Blank Last Will and Testament Form for Connecticut

Making preparations for after we pass can be a daunting thought, but it's an essential step to ensure our wishes are honored and our loved ones are provided for. In Connecticut, a Last Will and Testament form serves as a powerful legal document that communicates your desires regarding how your estate should be distributed after your death. It empowers you to designate beneficiaries for your assets, appoint a guardian for minor children if necessary, and even specify your wishes for funeral arrangements. Understanding the specifics of this form, including the legal requirements for it to be considered valid in the state, the distinction between different types of property, and how it can be modified or revoked, is crucial. The form not only offers peace of mind but also facilitates a smoother legal and emotional process for your heirs, minimizing conflicts that could arise from a lack of clear direction. Crafting a Last Will and Testament is about taking control, providing clarity, and making a difficult time a little easier for those you care about the most.

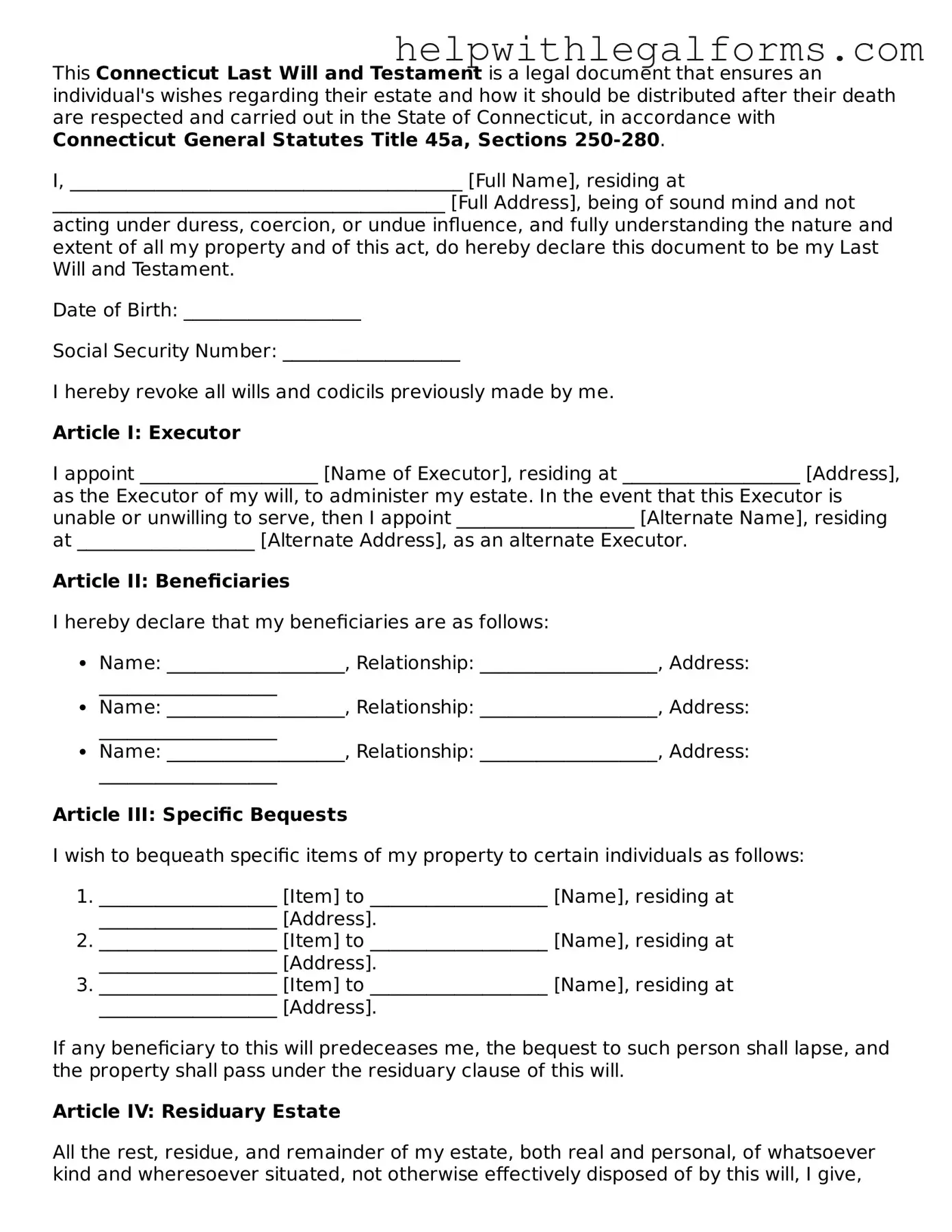

Example - Connecticut Last Will and Testament Form

This Connecticut Last Will and Testament is a legal document that ensures an individual's wishes regarding their estate and how it should be distributed after their death are respected and carried out in the State of Connecticut, in accordance with Connecticut General Statutes Title 45a, Sections 250-280.

I, __________________________________________ [Full Name], residing at __________________________________________ [Full Address], being of sound mind and not acting under duress, coercion, or undue influence, and fully understanding the nature and extent of all my property and of this act, do hereby declare this document to be my Last Will and Testament.

Date of Birth: ___________________

Social Security Number: ___________________

I hereby revoke all wills and codicils previously made by me.

Article I: Executor

I appoint ___________________ [Name of Executor], residing at ___________________ [Address], as the Executor of my will, to administer my estate. In the event that this Executor is unable or unwilling to serve, then I appoint ___________________ [Alternate Name], residing at ___________________ [Alternate Address], as an alternate Executor.

Article II: Beneficiaries

I hereby declare that my beneficiaries are as follows:

- Name: ___________________, Relationship: ___________________, Address: ___________________

- Name: ___________________, Relationship: ___________________, Address: ___________________

