Blank Last Will and Testament Form for Maryland

In Maryland, just as in other states, the Last Will and Testament form is a crucial document for anyone looking to ensure their property and assets are distributed according to their wishes after their passing. This legally binding document not only facilitates the distribution of assets among beneficiaries but also can specify guardians for minor children, make arrangements for pets, and even dictate funeral arrangements. The importance of this document cannot be overstated, as it provides peace of mind to the individual creating the will, known as the testator, and helps prevent potential disputes among surviving family members. Maryland's specific legal requirements mandate that the testator is of sound mind and legal age and that the will is written, signed, and witnessed in a particular manner to be considered valid. Understanding these aspects is essential for anyone in Maryland planning their estate or involved in estate planning processes.

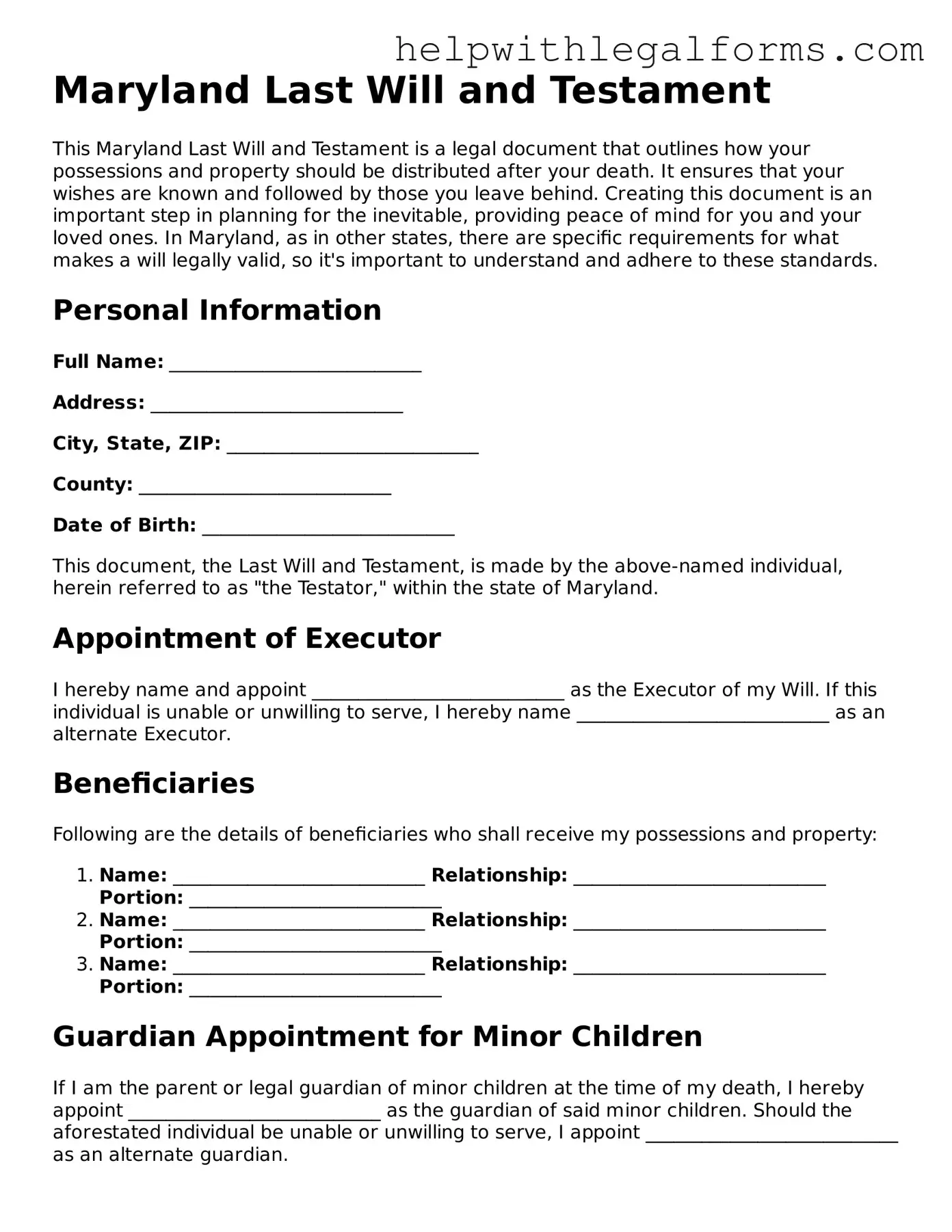

Example - Maryland Last Will and Testament Form

Maryland Last Will and Testament

This Maryland Last Will and Testament is a legal document that outlines how your possessions and property should be distributed after your death. It ensures that your wishes are known and followed by those you leave behind. Creating this document is an important step in planning for the inevitable, providing peace of mind for you and your loved ones. In Maryland, as in other states, there are specific requirements for what makes a will legally valid, so it's important to understand and adhere to these standards.

