Blank Transfer-on-Death Deed Form for Texas

In the realm of estate planning, the Texas Transfer-on-Death (TOD) Deed stands out as a significant instrument for property owners seeking a streamlined method to pass on real estate to their beneficiaries upon death, without the need for the property to go through the probate process. This legal document allows individuals to designate a beneficiary or multiple beneficiaries to inherit their property, effectively bypassing the often lengthy and costly court proceedings associated with traditional inheritance methods. Crafted with the aim of simplifying the transfer of assets, the Texas TOD Deed is subject to certain legal requisites, including proper completion and recording before the property owner's death, to ensure its validity and enforceability. Furthermore, it grants property owners the flexibility to change beneficiaries or revoke the deed without any constraints as long as they adhere to the stipulated legal process. The introduction of the TOD Deed in Texas reflects a broader trend toward simplifying estate planning and providing individuals with more control over the disposition of their assets, making it essential for property owners and beneficiaries alike to understand the major aspects and implications of executing such a document.

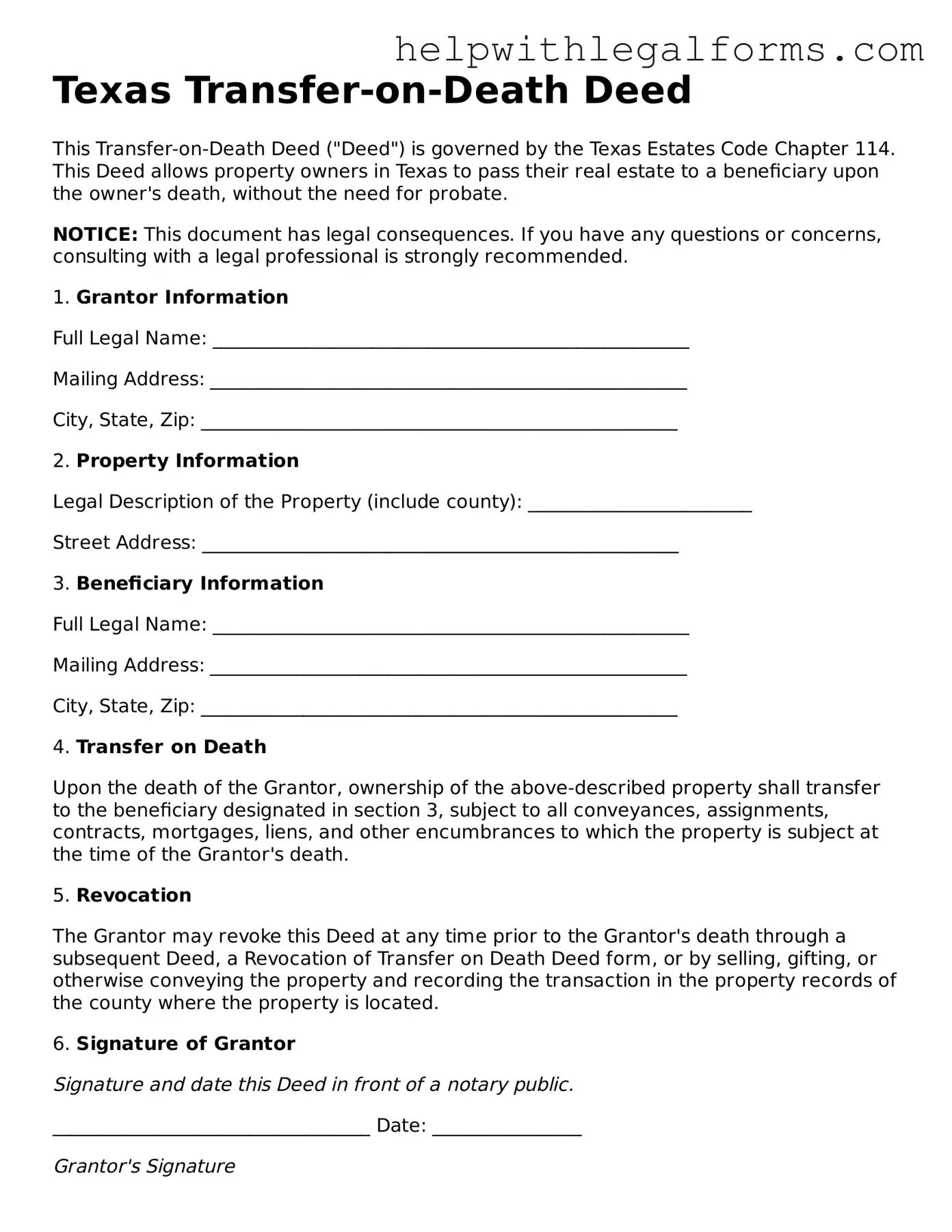

Example - Texas Transfer-on-Death Deed Form

Texas Transfer-on-Death Deed

This Transfer-on-Death Deed ("Deed") is governed by the Texas Estates Code Chapter 114. This Deed allows property owners in Texas to pass their real estate to a beneficiary upon the owner's death, without the need for probate.

NOTICE: This document has legal consequences. If you have any questions or concerns, consulting with a legal professional is strongly recommended.

1. Grantor Information

Full Legal Name: ___________________________________________________

Mailing Address: ___________________________________________________

City, State, Zip: ___________________________________________________

2. Property Information

Legal Description of the Property (include county): ________________________

Street Address: ___________________________________________________

3. Beneficiary Information

Full Legal Name: ___________________________________________________

Mailing Address: ___________________________________________________

City, State, Zip: ___________________________________________________

4. Transfer on Death

Upon the death of the Grantor, ownership of the above-described property shall transfer to the beneficiary designated in section 3, subject to all conveyances, assignments, contracts, mortgages, liens, and other encumbrances to which the property is subject at the time of the Grantor's death.

5. Revocation

The Grantor may revoke this Deed at any time prior to the Grantor's death through a subsequent Deed, a Revocation of Transfer on Death Deed form, or by selling, gifting, or otherwise conveying the property and recording the transaction in the property records of the county where the property is located.

6. Signature of Grantor

