Legal Letter of Intent to Lease Commercial Property Form

Navigating the commercial real estate terrain requires precision, clear communication, and a strong foundation of understanding between potential tenants and landlords. At the heart of initiating negotiations for leasing commercial property lies the Letter of Intent (LOI) to Lease Commercial Property form, a critical preliminary document that sets the stage for what is to come. This document, while not a legally binding agreement, plays an essential role in outlining the major terms expected by both parties involved in the transaction. It covers a broad range of aspects, including but not limited to, the desired lease term, monthly rent, description of the property, and any specific conditions or provisions desired by either party. The LOI acts as a formal gesture of interest from a prospective tenant to a landlord, demonstrating the seriousness of their intent to lease the space. What makes the LOI so important is its ability to lay a groundwork for negotiations, allowing both parties to agree on the main points before drafting a more detailed and binding lease agreement. Venturing into the leasing process without this step can lead to misunderstandings and potential disputes, making the Letter of Intent to Lease Commercial Property form an indispensable tool in the commercial leasing process.

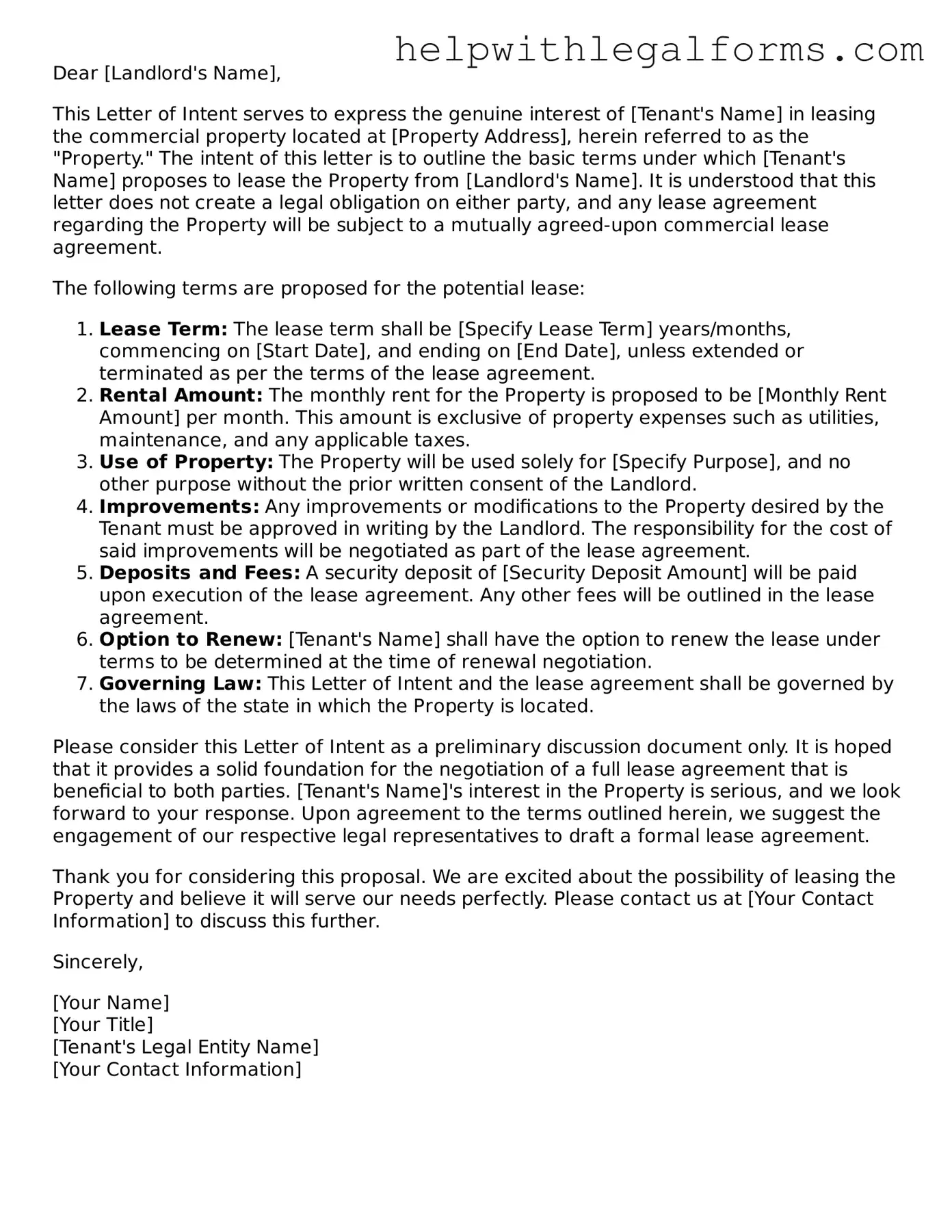

Example - Letter of Intent to Lease Commercial Property Form

Dear [Landlord's Name],

This Letter of Intent serves to express the genuine interest of [Tenant's Name] in leasing the commercial property located at [Property Address], herein referred to as the "Property." The intent of this letter is to outline the basic terms under which [Tenant's Name] proposes to lease the Property from [Landlord's Name]. It is understood that this letter does not create a legal obligation on either party, and any lease agreement regarding the Property will be subject to a mutually agreed-upon commercial lease agreement.

The following terms are proposed for the potential lease:

- Lease Term: The lease term shall be [Specify Lease Term] years/months, commencing on [Start Date], and ending on [End Date], unless extended or terminated as per the terms of the lease agreement.

- Rental Amount: The monthly rent for the Property is proposed to be [Monthly Rent Amount] per month. This amount is exclusive of property expenses such as utilities, maintenance, and any applicable taxes.

- Use of Property: The Property will be used solely for [Specify Purpose], and no other purpose without the prior written consent of the Landlord.

- Improvements: Any improvements or modifications to the Property desired by the Tenant must be approved in writing by the Landlord. The responsibility for the cost of said improvements will be negotiated as part of the lease agreement.

- Deposits and Fees: A security deposit of [Security Deposit Amount] will be paid upon execution of the lease agreement. Any other fees will be outlined in the lease agreement.

- Option to Renew: [Tenant's Name] shall have the option to renew the lease under terms to be determined at the time of renewal negotiation.

- Governing Law: This Letter of Intent and the lease agreement shall be governed by the laws of the state in which the Property is located.

