Blank Last Will and Testament Form for Oklahoma

When it comes to planning for the future, one of the most important steps any individual in Oklahoma can take is to create a Last Will and Testament. This critical document serves as a foundational piece of one's estate planning, ensuring that their wishes regarding the distribution of their assets, the care of their minor children, and any final personal requests are clearly stated and legally recognized. In Oklahoma, as in other states, the Last Will and Testament form is tailored to adhere to state-specific guidelines, making it vital for residents to familiarize themselves with these requirements to avoid any future legal complications. This form not only provides a platform for individuals to express their final wishes but also offers peace of mind to the person creating the will (known as the testator) and their loved ones, by laying out a clear plan that mitigates the potential for disputes and legal challenges after the testator's passing. Understanding the major aspects of this form, including the designation of an executor, the appointment of guardians for minor children, and the specifics of asset distribution, is essential for anyone looking to ensure their legacy is honored exactly as they envision.

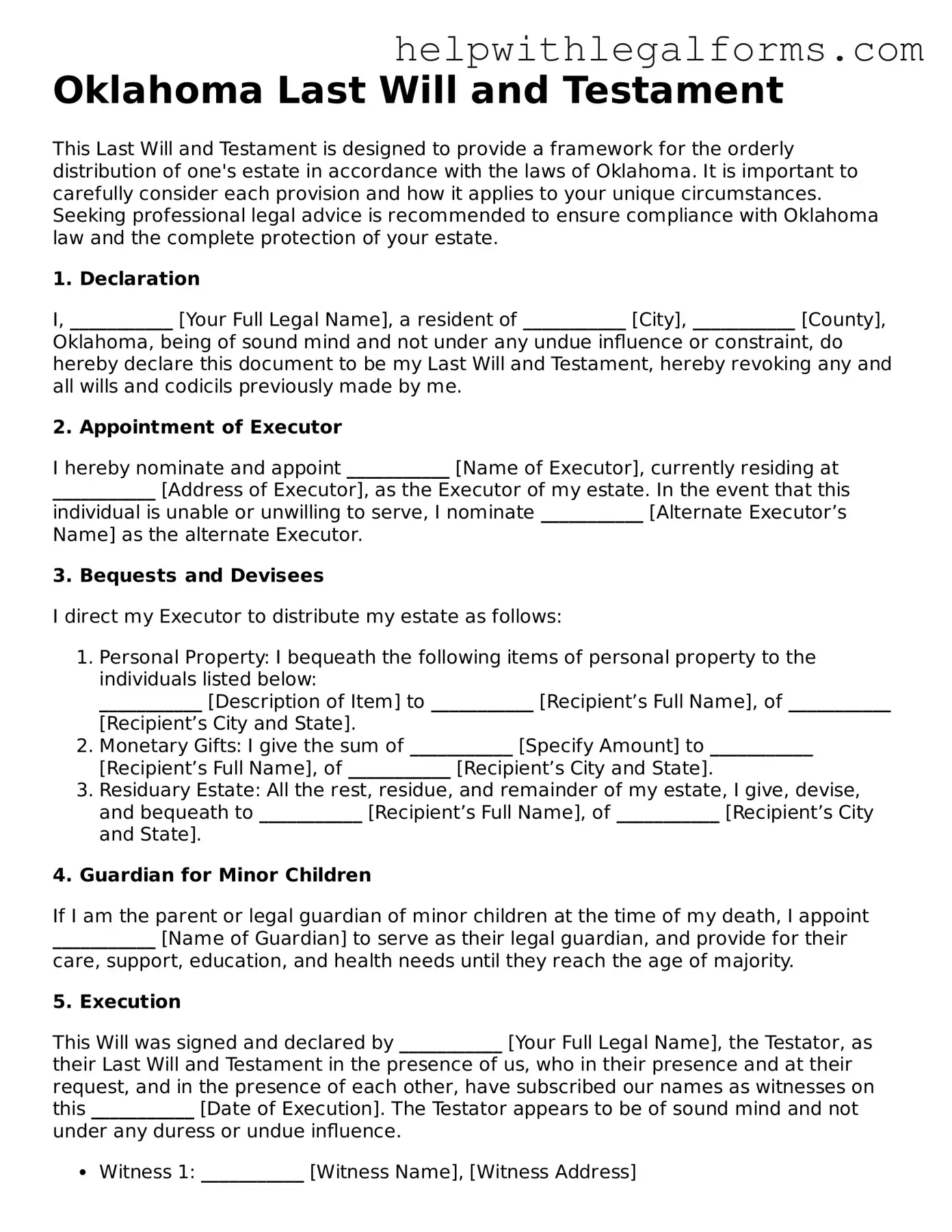

Example - Oklahoma Last Will and Testament Form

Oklahoma Last Will and Testament

This Last Will and Testament is designed to provide a framework for the orderly distribution of one's estate in accordance with the laws of Oklahoma. It is important to carefully consider each provision and how it applies to your unique circumstances. Seeking professional legal advice is recommended to ensure compliance with Oklahoma law and the complete protection of your estate.

1. Declaration

I, ___________ [Your Full Legal Name], a resident of ___________ [City], ___________ [County], Oklahoma, being of sound mind and not under any undue influence or constraint, do hereby declare this document to be my Last Will and Testament, hereby revoking any and all wills and codicils previously made by me.

2. Appointment of Executor

I hereby nominate and appoint ___________ [Name of Executor], currently residing at ___________ [Address of Executor], as the Executor of my estate. In the event that this individual is unable or unwilling to serve, I nominate ___________ [Alternate Executor’s Name] as the alternate Executor.

