Legal Rental Application Form

Embarking on the journey to rent a property can often be filled with excitement and anticipation, yet it comes with its fair share of paperwork and procedures that are crucial to securing a place that meets one’s needs and expectations. At the heart of this process lies the Rental Application form, a document that plays a pivotal role in bridging potential renters with their prospective landlords. This form not only allows the landlord to assess the eligibility of an applicant based on financial stability, rental history, and background checks, but it also provides a structured platform for applicants to present themselves in the best possible light. Given its importance, understanding the major aspects of the Rental Application form, including the personal information it gathers, the details it requires about financial status, employment, rental history, and the consent it seeks for various checks, is essential for both parties involved in the rental agreement. This mutual exchange of information ensures a level of transparency and trust that lays the foundation for a successful landlord-tenant relationship.

State-specific Rental Application Forms

Example - Rental Application Form

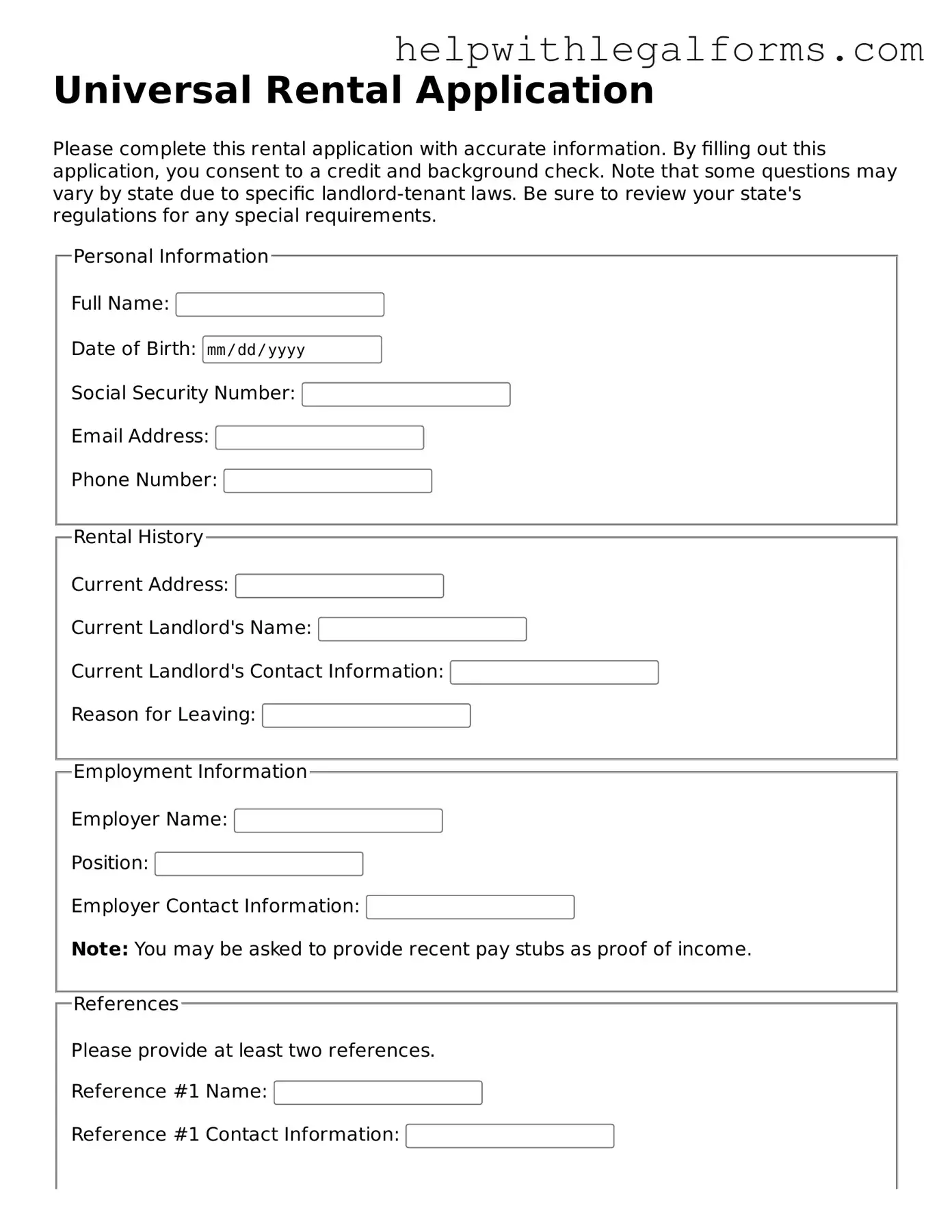

Universal Rental Application

Please complete this rental application with accurate information. By filling out this application, you consent to a credit and background check. Note that some questions may vary by state due to specific landlord-tenant laws. Be sure to review your state's regulations for any special requirements.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Rental Application Form is a document filled out by a prospective tenant, which landlords use to assess their suitability for a rental property. |

| Components | Typically includes information on the applicant's employment, income, credit history, and rental history. |

| Processing Fee | Many landlords charge a non-refundable fee to cover the costs of processing the application and running background checks. |

| Background Checks | Landlords often use the information provided to conduct credit and criminal background checks. |

| References | Applicants may be required to provide references from previous landlords or employers. |

| Co-signer Information | If an applicant's rental history or credit does not meet the landlord's requirements, they may ask for a co-signer on the lease. |

| Governing Law | Rental application processes are governed by state law, which can vary widely across the United States. |

| Privacy Concerns | Applicants often provide sensitive personal information, so landlords must handle this data responsibly to protect privacy. |

| State-Specific Forms | Some states require specific forms or clauses to be included in the application, addressing local tenant rights and rental regulations. |

Instructions on How to Fill Out Rental Application