- Name: ___________________, Relationship: ___________________, Address: ___________________

Article III: Specific Bequests

I wish to bequeath specific items of my property to certain individuals as follows:

- ___________________ [Item] to ___________________ [Name], residing at ___________________ [Address].

- ___________________ [Item] to ___________________ [Name], residing at ___________________ [Address].

- ___________________ [Item] to ___________________ [Name], residing at ___________________ [Address].

If any beneficiary to this will predeceases me, the bequest to such person shall lapse, and the property shall pass under the residuary clause of this will.

Article IV: Residuary Estate

All the rest, residue, and remainder of my estate, both real and personal, of whatsoever kind and wheresoever situated, not otherwise effectively disposed of by this will, I give, devise, and bequeath to ___________________ [Name], residing at ___________________ [Address].

Article V: Guardian

In the event that I am the parent or legal guardian of minor children at the time of my death, I nominate ___________________ [Name], residing at ___________________ [Address], to act as the guardian of said minor children. Should ___________________ [Name] be unable or unwilling to serve, I nominate ___________________ [Alternate Name], residing at ___________________ [Alternate Address], as alternate guardian.

Article VI: Signatures

I, ___________________ [Your Name], the testator, sign my name to this will this ___ day of _____________ [Date], at ___________________ [City], ___________________ [State], in the presence of the witnesses, attesting to this will, who signed it at my request, and in my presence.

___________________ [Your Signature]

Witnessed by:

- Name: ___________________, Signature: ___________________, Date: ___________________, Address: ___________________

- Name: ___________________, Signature: ___________________, Date: ___________________, Address: ___________________

- Name: ___________________, Signature: ___________________, Date: ___________________, Address: ___________________

This Last Will and Testament was signed and declared by ___________________ [Your Name], as the testator's Last Will and Testament, in the presence of us, who in their presence, and at their request, and in the presence of each other, have hereunto subscribed our names as witnesses. We declare under penalty of perjury under the laws of the State of Connecticut that the foregoing is true and correct, and that at the time of the signing the testator appeared to us to be of sound mind and memory.

