Blank Last Will and Testament Form for New Jersey

In New Jersey, like in many states, the Last Will and Testament form serves as a critical legal document that enables individuals to ensure their property and assets are distributed according to their wishes upon their death. This form not only outlines who will inherit the decedent's assets but also specifies the executor, the person entrusted with the task of carrying out the directives contained within the will. New Jersey law stipulates specific requirements for the creation of a valid will, including the need for the testator to be of sound mind and the necessity of signing the document in the presence of witnesses. Addressing a broad range of personal situations, the Last Will and Testament in New Jersey allows for detailed instructions regarding not just the division of assets, but also the guardianship of minor children, if applicable. This ensures that individuals have a significant degree of control over their legacy, providing peace of mind to themselves and their loved ones. Understanding the major aspects of this form is essential for anyone seeking to ensure their final wishes are honored in a manner that is both legally sound and reflective of their personal values.

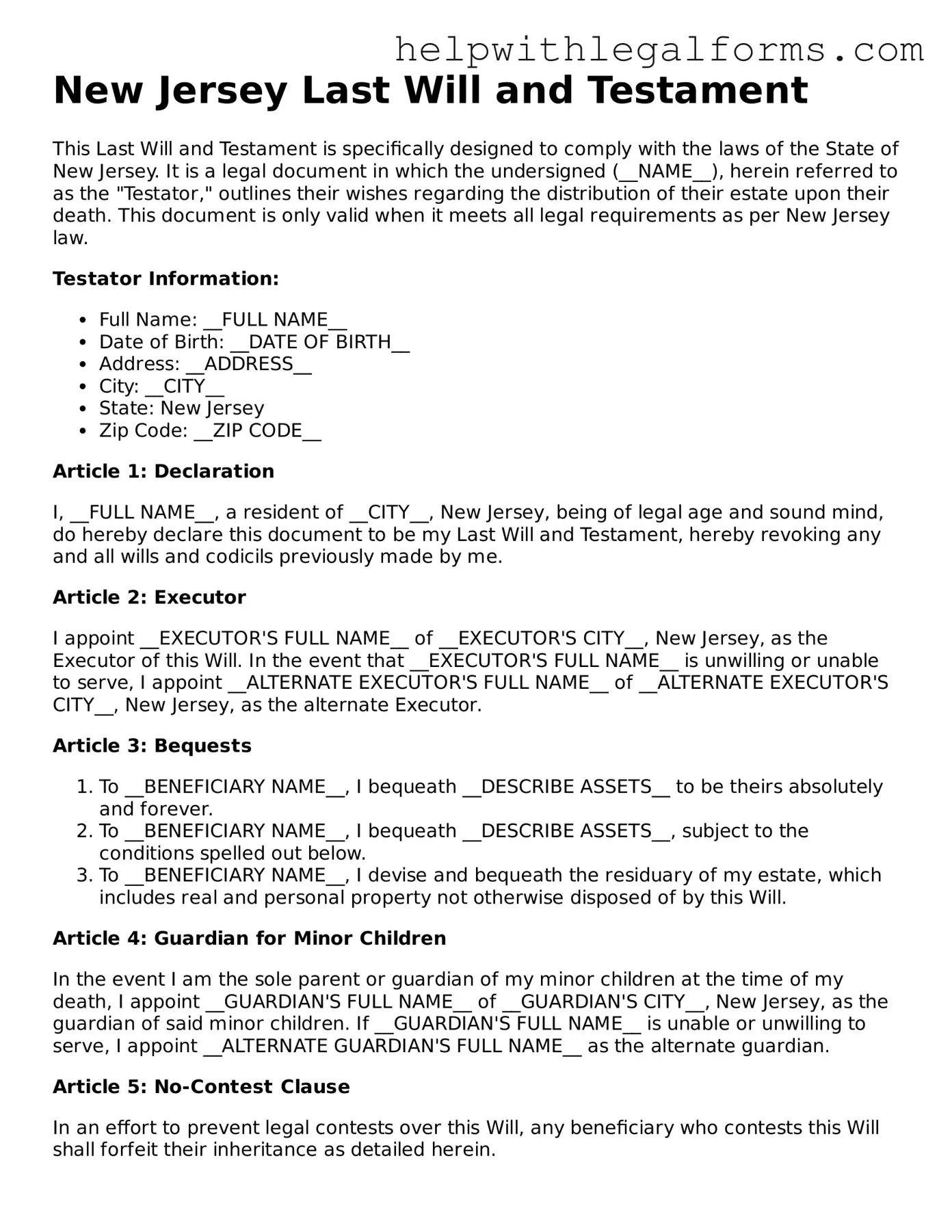

Example - New Jersey Last Will and Testament Form

New Jersey Last Will and Testament

This Last Will and Testament is specifically designed to comply with the laws of the State of New Jersey. It is a legal document in which the undersigned (__NAME__), herein referred to as the "Testator," outlines their wishes regarding the distribution of their estate upon their death. This document is only valid when it meets all legal requirements as per New Jersey law.

Testator Information:

- Full Name: __FULL NAME__

- Date of Birth: __DATE OF BIRTH__

- Address: __ADDRESS__

- City: __CITY__

- State: New Jersey

- Zip Code: __ZIP CODE__

Article 1: Declaration

I, __FULL NAME__, a resident of __CITY__, New Jersey, being of legal age and sound mind, do hereby declare this document to be my Last Will and Testament, hereby revoking any and all wills and codicils previously made by me.

Article 2: Executor

I appoint __EXECUTOR'S FULL NAME__ of __EXECUTOR'S CITY__, New Jersey, as the Executor of this Will. In the event that __EXECUTOR'S FULL NAME__ is unwilling or unable to serve, I appoint __ALTERNATE EXECUTOR'S FULL NAME__ of __ALTERNATE EXECUTOR'S CITY__, New Jersey, as the alternate Executor.

Article 3: Bequests

- To __BENEFICIARY NAME__, I bequeath __DESCRIBE ASSETS__ to be theirs absolutely and forever.

- To __BENEFICIARY NAME__, I bequeath __DESCRIBE ASSETS__, subject to the conditions spelled out below.

