Legal LLC Share Purchase Agreement Form

When individuals or entities decide to buy shares in a Limited Liability Company (LLC), they embark on a process that requires careful consideration and adherence to specific legal formalities. At the heart of this transaction is the LLC Share Purchase Agreement, a vital document that outlines the terms and conditions of the purchase. This agreement serves multiple purposes: it provides a clear record of the sale, specifies the number of shares being purchased, the price per share, any representations and warranties made by the seller and the buyer, and the conditions precedent to closing the transaction. Furthermore, it addresses any adjustments to be made post-closing and stipulates how disputes related to the agreement should be resolved. The completion of this form demands attention to detail and a thorough understanding of the rights and obligations it imposes on all parties involved. Ensuring that the agreement accurately reflects the intentions of the parties and complies with relevant laws is crucial for the legitimacy and smooth execution of the share purchase transaction.

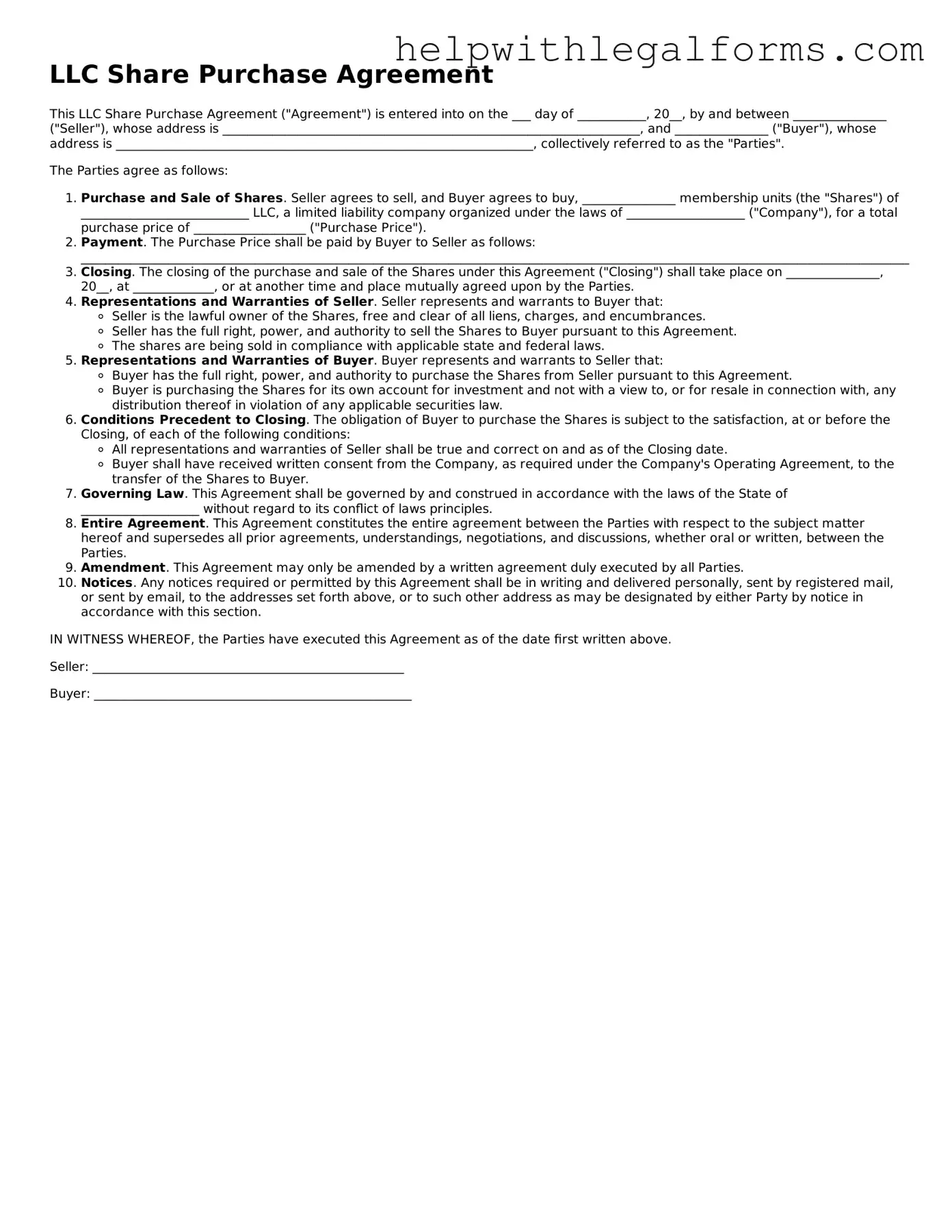

Example - LLC Share Purchase Agreement Form

LLC Share Purchase Agreement

This LLC Share Purchase Agreement ("Agreement") is entered into on the ___ day of ___________, 20__, by and between _______________ ("Seller"), whose address is ___________________________________________________________________, and _______________ ("Buyer"), whose address is ___________________________________________________________________, collectively referred to as the "Parties".

The Parties agree as follows:

- Purchase and Sale of Shares. Seller agrees to sell, and Buyer agrees to buy, _______________ membership units (the "Shares") of ___________________________ LLC, a limited liability company organized under the laws of ___________________ ("Company"), for a total purchase price of __________________ ("Purchase Price").

- Payment. The Purchase Price shall be paid by Buyer to Seller as follows: _____________________________________________________________________________________________________________________________________.

- Closing. The closing of the purchase and sale of the Shares under this Agreement ("Closing") shall take place on _______________, 20__, at _____________, or at another time and place mutually agreed upon by the Parties.

- Representations and Warranties of Seller. Seller represents and warrants to Buyer that:

- Seller is the lawful owner of the Shares, free and clear of all liens, charges, and encumbrances.

- Seller has the full right, power, and authority to sell the Shares to Buyer pursuant to this Agreement.

- The shares are being sold in compliance with applicable state and federal laws.

- Representations and Warranties of Buyer. Buyer represents and warrants to Seller that:

- Buyer has the full right, power, and authority to purchase the Shares from Seller pursuant to this Agreement.

- Buyer is purchasing the Shares for its own account for investment and not with a view to, or for resale in connection with, any distribution thereof in violation of any applicable securities law.