Once you've found the perfect rental, the next step is to make a strong impression on the landlord with a well-filled rental application form. This form is crucial in showcasing your reliability and readiness to become a trustworthy tenant. It involves sharing personal, financial, and previous rental history details that help the landlord make an informed decision. The process may seem daunting, but by following these clear, step-by-step instructions, you can complete the application accurately and effectively, moving one step closer to securing your new home.

- Gather all necessary documents. This includes your identification (such as a driver's license or passport), pay stubs or bank statements to verify income, and contact information for references.

- Begin by entering your full legal name, date of birth, and current address at the top of the form to identify yourself properly.

- Detail your employment history. Provide the name of your employer, job title, supervisor's contact information, and your salary. If self-employed, provide evidence of income.

- Next, list your previous addresses for the past two to three years, including the landlord's name and contact information. This helps the landlord verify your rental history.

- Include the names of all additional occupants who will live in the rental unit, specifying their relationship to you.

- Answer questions related to your credit history, if applicable. You may need to authorize a credit check by signing a consent section.

- Provide your emergency contact information, including the name, relationship, and contact details of someone who can be reached in urgent situations.

- Read through the terms and conditions carefully. Pay close attention to clauses about deposits, pet policies, and other regulations that could affect your tenancy.

- Sign and date the application to verify that all the information you provided is accurate and true. An electronic or handwritten signature may be required, depending on the submission method.

- Submit the completed application, along with the necessary documents (e.g., proof of income, photo ID) and application fee if required, to the landlord or property manager.

After submitting the application, it's time to wait for the landlord's response. They might take a few days to conduct background and credit checks. During this time, stay available to answer any questions they might have. Your patience and preparation can make a strong impression, raising your chances of being accepted as a tenant. Remember, a detailed and honest application is your best approach to securing that rental. Good luck!

Crucial Points on This Form

What information do I need to provide in a Rental Application form?

In a Rental Application form, you are typically required to provide personal information including your full name, current address, phone number, email, rental history, employment information, income level, and references. Additional details may include your Social Security Number for a credit check, driver's license number, and sometimes information about pets or vehicles.