PDF Form Attributes

| Fact | Description |

|---|---|

| Governing Law | Connecticut General Statutes, Sections 45a-250 to 45a-261 govern the creation and execution of Last Will and Testaments in Connecticut. |

| Age Requirement | The individual creating a Will (Testator) must be at least 18 years old. |

| Sound Mind Requirement | The Testator must be of sound mind, understanding the making of a Will, its effects, and the nature and extent of their property. |

| Writing Requirement | The Will must be written; oral Wills are not recognized, except in very specific circumstances outlined by state law. |

| Witness Requirement | The Will must be signed in the presence of two witnesses, who also must sign the Will in the presence of the Testator and each other. |

| Self-Proving Affidavit | A self-proving affidavit is not required but is recommended as it can simplify probate by providing a sworn statement by the witnesses verifying the Will's validity. |

Instructions on How to Fill Out Connecticut Last Will and Testament

Creating a Last Will and Testament is a fundamental step in managing your affairs and ensuring your assets are distributed according to your wishes after you pass away. For residents of Connecticut, completing a Last Will and Testament form requires attentiveness to detail and understanding of what information needs to be included to make the document legally binding. The process involves naming an executor, who will manage your estate, and beneficiaries, who are the individuals or organizations you wish to inherit your assets. Additionally, if applicable, you can specify guardians for any minor children. This guide offers step-by-step instructions to help you fill out the Connecticut Last Will and Testament form accurately.

- Start by listing your full legal name and address, providing a clear indication that the document is your Last Will and Testament.

- Appoint an executor for your estate by including their full name and address. This person will be responsible for carrying out your wishes as stated in the will.

- Designate a successor executor in the event that your primary choice is unable or unwilling to serve, again including their full name and address.

- Identify all beneficiaries with their full names and addresses. Specify the relationship between you and each beneficiary.

- Clearly describe the assets each beneficiary is to receive, being as specific as possible to prevent any potential confusion.

- If you have minor children, appoint a guardian for them, including the guardian’s full name and address. Also, consider naming an alternate guardian as a precaution.

- Detail any specific funeral or burial arrangements you desire. This can include instructions about cremation, burial location, or memorial services.

- Sign the document in the presence of at least two witnesses, who must be adults and should not be beneficiaries in the will. Include the date of signing.

- Have your witnesses sign the document, include their full names, addresses, and the date they witnessed your signature.

Upon completion, store the document in a safe place and inform your executor of its location. It is also wise to consult with a legal professional to ensure your Last Will and Testament complies with Connecticut law, especially since legal requirements can vary and change over time. Remember, this document can be updated whenever significant life events, such as marriage, divorce, the birth of a child, or significant changes in assets, occur. Regular reviews of your Last Will and Testament ensure it always reflects your current wishes and circumstances.

Crucial Points on This Form

What is a Last Will and Testament in the context of Connecticut law?

In Connecticut, a Last Will and Testament is a legal document that allows an individual, known as the testator, to specify how their property and assets should be distributed upon their death. It also allows the testator to designate guardians for any minor children. The document must comply with Connecticut law to be valid, including being signed by the testator and witnessed by at least two individuals who are not beneficiaries.

How does one create a Connecticut Last Will and Testament?

To create a valid Last Will and Testament in Connecticut, the person must be at least 18 years old and of sound mind. The document must be written, signed by the testator, and witnessed by at least two individuals who are not named as beneficiaries in the will. While not required, it is advised to have the document notarized to expedite the probate process and further affirm its validity.

Are there specific types of property that cannot be distributed through a Last Will and Testament in Connecticut?

Yes, there are certain types of property that cannot be distributed through a Last Will and Testament in Connecticut. This includes property held in joint tenancy, retirement accounts, life insurance policies with designated beneficiaries, and any assets placed in a living trust. These types of property pass outside of the will directly to the designated beneficiaries or surviving co-owners.

What happens if someone dies without a Last Will and Testament in Connecticut?

If an individual dies without a Last Will and Testament in Connecticut, the state’s intestacy laws come into effect. This means the state will determine how the deceased's property is distributed. Generally, assets will go to close relatives, starting with the spouse and children. If there are no living relatives as defined by law, the estate may eventually escheat to the state.