Please consider this Letter of Intent as a preliminary discussion document only. It is hoped that it provides a solid foundation for the negotiation of a full lease agreement that is beneficial to both parties. [Tenant's Name]'s interest in the Property is serious, and we look forward to your response. Upon agreement to the terms outlined herein, we suggest the engagement of our respective legal representatives to draft a formal lease agreement.

Thank you for considering this proposal. We are excited about the possibility of leasing the Property and believe it will serve our needs perfectly. Please contact us at [Your Contact Information] to discuss this further.

Sincerely,

[Your Name]

[Your Title]

[Tenant's Legal Entity Name]

[Your Contact Information]

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent to Lease Commercial Property is used by a potential tenant to express their intention to lease a space for commercial purposes. |

| Content | This document typically includes proposed lease terms, such as rent amount, lease duration, and any special provisions or requirements. |

| Legal Significance | While not always legally binding, this letter serves as a precursor to formal lease negotiations and can outline the terms to be included in the official lease agreement. |

| Governing Law | The letter is guided by the law of the state where the property is located, and any state-specific requirements should be included or addressed in the document. |

Instructions on How to Fill Out Letter of Intent to Lease Commercial Property

Filling out a Letter of Intent to Lease Commercial Property is a critical initial step in expressing your interest in renting a specific commercial space. It's a gesture that demonstrates serious commitment and begins the negotiation process for terms that will be favorable for both the lessee and the lessor. This document outlines essential terms and conditions of the lease agreement to be finalized later. To ensure clarity and avoid potential misunderstandings, it's important to provide precise and comprehensive details throughout the form. The instructions below are designed to guide you through each section, ensuring your intentions are clearly communicated.

- Start with your full legal name or the name of the entity that intends to lease the property, along with your current address, including street, city, state, and zip code.

- Specify the full legal name of the property owner or the managing agent of the commercial property and their contact address.

- Identify the commercial property by including its complete address, including any suite or unit numbers, city, state, and zip code, along with a brief description of the space (e.g., office, retail, warehouse, etc.).

- State the proposed use of the property, highlighting any specific activities or business types that will occur on the premises.

- Detail the desired term of the lease, including the start date and end date you are proposing.

- List the proposed rent amount, specifying the frequency of payments (e.g., monthly, quarterly) and any conditions that may affect lease terms (e.g., escalations, concessions).

- Include any additional terms you wish to negotiate, such as renewal options, tenant improvement allowances, parking arrangements, or maintenance responsibilities.

- State your timeline for receiving a response from the property owner or manager, indicating a specific date by which you wish to proceed to more formal lease negotiations.

- Conclude by providing your contact information, including phone number and email address, inviting them to reach out for further discussions or clarification.

