Blank Last Will and Testament Form for Florida

In the state of Florida, preparing for the future and ensuring that one's wishes are honored after passing is a significant consideration many people face. A Last Will and Testament form plays a crucial role in this process, allowing individuals to specify how their assets, from real estate to personal belongings, will be distributed among heirs and beneficiaries. It also provides an opportunity to appoint a trusted executor who will manage the estate in accordance with the deceased's instructions. Importantly, for those with minor children, the form can designate guardians, ensuring their care and welfare are handled by someone the individual trusts. Navigating the legal requirements in Florida for a valid Last Will and Testament, including the need for witness signatures and adherence to specific state laws, is foundational to creating a document that reflects an individual’s final wishes accurately and effectively. Understanding the major aspects of this form is a step toward securing peace of mind for both the individual and their loved ones, making it a vital component of estate planning.

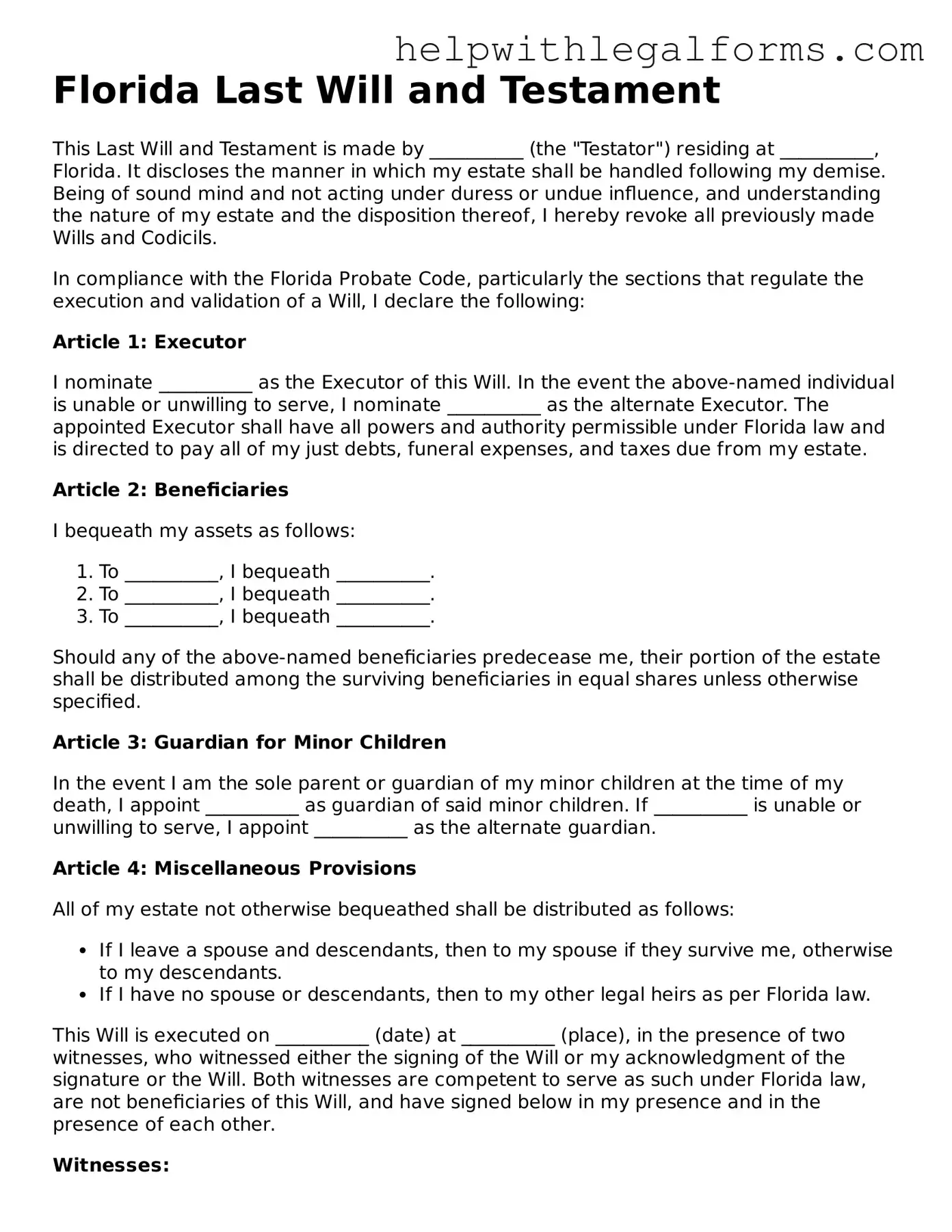

Example - Florida Last Will and Testament Form

Florida Last Will and Testament

This Last Will and Testament is made by __________ (the "Testator") residing at __________, Florida. It discloses the manner in which my estate shall be handled following my demise. Being of sound mind and not acting under duress or undue influence, and understanding the nature of my estate and the disposition thereof, I hereby revoke all previously made Wills and Codicils.