Signature and date this Deed in front of a notary public.

__________________________________ Date: ________________

Grantor's Signature

7. Notarization

This document was acknowledged before me on (date) _______________ by (name of Grantor)___________________________________.

__________________________________

Notary Public, State of Texas

My commission expires: _______________

Instructions for Recording: After notarization, file this Deed with the county clerk's office in the county where the property is located to make it effective.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | Allows property owners in Texas to transfer their real estate to a beneficiary upon the owner's death without the need for probate. |

| Governing Law | Texas Estates Code, Sections 114.001 to 114.151. |

| Revocability | The deed can be revoked by the owner at any time before death through a new deed, a revocation form, or by selling the property. |

| Effectiveness | It becomes effective upon the death of the owner, and the beneficiary gains control of the property without going through probate court. |

Instructions on How to Fill Out Texas Transfer-on-Death Deed

Filling out a Transfer-on-Death (TOD) Deed form in Texas is a vital step in managing your estate and ensuring that your property is transferred according to your wishes after your death, without the need for probate court proceedings. This document allows you to name a beneficiary who will inherit your real estate after your passing. It's important to carefully complete the form to ensure its validity. The following steps are designed to help guide you through the process, making it as straightforward as possible.

- Review the form requirements: Before starting, make sure you have the latest version of the Texas Transfer-on-Death Deed form. This can usually be found online on the Texas state or county website.

- Gather necessary information: You will need to have your property information, including the legal description of the real estate, and the full name and mailing address of the beneficiary.

- Enter your information: Fill in your name and address where indicated as the “Grantor”. Ensure the information is accurate and clearly readable.

- Describe the property: Insert the legal description of the property you are transferring. This must be accurate and match the description used in your property's current deed.

- Name the beneficiary: Clearly write the full legal name and address of the person or entity you wish to inherit the property upon your death. You can name more than one beneficiary if desired.

- Optional designation of successor beneficiary: If you wish, you can also name a successor beneficiary in case your primary beneficiary predeceases you. This step is optional.

- Review the deed: Carefully review all the information entered on the deed for accuracy. Any mistake could lead to complications in the transfer process after your death.

- Sign and notarize the deed: Once you have confirmed that all information is correct, sign the deed in front of a notary public. The notary will also need to sign and seal the document, making it official.