Can a Last Will and Testament be changed after it has been created in Connecticut?

Yes, in Connecticut, a Last Will and Testament can be altered at any time before the testator's death, as long as the testator is still of sound mind. This can be done by creating a new will to replace the old one or through a supplement to the existing will, known as a codicil, which must be executed with the same formalities as the initial will.

What is the role of the executor in a Connecticut Last Will and Testament?

The executor, designated by the testator in the Last Will and Testament, is responsible for administering the estate through the probate process. This includes collecting the estate’s assets, paying debts and taxes, and distributing the remaining property as directed by the will. It is crucial to choose someone trustworthy and capable, as this role involves significant responsibility.

Is a Connecticut Last Will and Testament subject to probate?

Yes, in most cases, a Last Will and Testament in Connecticut must go through the probate process. Probate is the legal procedure through which the will is validated, and the estate is distributed according to the will’s instructions. This process can be complex and time-consuming, making it important to prepare a clear and legally compliant will to facilitate smooth probate proceedings.

Common mistakes

When it comes to preparing a Last Will and Testament, the process can seem straightforward. However, a number of common mistakes often crop up, particularly with the Connecticut Last Will and Testament form. It's important to be mindful of these errors, as they can potentially render your will invalid or lead to disputes among heirs. Here's a rundown of these common pitfalls:

Not following state-specific requirements: Each state has its own set of laws governing wills. Failing to adhere to Connecticut's specific requirements, such as the need for a certain number of witnesses, can invalidate your document.

Omitting important information: Forgetting to include critical details like the full names and relationships of heirs or the complete description of assets can lead to confusion and misinterpretation.

Using vague language: Being unclear about your intentions can lead to disputes among your beneficiaries. Clear, concise language is key to ensuring your wishes are understood and followed.

Forgetting to update the will: Life changes, such as marriages, divorces, births, and deaths, necessitate updates to your will. An outdated will may not reflect your current wishes and relationships.

Choosing an inappropriate executor: The role of the executor is crucial. Selecting someone who is not responsible or lacks the capacity to handle the role can lead to complications in executing your will.

Overlooking the appointment of a guardian: If you have minor children, failing to appoint a guardian for them is a significant oversight. Without your direction, the courts will decide who will care for your children.

Ignoring tax implications: Not considering the tax implications of your bequests can lead to a significant financial burden on your heirs. Strategic planning can minimize or avoid these taxes.

Attempting to dispose of non-probatable assets in the will: Certain assets, such as those held in joint tenancy or designated beneficiaries like life insurance or retirement accounts, pass outside of the will. Including these in your will can create confusion.

Avoiding these common mistakes requires careful planning and consideration. It's often beneficial to consult with a legal professional who specializes in estate planning to ensure that your Last Will and Testament fully captures your wishes and adheres to Connecticut law. By taking these steps, you can provide clarity and peace of mind for yourself and your loved ones.

Documents used along the form

When creating a Last Will and Testament in Connecticut, it’s often just the beginning of a comprehensive estate planning journey. To ensure that an individual's wishes are fully honored and that their assets are handled according to their desires, several other legal documents may be utilized in tandem with a Last Will and Testament. These documents can help to cover aspects of one’s wishes that a will alone cannot, offering a more complete approach to estate planning.

- Living Will – A Living Will, also known as an advance healthcare directive, outlines an individual’s preferences for medical treatment in the event they become unable to communicate these wishes themselves. This document can specify which life-sustaining treatments, if any, an individual wants if they are in a terminal condition or permanently unconscious.

- Healthcare Power of Attorney – This document designates a trusted person to make medical decisions on behalf of the individual, should they become incapacitated and unable to make these decisions on their own. This role is critical for ensuring that medical choices are in line with the individual’s values and desires.

- Durable Power of Attorney for Finances – Similar to a Healthcare Power of Attorney, this legal document appoints someone to handle financial matters for the individual, should they become unable to do so. This can include paying bills, managing investments, and safeguarding assets.

