Legal Loan Agreement Form

In the realm of financial transactions, the Loan Agreement form serves as a critical document that meticulously outlines the terms and conditions under which money is lent and must be repaid. This comprehensive agreement is designed to protect both the lender and the borrower, ensuring clarity on the amount of money being borrowed, the interest rate applied, the repayment schedule, and any collateral involved. Beyond its primary function, the form encompasses provisions for late payments, defaults, and potential remedies, hence safeguarding the interests of all parties involved. Furthermore, it addresses legal obligations and the ramifications of failing to meet these commitments. By meticulously detailing every aspect of the loan process, this agreement form acts not only as a legal contract but also as a tool for financial planning and management. Its adaptability across various lending scenarios—from personal loans between family members to more complex commercial loans—underscores its importance in establishing a transparent and secure financial agreement.

Loan Agreement Document Subtypes

Example - Loan Agreement Form

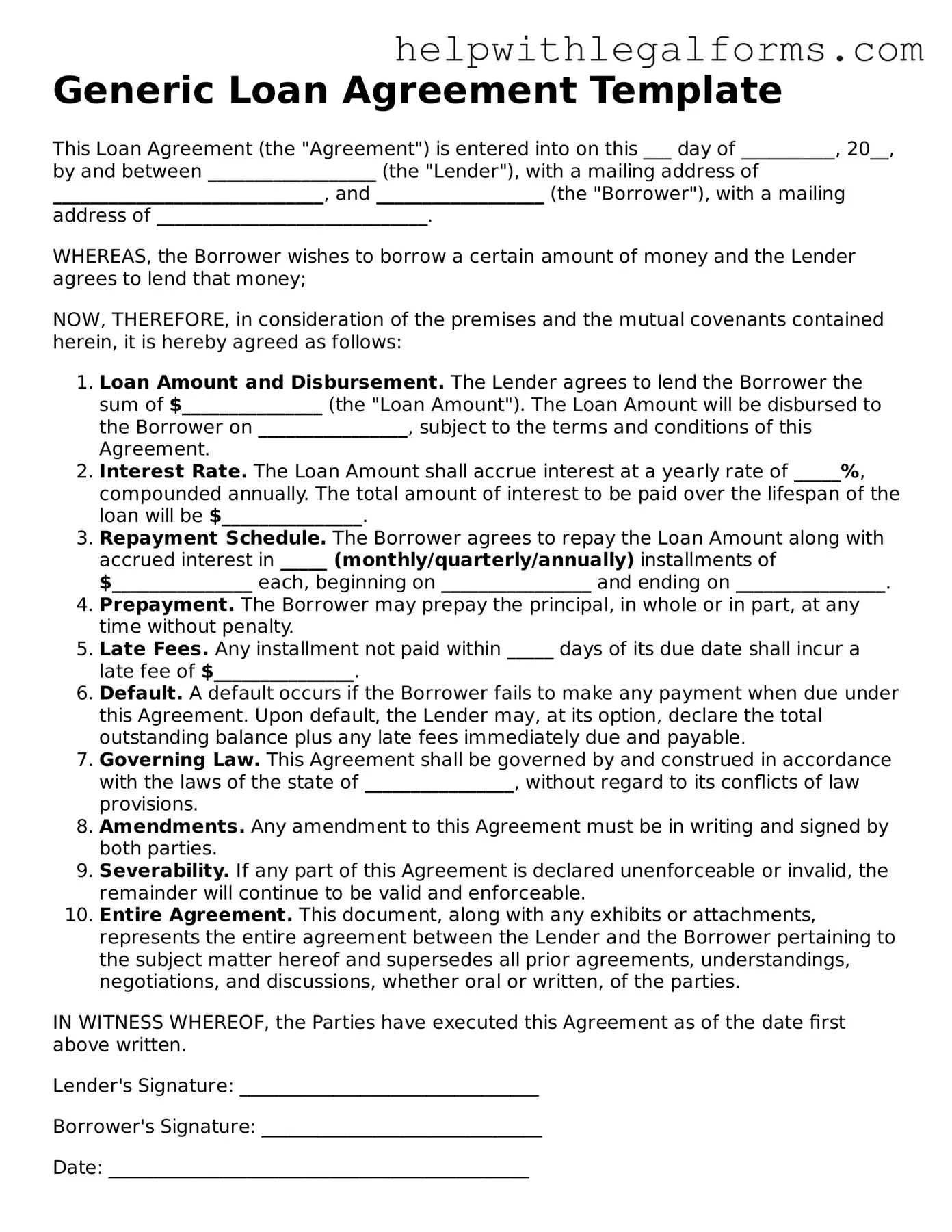

Generic Loan Agreement Template

This Loan Agreement (the "Agreement") is entered into on this ___ day of __________, 20__, by and between __________________ (the "Lender"), with a mailing address of _____________________________, and __________________ (the "Borrower"), with a mailing address of _____________________________.

