Blank Last Will and Testament Form for Texas

In Texas, the Last Will and Testament form serves as a crucial document for individuals looking to ensure their assets and belongings are distributed according to their wishes upon their passing. This form, fundamental to estate planning, allows one to designate beneficiaries for their property, appoint guardians for minor children, and even specify last wishes for their funeral arrangements. Understanding the requirements and the legal framework that governs the creation and validation of a will in Texas is indispensable. It includes specific criteria regarding the age and mental capacity of the testator (the person creating the will), the need for witnesses, and the necessity of the document being in writing. While the process may seem daunting at first, grasping its significance can greatly alleviate potential stress for one's family and loved ones, ensuring a smoother transition during what is often a difficult time. Properly executed, a Last Will and Testament in Texas stands as a powerful tool to protect one's legacy and to provide peace of mind, knowing that personal wishes will be honored and loved ones cared for in the manner one chooses.

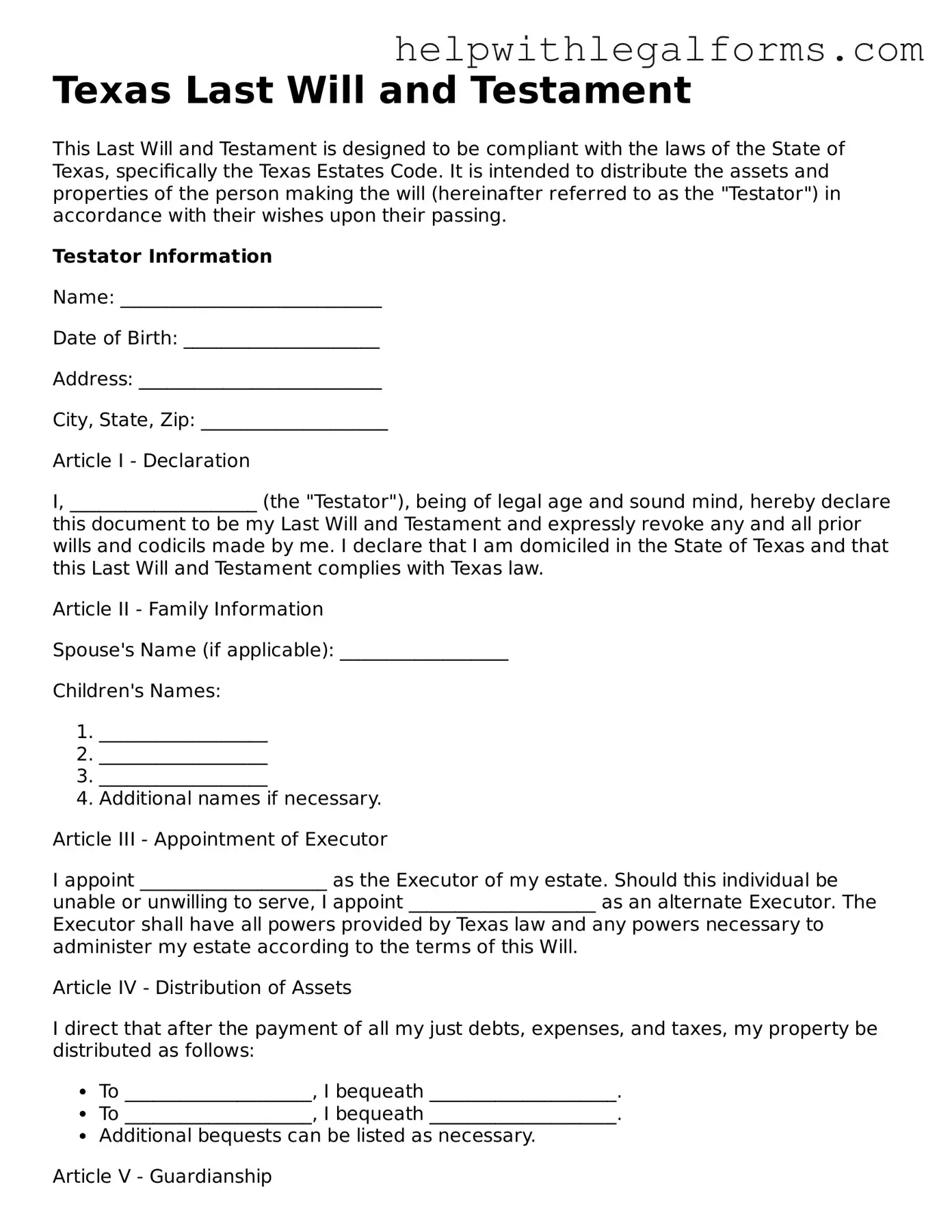

Example - Texas Last Will and Testament Form

Texas Last Will and Testament

This Last Will and Testament is designed to be compliant with the laws of the State of Texas, specifically the Texas Estates Code. It is intended to distribute the assets and properties of the person making the will (hereinafter referred to as the "Testator") in accordance with their wishes upon their passing.

