-on-Death Deed's role.

- Advance Directive for Health Care (Living Will): Though not directly related to property, this document is crucial for estate planning. It states your wishes regarding medical treatment if you're unable to communicate them yourself, including decisions about life support and end-of-life care.

- Revocation of Transfer-on-Death Deed form: If your circumstances or wishes change, this form allows you to cancel the previously recorded Transfer-on-Death Deed. It's a vital tool for maintaining control over your real estate plans until death.

When dealing with estate planning and property transfer, it's important to have a comprehensive strategy that includes not just the Transfer-on-Death Deed but also other legal documents to ensure your wishes are precisely followed. Consulting with a legal professional to tailor these documents to your unique situation is advisable, as this can provide peace of mind for both you and your loved ones regarding your estate's future.

Similar forms

A Last Will and Testament is similar because it specifies how a person's assets should be distributed upon their death. However, unlike a Transfer-on-Death Deed, which directly transfers real estate to a beneficiary, a will goes through probate.

A Beneficiary Designation on financial accounts like retirement accounts or life insurance policies is another similar document. Like transfer-on-death deeds, these designations allow assets to pass to beneficiaries without probate.

A Joint Tenancy With Right of Survivorship deed allows property to be owned by more than one person, with the surviving owner(s) automatically receiving the deceased's share. This bypasses probate, akin to transfer-on-death deeds' function for single owners.

The Living Trust serves a similar purpose by allowing property to be transferred to beneficiaries without probate. While a transfer-on-death deed applies only to real estate, a living trust can include various asset types.

Payable-on-Death (POD) Accounts for bank accounts operate similarly by designating beneficiaries who can directly inherit the funds without probate, echoing the simplicity of transfer-on-death deeds.

A Tenant by the Entirety deed, recognized in some states for married couples, automatically transfers property ownership to the surviving spouse, without probate, similarly to how transfer-on-death deeds work.

The Life Estate Deed allows the property owner to use the property during their lifetime, with ownership passing to a named remainderman at their death. This arrangement avoids probate, much like a transfer-on-death deed, but it's irrevocable without the remainderman’s consent.

A Community Property With Right of Survivorship allows spouses in community property states to co-own property and have it pass to the surviving spouse without probate. This mirrors the transfer-on-death deed's bypassing of probate but within the context of marital property.

The Revocable Transfer-on-Death Deed, where available, adds the option to revoke the deed, providing flexibility similar to a living trust, but specifically for real estate, making it closely aligned with the standard transfer-on-death deed.

Dos and Don'ts

Filling out the Oklahoma Transfer-on-Death (TOD) Deed form requires careful attention to detail and adherence to specific state laws. By ensuring that you correctly complete the form, you can smoothly transfer your property to a beneficiary upon your death, without the need for probate. Here are essential do's and don'ts to consider when filling out the TOD Deed form:

Do:

- Verify your eligibility: Ensure that you, as the property owner, are legally allowed to use a TOD deed for your property in Oklahoma. This includes confirming that the type of property in question is eligible for TOD designation.

- Provide accurate and complete information: Fill in all required fields with accurate details, including your full legal name, the exact legal description of the property, and the full legal names of all beneficiaries.

- Follow valid execution procedures: Oklahoma law requires specific execution procedures, such as signing the document in front of a notary public and obtaining the notary’s official seal or stamp.

- Record the deed properly: After completing and signing the TOD deed, it must be filed with the county clerk in the Oklahoma county where the property is located. Recording the deed makes it part of the official public record.

Don't:

- Leave sections incomplete: Avoid skipping any part of the form. Incomplete information can lead to misunderstandings, legal challenges, or even the invalidation of the deed.

- Forget to update as necessary: If your circumstances change (e.g., the beneficiary predeceases you or your relationship with the beneficiary changes significantly), do not neglect to update the TOD deed accordingly.

- Misunderstand the deed's effect: Remember, the TOD deed only takes effect upon your death. It does not grant any present interest or rights to the designated beneficiary while you are alive.

- Use vague or incorrect property descriptions: The legal description of the property needs to be exact and match the description used in the official property records. Using a vague or incorrect description can result in the TOD deed being challenged or declared invalid.