Is there a fee to submit a Rental Application form?

Yes, in many cases, landlords or property management companies charge a non-refundable fee to submit a Rental Application form. This fee covers the cost of processing the application and conducting background and credit checks. The amount of the fee can vary, so it's important to ask about this cost upfront.

How does the landlord use the information from my Rental Application form?

Landlords use the information from your Rental Application to assess your qualifications as a tenant. They will typically conduct a background check, credit check, and verify your employment and rental history. This process helps them determine if you are likely to be a reliable tenant who will pay rent on time and take good care of the property.

Can a landlord deny my application based on the information I provide?

Yes, a landlord can deny your application based on the information you provide if they have legitimate concerns about your ability to meet the obligations of the lease. Common reasons for denial include poor credit history, insufficient income, negative rental history, or a criminal background. However, it is important to note that landlords must comply with fair housing laws and cannot discriminate based on race, color, national origin, religion, sex, familial status, or disability.

What should I do if my Rental Application is denied?

If your Rental Application is denied, it’s important to ask the landlord or property manager for the specific reasons for the denial. If the denial is due to inaccurate information in a credit or background report, you have the right to correct this information and request that the application be reconsidered. If you believe you have been wrongly denied or discriminated against, you may contact a local fair housing advocate or seek legal advice to explore your options.

Common mistakes

When applying for a rental property, the application form is your first impression on a landlord or property management company. An accurate and well-prepared application can significantly improve your chances of securing the rental. Unfortunately, many people hastily fill out these forms, making common mistakes that can negatively impact their application's success. Below are eight common errors to avoid:

-

Not reading the application instructions carefully. Each application has its specific requirements and failing to follow them can lead to an immediate rejection.

-

Leaving sections incomplete. An application form should be completed in its entirety to provide landlords with a full picture of your suitability as a tenant.

-

Providing inaccurate information. Whether it’s your rental history, income details, or personal references, inaccuracies can be easily spotted and can disqualify you.

-

Failing to include necessary documentation. Most applications require additional documentation like proof of income or a copy of your ID. Missing documents can delay or derail your application.

-

Not checking your credit report before applying. Your credit score significantly affects your application. Knowing your score can help you address any issues beforehand.

-

Underestimating the importance of references. Landlords often contact references, so it’s crucial to ensure they depict you positively and are aware they might be contacted.

-

Ignoring the need to make a good impression. Beyond the paperwork, interactions with landlords or their representatives matter. Timeliness, politeness, and preparedness can positively influence their decision.

-

Forgetting to follow up. A polite follow-up can show your genuine interest in the property and keep your application top of mind.

To avoid these mistakes, take your time with your rental application. Double-check your information, prepare the required documents ahead of time, and ensure all sections are meticulously completed. Additionally, treat interactions with the rental agency or landlord as part of the application process. A carefully filled-out application, combined with a respectful and proactive approach, can significantly increase your chances of securing the rental property you desire.

Documents used along the form

When individuals embark on the journey to secure a rental property, the Rental Application Form is often just the first step in a series of documents they need to prepare and submit. This initial form provides landlords or property managers with basic information about the prospective tenant, such as employment history, rental history, and personal references. However, to comprehensively assess a candidate's suitability, other forms and documents are commonly requested. The following list elaborates on these additional documents, each playing a crucial role in the application process.

- Lease Agreement: This legal document outlines the terms and conditions under which the tenant agrees to rent the property from the landlord. It includes details on rent payments, security deposits, and lease duration.

- Security Deposit Receipt: This receipt acknowledges the tenant's payment of the security deposit. It details the amount paid and the conditions under which the deposit will be held and possibly refunded.

- Renters Insurance Declaration: Some landlords require tenants to obtain renters insurance. This document serves as proof that the tenant holds a policy covering damages or losses to the property that might occur during the rental period.

