Blank Loan Agreement Form for California

Navigating through the complexities of loan agreements in California can seem daunting at first glance, yet understanding the nuances of the California Loan Agreement form is crucial for both lenders and borrowers engaged in financial transactions within the state. This document, fundamental in nature, outlines the terms and conditions under which money is lent and repaid, including the loan amount, interest rate, repayment schedule, and any other pertinent details that govern the financial relationship between the parties involved. The California Loan Agreement form serves not only as a binding contract that ensures the lender's interests are protected and provides the borrower with a clear understanding of their obligations, but it also complies with state-specific legal requirements, avoiding common pitfalls and legal grey areas. Its importance cannot be overstated, as it plays a critical role in formalizing the loan process, ensuring transparency, and fostering a sense of security for both parties involved. Whether for personal loans, business ventures, or real estate transactions, this form stands as a cornerstone of financial agreements in the Golden State, making a thorough comprehension of its contents and implications a necessity.

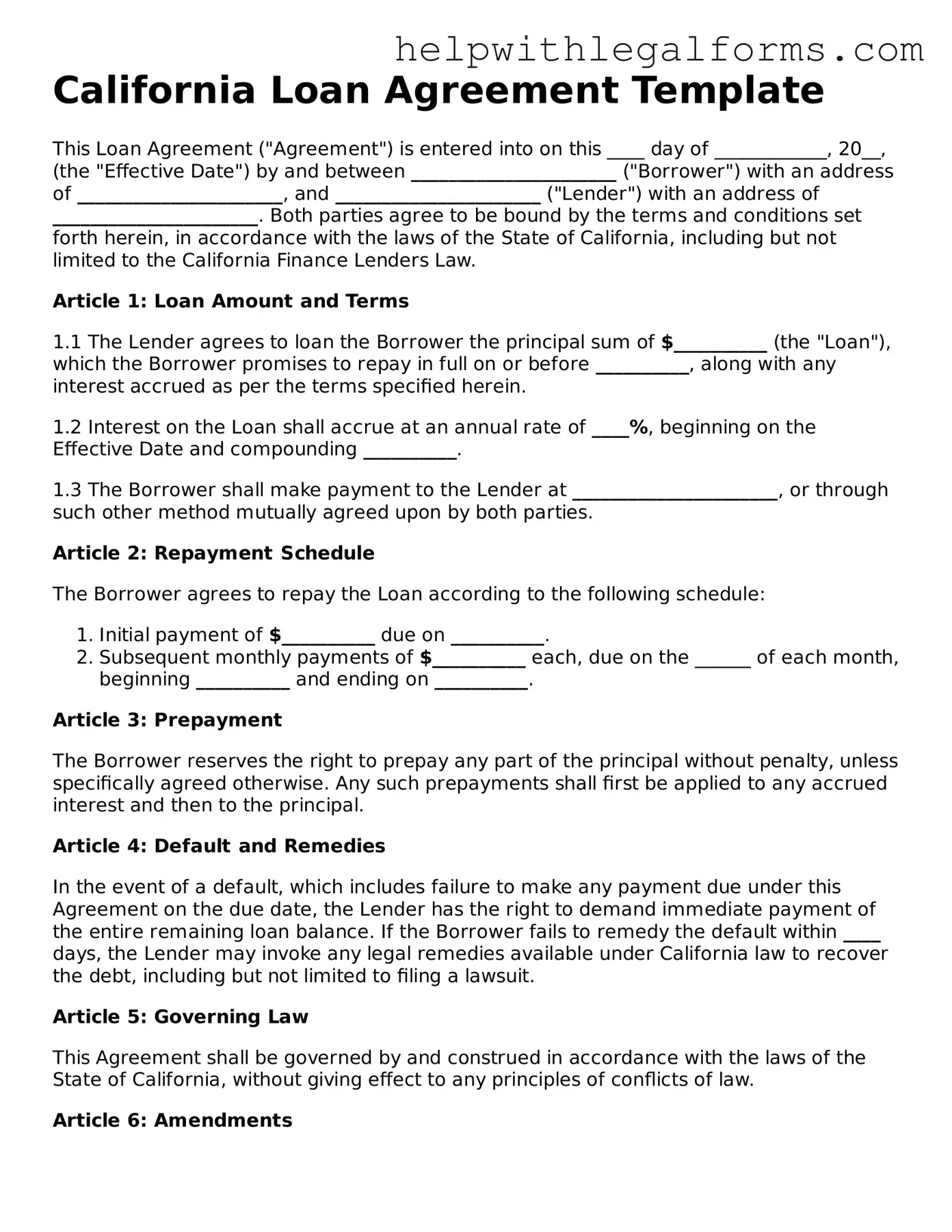

Example - California Loan Agreement Form

California Loan Agreement Template

This Loan Agreement ("Agreement") is entered into on this ____ day of ____________, 20__, (the "Effective Date") by and between ______________________ ("Borrower") with an address of ______________________, and ______________________ ("Lender") with an address of ______________________. Both parties agree to be bound by the terms and conditions set forth herein, in accordance with the laws of the State of California, including but not limited to the California Finance Lenders Law.

Article 1: Loan Amount and Terms

1.1 The Lender agrees to loan the Borrower the principal sum of $__________ (the "Loan"), which the Borrower promises to repay in full on or before __________, along with any interest accrued as per the terms specified herein.

1.2 Interest on the Loan shall accrue at an annual rate of ____%, beginning on the Effective Date and compounding __________.

1.3 The Borrower shall make payment to the Lender at ______________________, or through such other method mutually agreed upon by both parties.

Article 2: Repayment Schedule

The Borrower agrees to repay the Loan according to the following schedule:

- Initial payment of $__________ due on __________.

- Subsequent monthly payments of $__________ each, due on the ______ of each month, beginning __________ and ending on __________.

Article 3: Prepayment

The Borrower reserves the right to prepay any part of the principal without penalty, unless specifically agreed otherwise. Any such prepayments shall first be applied to any accrued interest and then to the principal.

Article 4: Default and Remedies