3. Bequests and Devisees

I direct my Executor to distribute my estate as follows:

- Personal Property: I bequeath the following items of personal property to the individuals listed below:

___________ [Description of Item] to ___________ [Recipient’s Full Name], of ___________ [Recipient’s City and State]. - Monetary Gifts: I give the sum of ___________ [Specify Amount] to ___________ [Recipient’s Full Name], of ___________ [Recipient’s City and State].

- Residuary Estate: All the rest, residue, and remainder of my estate, I give, devise, and bequeath to ___________ [Recipient’s Full Name], of ___________ [Recipient’s City and State].

4. Guardian for Minor Children

If I am the parent or legal guardian of minor children at the time of my death, I appoint ___________ [Name of Guardian] to serve as their legal guardian, and provide for their care, support, education, and health needs until they reach the age of majority.

5. Execution

This Will was signed and declared by ___________ [Your Full Legal Name], the Testator, as their Last Will and Testament in the presence of us, who in their presence and at their request, and in the presence of each other, have subscribed our names as witnesses on this ___________ [Date of Execution]. The Testator appears to be of sound mind and not under any duress or undue influence.

- Witness 1: ___________ [Witness Name], [Witness Address]

- Witness 2: ___________ [Witness Name], [Witness Address]

6. Declaration

This Last Will and Testament complies with the relevant laws of Oklahoma, specifically catering to the unique estate planning needs of its residents.

In witness hereof, I have hereunto set my hand and seal this ___________ [Day], ___________ [Month], ___________ [Year].

_________________________________________________

[Your Signature]

_________________________________________________

[Printed Name of Testator]

_________________________________________________

[Signature of Witness #1]

_________________________________________________

[Printed Name of Witness #1]

_________________________________________________

[Signature of Witness #2]

_________________________________________________

[Printed Name of Witness #2]