- Co-signer Agreement: If the tenant's income or credit history does not meet the landlord's requirements, a co-signer agreement might be needed. This document obligates a third party to fulfill the tenant's lease obligations if the tenant fails to do so.

- Employment Verification Form: This form is used to verify the employment details provided by the applicant on their Rental Application. It confirms the applicant's position, income, and employment stability.

- Previous Landlord References: Letters or forms from previous landlords that vouch for the tenant's reliability, timeliness in rent payments, and overall tenancy conduct.

- Credit Report Authorization Form: Since assessing a tenant's financial reliability is crucial, landlords often require permission to obtain the tenant's credit report. This form grants them that authorization.

- Income Documentation: This includes documents such as recent pay stubs, tax returns, or bank statements, providing proof of the tenant's financial ability to pay the rent.

- Pet Agreement: If the tenant plans to move in with a pet, this agreement outlines the terms and conditions, including any extra fees or deposits required.

- Move-In/Move-Out Checklist: Used to record the condition of the property at move-in and move-out, this checklist protects both parties from disputes over damages that may occur during the tenancy.

Gathering these documents can be a demanding process, yet it's essential for ensuring a transparent and legal rental agreement between the tenant and landlord. Each document plays a pivotal role in building a mutual understanding and setting the foundation for a harmonious tenant-landlord relationship. By providing a comprehensive view of the tenant's background, financial stability, and rental history, these documents help landlords make informed decisions, while helping tenants secure their desired rental property.

Similar forms

Loan Application Form: Both the rental and loan application forms serve as preliminary screening tools for applicants, aiming to assess their financial stability and responsibility. Like rental applications, loan applications require personal identification, financial information, employment history, and credit history. This ensures that applicants for loans, much like those for rentals, are evaluated thoroughly to determine if they meet the financial criteria set forth by the lender or landlord.

Employment Application Form: Rental and employment applications both collect detailed personal information, including work history, for the purpose of evaluating an applicant’s qualifications and reliability. Employment applications, like rental ones, often request references to verify the applicant's history and character. This similarity underscores the importance of assessing an applicant’s track record, whether it be for a job or a housing opportunity.

Mortgage Application Form: Similar to rental applications, mortgage applications are designed to assess an applicant's financial health and the likelihood that they will fulfill their payment obligations. Both forms request extensive financial data, including income, debts, and credit scores. Additionally, mortgage applications, like their rental counterparts, play a crucial role in determining whether an applicant is a suitable candidate for what is often a long-term financial commitment.

Visa Application Form: Visa and rental applications share the common objective of vetting an individual’s background to ensure they meet specific eligibility criteria. Both applications require personal information, such as nationality, employment status, and financial stability, to ensure the applicant can sustain themselves during their stay, be it in a country or a rental property. Though one pertains to international travel and the other to housing, the foundational purpose of gathering detailed background information is much aligned.

Membership Application Form: This form, while often associated with clubs or organizations, shares a fundamental goal with rental applications: to ascertain the suitability of applicants according to predefined criteria. Membership applications often require personal details, interests, and references, similar to rental applications that gauge the reliability and compatibility of potential tenants with the property and landlord’s requirements. The process of reviewing applications in both contexts is geared toward ensuring a harmonious and mutually beneficial relationship between the two parties.

Dos and Don'ts

When filling out a Rental Application form, it’s crucial to be thorough and accurate to enhance your chances of securing the property. Here are things you should and shouldn't do to ensure your application stands out positively.

What you should do:

- Double-check your personal information for accuracy, including your full name, contact information, and current address.

- Provide complete employment history and current income details to demonstrate your financial stability.

- Include references from previous landlords or property managers to vouch for your reliability as a tenant.

- Ensure all required documents, such as photo identification and recent pay stubs, are attached and legible.

- Complete every section of the application. If a section doesn’t apply, indicate with “N/A” instead of leaving it blank.

- Review the application form for any mistakes or typos before submitting.

- Submit the application as soon as possible to show your strong interest in the property.