Testator Information

Name: ____________________________

Date of Birth: _____________________

Address: __________________________

City, State, Zip: ____________________

Article I - Declaration

I, ____________________ (the "Testator"), being of legal age and sound mind, hereby declare this document to be my Last Will and Testament and expressly revoke any and all prior wills and codicils made by me. I declare that I am domiciled in the State of Texas and that this Last Will and Testament complies with Texas law.

Article II - Family Information

Spouse's Name (if applicable): __________________

Children's Names:

- __________________

- __________________

- __________________

- Additional names if necessary.

Article III - Appointment of Executor

I appoint ____________________ as the Executor of my estate. Should this individual be unable or unwilling to serve, I appoint ____________________ as an alternate Executor. The Executor shall have all powers provided by Texas law and any powers necessary to administer my estate according to the terms of this Will.

Article IV - Distribution of Assets

I direct that after the payment of all my just debts, expenses, and taxes, my property be distributed as follows:

- To ____________________, I bequeath ____________________.

- To ____________________, I bequeath ____________________.

- Additional bequests can be listed as necessary.

Article V - Guardianship

If I am the parent or legal guardian of minor children at the time of my death, I appoint ____________________ as the guardian of said children. If this person is unable or unwilling to serve, I appoint ____________________ as an alternate guardian.

Article VI - Signatures

This Will was executed on the ______ day of ____________, 20____, at ____________________, Texas. I sign my name to this Last Will and Testament, in the presence of the persons witnessing at my request, who also sign their names as witnesses.

Testator's Signature: ____________________________

Witness #1 Signature: ___________________________

Witness #1 Name: _______________________________

Witness #1 Address: _____________________________

Witness #2 Signature: ___________________________

Witness #2 Name: _______________________________

Witness #2 Address: _____________________________

Notarization

This document was acknowledged before me on ________ (date) by ____________________ (name of Testator), as the Testator's Last Will and Testament.

Notary Public's Signature: ________________________

Notary Public's Name (printed): ___________________

Commission Expiration: __________________________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Governing Law | Texas Estates Code |

| Age Requirement | 18 years or older, or legally married, or a member of the armed forces |

| Witness Requirement | Must be signed by at least two credible witnesses over the age of 14 |

| Self-Proving Affidavit | Optional, but recommended to expedite the probate process |

Instructions on How to Fill Out Texas Last Will and Testament

Completing a Last Will and Testament in Texas is a critical step for ensuring that a person's wishes are respected and fulfilled after they pass away. It permits individuals to dictate how their possessions, including property and other assets, should be distributed. This process contributes to the minimization of disputes among surviving relatives and expedites the legal procedures following a person's death. The steps below guide individuals through filling out the form correctly to ensure that their final wishes are accurately recorded and legally recognized.

- Begin by clearly printing your full legal name and physical address, including city, county, and state, to establish your identity as the testator (the person creating the will).

- Next, if applicable, specify your marital status and the name of your spouse. This information helps in clarifying the distribution of assets if any marital provisions are required.

- Appoint an executor, the person you trust to carry out the instructions of your will. Include their full name and address. It's advisable to also name an alternate executor in case the primary executor is unable to fulfill their duties.

- Detail how you wish your assets to be distributed. Specify the recipient's full name, relationship to you, and the exact details of what you are bequeathing to them. If you are leaving assets to minor children, consider appointing a guardian to manage those assets until the children reach legal age.

- If you have minor children, name a guardian for them in your will. Provide the full name of the guardian and an alternate guardian, ensuring your children will be cared for by someone you trust in your absence.

- Include any specific instructions for your burial or memorial service. This might include location, type of service, or other personal preferences.

- Review the will carefully, ensuring all information is correct and reflects your wishes accurately. Any mistakes could lead to challenges or issues in executing your will.