Personal Information

Full Name: ___________________________

Address: ___________________________

City, State, ZIP: ___________________________

County: ___________________________

Date of Birth: ___________________________

This document, the Last Will and Testament, is made by the above-named individual, herein referred to as "the Testator," within the state of Maryland.

Appointment of Executor

I hereby name and appoint ___________________________ as the Executor of my Will. If this individual is unable or unwilling to serve, I hereby name ___________________________ as an alternate Executor.

Beneficiaries

Following are the details of beneficiaries who shall receive my possessions and property:

- Name: ___________________________ Relationship: ___________________________ Portion: ___________________________

- Name: ___________________________ Relationship: ___________________________ Portion: ___________________________

- Name: ___________________________ Relationship: ___________________________ Portion: ___________________________

Guardian Appointment for Minor Children

If I am the parent or legal guardian of minor children at the time of my death, I hereby appoint ___________________________ as the guardian of said minor children. Should the aforestated individual be unable or unwilling to serve, I appoint ___________________________ as an alternate guardian.

Special Bequests

I may wish to leave specific items to certain individuals or organizations. Below are any such special bequests:

- Item and Description: ___________________________ Recipient Name: ___________________________

- Item and Description: ___________________________ Recipient Name: ___________________________

Signing Details

As required by Maryland law, the signing of this Last Will and Testament must be witnessed by two individuals who are not beneficiaries of the will. It should also be notarized to add an additional layer of legal validity.

In witness whereof, I, ___________________________ (Testator's name), have to this Last Will and Testament, written on this date, ______________, set my hand.

Testator Signature: ___________________________

Date: ___________________________

Witness #1 Signature: ___________________________ Date: ___________________________

Witness #2 Signature: ___________________________ Date: ___________________________

Notary Public: As a Notary Public in and for the State of Maryland, I hereby confirm that the Testator, known to me (or satisfactorily proven) to be the person whose name is subscribed to this instrument, has acknowledged that they executed the same in my presence.

Notary Signature: ___________________________

Date: ___________________________

Seal:

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Governing Law | The Maryland Last Will and Testament is governed by Title 4 of the Estates and Trusts Article of the Maryland Code. |

| 2. Age Requirement | In Maryland, an individual must be at least 18 years old to create a valid Last Will and Testament. |

| 3. Witnesses | A valid will in Maryland must be signed in the presence of at least two credible witnesses. |

| 4. Written Document | The law requires the will to be a written document; oral wills are not considered valid. |

| 5. Capability | The person creating the will (testator) must be of sound mind, understanding the document’s purpose, content, and effect. |

| 6. Signature Required | The testator must sign the document or direct someone else to sign in their presence and by their express direction. |

| 7. Self-Proving Affidavit | A self-proving affidavit is not required but is recommended as it simplifies probate by verifying the will’s authenticity. |

| 8. Notarization | Notarization is not a requirement for a will to be valid in Maryland, though it is necessary for a self-proving affidavit. |

| 9. Codicils | Changes to a will can be made through a codicil, which must be executed with the same formalities as the original will. |

| 10. Spousal Rights | In Maryland, a spouse cannot be completely disinherited and is entitled to an elective share of the estate unless there's a valid agreement. |

Instructions on How to Fill Out Maryland Last Will and Testament

Preparing a Last Will and Testament is a step many take to ensure their wishes are respected and loved ones are cared for after their departure. While the thought of drafting a will can seem daunting, understanding the process and what information you need can simplify the task considerably. In Maryland, like in many states, the specifics of the process can vary, but certain key steps remain the same. These instructions will guide you through each section of the Maryland Last Will and Testament form, ensuring you can confidently complete it. Remember, while filling out the form is an important step, consulting a legal professional to review your document can ensure it meets all legal requirements and accurately reflects your intentions.

- Gather personal information: Start by collecting all necessary personal information, including your full legal name, date of birth, and address. This will identify you as the testator—the person making the will.

- Designate an executor: Choose someone you trust to carry out the instructions in your will. Write down their full name and relationship to you. Ensure they are willing and able to take on this responsibility.

- Appoint a guardian for minor children (if applicable): If you have minor children, selecting a guardian is crucial. Provide the name and relationship of the person(s) you wish to take care of your children should you pass away before they reach legal adulthood.