- Record the deed: Finally, file the signed and notarized deed with the county clerk's office in the county where the property is located. There may be a filing fee, so it’s a good idea to check in advance.

After these steps are completed, your Transfer-on-Death Deed will be legally effective. It is a significant step in planning for the future of your estate and can provide peace of mind knowing your property will be transferred according to your wishes. Remember, it's always advisable to consult with a legal professional if you have questions or need assistance with the process.

Crucial Points on This Form

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed is a legal document that allows property owners to pass their real estate to a beneficiary upon their death, without the need for the property to go through probate. This means the property can be transferred more quickly and easily to the named person or persons.

Who can use a Transfer-on-Death Deed?

Any property owner in Texas can use a Transfer-on-Death Deed as long as they are competent to make their own financial decisions. This form is especially useful for individuals who wish to ensure their property is smoothly transitioned to a loved one or an heir without the complexities and delays associated with the probate process.

How can someone create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, a property owner must complete the deed form, making sure to follow all the required legal formalities, including having the deed signed in the presence of a notary public. The deed must then be filed with the county recorder's office in the county where the property is located before the owner's death.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time by the property owner. Revocation can be done in a few ways, such as by creating and filing a new deed that explicitly revokes the previous one, transferring the property to someone else, or by creating a new Transfer-on-Death Deed that names a different beneficiary. Whichever method is chosen, it must be completed before the owner's death to be effective.

Are there any limitations to what can be transferred using a Transfer-on-Death Deed?

While a Transfer-on-Death Deed is a powerful tool for estate planning, it does have its limitations. It can only be used for real estate, meaning personal property, such as cars, bank accounts, or other types of assets cannot be transferred using this deed. Additionally, it's important to note that the deed only takes effect upon death, so it does not affect the owner's rights or control over the property during their lifetime.

Common mistakes

Filling out a Texas Transfer-on-Death (TOD) Deed form is an important process for property owners looking to pass on their real estate without going through the probate court. However, many people tend to make mistakes during this procedure. Recognizing and avoiding these errors can ensure a smooth transfer of property upon the owner's death.

Not providing precise identification of the property. It's essential to include the exact legal description of the property, not just its address. This description can usually be found on the property deed or tax assessment documents.

Failing to properly identify the beneficiary. The beneficiary's full legal name, including any middle names or initials, should be clearly stated. If the beneficiary is not accurately named, it may lead to disputes or confusion during the transfer process.

Overlooking the need for witnessing or notarization. The Texas TOD Deed must be signed in the presence of a notary public to be valid. Skipping this vital step can invalidate the whole deed.

Ignoring the option to name alternate beneficiaries. Life is unpredictable, and the primary beneficiary may predecease the property owner. By designating alternate beneficiaries, property owners can ensure that the property passes according to their wishes, even if circumstances change.

Not using the correct form or version. The Texas legislature occasionally updates legal forms, including the TOD Deed form. Using an outdated form may cause the TOD to be void.

Mistakes in signing or dating the form. The signature and date are critical to the deed's validity. The property owner must sign and date the form according to Texas law requirements, which may involve specific witnessing or notarization procedures.

Assuming the TOD Deed overrides other legal documents. If there are conflicting instructions in other estate planning documents, such as wills or trusts, it might create legal disputes. It’s important to ensure all estate planning documents are consistent and reflect the current wishes of the property owner.

Not filing the deed with the county records. After the TOD Deed is properly filled out, it should be filed with the county clerk’s office where the property is located. Failing to do so means the deed might not take effect upon the property owner's death.

Avoiding these mistakes can greatly enhance the effectiveness of a Transfer-on-Death Deed, ensuring the property is transferred smoothly and according to the owner’s wishes.

Documents used along the form

When managing affairs related to a Transfer-on-Death (TOD) deed in Texas, it's important to recognize that this process often involves more than just the TOD deed form itself. Additional forms and documents can help ensure a comprehensive approach to property management and estate planning. Understanding the purpose and significance of each document can provide peace of mind and clarity for all those involved.

- Last Will and Testament: This document outlines how a person's assets and responsibilities are to be handled after their death. While a TOD deed directs the transfer of specific property, a Last Will and Testament covers the broader scope of an individual's estate.