- Sign the letter to authenticate your interest, including your printed name or the name of the authorized representative and the date of signing.

After completing and signing the Letter of Intent to Lease Commercial Property, it should be delivered to the property owner or managing agent through the most appropriate means, whether that be email, fax, or postal service. This action sets the stage for direct negotiations and closer examination of the lease terms. Promptly addressing any responses or requests for additional information will keep the process moving smoothly, underscoring your commitment to securing the commercial space.

Crucial Points on This Form

What is a Letter of Intent to Lease Commercial Property?

A Letter of Intent to Lease Commercial Property is a preliminary agreement between a potential tenant and a landlord or property manager, outlining the primary terms and conditions under which the tenant proposes to lease a commercial space. It serves as a foundation for the lease agreement but is not legally binding regarding the lease itself. It typically includes terms such as lease duration, rent amount, property description, and any conditions or contingencies that need to be met before finalizing the lease.

Why use a Letter of Intent before leasing commercial property?

Using a Letter of Intent is a crucial step in the leasing process as it clearly outlines the expectations and obligations of both parties before entering into a binding lease agreement. It helps in negotiating terms and avoids misunderstandings by providing a written record of the proposed terms. Additionally, it demonstrates the tenant's serious interest in the property, which can be beneficial in competitive leasing environments.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent itself is not legally binding in terms of obligating either party to finalize the lease. However, it can contain binding provisions regarding negotiation confidentiality, exclusivity period for negotiations, and any earnest money deposit terms. It's crucial to carefully review and understand which sections, if any, are intended to be legally binding.

What key information should be included in a Letter of Intent to Lease Commercial Property?

A comprehensive Letter of Intent should include the full names and contact information of both the prospective tenant and the landlord, a detailed description of the property, proposed lease term, rent amount, details on utilities and maintenance responsibilities, signage rights, any allowances for modifications, and conditions like obtaining financing or zoning approvals. It may also outline responsibilities for taxes, insurance, and repair obligations.

How do you negotiate the terms in a Letter of Intent?

Negotiating the terms in a Letter of Intent involves open communication and often, compromise between the potential tenant and the landlord. Prioritize your needs such as the length of the lease, monthly rent, and any tenant improvements. It's beneficial to understand the market conditions and the landlord's position to create a compelling offer. Sometimes, it may be helpful to engage a commercial real estate broker or a legal professional to negotiate on your behalf.

What happens after both parties sign the Letter of Intent?

After the Letter of Intent is signed by both parties, it typically signals the end of preliminary negotiations, and the focus shifts to drafting the formal lease agreement based on the terms outlined in the letter. It's important to proceed with due diligence, such as verifying the property's condition and ensuring compliance with local zoning laws. Professional legal advice may be sought to draft or review the lease agreement to ensure it accurately reflects the negotiated terms and protects your interests.

Can either party back out after signing a Letter of Intent?

Since the letter of intent is generally not considered legally binding in terms of the lease commitment, either party can technically back out before signing the official lease agreement. However, if there are any legally binding clauses within the letter, such as confidentiality or exclusivity agreements, those must still be honored. Backing out without just cause after signing a Letter of Intent, especially if it includes binding provisions, can sometimes lead to legal disputes over those specific terms.

How can a tenant terminate a Letter of Intent?

To terminate a Letter of Intent, a tenant should first review the document to ensure understanding of any binding clauses that might affect the termination process. If the letter allows for termination, the tenant should notify the landlord in writing according to the terms specified for termination, respecting any agreed notice periods. If there are no binding terms, a simple written statement expressing the decision not to proceed with the lease, ideally with a reasonable explanation, should suffice. It's always recommended to handle such matters professionally to maintain goodwill, as future opportunities could arise.

Common mistakes

Not specifying the duration of the lease accurately. Many falter by leaving the lease term vague or not aligning it with their business needs, risking binding agreements that don't serve their long-term goals.

Overlooking the description of the premises. It's vital to detail the specific area being leased, including suites, parking spaces, and any shared areas, to prevent future disputes over the leased space's extent and use.

Failing to negotiate and specify rent adjustments. Rent typically increases over the lease term. Not clarifying the calculation method can lead to unexpected costs, straining the lessee's finances.

Ignoring the assignment and subletting conditions. Business needs change, and without the flexibility to assign or sublet, lessees might find themselves trapped in an unsuitable space or financial arrangement.

Omitting renewal options. A lease without options to renew can stymie a business’s growth within a desired location, forcing a move that could have been avoidable.

Forgetting to specify maintenance and repair obligations. Clarity on who is responsible for what can prevent future conflicts and unexpected expenses for the lessee.