- Conditions Precedent to Closing. The obligation of Buyer to purchase the Shares is subject to the satisfaction, at or before the Closing, of each of the following conditions:

- All representations and warranties of Seller shall be true and correct on and as of the Closing date.

- Buyer shall have received written consent from the Company, as required under the Company's Operating Agreement, to the transfer of the Shares to Buyer.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of ___________________ without regard to its conflict of laws principles.

- Entire Agreement. This Agreement constitutes the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, between the Parties.

- Amendment. This Agreement may only be amended by a written agreement duly executed by all Parties.

- Notices. Any notices required or permitted by this Agreement shall be in writing and delivered personally, sent by registered mail, or sent by email, to the addresses set forth above, or to such other address as may be designated by either Party by notice in accordance with this section.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

Seller: __________________________________________________

Buyer: ___________________________________________________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | An LLC Share Purchase Agreement outlines the terms under which shares in a Limited Liability Company (LLC) are bought and sold. |

| 2 | This agreement includes specific information about the selling and purchasing parties, price of shares, and the number of shares being transacted. |

| 3 | It is used to ensure that the sale is conducted in a manner that is fair and legally compliant with state regulations. |

| 4 | The agreement may include representations and warranties of the seller and buyer, protecting both parties from future legal disputes arising from the transaction. |

| 5 | State-specific laws govern the agreement, necessitating adjustments to the document to ensure compliance with local regulations where the LLC is registered. |

| 6 | It serves as a record of the sale, providing evidence of the change in ownership for the LLC's internal records and, if required, state filings. |

| 7 | Confidentiality clauses may be included to protect the business secrets of the LLC during the transition period and after the sale is finalized. |

| 8 | The agreement may require notarization depending on the state in which the LLC operates, adding an additional layer of legal validation to the document. |

Instructions on How to Fill Out LLC Share Purchase Agreement

Embarking on the journey of buying shares in a Limited Liability Company (LLC) is both exciting and complex. One crucial step in this process involves the precise completion of the LLC Share Purchase Agreement form. This document is essential as it sets the terms and conditions of the sale, including the number of shares being purchased, the price per share, and other vital details. Doing this correctly ensures that the transaction proceeds smoothly, with both parties having clear expectations. Here's a step-by-step guide to help you navigate through the form filling process.

