Legal Last Will and Testament Form

Planning for the future involves addressing how personal assets should be distributed upon death. A Last Will and Testament form serves as a critical tool in this process, allowing individuals to specify their final wishes regarding their estate, including the distribution of assets, the care of minor children, and the appointment of an executor tasked with carrying out these directives. By clearly outlining these preferences, the document helps to minimize confusion and disputes among surviving family members, ensuring that the deceased’s wishes are respected and executed according to their specifications. Additionally, it can provide peace of mind to the person creating the will, knowing that their loved ones will be taken care of and that their estate will be handled as they desired.

State-specific Last Will and Testament Forms

Example - Last Will and Testament Form

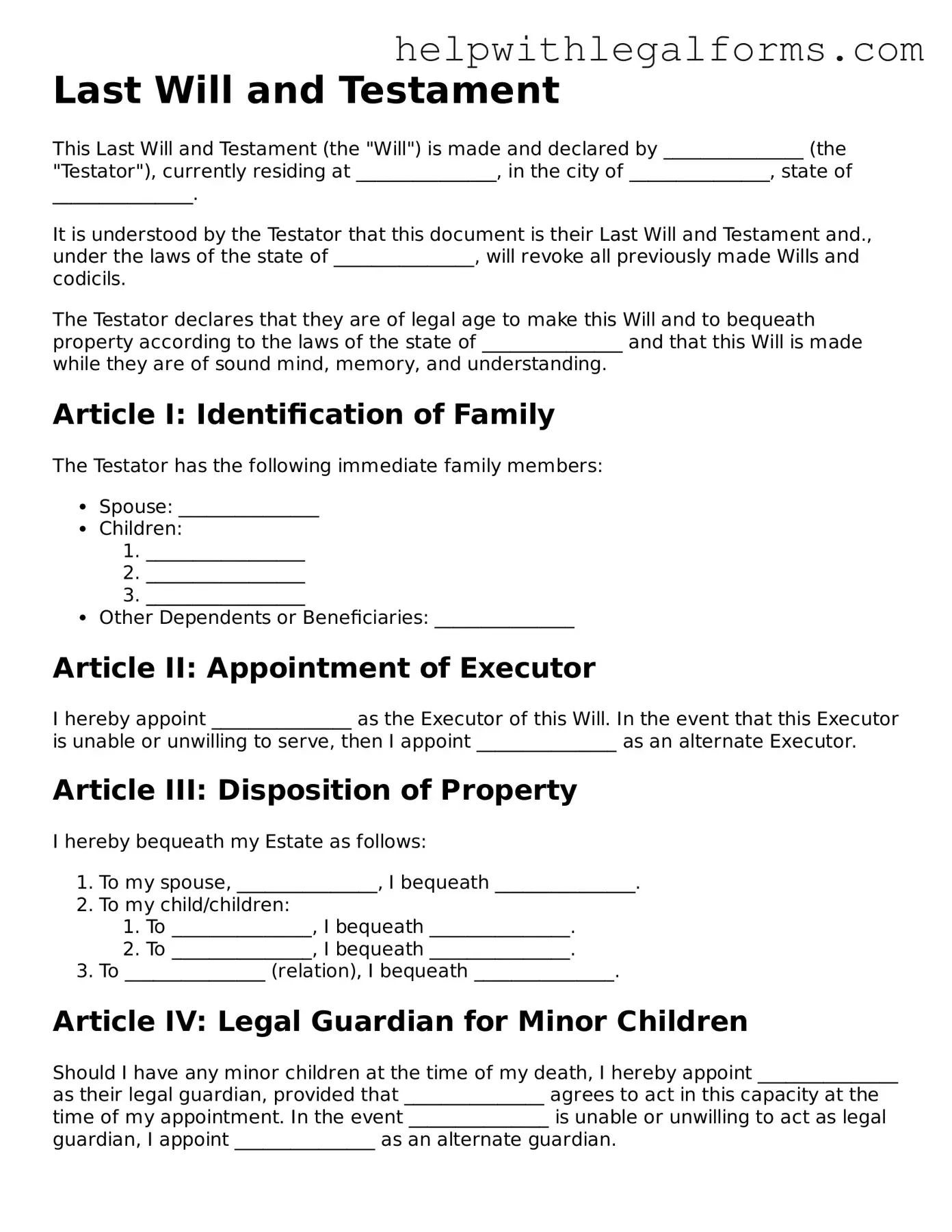

Last Will and Testament

This Last Will and Testament (the "Will") is made and declared by _______________ (the "Testator"), currently residing at _______________, in the city of _______________, state of _______________.

