Blank Last Will and Testament Form for New York

Creating a Last Will and Testament is an important step in ensuring your wishes are respected and your loved ones are taken care of after your passing. In New York, this form serves as a legal document, guiding the distribution of your assets, the care of your minor children, and even your final arrangements, according to your desires. The process involves clearly listing your assets, specifying beneficiaries, choosing an executor to manage the estate, and, crucially, making decisions in the best interest of any minor children. It's imperative to follow New York's specific legal requirements to ensure the document is valid. This not only provides peace of mind for you but also simplifies the process for your family during a difficult time. Although thinking about these matters can be challenging, taking the time to prepare your Last Will and Testament is a proactive step toward protecting your legacy and offering clarity and guidance to your loved ones when they need it most.

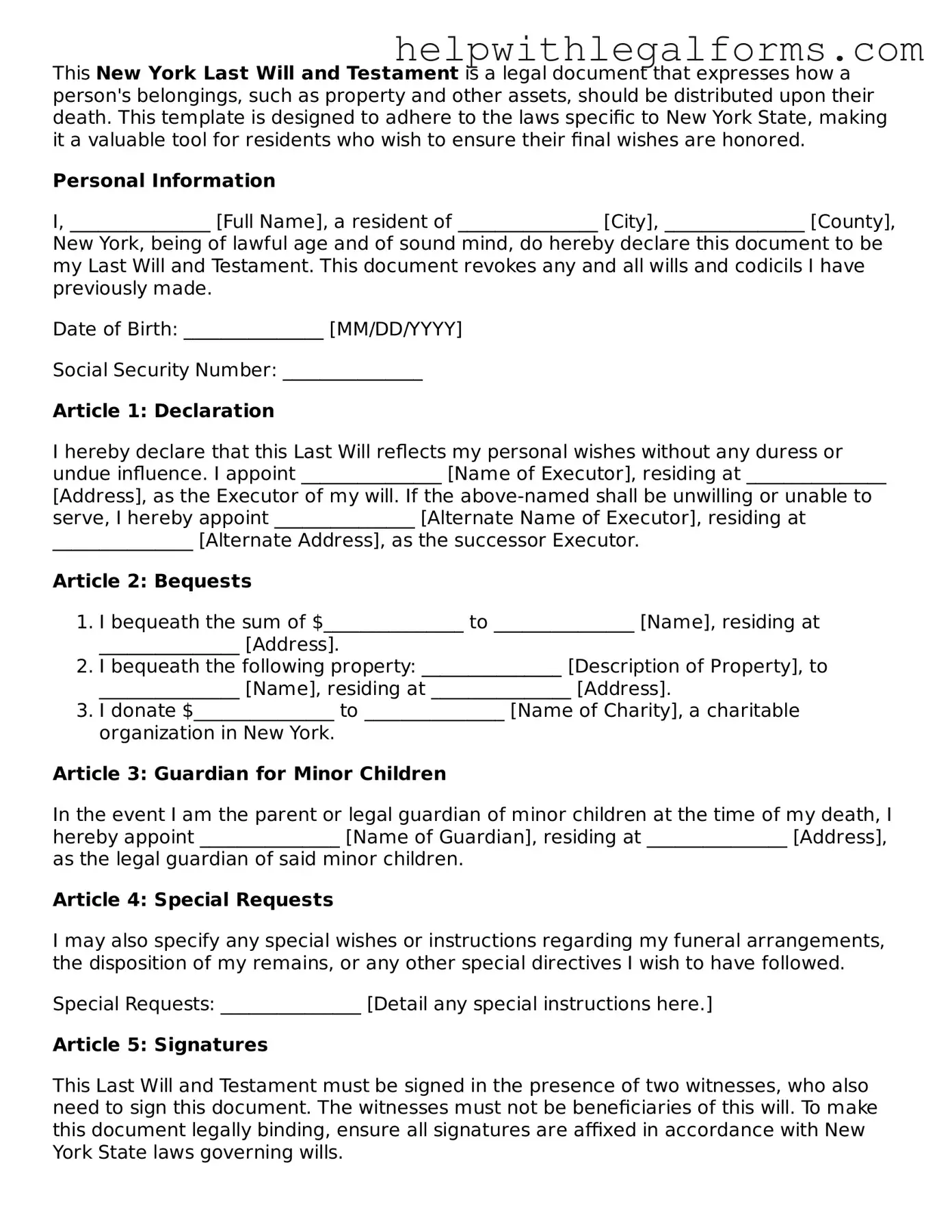

Example - New York Last Will and Testament Form

This New York Last Will and Testament is a legal document that expresses how a person's belongings, such as property and other assets, should be distributed upon their death. This template is designed to adhere to the laws specific to New York State, making it a valuable tool for residents who wish to ensure their final wishes are honored.

Personal Information

I, _______________ [Full Name], a resident of _______________ [City], _______________ [County], New York, being of lawful age and of sound mind, do hereby declare this document to be my Last Will and Testament. This document revokes any and all wills and codicils I have previously made.

Date of Birth: _______________ [MM/DD/YYYY]

Social Security Number: _______________

Article 1: Declaration

I hereby declare that this Last Will reflects my personal wishes without any duress or undue influence. I appoint _______________ [Name of Executor], residing at _______________ [Address], as the Executor of my will. If the above-named shall be unwilling or unable to serve, I hereby appoint _______________ [Alternate Name of Executor], residing at _______________ [Alternate Address], as the successor Executor.