- To __BENEFICIARY NAME__, I devise and bequeath the residuary of my estate, which includes real and personal property not otherwise disposed of by this Will.

Article 4: Guardian for Minor Children

In the event I am the sole parent or guardian of my minor children at the time of my death, I appoint __GUARDIAN'S FULL NAME__ of __GUARDIAN'S CITY__, New Jersey, as the guardian of said minor children. If __GUARDIAN'S FULL NAME__ is unable or unwilling to serve, I appoint __ALTERNATE GUARDIAN'S FULL NAME__ as the alternate guardian.

Article 5: No-Contest Clause

In an effort to prevent legal contests over this Will, any beneficiary who contests this Will shall forfeit their inheritance as detailed herein.

Article 6: Signatures

This Will shall be executed on __DATE OF SIGNING__, in the presence of three witnesses, thereby validating it as the Last Will and Testament of __FULL NAME__.

Testator's Signature: ___________________________ Date: __DATE__

Witness #1 Signature: ___________________________ Date: __DATE__

Witness #2 Signature: ___________________________ Date: __DATE__

Witness #3 Signature: ___________________________ Date: __DATE__

This Last Will and Testament was signed in our presence by the Testator, or by someone in the Testator's presence and at the Testator's direction. We then witnessed each other sign this Will in the presence of the Testator and declare that to the best of our knowledge the Testator is of the age of majority, or is otherwise legally empowered to make a Will, and appears to be of sound mind and under no constraint or undue influence.

PDF Form Attributes

| Fact | Detail |

|---|---|

| Governing Law | New Jersey Revised Statutes, Title 3B: Wills, Estates and Probate |

| Age Requirement | 18 years or older |

| Sound Mind Requirement | Individual must be of sound mind |

| Writing Requirement | Must be in writing |

| Signature Requirement | Must be signed by the testator |

| Witness Requirement | Must be witnessed by two individuals |

| Notarization | Not required but a self-proving affidavit is recommended |

| Holographic Wills | Recognized if entirely handwritten and signed by testator |

| Oral Wills | Not recognized |

Instructions on How to Fill Out New Jersey Last Will and Testament

Creating a Last Will and Testament is a vital step in planning for the future. It's a document that outlines how you wish your assets to be distributed and who will take care of your minor children after your passing. In New Jersey, filling out a Last Will and Testament form is a straightforward process, yet it requires attention to detail to ensure your wishes are clearly expressed and legally valid. Following the recommended steps will help you successfully complete the form.

