Legal Family (Friends) Personal Loan Agreement Form

Lending money to a friend or family member can sometimes feel like navigating through a thick fog, fraught with potential misunderstandings and missed expectations. It's a path where many hesitate to tread, despite the best intentions from all parties involved. But there's a beacon of clarity that can guide the way: the Family (Friends) Personal Loan Agreement form. This document serves as a mutual understanding and puts everything in black and white, setting the terms for repayment, interest rates (if any), and what happens if things don't go as planned. It's designed to protect the relationship as much as it is to safeguard the loan. The form includes not just the essentials like amount and timelines, but also details on late fees and dispute resolution, making it a comprehensive tool for any personal lending situation. With this agreement, both lenders and borrowers can ensure that their financial arrangement doesn't lead to personal discord, preserving the bonds that matter most. Crafting this agreement thoughtfully can turn a potentially awkward conversation into a straightforward, transparent process, making lending among loved ones less daunting and more secure.

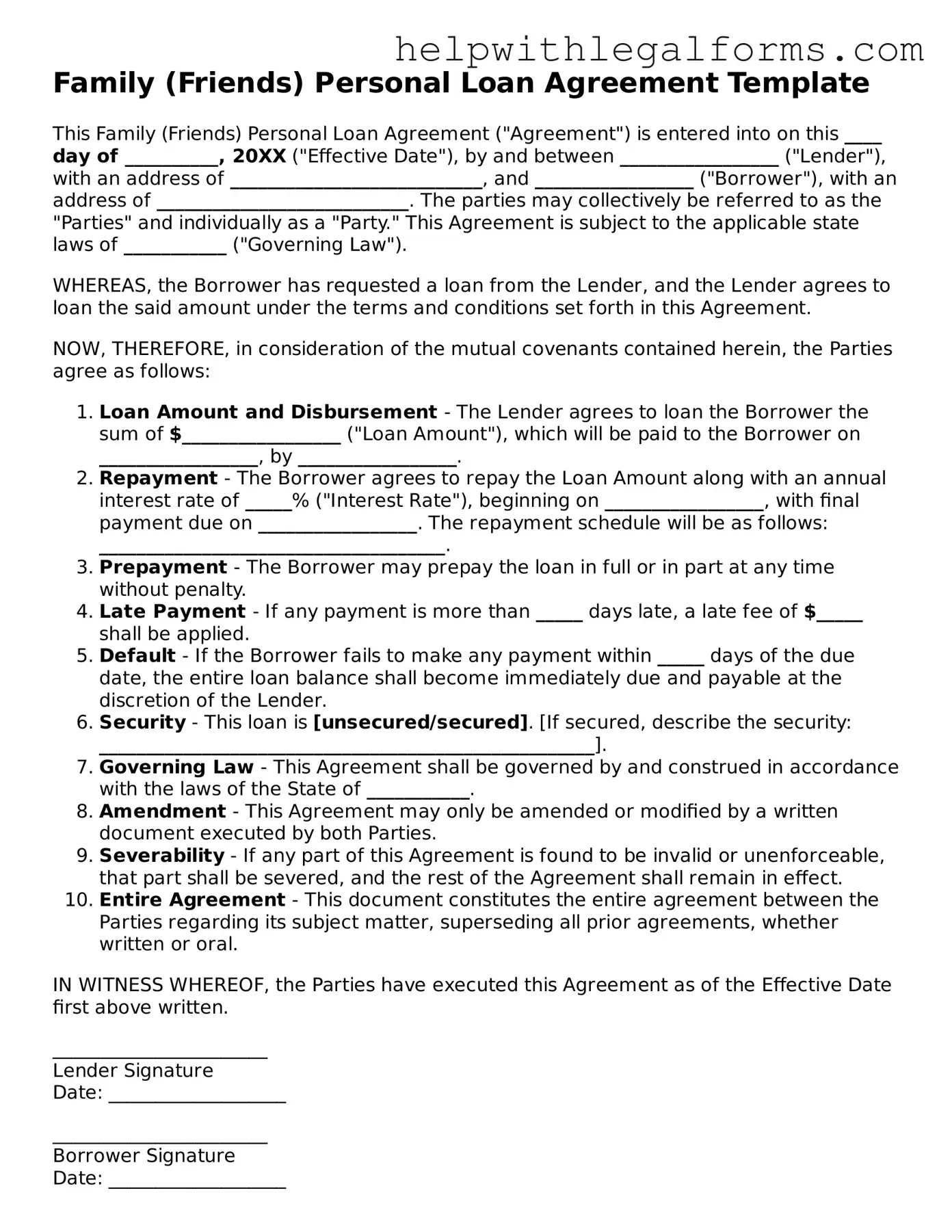

Example - Family (Friends) Personal Loan Agreement Form

Family (Friends) Personal Loan Agreement Template

This Family (Friends) Personal Loan Agreement ("Agreement") is entered into on this ____ day of __________, 20XX ("Effective Date"), by and between _________________ ("Lender"), with an address of ___________________________, and _________________ ("Borrower"), with an address of ___________________________. The parties may collectively be referred to as the "Parties" and individually as a "Party." This Agreement is subject to the applicable state laws of ___________ ("Governing Law").

WHEREAS, the Borrower has requested a loan from the Lender, and the Lender agrees to loan the said amount under the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the Parties agree as follows:

- Loan Amount and Disbursement - The Lender agrees to loan the Borrower the sum of $_________________ ("Loan Amount"), which will be paid to the Borrower on _________________, by _________________.

- Repayment - The Borrower agrees to repay the Loan Amount along with an annual interest rate of _____% ("Interest Rate"), beginning on _________________, with final payment due on _________________. The repayment schedule will be as follows: _____________________________________.

- Prepayment - The Borrower may prepay the loan in full or in part at any time without penalty.

- Late Payment - If any payment is more than _____ days late, a late fee of $_____ shall be applied.

- Default - If the Borrower fails to make any payment within _____ days of the due date, the entire loan balance shall become immediately due and payable at the discretion of the Lender.

- Security - This loan is [unsecured/secured]. [If secured, describe the security: _____________________________________________________].