- Living Trust – A Living Trust is a legal arrangement that allows for the easy transfer of an individual’s assets to their beneficiaries upon their death, bypassing the often lengthy and costly probate process. Assets placed in a trust can be managed by the trustee for the benefit of the beneficiaries according to the terms set by the trust’s creator.

Including these documents as part of an estate plan can offer peace of mind, knowing that not only will an individual's assets be distributed according to their final wishes, but their healthcare and financial matters will also be handled according to their preferences. Each document plays a unique role in ensuring that an individual's holistic planning needs are met, providing a safety net for both them and their loved ones.

Similar forms

Living Will: Like a Last Will and Testament, a Living Will expresses personal wishes regarding medical treatment but is focused specifically on end-of-life care. Both documents communicate critical decisions in writing, though a Living Will takes effect while the individual is still alive but incapacitated.

Trust Document: Similar to a Last Will, a Trust Document is also used to manage and distribute an individual's assets. However, a Trust can be used to distribute assets before death, upon death, or afterwards, offering more flexibility and privacy since it does not go through probate.

Power of Attorney: This document grants someone else the authority to make decisions on one’s behalf, like a Last Will. However, its power is only effective during the individual's lifetime and ceases upon death, contrary to a Last Will which only comes into effect after death.

Healthcare Proxy: Similar to a Last Will, a Healthcare Proxy appoints someone to make medical decisions on one's behalf if they're unable to. Both documents ensure someone’s wishes are respected, though the Healthcare Proxy focuses solely on medical decisions during life.

Beneficiary Designations: Often found in life insurance policies or retirement accounts, beneficiary designations are like a Last Will because they specify who will receive assets after death. However, these designations bypass the will and probate process, directly transferring assets to the beneficiaries.

Advance Directive: An Advance Directive is like a Last Will and Living Will combined, detailing preferences for medical care towards the end of life. It communicates wishes about life-sustaining treatments, ensuring one’s healthcare preferences are known in advance.

Durable Power of Attorney for Finances: Similar to a Power of Attorney, this document allows someone to handle your financial affairs if you're unable to do so. Like a Last Will, it deals with financial assets, but it does so during the individual's lifetime.

Letter of Intent: A Letter of Intent for personal possessions or final wishes provides instructions for personal possessions and can complement a Last Will, detailing how specific items should be distributed. It’s informal and not legally binding but helps clarify the will’s intentions.

Guardianship Designations: Similar to a Last Will that appoints a guardian for minor children, this standalone document specifies one’s preference for a guardian, ensuring children are cared for by a trusted adult if the parents are unable to do so for any reason.

Dos and Don'ts

Filling out a Connecticut Last Will and Testament form requires careful attention to detail and compliance with state laws to ensure it is legally binding. Below are 10 critical dos and don'ts to guide you through the process.

Do thoroughly read every section of the form before filling it out to understand the requirements and implications of each provision.

Do ensure you meet the legal age and sound mind criteria set out by Connecticut law to draft a Last Will and Testament.

Do use precise language to describe your assets and how you want them distributed to avoid ambiguity.

Do designate a trusted executor who will manage your estate according to the wishes outlined in your will.

Do choose a guardian for your minor children, if applicable, to ensure they are cared for by someone you trust in the event of your passing.

Do have the form witnessed as required by Connecticut law, typically by two individuals who do not stand to inherit anything from the will.

Do regularly review and update your will to reflect any changes in your life or financial situation.

Don't try to include instructions for your funeral or burial in your will, as these details are usually decided by your family or based on your pre-arrangements before the will is read.

Don't sign the form without ensuring that all information is correct and reflects your current wishes. Mistakes or outdated information can lead to disputes among your heirs.

Don't forget to store your completed will in a safe, accessible place and inform your executor or a trusted individual of its location.

By following these guidelines, you can help make sure your Connecticut Last Will and Testament will be executed according to your wishes, providing peace of mind for you and your loved ones.