In the event of a default, which includes failure to make any payment due under this Agreement on the due date, the Lender has the right to demand immediate payment of the entire remaining loan balance. If the Borrower fails to remedy the default within ____ days, the Lender may invoke any legal remedies available under California law to recover the debt, including but not limited to filing a lawsuit.

Article 5: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California, without giving effect to any principles of conflicts of law.

Article 6: Amendments

Any amendments or modifications to this Agreement must be made in writing and signed by both parties.

Article 7: Notices

All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, at the address specified above or as the parties may provide from time to time in writing.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date first above written.

______________________

Lender Signature

______________________

Borrower Signature

______________________

Witness Signature (Optional)

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Purpose | California Loan Agreement forms are legal documents used to outline the terms and conditions between a lender and a borrower. |

| 2. Key Elements | These agreements typically include details such as loan amount, interest rate, repayment schedule, and consequences of default. |

| 3. Governing Law | California Loan Agreements are governed by the laws of the State of California, including but not limited to, the California Civil Code. |

| 4. Usury Law Considerations | The California Constitution and the California Civil Code place restrictions on the amount of interest that can be charged on a loan, to protect borrowers from excessive rates. |

| 5. Security | Loan agreements can be secured or unsecured, with secured loans requiring collateral from the borrower as a security for loan repayment. |

| 6. Parties Involved | These agreements are a binding contract between at least two parties - the lender, who provides the loan, and the borrower, who receives the loan and agrees to repay it. |

| 7. Signatory Requirements | All parties involved must sign the agreement for it to be legally binding, with witnesses and/or a notary public possibly required depending on the amount and terms. |

| 8. Default and Remedies | The agreement outlines the lender's remedies in cases of default by the borrower, including but not limited to, acceleration of the loan, repossession of collateral, and legal action. |

Instructions on How to Fill Out California Loan Agreement

Completing a California Loan Agreement form is a critical step for both the borrower and the lender. This document outlines the terms and conditions of the loan, ensuring clarity and legal accountability for both parties involved. It is essential to approach this process with attention to detail to ensure all information is accurate and comprehensive. The steps listed below will guide you through filling out the form correctly.

- Begin by entering the date on which the loan agreement is being executed at the top of the form.

- Fill in the full legal names of both the lender and the borrower, ensuring the spelling is accurate. If there are co-signers, their names must also be included.