WHEREAS, the Borrower wishes to borrow a certain amount of money and the Lender agrees to lend that money;

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, it is hereby agreed as follows:

- Loan Amount and Disbursement. The Lender agrees to lend the Borrower the sum of $_______________ (the "Loan Amount"). The Loan Amount will be disbursed to the Borrower on ________________, subject to the terms and conditions of this Agreement.

- Interest Rate. The Loan Amount shall accrue interest at a yearly rate of _____%, compounded annually. The total amount of interest to be paid over the lifespan of the loan will be $_______________.

- Repayment Schedule. The Borrower agrees to repay the Loan Amount along with accrued interest in _____ (monthly/quarterly/annually) installments of $_______________ each, beginning on ________________ and ending on ________________.

- Prepayment. The Borrower may prepay the principal, in whole or in part, at any time without penalty.

- Late Fees. Any installment not paid within _____ days of its due date shall incur a late fee of $_______________.

- Default. A default occurs if the Borrower fails to make any payment when due under this Agreement. Upon default, the Lender may, at its option, declare the total outstanding balance plus any late fees immediately due and payable.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the state of ________________, without regard to its conflicts of law provisions.

- Amendments. Any amendment to this Agreement must be in writing and signed by both parties.

- Severability. If any part of this Agreement is declared unenforceable or invalid, the remainder will continue to be valid and enforceable.

- Entire Agreement. This document, along with any exhibits or attachments, represents the entire agreement between the Lender and the Borrower pertaining to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

Lender's Signature: ________________________________

Borrower's Signature: ______________________________

Date: _____________________________________________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | A Loan Agreement form outlines the terms and conditions under which a loan will be provided and repaid. |

| 2 | It details the loan amount, interest rate, repayment schedule, and any collateral securing the loan. |

| 3 | The agreement serves to protect both the lender and the borrower by legally formalizing the loan’s terms. |

| 4 | Interest rates can be fixed or variable, depending on the agreement's terms. |

| 5 | Default terms are included to address what happens if the borrower fails to repay the loan according to the agreed terms. |

| 6 | State-specific legal requirements may dictate certain provisions of the loan agreement, such as caps on interest rates and required disclosures. |

| 7 | The governing law clause specifies the state laws that apply to interpreting the agreement, resolving any disputes, and enforcing terms. |

Instructions on How to Fill Out Loan Agreement

When you're set to formalize the terms of a loan between two parties, filling out a loan agreement form is a crucial step. This document outlines the specifics of the loan, such as the amount, interest rate, repayment schedule, and any collateral involved. By clearly stating these terms, both the lender and borrower can ensure a mutual understanding and reduce potential disputes. Here's a straightforward guide to help you navigate through the form filling process, ensuring all necessary details are accurately captured.

- Start with the basics: Enter the full legal names and contact information of both the lender and borrower at the top of the form. This identification includes addresses, phone numbers, and email addresses.

- Specify the loan amount: Write down the total amount of money being loaned in the designated section. Ensure this amount is in numbers and words for clarity.

- Detail the interest rate: Input the agreed-upon interest rate. This should be represented as an annual percentage of the principal loan amount.

- Outline the repayment plan: Decide and document how the loan will be repaid. This includes the frequency of payments (monthly, quarterly, etc.), the amount of each payment, and the duration of the repayment period. Don't forget to include the start date of the repayment.

- Address late fees: If applicable, define the terms for any late fees, including the grace period before a late fee is applied and the amount of the fee.

- Include collateral information: If the loan is secured with collateral, clearly describe the collateral item(s) and state the conditions under which the lender can take possession of the collateral.

- Define default terms: Describe what constitutes a default on the loan and what actions can be taken by the lender if the borrower fails to meet the loan obligations.

- Add cosigner details (if any): If there's a cosigner for the loan, their information should be recorded, similar to the borrower's details outlined in step 1.

- Include governing law: Specify the state laws that will govern the agreement, determining how legal issues will be resolved should they arise.