It is understood by the Testator that this document is their Last Will and Testament and., under the laws of the state of _______________, will revoke all previously made Wills and codicils.

The Testator declares that they are of legal age to make this Will and to bequeath property according to the laws of the state of _______________ and that this Will is made while they are of sound mind, memory, and understanding.

Article I: Identification of Family

The Testator has the following immediate family members:

- Spouse: _______________

- Children:

- _________________

- _________________

- _________________

- Other Dependents or Beneficiaries: _______________

Article II: Appointment of Executor

I hereby appoint _______________ as the Executor of this Will. In the event that this Executor is unable or unwilling to serve, then I appoint _______________ as an alternate Executor.

Article III: Disposition of Property

I hereby bequeath my Estate as follows:

- To my spouse, _______________, I bequeath _______________.

- To my child/children:

- To _______________, I bequeath _______________.

- To _______________, I bequeath _______________.

- To _______________ (relation), I bequeath _______________.

Article IV: Legal Guardian for Minor Children

Should I have any minor children at the time of my death, I hereby appoint _______________ as their legal guardian, provided that _______________ agrees to act in this capacity at the time of my appointment. In the event _______________ is unable or unwilling to act as legal guardian, I appoint _______________ as an alternate guardian.

Article V: Debts and Taxes

It is my wish that all my just debts, funeral expenses, and expenses of last illness, be first paid from my estate, and thereafter, the specific bequests I have directed in this Will to be transferred or delivered, should be free of any tax or duty as a result of my death.

Article VI: General Provisions

All my property and assets, of any kind and wherever situated, not otherwise disposed of by this Will or in any other manner together with any property and assets over which I have a power of appointment at my death, shall be disposed of as follows:

- If I have not otherwise directed, to my then-surviving descendants, per stirpes.

- If I have no surviving descendants, then to my surviving parents, or the survivor of them.

- If I have no surviving descendants or parents, then in equal shares to my then-surviving siblings.

In witness whereof, I, _______________ (the Testator), hereby set my hand to this Will on this day of _______________, 20__.

Testator's Signature: _______________

Printed Name: _______________

Signed in the presence of:

- Witness #1

Name: _______________

Signature: _______________

Date: _______________

- Witness #2

Name: _______________

Signature: _______________

Date: _______________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that expresses a person's wishes regarding the distribution of their property and the care of any minor children after their death. |

| State-Specific Requirements | Requirements vary by state, including the number of witnesses needed and whether the document must be notarized. |

| Main Components | Typically includes the declaration, executor appointment, beneficiary designations, guardian appointments for minors, and signatures. |

| Revocation | The document can be revoked or altered anytime by the testator as long as they are mentally competent. |

| Governing Law | Each state has its own statutes governing the validity and enforcement of Last Will and Testament forms. |

Instructions on How to Fill Out Last Will and Testament

When it comes time to think about the future and how your assets and belongings should be distributed, filling out a Last Will and Testament form is a crucial step. This document ensures that your wishes are clearly stated and can be legally recognized. The process can seem daunting at first, but by following a few straightforward steps, you can ensure that your intentions are properly documented. It's an act of care for your loved ones, ensuring that your decisions are known and respected after you're gone.

- Gather all necessary information, including a complete list of your assets (such as property, investments, and bank accounts) and the full names and addresses of those you wish to inherit them.

- Choose an executor, the person who will manage your estate and ensure your wishes are carried out. Select someone you trust deeply for this role.

- If you have minor children, decide on a guardian for them. This is someone who will take care of your children until they are adults, in case you pass away before this time.

- Start by filling in your full legal name and address at the top of the form to identify yourself as the testator (the person making the will).

- Detail your assets and specify who will inherit each item or sum. Be as clear as possible to prevent any confusion later on.

- Include any specific bequests, which are particular items or amounts of money that you want to leave to certain individuals or charities.

- Name your executor and any guardians for minor children in the designated sections, including their full names and addresses.

- Review the will thoroughly. It's wise to have a trusted person read over the document as well to ensure clarity and that your wishes are accurately reflected.

- Sign and date the will in the presence of two witnesses. The witnesses must also sign and date the document, validating its legitimacy. Witnesses should be people who do not stand to inherit anything from the will.