Not asking for exclusivity. Without an exclusivity clause, a landlord could lease nearby spaces to a tenant's direct competitors, potentially harming the tenant's business.

Lack of due diligence on the landlord and property. Failing to research the property’s compliance with zoning, environmental regulations, and the landlord's financial stability could lead to significant operational disruptions.

In summary, when drafting a Letter of Intent to Lease Commercial Property, attention to detail and foresight are paramount. By avoiding these common mistakes, tenants can better protect their interests and position themselves for a successful lease negotiation and tenancy.

Documents used along the form

The process of leasing commercial property involves numerous documents in addition to the Letter of Intent (LOI) to Lease Commercial Property. These forms and documents each play a crucial role in clarifying the terms, obligations, and rights of both the landlord and the tenant. They ensure a smooth lease process, protect both parties, and prevent future disputes. Below is a list of other forms and documents often used alongside the Letter of Intent to Lease Commercial Property, providing insight into their purpose and how they contribute to the leasing process.

- Lease Agreement: A formal document that outlines the detailed terms and conditions of the lease, including rent, lease duration, and responsibilities of both parties. This legally binding agreement follows the LOI and is the primary document governing the lease.

- Personal Guarantee: Often required for small businesses or startups, this document makes the business owner personally liable for the lease payments if the business fails to pay rent.

- Security Deposit Receipt: Acknowledges receipt of the security deposit from the tenant, which is held to cover any potential damages or unpaid rent.

- Condition Report: Documents the state of the property at the time of leasing, protecting both tenant and landlord by providing a baseline against which any end-of-lease damage can be measured.

- Amendment to Lease: Formalizes any changes both parties agree to make to the original lease agreement post-signature. It is a legally binding document that any changes should be documented through.

- Renewal Option Notice: Allows the tenant to notify the landlord of their intention to renew the lease under the terms specified in the original agreement or to negotiate new terms.

- Assignment and Subletting Agreement: Used when the tenant wishes to transfer part or all of their leasehold interest to another party. It typically requires landlord approval.

- Termination Agreement: Outlines the terms under which the lease can be prematurely terminated, including notice periods and any penalties incurred.

- Consent to Sublease: Granted by the landlord, this document allows the original tenant to sublease the space to a third party under certain conditions.

- Estoppel Certificate: A document frequently required during the sale of the leased property or its refinancing, where the tenant confirms the terms and status of their lease to reassure the potential buyer or lender.

Navigating through the lease process and understanding each document’s relevance can seem daunting. Yet, each form and document plays a vital role in safeguarding the interests of both the landlord and the tenant. Used in conjunction, these documents ensure that both parties have a clear understanding of the terms of the lease and are protected against future legal issues. Ensuring accuracy and completeness when dealing with these documents can lead to a successful and amicable leasing relationship.

Similar forms

-

Commercial Lease Agreement: The Letter of Intent to Lease Commercial Property and a Commercial Lease Agreement are closely related. The Letter of Intent is often a precursor to the actual lease agreement, outlining the basic terms and intentions that will later be formalized in the lease. Both documents cover essential aspects such as rental amount, lease duration, and property use, but the Lease Agreement is legally binding, whereas the Letter of Intent usually is not.

-

Term Sheet: A Term Sheet, used in various financing deals, shares similarities with the Letter of Intent to Lease Commercial Property because it summarizes the main points of a deal. While Term Sheets are commonly used for outlining the conditions of investment agreements, they, like a Letter of Intent, serve as a negotiation tool that lays down the key terms before drafting a detailed agreement. The main difference is in their common usage contexts—financial investments versus leasing agreements.

-

Memorandum of Understanding (MOU): An MOU is akin to a Letter of Intent as both function as preliminary agreements indicating mutual intention to move forward, but are not in themselves legally binding contracts. They are used to document the terms and scope of a negotiation or deal, such as roles, responsibilities, and timelines, before the final agreements are drafted. The MOU is more common in partnerships and collaborative agreements across various sectors.

-

Offer to Lease: The Letter of Intent to Lease Commercial Property is similar to an Offer to Lease in that both serve as an initial proposition from one party to another regarding the leasing of property. However, the Offer to Lease often comes closer to a formal proposal, frequently leading directly to a lease agreement if accepted. While the Letter of Intent outlines mutual interest and basic terms, an Offer to Lease typically goes into greater detail and may be more binding than a Letter of Intent.