- Specify the loan amount in words and then in parentheses, indicate the amount in numerals to avoid any confusion.

- Detail the loan repayment terms, including the interest rate, payment schedule (monthly, quarterly, etc.), and the final due date for the loan to be paid in full.

- Include any collateral that will be used to secure the loan. Clearly describe the collateral and state its approximate value.

- Outline any late fees or penalties for missed or late payments, ensuring this section is detailed and precise to prevent future disputes.

- Insert provisions for the loan's prepayment, if allowed. Specify any penalties or discounts for early payment.

- Both parties should read the agreement carefully, paying special attention to the default terms that detail what actions will be taken should the borrower fail to meet the conditions of the loan.

- Designate a space for both the borrower and the lender to provide signatures and print their names, which acknowledges their understanding, acceptance, and commitment to the agreement's terms. Include the date next to the signatures.

- If applicable, have the form notarized to further authenticate the document.

Once the California Loan Agreement form is fully completed and signed, both parties should keep copies for their records. This document now serves as a legally binding agreement between the borrower and the lender. It is crucial to adhere to all the terms specified within the form to maintain a positive contractual relationship and to avoid potential legal complications. Should any questions or issues arise during the completion of the form, it's advisable to seek legal guidance to ensure that both parties' interests are sufficiently protected.

Crucial Points on This Form

What is a California Loan Agreement form?

A California Loan Agreement form is a legal document that details the terms and conditions between a borrower and a lender where the lender agrees to loan a specific amount of money to the borrower in California. This document includes the loan amount, interest rate, repayment schedule, and other terms pertinent to the loan.

Who needs to sign the California Loan Agreement form?

Both the borrower and the lender need to sign the California Loan Agreement form. In some cases, a witness or a notary public may also be required to sign, ensuring that the agreement is legally binding and that all parties have willingly agreed to the terms.

Can the terms of a California Loan Agreement be modified after it is signed?

Yes, the terms of a California Loan Agreement can be modified, but any changes must be agreed upon by both the borrower and the lender. The modifications should be documented in writing and added to the original agreement as an amendment, with both parties providing their signatures to validate the changes.

What happens if the borrower fails to repay the loan as agreed?

If the borrower fails to repay the loan according to the agreed terms, several actions can be taken as outlined in the loan agreement. This could include imposing late fees, reporting the default to credit agencies, or taking legal action to recover the owed amount. The exact consequences depend on the specific terms stated in the Loan Agreement.

Is collateral required for a California Loan Agreement?

Whether collateral is required for a California Loan Agreement depends on the type of loan and the agreement between the borrower and the lender. Secured loans require collateral, while unsecured loans do not. The agreement should clearly state if collateral is part of the loan terms.

How can parties ensure the California Loan Agreement is legally binding?

To ensure the California Loan Agreement is legally binding, both parties should review the terms carefully, sign the document, and preferably have it notarized. Keeping accurate records and copies of the agreement for both the borrower and lender also strengthens its enforceability.

Common mistakes

In navigating the complexities of the California Loan Agreement form, it's not uncommon for individuals to encounter a few stumbling blocks. Attention to detail and a thorough understanding of the form’s requirements can significantly streamline the process and ensure a smooth path forward. Below are five frequent mistakes that deserve attention:

-

Not specifying the loan terms clearly. People often forget to delineate the specifics of the loan, including the interest rate, repayment schedule, and the loan's duration. These details are crucial for a binding and enforceable agreement.

-

Failing to include the full legal names and contact details of all parties involved. Sometimes, there's a tendency to use nicknames or incomplete addresses. For a loan agreement to hold legal weight, full and accurate information of both the lender and the borrower is essential.

-

Omitting the consequences of a default. It's critical yet often missed, to outline what happens if the borrower fails to adhere to the terms of the agreement, including late fees, legal actions, and other penalties.

-

Misunderstanding the role of the collateral. If the loan is secured, a common mistake is not properly describing or incorrectly valuing the collateral that secures the loan. This oversight can lead to disputes or complications in case of default.

-

Ignoring the need for witness or notary signatures. Though not always mandatory, having the loan agreement witnessed or notarized can add an extra layer of validity and protection for all involved parties, yet this step is frequently overlooked.