- Sign the will in front of two witnesses, who are not beneficiaries in the will. Under Texas law, the witnesses must be at least 14 years old. Have the witnesses sign the will in your presence and in the presence of each other.

- In the presence of a notary public, you and your witnesses should formalize the document by signing a self-proving affidavit. This step is not mandatory but highly recommended as it simplifies the probate process.

Upon completion, store the will in a safe but accessible place and inform the executor, or at least a trusted individual, of its location. Regularly reviewing and potentially updating the will is wise, especially after major life events such as marriage, divorce, the birth of a child, or significant changes in assets. This ensures that the document remains relevant and reflects current wishes and circumstances.

Crucial Points on This Form

What is a Texas Last Will and Testament form?

A Texas Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets and the care of any minor children after they pass away. In Texas, this document must meet specific legal requirements to be considered valid, including being signed by the person making the will (known as the testator) and witnessed by at least two individuals who are not beneficiaries.

Who can create a Texas Last Will and Testament?

Any person 18 years of age or older and of sound mind can create a Last Will and Testament in Texas. Being of "sound mind" generally means that the person understands the nature of the will, knows the nature and extent of their property, and recognizes the natural beneficiaries of their estate.

Does a Texas Last Will need to be notarized?

No, a Texas Last Will and Testament does not need to be notarized to be legally valid. However, it's highly recommended to include a "self-proving" affidavit with the will, which does require notarization. This affidavit can speed up the probate process because it serves as evidence that the will was signed in compliance with Texas law.

What happens if someone dies without a Last Will in Texas?

If someone dies without a Last Will in Texas, their estate will be distributed according to the state's intestacy laws. This means the state decides how their assets are distributed, typically to the closest surviving relatives. The specific division depends on the family situation of the deceased at the time of death, such as whether they were married, had children, or had surviving parents or siblings.

Can a Texas Last Will be changed or revoked?

Yes, a person can change or revoke their Texas Last Will at any time as long as they are of sound mind. This can be done by creating a new will that states previous wills are revoked or by physically destroying the previous version. However, if a new will is made, it must also comply with Texas legal requirements to be considered valid.

How can someone ensure their Texas Last Will is legally binding?

To ensure a Texas Last Will is legally binding, it must be written (handwritten or typed), signed by the testator, and witnessed by at least two individuals over the age of 14 who are not beneficiaries of the will. Including a self-proving affidavit, though not required, can also help confirm the will's validity during probate. It is also wise to seek legal advice when drafting a will to make sure all legal requirements are met and the document reflects the testator's wishes accurately.

Common mistakes

Creating a Last Will and Testament is a critical step in ensuring one's wishes are honored after passing. However, when completing a Last Will and Testament form in Texas, individuals often make mistakes that can potentially complicate the execution of their wishes. Here are ten common errors to avoid:

Failing to comply with Texas legal requirements: For a Will to be valid in Texas, it must meet specific legal standards, such as being signed by the testator and witnessed by at least two individuals over the age of 14 who are not beneficiaries.

Omitting a residuary clause: This oversight can lead to parts of the estate not being distributed according to the deceased’s wishes if all assets are not specifically accounted for in the Will.

Not updating the Will after major life changes: Significant life events, such as marriage, divorce, birth of a child, or acquisition of substantial assets, necessitate revisions to ensure the Will reflects current wishes and circumstances.

Choosing an unsuitable executor: An executor with a conflict of interest, or who lacks the organizational skills or time to manage an estate, can hinder the smooth execution of a Will.

Leaving ambiguous instructions: Vague or unclear directives in the Will can lead to disputes among beneficiaries, potentially resulting in litigation that can deplete estate assets.

Skipping details on the distribution of personal items: Sentimental belongings or items of modest monetary value can still lead to disagreements if not clearly addressed in the Will.

Failing to designate guardians for minor children: Without this essential step, the court will decide who cares for minor children, which might not align with the deceased’s preferences.

Overlooking digital assets: In today’s digital age, failing to consider how online accounts and digital properties should be handled can leave significant assets unaddressed.

Not considering tax implications: Without proper planning, the estate and its beneficiaries could face unnecessary tax burdens.

Attempting to dispose of property jointly owned with rights of survivorship: Such attempts are ineffective because the surviving owner automatically inherits the deceased’s share of the property, outside the Will.

