Blank Last Will and Testament Form for California

In California, as in many states, the Last Will and Testament form serves as a crucial document for individuals planning the future of their estates. This legal instrument allows a person, known as the testator, to outline precisely how their assets, including money, property, and personal belongings, should be distributed upon their death. It not only ensures that the testator's wishes are respected but also aims to provide clarity and prevent potential disputes among beneficiaries. The form facilitates the appointment of an executor, who will be responsible for administering the estate according to the will's directives. Also noteworthy is the option for testators to specify guardians for their minor children, a provision that offers peace of mind about the well-being of their dependents. However, to be legally binding in California, this document must adhere to specific requirements, such as being signed in the presence of witnesses. Understanding the major aspects of the Last Will and Testament form is essential for California residents who wish to execute their estate plans effectively, ensuring their last wishes are honored and their loved ones are taken care of.

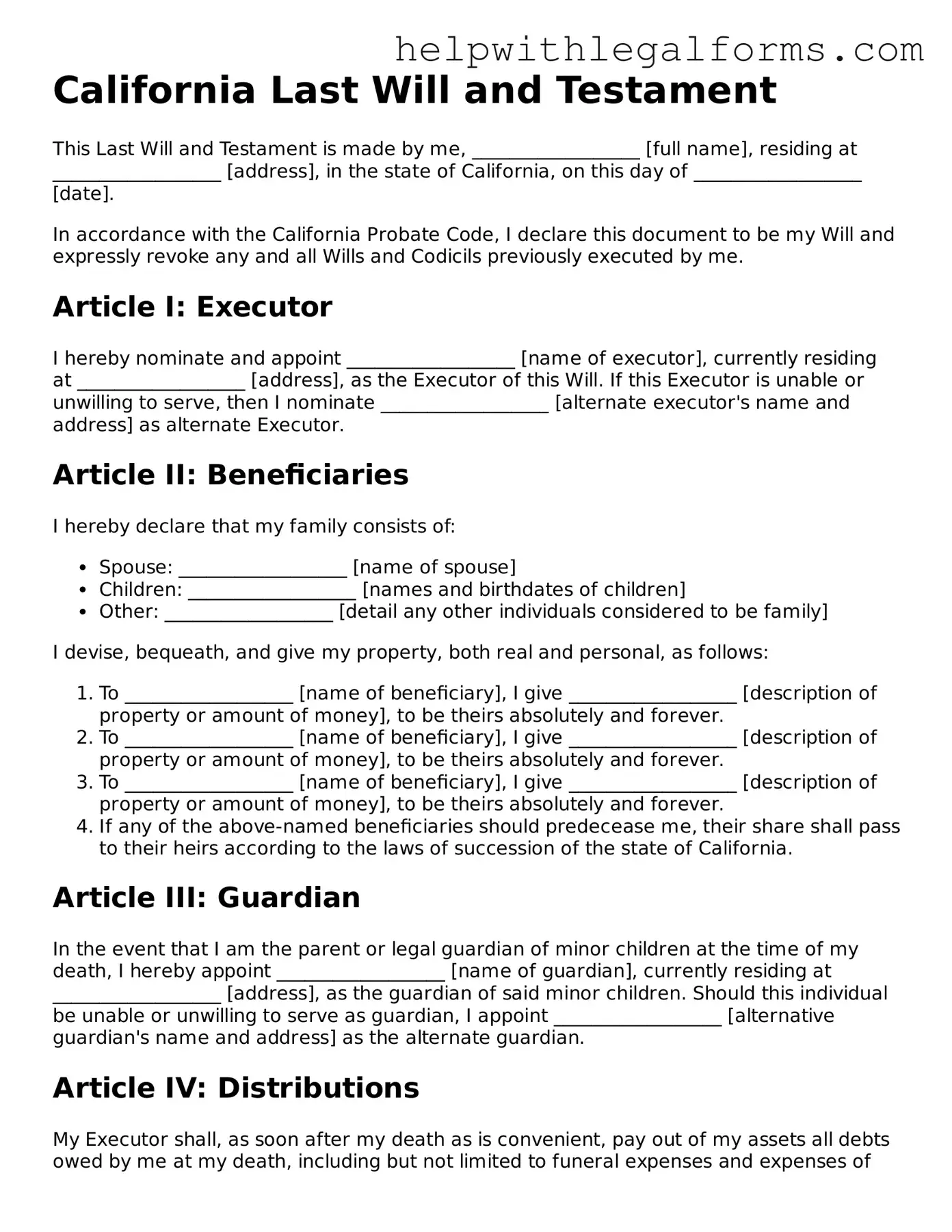

Example - California Last Will and Testament Form

California Last Will and Testament

This Last Will and Testament is made by me, __________________ [full name], residing at __________________ [address], in the state of California, on this day of __________________ [date].