- Begin by entering the date on which the agreement is being made at the top of the form.

- Fill in the full name and address of the seller on the designated lines.

- Enter the full name and address of the buyer below the seller's information.

- Specify the number of shares being sold in the space provided.

- State the purchase price per share next to the number of shares being purchased.

- Detail any representations and warranties of the seller. This includes any assurances the seller is making about the state and legality of the shares being sold.

- List any conditions precedent to the sale. These are conditions that must be met before the transaction can be finalized, such as approval from regulatory bodies.

- Include the governing law, specifying the jurisdiction under which disputes will be resolved.

- If applicable, insert any additional provisions that have been agreed upon. This could include a confidentiality agreement or obligations post-sale.

- Both the buyer and the seller should sign and date the agreement at the bottom, in the presence of a notary or witness if required.

With these steps, you'll have diligently completed the LLC Share Purchase Agreement form. This thoroughness ensures that all parties are on the same page, reducing potential conflicts and misunderstandings during the share transfer process. Remember, it is always recommended to consult with a legal professional or a contract specialist when dealing with complex agreements to ensure your interests are adequately protected.

Crucial Points on This Form

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a comprehensive document that outlines the terms and conditions under which shares of a limited liability company (LLC) are bought and sold between a seller and a buyer. This agreement covers various important aspects, including the price of the shares, the number of shares being traded, warranties, and representations, among other crucial details to ensure a transparent and agreed-upon transaction.

Why is an LLC Share Purchase Agreement important?

This agreement is crucial because it provides a detailed, legally binding record of the sale of LLC shares. It protects both the buyer and the seller by ensuring that all parties have a clear understanding of the terms of the sale, any representations or warranties made, and the obligations and rights of all involved. Moreover, it helps to prevent misunderstandings and provides a legal framework for resolving disputes should they arise.

Who needs to sign the LLC Share Purchase Agreement?

Typically, the seller of the LLC shares and the buyer of those shares are required to sign the agreement. In addition, if the LLC has specific requirements for sale outlined in its operating agreement, other members of the LLC may also need to give their consent or sign the agreement. Consulting with legal counsel can clarify who exactly should sign in the context of the specific LLC’s rules.

How does the LLC Share Purchase Agreement affect the LLC's operating agreement?

The LLC Share Purchase Agreement does not directly change the LLC's operating agreement. However, the sale of shares might necessitate amendments to the operating agreement to reflect the new ownership structure. This could include updating the list of members, their respective ownership percentages, and their capital contributions. It's important that these changes are made in accordance with the operating agreement's provisions for amendments.

Can the terms of an LLC Share Purchase Agreement be negotiated?

Yes, the terms of an LLC Share Purchase Agreement can be negotiated before the agreement is signed. This negotiation phase is critical, as it allows both the buyer and the seller to discuss the details of the sale, including the price of the shares, payment terms, representations and warranties, and other important details. It's often beneficial for both parties to have legal representation during negotiations to ensure their interests are adequately protected.

What happens if either party breaches the LLC Share Purchase Agreement?

If either party breaches the terms of the LLC Share Purchase Agreement, the non-breaching party has the right to pursue legal remedies. These remedies can include seeking specific performance (forcing the breaching party to fulfill their obligations under the agreement), rescission (cancellation of the agreement), or damages (compensation for any financial losses resulting from the breach). The agreement itself may also outline specific consequences or procedures for handling breaches.

Are there any circumstances under which an LLC Share Purchase Agreement can be terminated?

An LLC Share Purchase Agreement can be terminated under conditions agreed upon by both parties in the agreement itself. Common termination conditions include a breach of the agreement by either party, mutual agreement between the parties to terminate, or the occurrence of a specific event outlined in the agreement as a condition for termination. It's important to review the agreement's termination provisions to understand under what circumstances and how the agreement can be ended.

