Blank Last Will and Testament Form for Georgia

In the state of Georgia, the Last Will and Testament form is a crucial document that protects the final wishes of an individual regarding the distribution of their estate. This legal instrument ensures that a person's assets are allocated according to their preferences after passing away, minimizing disputes among surviving relatives and friends. It allows the testator, the person creating the will, to appoint an executor who will manage the estate's distribution and handle various responsibilities, including paying off debts and distributing the remainder of the estate to the chosen beneficiaries. Georgia law requires the Last Will to adhere to specific legal standards, including the testator's legal capacity, the presence of witnesses, and the document's proper execution, to be considered valid. This form offers peace of mind to the person creating it, knowing that their wishes will be honored and that their loved ones will be taken care of according to their directives. The importance of this document cannot be understated, as it not only provides clear instructions for the handling of one's affairs but also protects the rights and inheritances of the designated beneficiaries, ensuring that the testator's legacy is preserved and respected.

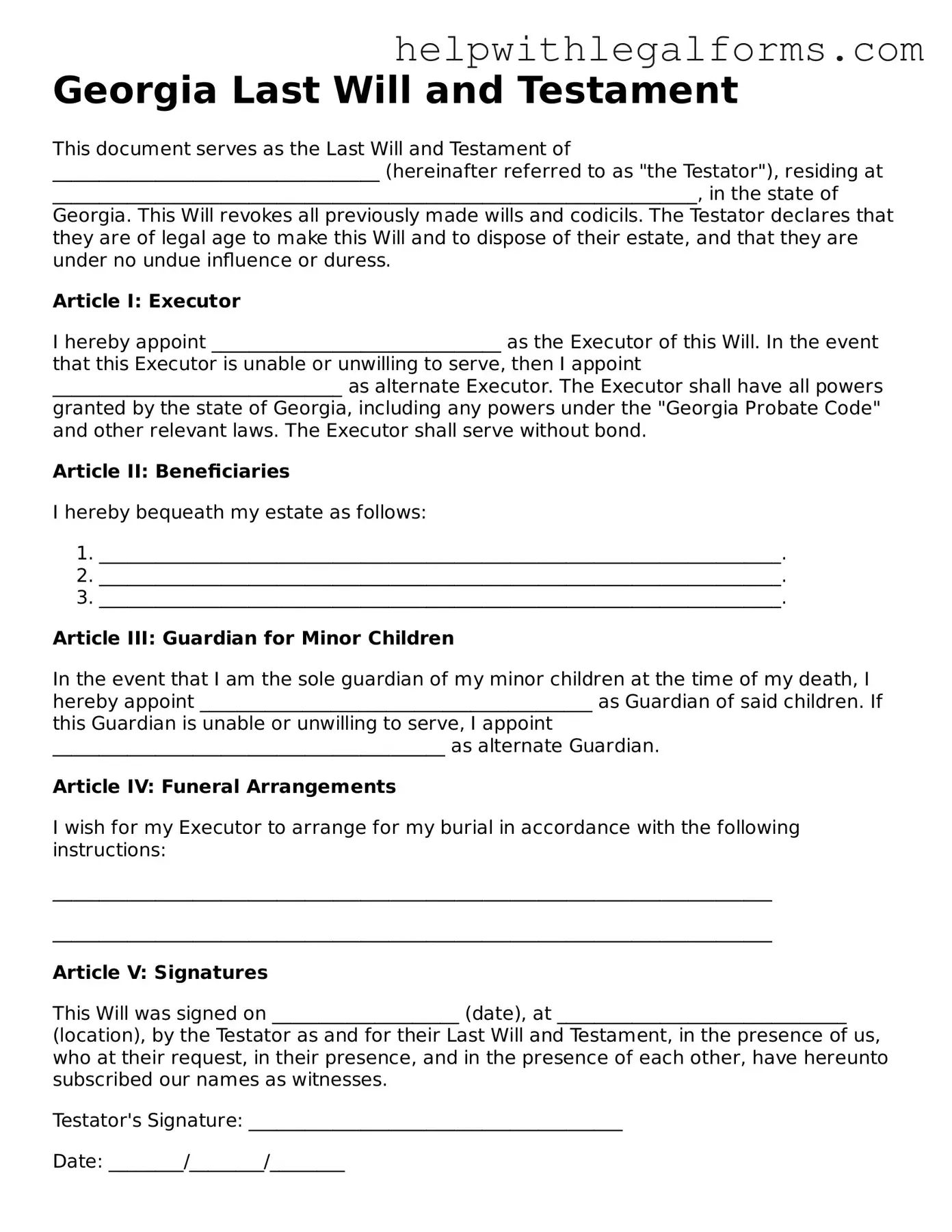

Example - Georgia Last Will and Testament Form

Georgia Last Will and Testament

This document serves as the Last Will and Testament of ___________________________________ (hereinafter referred to as "the Testator"), residing at _____________________________________________________________________, in the state of Georgia. This Will revokes all previously made wills and codicils. The Testator declares that they are of legal age to make this Will and to dispose of their estate, and that they are under no undue influence or duress.

Article I: Executor

I hereby appoint _______________________________ as the Executor of this Will. In the event that this Executor is unable or unwilling to serve, then I appoint _______________________________ as alternate Executor. The Executor shall have all powers granted by the state of Georgia, including any powers under the "Georgia Probate Code" and other relevant laws. The Executor shall serve without bond.

Article II: Beneficiaries

I hereby bequeath my estate as follows:

- _________________________________________________________________________.

- _________________________________________________________________________.

- _________________________________________________________________________.

Article III: Guardian for Minor Children

In the event that I am the sole guardian of my minor children at the time of my death, I hereby appoint __________________________________________ as Guardian of said children. If this Guardian is unable or unwilling to serve, I appoint __________________________________________ as alternate Guardian.

Article IV: Funeral Arrangements

I wish for my Executor to arrange for my burial in accordance with the following instructions:

_____________________________________________________________________________

_____________________________________________________________________________

Article V: Signatures

This Will was signed on ____________________ (date), at _______________________________ (location), by the Testator as and for their Last Will and Testament, in the presence of us, who at their request, in their presence, and in the presence of each other, have hereunto subscribed our names as witnesses.