In accordance with the California Probate Code, I declare this document to be my Will and expressly revoke any and all Wills and Codicils previously executed by me.

Article I: Executor

I hereby nominate and appoint __________________ [name of executor], currently residing at __________________ [address], as the Executor of this Will. If this Executor is unable or unwilling to serve, then I nominate __________________ [alternate executor's name and address] as alternate Executor.

Article II: Beneficiaries

I hereby declare that my family consists of:

- Spouse: __________________ [name of spouse]

- Children: __________________ [names and birthdates of children]

- Other: __________________ [detail any other individuals considered to be family]

I devise, bequeath, and give my property, both real and personal, as follows:

- To __________________ [name of beneficiary], I give __________________ [description of property or amount of money], to be theirs absolutely and forever.

- To __________________ [name of beneficiary], I give __________________ [description of property or amount of money], to be theirs absolutely and forever.

- To __________________ [name of beneficiary], I give __________________ [description of property or amount of money], to be theirs absolutely and forever.

- If any of the above-named beneficiaries should predecease me, their share shall pass to their heirs according to the laws of succession of the state of California.

Article III: Guardian

In the event that I am the parent or legal guardian of minor children at the time of my death, I hereby appoint __________________ [name of guardian], currently residing at __________________ [address], as the guardian of said minor children. Should this individual be unable or unwilling to serve as guardian, I appoint __________________ [alternative guardian's name and address] as the alternate guardian.

Article IV: Distributions

My Executor shall, as soon after my death as is convenient, pay out of my assets all debts owed by me at my death, including but not limited to funeral expenses and expenses of last illness.

Article V: Miscellaneous Provisions

I direct that no bond or security of any kind shall be required of any Executor, Trustee, or Guardian appointed in this Will.

Article VI: Signatures

IN WITNESS WHEREOF, I have hereunto signed my name on __________________ [date], at __________________ [location], in the presence of two witnesses, who also signed their names in my presence.

__________________ [signature of testator]

Witnessed By:

- __________________ [witness 1 name] - __________________ [witness 1 address]

- __________________ [witness 2 name] - __________________ [witness 2 address]

Note: This Will template is intended as a general guide. Individuals should consult with a qualified attorney in the state of California to ensure compliance with state law and the proper execution of this document.

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A California Last Will and Testament is a legal document specifying how a person's assets and responsibilities are handled after their death. |

| Governing Law | It is governed by the California Probate Code. |

| Age Requirement | The individual creating the will must be at least 18 years old. |

| Sound Mind Requirement | The individual must be of sound mind at the time of making the will. |

| Witness Requirement | California law requires at least two witnesses present at the signing of the will. |

| Holographic Wills | Handwritten (holographic) wills are accepted if they meet specific criteria, including being written, dated, and signed by the hand of the will maker. |

| Self-Proving Affidavit | A self-proving affidavit is not required but can speed up probate since it pre-verifies the will's authenticity in court. |

| Digital Wills | As of the knowledge cutoff in 2023, California does not recognize digital wills as valid. |

| Revocation | The will maker can revoke the will at any time through destruction or the creation of a new will. |

Instructions on How to Fill Out California Last Will and Testament

Creating a Last Will and Testament is a crucial step in managing your end-of-life affairs, ensuring that your property is distributed according to your wishes. It’s important to comprehend each part of the form to make it legally binding and reflective of your desires. The California Last Will and Testament form requires careful attention to detail as you walk through the sections. By following these steps, you will be guided through filling out the form properly, helping you secure peace of mind for yourself and your loved ones. Remember, this document is central to estate planning, and it's advised to review everything thoroughly or consult with a legal professional if you're in doubt.

- Begin by entering your full name and address in the designated space at the top of the form, confirming your residency in California and your intention to make this document your Last Will and Testament.

- Appoint an executor by inserting the name, address, and relationship of the person you trust to manage your estate after your passing. This role is vital as the executor will oversee the distribution of your assets according to the wishes laid out in your will.

- Specify guardianship for any minor children. If applicable, write the names and addresses of the guardians you choose to care for your children should there be no surviving parent.

- List each of your assets and the corresponding beneficiaries. Be as specific as possible, including the full names of the individuals or organizations you wish to inherit your property, along with a clear description of what each beneficiary is to receive.