By avoiding these common pitfalls, parties can help protect their interests and ensure that the loan process is both clear and legally sound.

Documents used along the form

When engaging in loan transactions in California, the Loan Agreement form is a crucial document. However, it is often accompanied by several other forms and documents to ensure a legally binding and comprehensively documented loan process. These supplemental documents address various aspects of the loan arrangement, offering clarity and legal protection to both lender and borrower. Highlighting these documents can help parties understand the full scope of documentation necessary for a robust loan agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, repayment schedule, and consequences of non-payment.

- Deed of Trust: For loans secured by real estate, this document provides the lender with a security interest in the property. It allows for foreclosure if the borrower fails to comply with the loan terms.

- Security Agreement: Similar to the Deed of Trust but for personal property, this agreement grants the lender a security interest in specific assets other than real estate.

- Guaranty: This is an agreement by a third party to repay the loan if the borrower fails to do so, offering an additional layer of security to the lender.

- UCC Financing Statement (Form UCC-1): Used when personal property is used as collateral, this form is filed with the state to perfect the lender's security interest, making it public record.

- Personal Financial Statement: Often required from the borrower, this document provides a detailed overview of the borrower’s financial status, including assets, liabilities, income, and expenses.

- Loan Modification Agreement: If the terms of the original loan agreement need to be changed, this document formalizes those changes, such as adjustments to the interest rate, repayment schedule, or the principal amount of the loan.

- Release of Lien: Upon full repayment of the loan, this document is used to release the borrower from the lien created by the security instrument, clearing the title to the property.

These documents serve vital roles in protecting the interests of both parties involved in a loan agreement. They ensure that all terms are clearly defined and legally enforceable, while also providing mechanisms for recourse in the event of dispute or default. Individuals entering into loan agreements should consider these documents carefully as part of their overall legal strategy.

Similar forms

A Mortgage Agreement is also a binding contract between a borrower and lender, detailing the conditions under which a loan is provided for the purchase of real estate. Like a Loan Agreement, it specifies repayment terms, interest rates, and the actions that can be taken if the borrower fails to repay the loan.

A Promissory Note is quite similar because it is a written promise to pay a specified sum of money to another party by a certain date, usually with interest. It mainly differs in its simplicity and lack of detailed terms that a Loan Agreement includes, such as dispute resolution methods or collateral.

The Line of Credit Agreement shares similarity with a Loan Agreement in that it grants the borrower access to a certain amount of funds from the lender. However, the borrower can draw upon these funds as needed, up to the limit specified, and interest is typically charged only on the amount used.

A Debt Settlement Agreement is related to a Loan Agreement when a borrower cannot repay the original loan under its original terms. It outlines new terms for repayment, which can include a reduction in the overall debt or a change in repayment schedule, allowing both parties to avoid potential legal action.

Lease Agreements, used for renting properties, share the structure of detailing terms and conditions between two parties. Though not a loan in the traditional sense, they specify payments, use conditions, and the duration of the agreement, similar to how a Loan Agreement delineates loan terms.

The Security Agreement is an important document that complements a Loan Agreement by specifying the collateral that secures the loan. While a Loan Agreement details the loan's repayment conditions, a Security Agreement details what assets can be seized if the loan is not repaid.

Personal Guarantee agreements are similar as they involve a promise, where an individual or entity agrees to be liable for the borrower's debt should the borrower fail to repay the loan. This is often required by lenders as part of the Loan Agreement to provide an additional layer of security for the loan.

A Business Purchase Agreement outlines the terms and conditions for the sale of a business. While its primary function is different, it resembles a Loan Agreement in its complexity and detail, specifying payment terms, responsibilities of each party, and actions in the case of a breach.

Lastly, the Partnership Agreement outlines the relationship between partners in a business, including contributions, profit distributions, and dispute resolution. It mirrors a Loan Agreement in its functionality to dictate financial transactions and responsibilities between parties involved.

Dos and Don'ts

When filling out the California Loan Agreement form, it's crucial to approach the process with diligence and attention to detail. Both lenders and borrowers need to be aware of the do's and don'ts to ensure the agreement is legally binding and reflects the terms accurately. Below are essential tips to guide you through the preparation of your loan agreement.

