Blank Last Will and Testament Form for Colorado

Creating a Last Will and Testament is a critical step for residents of Colorado looking to ensure their wishes are honored regarding the distribution of their assets after their death. This document, fundamental to estate planning, allows individuals to specify how their belongings, such as real estate, personal property, and investments, should be distributed among their heirs and beneficiaries. Besides asset distribution, the Colorado Last Will and Testament form serves to appoint an executor, the person responsible for managing the estate's affairs according to the will's instructions. Importantly, the form also allows parents to appoint a guardian for minor children, ensuring their care and well-being are managed by someone they trust in the event of the parents' untimely death. To be legally valid, this document must meet specific requirements, including being signed by the testator (the person making the will) in the presence of witnesses. Addressing these aspects adequately in the Colorado Last Will and Testament not only secures an individual's legacy but also provides peace of mind knowing that their final wishes will be respected and their loved ones cared for.

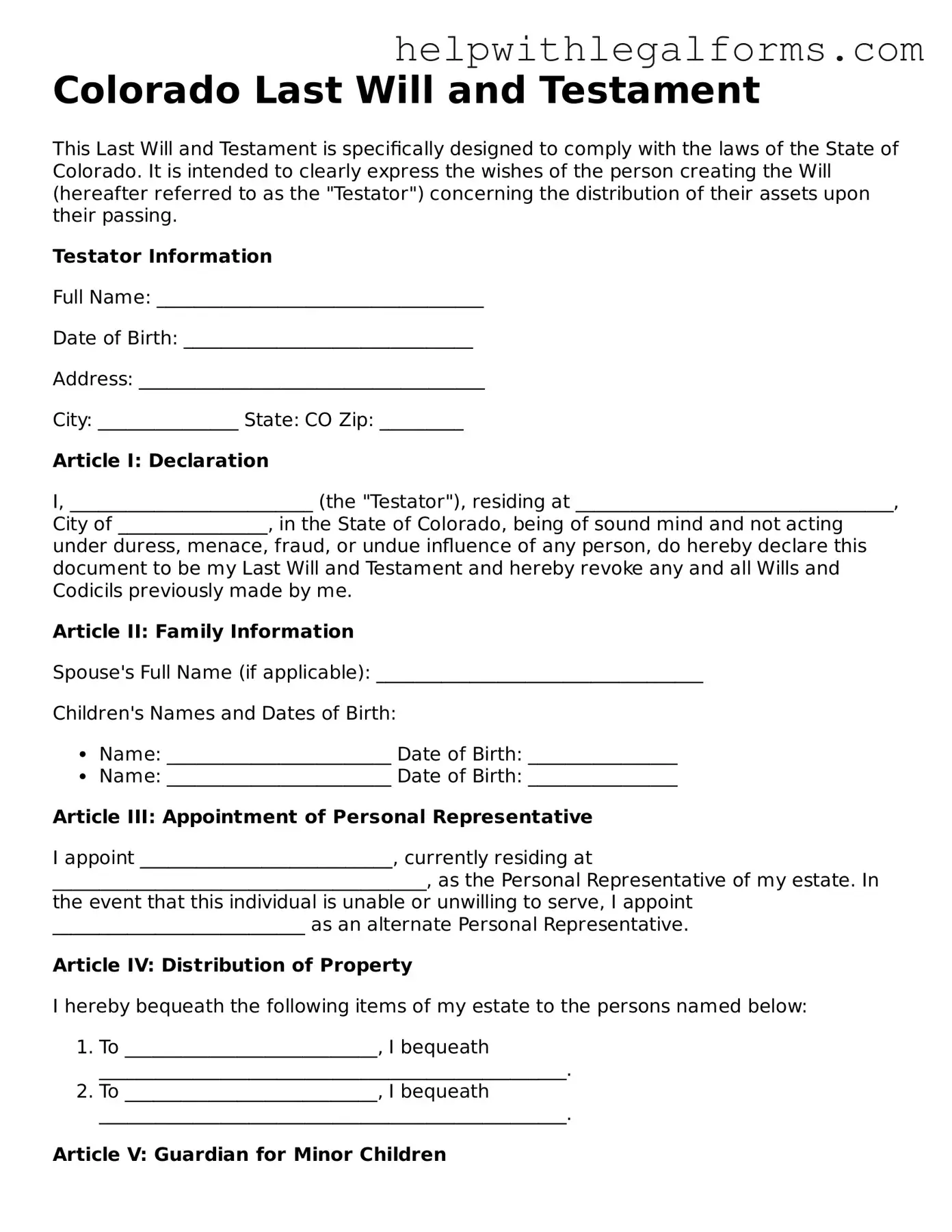

Example - Colorado Last Will and Testament Form

Colorado Last Will and Testament

This Last Will and Testament is specifically designed to comply with the laws of the State of Colorado. It is intended to clearly express the wishes of the person creating the Will (hereafter referred to as the "Testator") concerning the distribution of their assets upon their passing.

Testator Information

Full Name: ___________________________________

Date of Birth: _______________________________

Address: _____________________________________

City: _______________ State: CO Zip: _________

Article I: Declaration

I, __________________________ (the "Testator"), residing at __________________________________, City of ________________, in the State of Colorado, being of sound mind and not acting under duress, menace, fraud, or undue influence of any person, do hereby declare this document to be my Last Will and Testament and hereby revoke any and all Wills and Codicils previously made by me.

Article II: Family Information

Spouse's Full Name (if applicable): ___________________________________

Children's Names and Dates of Birth:

- Name: ________________________ Date of Birth: ________________

- Name: ________________________ Date of Birth: ________________

Article III: Appointment of Personal Representative

I appoint ___________________________, currently residing at ________________________________________, as the Personal Representative of my estate. In the event that this individual is unable or unwilling to serve, I appoint ___________________________ as an alternate Personal Representative.

Article IV: Distribution of Property

I hereby bequeath the following items of my estate to the persons named below:

- To ___________________________, I bequeath __________________________________________________.

- To ___________________________, I bequeath __________________________________________________.

Article V: Guardian for Minor Children