- Governing Law - This Agreement shall be governed by and construed in accordance with the laws of the State of ___________.

- Amendment - This Agreement may only be amended or modified by a written document executed by both Parties.

- Severability - If any part of this Agreement is found to be invalid or unenforceable, that part shall be severed, and the rest of the Agreement shall remain in effect.

- Entire Agreement - This document constitutes the entire agreement between the Parties regarding its subject matter, superseding all prior agreements, whether written or oral.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date first above written.

_______________________

Lender Signature

Date: ___________________

_______________________

Borrower Signature

Date: ___________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Function | Serves as a formal agreement between family or friends for a personal loan, outlining the loan's terms and conditions. |

| Key Components | Includes loan amount, interest rate (if any), repayment schedule, and any collateral. |

| Importance of Clarity | Reduces misunderstandings and potential conflicts by clearly defining terms and expectations. |

| Governing Laws | Subject to state-specific laws where the agreement is executed, affecting interest rates and legal enforceability. |

| Benefit of Written Agreement | Provides a legal framework for recourse in case of disputes, unlike verbal agreements which are harder to enforce. |

Instructions on How to Fill Out Family (Friends) Personal Loan Agreement

When family or friends decide to lend money to one another, it's a wise idea to put the agreement in writing. A Family (Friends) Personal Loan Agreement form is a tool that helps in documenting the terms of the loan, thereby preventing misunderstandings and ensuring commitment from both parties involved. This form spells out the loan amount, interest rate (if any), repayment schedule, and any other terms or conditions agreed upon. To ensure that all necessary details are accurately captured, and the agreement is legally binding, follow these steps to fill out the form properly.

- Gather Important Information: Before starting, collect all the necessary information including the loan amount, interest rate (if applicable), repayment schedule, and personal details of both the lender and borrower.

- Fill in Personal Details: Start by entering the names and addresses of both the lender and the borrower. Make sure to clearly identify each party to prevent any confusion.

- Specify Loan Details: Clearly state the total amount of money being lent. If interest is being charged, mention the rate and how it's calculated - for example, annually. Specify if the interest rate is fixed or variable.

- Determine the Repayment Schedule: Agree upon and detail the schedule for repayments. This includes the frequency of payments (e.g., monthly), the amount of each payment, and the due date for the first and last payments. Document any allowances for early repayments or what happens in case of missed payments.