In compliance with the Florida Probate Code, particularly the sections that regulate the execution and validation of a Will, I declare the following:

Article 1: ExecutorI nominate __________ as the Executor of this Will. In the event the above-named individual is unable or unwilling to serve, I nominate __________ as the alternate Executor. The appointed Executor shall have all powers and authority permissible under Florida law and is directed to pay all of my just debts, funeral expenses, and taxes due from my estate.

Article 2: BeneficiariesI bequeath my assets as follows:

- To __________, I bequeath __________.

- To __________, I bequeath __________.

- To __________, I bequeath __________.

Should any of the above-named beneficiaries predecease me, their portion of the estate shall be distributed among the surviving beneficiaries in equal shares unless otherwise specified.

Article 3: Guardian for Minor ChildrenIn the event I am the sole parent or guardian of my minor children at the time of my death, I appoint __________ as guardian of said minor children. If __________ is unable or unwilling to serve, I appoint __________ as the alternate guardian.

Article 4: Miscellaneous ProvisionsAll of my estate not otherwise bequeathed shall be distributed as follows:

- If I leave a spouse and descendants, then to my spouse if they survive me, otherwise to my descendants.

- If I have no spouse or descendants, then to my other legal heirs as per Florida law.

This Will is executed on __________ (date) at __________ (place), in the presence of two witnesses, who witnessed either the signing of the Will or my acknowledgment of the signature or the Will. Both witnesses are competent to serve as such under Florida law, are not beneficiaries of this Will, and have signed below in my presence and in the presence of each other.

Witnesses:Witness #1

Name: __________

Address: __________

Signature: __________

Date: __________

Witness #2

Name: __________

Address: __________

Signature: __________

Date: __________

Testator:

Name: __________

Signature: __________

Date: __________

PDF Form Attributes

| Fact | Description |

|---|---|

| Governing Law | Florida Statutes, Section 732.502 |

| Witness Requirement | Two witnesses are required for the will to be considered valid in Florida. |

| Notarization | Notarization is not required for a will to be valid in Florida, but it can be beneficial to make it self-proving. |

| Age Requirement | The testator must be at least 18 years old or an emancipated minor. |

| Writing Requirement | The will must be written (typed or handwritten). |

| Self-Proving Affidavit | A self-proving affidavit can be attached to the will, making probate easier by verifying the will’s validity without witness testimony. |

Instructions on How to Fill Out Florida Last Will and Testament

When preparing a Last Will and Testament in Florida, it's essential to understand each step carefully. This document plays a crucial role in ensuring your wishes are carried out after your passing. It requires thoughtful consideration and accuracy to reflect your intentions regarding your estate, including how your assets will be distributed among beneficiaries, who will manage your estate, and, if applicable, who will take care of your minor children. Follow these outlined steps closely to complete your Florida Last Will and Testament form effectively.

- Begin by clearly printing your full legal name and current address, including the city, state, and zip code, to identify the testator.

- Appoint an executor, also known as a personal representative, by providing their full name and address. This person will be responsible for managing and distributing your estate according to your will.

- Designate an alternate executor in the event your primary executor is unable or unwilling to serve, including their full name and address.

- List the full names and addresses of all your beneficiaries, specifying the relationship to you and what you wish to leave to each one.

- If you have minor children, nominate a guardian for them, including the guardian's full name and address, to ensure they are cared for by someone you trust in your absence.

- Detail any specific bequests, such as particular items or fixed amounts of money, that you want to leave to certain individuals or organizations. Include full descriptions and beneficiary information for these items.

- Provide instructions for the distribution of your remaining estate, also known as the residue, outlining who receives what remains after specific bequests have been fulfilled.

- Specify any conditions on bequests, if applicable, to clarify when and how beneficiaries receive their inheritance.