- List your assets: Detail your assets, including real estate, bank accounts, investments, and personal property you wish to bequeath. Being specific can prevent potential disputes among beneficiaries.

- Specify beneficiaries: Clearly state who will inherit each of your assets. Include full names and relationships to avoid any confusion.

- Add specific instructions (if necessary): If you have particular wishes on how your assets should be distributed or used (e.g., a piece of property to only be used as a family home), clearly outline these instructions.

- Select alternate beneficiaries: In the event your primary beneficiaries are unable to inherit, it’s wise to name alternate beneficiaries. This ensures your assets are distributed according to your wishes, even if the unexpected happens.

- Sign the will: For a will to be valid in Maryland, it must be signed by you in the presence of two witnesses. These witnesses must also sign the will, acknowledging they witnessed your signature.

- Store the document safely: Once completed and signed, store your will in a safe place. Inform your executor of its location so it can be easily found when needed.

Filling out a Last Will and Testament is a straightforward process once you understand what information is necessary and how it should be structured. By following these steps, you can ensure your document is thorough and reflective of your final wishes. Remember, the attention and care you put into preparing your will can greatly ease the process for your loved ones during a difficult time.

Crucial Points on This Form

What is a Last Will and Testament?

A Last Will and Testament, often simply called a Will, is a legal document that allows an individual, known as the testator, to specify how their assets should be distributed upon their death. It can also appoint guardians for minor children and express the testator's wishes regarding funeral arrangements and other matters.

Who can create a Last Will and Testament in Maryland?

In Maryland, any person 18 years of age or older and of sound mind can create a Last Will and Testament. "Sound mind" generally means having the mental capacity to understand the nature and extent of your property and the identity of those who would naturally inherit your assets.

Does a Maryland Last Will and Testament need to be notarized?

No, a Last Will and Testament in Maryland does not need to be notarized to be legally binding. However, to make the Will "self-proving," which can speed up the probate process, the testator and witnesses can sign an affidavit before a notary. A "self-proving" Will is generally accepted by the court without contacting the witnesses who signed it.

How many witnesses are required for a Will in Maryland?

Maryland law requires that a Last Will and Testament be signed by at least two witnesses. These witnesses must be present to observe the testator signing the Will or acknowledging the Will and must understand that the document is intended to be the testator's Will.

Can a Last Will and Testament be changed after it has been signed?

Yes. A testator can change or revoke a Last Will and Testament at any time before their death, provided they are of sound mind. This can be done by creating a new Will or executing a legal document called a codicil, which amends the original Will.

What happens if someone dies without a Last Will and Testament in Maryland?

If someone dies without a Last Will and Testament in Maryland, their assets will be distributed according to Maryland's intestacy laws. These laws set out a fixed order of heirs, typically starting with the deceased's spouse and children, and then extending to other family members if no spouse or children are alive.

Are digital or electronic Wills legal in Maryland?

As of the last known update, Maryland law does not specifically recognize electronic Wills as valid. For a Will to be considered legally binding in Maryland, it generally must be a physical document signed by the testator and the required witnesses.

Can a spouse be disinherited in Maryland?

While it is possible to leave a spouse out of a Will, under Maryland law, the surviving spouse may claim an elective share of the estate. This means that the spouse can choose to receive a portion of the estate assets, regardless of what the Will specifies, subject to certain limitations and procedures.

Is a Last Will and Testament filed with a court in Maryland before a person's death?

No, a Last Will and Testament is not typically filed with the court in Maryland before the testator's death. Instead, it should be kept in a safe place and accessible to the executor or personal representative who will be responsible for administering the estate according to the Will's instructions after the testator's death.

Common mistakes

When it comes to the preparation of a Last Will and Testament, particularly in Maryland, individuals aim to ensure their estate is managed and distributed according to their wishes after their passing. However, mistakes can occur during this process, which might lead to unintended consequences or even disputes among beneficiaries. Here are four common mistakes people make:

-

Not adhering to Maryland-specific requirements: Each state has unique rules regarding how a Last Will and Testament must be executed. In Maryland, failing to comply with these specific legal requirements, such as the need for the Will to be in writing, signed by the person making the Will (testator), and witnessed by two individuals, can invalidate the document.

-

Overlooking the appointment of a suitable executor: The executor plays a critical role in managing and executing the estate according to the Will. Selecting someone who is not willing, capable, or legally eligible to serve in this capacity can cause delays and complications in the estate administration process.

-

Forgetting to update the Will: Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, necessitate updates to your Will. Not updating your Will to reflect these life events can result in assets being distributed in a manner that no longer aligns with your current wishes or intentions.