- Start by gathering all necessary information, including your full legal name, address, and the details of your assets such as bank accounts, real estate, and personal property of value.

- Decide on the beneficiaries for your assets. These can be family members, friends, or organizations that you wish to inherit your property.

- Choose an executor for your will. This person will be responsible for managing your estate, following the wishes outlined in your Last Will and Testament.

- If you have minor children, select a guardian for them. Consider someone you trust to raise your children in your absence.

- Complete the Last Will and Testament form. Begin by entering your name and address at the top of the document. Be sure to specify that you're of sound mind and not under any duress as you make your will.

- List your beneficiaries and clearly state what assets each beneficiary will receive. Be as specific as possible to avoid any confusion.

- Appoint your executor by including their full name and relationship to you.

- Name the guardian for your children, if applicable, providing their full name and relationship to the children.

- Review your will, ensuring all information is correct and clearly stated.

- Sign your will in the presence of two witnesses. These witnesses should not be beneficiaries in the will. They must also sign the document, verifying they witnessed your signature.

- Consider getting the will notarized. Although this is not a requirement in New Jersey, it can add an extra layer of validation to the document's authenticity.

After these steps, keep your Last Will and Testament in a safe place, such as a fireproof safe or with an attorney, and inform your executor where it is stored. Letting loved ones know about the will's existence and its location can ensure your wishes are honored. Always consider consulting with a legal professional to make sure your will meets all legal requirements and accurately reflects your wishes. Remember, life changes such as marriage, divorce, the birth of children, or acquiring significant assets are good reasons to update your will. Regularly reviewing and updating your will can prevent future complications and ensure your legacy is preserved according to your wishes.

Crucial Points on This Form

What is a Last Will and Testament in New Jersey?

A Last Will and Testament in New Jersey is a legal document that outlines an individual's wishes regarding the distribution of their assets and the care of any minor children upon their death. It allows the testator (the person making the will) to specify beneficiaries for their property and to appoint an executor who will manage the estate until its final distribution.

Who can create a Last Will and Testament in New Jersey?

Any person who is 18 years of age or older and of sound mind can create a Last Will and Testament in New Jersey. Being of "sound mind" means the individual understands the nature of their assets, the act of making a will, the effect of their decisions, and can make rational decisions about beneficiary designations.

Are there specific requirements for a Will to be valid in New Jersey?

Yes, for a Will to be valid in New Jersey, it must be written, signed by the testator, and witnessed by at least two individuals who do not stand to benefit from the Will. These witnesses must observe the testator's signing or acknowledge the testator's signature or Will.

Can I appoint a guardian for my children in my Will?

Yes, in New Jersey, you can appoint a guardian for your minor children in your Will. This is highly recommended to ensure that your children are cared for by someone you trust in the event of your death. Without such an appointment, the court will decide who will care for your children.

How can I change my Will?

You can change your Will in New Jersey by creating a new Will that revokes the previous one or by making an amendment called a codicil. The codicil must be executed with the same formalities as a Will—written, signed, and witnessed.

What happens if I die without a Will in New Jersey?

If you die without a Will in New Jersey, your assets will be distributed according to the state's intestacy laws. The court will determine who your heirs are and divide your estate among them, which may not align with your wishes. Additionally, without a nominated guardian in a Will, the court will decide who will care for any minor children.

Can I disinherit a family member in New Jersey?

Yes, in New Jersey, you can disinherit a family member in your Will. However, certain protections exist for spouses under the state's elective share statute, which may allow a surviving spouse to claim a portion of your estate regardless of your will's instructions. It's advisable to consult with a legal professional to navigate these specific circumstances effectively.

Common mistakes

Filling out a Last Will and Testament form is an important step in ensuring that one's wishes are respected and followed after they pass away. However, when it comes to completing such forms, especially in New Jersey, there are common mistakes that many individuals tend to make. Recognizing and avoiding these errors can help ensure that the will is valid and effectively communicates the person’s final wishes.