- Include any additional wishes, such as funeral arrangements or organ donation preferences, ensuring these instructions are clear and concise.

- Review the will thoroughly to confirm that all information is accurate and reflects your wishes. Any mistakes could lead to unintended consequences.

- Sign and date the document in the presence of two witnesses, who should also sign and print their names, confirming they observed you signing the will and consider you competent to do so.

- In some cases, it's advisable to notarize the will, although this is not a requirement in Florida, it can help in the probate process.

After completing these steps, your Last Will and Testament should be ready. Remember to store it in a safe place where your executor can easily access it when needed. It's also wise to inform the executor and close family members of its location. Consulting with a legal professional can provide peace of mind, ensuring that your document is valid and aligns with your final wishes.

Crucial Points on This Form

What is a Florida Last Will and Testament?

A Florida Last Will and Testament is a legal document that allows an individual, known as the testator, to specify how their property and assets should be distributed upon their death. It outlines who will inherit the property, who will be the executor to manage the estate, and may include guardianship preferences for minor children. This document is crucial for ensuring that the testator’s wishes are respected and legally enforced in Florida.

How does one create a valid Last Will and Testament in Florida?

To create a valid Last Will and Testament in Florida, the document must adhere to specific legal requirements. The testator must be at least 18 years old or an emancipated minor and must be of sound mind at the time of drafting the will. The will needs to be written, as oral wills are generally not recognized. It must also be signed by the testator in the presence of at least two witnesses, who must also sign the document acknowledging they witnessed the testator’s signature. These steps are crucial for the will to be considered legally binding in Florida.

Can I amend my Florida Last Will and Testament after it’s been created?

Yes, amendments to a Last Will and Testament in Florida are permissible through an instrument called a codicil. The codicil must be executed with the same formalities as the original will, meaning it must be written, signed by the testator, and witnessed by at least two individuals. It's used for making minor changes or additions without the need to draft a new will. However, if significant changes are desired, creating a new will might be more appropriate.

What happens if someone dies without a Last Will and Testament in Florida?

When a person dies without a Last Will and Testament in Florida, they are said to have died "intestate." In such cases, Florida's intestacy laws come into play. These laws determine the distribution of the deceased's assets based on their familial relationships. Generally, the estate is divided among the surviving spouse, children, parents, or other relatives in a predefined order. Dying intestate can often lead to outcomes that differ significantly from the deceased's would-be wishes, underlining the importance of having a will.

Common mistakes

-

Not personalizing the document to fit their specific situation. Many people use generic forms without adding provisions that reflect their unique wishes and family dynamics. This oversight can lead to unintended consequences and disputes among heirs.

-

Failure to adequately describe assets. Sometimes, individuals do not provide enough detail about their assets, making it difficult for executors to identify and distribute them according to the will's instructions.

-

Choosing the wrong executor. The importance of selecting a trustworthy and competent executor cannot be overstated, yet many people appoint someone based on personal relationships alone, without considering if they have the organizational skills and temperament to handle the task.

-

Not updating the will. Life changes such as marriage, divorce, the birth of a child, or the acquisition of significant assets warrant updates to a Last Will and Testament. Neglecting to make these updates can result in a will that does not accurately reflect the testator's final wishes.

-

Overlooking the need for witnesses. In Florida, a will must be signed in the presence of two witnesses, who also must sign the will. Forgetting this crucial step can invalidate the entire document.

-

Assuming a will covers all assets. Certain assets, like those held in joint tenancy or designated with a beneficiary (like life insurance policies), pass outside of a will. Some people mistakenly believe their will has authority over these assets too, which can lead to confusion and incorrect assumptions about asset distribution.

-

Ignoring legal requirements specific to Florida. Each state has its own laws regarding wills, including Florida. People often make the mistake of using forms or templates that do not comply with Florida's specific legal requirements, potentially rendering the will invalid.

Documents used along the form

When preparing a Last Will and Testament in Florida, it's important to understand that various other documents might be needed to fully ensure your wishes are honored and your estate is managed according to your desires after you pass away. Each document serves its own unique purpose and contributes to a comprehensive estate plan. Below are nine critical documents people often use alongside their Florida Last Will and Testament.

- Durable Power of Attorney: This document grants someone you trust the authority to manage your financial affairs in case you become incapacitated and cannot make decisions yourself.