- Revocable Living Trust: Allows individuals to manage their assets during their lifetime and specify how these assets are distributed upon their death. A Revocable Living Trust can complement a TOD deed by providing detailed instructions for the estate outside of the transferred property.

- Power of Attorney: Empowers another person to make decisions on one’s behalf should they become incapable of doing so themselves. There are different types, including financial and medical, each serving a distinct purpose in estate planning and asset management.

- Designation of Health Care Surrogate: Specifies who will make medical decisions for a person if they are unable to do so themselves. This document is critical for ensuring that medical care aligns with the individual’s wishes when they are not in a position to communicate.

- Living Will: Also known as an advance directive, it outlines a person’s wishes regarding life-prolonging medical treatments. This document helps family and healthcare providers make informed decisions in line with the individual's preferences if they become incapacitated.

- Declaration of Guardian in Advance: Allows a person to designate who should become their guardian should they become incapacitated. This document ensures that guardianship is granted based on the individual's preference rather than a court's decision.

By considering these documents in conjunction with a Transfer-on-Death deed, individuals can create a thorough plan that addresses various aspects of their estate. This comprehensive approach not only helps in transferring property according to the owner's wishes but also in managing broader estate-related matters effectively. It's advisable to consult with a legal professional to ensure all documents are accurately prepared and aligned with Texas state laws.

Similar forms

Last Will and Testament: Similar to a Transfer-on-Death (TOD) deed, a Last Will and Testament allows someone to specify how their assets should be distributed after their death. Both documents help in planning estate affairs, though a Last Will covers a broader range of assets.

Beneficiary Designations on Financial Accounts: Similar to the TOD deed, which designates beneficiaries for real estate, financial accounts like savings, retirement, or brokerage accounts often allow the owner to name a beneficiary who will receive the assets without going through probate.

Life Estate Deed: This deed also concerns property transfer upon death. With a life estate deed, the owner transfers property but retains the right to use it during their lifetime. Upon the owner's death, the property automatically passes to the remaining beneficiary, much like a TOD deed.

Joint Tenancy with Right of Survivorship: Similar in effect to a TOD deed, this form of co-ownership means that when one owner dies, the surviving owner(s) automatically inherit the deceased's share of the property, bypassing the need for probate.

Payable-on-Death (POD) Account: A POD account is a type of bank or investment account that works similarly to a TOD deed but for financial assets. Upon the account holder's death, the assets are directly transferred to the designated beneficiary.

Trust Documents: Trusts are arrangements where one party holds property on behalf of another party. Similar to a TOD deed, trusts can specify the transfer of assets, including real estate, to beneficiaries upon the death of the trustor, often avoiding probate.

Gift Deed: A gift deed allows an individual to transfer property to another person without receiving payment, usually during the giver's lifetime. While its immediate effect differs from a TOD deed, both involve the transfer of property rights.

Revocable Living Trust: Like a TOD deed, a revocable living trust allows for the direct transfer of assets, including real estate, upon the trustor's death, without the need for probate. The trustor can also change or revoke the trust during their lifetime.

Medical Power of Attorney: While primarily for healthcare decisions rather than asset transfer, like a TOD deed transfers property upon death, a medical power of attorney designates someone to make healthcare decisions on the grantor's behalf if they become incapacitated.

Durable Power of Attorney: This document is akin to a TOD deed in that it allows someone to manage your affairs, but instead of focusing on asset transfer after death, it appoints someone to handle your finances or legal matters if you are unable to do so yourself.

Dos and Don'ts

Completing a Texas Transfer-on-Death Deed requires careful attention to detail. To ensure that your document accurately reflects your wishes and is legally binding, consider the following guidelines:

Do:

Review all the instructions provided with the form carefully to ensure understanding and compliance.

Clearly identify the property being transferred, using the legal description found on your property deed.

Include the full legal names and addresses of the beneficiaries to avoid any confusion.

Sign the deed in front of a notary public to validate its authenticity.

Keep a copy of the completed deed for your records.

File the signed and notarized deed with the county clerk's office in the county where the property is located.

Update your Transfer-on-Death Deed if circumstances change, such as the addition of new beneficiaries.

Don't:

Leave any fields blank. If a section does not apply, consider marking it as "N/A" (not applicable).