- Do read through the entire form before filling it out. This ensures you understand the requirements and the scope of information needed.

- Do fill out the form using clear, legible handwriting if completing it by hand. Alternatively, if the form allows, type the information to avoid any misinterpretations.

- Do verify all the details provided, such as the loan amount, interest rate, repayment schedule, and any other crucial terms specific to the agreement.

- Do include the full legal names and contact information of both the lender and the borrower to ensure there's no ambiguity about the parties involved.

- Do double-check the accuracy of the interest rate and ensure it complies with California's usury laws to prevent any legal issues.

- Don't leave any sections blank. If a section does not apply, fill in with “N/A” (not applicable) to acknowledge that you have read and considered every part of the form.

- Don't sign the agreement without both parties understanding every term and condition. It's often helpful to review the document together before signing.

- Don't forget to make copies of the signed agreement for both parties. Having a physical copy or a digital record is crucial for future reference.

- Don't hesitate to seek legal advice if there's any part of the agreement that's unclear. It's better to consult a professional than to risk misunderstanding the legal obligations and rights each party has under the agreement.

Misconceptions

There are several misconceptions about the California Loan Agreement form that can confuse both lenders and borrowers. Understanding these can help clear up misunderstandings and lead to smoother financial transactions.

It is only for use with large loan amounts: A common misunderstanding is that the California Loan Agreement form is designed solely for large loans. In reality, this form can be utilized for loans of any size, whether small or large. It serves to outline the terms and ensure that both parties are clear on the agreement, regardless of the amount.

It’s too complicated for personal loans between family members: Some people think that the California Loan Agreement form is too complex for personal loans between family members or friends. However, using this form can actually help clarify repayment expectations and interest rates, which can prevent misunderstandings that might harm personal relationships.

A verbal agreement is just as binding: While verbal agreements can be legally binding, proving the terms and existence of a verbal agreement can be very challenging. The California Loan Agreement form provides a written record of the loan’s details, making it easier to enforce and reducing potential disputes.

Only banks and financial institutions need to use it: Another misconception is that only formal financial entities need to use the California Loan Agreement form. In fact, anyone lending or borrowing money can benefit from using this form. It sets out clear terms and conditions, making the agreement more secure for both lender and borrower, regardless of their official status or relationship.

Key takeaways

When considering the use of the California Loan Agreement form, it's crucial to understand its significance and how properly filling it out can protect both the borrower and the lender within the state of California. Below are key takeaways to ensure that both parties are well-informed and prepared before entering into such agreements.

- Read carefully before signing: Both parties should thoroughly read and understand each provision of the loan agreement to ensure it accurately reflects their understanding and agreement. It's essential to recognize the commitment being made.

- Complete all fields accurately: Incomplete or inaccurate information can lead to disputes or legal issues down the line. Ensure that all requested information is filled out correctly and completely.

- Specify loan details: Clearly outline the loan amount, interest rate, repayment schedule, and any other relevant details to avoid ambiguity. These specifics are crucial for a clear understanding of the obligations of each party.

- Consider the necessity of notarization: Notarizing the document might not be mandatory, but it can add a layer of verification and formality, potentially providing an additional legal safeguard for both parties involved in the transaction.

- Understand the legal implications: Be aware of the legal obligations and ramifications that come with the signing of the loan agreement. This understanding can prevent potential legal disputes in the future.

- Keep copies of the agreement: After both parties have signed, ensure each party retains a copy of the agreement. This document serves as proof of the terms agreed upon and can be vital in the event of a disagreement.

- Consult with a professional if necessary: If there are any doubts or uncertainties about the loan agreement, seeking advice from a legal expert might clarify terms and conditions, preventing potential issues.

Following these guidelines can significantly aid in ensuring that the California Loan Agreement form is filled out and used correctly, benefiting both the lender and borrower in the long term.

Create Other Loan Agreement Forms for US States

Promissory Note Template Georgia - A detailed agreement that plays a crucial role in financial transactions, clearly delineating the responsibilities of each party in a loan process.

Promissory Note Template Florida Pdf - Adjustments to the original terms, such as extending the loan period or changing the interest rate, can be efficiently handled through amendments to the agreement.

Promissory Note Texas - A Loan Agreement can be used for personal, business, or real estate financing.