- Health Care Surrogate Designation: It lets you appoint a person to make healthcare decisions on your behalf if you are unable to do so.

- Living Will: This outlines your wishes for medical treatment if you become terminally ill or permanently unconscious and cannot communicate your health care choices.

- Revocable Living Trust: A tool that helps manage your assets while you're alive and distribute them after your death, often without the need for probate.

- Designation of Preneed Guardian: In this document, you can name a guardian for yourself in the event of incapacitation and for your minor children, should you become unable to care for them.

- HIPAA Authorization Form: This form allows designated individuals to access your medical records, making it easier for them to make informed health decisions on your behalf if necessary.

- Declaration of Preneed Guardian for Minor Children: Similar to the designation of preneed guardian, this specifies a guardian for your minor children in the event of your death or incapacitation.

- Tangible Personal Property List: This supplemental document to your will specifies who will receive specific items of personal property.

- Funeral Planning Declaration: While not legally binding in all states, this document outlines your wishes for your funeral arrangements, helping relieve your family of the burden of making these decisions during a difficult time.

Even though the Last Will and Testament is a pivotal document in estate planning, these additional forms and documents can provide clearer direction, ensure your healthcare wishes are followed, protect your financial interests, and simplify the management of your estate for your beneficiaries. It is always a good decision to consult with a legal professional when preparing your estate plan to make sure all documents are correctly filled out and legally binding.

Similar forms

Living Will: A Living Will, similar to a Last Will and Testament, is a legal document that outlines a person's wishes regarding medical care in the event they become unable to communicate those wishes themselves. While a Last Will dictates what happens after death, a Living Will applies while the individual is still alive but incapacitated.

Power of Attorney: This document grants someone else the authority to make decisions on your behalf, often covering financial and legal matters. Like a Last Will and Testament, it's essential for managing your affairs when you cannot do so yourself, but it's effective during your lifetime, not after your death.

Trust: A Trust is an estate planning tool that, like a Last Will and Testament, dictates how your assets will be distributed upon your death. However, a Trust has the advantage of avoiding probate—the legal process through which a Will is reviewed—allowing for a potentially smoother, more private transfer of assets.

Beneficiary Designations: These are specific instructions within financial accounts or insurance policies that outline who will receive the assets upon your death. Similar to a Last Will, beneficiary designations ensure your assets are distributed to your chosen individuals, but they trump what's stated in a Will when discrepancies occur.

Healthcare Proxy (or Healthcare Power of Attorney): This appoints someone to make medical decisions on your behalf if you're incapable. Although it shares the proactive planning aspect of a Last Will, its focus is on healthcare choices rather than asset distribution.

Advance Directive: Combining elements of a Living Will and a Healthcare Proxy, an Advance Directive sets out your wishes for medical treatment and appoints someone to speak for you. It's like a Last Will in its anticipatory nature, preparing for a time when you can't make your own decisions.

Digital Asset Will: This newer type of document dictates what should happen to your digital assets (such as social media accounts, online bank accounts, etc.) after your death. It parallels a Last Will by ensuring your digital legacy is handled according to your wishes.

Letter of Intent: This document provides informal guidance to your executor or a beneficiary about personal wishes that might not be strictly legal demands, such as funeral arrangements or personal messages to loved ones. While not legally binding like a Last Will, it can accompany one to give more personalized instructions.

Dos and Don'ts

When filling out the Florida Last Will and Testament form, it's essential to pay attention to the details to ensure your final wishes are clearly understood and legally binding. Here are 10 guidelines to help you navigate the process smoothly:

Do:

- Ensure that you meet the legal age requirement, which is 18 years or older, or an emancipated minor.

- Use clear and precise language to avoid any ambiguity regarding your wishes.

- Have the document witnessed by two individuals who are not beneficiaries in the will to avoid conflicts of interest.

- Make sure witnesses are present at the same time to observe you signing the will and each other signing as witnesses.

- Review and update your will regularly, especially after significant life events such as marriage, divorce, the birth of a child, or the acquisition of substantial assets.

Don't:

- Attempt to make oral amendments to your will; all changes should be made in writing and with the same formalities as the original will.

- Forget to date the document, as the most recent date is crucial if there are multiple versions of your will.

- Include instructions for your funeral or final arrangements, as the will may not be read until after these services have taken place. It's better to communicate these wishes separately.