Dos and Don'ts

Filling out a Letter of Intent to Lease Commercial Property is the first step in securing a commercial space. It's important to approach this document carefully to ensure your interests are well-represented and understood by the property owner. Below are some key dos and don'ts to guide you through the process.

- Do carefully read the entire form before you start filling it out. Understanding all sections in advance can help you gather the necessary information and avoid any confusion.

- Do provide complete and accurate information about your business. This includes your legal business name, the type of business, and your contact information.

- Do specify the preferred lease term and any renewal options you desire. Being clear about your lease length preferences can help avoid future misunderstandings.

- Do outline your needs regarding the space, such as the desired square footage, specific layout requirements, or any modifications you anticipate needing.

- Do consider including a confidentiality agreement, especially if you are disclosing sensitive business information in your Letter of Intent.

- Don't leave any sections blank. If a section doesn't apply, it's better to note that it's not applicable rather than leaving it empty, which could be confusing.

- Don't sign the Letter of Intent without reviewing it thoroughly. Ensure all agreed-upon terms are accurately reflected, and consult a professional if you have any doubts.

- Don't forget to negotiate any terms that are important to you. The Letter of Intent is a preliminary agreement and can often be negotiated to better fit your needs.

- Don't hesitate to seek professional advice. Whether from a lawyer or a commercial real estate advisor, professional guidance can ensure your interests are properly protected.

Misconceptions

Many individuals entering into commercial lease negotiations often misinterpret the nature and implications of a Letter of Intent to Lease Commercial Property. Below are four common misconceptions:

It is legally binding. A widespread misconception holds that a Letter of Intent (LOI) is a legally binding agreement committing the parties to the lease. The truth is, an LOI typically outlines the preliminary terms of the lease and serves as a foundation for formal lease negotiations. It is generally not legally binding concerning the lease terms, except for specific provisions such as confidentiality or exclusivity, which should be clearly marked as such.

It substitutes for a lease agreement. Some believe that once an LOI is signed, there is no need for a formal lease agreement. However, an LOI is only a precursor to the lease agreement, outlining the key terms and conditions agreed upon in principle. A comprehensive lease agreement is required to officially document the rights and obligations of both parties.

It is unnecessary if terms are verbally agreed upon. Verbal agreements are inherently risky and difficult to enforce, particularly in real estate transactions. An LOI provides a written record of the agreed-upon terms before entering into a formal lease agreement, reducing misunderstandings and discrepancies between the parties involved.

It details every condition of the lease. While an LOI includes major terms such as rental rate, lease duration, and property description, it does not cover every detail of the lease agreement. Comprehensive lease agreements delve into detailed obligations and conditions, such as maintenance responsibilities, sublease policies, and default provisions, which are typically not addressed in an LOI.

Key takeaways

Filling out and using the Letter of Intent to Lease Commercial Property form is a critical step in securing a lease. This document serves as a preliminary agreement between the potential tenant and the landlord. Here are key takeaways to ensure that the process is carried out efficiently and effectively:

- Accuracy is crucial: Ensure all information provided in the letter is accurate, including the legal names of both the tenant and the landlord, the property address, and specifics about the lease such as the term length and rent amount.

- Clarify lease terms: The letter should clearly state the lease term, rent amount, any escalation clauses, renewal options, and other relevant financial terms to avoid any ambiguity later on.

- Outline tenant improvements: If the tenant requires specific improvements or modifications to the property, these should be detailed in the letter, including who is responsible for the costs.

- Discuss property use: Clearly define the permitted uses of the property to ensure it aligns with the tenant’s business needs and to avoid violations of zoning laws or property agreements.

- Contingencies are important: Include any conditions that must be met before the lease is finalized, such as obtaining financing, zoning approvals, or inspection results.

- Non-binding agreement: Understand that the Letter of Intent is typically a non-binding agreement, except for certain sections such as confidentiality or exclusivity, which should be clearly identified.

- Confidentiality: If the negotiations or terms of the lease require discretion, include a confidentiality clause to protect sensitive information.

- Exclusivity: Request an exclusivity clause to prevent the landlord from leasing the property to another tenant while negotiations are ongoing.

- Legal review is advised: Before submitting the letter, having it reviewed by a legal professional can prevent misunderstandings and ensure that the letter aligns with your interests and intentions.

Remember, the Letter of Intent is the foundation for your lease negotiation. It sets the stage for a successful lease agreement, so taking the time to carefully craft and review it is in the best interest of both parties.

Discover Other Types of Letter of Intent to Lease Commercial Property Documents

Intent to Purchase - This document often outlines the responsibilities of each party, such as who will handle legal fees, taxes, or other expenses related to the transaction.