Not adhering to New Jersey's legal requirements: Each state has specific laws regarding how a will must be signed and witnessed. In New Jersey, the person making the will (known as the testator) must sign the document in the presence of two witnesses, who must also sign the will. Neglecting these legal formalities can render the will invalid.

Forgetting to name an executor: An executor is the person responsible for managing the estate according to the will’s instructions. Failing to appoint an executor can complicate the probate process, as the court will then need to assign someone to this role.

Using unclear language: Ambiguity in a will can lead to disputes among heirs and potentially result in the will not being executed as intended. It's crucial to use clear and precise language.

Not updating the will: Life changes such as marriage, divorce, the birth of children, or the death of a named heir or executor can affect the validity and relevance of your will. Regularly updating the document to reflect these changes is essential.

Omitting digital assets: In today’s digital age, many people have significant digital assets, such as social media accounts or cryptocurrency. Failing to include these in your will can lead to complications in managing your online presence or digital wealth after your passing.

Choosing the wrong witnesses: Witnesses must be of legal age and must not be beneficiaries of the will. Having a beneficiary witness the will can lead to conflicts of interest and potentially challenge the validity of the document.

Lack of specificity in bequests: When bequeathing property, specificity is key. General statements without clear identification of property or beneficiaries can result in confusion and legal battles, delaying the probate process.

By avoiding these mistakes, individuals can create a more robust and effective Last Will and Testament that clearly communicates their end-of-life wishes and helps facilitate a smoother transition for their loved ones.

Documents used along the form

In New Jersey, creating a Last Will and Testament is a significant step in managing one's estate, but it's often just part of a broader estate planning strategy. To ensure a comprehensive approach to estate planning, several other important documents and forms are frequently used in conjunction with a Last Will. These documents help address various aspects of a person's financial and healthcare decisions, providing a complete framework for managing one's affairs. Here's a look at some of these critical documents:

- Advance Directive for Health Care (Living Will): This document allows individuals to outline their preferences for medical treatment and interventions in scenarios where they are unable to make decisions for themselves due to incapacity or serious illness. It often includes specifications about resuscitation, life support, and other critical medical interventions.

- Durable Power of Attorney for Health Care: Unlike the Advance Directive, which specifies types of medical care, this form designates another person to make healthcare decisions on behalf of the individual if they become unable to do so themselves.

- Financial Power of Attorney: This legal document grants a trusted individual the authority to handle financial affairs, such as managing bank accounts, paying bills, and making investment decisions, should the person become incapacitated or otherwise unable to manage their finances.

- Trust Agreement: A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries. They are often used to minimize estate taxes and can offer protection from creditors and legal judgments.

- Beneficiary Designations: For certain assets like life insurance policies and retirement accounts, beneficiary designations specify who will receive the asset upon the death of the account holder. These designations can supersede wishes laid out in a will, so it’s crucial to keep them updated and consistent with one's estate plan.

- Digital Asset Trust or Will: As digital assets, including social media accounts, digital currencies, and online business assets, become more prevalent, it’s important to have a plan for managing these in one’s estate. A digital asset trust or will can provide instructions for how these assets should be handled after death.

- Letter of Intent: This document provides supplementary instructions that may not be included within the will or trust documents. A letter of intent can guide the executor or a beneficiary through the distribution of personal belongings, the care of pets, or even funeral and memorial preferences.

- Property Deeds: For real estate to be transferred upon death, proper documentation, including the latest deeds, should be in order and accessible. If the property is meant to be transferred to a trust, ensuring the deed reflects this arrangement is critical.

- Guardianship Designations: If there are minor children or dependent adults involved, it’s essential to establish guardianship designations. These ensure that there is a legally appointed guardian to take care of dependents in the event of the parent's or guardian's death or incapacitation.

By incorporating these documents into their estate planning, individuals can ensure a well-rounded strategy that addresses not just the distribution of their assets, but also their healthcare and financial decisions, in the event they're no longer able to make those decisions themselves. It’s always advisable to consult with legal and financial professionals when preparing these documents to ensure they are executed correctly and reflect the individual's wishes accurately.

Similar forms

Living Will: Like a Last Will and Testament, a Living Will expresses personal wishes, focusing on medical treatment preferences in scenarios where an individual is unable to communicate their decisions. Both legal documents are used to guide family and doctors in making choices based on the individual's desires.