What you shouldn't do:

- Do not leave any fields incomplete unless you've marked them as “N/A”.

- Do not provide false information, as this can lead to your application being rejected or later eviction if discovered.

- Avoid guessing your financial information; ensure all figures are accurate and can be proved with documentation.

- Do not forget to sign and date the application. An unsigned application can often be considered incomplete.

- Do not ignore the need for a co-signer if your financial history requires it.

- Do not submit the application without reviewing it for errors or omissions.

- Do not hesitate to follow up with the landlord or property manager if you haven’t received a response within a reasonable timeframe.

Misconceptions

There are several common misconceptions regarding the rental application process that can lead to confusion for both landlords and prospective tenants. Understanding these can help navigate the often complex world of renting with greater ease.

Rental applications can be used to discriminate unfairly. While it's true that landlords must screen potential tenants, the law requires this process to be conducted fairly. Federal, state, and local laws, such as the Fair Housing Act, prohibit discrimination based on race, color, national origin, religion, sex, familial status, or disability. Landlords must apply the same criteria equally to all applicants.

Landlords can request any information they want on an application. This is not accurate. While landlords can collect information necessary to make an informed decision, certain types of inquiry are restricted or guided by law. For instance, asking about specifics of a disability or demanding access to personal financial accounts might violate privacy rights and anti-discrimination laws.

A rental application is a binding agreement to lease. Completing a rental application is merely the first step in the process of seeking to rent a property. It is not an agreement to lease, nor does it guarantee that the lease will be granted. It is a tool for landlords to assess eligibility. The lease agreement itself is a separate, binding document that outlines the tenancy terms.

Application fees are always refundable. Many people believe that if they are not approved for the apartment or choose not to take it, their application fee will be refunded. However, this fee typically covers the cost of the screening process, such as credit checks and administrative expenses, and is not refundable in most cases. Prospective tenants should inquire about the fee's purpose and refundability before submitting their application and payment.

Rental applications don’t affect your credit score. Many prospective renters think that the application process has no impact on their credit score. However, if the landlord runs a hard inquiry on your credit report to evaluate your creditworthiness, it can temporarily lower your score by a few points. Applicants should ask landlords if they intend to perform a "soft" or "hard" pull, as soft inquiries do not affect credit scores.

Key takeaways

When preparing to fill out or utilize a Rental Application form, it is crucial to understand several key aspects that can make the process smoother and ensure all necessary information is accurately captured. Here are some important takeaways:

- Accurate Information: Applicants must provide accurate and current information throughout the application. This includes personal information, rental history, employment details, and any references. False information can lead to the rejection of the application.

- Proof of Income: Most landlords require proof of income to verify that the applicant has the means to pay the rent. This can include recent pay stubs, tax returns, or other financial documents.

- Application Fees: Be aware that many rental applications come with a fee to cover the cost of background and credit checks. This fee is usually non-refundable, even if the application is not accepted.

- Consent for Background Checks: Filling out the application typically gives the landlord consent to perform background and credit checks. It is important for applicants to understand what this entails and how it may affect their chances of securing the rental.

- Reference Contact Information: Providing contact information for references is often a requirement. References can include former landlords, employers, or other professional or personal contacts who can vouch for the applicant's reliability and character.

- Rental History: Applicants should be prepared to detail their rental history, including addresses, duration of stay, and landlord contact information. This information helps landlords assess the applicant's reliability as a tenant.

- Read Carefully Before Signing: It is crucial to read the entire application and understand all its terms before signing. Signing the application generally indicates that the applicant agrees to its terms and acknowledges the accuracy of the information provided.

This list offers a foundational understanding of the components and considerations involved in completing a Rental Application form. By diligently preparing and understanding what is required, applicants can streamline the process and increase their chances of success.

Discover Other Types of Rental Application Documents

Garage Rental Lease - The form can specify requirements for modifications or improvements to the garage, including landlord approval and the state of the garage at lease’s end.