- Signatures: Have both parties sign and date the form. It's also recommended to have witness signatures or a notary public seal to authenticate the agreement.

Completing a loan agreement form is an essential step in ensuring that both parties are on the same page regarding the loan specifics. By following these step-by-step instructions, you can fill out the form with confidence, knowing that you've thoroughly documented the terms of your agreement. Remember, it's always a good idea to review the form with a legal expert before finalizing it to ensure its correctness and completeness.

Crucial Points on This Form

What is a Loan Agreement form?

A Loan Agreement form is a legally binding document between two parties, a lender and a borrower, outlining the terms and conditions under which money is lent. The agreement specifies the loan amount, interest rate, repayment schedule, and any other terms necessary to clearly detail the obligations of both the lender and the borrower. This document is crucial for ensuring clarity and accountability, helping to prevent misunderstandings and providing a legal framework to resolve disputes.

Who needs to use a Loan Agreement form?

The necessity of a Loan Agreement form arises whenever an individual or entity lends money to another. It is particularly recommended for lenders who wish to loan money to friends, family members, or small businesses. Using a formal agreement not only protects the lender by legally enforcing the borrower's promise to repay the loan but also safeguards the borrower by specifying the loan's terms, thereby preventing the lender from arbitrarily changing the agreed-upon conditions.

Can I customize a Loan Agreement form to fit my needs?

Yes, a Loan Agreement form can and should be customized to fit the specific needs of the parties involved. While standard templates provide a good foundation, the details of the loan such as the repayment schedule, interest rate, collateral, and any special conditions relevant to the agreement should accurately reflect the mutual understanding of both the lender and the borrower. Customizing the agreement helps ensure that all aspects of the loan are clearly understood and agreed upon by everyone involved.

What information is required to complete a Loan Agreement form?

To complete a Loan Agreement form, several key pieces of information are needed. This includes the identities of the lender and borrower, the amount of money being loaned, the interest rate if applicable, the repayment schedule, and any collateral securing the loan. Additionally, it should include provisions for late payments, default conditions, and any legal actions that can be taken if the agreement is breached. This comprehensive approach guarantees that all aspects of the loan are well-documented and legally enforceable.

Is a witness or notarization required for a Loan Agreement form to be legally binding?

The requirement for a witness or notarization varies depending on the law of the jurisdiction where the agreement is made. While not always necessary, having the Loan Agreement form witnessed or notarized can add an extra layer of authenticity and may aid in the enforcement of the document in some legal systems. It is advisable to consult legal advice in your area to ensure that the form meets all the requirements to be considered legally binding and enforceable in a court of law.

Common mistakes

Filling out a Loan Agreement form is a crucial step in the borrowing process, and it's essential to do it correctly. Unfortunately, people often make mistakes that can lead to misunderstandings or legal complications down the line. Here are some of the most common mistakes:

- Not Reading the Entire Form: Many people start filling out the loan agreement without thoroughly reading the document first. It's crucial to understand every part of the agreement to ensure it reflects the agreed-upon terms.

- Skipping Over Terms and Conditions: Skipping the fine print can result in overlooking critical terms, including repayment schedules, interest rates, and penalties for late payments.

- Incorrect Personal Information: People often make the mistake of entering incorrect information, such as wrong names, addresses, or social security numbers. Accuracy is fundamental to avoid future disputes or processing delays.

- Incomplete Sections: Some sections might be left incomplete, either because they were missed or deemed unimportant by the applicant. Every part of the form should be filled out to ensure a complete agreement.

- Signing Without a Witness: Depending on the jurisdiction and the nature of the loan, having a witness or notary public sign the agreement might be necessary to add legal weight to the document.

- Misunderstanding the Interest Rate: Borrowers sometimes fail to understand whether the interest rate is fixed or variable, leading to surprises in payment amounts if rates increase.

- Not Specifying the Loan Purpose: For certain loans, not detailing the purpose can be problematic, especially if the lender has restrictions on how their funds can be used.

- Forgetting to Include a Repayment Plan: Clearly outlining how and when the loan will be repaid is crucial; otherwise, there’s a risk of misunderstanding or conflict.

- Ignoring State Laws: The legality of certain loan terms can vary by state. It's important for both parties to ensure their agreement complies with state laws to avoid it being voided.

Avoiding these mistakes can save both parties a lot of trouble. It's always a good idea to ensure everything is double-checked and, if possible, reviewed by a legal professional before finalizing any loan agreement.