Trust: A Trust, specifically a Revocable Living Trust, shares similarities with a Last Will in that it designates beneficiaries for one's assets. However, it avoids probate, the legal process through which a Last Will and Testament is verified, making asset distribution quicker and often more private.

Power of Attorney (POA): Both a POA and a Last Will and Testament deal with the aspect of taking control when an individual cannot make decisions themselves. While a Last Will activates posthumously, a POA is effective during the individual's lifetime, granting another person the authority to make financial or health-related decisions.

Healthcare Proxy: Similarly, a Healthcare Proxy designates someone to make medical decisions on behalf of the individual if they become unable to do so. Both documents are vital in planning for future incapacity, ensuring that personal wishes in health care and asset distribution are respected.

Living Trust: A Living Trust and a Last Will and Testament both provide instructions for handling an individual’s assets. The primary difference lies in when these instructions take effect. A Living Trust becomes operational during the grantor's lifetime, whereas a Last Will comes into effect after the individual's death.

Guardianship Designation: Similar to a Last Will, a Guardianship Designation names a guardian for minor children or dependent adults. This is crucial for ensuring that dependents are cared for by a trusted individual, aligning with one's wishes upon their incapacity or death.

Beneficiary Designation Forms: These forms, often used with retirement accounts, life insurance, and other assets, specify who will receive the asset upon the account holder’s death. Like a Last Will, they ensure assets are distributed according to the individual’s wishes, bypassing the will and probate process.

Durable Power of Attorney for Finances: This specific type of POA allows someone to manage the financial affairs of another, akin to how a Last Will enables asset distribution after death. The key difference is that it takes effect during the individual's lifetime, whereas the Last Will takes effect after death.

Advance Healthcare Directive: An Advance Healthcare Directive, much like a Living Will, gives instructions for future health care if one cannot express their wishes. It intersects with the idea behind a Last Will by preparing for future incapacities, but it exclusively focuses on medical decisions rather than asset distribution.

Funeral Directive: Though primarily focusing on posthumous wishes regarding funeral arrangements, a Funeral Directive shares the forward-thinking aspect of a Last Will and Testament. It allows individuals to document their funeral preferences in advance, relieving loved ones of decision-making burdens during a time of grief.

Dos and Don'ts

When preparing a Last Will and Testament in New Jersey, it's crucial to be meticulous and thoughtful. This document is a person's final statement about how their estate should be handled, and as such, demands careful attention to detail. Below are key dos and don'ts to keep in mind during the process.

DO:- Review New Jersey estate laws: Familiarize yourself with the latest estate laws in New Jersey to ensure your will complies with state requirements.

- Be specific about beneficiaries: Clearly identify who your beneficiaries are, using their full names and their relationship to you to avoid any confusion.

- Choose an executor wisely: Pick someone you trust and who is capable of managing your estate. Ensure they are willing and able to serve in this role.

- Sign in the presence of witnesses: New Jersey law requires your will to be signed in the presence of two witnesses, who also need to sign the document.

- Include a residuary clause: This ensures any part of your estate not specifically mentioned will still be distributed according to your wishes.

- Secure the document: Keep your will in a safe place where your executor can access it when needed, and inform them of its location.

- Be clear and concise: Use straightforward language to avoid ambiguity and ensure your wishes are understood.

- Update regularly: Review and revise your will as necessary, especially after major life events or changes in your estate.

- Consider a self-proving affidavit: This can speed up the probate process, as it verifies your will’s authenticity.

- Seek professional advice: Consulting with a legal professional can help ensure your will is valid and fully expresses your intentions.

- Forget about digital assets: Remember to include instructions for your digital assets, including social media accounts and digital currencies.

- Assume verbal wishes will be followed: Verbal instructions are not legally binding. Ensure all your wishes are documented in your will.

- Use unclear language: Ambiguities can lead to disputes among beneficiaries, so strive for clarity in your wording.

- Leave out important details: Failing to provide essential information can create confusion and complicate the estate distribution process.

- Ignore tax implications: Be mindful of how your bequests might impact beneficiaries’ taxes and structure your will accordingly.