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Legal Document | The Oklahoma Last Will and Testament is a legal document that allows an individual to outline how their property and other assets will be distributed upon their death. |

| 2. Testator Requirements | The person creating the will, known as the testator, must be at least 18 years old and of sound mind at the time of signing. |

| 3. Witnesses | Oklahoma law requires the Last Will and Testament to be signed in the presence of at least two witnesses, who must also sign the document affirming they observed the testator’s signing. |

| 4. Witness Qualifications | Witnesses must be at least 18 years old and should not be beneficiaries in the will to avoid potential conflicts of interest. |

| 5. Self-Proving Affidavit | A self-proving affidavit is recommended in Oklahoma. It is a sworn statement by the witnesses, notarized and attached to the will, which can speed up probate because it validates the will’s signatures. |

| 6. Notarization | Notarization is not required for the will itself to be valid in Oklahoma, but it is necessary if the will is to be self-proved through an affidavit. |

| 7. Revocation | The testator may revoke or change the will at any time, provided they are of sound mind, by creating a new will or by some act of destruction with the intent to revoke. |

| 8. Holographic Wills | Oklahoma recognizes holographic (handwritten) wills as valid, provided they are written entirely in the testator's handwriting and signed by them, but they do not need to be witnessed. |

| 9. Codicils | Amendments or changes to an existing will must be made through a codicil, which follows the same legal formalities as the original will for it to be valid. |

| 10. Governing Laws | The Oklahoma Last Will and Testament is governed by Title 84 of the Oklahoma Statutes, which detail the state-specific requirements and provisions for wills and estates. |

Instructions on How to Fill Out Oklahoma Last Will and Testament

Filling out a Last Will and Testament in Oklahoma is a significant step in ensuring that your wishes regarding the distribution of your estate are honored after your passing. This document allows you to specify who will inherit your assets, nominate an executor to oversee the distribution of your estate, and, if necessary, name guardians for minor children. The process does not need to be complicated, but it requires careful attention to detail.

- Begin by gathering all necessary information, including a comprehensive list of your assets (real estate, bank accounts, personal property, etc.), the names and addresses of all beneficiaries, and details about any special bequests or distributions you want to include in your will.

- Enter your full legal name and address at the top of the form to establish your identity as the testator (the person making the will).

- Designate an executor who will be responsible for carrying out the terms of your will. Include the executor’s full name and address.

- If you have minor children, appoint a guardian for them, and provide the guardian's full name and address. It’s crucial to discuss this responsibility with the chosen guardian before listing them in your will to ensure they are willing and able to take on the role.

- Clearly specify your beneficiaries and what assets they are to receive. If you wish to leave specific items or amounts of money to certain individuals, detail these bequests clearly.

- If there are any conditions you wish to attach to these bequests, such as a beneficiary reaching a certain age, describe these conditions precisely.

- Review the will to ensure it reflects your wishes accurately. It’s essential to ensure that all the information provided is correct and there are no spelling errors, especially in names and addresses.

- Sign the will in the presence of at least two witnesses who are not beneficiaries of the will. Under Oklahoma law, these witnesses must be at least 18 years old and of sound mind. Their responsibility is to attest to your capacity to create the will and your voluntary signing of it.

- Have the witnesses sign the will as well, including their full names and addresses. This step validates the will.

- Consider having the will notarized to further authenticate it, though this is not a requirement in Oklahoma for the will to be valid.

- Keep the original will in a safe place, such as a fireproof safe or a safety deposit box, and inform your executor or a trusted family member of its location.

Completing your Last Will and Testament is an act of foresight and consideration for your loved ones. By taking these steps, you can ensure that your estate is distributed according to your wishes, and potentially simplify the legal process for your heirs. Remember, while this guide can help you fill out the form, consulting with a legal professional can provide you with tailored advice and peace of mind that your estate plan is sound.

Crucial Points on This Form

What is a Last Will and Testament form in Oklahoma?

A Last Will and Testament form in Oklahoma allows individuals to legally specify how they want their property and affairs handled after their death. It outlines who inherits assets, who will be the guardian of any minor children, and who will execute the will, ensuring that the decedent’s wishes are adhered to.

Do I need a lawyer to create a Last Will and Testament in Oklahoma?

While it's not mandatory to use a lawyer to create a Last Will and Testament in Oklahoma, consulting with a legal professional can ensure that the document accurately reflects your wishes and adheres to Oklahoma laws. This can help prevent any legal challenges after your passing.

How can I make sure my Last Will and Testament is valid in Oklahoma?