- Outline Additional Terms: If there are any specific conditions attached to the loan, such as the use of the loaned money for a specific purpose, it’s important to list those in this section. Additionally, consider what happens if the borrower is unable to repay the loan. Will there be collateral? Discuss and document these terms clearly.

- Signatures: The most critical part of the form is the signatures. After reviewing all the details and ensuring both parties agree, both the lender and the borrower should sign and date the form. It's also wise to have witness signatures or a notary public to legitimize the document.

- Keep Copies: Once the document is fully executed with signatures, make sure each party has a copy of the agreement to refer back to if any questions or disputes arise in the future.

After thoroughly completing the Family (Friends) Personal Loan Agreement form, both parties involved will have a clear understanding of the loan's terms and conditions. This not only solidifies the agreement in a formal, legally binding way but also preserves personal relations by preventing potential misunderstandings. Remember, having a written agreement is always better than relying on verbal agreements, especially when it comes to financial transactions between family and friends.

Crucial Points on This Form

What is a Family (Friends) Personal Loan Agreement?

A Family (Friends) Personal Loan Agreement is a document used to outline the terms of a loan between individuals who have a personal relationship, typically family members or friends. This agreement specifies the loan amount, interest rate (if any), repayment schedule, and any other conditions related to the loan. Its purpose is to provide clarity and protect the interests of both parties involved.

Why should I use a Family (Friends) Personal Loan Agreement?

Using such an agreement helps to prevent misunderstandings and disagreements between the lender and the borrower by clearly setting out the terms of the loan in writing. It can also serve as legal evidence of the loan terms if any disputes arise or if the matter is brought to court. Further, it helps to ensure that both parties are serious about the arrangement and understand their responsibilities.

What key elements should be included in the agreement?

A comprehensive agreement should include the full names and contact information of the parties involved, the loan amount, interest rate (if applicable), repayment schedule, late payment policies, and any collateral securing the loan. It's also wise to include what happens if the borrower can't repay the loan.

Is interest necessary in a Family (Friends) Personal Loan Agreement?

Charging interest is not mandatory. However, including an interest rate, even a minimal one, can provide an incentive for timely repayment and compensate the lender for the opportunity cost of lending the money. If interest is charged, it should adhere to applicable state laws to avoid being considered usurious.

How can I ensure the agreement is legally binding?

To make the agreement legally binding, all parties involved should sign and date the document. It may also be notarized for additional legal validation. Ensure that the agreement complies with state and federal laws, especially regarding interest rates and lending practices.

Do I need a lawyer to create a Family (Friends) Personal Loan Agreement?

While it's not strictly necessary to have a lawyer draft the agreement, consulting with a legal professional can ensure that the agreement complies with relevant laws and fully protects your rights. A lawyer can also help address any specific concerns or unique circumstances related to the loan.

Can the terms of the agreement be modified after it has been signed?

Yes, the terms of the agreement can be modified, but any changes should be agreed upon by all parties in writing. The amended agreement should be signed by everyone involved, similarly to the original agreement, to ensure that the changes are legally enforceable.

Common mistakes

Filling out a Family (Friends) Personal Loan Agreement form can sometimes be a straightforward process, but errors can occur that might result in misunderstandings or legal complications down the line. Recognizing and avoiding these common mistakes can help ensure that both parties understand the terms and respect the agreement fully.

Not Specifying Loan Details: A common mistake is not being clear about the loan amount, interest rate (if any), and repayment schedule. These are crucial details that should be explicitly stated.

Ignoring the Need for Witness or Notarization: Depending on the jurisdiction, having the agreement witnessed or notarized can add an extra layer of legal validity. Skipping this step can make the agreement less enforceable.

Forgetting to Include Consequences of Late Payments: Failing to outline the repercussions for late or missed payments can lead to disputes and uncertainty about how to handle these situations.

Lack of Clarity on Loan Purpose: Not specifying the purpose of the loan can result in misunderstandings, especially if the lender assumes the loan is for a specific need.

Omitting a Repayment Plan: A vague or non-existent repayment plan can lead to confusion and disagreements. It's essential to detail how the borrower intends to repay the loan.

Skipping Signatures: An agreement without the signatures of all parties involved is typically not legally binding. It’s a significant oversight to leave this section blank.

Not Specifying the Date: Failing to document the date when the agreement was made and when the repayment is expected to begin often leads to ambiguity about the timeline of the loan.