- Attempt to control everything indefinitely: Understand that certain conditions or controls may not be enforceable or might complicate the probate process.

- Forget to name a guardian for minor children: Without this designation in your will, the court will decide who cares for your children.

- Overlook debts and taxes: Ensure your will addresses the payment of any debts, expenses, and taxes from your estate.

- DIY without guidance: While templates exist, a one-size-fits-all approach might not suit your unique situation. Professional advice can be invaluable.

- Rely on outdated information: Laws and personal circumstances change. Basing your will on outdated information can lead to unintended outcomes.

Misconceptions

When discussing the New Jersey Last Will and Testament, several misconceptions often come to light. It's important to address these misunderstandings directly to ensure individuals are well-informed about how to effectively plan for the future. Here are four common misconceptions:

A will is only for the wealthy. This is a prevalent misconception. Many people believe that wills are only necessary for those with extensive assets. However, a will is crucial for anyone who wishes to have a say in how their property is distributed after their passing, regardless of the estate's size. In New Jersey, a will can also designate guardians for minor children, making it significant for parents.

If you die without a will in New Jersey, your assets go to the state. This is not entirely accurate. If someone dies without a will (intestate), New Jersey's laws of intestacy kick in. These laws determine how your assets will be distributed, typically to your closest relatives. While it's rare for the state to claim an estate (escheat), it's only a possibility when no living relatives can be found.

Your will covers all of your assets. Not everything you own might be covered by your will. Certain assets, such as those held in a trust, life insurance payouts, and retirement accounts, usually pass to the named beneficiaries directly and are not governed by the will. It's essential to understand which of your assets are affected by your will and plan accordingly.

Creating a will in New Jersey is complicated and expensive. Many people are deterred by the presumed complexity and high cost of creating a will. While it's advisable to seek professional guidance, especially for complex estates, drafting a will does not have to be an expensive or overwhelmingly complex process. There are numerous resources available to help individuals create a valid will, ensuring their wishes are honoured without breaking the bank.

Key takeaways

Creating a Last Will and Testament is a vital step in planning for the future. It specifies how your assets should be distributed upon your death, ensuring that your wishes are followed. If you're in New Jersey, understanding how to properly fill out and use the Last Will and Testament form is crucial. Here are key takeaways to guide you through the process:

- Legal Requirements: In New Jersey, the person creating the will (testator) must be at least 18 years old and of sound mind. The document must be in writing to be considered valid.

- Witnesses: New Jersey law requires the presence of two witnesses during the signing of the will. These witnesses must also sign the will, attesting that they observed the testator signing it and that they believe the testator to be of sound mind.

- Notarization: Although notarization is not a necessity for the will to be valid in New Jersey, it is highly recommended as it facilitates the probate process. A notarized will is presumed to be self-proving, making it easier to execute.

- Executor: Choosing an executor is a critical decision. This person will be responsible for managing and distributing your estate according to the will’s instructions. Select someone trustworthy and capable of handling financial matters.

- Beneficiaries: Clearly identify your beneficiaries, those who will inherit your assets. Include as much detail as necessary to avoid any confusion about your intentions.

- Specific Gifts: If you wish to leave specific items to certain individuals, clearly list these items and their intended recipients in the will to prevent misunderstandings.

- Guardianship: If you have minor children or dependents, appointing a guardian is a paramount consideration. This ensures they are cared for by someone you trust in the event of your early death.

- Review and Update: Life changes such as marriage, divorce, the birth of a child, or the death of a beneficiary warrant a review and possibly an update to your will to reflect your current wishes.

- Signing Location: Sign your will in a safe, yet accessible place. While the signing doesn't need to occur in New Jersey, the will should comply with New Jersey laws to be valid within the state.

- Storage: Store your will in a secure location, but ensure that your executor knows where it is. It’s not useful if it cannot be found when needed.

Understanding these key points ensures that your Last Will and Testament accurately reflects your wishes and complies with New Jersey law, ultimately providing peace of mind for you and your loved ones.

Create Other Last Will and Testament Forms for US States

Executor of Estate Form - Can specify the management of investment accounts and financial instruments after your passing.

Free Will Template California - The Last Will and Testament can designate charitable contributions, ensuring a legacy of generosity.