In the event that I am survived by minor children, I appoint ___________________________ as the guardian of said children. If this person is unable or unwilling to serve, I appoint ___________________________ as an alternate guardian.

Article VI: Signatures

This Will shall be executed on the ______ day of ____________, 20__ in the presence of two witnesses, who will not be beneficiaries of this Will. My signature below and the signatures of the witnesses affirm that this Last Will and Testament expresses my wishes without any reservation or limitation.

______________________________

Signature of the Testator

Witness #1 Name: ___________________________

Witness #1 Signature: _______________________

Address: ____________________________________

Witness #2 Name: ___________________________

Witness #2 Signature: _______________________

Address: ____________________________________

Article VII: Affirmation by Notary Public

This Last Will and Testament was acknowledged before me on this day by ___________________________, the Testator, who is personally known to me or has produced _____________________________ as identification and who did not appear to be under any duress or undue influence.

Notary Public: ___________________________

Commission Number: ______________________

Expiration Date: _________________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Legal Requirement | The Colorado Last Will and Testament must be in writing to be legally valid. |

| Age Requirement | An individual must be at least 18 years old to create a will in Colorado. |

| Witnesses | The will must be signed by at least two individuals who have witnessed the signing of the will and understand it to be the testator's will. |

| Witness Qualifications | Witnesses must be at least 18 years old and should not be beneficiaries of the will. |

| Self-proving Affidavit | A self-proving affidavit can accompany the will but is not required, making the probate process easier by verifying the will's validity without the need for witness testimony. |

| Holographic Wills | Colorado recognizes holographic wills (wills that are handwritten and signed by the testator) as valid even if they are not witnessed, provided that the material portions are in the testator’s handwriting. |

| Revocation | A will may be revoked by the creation of a new will or by physically destroying the original document with the intent to revoke. |

| Governing Laws | The making and execution of Colorado Last Wills and Testaments are governed by the Colorado Revised Statutes, Title 15, Article 11. |

Instructions on How to Fill Out Colorado Last Will and Testament

Creating a Last Will and Testament is a critical step for residents of Colorado who wish to ensure their property and assets are distributed according to their wishes after they pass away. This document allows individuals to specify how their estate should be managed and who should be responsible for carrying out their final wishes. The process can seem daunting at first, but by following a sequence of clear steps, the task becomes more straightforward. Below is a guide to help you accurately complete the Colorado Last Will and Testament form.

