Legal Purchase Letter of Intent Form

Navigating the intricacies of business transactions often requires clear documentation that outlines the intentions and terms agreed upon by the involved parties. Among the essential tools for facilitating these negotiations is the Purchase Letter of Intent (LOI) form, which plays a critical role as a precursor to formal agreements. This document not only signifies the serious intent of a buyer to proceed with the purchase of goods, services, or property but also provides a framework within which the terms of the sale are clearly outlined. The LOI acts as a safeguard for both parties, offering a structured avenue for discussing and finalizing details before entering into binding agreements. Its relevance spans across various sectors, being particularly pivotal in real estate transactions, mergers and acquisitions, and large-scale procurement deals. The utility of the Purchase LOI lies in its ability to bridge initial negotiations and the closing of the deal, ensuring that all parties have a mutual understanding of the terms, conditions, and expectations before deploying considerable resources towards the transaction's completion.

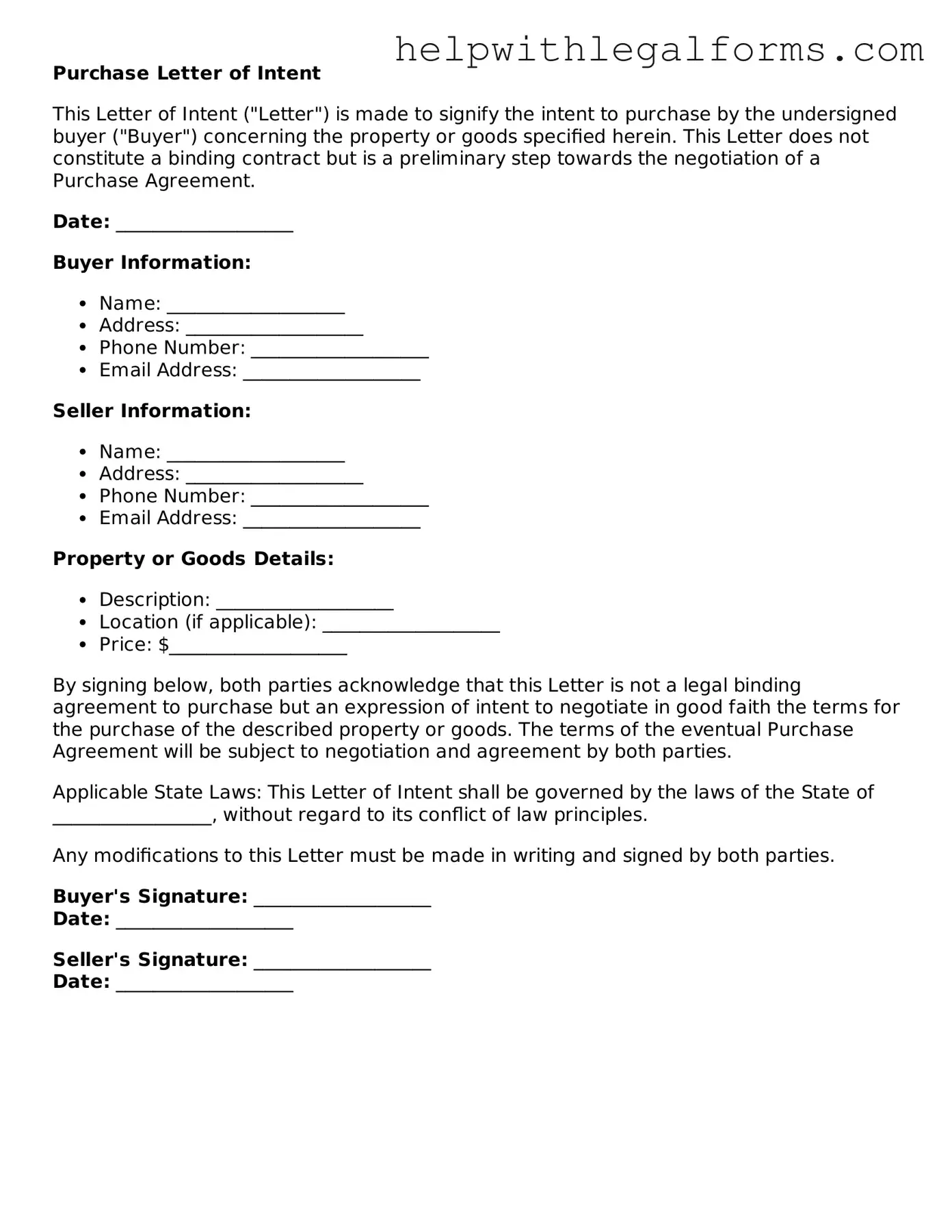

Example - Purchase Letter of Intent Form

Purchase Letter of Intent

This Letter of Intent ("Letter") is made to signify the intent to purchase by the undersigned buyer ("Buyer") concerning the property or goods specified herein. This Letter does not constitute a binding contract but is a preliminary step towards the negotiation of a Purchase Agreement.

Date: ___________________

Buyer Information:

- Name: ___________________

- Address: ___________________

- Phone Number: ___________________

- Email Address: ___________________

Seller Information:

- Name: ___________________

- Address: ___________________

- Phone Number: ___________________

- Email Address: ___________________

Property or Goods Details:

- Description: ___________________

- Location (if applicable): ___________________

- Price: $___________________

By signing below, both parties acknowledge that this Letter is not a legal binding agreement to purchase but an expression of intent to negotiate in good faith the terms for the purchase of the described property or goods. The terms of the eventual Purchase Agreement will be subject to negotiation and agreement by both parties.

Applicable State Laws: This Letter of Intent shall be governed by the laws of the State of _________________, without regard to its conflict of law principles.

Any modifications to this Letter must be made in writing and signed by both parties.

Buyer's Signature: ___________________

Date: ___________________

Seller's Signature: ___________________

Date: ___________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Purchase Letter of Intent is a document expressing the preliminary commitment of one party to buy goods, services, or property from another. |