- If you wish to make specific bequests, such as family heirlooms, jewelry, or donations to charity, detail these items separately, indicating who receives what.

- Address the residue of your estate, which encompasses anything not specifically mentioned earlier in the document. Indicate how you want these remaining assets to be distributed among your listed beneficiaries.

- For any previous wills or testamentary documents, include a statement that declares this document revokes all prior wills and codicils. This ensures your most current wishes are the ones recognized legally.

- Review the form to ensure all information is accurate and complete. Errors or omissions could create legal complications or delay the distribution of your estate.

- Sign the form in the presence of two witnesses who are not beneficiaries in your will. The witnesses also need to sign, verifying they observed you sign the document and that you declared the document as your will.

- Consider having the form notarized to add an extra layer of legal protection, although not mandatory in California, it can help authenticate the document.

Completing the California Last Will and Testament form is a significant act of responsibility. It doesn't just ensure that your assets are passed on according to your wishes; it also provides clarity and direction for your loved ones during a challenging time. Invest the necessary effort into filling out this form accurately, and don't hesitate to seek professional advice if needed. This way, you can rest assured that your final wishes will be honored and that you've made the process as smooth as possible for those you care about.

Crucial Points on This Form

What is a California Last Will and Testament?

A California Last Will and Testament is a legal document that outlines how a person’s assets and property are to be distributed upon their death. It allows the person, known as the testator, to appoint an executor who will manage the estate until its final distribution. In California, this is governed by the California Probate Code.

Who can create a Last Will and Testament in California?

In California, any person 18 years of age or older and of sound mind can create a Last Will and Testament. This means they must be able to understand the nature of the document, what they own, and who the beneficiaries of their estate will be.

Does a California Last Will need to be notarized?

No, a Last Will and Testament in California does not need to be notarized to be considered legal. However, it must be signed by the testator in the presence of two witnesses, who must also sign the document, attesting that they observed the testator’s signing.

Can I write my own Last Will and Testament in California?

Yes, you can write your own Last Will and Testament in California. However, it is important to follow all the legal requirements, including having it witnessed properly. While writing your own will can save money, seeking the advice of a legal professional can ensure that it complies with state laws and your wishes are clearly communicated.

What happens if someone dies in California without a Last Will?

If someone dies without a Last Will and Testament in California, their assets are distributed according to the state's intestate succession laws. Generally, this means the estate will be passed on to the closest relatives, beginning with the spouse and children, and then extending outward to more distant relatives if necessary.

How can I change or revoke my Last Will and Testament in California?

You can change or revoke your Last Will and Testament at any time as long as you are of sound mind. This can be done through creating a new will that states it revokes all prior wills or by physically destroying the previous version with the intention of revoking it.

Does a Last Will and Testament cover all of my assets in California?

No, a Last Will and Testament in California does not cover all your assets. Certain assets, such as those held in a living trust, retirement accounts, life insurance policies, and jointly owned property, are not covered because they typically pass outside of the will to a named beneficiary or by the right of survivorship.

What should I do with my completed Last Will and Testament?

After completing your Last Will and Testament, it should be kept in a safe and accessible place. Inform your executor or a trusted family member of its location. Some people choose to keep their will in a safe deposit box at a bank, though it is crucial to ensure the executor will have access to it upon the testator’s death.

Common mistakes

The California Last Will and Testament form is a critical document for ensuring your wishes are respected after your passing. However, mistakes can be made during its completion, leading to potential confusion or disputes. To avoid these pitfalls, here are ten common errors people often make:

-

Not adhering to California legal requirements: The form must be completed in accordance with state laws, including being witnessed by two individuals who are not beneficiaries.

-

Failing to fully complete the form: Every section of the form should be filled out to avoid ambiguity or questions about your intentions.

-

Ignoring the need for specificity: Clearly identifying assets and their intended recipients helps prevent misunderstandings among heirs and beneficiaries.

-

Omitting a residuary clause: This clause addresses how to distribute assets that were not specifically mentioned elsewhere in the will.

-

Using unclear language: The wording should be straightforward and precise to prevent misinterpretation of your wishes.

-

Neglecting to update the will: Life changes such as marriage, divorce, and the birth of children necessitate updates to ensure the document reflects your current situation and wishes.

-

Forgetting to name an executor: An executor is responsible for carrying out the directions in your will, so it's important to appoint someone you trust.

-

Selecting inappropriate witnesses: Witnesses must be impartial and not stand to benefit from the will, to uphold its validity.