- Gather all necessary information, including full names and relationships of beneficiaries, details of assets, and the name of the executor.

- Start by entering your full legal name and address, establishing you as the Testator of the Will.

- Designate an executor who will manage and distribute your estate. Include their full name, relationship to you, and contact information.

- List all beneficiaries, their relationship to you, and the specific gifts or portions of your estate you wish to leave to each. Specify any conditions related to these bequests.

- If applicable, name a guardian for your minor children and an alternate guardian, providing full details and addresses for each.

- Detail any specific funeral or burial arrangements you desire, including location, ceremony type, and payment plans, if any.

- Sign and date the form in the presence of two witnesses. Ensure these witnesses are not beneficiaries of the will and that they sign and date the form as well.

- Consider having the document notarized to add an extra layer of verification, although this is not mandatory in Colorado.

Once your Colorado Last Will and Testament is fully completed, signed, and witnessed, it is recommended to store the document in a safe place where your executor can easily access it. Additionally, inform a trusted family member or friend about the location of your will. While this process may involve careful consideration and decision-making, taking these steps will provide peace of mind and clarity regarding the future of your assets and the fulfillment of your final wishes.

Crucial Points on This Form

What is a Colorado Last Will and Testament?

A Colorado Last Will and Testament is a legal document that allows a person, known as the testator, to detail how their property and assets should be distributed after their death. It also allows them to appoint guardians for any minor children and designate an executor who will manage the estate until its final distribution.

Who can create a Last Will and Testament in Colorado?

In Colorado, any person who is 18 years of age or older and of sound mind can create a Last Will and Testament. Being of "sound mind" generally means the person understands the nature of the will, knows the extent of their assets, and is aware of the people who are the natural beneficiaries of their estate.

Does a Colorado Last Will need to be notarized?

While a Colorado Last Will and Testament does not need to be notarized to be legally valid, it does need to be signed by the testator and by at least two witnesses who are not beneficiaries of the will. Notarization can, however, make the probate process smoother.

What happens if someone dies in Colorado without a Last Will?

If someone dies without a Last Will in Colorado, they are considered to have died "intestate." In such cases, Colorado’s intestacy laws come into play, and the estate is distributed according to these laws, typically to the closest relatives, starting with the spouse and children, then parents, siblings, and so on.

Can a Last Will and Testament be changed after it has been created?

Yes, a Last Will and Testament can be changed at any time before the testator’s death, as long as they are mentally competent. This is often done through a document called a codicil, which is an amendment to the will. The codicil must be executed with the same formalities as a will to be considered valid.

Is a handwritten Last Will and Testament legal in Colorado?

Yes, a handwritten will, also known as a holographic will, is legal in Colorado. It must be written entirely in the testator's handwriting, dated, and signed by the testator. However, because holographic wills can be more easily challenged in court, it is generally recommended to have a will that is typed and formally witnessed.

How does one revoke or cancel a Last Will and Testament in Colorado?

A Last Will and Testament can be revoked or cancelled by creating a new will that states it is revoking previous wills or by physically destroying the original will with the intent to revoke it (e.g., burning, tearing, or otherwise destroying the document).

What are the main components that should be included in a Colorado Last Will and Testament?

The main components include the declaration of the document as the testator’s will, the appointment of an executor, the designation of guardians for minor children, if applicable, instructions for the payment of debts and taxes, and detailed instructions on the distribution of the remainder of the estate to the named beneficiaries.

How is a Colorado Last Will and Testament executed?

To execute a Colorado Last Will and Testament, the testator must sign the document in the presence of at least two witnesses, who must also sign the will. These witnesses should be people who do not stand to inherit anything from the will. The signing process should be completed with all parties together to avoid any doubts regarding its validity.

Can digital assets be included in a Colorado Last Will and Testament?