| Purpose | It outlines the main terms of a deal and demonstrates the buyer's serious interest in proceeding. |

| Non-Binding | Generally, the letter is non-binding, meaning it does not legally compel the buyer or seller to finalize the deal. |

| Contents | Typically includes buyer and seller information, description of the goods, services or property, purchase price, and tentative closing date. |

| Due Diligence | The document often grants the buyer the opportunity to conduct due diligence before finalizing the purchase. |

| Confidentiality | It may include a confidentiality clause to protect sensitive information shared during negotiation. |

| Governing Law | Varies by state; it's crucial to refer to the state-specific laws that will govern the agreement. |

| Advantages for Buyer | Secures the deal's terms provisionally and allows time for due diligence. |

| Advantages for Seller | Confirms the buyer's intent and can expedite the transaction process. |

Instructions on How to Fill Out Purchase Letter of Intent

Completing a Purchase Letter of Intent is a critical step towards finalizing a deal between two parties interested in the transaction of goods or services. This document serves as a formal declaration of the buyer's intent to purchase from the seller under agreed conditions. Before diving into the specifics of how to fill it out, it's important to gather all necessary information including details about the buyer, seller, description of the goods or services, and the proposed terms of the sale. Following a structured approach ensures that all key elements are clearly communicated and agreed upon, setting a positive tone for subsequent negotiations and the drafting of a binding contract.

- Begin by clearly stating the date at the top of the document.

- Enter the full legal name and address of the buyer in the designated section.

- Provide the full legal name and address of the seller in the corresponding section.

- Describe the goods or services to be purchased. Include specific details such as quantity, color, model, size, or any other pertinent specifications that define the scope of the transaction.

- List the proposed purchase price or the method of determining the price. Include any conditions that may affect the final amount, such as discounts, taxes, and shipping costs.

- Specify any contingencies that must be met before the transaction can be finalized. This can include inspections, approvals, or any due diligence requirements.

- Outline the intended payment method and terms. Detail whether the payment will be made in installments, upon delivery, or through financing arrangements.

- Set forth any confidentiality agreements, non-compete clauses, or other legal stipulations that both parties must adhere to.

- Establish a timeline for when the purchase is to be completed and any milestones that must be met leading up to the final transaction.

- Provide space for both the buyer and seller to sign and date the document, acknowledging their understanding and acceptance of its terms.