- Consider having the document notarized, though this isn't a requirement in every state. It can add an extra layer of legal protection.

Filling out a Last Will and Testament is a powerful step in managing your affairs and ensuring your loved ones are taken care of according to your wishes. While the process might bring up complex emotions, it’s a profound way to communicate your care and intentions for those important to you. Once complete, store the document in a safe place and inform your executor or a trusted family member of its location. Remember, this isn't a one-and-done task; it's wise to review and possibly update your will periodically, especially after major life events.

Crucial Points on This Form

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and properties will be distributed after their death. It allows individuals to specify their wishes regarding who will inherit their possessions, who will be the guardians of any minor children, and how any debts or taxes should be handled.

Who should have a Last Will and Testament?

Any adult who owns assets, has dependent children, or wishes to specify how their affairs should be managed after death should have a Last Will and Testament. It's essential for ensuring that your wishes are respected and can help prevent disputes among surviving family members.

How do you create a Last Will and Testament?

Crafting a Last Will and Testament typically involves determining your assets, deciding on beneficiaries, choosing an executor for your estate, and appointing guardians for any minor children. Once these decisions are made, the will should be written clearly to reflect your wishes. It's highly recommended to seek the assistance of a legal professional to ensure the document meets all legal requirements and fully represents your intentions.

Is a lawyer required to make a Last Will and Testament?

While a lawyer is not strictly necessary to create a Last Will and Testament, consulting one can be highly beneficial. A lawyer can help ensure that the will complies with state laws, provide advice on complex issues such as estate tax, and help avoid common mistakes that could lead to disputes or the will being contested.

Can a Last Will and Testament be changed?

Yes, a Last Will and Testament can be changed as long as the person making it is alive and has the legal capacity to make decisions. This is done through a document called a codicil, which amends parts of the will, or by creating a completely new will that revokes the old one.

What happens if someone dies without a Last Will and Testament?

If a person dies without a Last Will and Testament, their assets are distributed according to the intestacy laws of the state in which they resided. This can lead to outcomes that might not align with the deceased's wishes and could potentially cause conflicts among surviving relatives. It underscores the importance of having a well-drafted will in place.

Common mistakes

Filling out a Last Will and Testament form is a crucial step in planning for the future. It ensures your assets are distributed according to your wishes after your passing. However, several common mistakes can jeopardize the legal validity of the document or lead to unintended consequences. Awareness of these errors can guide individuals to approach this task with caution and accuracy.

-

Not adhering to state-specific laws: Laws regarding wills vary significantly from one state to another. Individuals often overlook the importance of understanding and complying with their state's specific requirements, which may include the number of witnesses required or the acknowledgment of a notary public. This mistake can potentially render a will invalid.

-

Choosing the wrong executor: The executor of a will bears the responsibility of overseeing the decedent's estate's settlement. People sometimes mistakenly appoint someone based on emotional ties rather than considering the individual's ability to manage complex tasks and make impartial decisions. This oversight can lead to disputes and mismanagement of estate affairs.

-

Omitting details about the distribution of personal property: A general statement about dividing assets equally among heirs might seem straightforward, but it can cause confusion and conflict. Specific items of sentimental or monetary value should be clearly allocated to prevent disputes among beneficiaries.

-

Forgetting to update the will: Life events such as marriage, divorce, the birth of children, or the death of a named beneficiary can significantly affect the relevance of your will's provisions. Failing to update your will to reflect these changes can lead to unintended beneficiaries or the exclusion of others.

-

Ignoring potential tax implications: Without proper planning, your estate might be subject to significant taxes, which can diminish the value of the assets distributed to your heirs. Neglecting to consider the tax implications of the bequests made in your will can result in a financial burden on your beneficiaries.

-

Failing to address the guardianship of minor children: If you have minor children, it’s vital to designate a guardian in your will. Without explicit instructions, the court will decide who will care for your children, which may not align with your preferences.

-

Attempting to include conditions on gifts that are illegal or unenforceable: Some people try to exert control over their assets from beyond the grave by attaching conditions to gifts in their wills. However, conditions that are illegal or grossly unreasonable are likely to be invalidated by a court, leading to parts of the will being disregarded.

In conclusion, drafting a Last Will and Testament requires careful attention to detail and an understanding of legal principles. By avoiding these common mistakes, you can ensure your assets are distributed according to your wishes and provide peace of mind for yourself and your loved ones.