-

Using ambiguous language: Clarity is paramount in a Last Will and Testament. Using ambiguous language or failing to clearly identify beneficiaries, assets, or the proportions of your estate to be distributed can lead to disputes among your heirs. This can also result in a portion of your estate being distributed in a way that you did not intend.

By avoiding these common mistakes, you can help ensure that your Last Will and Testament in Maryland accurately represents your final wishes and provides clear instructions for the distribution of your estate.

Documents used along the form

When preparing a Last Will and Testament in Maryland, it's crucial to consider other essential documents to ensure a comprehensive estate plan. These documents can complement your will, covering aspects your will may not address and ensuring your wishes are followed in various situations. Below is a brief overview of four key documents often used alongside the Maryland Last Will and Testament form.

- Advance Directive: This important document allows you to express your wishes regarding medical treatment if you become unable to make healthcare decisions for yourself. It includes a living will and a healthcare proxy (or durable power of attorney for health care), empowering someone you trust to make medical decisions on your behalf.

- Durable Power of Attorney for Finances: This document gives someone you choose the authority to handle your financial affairs. This can include paying your bills, managing your investments, and taking care of other financial matters if you are incapacitated and unable to do this yourself.

- Revocable Living Trust: A revocable living trust is a document that allows you to manage your assets during your lifetime and distribute them upon your death, without the need for probate. It can be changed or revoked at any time, offering flexibility and privacy not typically associated with a will.

- Beneficiary Designations: Often used for retirement accounts, life insurance policies, and other financial instruments, beneficiary designations specify who will receive these assets upon your death. These designations can override instructions in a will, so it’s important to keep them updated and consistent with your estate planning documents.

Together, these documents form a robust estate plan that can address a wide range of scenarios, from healthcare decisions to the distribution of your assets. While a Last Will and Testament is a cornerstone of any estate plan, integrating it with these additional documents can provide a comprehensive approach to planning for the future, ensuring your wishes are respected and your loved ones are taken care of in the best way possible.

Similar forms

A Living Will is another important document that bears resemblance to a Last Will and Testament in the way it outlines a person's preferences. However, a Living Will specifically addresses medical care preferences in situations where an individual cannot communicate their wishes due to incapacitation. Like a Last Will and Testament, it serves as a guide for family members and healthcare providers, ensuring that the person's medical treatment preferences are honored.

The Durable Power of Attorney (POA) shares similar goals with a Last Will and Testament by appointing someone to act on an individual's behalf. While a Last Will and Testament becomes effective after death, a Durable Power of Attorney is operative during the individual’s lifetime. It grants an appointed person the authority to make financial or health care decisions, depending on its type, should the individual become unable to do so themselves.

A Trust document also parallels a Last Will and Testament in its function of asset distribution. Trusts allow for more control over when and how assets are distributed to beneficiaries, potentially avoiding the probate process that a Last Will must go through. This document can manage assets both during the creator's lifetime and after their death, offering a flexible alternative for managing an estate.

The Living Trust, specifically a Revocable Living Trust, closely aligns with a Last Will in intent but operates differently. It holds the individual’s assets in a trust to be transferred to designated beneficiaries upon death, effectively bypassing the time-consuming and public probate process. While a Last Will lays out intentions for estate distribution after death, a Living Trust actively holds the assets in trust for the beneficiaries and can be amended or revoked as long as the person is alive.

Dos and Don'ts

When preparing your Last Will and Testament in Maryland, it is imperative to understand and adhere to specific guidelines. These guidelines ensure that your final wishes are legally recognized and effectively carried out. Below are essential dos and don'ts to consider:

Things You Should Do

- Ensure the will is in writing. While Maryland recognizes oral wills under very limited circumstances, a written will is the most reliable way to ensure your wishes are upheld.

- Have the will signed in the presence of two witnesses. These witnesses must also sign the document, affirming that they observed you sign the will or acknowledge your signature on the document.

- Consider having the will notarized. Although not a requirement in Maryland for the will to be valid, having it notarized can expedite the probate process since it automatically proves its authenticity, assuming the will is self-proved.

- Name an executor whom you trust to carry out the provisions of your will. This is a critical step in ensuring your estate is managed according to your wishes.

- Be specific about who receives what. Vague instructions can lead to disputes among beneficiaries which could complicate the probate process.

- Review and update your will periodically, especially after major life events such as marriage, divorce, the birth of a child, or the acquisition of significant assets.

Things You Shouldn't Do

- Don't use vague or ambiguous language. Clarity is key when detailing how you wish your estate to be divided.