Testator's Signature: ________________________________________

Date: ________/________/________

Witness #1:

Name: ________________________________________

Address: ______________________________________

Signature: ____________________________________

Date: ________/________/________

Witness #2:

Name: ________________________________________

Address: ______________________________________

Signature: ____________________________________

Date: ________/________/________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Governing Law | Georgia Probate Code - O.C.G.A. Title 53 |

| Age Requirement | The testator must be at least 14 years old |

| Witness Requirement | Must be signed by at least two witnesses who are not beneficiaries |

| Writing Requirement | Must be in writing to be considered valid |

Instructions on How to Fill Out Georgia Last Will and Testament

Filling out a Last Will and Testament form in Georgia is a careful process that enables an individual to specify how their assets and estate should be managed and distributed after their passing. It's vital to approach this task thoughtfully to ensure that your wishes are clearly expressed and legally binding. The procedure involves several steps, from identifying assets to appointing an executor who will manage the estate in line with your directives. Understanding and following these steps correctly can provide peace of mind for both you and your loved ones, ensuring that your final wishes are respected and implemented accordingly.

- Personal Information: Start by entering your full legal name and complete address, including the county in which you reside. Confirm that you are of sound mind and legal age to create a Will, and declare the document as your Last Will and Testament.

- Appointment of Executor: Designate an individual, known as the executor, who will be responsible for managing and distributing your estate according to your Will. Include the executor's full name and address. Consider naming an alternate executor to serve if the primary executor is unable or unwilling to serve.

- Appointment of Guardian: If you have minor children, appoint a guardian to take care of them. Include the guardian's full name and address. An alternate guardian should also be named should the primary guardian be unable to serve.

- Disposition of Property: Clearly describe how your assets and property should be distributed. This can include real estate, bank accounts, securities, and personal property. Specify which beneficiaries receive specific assets, using their full names and relationships to you.

- Special Instructions: If you have particular wishes about how your estate should be managed or have specific funeral arrangements, include those instructions in this section.

- Signatures: After reviewing the Will to ensure all information is accurate and reflects your wishes, sign the document in the presence of two witnesses. These witnesses must be of legal age and should not be beneficiaries of the Will. They must also provide their full names, addresses, and signatures.

- Notarization: Although not required in Georgia, having your Will notarized can add an extra layer of validity. If you choose to notarize the Will, do so in the presence of a notary public. The notary will fill out, date, and affix their seal to the document, confirming that you and the witnesses have signed it in their presence.