Common mistakes

When it comes to the complex world of business transactions, filling out an LLC Share Purchase Agreement form is a task that demands attention to detail. Unfortunately, even with the best intentions, people often stumble on common pitfalls that can lead to bigger issues down the line. Recognizing and avoiding these mistakes is crucial for a smooth transaction. Here’s a roundup of the frequent missteps made:

Not reviewing the entire document — It's tempting to skim through lengthy documents, but every section of the LLC Share Purchase Agreement is vital. Missing out on key details can lead to misunderstandings or legal issues later on.

Incorrect information — Entering wrong information, no matter how minor it seems, can invalidate the entire agreement. Double-check names, addresses, and particularly the details related to the LLC and the share quantities.

Omitting essential details about the payment — The payment section requires thorough details, including the amount, method, and timeline for payment. Vague details can lead to disputes.

Forgetting signatures — An agreement isn't valid until it's signed by all parties. Overlooking signatures is more common than you think and entirely avoidable.

Ignoring state laws — LLC regulations can vary significantly by state. Not tailoring the agreement to comply with relevant state laws can render the document ineffective.

Failing to specify dispute resolution methods — Without clear instructions on how to resolve disputes, parties can find themselves stuck in costly litigation. Agreeing on a method in advance is prudent.

Overlooking confidentiality clauses — Protecting sensitive information is crucial in business transactions. Neglecting to include or properly detail confidentiality agreements is a risky oversight.

Misunderstanding the rights and obligations — Each party needs a clear understanding of what is expected of them. Misinterpretations of rights and obligations can lead to non-compliance issues.

Not consulting a professional — It's understandable to want to save on expenses, but consulting with a legal expert can prevent costly mistakes. An expert's review can catch errors or omissions you might miss.

Avoiding these mistakes requires a methodical approach and, often, a professional's guidance. While filling out an LLC Share Purchase Agreement might seem straightforward, its implications are far-reaching. Taking the time to get it right is not just beneficial; it's essential.

Documents used along the form

When parties engage in transactions involving the purchase of shares in a Limited Liability Company (LLC), the LLC Share Purchase Agreement form is essential. However, this agreement rarely stands alone. To ensure a smooth and legally sound transfer of ownership, several other documents are often used in conjunction with this agreement. These documents help clarify the terms, offer additional legal protections, and ensure compliance with relevant laws and regulations. Below is a list of other forms and documents frequently used alongside the LLC Share Purchase Agreement form, each serving a specific purpose in the transaction process.

- Due Diligence Checklist: This document outlines all the necessary information and materials to be reviewed before the purchase. It ensures that the buyer is fully informed about the LLC's financial health, liabilities, contracts, and operational status.

- Bill of Sale: It serves as a receipt for the transaction, detailing the assets being transferred as part of the share purchase. This document proves ownership transfer and specifies the assets included in the sale.

- Non-Disclosure Agreement (NDA): Particularly important during the due diligence phase, the NDA ensures that confidential information disclosed during the negotiations remains secure and is not improperly used or leaked.

- Non-Compete Agreement: Sometimes included to prevent the seller from starting or investing in a competing business within a certain geographical area and time frame, protecting the buyer's investment.

- Employment Agreement: If key employees are critical to the LLC's ongoing success, new or updated employment agreements may be negotiated as part of the share purchase deal to ensure these individuals remain with the company post-transaction.

- Indemnity Agreement: This contract provides protection against potential losses or damages arising from the transaction. It specifies the conditions under which one party must compensate the other.

- Stock Power: Also known as a stock assignment, this document facilitates the actual transfer of shares from the seller to the buyer, evidencing the change in ownership.

- Resolution of LLC Members: An official record that the LLC's members have approved the share sale and any terms related to the transaction, ensuring that the sale complies with the LLC's operating agreement.

Each of these documents plays a vital role in complementing the LLC Share Purchase Agreement form, addressing various aspects of the transaction, from due diligence to legal protections. Their use helps both buyer and seller navigate the complexities of the transaction, aiming for a seamless transfer of share ownership while mitigating risks and ensuring compliance with applicable laws. Legal advice is recommended when preparing and reviewing these documents to ensure they meet the specific needs and circumstances of the transaction.

Similar forms

Stock Purchase Agreement: This document is closely related to the LLC Share Purchase Agreement as both are used in transactions involving the sale of equity in a company. While the LLC Share Purchase Agreement is specific to limited liability companies, the Stock Purchase Agreement is commonly used for corporations. Both outline the terms and conditions of the sale, including the purchase price, representations and warranties, and closing conditions. The main difference lies in the type of equity being transferred, with shares commonly associated with corporations and membership interests with LLCs.