-

Not considering a self-proving affidavit: This is a document that can expedite the probate process, yet many people overlook including it with their will.

-

Failing to safely store the will: The original document should be kept in a secure location that is known and accessible to the executor.

By avoiding these mistakes, you can help ensure that your Last Will and Testament clearly reflects your wishes and can be effectively executed without unnecessary complications.

Documents used along the form

Preparing a Last Will and Testament in California is a significant step in planning one's estate. However, it's often just a part of the larger picture of estate planning. To ensure a comprehensive approach, individuals frequently need to consider additional forms and documents that complement and support their final wishes as outlined in their will. Below is a list of documents commonly used in conjunction with the California Last Will and Testament to provide a more complete estate plan.

- Advance Health Care Directive: This document allows individuals to specify their preferences for medical treatment and appoint someone to make health care decisions for them if they become unable to do so themselves.

- Durable Power of Attorney for Finances: This grants a trusted individual the authority to handle financial matters on someone's behalf, making decisions about property, taxes, and bills, especially if the person becomes incapacitated.

- Living Trust: Helps avoid probate by transferring assets into a trust during an individual's lifetime. Upon their death, assets are passed to the trust's beneficiaries, according to the terms set by the person who created the trust.

- Guardianship Designation: Allows parents or guardians to appoint someone to look after their minor children if they can't do it themselves, due to death or incapacity, ensuring that the children's well-being is taken care of by a trusted adult.

- Beneficiary Designations: Often used for life insurance policies, retirement accounts, and other financial accounts, enabling individuals to specify who will receive the assets in these accounts directly, outside of the will or trust.

- Property Deed with Right of Survivorship: Enables co-owned property to transfer smoothly to the surviving owner(s) without going through probate, bypassing the will entirely.

- Personal Property Memorandum: Linked to the will, this flexible document allows for the distribution of personal items not specifically listed in the will, like jewelry or family heirlooms, to be easily modified without changing the will itself.

- Final Arrangements: A document that outlines preferences for funeral and burial or cremation arrangements, taking the burden off family members during a difficult time and ensuring wishes are respected.

While the Last Will and Testament serves as the cornerstone of a well-structured estate plan, incorporating these additional documents can significantly enhance the plan's effectiveness. Each plays a unique role in ensuring that various aspects of an individual's life and legacy are addressed, making the estate planning process as smooth and comprehensive as possible. Seeking the assistance of professionals while preparing these documents can provide further peace of mind, knowing that one's final wishes will be honored and loved ones are cared for.

Similar forms

A Living Trust shares similarities with a Last Will and Testament as it dictates how one's assets should be distributed after death. However, a Living Trust is active during the individual's lifetime and allows for a smoother transition of assets without the need for probate court.

A Power of Attorney is akin to a Last Will and Testament because it grants someone else the authority to manage your affairs. However, its powers are only in effect during the individual's lifetime, ceasing upon death, whereas the directives in a Last Will and Testament come into play after death.

The Healthcare Directive, also known as a Living Will, parallels the Last Will and Testament in its provision for future wishes. It lays out specific directions for medical care if one becomes unable to make decisions due to illness or incapacity, focusing on end-of-life care rather than asset distribution.

Finally, a Beneficiary Designation form, commonly used with retirement accounts or life insurance policies, bears resemblance as it designates who will receive the assets upon the account holder's death. Unlike a Last Will and Testament, beneficiary designations bypass the probate process and take immediate effect upon the account holder's death, directly transferring the named assets to the beneficiaries.

Dos and Don'ts

Preparing a Last Will and Testament in California is a crucial step in managing your estate and ensuring that your desires are honored after your passing. To help you navigate this process smoothly, here are five dos and don'ts to consider:

Do:Understand the requirements. Be aware of the legal necessities in California, like how the will must be signed and witnessed. This knowledge ensures the document's validity.

Be clear and specific about your wishes. When distributing your assets, clarity can prevent potential disputes among heirs.

Choose an executor you trust. This person will manage your estate, so pick someone responsible and capable.

Update your will as needed. Life changes, such as marriages, divorces, births, or acquiring significant assets, may necessitate updates to your will.

Get it signed correctly. California law requires your will to be signed in the presence of two witnesses, who must also sign the document.

Don’t overlook the appointment of a guardian if you have minor children. This decision can safeguard your children's future should the worst happen.

Don’t assume verbal agreements will be honored. Without documentation, these agreements might not be legally enforceable.