With the Purchase Letter of Intent accurately filled out, it acts as a blueprint for moving forward. It is the foundation upon which a comprehensive and legally-binding purchase agreement will be built. Following this, parties usually engage in more detailed negotiations, finalize the agreement, and proceed with the necessary steps to close the deal. Ensuring accuracy and clarity in this initial document can greatly streamline the process, helping both buyer and seller to align their expectations and reach a mutually beneficial agreement.

Crucial Points on This Form

What is a Purchase Letter of Intent?

A Purchase Letter of Intent is a document that outlines the preliminary agreements between a buyer and a seller before the final purchase agreement is signed. It serves as a roadmap for the transaction, detailing the basic terms, conditions, and the intended purchase price. This document is not legally binding in terms of the transaction itself but may contain provisions that are, such as confidentiality agreements.

Why use a Purchase Letter of Intent?

Using a Purchase Letter of Intent can help both parties clearly communicate their intentions and understandings regarding the purchase. It allows the buyer and seller to agree on key aspects of the deal before investing time and resources into due diligence and final negotiations. This can save time and help avoid misunderstandings or disputes later in the purchasing process.

What information should be included in a Purchase Letter of Intent?

Typically, a Purchase Letter of Intent should include details such as the identification of the buyer and seller, a description of the item or property being purchased, the proposed purchase price, payment terms, due diligence periods, any contingencies such as financing or inspections, and a timeline for moving to a binding purchase agreement.

Is a Purchase Letter of Intent legally binding?

Generally, the Purchase Letter of Intent itself is not legally binding in terms of obligating the parties to complete the transaction. However, it can include legally binding provisions, such as exclusivity clauses that prevent the seller from negotiating with other buyers for a specified period, or confidentiality agreements that protect the sensitive information shared during negotiations.

How do I draft a Purchase Letter of Intent?

To draft a Purchase Letter of Intent, start by listing the basic information about the transaction, including the names of the buyer and seller and the specifics of what is being bought and sold. Then, detail the key terms of the deal, such as the purchase price and terms, due diligence requirements, and any contingencies. Lastly, include any legally binding terms that both parties agree to adhere to during the negotiation process. Consulting with a legal professional can ensure the document accurately reflects the parties' intentions and complies with local laws.

Can a Purchase Letter of Intent be changed or terminated?

Yes, since a Purchase Letter of Intent is typically not a legally binding contract regarding the transaction, the parties can usually modify or terminate it by mutual agreement. If there are any binding provisions within the document, those must be adhered to unless both parties agree to amend or nullify them. It’s important to clearly specify the process for making changes or terminating the agreement within the document itself.

What happens after a Purchase Letter of Intent is signed?

After a Purchase Letter of Intent is signed, the buyer usually conducts due diligence to verify the condition and value of the property being purchased. During this period, both parties may negotiate the final terms of the purchase agreement based on findings or changes in circumstances. If everything proceeds as planned, the next step is drafting and signing the binding purchase agreement, at which point the transaction moves towards closing.

How does a Purchase Letter of Intent affect negotiations?

A Purchase Letter of Intent can streamline negotiations by setting the framework for the deal. It puts in writing what both parties have agreed upon in principle, reducing areas of potential conflict by clarifying the terms and expectations from the outset. However, it’s also a negotiation tool that can be used to lock in certain terms early in the process, providing a foundation upon which to build the final agreement.

Who should use a Purchase Letter of Intent?

Both buyers and sellers in a variety of transactions can benefit from using a Purchase Letter of Intent. It's commonly used in real estate deals, business acquisitions, and large personal property purchases. This document is especially useful in complex transactions that require extensive negotiations and due diligence before a final purchase agreement can be signed.

Common mistakes

When parties decide to enter into negotiations for buying and selling property, a Purchase Letter of Intent (LOI) is often the first formal step. This document outlines the basic terms of the deal before drafting a detailed purchase agreement. However, individuals often make critical errors while filling out this form, potentially complicating the process or leading to misunderstandings. Here are four common mistakes to be aware of:

Not specifying the details of the property clearly: It's crucial that the property in question is described with absolute clarity. This includes the address, legal description, and any identifiers that prevent any ambiguity about what is being bought or sold. Failing to do so can lead to disputes about what was intended to be included in the transaction.

Being vague about the terms of payment: The LOI should outline how and when the payment will be made. This includes any deposits, financing details, and the total purchase price. A clear timeline helps prevent misunderstandings and sets a clear path forward for both parties.