Article 2: Bequests

- I bequeath the sum of $_______________ to _______________ [Name], residing at _______________ [Address].

- I bequeath the following property: _______________ [Description of Property], to _______________ [Name], residing at _______________ [Address].

- I donate $_______________ to _______________ [Name of Charity], a charitable organization in New York.

Article 3: Guardian for Minor Children

In the event I am the parent or legal guardian of minor children at the time of my death, I hereby appoint _______________ [Name of Guardian], residing at _______________ [Address], as the legal guardian of said minor children.

Article 4: Special Requests

I may also specify any special wishes or instructions regarding my funeral arrangements, the disposition of my remains, or any other special directives I wish to have followed.

Special Requests: _______________ [Detail any special instructions here.]

Article 5: Signatures

This Last Will and Testament must be signed in the presence of two witnesses, who also need to sign this document. The witnesses must not be beneficiaries of this will. To make this document legally binding, ensure all signatures are affixed in accordance with New York State laws governing wills.

Signature of Testator: _______________

Date: _______________ [MM/DD/YYYY]

Witness 1 Signature: _______________

Witness 1 Printed Name: _______________

Witness 1 Address: _______________

Witness 2 Signature: _______________

Witness 2 Printed Name: _______________

Witness 2 Address: _______________

Article 6: Declaration of Witnesses

We, the undersigned, declare that the testator, _______________ [Full Name of Testator], sign their name to this instrument, willingly and as a free act and deed, in our presence and in the presence of each other. The testator declared the instrument to be their Last Will and Testament in our presence, who, at the testator's request and in the testator's presence, and in the presence of each other, have signed our names as witnesses. We understand this will is executed in accordance with the laws of New York State, and we are of sufficient age to witness a will and are not named as beneficiaries in this will.