Documents used along the form

When preparing for the future, a Last Will and Testament is a crucial document that outlines how one's belongings should be distributed after they pass away. However, to ensure a comprehensive approach to estate planning, it's often necessary to include additional documents that can address circumstances the will itself does not cover. Here is a list of eight documents that are commonly used alongside a Last Will and Testament to provide a full scope of preparations.

- Durable Power of Attorney – This document allows someone to make financial decisions on your behalf if you become unable to do so. It's essential for managing your assets if you're incapacitated.

- Medical Power of Attorney – Similar to the Durable Power of Attorney, this document appoints someone to make medical decisions for you if you're unable to communicate your wishes due to health reasons.

- Living Will – This document specifies your wishes regarding medical treatments and life support measures if you're terminally ill or incapacitated, guiding your healthcare providers and loved ones.

- Revocable Living Trust – By placing assets in a trust, you can manage them during your lifetime and dictate how they're distributed after your death, often bypassing the lengthy and costly probate process.

- Beneficiary Designations – These are forms you complete to designate who will receive benefits from your life insurance policies, retirement accounts, and other financial products upon your death.

- Letter of Intent – This document provides additional personal instructions that might not be included in a will, such as funeral arrangements or specific wishes concerning the distribution of your personal belongings.

- Guardianship Designations – In the event that minor children or dependents are left without a parent, this document specifies who you wish to take care of them, ensuring their wellbeing and safety.

- Digital Asset Trust – This relatively new type of document outlines how your digital assets (like social media accounts, online banking, and emails) should be handled after your death.

Each of these documents plays a critical role in estate planning, offering clarity and directions for various scenarios that a Last Will and Testament alone might not address. Incorporating them into your estate plan can provide peace of mind for you and your loved ones, ensuring that your wishes are respected and followed in both life and death.

Similar forms

Living Will: Much like the Last Will and Testament, which dictates the distribution of one's assets after death, a Living Will specifies an individual's preferences regarding medical treatment in situations where they can no longer express informed consent. Both documents serve to communicate the wishes of an individual, ensuring they are honored in critical times—either at the end of life or upon passing away.

Trust: A Trust, similar to a Last Will and Testament, is a means to manage the distribution of a person's assets. However, it differs in that it takes effect while the person (grantor) is still alive. Both documents allow an individual to detail how their assets should be handled and distributed, but a Trust also offers the added advantages of potentially avoiding probate and providing more control over the assets during the grantor's lifetime.

Power of Attorney: This document grants another person the authority to make decisions on one's behalf, akin to how a Last Will and Testament appoints an executor to manage estate affairs after death. While the Last Will operates posthumously, a Power of Attorney is effective during the principal’s lifetime, ceasing at their death. Both play pivotal roles in ensuring an individual's affairs are managed according to their preferences when they are unable to do so themselves.

Healthcare Proxy: Similarly to a Last Will and Testament laying out instructions for after one's passing, a Healthcare Proxy appoints someone to make medical decisions on behalf of the individual if they become incapacitated. Both documents are integral in preemptive planning, ensuring decisions align with the individual’s values and desires, whether for after-life asset distribution or life-sustaining treatment choices.

Dos and Don'ts

Creating a Last Will and Testament is a significant step in managing your affairs and ensuring your assets are distributed according to your wishes after you pass away. To make this process as smooth and error-free as possible, here are six things you should do and six things you shouldn't do when filling out the Last Will and Testament form:

Do:

- Review all instructions carefully before you begin to ensure you understand the requirements and follow them closely.

- Clearly identify your assets and to whom you wish to leave them, using precise descriptions to avoid any ambiguity.

- Choose an executor you trust to manage your estate and include their full name and contact information in the document.

- Consider appointing a guardian for any minor children or dependents, making sure to discuss this responsibility with them in advance.

- Sign the document in the presence of witnesses who are not beneficiaries of your will to avoid any potential conflicts of interest.

- Keep the document in a safe, secure place and let your executor know where to find it.

Don't:

- Procrastinate on making a will, as unforeseen circumstances can arise at any time.

- Attempt to handle complex legal arrangements without consulting a legal professional, especially if your estate involves significant assets or complicated family dynamics.

- Leave out important details or instructions, which could lead to disputes among your heirs or beneficiaries.

- Rely solely on a digital copy; always have a physical copy of your Last Will and Testament that meets legal standards.

- Forget to update your will after significant life events, such as marriage, divorce, the birth of a child, or the acquisition of significant assets.