- Don't forget to date the will. A will without a date could raise questions regarding its validity or whether it supersedes any prior wills.

- Don't attempt to make arrangements for your pet in a way that suggests they can directly inherit assets. Instead, assign a caregiver and allocate funds for the pet's care through a trust or an arrangement with the beneficiary.

- Don't neglect to consider how debts, taxes, and funeral expenses will be paid. These should be addressed in your will to prevent unnecessary stress on your estate or beneficiaries.

- Don't have a beneficiary act as a witness. This can create a conflict of interest and may challenge the validity of the will or the beneficiary's share.

- Don't fail to consult with a legal professional. While it's possible to create a will on your own, obtaining legal advice can ensure your will complies with Maryland laws and fully captures your intentions.

Misconceptions

Many people have misconceptions about the Last Will and Testament form in Maryland. Understanding the facts can help individuals make more informed decisions regarding their estate planning.

It must be notarized to be valid. There is a common belief that a Last Will and Testament must be notarized to be legal in Maryland. However, the law requires it to be signed by the person making the will (the testator) in the presence of two credible witnesses, who also sign the document. Notarization is not a requirement for validity but can be part of a self-proving affidavit, which helps streamline the probate process.

A handwritten will is not valid. Contrary to this common misconception, Maryland recognizes handwritten (holographic) wills as long as they meet specific criteria. The primary requirement is that the material provisions and the signature must be in the handwriting of the testator. However, witnesses to holographic wills may still be required for probate.

All assets are distributed through the will. Many people believe a will covers the distribution of all the assets owned by the testator. However, certain assets, such as those held in joint tenancy, life insurance proceeds with a named beneficiary, and retirement accounts, bypass the will and pass directly to the named beneficiary or surviving co-owner.

If you die without a will, your assets go to the state. This is only partially true. While assets can escheat to the state, this happens as a last resort. Maryland law outlines a clear hierarchy of heirs who will inherit in the absence of a will, starting with spouses and children, and then moving to more distant relatives.

Only the elderly or wealthy need a will. This misconception overlooks the importance of a will for various legal and personal reasons beyond asset distribution. A will allows you to appoint a guardian for minor children, specify funeral arrangements, and leave specific items to friends or charities, regardless of your age or wealth.

Creating a will once is enough. Life changes—such as marriage, divorce, the birth of a child, or significant changes in financial situations—necessitate updates to your will. Failing to update your will to reflect these changes can lead to unintended consequences in the distribution of your estate.

Key takeaways

When it comes to preparing and utilizing the Maryland Last Will and Testament form, it's essential to understand the legal aspects that affect the document's validity and your estate planning goals. Here are key takeaways to guide you:

- Legal Requirements: The person creating the will (testator) must be at least 18 years old and possess the mental capacity to comprehend the document's significance. The will must be in writing, and the testator must sign it in the presence of two credible witnesses, who also need to sign the document.

- Selecting an Executor: It's critical to appoint a trustworthy executor who will manage the estate according to the will's instructions. The executor handles tasks such as paying debts and distributing assets to beneficiaries.

- Witness Requirements: Witnesses to the will should not be beneficiaries to avoid conflicts of interest. Maryland law requires two witnesses, who must both be present when they and the testator sign the will.

- Specificity Is Key: While outlining asset distribution, be as detailed as possible to minimize confusion and disputes among heirs. The clear identification of heirs and specific assets ensures your wishes are executed according to plan.

- Revoking or Amending the Will: If you wish to change or revoke your will, it must be done with the same formalities as creating a new will or by executing a legal document called a codicil, which amends portions of the existing will.

- Safe Storage: Securely storing your will is crucial. It should be accessible to the executor upon your death. Consider a fireproof safe or deposit box, but make sure someone you trust knows its location and how to access it.

Properly filling out and using the Maryland Last Will and Testament form is a profound responsibility that ensures your assets are distributed according to your wishes. Consulting with a legal professional can provide additional peace of mind that your will complies with Maryland law and addresses all aspects of your estate planning needs.

Create Other Last Will and Testament Forms for US States

Free Will Template California - In the Last Will and Testament form, the individual can appoint an executor, a trusted person to carry out the terms of the will.

How to Make a Will in Ct - It includes provisions for the care of underage children, appointing guardians to ensure they are looked after according to your wishes.

Last Will and Testamont - Having a Last Will and Testament is particularly important in blended families, ensuring fair and intended asset distribution.

Last Will and Testament Template Oklahoma - This legal document lets you choose an executor to manage your estate, ensuring your wishes are honored.