Witness 1 Date: _______________ [MM/DD/YYYY]

Witness 2 Date: _______________ [MM/DD/YYYY]

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The New York Last Will and Testament must be in writing to be legally valid. |

| 2 | In New York, the person creating the will (testator) must be at least 18 years old. |

| 3 | The testator must be of sound mind at the time of creating the will, understanding the nature of their act. |

| 4 | Under New York law, there must be at least two witnesses present at the time of the will’s signing. |

| 5 | Witnesses must sign the will in the presence of the testator and each other for it to be valid. |

| 6 | A self-proving affidavit is not required in New York, but it can speed up the probate process. |

| 7 | The will may designate a personal representative (executor) to carry out the wishes of the testator. |

| 8 | Holographic (handwritten) wills are recognized in New York if they meet specific legal standards. |

| 9 | Oral (nuncupative) wills are generally not recognized, with few exceptions, such as for members of the armed forces. |

| 10 | Governing Law: The New York Estates, Powers and Trusts Law (EPTL) provides the laws governing wills in the state. |

Instructions on How to Fill Out New York Last Will and Testament

Creating a Last Will and Testament is a pivotal step in planning for the future. In New York, the process is geared towards ensuring that your wishes regarding the distribution of your estate are clearly laid out and legally binding. This document not only outlines who will receive your assets but also appoints an executor to manage the estate's affairs. As you embark on this process, it's essential to follow the steps carefully to ensure your Will is valid and reflective of your intentions. Below is a guide to assist you in filling out the New York Last Will and Testament form.

- Gather necessary information, including the full names and addresses of your beneficiaries, the executor, and any guardians for minor children.

- Start by stating your full name and address, confirming you are of legal age and sound mind, and expressing that the document is your Last Will and Testament.

- Appoint an executor by including the name and address of the person or institution you wish to handle your estate after your death. It’s vital to choose someone you trust and ensure they're willing to take on this responsibility.

- If you have minor children, nominate a guardian for them in the event both parents are deceased, providing the guardian's full name and address.

- List your beneficiaries, specifying their relationship to you (e.g., spouse, child, friend), along with a detailed description of the assets each is to receive.

- For specific bequests (particular items or sums of money given to specific people), clearly describe the item or amount and the beneficiary's name.

- Outline the distribution of the remainder of your estate (residuary estate) after specific bequests have been made, ensuring the division is clear to avoid potential disputes.

- Include a provision for the payment of debts and taxes from your estate. This clarifies that such financial obligations should be settled before the distribution of assets.

- Sign the Will in the presence of two witnesses. New York law requires that both witnesses be present at the same time and observe you signing the Will. They must then sign the document themselves, attesting to its validity.

- Consider having the Will notarized to further affirm its authenticity, although this step is not required in New York State.

After completing these steps, ensure that the Last Will and Testament is stored in a safe but accessible place. Inform your executor and a trusted family member or friend of its location. Remember, life’s circumstances change, and so do relationships and assets. Regularly reviewing and updating your Will ensures it remains an accurate reflection of your wishes. Consider consulting with a legal professional to navigate any complexities and ensure your Will meets all legal requirements.

Crucial Points on This Form

What is a Last Will and Testament in New York?

A Last Will and Testament in New York is a legal document that allows you to specify how you want your assets to be distributed after you pass away. It lets you choose beneficiaries for your possessions, name guardians for any minor children, and appoint an executor to manage the estate through probate.

Who can create a Last Will and Testament in New York?

Any individual over the age of 18 who is of sound mind can create a Last Will and Testament in New York. Being of "sound mind" means you understand the nature of your assets, who your beneficiaries are, and the implications of creating a will.

What are the requirements for a Last Will and Testament to be valid in New York?

In New York, for a Last Will and Testament to be considered valid, it must be written and signed by the testator (the person making the will) or by another person under the testator's direction and in their presence. It must also be signed by at least two witnesses who are not beneficiaries, within 30 days of each other. Witnesses must understand that the document they are signing is intended to be the testator's will.

Can I write my own Last Will and Testament in New York, or do I need an attorney?

While it is possible to write your own Last Will and Testament in New York, consulting with an attorney is highly advised. An attorney can help ensure that the will is valid, meets all legal requirements, and truly reflects your wishes. Do-it-yourself or online forms may not account for all aspects of your situation.

What happens if I die without a Last Will and Testament in New York?

If you pass away without a Last Will and Testament in New York, your estate will be distributed according to the state's intestacy laws. This means the court will determine how your assets are divided among your closest relatives, which may not align with your personal wishes.