Documents used along the form

When someone enters into a loan agreement, it often involves more than just signing a single document. To fully protect all parties involved and ensure the terms are clear and enforceable, several additional forms and documents are typically used alongside the Loan Agreement form. Each of these documents plays a crucial role in the lending process, covering aspects from collateral security to the borrower's financial information.

- Promissory Note: This is a crucial document that outlines the borrower's promise to repay the loan. It includes the loan amount, interest rate, repayment schedule, and what happens if the borrower fails to repay the loan. Unlike the broader loan agreement, the promissory note focuses solely on the repayment terms.

- Personal Guarantee: Often required for business loans, this document is an agreement that an individual (often a business owner) will be personally responsible for repaying the loan if the business cannot. This provides an added layer of security to the lender, especially when lending to new or small businesses with limited credit history.

- Security Agreement: If the loan is secured with collateral, a Security Agreement specifies the assets that the borrower is putting up as security. It details the rights the lender has over the collateral if the loan is not repaid, including the right to seize and sell the assets.

- Amortization Schedule: This document provides a detailed breakdown of each payment over the life of the loan, showing how much of each payment goes towards the principal (the original loan amount) and how much goes towards interest. It helps both the lender and the borrower keep track of the loan balance and interest payments over time.

Together with the Loan Agreement form, these documents form a comprehensive framework that governs the lending relationship. They serve to clarify expectations, provide legal protections, and outline the specifics of the repayment plan. Ensuring that these documents are in order can help prevent misunderstandings and disputes, making for a smoother lending process for both parties involved.

Similar forms

Mortgage Agreement: Both a loan agreement and a mortgage agreement involve borrowing money, with terms dictated for repayment. The key similarity is their purpose to define the relationship between the borrower and the lender, including details about repayment. However, a mortgage is specifically tied to real estate as collateral.

Personal Guarantee: This document, much like a loan agreement, obligates an individual to repay a debt. In a personal guarantee, an individual promises to be responsible for the debt if the primary borrower defaults, similar to the borrower's repayment obligations under a loan agreement.

Promissory Note: Promissory notes and loan agreements share the fundamental characteristic of being written promises to pay a specific sum of money to another party under specified terms. However, a promissory note is typically simpler and might not detail the repayment structure as comprehensively as a loan agreement.

Line of Credit Agreement: Both documents establish terms under which money can be borrowed. A line of credit agreement, like a loan agreement, specifies interest rates, repayment terms, and the consequences of default. The primary difference lies in the borrowing mechanism— a line of credit is more flexible, allowing for drawing, repaying, and re-drawing up to the credit limit.

Lease Agreement: Lease agreements and loan agreements share the concept of scheduled payments and terms for breach of agreement. While a lease agreement concerns the use of property (such as real estate or equipment), a loan agreement is about borrowing money. Both include terms related to maintenance of the asset or capital, respective obligations, and consequences for non-compliance.

Debt Settlement Agreement: This type of agreement is similar to a loan agreement in that it involves the repayment of borrowed money. A debt settlement agreement often comes into play when renegotiating the original terms of a loan agreement, providing for the repayment of debt under new conditions, often at a reduced amount.

Business Purchase Agreement: While primarily focused on the sale and purchase of a business, this document resembles a loan agreement because it may involve seller financing, where the seller extends credit to the buyer for the purchase, necessitating repayment terms similar to those found in loan agreements.

Partnership Agreement: In instances where a partnership may take a loan for business purposes, the agreement between partners will detail contributions and distributions similar to how a loan agreement outlines the handling of funds between borrower and lender. Terms for resolving disputes or handling defaults can also bear similarities.

Shareholder Loan Agreement: This is akin to a conventional loan agreement in that it involves a loan, typically from a shareholder to a corporation. It outlines the loan's terms, repayment schedule, and interest rates, ensuring the interests of both the shareholder-lender and the company.

Collateral Agreement: Linked to loan agreements, a collateral agreement specifies the assets pledged as security for a loan. It complements a loan agreement by detailing the conditions under which collateral is to be appraised, maintained, and, if necessary, liquidated—a crucial aspect of securing and enforcing the loan’s terms.

Dos and Don'ts

When you're getting ready to fill out a Loan Agreement form, it's important to step carefully. A Loan Agreement is a binding contract that sticks with you, affecting both your finances and legal standing. Making sure you fill it out accurately and thoughtfully can save a lot of headaches down the road. Here are some essential dos and don'ts to keep in mind:

Do:- Read through the entire form before you start filling it out. Understanding every section will help you provide accurate and complete information.