Avoiding these mistakes requires careful planning and, often, consultation with legal professionals familiar with Texas estate law. By doing so, individuals can create a solid Last Will and Testament that clearly expresses their wishes and helps ensure a smoother transition for their loved ones.

Documents used along the form

When preparing a Last Will and Testament in Texas, it's crucial to consider additional documents that ensure a comprehensive estate plan. These documents can provide clarity on your wishes regarding medical decisions, asset distribution, and the care of dependents, further safeguarding your intentions and providing peace of mind for both you and your loved ones.

- Durable Power of Attorney: This legal document allows you to appoint someone to manage your financial affairs if you become incapacitated. Whether it's handling your banking transactions, managing real estate, or addressing tax issues, this appointee can make decisions on your behalf, ensuring that your financial responsibilities are taken care of.

- Medical Power of Attorney: Similar to a Durable Power of Attorney, but for healthcare. This grants a trusted person the authority to make medical decisions for you if you're unable to do so yourself, ensuring that your healthcare wishes are respected and followed.

- Living Will (also known as an Advance Directive): This document specifies your wishes regarding life-sustaining treatment if you're incapacitated and facing a terminal condition. It guides your healthcare providers and loved ones in making difficult medical decisions based on your preferences.

- Declaration of Guardian: Should you become incapacitated, this document specifies who you would like to act as your guardian, making it an essential component of planning for the unexpected. It can cover guardianship for both yourself and your minor children, if applicable.

- Revocable Living Trust: A trust allows you to maintain control over your assets while you're alive and dictates how they should be handled after your death. A revocable living trust can help your estate avoid probate, potentially saving time and money, as well as maintaining privacy regarding the details of your estate.

- Directive to Physicians and Family or Surrogates: This is another form of living will specific to Texas, affirming your wishes regarding the use of medical treatments that can delay the moment of death. It makes your desires clear in situations where you are diagnosed with a terminal or irreversible condition.

Together with a Last Will and Testament, these documents form a robust estate plan that comprehensively covers various aspects of your life and afterlife. Each document plays a pivotal role in ensuring your wishes are understood and honored, offering you and your loved ones a sense of security and clarity during challenging times.

Similar forms

Living Will: A living will, much like a Last Will and Testament, is a legal document that spells out a person's wishes regarding medical treatments and life-sustaining measures should they become incapable of communicating their decisions due to illness or incapacitation. While a Last Will deals with the distribution of assets after death, a Living Will takes effect while the individual is still alive but unable to express their wishes, guiding healthcare professionals and family members.

Trust: Similar to a Last Will and Testament which outlines how a person's assets should be distributed upon their death, a Trust is a legal entity created to hold assets for the benefit of certain persons or entities. The significant difference is that a Trust allows for the distribution of assets during the grantor's lifetime, upon death, or after death, thus offering a more flexible approach to asset management and distribution without necessarily going through probate, which is a legal process that wills typically undergo.

Power of Attorney: This legal document shares a significant similarity with a Last Will and Testament in that it allows an individual to designate another person (known as the attorney-in-fact or agent) to make decisions on their behalf. While a Last Will and Testament activates upon death, a Power of Attorney can take effect while the individual is still alive, granting an agent the authority to manage financial, legal, or health-related decisions, depending on the document's specifics.

Beneficiary Designations: Typically found in accounts such as IRAs, retirement plans, and life insurance policies, beneficiary designations operate on a similar principle to a Last Will and Testament by directing where and to whom assets will go after death. Unlike a will, however, beneficiary designations are specific to certain accounts or policies and can supersede a will's instructions for those assets, providing a direct transfer mechanism to the named beneficiaries outside of the probate process.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it is crucial to approach it thoughtfully and accurately. The document will dictate how your assets are distributed and managed after your passing, ensuring your wishes are respected and legally upheld. Below, you'll find guidelines on what you should and shouldn't do when completing this form.

Things You Should Do:

- Review the form carefully to ensure you understand each section before you begin writing.

- Be clear and precise in your language to avoid any ambiguity about your intentions.

- Include a complete inventory of your assets and specify exactly who will inherit each asset.

- Choose an executor you trust to administer your estate according to your wishes.

- Have the form witnessed as required by Texas law, typically needing two witnesses who are not beneficiaries.

- Consult with a lawyer if you have a complex estate or specific legal questions to ensure your will is valid and enforceable.

- Keep the will in a safe place and inform your executor where it can be found.