- Sign the will without the required number of competent witnesses, which could invalidate the document.

- Assume that your will is enough to cover all aspects of your estate plan. Consider having a lawyer review your entire estate plan, including trusts, life insurance, and joint property arrangements.

Misconceptions

When it comes to creating a Last Will and Testament in Florida, there are several misconceptions that can lead to confusion and potential mistakes. Understanding these misconceptions is crucial for ensuring your final wishes are legally recognized and carried out in accordance with your intentions.

Only the Wealthy Need a Will: A common misconception is that Last Wills are only for those with significant assets. In reality, a will is vital for anyone wanting to dictate how their assets, regardless of size, are distributed upon their death. It's also crucial for appointing guardians for minor children.

A Will Avoids Probate: Many believe that having a will means avoiding the probate process. This is not true in Florida. A will does not bypass probate; it guides the probate court on how to distribute your assets. Some assets, however, can avoid probate through beneficiary designations.

Oral Wills are Recognized in Florida: Florida law does not recognize oral wills. For a Last Will and Testament to be legally valid in Florida, it must be written, signed by the testator, and witnessed by at least two individuals who must also sign the document in the presence of the testator and each other.

You Can Disinherit Your Spouse Completely: Many people believe they can completely disinherit their spouse through their will. However, in Florida, a spouse is entitled to a portion of the estate under the elective share statute, regardless of what the will says, unless there is a valid prenuptial or postnuptial agreement in place.

Online Templates Are Just as Good as Professional Advice: While online templates can provide a basic framework, they often cannot account for individual circumstances or comply with all specifics of Florida law. Tailoring your will to your unique situation and ensuring its legality often requires professional legal advice.

Navigating the complexities of estate planning and the legalities of a Last Will and Testament in Florida underscores the importance of accurate information and professional guidance. Dispelling these misconceptions is the first step towards creating a will that effectively communicates your wishes and secures your legacy.

Key takeaways

The Florida Last Will and Testament form is a crucial document for anyone looking to ensure their wishes are honored after they pass away. It allows an individual, known as the testator, to specify how they want their assets distributed and who should manage this process. Here are key takeaways to understand when filling out and using this form:

- Legal Requirements: Florida law has specific requirements for a will to be considered valid. The testator must be at least 18 years old or an emancipated minor. The will must be written, signed by the testator and by at least two witnesses who observed the testator signing.

- Choose an Executor Wisely: The person you name as your executor will manage your estate, following the wishes you’ve documented in your will. Select someone who is responsible and capable of handling financial matters effectively.

- Guardianship: If you have minor children, you can use your will to nominate a guardian for them. This is an important step to ensure they are cared for by someone you trust, should the worst happen.

- Be Specific About Bequests: Clearly describe which assets go to which beneficiaries. Vagueness can lead to disputes among your heirs, potentially leading to lengthy and costly legal battles.

- Update Regularly: Life changes—marriages, divorces, births, and deaths can all affect your original intentions for your estate. Review and update your will as needed to reflect your current wishes.

- Witnesses: Florida law requires your will to be signed in the presence of two witnesses, who also need to sign the will in the presence of each other and the testator. This is critical for the will to be legally binding.

- Notarization Is Not Required: While notarization is not a legal requirement for wills in Florida, it can be beneficial. A notarized will can be a "self-proving" will, making the probate process smoother and simpler.

- Avoiding Probate: Some assets can be set up to pass directly to beneficiaries outside of the will, potentially avoiding probate. Consider designations like transfer-on-death accounts or joint tenancy arrangements for assets you wish to pass outside of your will.

Creating a Last Will and Testament is a foundational step in planning for the future. It ensures your assets are distributed according to your wishes and can provide peace of mind for both you and your loved ones. Bear in mind, the laws can change, so it might be wise to consult with a legal professional when preparing your will to ensure it complies with the latest Florida laws and best practices.

Create Other Last Will and Testament Forms for US States

How to Make a Will in Ct - For business owners, it's crucial for planning the succession and continued operation of their business, ensuring a smooth transition.

Online Will Georgia - This document is indispensable for those wanting to control their estate's destiny beyond their death.

Last Will and Testamont - A well-prepared will is crucial for individuals with complex financial or familial situations to ensure their estate is handled as desired.

Last Will and Testament Template Oklahoma - A crucial document for estate planning, ensuring that your assets are protected and passed on as intended.