Misconceptions

Many people have misunderstandings about the Last Will and Testament, especially regarding how it's applied in Connecticut. It's crucial to dispel these misconceptions to ensure individuals are well-informed when planning their estates. Let's explore some common misconceptions about the Connecticut Last Will and Testament form:

- It must be notarized to be valid. While having a will notarized may add an extra layer of authentication, Connecticut law does not require notarization for a Last Will and Testament to be valid. It primarily needs to be signed in the presence of two witnesses.

- Oral wills are legally binding. Connecticut generally requires that wills be in writing. Oral wills, also known as nuncupative wills, are not recognized as valid, except in very rare and specific circumstances, such as being in imminent peril of death and not surviving said peril.

- All assets can be distributed through a will. Certain assets, like those held in joint tenancy, life insurance proceeds with a named beneficiary, or retirement accounts, bypass the will and go directly to the named beneficiary or surviving co-owner.

- If you die without a will, the state takes everything. This is a common misunderstanding. If someone dies intestate (without a will), state succession laws determine the distribution of assets, usually to the closest relatives. The state only inherits if there are no identifiable heirs.

- A will eliminates the need for probate. Even with a will, most estates must go through some form of probate process to validate the will and oversee the distribution of assets, though measures can be taken to streamline or bypass the process for some assets.

- My spouse will automatically inherit everything without a will. Without a will, state laws dictate the inheritance distribution. In Connecticut, if there are surviving children not of the surviving spouse, the spouse may not inherit everything.

- A will can include funeral instructions. While you can include funeral instructions in your will, it’s often not the best place for them. Wills are typically read after funeral services, so it’s advisable to communicate these wishes separately.

- Handwritten changes to a typed will are legally binding. Merely writing changes onto a will without the proper formalities (e.g., having the changes witnessed) may not legally alter the document and can lead to disputes during probate.

- I don’t need a lawyer to draft a will. While it's true that you can create a will without a lawyer, seeking legal advice ensures that your will is valid, accurately reflects your wishes, and anticipates and addresses potential legal issues.

- Once made, a will is final and unchangeable. Wills can be updated as life circumstances change. New versions can completely replace older ones, or specific changes can be made through codicils, which are amendments to your existing will.

By understanding the real facts about Last Wills and Testaments in Connecticut, you can better prepare for the future and ensure your wishes are carried out as intended.

Key takeaways

Filling out and using the Connecticut Last Will and Testament form is a significant step in planning for the future. It is essential not only for the individual drafting the document but also for their family and loved ones. Here are some key takeaways to consider when navigating this process:

- Understand the requirements: Connecticut law sets specific standards for a Last Will and Testament to be considered valid. It requires the person writing the will (testator) to be at least 18 years old and of sound mind. The will must be in writing and signed by the testator, or by another person under the testator’s direction, in the presence of two witnesses. These witnesses must also sign the will, affirming they witnessed the testator’s signing or acknowledgment of the signature or will.

- Choose an executor wisely: The executor is responsible for managing the estate according to the will’s instructions after the testator's death. The choice of an executor should be made with care, considering the person's honesty, organizational skills, and willingness to serve.

- Be explicit about your wishes: Clearly specifying how property should be distributed can prevent misunderstandings and legal challenges after the testator’s death. It is vital to provide clear direction to ensure that the testator’s wishes are followed precisely.

- Keep it in a safe place: After creating a Last Will and Testament, the original document should be kept in a secure location. This place should be accessible to the executor or trusted person who knows the will's location and can retrieve it when necessary. Additionally, it’s advisable to inform family members or beneficiaries of the will’s existence without necessarily disclosing its contents.

Adhering to these guidelines will help ensure that the Connecticut Last Will and Testament fulfills its intended purpose, thereby providing peace of mind to the testator and their loved ones.

Create Other Last Will and Testament Forms for US States

Making a Will in Colorado - Without a Last Will, state laws determine how your assets are distributed, which might not align with your wishes.

Free Will Template California - This document can also include instructions for the care of pets, safeguarding their well-being after the owner’s death.

Last Will and Testamont - It is a tool for strategic estate planning, offering a way to manage estate taxes and potentially leaving more for beneficiaries.