Don’t leave your will in an inaccessible place. Ensure your executor knows where it can be found.

Don’t use vague language that could lead to misinterpretation. Precision in your will can help avoid unnecessary legal battles.

Don’t attempt to pass on property that has specified beneficiaries in other legal methods, like living trusts or joint tenancies, through your will.

By following these guidelines, you can create a robust Last Will and Testament that safeguards your wishes and provides for those you care about.

Misconceptions

Understanding the Last Will and Testament form in California is crucial for ensuring that one's final wishes are honored. However, numerous misconceptions exist that can lead to confusion and potentially unintended consequences. Below is a list of common misunderstandings and explanations aimed at clarifying these aspects.

- Only the Wealthy Need a Will: Many people believe that wills are only necessary for those with substantial assets. In reality, a Last Will and Testament is vital for anyone who wishes to have a say in how their possessions, regardless of value, are distributed after death.

- Oral Wills are Just as Good as Written Ones in California: While some states may recognize oral wills under very specific conditions, California law requires wills to be written. An oral will is not legally binding in California.

- A Will Eliminates the Need for Probate in California: Another common misconception is that having a will allows an estate to bypass the probate process. In truth, a will must go through probate to validate the document and execute its terms.

- My Spouse Will Automatically Get Everything: Without a will, California's intestacy laws determine inheritance distributions. If someone dies intestate (without a will), their assets might not automatically go to their spouse, especially if there are children or parents still living.

- You Can Disinherit Your Spouse Completely: California is a community property state, meaning that simply writing someone out of a will does not necessarily strip them of their entitlement to community property acquired during the marriage.

- Wills Cover Every Aspect of Your Estate: Certain assets, like those held in joint tenancy or with designated beneficiaries (such as life insurance policies), pass outside of the will. It’s crucial to understand which parts of your estate are governed by the will and which are not.

- Signing a Will is Enough to Make it Legitimate: In California, for a will to be considered valid, it must not only be signed but also witnessed by at least two individuals who are not beneficiaries of the will.

- Once Written, a Will is Forever: Wills can and should be updated to reflect life changes such as marriage, divorce, the birth of children, or significant changes in financial status. A will is not a static document.

- A Will Ensures Your Funeral Wishes are Followed: While a will can express funeral preferences, it is often not consulted until after funeral arrangements are made. Communicating these wishes separately to family members or other intended agents is advisable.

- Homemade Wills are Fine: Though it is technically true that one can draft a will without professional assistance, this approach is fraught with risks. Improper wording or failure to adhere to legal requirements can invalidate the entire document or parts of it.

Knowing the facts about Last Will and Testament forms in California ensures that one's final wishes regarding the distribution of their estate are properly documented and legally binding. Misunderstandings can lead to complications, but educating oneself about these common misconceptions can help prevent these issues.

Key takeaways

Filling out and using the California Last Will and Testament form is a significant step in ensuring your wishes are honored after your passing. Here are key takeaways to help guide you through this process:

Ensure the form complies with California law. California has specific requirements related to the preparation and execution of a Last Will and Testament. It's crucial that the form meets these legal standards to be considered valid.

Clear identification of assets and beneficiaries. Be detailed when listing your assets and whom you wish to inherit them. This clarity helps prevent disputes among beneficiaries.

Choose an executor wisely. The person you appoint as executor will be responsible for managing your estate and carrying out your wishes as outlined in your will. Select someone who is trustworthy and capable of handling these responsibilities.

Signature and witnesses are essential. For a Last Will and Testament to be legally valid in California, it must be signed by you and witnessed by at least two individuals who are not beneficiaries in the will. These witnesses also need to sign the will in your presence.

Consider a notary public. Although not mandatory in California, having your Last Will and Testament notarized can add an extra layer of legitimacy and may help in the probate process.

Keep the document in a safe place. Once completed, store your Last Will and Testament in a secure location and inform your executor or a trusted person of its whereabouts. Accessibility is crucial during the probate process.

By following these guidelines, you can ensure that your Last Will and Testament clearly communicates your final wishes and is executed accordingly.

Create Other Last Will and Testament Forms for US States

Making a Will in Colorado - This form can also minimize potential conflicts by clearly outlining the distribution of your assets.

Nj Living Will - Can detail arrangements for digital assets, including social media accounts and digital files.

Online Will Georgia - This document outlines who will inherit the assets, property, and other financial benefits of the deceased.

How to Make a Will in Ct - Including contingency plans for various scenarios ensures your estate is prepared for unexpected changes in beneficiary circumstances.