Completing a Last Will and Testament is an important step in managing your estate and ensuring that your assets are distributed according to your wishes. It's recommended to consult with a legal professional to help guide you through the process and address any state-specific requirements or legal considerations. Taking the time to create a well-thought-out Will can prevent potential disputes among surviving relatives and provide clear directions for the handling of your affairs.

Crucial Points on This Form

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and responsibilities are to be handled after their death. In Georgia, it allows you to specify beneficiaries for your possessions, appoint an executor to manage your estate, and can include guardianship wishes for any minor children.

How does one create a Last Will and Testament in Georgia?

To create a valid Will in Georgia, the person making the will (testator) must be at least 14 years old. The Will must be in writing, signed by the testator, and witnessed by at least two individuals, who must also sign the Will in the presence of the testator.

Are there specific requirements for witnesses in Georgia?

Yes, in Georgia, witnesses to a Will must be at least 14 years old. They should not be beneficiaries of the Will to avoid conflicts of interest. Witnesses must also be competent to testify in court should the Will be contested.

Can I change my Will after creating it?

Yes, you can change your Will at any time. Changes can be made through a new will or through a supplement called a codicil, which must be executed with the same formalities as a Will. It's recommended to review and possibly update your Will after major life events such as marriage, divorce, the birth of a child, or significant changes in financial status.

What happens if I die without a Will in Georgia?

If you die without a Will in Georgia, your assets will be distributed according to state "intestacy" laws. Typically, this means your assets will go to your closest relatives, starting with your spouse and children. If you don't have a spouse or children, your assets might go to other relatives like parents, siblings, or grandparents. This distribution might not align with your wishes, which is why having a Will is important.

Does a Last Will and Testament cover all types of property?

A Will can cover most types of property, but there are exceptions. Items not covered may include property held in joint tenancy, life insurance proceeds with a named beneficiary, retirement accounts with designated beneficiaries, and any assets placed in a living trust.

Is a handwritten Will valid in Georgia?

Yes, a handwritten Will, also known as a holographic Will, can be valid in Georgia as long as it meets the state's legal requirements. However, without the formal witnessing process, proving its validity in court may be more challenging.

Can I appoint a guardian for my children in my Will?

Yes, in Georgia, you can appoint a guardian for your minor children in your Will. This decision will be taken into account by the court, assuming the chosen guardian is available and suitable to serve, and it meets the best interests of the children.

How should I store my Last Will and Testament?

Your Will should be stored in a safe, secure location that is accessible to your executor or a trusted individual. Consider telling your executor or a close family member where the Will is stored. Avoid safety deposit boxes that may require court intervention to access after your death.

Common mistakes

When preparing a Last Will and Testament in Georgia, many people make errors that can lead to complications or the will being deemed invalid. Below are nine common mistakes individuals often make during this serious and detailed process.

Not adhering to Georgia's legal requirements: The state of Georgia has specific legal requirements for a will to be considered valid. These include the necessity for the testator (the person making the will) to be at least 14 years old, the will being in writing, and the presence of at least two witnesses during the signing. Overlooking any of these stipulations can render the will invalid.

Failing to name an executor: An executor is responsible for carrying out the terms of the will. Not naming one, or choosing someone without the capability or willingness to take on this responsibility, can lead to delays and challenges in the estate administration process.

Not updating the will after major life events: Life changes such as marriage, divorce, the birth of a child, or the death of a beneficiary or the executor necessitate updates to a will. Failure to do so may mean the will does not accurately reflect the testator's final wishes.

Leaving out important details about beneficiaries: Simply naming beneficiaries without specifying their full names and relationships can lead to confusion and misinterpretation of the testator's intentions.

Ignoring the assignment of a guardian for minor children: If the will does not appoint a guardian for minor children, the decision will fall to the court, which may not align with the deceased's wishes.

Neglecting to specify bequests clearly: Vague or incomplete instructions regarding the distribution of specific assets can lead to disputes among beneficiaries.

Assuming all assets are covered by the will: Certain assets, like those held in joint tenancy or designated with a beneficiary (such as life insurance policies), pass outside the will. Misunderstanding which assets are governed by the will can result in unintended exclusions or distributions.