- Double-check the details. Make sure names, addresses, loan amounts, and other critical information are correct.

- Be clear about the terms. This includes the interest rate, repayment schedule, and any collateral involved. Clarity here can prevent disputes later on.

- Keep a copy for your records. After both parties have signed, make sure you have a copy of the agreement for your own files.

- Consult a legal advisor if you're unsure about any part of the agreement. Getting professional advice can clarify complex terms and protect your interests.

- Ensure that all parties sign the agreement. A Loan Agreement isn't enforceable if it's missing signatures.

- Include a section about dispute resolution. Agreeing upfront on how to handle potential disagreements can streamline resolutions.

- Rush through the process. Take your time to understand every part of the agreement.

- Skip reading the fine print. This is often where important details are hidden.

- Ignore the importance of a witness or notarization, if required. This step can add an extra layer of legality and enforcement.

- Forget to specify the loan purpose, if applicable. This can include details on how the loan amount should be used.

- Leave spaces blank. If a section doesn't apply, write 'N/A' instead of leaving it empty to prevent unauthorized additions later.

- Assume good faith is enough. While trust is important, a written agreement is crucial for both parties' protection.

- Underestimate the consequences of breaching the agreement. Both parties should understand the penalties and steps that will follow.

Filling out a Loan Agreement form correctly can prevent a world of trouble. Both lenders and borrowers should approach this document with seriousness and attention to detail. By following these dos and don'ts, you're more likely to create an agreement that is fair, clear, and enforceable.

Misconceptions

Many people hold misconceptions about loan agreement forms that can impact their understanding and management of financial obligations. It's crucial to clear up these misunderstandings for borrowers and lenders alike to ensure clear, fair, and enforceable agreements are made. Here are four common misconceptions:

All loan agreements are essentially the same. This is not true. Loan agreements can vary significantly in terms of interest rates, repayment schedules, collateral requirements, and consequences of default. Customization to the specific circumstances of the borrower and lender is crucial for a fair and effective agreement.

A verbal agreement is as good as a written one. While verbal agreements can be legally binding, proving the terms of the agreement in court can be challenging. A written loan agreement provides clear evidence of the terms agreed upon by both parties, significantly reducing potential disputes.

You don't need a loan agreement among friends or family. This assumption can lead to strained relationships and financial disputes. A formal agreement clarifies the terms and expectations for both parties, making it easier to manage the loan responsibly and maintain personal relationships.

Loan agreements are too complex for non-professionals to understand. Although legal documents can be daunting, loan agreements should be written in clear, understandable language. Individuals should feel empowered to ask questions and seek clarification or legal advice to ensure they fully understand the terms before signing.

Key takeaways

Filling out and using a Loan Agreement form is a critical step for both the lender and the borrower. It formalizes the terms of the loan, protects both parties, and ensures that there is a clear agreement in place. Here are key takeaways to consider:

- Accuracy is paramount. Ensure all details entered into the Loan Agreement form, including names, addresses, loan amount, interest rates, repayment schedule, and any collateral, are accurate. This helps prevent disputes and confusion.

- Clear terms. The terms of the loan, such as the interest rate, the repayment schedule, and any penalties for late payments, should be clearly outlined to avoid any ambiguity.

- Legal compliance. Make sure the Loan Agreement adheres to state and federal laws governing loans and interest rates to ensure it is enforceable and does not infringe upon any legal statutes.

- Signatures are essential. The Loan Agreement must be signed by all parties involved. Consider having the signatures notarized to add a layer of verification and authenticity.

- Right of recourse. The agreement should specify the legal actions that can be taken if the borrower defaults on the loan. This could include legal proceedings or confiscation of collateral.

- Collateral security. If the loan is secured by collateral, this should be explicitly mentioned, along with a detailed description of the collateral and the conditions under which it can be seized.

- Consultation with professionals. Before finalizing the Loan Agreement, consulting with a legal or financial professional can prevent legal pitfalls and ensure that the agreement is fair and compliant with current laws.

Utilizing a Loan Agreement form is not just a formality; it's a crucial document that ensures clarity, legality, and fairness in the lending process. Keeping these key takeaways in mind can help safeguard interests and foster a positive relationship between borrower and lender.

Other Forms

Selling Limited Edition Prints - Ensures a lawful transfer of art with a document that outlines the sale's specifics, including payment and artwork particulars.

Death of Joint Tenant California - For inheritors, this document is a starting point in managing the estate's transition and handling succession issues.