Failing to Include Contact Information: Without the current contact details of the involved parties, addressing concerns or changes to the agreement can become challenging.

Ignoring the Need for Amendments: The original agreement might require changes. Not including a clause for how amendments can be made is a mistake. Such a clause facilitates future changes formally.

Leaving Out Default Terms: Not considering what happens if the borrower cannot repay the loan is a critical error. It is advisable to include terms that define the course of action in case of default.

Thoroughly understanding and addressing these aspects when completing a Family (Friends) Personal Loan Agreement can prevent potential disputes and ensure that the agreement serves its intended purpose effectively.

Documents used along the form

When individuals engage in a financial transaction like a personal loan between family members or friends, several documents are typically used to ensure the process is handled professionally and legally. Besides the core Family (Friends) Personal Loan Agreement form, there are other forms and documents often utilized to complement the agreement and support the terms outlined. Each of these documents serves a unique purpose, reinforcing the agreement's integrity and providing additional legal security for both parties involved.

- Amendment Agreement Form: This document is used if both parties decide to modify any of the original terms of the loan agreement. It ensures any changes are legally documented and agreed upon by both the lender and borrower.

- Promissory Note: A promissory note is a written promise from the borrower to pay back the loan to the lender by a certain date. It typically includes details about the loan amount, interest rate, repayment schedule, and consequences of non-payment.

- Payment Schedule: This document outlines the specific dates when payments are due and the amount of each payment. It helps both parties keep track of repayments and ensures clarity on the payment expectations.

- Guarantee Agreement: If there is a third party acting as a guarantor for the loan, a Guarantee Agreement might be used. This form outlines the guarantor's legal obligations should the borrower fail to repay the loan.

- Collateral Agreement: In cases where the loan is secured with collateral (an asset pledged as security for repayment), a Collateral Agreement describes the asset and the conditions under which the lender can seize it if the loan is not repaid.

- Release Form: Upon the full repayment of the loan, a Release Form is often used to formally acknowledge that the borrower has fulfilled their obligations and the lender releases them from further liability.

Together, these forms and documents provide a comprehensive framework for personal loans between friends or family. They not only help in establishing clear expectations and responsibilities but also protect the interests of both the lender and borrower. Ensuring that all these supporting documents are in place can prevent misunderstandings and conflicts, making the lending process smoother and more transparent for everyone involved.

Similar forms

A Promissory Note is a document quite similar to a Family (Friends) Personal Loan Agreement as it outlines the details of a loan between two parties. It specifies the amount of the loan, the repayment schedule, the interest rate if applicable, and the consequences of non-payment. Both documents serve as legally binding agreements to ensure that the borrower repays the borrowed amount to the lender under the terms specified.

An IOU (I Owe You) document also shares similarities with a Family (Friends) Personal Loan Agreement, albeit being less formal. An IOU simply acknowledges that a debt exists and the borrower intends to repay it, but it might lack specific details such as repayment dates, interest rates, and what happens if the loan is not repaid. Despite its simplicity, it is a recognition of debt similar to the more detailed personal loan agreement.

A Secured Loan Agreement is similar in its foundation but includes an additional element that is not always present in a Family (Friends) Personal Loan Agreement: collateral. This agreement provides a lender security - property or other assets - as a guarantee for loan repayment. If the borrower fails to repay the loan according to the terms of the agreement, the lender may seize the collateral. Both documents delineate the amount loaned, repayment schedules, and the consequences of non-payment, but the secured loan agreement additionally involves an asset to secure the loan.

The Line of Credit Agreement is another document bearing resemblance to the personal loan agreement among family or friends. This agreement outlines the terms under which a lender provides a maximum loan amount that the borrower can access over a set period. Unlike the lump-sum loan discussed in a personal loan agreement, a line of credit allows for variable borrowing up to a fixed limit. The commonality lies in the formal recognition of a lending agreement, including interest rates, payment schedules, and the obligations of the borrower to repay the borrowed funds.

Dos and Don'ts

When it comes to drafting a Family (Friends) Personal Loan Agreement, it's important to ensure clarity and prevent potential misunderstandings in the future. Here are some essential dos and don'ts to consider:

Do:

- Clearly list the names and addresses of both the lender and borrower to avoid any confusion.

- Specify the loan amount in words and numbers to ensure there are no discrepancies regarding the loan amount.