Can I change my Last Will and Testament once it has been created?

Yes, you can change your Last Will and Testament at any time as long as you are of sound mind. This is often done through a codicil, which is an amendment to the will. However, for significant changes, it may be more appropriate to create a new will. Any changes should comply with New York laws to ensure the document's validity.

How can I ensure that my Last Will and Testament is found after I pass away?

It's important to keep your Last Will and Testament in a safe but accessible place and to let trusted family members or the executor know where it is. Some choose to keep their will with their attorney or in a safe deposit box. Communication is key to ensuring that your will is found and your wishes are respected.

Is a Last Will and Testament enough to handle all my affairs after I pass away?

A Last Will and Testament is a key part of estate planning, but it might not cover every aspect of your affairs. Depending on your situation, you may also need to consider living trusts, powers of attorney, and healthcare directives as part of a comprehensive estate plan. Consulting with an estate planning attorney can help you understand all your options.

Common mistakes

When filling out the New York Last Will and Testament form, there are several common mistakes that individuals often make. Recognizing and avoiding these errors can help ensure that the document accurately reflects the person's wishes and complies with state laws.

Not following specific state requirements: Each state has particular laws regarding wills, and New York is no exception. Mistakes can be made if the form doesn’t comply with New York’s specific legal requirements, such as those concerning the number of witnesses.

Failing to sign the document in the presence of witnesses: The law requires that the person making the will (the testator) signs it in front of witnesses, and failing to do so can invalidate the document.

Choosing an ineligible executor: Naming someone who does not meet New York’s criteria for serving as an executor, possibly because they are a minor or have a felony conviction, is a common oversight.

Omitting a residuary clause: Failing to include this clause can create complications, leaving it up to state law to decide how any unmentioned residue of the estate should be distributed.

Incorrectly describing assets: Not being specific enough about which assets go to which beneficiaries can lead to disputes and confusion.

Not updating the will after significant life changes such as marriage, divorce, the birth of a child, or the death of a beneficiary or named executor.

Assuming a will can cover all types of property: Certain assets, like life insurance policies or joint bank accounts, are not distributed through a will.

Failing to designate guardians for minor children or dependents, an omission that leaves their future care uncertain.

Overlooking tax implications: Not considering how estate taxes will affect the distribution of assets can unintentionally burden beneficiaries.

Using ambiguous language that can lead to multiple interpretations, potentially resulting in legal battles among beneficiaries.

Avoiding these mistakes requires careful attention to detail and, often, guidance from a legal professional knowledgeable in New York estate law. Properly executed, a Last Will and Testament is a powerful tool that ensures a person’s final wishes are respected and that their loved ones are cared for in their absence.

Documents used along the form

When preparing a Last Will and Testament in New York, several other documents are often used in conjunction to ensure a comprehensive estate plan. This collection of documents provides a full scope of directives regarding an individual's preferences on personal, medical, and financial matters in the event of their incapacity or death. Employing these documents together can offer peace of mind to both the individual and their loved ones.

- Power of Attorney: This document empowers another individual to make financial decisions on the principal's behalf. It's crucial for managing financial affairs, especially if the principal becomes incapacitated.

- Health Care Proxy: A health care proxy grants another person the authority to make medical decisions if the principal is unable to do so. This ensures that medical treatment aligns with the individual's wishes.

- Living Will: This document specifies an individual's preferences regarding end-of-life medical care, including life support and other life-sustaining measures. It works in concert with a health care proxy by providing clear instructions to healthcare providers.

- Revocable Living Trust: Often used to avoid probate, a revocable living trust holds assets during an individual's lifetime and stipulates how these assets are distributed after death. The individual retains control over the trust and can make changes as needed.

- Beneficiary Designations: Forms that designate beneficiaries for specific assets, such as retirement accounts and life insurance policies. These designations supersede instructions in a will or trust for the specific assets.