To ensure your Last Will and Testament is valid in Oklahoma, it must be in writing, you must be at least 18 years old or a legally emancipated minor, and of sound mind. Additionally, it needs to be signed by you and witnessed by at least two individuals, neither of whom are beneficiaries in the will, who are also of legal age and of sound mind.

Can I update my Last Will and Testament?

Yes, you can update your Last Will and Testament at any time. This can be done either by creating a new will or by preparing a legal addition to your existing will, known as a codicil. Both require the same formal signing and witness process as the original will to be considered valid.

What happens if I die without a Last Will and Testament in Oklahoma?

If you die without a Last Will and Testament in Oklahoma, your property will be distributed according to state intestacy laws. Typically, this means your closest relatives, such as your spouse, children, or parents, will inherit your assets. Without a will, you lose control over who receives your possessions and who is appointed guardian of your minor children.

Common mistakes

When it comes to preparing a Last Will and Testament, precision and attention to detail are paramount, especially in Oklahoma. This essential document outlines one’s final wishes regarding the distribution of assets and care of minors, making any errors potentially critical. Here are five common mistakes people make:

-

Not adhering to Oklahoma’s legal requirements: Each state has its specific mandates for what makes a will legally valid. In Oklahoma, for instance, the person making the will (testator) must be at least 18 years old and of sound mind. The will must be in writing and signed by the testator and by at least two witnesses who are present at the same time and who witnessed either the testator signing the will or the testator’s acknowledgment of the signature or of the will. Overlooking these requirements can render the will invalid.

-

Forgetting to name an executor: The executor plays a critical role in managing and distributing the testator's estate according to the will's instructions. Failure to appoint an executor means the court will decide who will fulfill this role, potentially leading to delays and additional costs.

-

Leaving out alternate beneficiaries: Life is unpredictable. The designated beneficiaries may predecease the testator. Not naming alternate beneficiaries can lead to portions of the estate defaulting to the rules of intestacy, which may not align with the testator's wishes.

-

Being vague in the distribution of assets: Vagueness in specifying who gets what can lead to disputes among heirs and beneficiaries. It’s crucial to be as clear and specific as possible when detailing the distribution of assets to avoid confusion and legal battles.

-

Failing to update the will: Major life events, such as marriage, divorce, the birth of a child, or the acquisition of significant assets, necessitate a review and, likely, a revision of one’s will. Not updating the will to reflect these changes can result in unintended distribution of assets.

Avoiding these mistakes can help ensure that a Last Will and Testament in Oklahoma accurately reflects one's wishes and is legally binding. Consulting with a legal professional can provide additional assurance that the document adheres to all state requirements and best practices.

Documents used along the form

Creating a Last Will and Testament is a significant step toward ensuring one's final wishes are honored. In Oklahoma, as in other states, this essential document is only a part of a comprehensive estate plan. Several other forms and documents often accompany an Oklahoma Last Will and Testament, each serving a unique purpose to provide a complete legal framework to protect the individual's interests both before and after their passing. Understanding these additional documents is crucial for a well-rounded estate plan.

- Durable Power of Attorney: This legal document grants another person the authority to make financial decisions on behalf of the individual, should they become unable to do so themselves. It becomes effective immediately upon signing and continues to be effective even if the individual becomes mentally incapacitated.

- Health Care Proxy (Medical Power of Attorney): Similarly to a Durable Power of Attorney for financial decisions, a Health Care Proxy grants another person the authority to make medical decisions for the individual if they are not in a state to make those decisions themselves. This is crucial for ensuring that one's health care preferences are followed.

- Living Will: Sometimes known as an advance directive, a Living Will outlines an individual's wishes regarding end-of-life care. It is used to inform family members and healthcare providers of preferences in situations where the individual cannot communicate their wishes due to incapacity.

- Transfer on Death Deed: This document allows individuals to name beneficiaries to receive real property upon their death, bypassing the often lengthy and complicated probate process. In Oklahoma, this is a useful tool for streamlining the transfer of real estate to heirs.