- Define the repayment terms, including the repayment schedule, to ensure both parties have clear expectations.

- Include any agreed-upon interest rates or fees to avoid disputes about additional charges later on.

- State the consequences of late payments or default to protect both parties’ interests.

- Have all parties sign and date the agreement to legally acknowledge their understanding and agreement.

Don't:

- Leave any sections blank; if something does not apply, write “N/A” (not applicable) instead.

- Use technical legal terminology that might confuse any party; keep the language simple and straightforward.

- Forget to specify the loan's purpose if it’s a crucial part of the agreement.

- Overlook including a clause about what happens if the borrower pays off the loan early.

- Rely on verbal agreements; ensure everything is documented in the loan agreement.

- Fail to give each party a copy of the signed agreement for their records.

Misconceptions

When it comes to lending money within families or among friends, many often resort to the Family (Friends) Personal Loan Agreement form. Misunderstandings about the form's purpose, legality, and implications are common. Highlighting these misconceptions can help clarify its use and importance.

- It’s merely a formality. Some people believe that this document is just a formality and lacks any real legal standing. In truth, the agreement is a legally binding contract that ensures both parties are aware of and agree to the terms of the loan.

- Not necessary for small loans. Regardless of the loan size, documenting the agreement can prevent misunderstandings and provide a clear record of the loan terms and repayment expectations.

- Lacks flexibility. Contrary to what some might think, these agreements can be as flexible as the parties decide. They can include clauses that allow for changes in repayment schedules, interest rates, or loan terms with mutual consent.

- Too complex to understand. While legal documents can be daunting, the Family (Friends) Personal Loan Agreement form is designed to be straightforward. Its aim is to cover the essentials of the loan agreement in an accessible manner.

- Legal representation is required. It's a misconception that legal counsel needs to draft or review the agreement. Parties can create and agree upon the document themselves, though seeking legal advice can ensure their interests are fully protected.

- Only about the money. Beyond specifying the loan amount, repayment schedule, and interest (if any), this agreement can outline dispute resolution processes and what happens if the borrower defaults, protecting relationships and providing peace of mind.

- Enforcement is difficult. Should a dispute arise, having a written and signed agreement provides a framework for legal recourse, making it easier to enforce than verbal agreements.

- It’s binding forever. Parties can mutually agree to modify the terms or even terminate the agreement, provided such changes are documented in writing and signed by both parties.

- Interest must be charged. While including interest can formalize the loan and possibly benefit the lender, it’s not a requirement. The agreement can specify a 0% interest rate, acknowledging the loan's personal nature.

- It will harm the relationship. Many fear that signing a formal agreement implies a lack of trust. On the contrary, clear communication and agreed-upon terms can prevent misunderstandings and protect the relationship in the long run.

Understanding these misconceptions can guide individuals in handling personal loans with more confidence and security, recognizing the Family (Friends) Personal Loan Agreement form as a useful tool in managing personal finance matters between parties who share a close relationship.

Key takeaways

Filling out a Family (Friends) Personal Loan Agreement form is a step toward formalizing a loan arrangement between loved ones. This process, when done correctly, can help maintain relationships and ensure financial clarity. Here are key takeaways to consider:

- Clearly identify the parties involved: the lender and the borrower. Full legal names should be used to avoid any confusion.

- Determine the loan amount and write it both in numbers and words to ensure there is no misunderstanding about the amount being loaned.

- Establish a repayment plan. Include specific dates for repayment and any details about installments. Deciding whether the loan will be repaid in a lump sum or over time in regular intervals is crucial.

- Set the interest rate, if applicable. Many family or friend loan agreements may not include interest. However, if you decide to charge interest, ensure it's clearly stated in the document and complies with applicable state laws.

- Include a clause about late payments and potential penalties. This helps manage expectations and allows the borrower to understand the consequences of missing payments.

- Outline what happens in the event of a default. Defining what constitutes a default and the steps that will follow provides clarity and protection for both parties.

- Add a governing law section to state which state's laws will interpret the agreement. This is particularly important if the lender and borrower live in different states.

- Ensure all parties sign the agreement and consider having the signatures notarized. While not always necessary, notarization can lend additional legal validity to the document.

Remember, both the lender and the borrower should keep a copy of the agreement for their records. Proper documentation and clear communication are key components of a successful personal loan arrangement between family and friends.