Yes, digital assets, such as social media accounts, online banking, and cryptocurrency, can and should be included in a Colorado Last Will and Testament. It’s important to provide clear instructions on how these assets should be handled and to give the executor the necessary authority to manage them.

Common mistakes

Filling out a Last Will and Testament form is an important step in planning for the future. However, many make errors in this process, particularly when completing the Colorado Last Will and Testament form. It is crucial to avoid these common mistakes to ensure that your wishes are accurately reflected and legally binding.

- Not adhering to Colorado laws: The rules for a Last Will and Testament can vary significantly from one state to another. Colorado has specific requirements regarding how the document must be signed and witnessed. Failure to follow these could invalidate the will.

- Using unclear language: The language used in the will must be clear and unambiguous. Vague terms or instructions can lead to disputes among beneficiaries or could result in unintended interpretations by the court.

- Forgetting to appoint an executor: The executor plays a critical role in managing and distributing your estate according to your wishes. Omitting this appointment can complicate the process significantly.

- Leaving out a guardian for minor children: If you have minor children, the will should specify who you want to take care of them in your absence. Without this, the court will decide on their guardianship, which may not align with your preferences.

- Not specifying alternate beneficiaries: Life’s circumstances change, and if a beneficiary predeceases you without an alternate in place, that portion of your estate could end up in probate, delaying distribution and possibly going against your wishes.

- Failure to update: Not keeping your will updated can lead to issues, especially if your marital status, the number of your children, or your relationships with the named beneficiaries or executor have changed over time.

- Inadequate witnesses: Colorado law may require your will to be witnessed by a certain number of individuals who are not beneficiaries. Not adhering to this or having interested parties as witnesses can void the will.

- Attempting to pass along certain types of property: Certain assets, like those held in joint tenancy or named beneficiaries (e.g., life insurance, retirement accounts), pass outside of a will. Including these in a will can create confusion and potential conflict.

Avoiding these mistakes can help ensure your Colorado Last Will and Testament accurately reflects your wishes and complies with Colorado laws. It's recommended that you consult with a legal professional to guide you through this process and to confirm that all components of your will are properly executed.

Documents used along the form

The Colorado Last Will and Testament form is a crucial document for outlining how an individual’s estate should be managed and distributed after their death. To ensure that one's final wishes are honored in full, several other important legal documents should be considered. These documents can offer clarity, legal protection, and peace of mind for both the individual and their loved ones. Below is a list of documents that are often used in conjunction with the Last Will and Testament form.

- Durable Power of Attorney: This legal document enables an individual to appoint another person to make decisions on their behalf, particularly regarding financial matters, in the event that they become unable to do so themselves.

- Medical Power of Attorney: Similar to the Durable Power of Attorney, this document allows an individual to designate someone to make medical decisions for them if they become incapacitated and cannot make those decisions themselves.

- Advance Directive: Also known as a living will, this document outlines an individual's preferences regarding end-of-life care and medical interventions, providing guidance to family members and healthcare providers.

- Beneficiary Designations: Often accompanying accounts like retirement savings, life insurance policies, and bank accounts, these forms specify who will receive the assets in these accounts upon the account holder's death, bypassing the probate process.

- Funeral Instructions: Although not a legally binding document, it specifies an individual's wishes for their funeral arrangements, helping to relieve the family of decision-making burdens during a time of grief.

- Trust Documents: For those who establish a trust as part of their estate plan, these documents are critical for detailing how assets placed in the trust should be managed and distributed.

- Letter of Intent: This is a personal letter addressed to the executor or a beneficiary, providing additional information and wishes that may not be included in the will. It might include details about personal effects, social media accounts, or specific desires concerning the distribution of assets.

- Property Deeds: To ensure the smooth transfer of real estate property, current property deeds that show how the property is titled need to be accessible. These documents can indicate whether or not the property automatically transfers to a joint owner upon death.

In addition to the Last Will and Testament, the completion and secure storage of these documents are integral to a comprehensive estate plan. Preparing these documents in advance can significantly reduce uncertainty and complexity for an individual's family and heirs. It's always recommended to consult with a legal professional when preparing or updating any legal documents to ensure they are correctly executed and reflect current laws and personal wishes.