Omitting due diligence periods: The buyer typically needs time to perform due diligence to ensure the property meets their needs and is as represented. Not specifying or allowing enough time for this process can result in a rushed transaction, where important details may be overlooked.

Forgetting to include contingencies: Often, the purchase is subject to certain conditions being met, such as financing approval, sale of another property, or satisfactory inspections. Not listing these contingencies clearly can lead to disputes if either party wishes to back out of the deal because conditions aren't met.

Ensuring that a Purchase Letter of Intent is thoroughly and accurately completed is the first step towards a successful transaction. By paying attention to these common pitfalls, parties can avoid unnecessary complications and pave the way for a smoother negotiation process.

Documents used along the form

When businesses engage in negotiations leading up to a purchase, a Purchase Letter of Intent (LOI) is a crucial initial step. This non-binding document signifies a serious commitment from the buyer to proceed under specified terms. However, the LOI is just the beginning. Several other forms and documents complement this process, ensuring clarity, compliance, and readiness for all parties involved. Here, we introduce and briefly describe eight essential documents often used alongside the Purchase LOI to navigate the complexities of transactions seamlessly.

- Non-Disclosure Agreement (NDA): This legal contract protects confidential information shared between parties during negotiations. It's pivotal early in the discussions to ensure that sensitive data about the business, its operations, or the transaction do not become public.

- Due Diligence Checklist: This document outlines all the information and records the buyer needs to review before finalizing the purchase. It ensures the buyer is fully informed about the business's operational, financial, and legal standing.

- Term Sheet: A term sheet summarises the key financial and other terms of the transaction. While not all transactions will utilize a term sheet, it’s particularly common in complex deals to lay out essential deal points before drafting detailed legal documents.

- Confidentiality Agreement: Similar to an NDA, this agreement may be used specifically with employees or consultants to protect proprietary information during the acquisition process.

- Memorandum of Understanding (MOU): The MOU is a more formal agreement than the LOI, detailing the specific terms of the agreement between parties. It's a step towards a binding agreement, reflecting a deeper commitment to the transaction.

- Conditional Sales Agreement: This contract specifies that the sale is subject to certain conditions being met, usually by the buyer. These conditions might include securing financing, satisfactory results of due diligence, or regulatory approvals.

- Asset Purchase Agreement: For transactions focusing on the purchase of specific assets rather than the entire business, this detailed agreement outlines the terms, conditions, and assets included in the sale.

- Stock Purchase Agreement: When the transaction involves the purchase of a company's stock rather than its physical assets, this agreement provides the framework, detailing the number of shares being bought, the price, and the terms of the purchase.

Employing these documents in conjunction with a Purchase LOI provides a robust framework for navigating the complexities of business acquisitions. They help in safeguarding the interests of all parties involved, ensuring due diligence is performed and setting clear expectations and conditions for the transaction to proceed. Understanding the role and importance of each document in the acquisition process can significantly impact the success of the negotiation, ultimately leading to a smoother transition for both the buyer and the seller.

Similar forms

A Memorandum of Understanding (MOU) shares similarities with a Purchase Letter of Intent as both act as preliminary agreements before finalizing a deal. They set the foundation for the terms and expectations between parties, without being formally binding.

A Term Sheet is akin to a Purchase Letter of Intent because it outlines the key financial and other terms of a transaction. Although a term sheet is more common in investment or financial deals, like the LOI, it serves as a blueprint for the negotiations ahead.

The Heads of Agreement document has resemblances to a Purchase Letter of Intent because it typically summarizes the main points of a deal before the full contract is drafted. It indicates a commitment to proceed but is generally not legally enforceable.

A Conditional Sale Agreement is somewhat similar to a Purchase Letter of Intent in that it may set forth the conditions under which a sale will be completed. The key difference is that a conditional sale agreement is often a binding contract, whereas the LOI usually is not.

Dos and Don'ts

When filling out a Purchase Letter of Intent form, there are several key dos and don'ts to keep in mind to ensure that everything goes smoothly. Here's a helpful list to guide you:

- Do:

- Review the form carefully before you start filling it out to understand all the sections and requirements.

- Provide accurate and complete information in every section to avoid any misunderstandings or delays.

- Use clear, professional language to convey your intentions and terms.