Not considering the impact of taxes and debts: Failing to account for the decedent's debts and potential estate taxes can significantly affect the distribution of assets, leaving beneficiaries with less than intended.

Choosing witnesses improperly: Witnesses to a will must be disinterested, meaning they should not stand to benefit from it. Using interested parties as witnesses can lead to the will's contestation and invalidation.

By avoiding these common mistakes, individuals creating a Last Will and Testament in Georgia can ensure that their final wishes are respected and executed according to plan, providing peace of mind to themselves and their loved ones.

Documents used along the form

Creating a Last Will and Testament is a fundamental step in planning one's estate in Georgia. However, to ensure a comprehensive approach to estate planning, several other documents are often prepared in conjunction with this form. These supporting documents can help clarify wishes regarding health care, manage financial assets, and ensure that personal matters are handled according to the individual's preferences.

- Advanced Directive for Health Care - This document combines a living will and a health care power of attorney. It allows an individual to specify their preferences for medical treatment if they become unable to make decisions for themselves and to appoint someone to make health care decisions on their behalf.

- Financial Power of Attorney - Through this legal form, an individual can appoint another person, known as an agent, to handle financial affairs on their behalf. This can include paying bills, managing investments, and conducting other financial transactions, which can be particularly useful in case of incapacitation.

- Revocable Living Trust - A living trust provides a way to manage one's assets during their lifetime and distribute them after death, often without the need for probate. The creator of the trust retains control over the assets placed within it and can alter or revoke the trust at any time before death.

- Funeral and Burial Instructions - Although not always a formal legal document, providing instructions for one's funeral and burial wishes can be an essential aspect of end-of-life planning. This written document can specify preferences for funeral arrangements, cremation, burial, and memorials, helping to alleviate the burden on family members during a difficult time.

- Asset Inventory - While not a legal document per se, creating a detailed list of assets, including bank accounts, real estate, personal property, and online accounts, can be invaluable. It aids executors and family members in comprehensively understanding the estate, facilitating smoother administration and distribution of assets.

While the Last Will and Testament is pivotal for expressing final wishes and distributing assets upon death, incorporating these additional documents into one's estate plan can provide a more detailed roadmap for loved ones. It ensures personal and financial matters are handled thoughtfully and according to the individual's wishes, reducing uncertainties and potential conflicts during challenging times.

Similar forms

Living Will: Similar to a Last Will and Testament, a Living Will specifies an individual's wishes, but these pertain to their healthcare decisions in the event they are unable to communicate these wishes themselves. Both documents serve as a means to guide decisions when the individual cannot do so.

Trust: Much like a Last Will and Testament, a Trust details what will happen to an individual’s assets, but it allows for the bypassing of the probate process. Both serve the purpose of asset distribution, but they operate differently in legal terms and timing.

Power of Attorney: This document appoints someone to make decisions on the signer's behalf, similar to how an executor is named in a Last Will and Testament. However, the Power of Attorney is active during the individual's lifetime, whereas the Last Will takes effect upon death.

Advance Health Care Directive: Similar to both a Living Will and Last Will in that it specifies the individual’s wishes regarding medical treatment and care, an Advance Health Care Directive can also designate someone to make health-related decisions on their behalf.

Beneficiary Designations: These designations dictate who will receive specific assets, such as life insurance or retirement accounts, bypassing a Last Will and Testament. Both types of documents control asset distribution but through different mechanisms.

Financial Inventory: While not a directive, a Financial Inventory complements a Last Will and Testament by providing a detailed list of the individual's assets and liabilities. This document aids executors and beneficiaries by mapping out the estate’s contents.

Funeral Instructions: These instructions outline the deceased’s wishes for their funeral and are similar to a Last Will in that they guide decisions after the individual's death. Though not legally binding in some states, they are often respected by survivors.

Property Agreement: A Property Agreement, especially relevant in the case of co-owned assets, outlines how property is shared or divided. It is similar to a Last Will and Testament in managing assets, but focuses on co-ownership dynamics.

Guardianship Designation: This document names a guardian for minor children, a function that is often included within a Last Will and Testament. Both address the care and responsibility for minors in the event of the parent’s inability to do so.

Letter of Intent: A Letter of Intent for property or educational purposes outlines the writer's wishes and intentions. While not legally binding, it is similar to a Last Will in that it helps guide the decisions and actions of others based on the specified intentions.