- Underestimate the importance of having witnesses; their signatures are essential to validate the document.

Misconceptions

When it comes to planning for the future, understanding the facts about creating a Last Will and Testament is crucial. Unfortunately, several misconceptions can lead to confusion and improper estate planning. Below are ten common misunderstandings clarified to aid in navigating this important document.

Only the Wealthy Need a Will: Many people assume that wills are only for those with significant assets. However, a will is crucial for anyone who wishes to dictate how their belongings, regardless of their value, are distributed after their passing. It also allows for the appointment of guardians for minor children.

Everything Goes Through the Will: It's a common belief that all assets are distributed through a will upon death. However, certain assets like life insurance proceeds, retirement accounts, and jointly owned property typically pass outside of the will, directly to a named beneficiary or surviving co-owner.

A Will Avoids Probate: Many think that having a will means an estate won’t go through probate. While a will can streamline the process, it does not eliminate the need for probate, which is the court-supervised process of authenticating the will and settling the estate.

Oral Wills are Sufficient: While some jurisdictions recognize oral wills under very specific circumstances, relying on one is risky. For a will to be valid in most places, it must meet specific legal standards, including being written down and witnessed.

Wills Can Disinherit Spouses Completely: In many jurisdictions, laws protect spouses from being completely disinherited, regardless of the will's contents. These laws ensure that a spouse can claim a portion of the estate, known as an elective share, even if the will says otherwise.

Once Written, Wills Are Final: A will can be updated as often as needed. Life changes, such as marriage, divorce, the birth of children, or changes in assets, are common reasons to revise a will. It's advisable to review and potentially update a will regularly or after significant life events.

Wills Cover Incapacity Planning: Wills take effect after death, which means they do not provide instructions or powers concerning an individual’s care or finances if they become incapacitated. Estate planning should also include documents like powers of attorney and living wills for these situations.

Children Can Be Left to Anyone: While a will can suggest guardians for minor children, the final decision rests with the court. The court's primary concern is the children's best interests and may consider the will's recommendations alongside other factors.

Wills Must Be Notarized: Although notarization can add an extra layer of authenticity, most jurisdictions do not require a will to be notarized to be considered valid. It must be signed in the presence of witnesses, whose requirements vary by location.

A Will Guarantees Assets Will Be Distributed Immediately: The process of settling an estate can take time, often months or even years, before assets are distributed. The will must be validated, debts settled, and assets located and appraised, which all precede distribution to heirs.

Understanding these misconceptions and obtaining accurate information can greatly assist individuals in creating a Last Will and Testament that effectively conveys their wishes and provides for their loved ones in accordance with the law.

Key takeaways

Filling out a Last Will and Testament form is a crucial step in planning for the future. It not only helps ensure that your wishes are respected after your passing but also provides clarity and guidance for your loved ones during a difficult time. Here are four key takeaways to consider when working with a Last Will and Testament form:

- Clarity is Key: When you're filling out your Last Will and Testament, clarity is paramount. Using clear, unambiguous language prevents misunderstandings and legal challenges. Be specific about who gets what, using full names and relationships to avoid any confusion.

- State Laws Vary: Each state has its own set of laws governing the creation and validity of Last Wills and Testaments. Therefore, it's crucial to familiarize yourself with your state's specific requirements to ensure your will is legally binding. This could include rules about notarization, witnesses, and the minimum age of the testator (the person making the will).

- Choose Your Executor Wisely: The executor of your will plays a central role in managing your estate after your death. This should be someone you trust implicitly, who is also organized and responsible. They will be in charge of carrying out your wishes, paying off debts, and distributing your assets according to the instructions left in your will.

- Keep It Updated: Life changes—such as marriage, divorce, the birth of children, or the acquisition of significant assets—mean your Last Will and Testament should be a living document. Regularly reviewing and updating it ensures that it always reflects your current wishes and circumstances.

Remember, while a Last Will and Testament is a powerful tool for estate planning, it's most effective when thoughtfully prepared and regularly updated. Engaging with legal counsel can provide personalized advice and peace of mind, ensuring that your will accurately reflects your wishes and complies with state laws.

Other Forms

Bill of Sale Rv - It asserts the buyer’s responsibility for the RV, including maintenance and any necessary registration changes thereafter.

What Are the 3 Types of Separation? - Designed to cover all necessary legal bases, providing comprehensive protection for both individuals during the separation.