Things You Shouldn't Do:

- Don't leave any sections incomplete, as this could lead to confusion or misinterpretation of your intentions.

- Don't use vague terms when identifying beneficiaries or assets, which could lead to disputes among heirs.

- Don't forget to sign and date the document in accordance with Texas law to ensure its validity.

- Don't fail to update your will after significant life events, such as marriage, divorce, the birth of a child, or acquiring new assets.

- Don't attempt to include conditions on bequests that are illegal or impossible to fulfill.

- Don't write instructions in your will that contradict current Texas law, as this could render parts or all of your will invalid.

- Don't neglect the impact of taxes and debts on your estate and how they should be handled after your passing.

Misconceptions

There are several common misconceptions about the Texas Last Will and Testament form. Understanding these can help individuals navigate estate planning more effectively, ensuring their wishes are honored and their loved ones are provided for according to their intentions. Here’s a clear breakdown of these misconceptions:

- It needs to be notarized to be valid. Many people believe that for a Last Will and Testament to be valid in Texas, it must be notarized. However, Texas law requires only that it be signed by the person making the will (the testator) in the presence of two credible witnesses, who must also sign the will. Notarization is not a legal requirement for the validity of the will itself, though a notarized Self-Proving Affidavit can simplify the probate process.

- A lawyer must prepare it. While having a lawyer prepare your will can ensure that all legal requirements are met and your estate is planned according to your wishes, it is not legally necessary to have a lawyer draft your will. Individuals can prepare their own will, using statutory will forms or guidance, but should be mindful to ensure that it complies with Texas law to be valid.

- Verbal wills are just as valid as written ones. This is not entirely true. Texas recognizes oral (nuncupative) wills only under very specific circumstances, such as during the testator's last illness or in active military service, and they have many limitations. For most people, a written and properly witnessed will is necessary to have their final wishes honored.

- All assets will be distributed according to the will. Some assets are not distributed through a will. These include life insurance proceeds, retirement accounts, and any other assets that have a designated beneficiary. Additionally, property held in joint tenancy will pass automatically to the surviving joint tenant(s), not according to the will's terms.

- If I die without a will, the state takes everything. If a person dies intestate (without a will), Texas has laws that determine how their assets are distributed. These laws provide a hierarchy of heirs, such as the spouse and children, who will inherit the property. The state will take the property only if there are no qualifying heirs, which is very rare.

- A Last Will and Testament can eliminate all estate taxes. While proper estate planning, including the use of a Last Will and Testament, can help reduce estate taxes, it cannot eliminate them entirely. The effect of a will on estate taxes depends on the size of the estate, the types of assets involved, and current tax laws. It is important to seek professional advice for tax planning as part of estate planning.

Dispelling these misconceptions can empower individuals to better prepare their Last Will and Testament, reflecting their wishes accurately and making the process much smoother for their heirs. Estate planning is an important step for everyone, and understanding the facts about it can make all the difference.

Key takeaways

When preparing a Texas Last Will and Testament, understanding the process and its significance is crucial for ensuring your wishes are carried out after your passing. Here are several key takeaways to consider:

- The Last Will and Testament must be written by an individual who is 18 years of age or older and of sound mind.

- This document allows you to designate an executor, who will manage the estate, pay debts, and distribute your property as you have directed.

- It's important to clearly identify your beneficiaries and be specific about the assets each will receive to prevent any potential disputes.

- Having the Last Will and Testament signed in the presence of at least two witnesses, who are not beneficiaries, is a legal requirement in Texas to ensure the document's validity.

- Regularly updating your will is recommended, especially after significant life events such as marriage, divorce, the birth of a child, or the acquisition of significant assets.

- For individuals with minor children, the will can also be used to appoint a guardian for those children in the unfortunate event both parents are deceased.

- Upon death, the will must be submitted to a Texas probate court to begin the process of estate administration.

In taking the time to properly complete a Texas Last Will and Testament, you not only protect your assets but also provide clear instructions and peace of mind for your loved ones. It's advisable to consult with a legal professional to ensure your will complies with Texas law and fully captures your wishes.

Create Other Last Will and Testament Forms for US States

Nj Living Will - A document to specify how your assets should be distributed after your passing.

Free Last Will and Testament Forms - By specifying a durable power of attorney within the will, individuals can ensure their affairs are managed if they become incapacitated before death.

Last Will and Testamont - If charitable giving is important, this document enables individuals to contribute to causes they care about even after their death.