Asset Purchase Agreement: Similar to the LLC Share Purchase Agreement, an Asset Purchase Agreement details the terms under which business assets, rather than shares, are purchased. Both documents are essential in business transactions and contain provisions regarding the sale specifics, including payment structure, liabilities, and representations and warranties made by both seller and buyer. The Asset Purchase Agreement is particularly used when a buyer wishes to acquire specific assets and not take on the liabilities attached to the company's shares.

Membership Interest Purchase Agreement: This document has a lot in common with the LLC Share Purchase Agreement because it's specifically designed for transactions involving the sale of ownership interests in an LLC. It details the agreement between the buyer and the seller for the purchase of a member's interest in an LLC, including the purchase price, payment terms, and any conditions precedent to closing. Essentially, it serves the same purpose as the LLC Share Purchase Agreement but might be preferred for its explicit reference to membership interests, which are unique to LLCs.

Business Purchase Agreement: Often used interchangeably with the LLC Share Purchase Agreement, this document facilitates the sale and transfer of a business from one party to another. However, it can be broader, encompassing not only the sale of shares or membership interests but also the company's assets, name, and operational capabilities. Both agreements are pivotal in mergers and acquisitions, ensuring that all aspects of the sale are clearly understood and agreed upon by both parties. The terms within focus on the overall structure of the deal, including representations and warranties, covenants, and conditions to closing.

Dos and Don'ts

Filling out an LLC Share Purchase Agreement requires meticulous attention to detail and a clear understanding of the transaction at hand. This legally binding document outlines the terms of sale regarding shares of an LLC from one party to another. Here are five essential do's and don'ts to keep in mind during this process.

Do:- Review the LLC’s operating agreement. Before filling out the form, it’s crucial to understand any provisions within the LLC’s operating agreement that may influence the sale or transfer of shares. This ensures that the share purchase aligns with the existing conditions and regulations.

- Ensure accuracy of all information. The names of the parties, the number of shares, the sale price, and all other details must be accurately represented in the document. Any mistake, no matter how minor, could potentially invalidate the agreement or lead to disputes later on.

- Clarify payment terms. The agreement should explicitly state how and when the payment is to be made. This includes specifying whether the payment will be in a lump sum or in installments, the method of payment, and any conditions for payment release.

- Include any representations and warranties. It’s wise to have both parties make certain assertions about the shares and their authority to engage in the transaction. This could include assurances that the shares are free of any encumbrances and that all information provided is true and accurate.

- Seek legal advice. Due to the complexities and legal implications of such agreements, consulting with a lawyer who can provide guidance tailored to your specific circumstances and needs is invaluable.

- Overlook confidentiality clauses. Neglecting to include confidentiality terms can lead to sensitive information being disclosed inadvertently. Protecting business information is critical in share purchase transactions.

- Ignore non-compete clauses. Failing to address whether the seller is restricted from competing with the LLC after the sale can lead to potential business conflicts. Consider the future impacts and incorporate appropriate terms.

- Forget about dispute resolution. It’s important to outline how disputes related to the agreement will be handled. Specifying whether arbitration, mediation, or court proceedings will be used can save both parties time and money in case of disagreements.

- Rush the process. Taking the time to thoroughly review and understand every aspect of the agreement before signing is crucial. This caution can prevent misunderstandings and legal issues down the line.

- Assume state laws are the same. The laws governing LLCs and share transactions can vary significantly from one state to another. It’s essential to ensure that the agreement complies with the specific legal requirements of the state in which the LLC is registered.

Misconceptions

When it comes to the legal documents that shape our business dealings, few are as pivotal yet misunderstood as the LLC Share Purchase Agreement. This agreement is a cornerstone for transactions involving the sale and purchase of shares in a Limited Liability Company (LLC). Despite its importance, there are several misconceptions surrounding its nature and implications. Here, we aim to clarify some of the most common misunderstandings.