Dos and Don'ts

Filling out a Last Will and Testament form in Georgia is a crucial step in ensuring your wishes are honored. Here are 10 important dos and don'ts to consider:

- Do thoroughly review the requirements specific to Georgia before starting. This ensures your will complies with state laws.

- Do include clear identification of yourself, demonstrating that the will belongs to you and reflects your wishes.

- Do appoint a trustworthy executor. This person will manage your estate and ensure your will is executed as intended.

- Do choose a guardian for your minor children, if applicable, to ensure they are cared for by someone you trust.

- Do list your assets and to whom they should be distributed clearly to avoid any confusion or disputes among beneficiaries.

- Do consider adding a residuary clause. This addresses any assets not specifically mentioned in your will.

- Do not forget to sign and date the will in the presence of at least two witnesses. Georgia law requires this for the will to be valid.

- Do not overlook the need for your witnesses to sign the will. Their signatures confirm they observed your signing and acknowledged the document as your will.

- Do not attempt to make changes to the will by simply crossing out sections and handwriting in the margins. Such alterations may not be legally valid.

- Do not assume verbal agreements or promises will be recognized. Only the stipulations in the signed will are legally enforceable.

Misconceptions

Many people have misconceptions about the Last Will and Testament form, especially in Georgia. It's crucial to understand the facts to ensure that one's final wishes are properly carried out. Here are seven common myths and the realities that debunk them:

Myth 1: You don't need a will if you don't have a lot of assets.

Despite the size of your estate, having a will ensures that your assets are distributed according to your wishes, not the state's default laws.Myth 2: Your debts die with you.

In reality, your debts are settled by your estate after your death. If there are insufficient assets to cover debts, they may not all be paid off, but the responsibility does not pass to your family unless they co-signed or are otherwise legally responsible.Myth 3: All your assets are covered by your will.

Some assets, like those in joint tenancy, retirement accounts, and life insurance policies, typically pass to the named beneficiaries outside of the will.Myth 4: Wills prevent probate.

Wills do not avoid probate; they guide the probate process. Some assets might bypass probate through proper titling or if they have designated beneficiaries.Myth 5: Wills are only for the elderly.

Anyone 18 or older can and, in many cases, should have a will, especially if they have assets, are married, or have children.Myth 6: A handwritten will is not valid in Georgia.

Georgia recognizes handwritten (holographic) wills as long as they meet specific legal requirements, though it's always safer to have a will that's typed and formally witnessed.Myth 7: You only need to write a will once.

Lives change — marriages, divorces, births, and asset changes are just a few reasons you should regularly review and possibly update your will.

Understanding these myths and realities can help ensure that your estate planning measures up to your intentions and provides for your loved ones as you intend. It's always a good idea to consult with a legal professional to make sure your will meets all legal requirements in Georgia and accurately reflects your wishes.

Key takeaways

Filling out and using the Georgia Last Will and Testament form is a crucial step in ensuring your wishes are honored after your passing. Understanding the key points of this process can make it smoother and more effective. Here are some important takeaways:

- Follow Georgia laws: For a Last Will and Testament to be valid in Georgia, it must comply with the state's laws. This typically means the person making the will (testator) must be at least 14 years old and of sound mind, the document must be in writing, and it must be signed by the testator and witnessed by at least two individuals who are not beneficiaries.

- Be specific about your wishes: Clearly outline how you want your assets distributed among your beneficiaries. The more detailed and precise you can be, the less room there is for interpretation or disputes among those left behind.

- Choose an executor wisely: The executor of your will is responsible for managing your estate and ensuring your wishes are carried out as specified. Choose someone who is responsible, trustworthy, and capable of handling the duties required.

- Regular updates are crucial: Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets should prompt a review and, if necessary, an update of your Last Will and Testament. This ensures the document remains an accurate reflection of your wishes over time.

Create Other Last Will and Testament Forms for US States

Nj Living Will - Gives you control over the disposition of your assets, avoiding default state inheritance laws.

Free Will Template California - The form serves as a legal protection for the decedent's wishes, ensuring assets are distributed and dependents are cared for as intended.

How to Make a Will in Ct - It can include instructions for the management of ongoing financial matters, such as investments, until the estate is settled.

Last Will and Testamont - By detailing asset distribution, it can prevent the selling of family heirlooms or significant properties to divide the estate.