Alongside a Last Will and Testament, these documents collectively ensure that an individual's financial, health, and personal preferences are respected and upheld in a variety of scenarios. It's important for everyone to consider these forms as part of their estate planning process to achieve peace of mind and provide clear instructions for their loved ones. Consulting with a knowledgeable estate planning attorney can provide guidance tailored to individual circumstances, ensuring a comprehensive and effective estate plan.

Similar forms

Living Will: A Living Will, much like a Last Will and Testament, is a legal document that outlines an individual's preferences regarding their medical care in situations where they are unable to communicate their decisions due to incapacity or illness. While a Last Will and Testament deals with the distribution of an individual's assets after death, a Living Will focuses on healthcare decisions during their lifetime.

Trust: A Trust is a legal arrangement where one party, known as the trustee, holds and manages assets on behalf of another party, the beneficiary. Similar to a Last Will and Testament, which specifies how assets should be distributed after death, a Trust can provide detailed instructions for managing and distributing assets both during and after the Trust maker's lifetime. Unlike a Last Will and Testament, a Trust can offer the advantage of avoiding probate.

Financial Power of Attorney: This document grants an appointed person or entity the authority to make financial decisions on behalf of the individual creating the document, known as the principal. It is similar to a Last Will and Testament in that it involves planning for the future handling of an individual’s assets. However, the authority granted by a Financial Power of Attorney is effective during the individual's lifetime, unlike a Last Will that comes into effect after death.

Advance Healthcare Directive: An Advance Healthcare Directive, like a Living Will, allows an individual to outline their preferences for medical care in advance. This document is similar to a Last Will and Testament as it is a preparatory step, ensuring that an individual's wishes are known and respected in case they are unable to articulate them due to a medical condition.

Beneficiary Designations: Often associated with specific assets like life insurance policies, retirement accounts, and some financial accounts, Beneficiary Designations directly name who will inherit these assets upon the account or policy holder's death. Similar to a Last Will and Testament, which outlines a person's wishes for asset distribution after death, Beneficiary Designations provide a direct way to pass on certain assets outside of the will, often avoiding the probate process.

Dos and Don'ts

Creating a Last Will and Testament is a significant step in planning for the future. It is a document that outlines how you wish your assets to be distributed after your passing. In Oklahoma, as in other states, specific requirements exist that you should be aware of to ensure your will is legally binding. Below are some critical do's and don'ts to consider when filling out an Oklahoma Last Will and Testament form.

- Do ensure that you fully meet Oklahoma's legal requirements, including being of sound mind and at least 18 years of age or a legally emancipated minor.

- Do have the document witnessed as required by Oklahoma law, which typically means having two disinterested parties present who do not stand to inherit from the will.

- Do consider having your Last Will and Testament notarized. While not a requirement in Oklahoma, it can help validate the document's authenticity and speed up the probate process.

- Do select an executor you trust. This individual will oversee the distribution of your assets and handle your estate's affairs following your guidelines.

- Do provide clear instructions on how you wish your assets to be distributed, including specifics on property, monetary assets, and personal belongings.

- Don't overlook the importance of specifying a guardian for your minor children or dependents, ensuring they are cared for by someone you trust in your absence.

- Don't leave any sections blank. If a section does not apply to your situation, make sure you write "N/A" (not applicable) to confirm you didn't overlook it.

- Don't forget to sign and date the document in the presence of your witnesses, making the will legally binding.

- Don't fail to regularly review and update your Last Will and Testament. Life changes such as marriage, divorce, the birth of a child, or asset acquisition should prompt a review to ensure your will reflects your current wishes.

Taking the time to correctly prepare your Last Will and Testament can significantly ease the burden on your loved ones during a difficult time. While the process requires attention to detail and a thorough understanding of your assets and how you wish them to be distributed, following these guidelines can help ensure that your final wishes are honored.

Misconceptions

When it comes to understanding the Oklahoma Last Will and Testament form, several misconceptions can lead to confusion. Addressing these inaccuracies is vital for clarity and ensuring individuals' wishes are honored accurately after their passing.