- Funeral Instructions: While not legally binding in some jurisdictions, a document detailing one's wishes for their funeral arrangements can ease decision-making for grieving family members and ensure the individual's final wishes are understood and considered.

Together with a Last Will and Testament, these documents form a robust estate plan that addresses an individual's wishes comprehensively, offering clarity and guidance during difficult times. The preparation and correct execution of these documents, under New York laws, can significantly ease the administrative and emotional burdens on loved ones, ensuring that the individual's estate is managed and distributed according to their wishes.

Similar forms

- Trust Document:

This document, similar to a Last Will and Testament, outlines the management and distribution of an individual’s assets. However, unlike a will, a trust can go into effect before death, providing for the assets' management during the grantor's lifetime.

- Living Will:

Although distinct in purpose, a living will shares the personal directive aspect of a Last Will. It specifies an individual's wishes regarding medical treatment in situations where they are unable to communicate their decisions due to incapacity.

- Power of Attorney:

Like a Last Will, a power of attorney is a document that allows an individual to designate another person to make decisions on their behalf. The critical difference lies in the power of attorney's operational timing; it becomes effective while the person is alive but can be designed to cease upon death or incapacity.

- Beneficiary Designations:

Often found in life insurance policies, retirement accounts, and other financial products, beneficiary designations direct the disbursement of these assets upon the owner’s death. Like a Last Will, these designations are crucial for ensuring assets are transferred according to the individual’s wishes.

- Guardianship Designations:

These documents are essential for parents or guardians, allowing them to appoint a guardian for their minor children or dependents in the event of their death. This is similar to a Last Will and Testament which also can include provisions for the care of minors.

- Durable Financial Power of Attorney:

Much like a Last Will, this document enables an individual to appoint someone to manage their financial affairs. Although it is effective during the individual's lifetime, it is a preparation for scenarios where they might not be able to manage their affairs themselves, ensuring a continuity of financial management that a will aims to secure posthumously.

Dos and Don'ts

Creating a Last Will and Testament is a significant step in managing your estate and ensuring your wishes are honored. When completing the New York Last Will and Testament form, attention to detail and adherence to state laws is crucial. Here are seven dos and don'ts to consider:

Dos:

- Ensure the form meets New York state requirements, including the need for it to be written, signed, and witnessed as prescribed by law.

- Clearly identify your assets and specify how you want them distributed among your beneficiaries. Be as detailed as necessary to avoid any ambiguity.

- Select an executor you trust. This person will be responsible for carrying out the instructions stated in your will.

- Have the will witnessed by at least two individuals who are not beneficiaries to avoid any appearance of conflict of interest.

- Review and update your will regularly or when significant life events occur (e.g., marriage, divorce, birth of a child) to ensure it always reflects your current wishes.

- Consider consulting with an attorney to ensure your will is valid and encompasses all aspects of your estate planning.

- Keep the will in a safe location and inform your executor or a trusted individual of its whereabouts.

Don'ts:

- Don't use vague language that could be open to interpretation. Be clear and concise in your directives.

- Don't forget to date and sign the will in the presence of witnesses; failing to do so may invalidate the document.

- Avoid choosing an executor who may not have the capability or willingness to act in this role effectively.

- Don't include directives that conflict with state laws, such as assigning property in a manner that's not allowed.

- Refrain from hiding your will or keeping its location a secret, as this could complicate matters after your passing.

- Don't name a beneficiary as a witness, as this can create legal complications or potentially invalidate the gift to that beneficiary.

- Avoid neglecting to provide for minor children or dependents in your will, ensuring arrangements are in place for their care and financial support.

Misconceptions

When discussing the Last Will and Testament in the context of New York State, several misconceptions often surface. These misunderstandings can lead to confusion about the legal process, the document's execution, and its implications. Below, we clarify some of the most common misconceptions to offer a clearer perspective.