- Check for any spelling or grammar mistakes that could make the document seem less professional.

- Sign and date the form as required, since an unsigned document might not be considered valid.

- Don't:

- Rush through filling out the form without double-checking the details you've entered.

- Leave any required fields blank. If a section doesn't apply to you, indicate with "N/A" (not applicable) instead of leaving it empty.

- Ignore the importance of reviewing the final document with a professional, if possible, to ensure all legalities are correctly addressed.

By following these simple guidelines, you can avoid common mistakes and ensure your Purchase Letter of Intent clearly communicates your intentions and lays the foundation for a successful transaction.

Misconceptions

When considering the steps in buying or selling a significant asset, such as real estate or a business, individuals often misunderstand the role and implications of a Purchase Letter of Intent (LOI). To navigate these processes successfully, it's crucial to dispel common misconceptions surrounding the Purchase LOI.

- Misconception 1: A Purchase LOI is Legally Binding. Many believe that once signed, a Purchase LOI places a legal obligation on the buyer and seller to complete the transaction. However, the truth is that a Purchase LOI typically outlines the preliminary agreement terms and conditions. It signifies the intention to enter into a contract in the future but, by itself, does not usually bind either party to the transaction.

- Misconception 2: A Purchase LOI Is Unnecessary If You Plan to Close Quickly. Some parties might assume that a Purchase LOI is a redundant step, especially when they expect to finalize the deal swiftly. Nevertheless, a Purchase LOI serves as a crucial blueprint for the formal agreement. It ensures that both parties have a mutual understanding of the deal's terms, which can prevent misunderstandings and speed up the closing process.

- Misconception 3: There Is a Standard Format for All Purchase LOIs. While certain elements are commonly included in many Purchase LOIs, such as payment terms, confidentiality agreements, and contingency clauses, there is no one-size-fits-all template. Each Purchase LOI should be tailored to reflect the specific details and conditions of the individual transaction.

- Misconception 4: Everything Negotiated in the Purchase LOI Is Final. A common misunderstanding is that the terms agreed upon in the Purchase LOI are set in stone. In reality, the Purchase LOI serves as a starting point. It sets the stage for negotiations, and terms can be adjusted or refined during the drafting of the final purchase agreement. Understanding this flexibility can alleviate undue pressure and allow for more productive negotiations.

Clarifying these misconceptions about the Purchase Letter of Intent fosters a smoother negotiation and transaction process for both buyers and sellers. By recognizing the Purchase LOI's true purpose and limitations, parties can better navigate the preliminary stages of their agreement with confidence and efficiency.

Key takeaways

When embarking on a transaction, the Purchase Letter of Intent (LOI) serves as a critical initial step to outline the agreement's terms between the buyer and seller. It's essential to grasp the key components and implications of correctly filling out and using this form. The following takeaways highlight the importance of accuracy, clarity, and forward-thinking during this process.

- Clear Articulation of Terms: The LOI should precisely describe the transaction's terms, including financial considerations, timelines, and any conditions or contingencies. Clarity at this stage can prevent misunderstandings and disputes as negotiations progress.

- Non-Binding Nature: Generally, the LOI is not a legally binding agreement to finalize the sale. However, it might contain provisions that are binding, such as confidentiality clauses or exclusivity agreements. Be mindful of these distinctions when drafting and agreeing to an LOI.

- Diligence and Documentation: The LOI often marks the beginning of a detailed due diligence process. It should thus mandate the sharing of relevant information and provide a timeline for this phase. Ensuring all necessary documentation is outlined can streamline subsequent steps.

- Path to a Binding Agreement: While the LOI itself is primarily non-binding, it is a pivotal step toward a binding purchase agreement. It sets the stage for negotiations and provides a framework for the final contract. A well-constructed LOI can significantly expedite the negotiation process and lead to a smoother transaction.

Understanding these takeaways can significantly impact the success of a transaction. A well-crafted Purchase Letter of Intent not only aids in laying down the groundwork for a solid agreement but also helps in maintaining a good working relationship between the buyer and seller throughout the negotiation and beyond.

Discover Other Types of Purchase Letter of Intent Documents

How to Write a Letter of Intent for Commercial Lease - A business’s first formal step towards leasing a commercial property, outlining desired lease conditions.