Only the Wealthy Need a Will: A common misconception is that only individuals with significant assets need a will. In reality, a will is crucial for anyone who wishes to dictate how their possessions, regardless of value, should be distributed and who should care for minor children.

Wills Avoid Probate: Many believe that having a will means an estate won’t go through probate. However, a will must go through probate to validate its authenticity and ensure the estate is distributed according to the decedent's wishes.

A Will Overrides All: Some think a will can override named beneficiaries in financial accounts or insurance policies. Beneficiary designations usually take precedence over wills, making it imperative to keep these designations updated.

Oral Wills are Just as Valid: In Oklahoma, the belief that an oral will is just as valid as a written one is mistaken. For a will to be legally binding, it generally must be written and meet specific criteria, including witness signatures.

My Spouse Will Automatically Inherit Everything: Without a will, it’s often assumed that a surviving spouse will inherit the entire estate. State laws may dictate otherwise, especially if there are children from outside the marriage or other close relatives.

Wills are Final: Another misconception is that once a will is made, it cannot be changed. Wills can and should be updated in accordance with life changes, such as marriage, divorce, the birth of children, or significant changes in financial status.

You Don’t Need a Lawyer to Create a Will: While it’s true you can write a will without legal assistance, consulting a lawyer ensures that the will complies with state laws and fully addresses complex situations or assets, potentially avoiding future disputes.

A Will Covers Funeral Instructions: Lastly, many believe wills are the place to leave instructions for one's funeral. Since wills are often read after funeral arrangements need to be made, it’s advisable to communicate these wishes separately to ensure they are known.

Dispelling these misconceptions about the Oklahoma Last Will and Testament form is essential for proper estate planning and ensuring that an individual's final wishes are accurately understood and executed.

Key takeaways

When it comes to preparing for the future, drafting a Last Will and Testament is a fundamental step in ensuring your wishes are honored. For those residing in Oklahoma, understanding how to properly fill out and use the form is crucial. Here are key takeaways to guide you through this important process:

- Compliance with Oklahoma Laws: It’s essential that the Oklahoma Last Will and Testament form complies with the state's legal requirements. This includes being of sound mind and at least 18 years old, or an emancipated minor, at the time of drafting the document. Additionally, it must be signed by the person creating the will (testator) and witnessed by at least two individuals who are not beneficiaries in the will.

- Clarity is Key: When filling out the form, clarity in expressing your wishes cannot be overstated. Clearly identifying your assets, beneficiaries, and any specific instructions will help in preventing disputes and ensuring your wishes are executed as intended. Ambiguities in a will can lead to unnecessary legal disputes that can significantly delay the distribution of your assets.

- Selection of an Executor: Choosing the right executor is a pivotal decision in the will-making process. The executor is responsible for administering your estate according to the will’s instructions. This role requires a trustworthy, competent, and preferably, a financially savvy individual who can navigate through legal and financial responsibilities effectively.

- Safekeeping and Accessibility: After creating your Last Will and Testament, finding a secure yet accessible location for it is vital. You must ensure that the designated executor knows where the will is stored. Banks, safe deposit boxes, or with a trusted attorney are common places to store important documents like your will. Just as important is to avoid locations where access could be delayed upon your death.

Taking the time to prepare your Oklahoma Last Will and Testament with care and in accordance with state laws will pay dividends in peace of mind for you and your loved ones. Ensuring your assets and personal matters are handled as you wish is not only a responsibility but a final gift to those you care about.

Create Other Last Will and Testament Forms for US States

Maryland Last Will and Testament Pdf - It's a foundational part of estate planning, along with documents like power of attorney and advance healthcare directives.

Online Will Georgia - A Last Will and Testament form allows an individual to specify how their property and assets should be distributed after their death.

Executor of Estate Form - Decreases the likelihood of legal costs and delays in distributing your assets.

Free Will Template California - It offers peace of mind, knowing that personal and financial matters will be handled according to one's desires after passing.