- Oral Wills are just as valid as written ones. In New York, unlike in some jurisdictions where oral wills may have legal standing under specific circumstances, a will must be in writing to be considered valid. While there are rare exceptions, such as for members of the armed forces under certain conditions, generally, for a will to be legally binding in New York, it must be a written document that meets specific statutory requirements.

- A Last Will and Testament automatically covers all assets. Not all assets are covered by a will in New York. Certain types of property, including jointly owned property, life insurance policies with designated beneficiaries, and retirement accounts, typically pass outside of a will. It is crucial to understand which assets will be distributed through the will and which will bypass it and pass directly to a named beneficiary or a co-owner.

- Holographic (handwritten) wills are not recognized in New York. This statement is partially accurate but needs clarification. While New York generally requires a will to be typed and formally witnessed to be considered valid, there are exceptions where a holographic will can be recognized, such as for members of the armed forces and for certain mariners at sea, under specific conditions. However, for the general public, relying on a handwritten will can lead to challenges in its execution and validity.

- Creating a Last Will and Testament is unnecessary if you don't have substantial assets. Many people believe that wills are only for the wealthy, which is a misconception. A will is vital for directing the distribution of whatever assets one does have, no matter how modest. Additionally, a will is crucial for appointing guardians for minor children, regardless of the parent's asset level. The absence of a will can result in the state making decisions that might not reflect the deceased's wishes.

- If I die without a Will, my assets will automatically go to the state. This is one of the most common misconceptions. While it's true that dying intestate (without a will) means the state laws dictate the distribution of your assets, this does not necessarily mean your assets will "escheat" or revert to the state. Typically, the assets are distributed to the closest relatives in a set order of succession. Only when no surviving relatives can be found might the assets escheat to the state.

Understanding these aspects of the New York Last Will and Testament can help individuals make informed decisions about their estate planning, ensuring that their wishes are honored and their loved ones are provided for according to their intentions.

Key takeaways

Filling out a Last Will and Testament form in New York is a crucial step in ensuring your wishes are honored after your passing. Here are nine key takeaways to guide you through this vital process:

Understand the requirements: In New York, the person making a will (known as the testator) must be at least 18 years old and of sound mind. This means understanding the nature of the act and knowing the extent of one's assets.

Signature essentials: The will must be signed by the testator or by another person under the testator’s direction, in their presence. This ensures the will is valid and reflects the testator’s intentions.

Witnesses matter: Two witnesses must sign the will within 30 days of each other, attesting they have witnessed the testator's signature or the testator's acknowledgment of the signature or will. Their role is crucial for the will’s validity.

Executor selection: Choosing a trustworthy executor is critical. This person will manage the estate according to the will's instructions. It’s wise to select someone who is capable and willing to take on this responsibility.

Be specific about assets: Clearly identify and describe how your assets should be distributed. Ambiguity can lead to disputes among beneficiaries, potentially resulting in long, costly legal battles.

Consider a guardian for minor children: If you have children under 18, naming a guardian is one of the most important decisions you can make, ensuring they are cared for by someone you trust in the event of your absence.

Notarization is not required: While not required, notarizing your will can add an extra layer of validity, especially against any future challenges to the document’s authenticity.

Keep it in a safe place: Once completed, store your will in a secure location, such as a fireproof safe, and ensure your executor knows where it is. Access by the right person at the right time is critical.

Review and update regularly: Life changes, such as births, deaths, marriages, or divorces, can affect your last wishes. Regularly reviewing and updating your will ensures it always reflects your current intentions.

By taking these steps, you're not just preparing a legal document; you're making sure your legacy is preserved and your loved ones are protected according to your wishes.

Create Other Last Will and Testament Forms for US States

Online Will Georgia - Individuals with pet animals can use this document to appoint caretakers, ensuring their well-being.

Free Will Template California - This document details how a person's estate will be managed, specifying beneficiaries and what assets they will inherit.

Nj Living Will - Addresses specific financial matters, such as the resolution of outstanding debts.