Misconceptions

When discussing the Oklahoma Transfer-on-Death (TOD) Deed form, several misunderstandings frequently arise. This document is important for estate planning, as it enables individuals to transfer their property upon death directly to a beneficiary without the need for probate. Below, we address common misconceptions to clarify the process and requirements.

-

Myth: A Transfer-on-Death Deed is difficult to create. Many believe creating a TOD deed is complicated and requires extensive legal help. In reality, Oklahoma has streamlined the process, providing clear guidelines. While seeking legal advice is advisable, the form itself is straightforward.

-

Myth: It overrides a will. Some think that the TOD deed supersedes any directives in a will concerning the same property. However, the TOD deed specifically transfers real estate upon death, directly and independently of the will's terms, assuming the deed is properly executed and recorded.

-

Myth: The beneficiary cannot be changed. Owners often mistakenly believe that once a TOD deed is created, the beneficiary's designation is permanent. In truth, the property owner can change the beneficiary at any time before death, as long as the change is legally documented and recorded.

-

Myth: The deed avoids all forms of probate. While a TOD deed does bypass the probate process for the specific property titled in the deed, it doesn't exempt the estate from probate regarding other assets that the decedent may have owned.

-

Myth: The beneficiary has no rights until the owner dies. This statement is true in that the beneficiary has no legal right to the property or its use before the owner's death. However, it's a misconception to assume beneficiaries have no interest; they have a future interest, ensuring the property will be transferred to them upon the owner's death.

-

Myth: A Transfer-on-Death Deed can transfer any type of property. People often think TOD deeds can be used to transfer any asset. However, in Oklahoma, the TOD deed is specifically for real estate. Other assets, like cars or bank accounts, require different mechanisms for transfer upon death.

-

Myth: The deed makes the beneficiary responsible for the owner's debts. There's a common fear that accepting property through a TOD deed automatically saddles the beneficiary with the decedent's debts. On the contrary, the beneficiary takes the property subject to any existing encumbrances, but isn't personally responsible for the decedent's other debts unless they agreed to such in another legal context.

-

Myth: It's only for seniors. Some assume that TOD deeds are solely for the elderly. But in fact, anyone owning real property in Oklahoma can use a TOD deed as part of their estate planning, providing a straightforward way to manage the succession of their real estate.

-

Myth: Once filed, it cannot be revoked. A significant misunderstanding is that a TOD deed is irrevocable. Property owners retain full control over their property and may revoke the deed at any time before death, as long as the revocation is properly executed and recorded.

Key takeaways

When considering the utilization of an Oklahoma Transfer-on-Death (TOD) Deed form, individuals are presented with a powerful tool for estate planning that avoids the necessity of probate for real estate. The following key takeaways provide essential guidance for anyone looking to navigate this process effectively.

- Eligibility Criteria: It's critical to understand that not all properties or owners might be eligible for transfer using a TOD deed. Prior verification of eligibility based on the property type and ownership status is advised.

- Form Details: Completing the TOD deed requires precise information: legal descriptions of the property, current owner details, and the beneficiary designation must be accurately provided to avoid disputes or rejections.

- Witness and Notarization: The execution of the TOD deed is not complete until it has been properly signed in the presence of a notary. Some situations may also require witnesses for additional validation.

- Recording Requirements: Once notarized, the TOD deed must be filed with the appropriate county clerk’s office. This step is pivotal for the deed to be effective and recognized under Oklahoma law.

- Revocation Process: Should the circumstances or intentions of the property owner change, the TOD deed allows for modification or complete revocation. However, this must be done with the same formality as the initial deed creation, including notarization and recording.

- Impact on Beneficiaries: Beneficiaries designated in a TOD deed do not have any legal right to the property until the owner's death, thereby ensuring the owner retains full control over the property during their lifetime.

Understanding and adhering to these key points when filling out and using an Oklahoma Transfer-on-Death Deed form can greatly simplify the process of transferring property upon one's passing, ensuring peace of mind for all parties involved.

Create Other Transfer-on-Death Deed Forms for US States

New Jersey Transfer on Death Deed - The use of a Transfer-on-Death Deed can protect the property from being tied up in legal disputes, ensuring the beneficiary's easy accession.

Does a Beneficiary Deed Avoid Probate - Transfer-on-Death Deeds maintain the owner's ability to use and control the property, including selling or mortgaging, while alive.

Avoid Probate in California - Empowers property owners to make clear, legally binding decisions about the future of their real estate.