- It's the same as a stock purchase agreement. While they share similarities, they govern different entities. LLCs are structured uniquely compared to corporations, thus requiring their own form of agreement to deal with the membership interests which are not "stock" in the traditional sense.

- One standard form fits all situations. Each LLC has its own operating agreement and state-specific regulations, influencing the structure and content of any Share Purchase Agreement. Customization is often necessary to address the specific rights, obligations, and conditions relevant to the participating parties.

- Legal representation isn't necessary. Given the complexity and legal implications of these agreements, consulting with legal professionals is crucial. They can navigate state laws, draft agreements to suit specific needs, and identify potential issues before they arise.

- It's only about buying and selling shares. The agreement often includes much more, such as representations and warranties, indemnification clauses, and covenants that can significantly affect the parties' rights and obligations.

- Pricing is straightforward. Valuing an LLC's membership interests can be complex and is subject to negotiation between the buyer and seller. Various factors, including the company's financial performance, potential, and the specifics of the interest being sold, play into this process.

- A verbal agreement is sufficient. For such a transaction to be legally enforceable, it must be documented in writing. Oral agreements regarding the sale of LLC interests are not only risky but often fail to meet legal requirements.

- All members must agree to the sale. This depends on the LLC’s operating agreement. Some agreements allow owners to sell their interests without additional consent, while others may require approval from certain members or a majority.

- The process is quick and simple. Completing the sale of LLC shares often involves negotiations, due diligence, drafting the agreement, and potentially state filings. The timeframe can vary significantly based on the complexity of the deal and the parties' responsiveness.

Understanding the intricacies of the LLC Share Purchase Agreement is essential for anyone involved in the buy-sell process of an LLC's membership interests. Misconceptions can lead to legal pitfalls and financial repercussions. Ensuring thorough comprehension and seeking appropriate legal counsel can safeguard the interests of all parties involved.

Key takeaways

When individuals or businesses decide to buy shares in a Limited Liability Company (LLC), the process is formalized through a document known as the LLC Share Purchase Agreement. This agreement serves as a critical legal document that outlines the terms and conditions of the sale, including the number of shares being purchased, the price per share, and any representations and warranties the buyer and seller are making to each other. Here are seven key takeaways to consider when filling out and using this form:

- Understand the Components: A well-drafted LLC Share Purchase Agreement should include sections that detail the purchase price, the payment method, any adjustments to the price, representations and warranties of both the buyer and the seller, conditions precedent to the closing, confidentiality obligations, and any post-closing commitments.

- Clarify the Share Details: It's imperative to accurately state the number of shares being sold and to ensure that these shares are clearly identified within the agreement. This may involve specifying the class of shares if the LLC has more than one class.

- Price Determination: The method of determining the purchase price should be clearly outlined in the agreement. This might include a fixed amount, a formula for calculating the price, or a mechanism for price adjustment based on certain financial metrics of the LLC at closing.

- Representations and Warranties: Both parties should carefully review the representations and warranties section. These statements provide assurances about the current state of the LLC and its business. They aim to disclose potential risks and liabilities to the buyer, thus playing a critical role in the negotiation process.

- Conduct Due Diligence: The buyer is usually given a period to perform due diligence, which allows them to verify the information provided by the seller and to inspect the financial and legal health of the LLC. The agreement should specify any access rights the buyer has to the company’s documents and records during this period.

- Understand Closing Conditions: The agreement should delineate any actions or approvals required before the transaction can be completed. This includes obtaining necessary consents from creditors or regulatory bodies, as well as the completion of any outstanding due diligence.

- Legal and Tax Implications: The sale and purchase of LLC shares can have significant legal and tax consequences for both parties. It's important to consult with legal and tax professionals to understand these implications and to structure the transaction in a way that is legally compliant and tax-efficient.

Given the complexity of LLC Share Purchase Agreements and the significant legal and financial stakes involved, parties are strongly encouraged to engage competent legal counsel to guide them through the process. Drafting, negotiating, and executing this agreement with due care ensures that both parties’ interests are adequately protected and that the transaction proceeds smoothly.

Other Forms

Bill of Sale Rv - It serves as a legal record that an RV has been sold by one party to another, including details like names and addresses of both parties.

Character Letter for Court Example - A testimonial emphasizing a parent’s engagement in their child’s school and community life.