Attempt to transfer property that is co-owned without consulting with a legal professional to understand the full implications.

Forget to update your deed if there are significant life changes (marriages, divorces, deaths, etc.) that could affect your estate planning.

Overlook the need for a witness along with notarization, depending on state-specific requirements and the complexity of the transfer.

Assume the form is your only estate planning tool. Other documents, such as a will or trust, might be necessary to fully protect your assets and wishes.

Skip the step of confirming the deed was correctly filed and recorded with the appropriate county office.

Ignore tax implications and potential eligibility for public benefits, both for yourself and the beneficiary. Consulting with a professional can provide clarity.

Misconceptions

The Texas Transfer-on-Death (TOD) Deed form allows property owners to pass their real estate to a beneficiary without the property going through probate upon their death. However, several misconceptions exist about how this legal document works. Understanding the truth behind these misconceptions is crucial for anyone considering this estate planning tool.

- Misconception #1: A Transfer-on-Death Deed guarantees the beneficiary will receive the property free of issues. While it's true that a TOD Deed can bypass the probate process, it doesn't eliminate all potential complications. For example, the property might still be subject to existing debts and liens against it.

- Misconception #2: The TOD Deed allows you to skip paying taxes on the property. While the deed simplifies the transfer process, it does not exempt the beneficiary from obligations such as property taxes or estate taxes that might be due upon the owner's death.

- Misconception #3: Once filed, the TOD Deed cannot be revoked or changed. Property owners have the flexibility to revoke or amend a TOD Deed as long as they do so according to the legal requirements and while they are still alive.

- Misconception #4: The beneficiary has rights to the property as soon as the TOD Deed is signed. In reality, the beneficiary's rights to the property only activate upon the death of the property owner. Until then, the owner retains full control and use of the property.

- Misconception #5: Creating a TOD Deed is a complicated and costly process. Actually, completing a TOD Deed can be straightforward, especially with proper legal guidance. It's a cost-effective way to manage the transfer of property upon death.

- Misconception #6: A TOD Deed replaces the need for a will or estate plan. While a TOD Deed is an effective tool for transferring real estate, it should not be the sole component of an estate plan. Other assets not covered by the deed still necessitate a comprehensive approach to estate planning.

Correcting these misconceptions helps in making an informed decision about incorporating a Transfer-on-Death Deed into your estate planning strategy. It's also important to consult with a legal professional to ensure that this document aligns with your overall estate planning goals and complies with Texas law.

Key takeaways

When it comes to managing your estate planning in Texas, a Transfer-on-Death (TOD) Deed can be a valuable tool. It allows property owners to pass on their real estate to a beneficiary without having to go through the probate process. Here are five key takeaways to keep in mind when filling out and using the Texas Transfer-on-Death Deed form:

- Accuracy is key. Make sure all the information you provide on the form is accurate. This includes the legal description of the property, your name as it appears on the current deed, and the names of the beneficiaries. Incorrect information can void the deed.

- Notarization is required. After filling out the form, it’s not just about signing it; you need to have it notarized. This step is crucial as it validates the deed, making it legally binding.

- The deed must be recorded. For the Transfer-on-Death Deed to be effective, it must be recorded with the county clerk in the county where the property is located, before the death of the grantor. Failing to do this means the deed won't be valid.

- Revocation is possible. If you change your mind, you have the option to revoke the TOD Deed. This can be done by filing a revocation form or by creating a new TOD Deed that states the previous one is revoked. Remember, revocation must also be recorded to be effective.

- Consider the impact on beneficiaries. It's important to discuss your plans with the beneficiaries or a legal advisor. Beneficiaries take the property subject to any mortgages or liens. Understanding how a TOD Deed affects everyone involved helps prevent surprises later on.

Using a Transfer-on-Death Deed can simplify the process of transferring property upon your passing. However, make sure you follow the proper procedures and legal requirements to ensure the deed is valid and reflects your wishes accurately.

Create Other Transfer-on-Death Deed Forms for US States

Free Printable Transfer on Death Deed Form Florida - The Transfer-on-Death Deed positions itself as a proactive measure, preempting potential disputes among heirs or claimants to the property.

Colorado Beneficiary Deed - The document must be properly executed and recorded according to state laws to be effective, similar to a traditional deed.