Similar forms

Living Will: Much like a Last Will and Testament, a Living Will specifies a person's wishes, focusing on healthcare directives in situations where they can't make decisions for themselves due to incapacity or severe illness. Both documents serve to communicate the wishes of the individual, though in different contexts.

Trust: Similar to a Last Will and Testament, a Trust manages the distribution of a person’s assets upon their death. However, a trust takes effect immediately after it's created and can also dictate terms for asset management and distribution during the grantor's lifetime, offering a level of control and protection not present in a Last Will and Testament.

Power of Attorney: Like a Last Will and Testament, a Power of Attorney (POA) involves assigning roles to handle one's affairs. While a Last Will becomes effective after death, a POA is active during the individual’s lifetime, allowing the appointed person to make decisions on behalf of the grantor should they become incapacitated.

Healthcare Proxy: This document appoints someone to make healthcare decisions on an individual's behalf, similar to how a Power of Attorney delegates decision-making. It's akin to a Last Will in that it specifies personal wishes regarding treatment preferences, but it's implemented while the individual is still alive under specific conditions.

Beneficiary Designations: Like a Last Will, beneficiary designations dictate who will receive assets upon the death of the account holder. These are common in life insurance policies, retirement accounts, and other financial products. It overrides the Last Will for those specific accounts, highlighting the importance of consistency in estate planning.

Guardianship Designation: Guardianship designations, often included within a Last Will, appoint a guardian for minor children or dependents in the event of the testator’s death. It shares the concept of appointing roles for the care of dependents, ensuring they are looked after according to the deceased’s wishes.

Letters of Instruction: Not legally binding, these letters provide guidance for the executor or beneficiaries, often accompanying a Last Will. They can detail wishes for funeral arrangements or explain decisions made in the Last Will, providing clarity and personal wishes that complement the formal document.

Property Deeds: Property deeds, while primarily for real estate transactions, share similarities with a Last Will when transferring property ownership. Upon the owner’s death, if the property is mentioned in the Last Will, the deed executes the transfer according to the deceased’s wishes.

Digital Asset Management Plan: This plan dictates the handling of digital assets and online identities after death. As with a Last Will, it outlines wishes for the management and distribution of digital property, ensuring online aspects of one’s estate are handled as desired.

Advance Directive: Similar to a Living Will and part of an overall estate planning strategy, an Advance Directive outlines wishes for end-of-life care. While a Last Will addresses financial assets and guardianship after death, an Advance Directive focuses on healthcare preferences in critical conditions.

Dos and Don'ts

Filling out a Last Will and Testament in Colorado requires careful consideration and an understanding of what you should and shouldn't do to ensure your final wishes are legally respected. Below are key dos and don'ts to guide you through this important process:

Do:

- Ensure the will is in writing. A typed document is preferred for clarity.

- Be at least 18 years old and of sound mind when creating your will.

- Sign your will in the presence of at least two witnesses, who are not beneficiaries, to validate it.

- Have your witnesses sign the will to confirm they observed you signing it and that you declared it to be your Last Will and Testament.

- Consider appointing an executor who will manage your estate and ensure your wishes are carried out.

- Clearly identify your beneficiaries and specify the belongings or assets each will receive.

- Include a provision for the care of any minor children, such as naming a guardian.

- Keep your will in a safe place and inform your executor or a trusted family member of its location.

- Review and update your will periodically, especially after significant life events like marriage, divorce, or the birth of a child.

- Consider consulting with a legal professional to ensure your will complies with Colorado law and fully captures your wishes.

Don't:

- Attempt to give away property that is co-owned or that has a designated beneficiary, such as life insurance proceeds.

- Sign your will without witnesses present, as it may invalidate the document.

- Choose witnesses who are beneficiaries of your will, to avoid potential conflicts of interest.

- Forget to date the will, as this can lead to challenges in probate court regarding its validity.

- Overlook the importance of naming an alternate executor in case your first choice is unable or unwilling to serve.

- Rely solely on verbal instructions or promises made outside of the will, as they are not enforceable in court.

- Fail to consider the tax implications of your bequests, which could significantly impact the value of the inheritance.

- Use vague language that could lead to misunderstandings or disputes among your heirs.

- Forget to destroy older versions of your will after updates, as this can cause confusion about your true intentions.

- Assume your will covers all aspects of estate planning, without considering other tools such as trusts or advance directives.

Misconceptions

Many people have misunderstandings about the Colorado Last Will and Testament form. It's crucial to clear up these misconceptions to ensure your final wishes are honored accurately and lawfully. Here are six common misunderstandings:

- It's unnecessary if you don't have a lot of assets. Many believe that a Last Will and Testament is only for those with substantial wealth or property. This is not true. Regardless of the size of your estate, a will ensures that your specific wishes for your assets, minor children, and any specific instructions are followed upon your death.

- Everything goes to your spouse automatically. Another common misconception is that if you pass away without a will, your entire estate will automatically be transferred to your spouse. While Colorado law provides for a significant portion of your estate to go to your spouse, the lack of a will means Colorado's intestacy laws will determine how your assets are distributed, which might not align with your wishes.

- Oral wills are just as valid. Some might think that verbally communicating their wishes to family or friends is sufficient. However, for a will to be legally binding in Colorado, it must meet specific legal standards, including being written and signed. An oral will is not considered valid under Colorado law.

- Once created, it's set in stone. Many assume that once a will has been made, it cannot be altered. This is false. You can, and should, update your will as circumstances change, such as marriage, divorce, the birth of children, or significant changes in assets.

- It covers all your assets. It's a common belief that a Last Will and Testament applies to all of your belongings. However, certain assets that have designated beneficiaries (like life insurance policies or retirement accounts) or that are owned jointly with rights of survivorship are not governed by your will.

- A Last Will can skip probate. Some people mistakenly believe that having a will means your estate won't have to go through probate. The truth is, a will often needs to be validated by the probate court, and your estate will be settled according to the will under the supervision of the court. However, certain types of trusts and other planning tools can help in avoiding or simplifying the probate process.

Understanding these misconceptions is crucial for the proper planning of your estate. Clearing up these misunderstandings can help in ensuring your wishes are fulfilled and can provide peace of mind to you and your loved ones.

Key takeaways

Creating a Last Will and Testament is an essential step in planning for the future. This document allows individuals to outline how their assets should be distributed upon their death. For residents of Colorado, understanding the specific requirements and implications of filling out a Colorado Last Will and Testament form is crucial. Here are six key takeaways to consider:

- Legal age: In Colorado, the person creating the will (known as the testator) must be at least 18 years old or be a married individual, demonstrating legal capacity to create a will.

- Witnesses: The will must be signed in the presence of at least two witnesses who are not beneficiaries of the will. These witnesses must also sign the document, affirming they observed the testator's signature.

- Writing requirement: A Colorado Last Will and Testament should be written clearly. While typed documents are more common and generally preferred for clarity and legibility, handwritten wills, also known as holographic wills, may be considered valid if the material portions and signature are in the handwriting of the testator.

- Executor specifications: The testator must appoint an executor, who will oversee the management and distribution of the estate according to the will's instructions. Choosing a trustworthy and competent executor is vital for the smooth execution of the will.

- Notarization: Although notarization is not a requirement for the will to be considered valid in Colorado, having the will notarized can speed up the probate process. A notarized will can be a self-proving will, which means the court can accept it without contacting the witnessing signatories.

- Safekeeping: Once completed, the Last Will and Testament should be stored in a safe but accessible place. Informing the executor or a trusted individual of the will's location is essential to ensure it can be found and executed upon the testator's death.

It's important for individuals to review their Last Will and Testament periodically and consider updates after significant life events, such as marriage, divorce, the birth of a child, or the acquisition of significant assets, to ensure the document remains reflective of their current wishes.

Create Other Last Will and Testament Forms for US States

Last Will and Testament Template Oklahoma - Provides a sense of peace, knowing that you have a plan in place for your possessions and loved ones.

How to Make a Will in Ct - This essential form allows you to make charitable donations from your estate, supporting causes important to you even after you're gone.